Market Overview

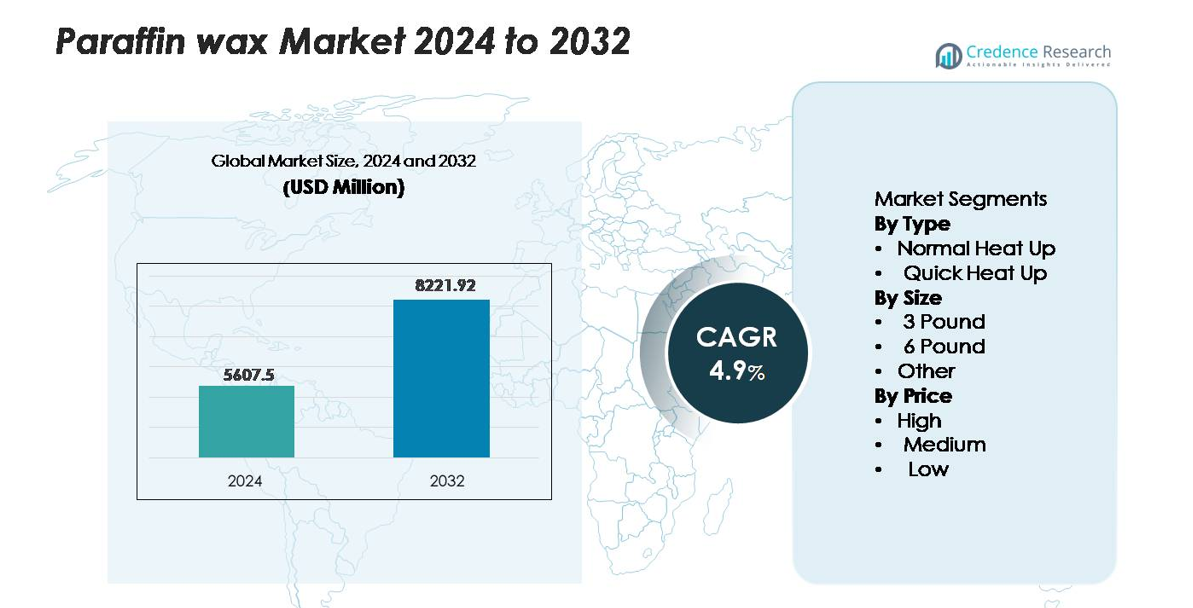

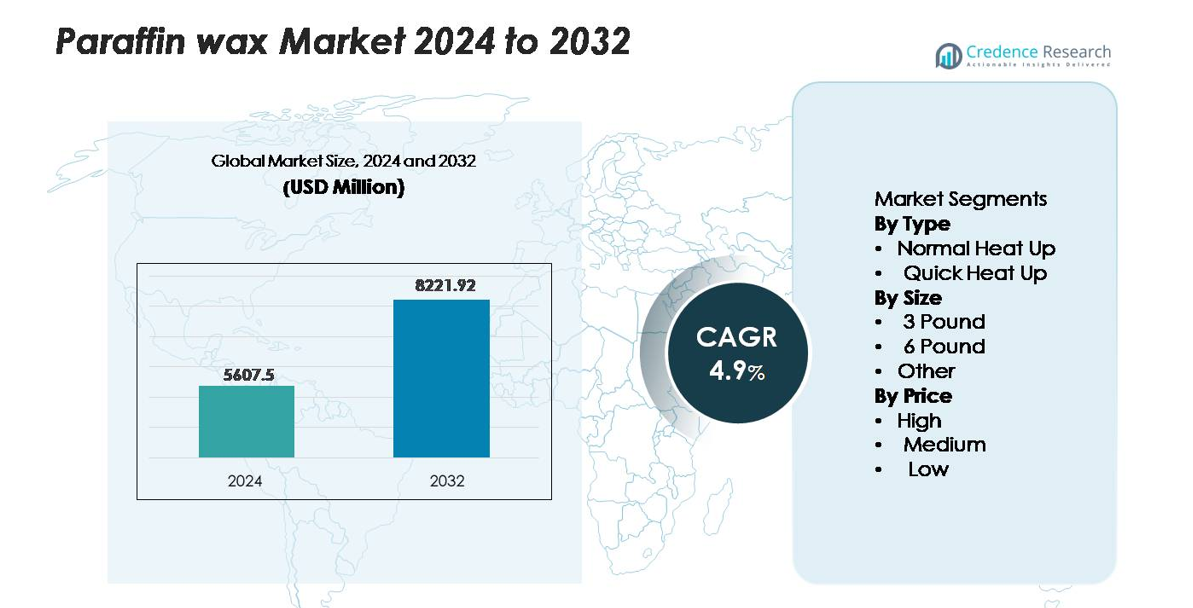

The paraffin wax market was valued at USD 5,607.5 million in 2024 and is anticipated to reach USD 8,221.92 million by 2032, registering a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Paraffin Wax Market Size 2024 |

USD 5,607.5 million |

| Paraffin Wax Market, CAGR |

4.9% |

| Paraffin Wax Market Size 2032 |

USD 8,221.92 million |

The paraffin wax equipment market is characterized by a mix of global wellness manufacturers, physiotherapy device suppliers, and aesthetic-care technology brands that collectively shape competitive dynamics through product innovation, safety features, and strong distribution networks. Asia-Pacific remains the leading region with a 32% market share, supported by large consumer bases, expanding physiotherapy infrastructure, and rapid adoption of home-use wellness devices. Key players emphasize digital temperature control, ergonomic designs, and enhanced hygiene solutions to strengthen their positions across medical, spa, and consumer segments. Competitive differentiation increasingly centers on reliability, melt-cycle efficiency, and user-safety enhancements tailored to both professional and personal applications.

Market Insights

- The paraffin wax equipment market reached USD 5,607.5 million in 2024 and is projected to hit USD 8,221.92 million by 2032, registering a 4.9% CAGR during the forecast period.

- Demand is driven by rising adoption of heat-therapy solutions in physiotherapy, rehabilitation, dermatology, and home-use wellness applications, with strong preference for normal heat-up units, which hold the largest share among equipment types.

- Key trends include rapid digitalization of devices, growing penetration of compact 3-pound units, and expanding cosmetic and dermatology applications that enhance user experience and treatment consistency.

- Competition intensifies as manufacturers prioritize safety features, wax-melting efficiency, and ergonomic design, while market restraints include hygiene concerns and increasing adoption of alternative heat-therapy technologies.

- Regionally, Asia-Pacific leads with 32%, followed by North America at 28% and Europe at 26%, while Latin America and MEA collectively account for the remaining market share, reflecting diverse adoption across professional and home-care settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Normal heat-up units represent the dominant segment due to their broad suitability for professional salons, therapeutic centers, and home users who prioritize consistent temperature stability over rapid heating cycles. This segment holds the largest market share because manufacturers position standard heat-up devices as reliable, energy-efficient options with lower maintenance requirements. Their compatibility with commonly used paraffin formulations and their reduced risk of overheating supports widespread adoption. Quick heat-up systems continue to grow, but normal heat-up models remain preferred for routine therapeutic treatments where prolonged, even heating is essential.

- For instance, the HoMedics ParaSpa® PAR-350 paraffin bath utilizes a pre-set, automatically controlled heating system to maintain a temperature range of approximately 123–131 degrees Fahrenheit (50–55 degrees Celsius). The unit accommodates up to 3 pounds of paraffin wax.

By Size

The 3-pound category leads the market, holding the highest share owing to its strong presence in personal wellness applications and compact professional setups. Its smaller footprint, lower wax requirement, and faster melt cycles make it an attractive option for consumers seeking convenient at-home therapy. Manufacturers also favor this size for mass-market distribution due to easier logistics and lower retail pricing. While 6-pound units remain popular among physiotherapy clinics and high-volume users, the 3-pound format maintains leadership by balancing capacity, portability, and operational efficiency across the broadest user base.

- For instance, HoMedics’ ParaSpa® PAR-350 paraffin bath is engineered specifically for this segment, featuring a wax reservoir that holds 3 pounds of paraffin and a heating element rated at approximately 150 watts, enabling controlled melting cycles suitable for routine at-home hand and foot therapy.

By Price

The medium-priced segment dominates the market, benefiting from strong appeal among both home users and professional buyers seeking durability and performance without premium pricing. This segment captures the largest share because mid-range units typically integrate reliable heating systems, adjustable temperature controls, and safety features that meet salon and therapy standards. Manufacturers frequently introduce product upgrades in this tier, enhancing value perception. While high-priced units attract specialized clinical environments and low-priced models appeal to entry-level users, medium-priced devices remain the preferred choice for consistent quality, longevity, and balanced cost-to-performance advantages.

Key Growth Drivers

Rising Adoption of Heat Therapy in Wellness and Rehabilitation

The growing emphasis on non-invasive pain-management therapies is a major driver for paraffin wax equipment demand. Physiotherapy clinics, sports rehabilitation centers, and home-care users are increasingly adopting paraffin heat therapy for arthritis, muscle stiffness, chronic hand pain, and circulatory enhancement. This rising integration of heat-based modalities aligns with broader wellness trends and an aging population that seeks routine pain relief without pharmaceuticals. Manufacturers benefit from this shift as practitioners require reliable temperature-controlled devices suited for frequent, multi-patient use. At-home users are also expanding the customer base due to the accessibility of compact, easy-to-operate models. Furthermore, therapeutic associations globally promote paraffin therapy for joint mobility improvement, strengthening its clinical acceptance. Collectively, the growing demand for non-drug pain relief, demographic aging, and the expansion of physiotherapy networks reinforce sustained market growth for paraffin wax heating systems.

- For instance, Karite’s paraffin wax machine integrates a metal heating pot capable of melting a full wax load in 20 minutes and offers a capacity of 4,500 mL, while HoMedics’ ParaSpa® PAR-350 supports repeated therapy cycles with a 150-watt heating system and a reservoir designed for 3 pounds of paraffin—features that align directly with clinical and at-home rehabilitation requirements.

Expansion of Home-Use Wellness Devices

The surge in home-based wellness consumption significantly accelerates adoption of paraffin wax equipment. Consumers increasingly prefer at-home spa treatments for skin hydration, relaxation, and therapeutic hand and foot care, boosting demand for compact and affordable devices. The growth of e-commerce and direct-to-consumer retail models enables wider product accessibility, while digital advertising accelerates awareness of paraffin therapy’s cosmetic and therapeutic benefits. Manufacturers are responding by designing lightweight, energy-efficient units with adjustable temperature controls, safety shutoffs, and simplified wax refilling mechanisms suited for daily home use. Personal wellness routines gained momentum following global shifts toward at-home self-care, strengthening long-term demand. In addition, dermatology professionals endorse paraffin treatments for their proven skin-softening and moisture-retention benefits, making them an appealing addition to consumer beauty regimens. This growing convergence of wellness, skincare, and accessibility continues to position home-use devices as a major growth pillar.

- For instance, EasyinBeauty’s paraffin wax machine features a 3,000 mL capacity tank and a digital heating system capable of melting paraffin within approximately 30 minutes, while Toyar’s home-use paraffin refill packs supply 2-pound lavender-scented wax blocks designed specifically for compact at-home units—demonstrating how manufacturers are engineering consumer-friendly solutions with precise, measurable performance specifications.

Product Innovation and Enhanced Safety Features

Technological advancements serve as a key growth driver in the paraffin wax equipment market, transforming device reliability and user confidence. Modern units incorporate precise digital thermostats, real-time temperature monitoring, auto-shutoff functions, and dual heating zones to ensure uniform wax consistency. These upgrades address longstanding issues related to overheating, uneven melting, and inconsistent treatment results. Enhanced safety compliance also makes devices more acceptable in professional settings, including physiotherapy clinics, dermatology centers, and spas where standardization is essential. Additionally, the development of low-melting-point wax formulations, disposable liners, and odor-controlled variants improves usability and hygiene. Manufacturers increasingly pursue ergonomic designs and durable materials to reduce maintenance cycles. Collectively, these innovations strengthen market competitiveness by offering reliable, efficient systems that meet evolving preferences for comfort, safety, and performance, driving adoption across both consumer and professional segments.

Key Trends & Opportunities

Growing Preference for Digital and Smart-Controlled Units

A key market trend is the shift toward digitally controlled paraffin wax equipment, driven by rising expectations for precision, safety, and ease of use. Smart units equipped with programmable temperature settings, LED display indicators, and automated cycling functions appeal to both home consumers and professionals seeking consistent therapeutic outcomes. This digitalization trend opens opportunities for manufacturers to differentiate through intuitive user interfaces, remote monitoring, and app-enabled features. As connected health devices gain traction globally, paraffin wax systems with embedded sensors or digital health integration could emerge as a strong niche. The trend also supports improved device longevity through intelligent power management and optimized heat distribution, expanding value for users and boosting replacement demand in clinics transitioning from older analog models.

- For instance, EasyinBeauty’s digital paraffin system integrates a touchscreen control panel with a 3,000 mL tank capacity and features two speed modes for melting, while Karite’s smart-controlled unit uses an advanced NTC temperature control system that melts a 4,500 mL wax load in 20 minutes, demonstrating how manufacturers are embedding measurable digital enhancements into next-generation paraffin therapy devices.

Expansion of Paraffin Therapy in Aesthetic and Dermatology Segments

Aesthetic clinics and dermatology practices increasingly adopt paraffin treatments for their moisturizing, exfoliating, and skin-softening effects, creating new opportunities beyond therapeutic pain relief. Paraffin wax therapy is gaining acceptance as a complementary treatment for dry skin conditions, cosmetic enhancement before manicures and pedicures, and pre-procedural skin conditioning. This trend aligns with the broader expansion of the beauty and wellness sector, where consumers value multi-benefit treatments. Manufacturers are responding by developing professional-grade units with faster melt cycles, enhanced hygiene features, and larger capacity tanks tailored for high-volume usage. The growing crossover between therapeutic and cosmetic applications broadens the addressable market and encourages service providers to integrate paraffin systems into bundled treatment offerings.

- For instance, Karite’s professional paraffin unit accommodates a 4,500 mL wax reservoir and achieves full melt readiness in 20 minutes, while HoMedics’ ParaSpa® PAR-350 utilizes a 150-watt heating system capable of maintaining stable temperatures for repeated aesthetic treatments—allowing dermatology and nail-care providers to support continuous, high-throughput service demand.

Increasing Penetration Across Emerging Markets

Expanding access to physiotherapy clinics, beauty salons, and orthopedic services across emerging economies presents a notable opportunity. Rising disposable income, improving healthcare infrastructure, and growing awareness of paraffin therapy’s therapeutic and cosmetic benefits are fostering adoption. Local distributors and e-commerce platforms support this trend by offering competitively priced devices suited for regional purchasing power. Manufacturers that invest in localized marketing, after-sales support, and compact portable models are positioned to capture rapid growth. Additionally, professional training programs for therapists in developing markets create stronger familiarity with paraffin therapy, supporting sustained demand.

Key Challenges

Competition from Alternative Therapies and Heating Technologies

The paraffin wax equipment market faces increasing competition from newer heat-therapy technologies such as infrared warmers, electric heat pads, hydrotherapy units, and advanced compression-heat systems. These alternatives often offer faster warm-up times, broader body coverage, and more digital control features, appealing to clinics seeking multifunctional equipment. Additionally, some consumers perceive paraffin therapy as less convenient due to wax handling, melt time, and post-treatment cleanup. This competitive pressure requires manufacturers to innovate continuously, enhance ease of maintenance, and highlight clinical benefits to maintain relevance. If alternative modalities outpace technological improvements in paraffin systems, market share erosion could intensify.

Hygiene Management and Infection-Control Concerns

Maintaining hygiene in shared paraffin wax systems presents an ongoing challenge, particularly in clinical and high-volume salon environments where infection-control standards are stringent. Concerns about cross-contamination, wax impurities, and improper cleaning practices can deter adoption, especially when compared to disposable or single-use heat therapy alternatives. Facilities must invest in strict sanitization protocols, disposable liners, and routine wax replacement to ensure compliance, increasing operational costs. Manufacturers need to improve equipment design for easier cleaning, integrate contamination-prevention features, and promote standardized usage guidelines. Without continued advancements in hygiene and safety solutions, institutional users may limit adoption or shift to substitute therapies.

Regional Analysis

North America

North America accounts for approximately 28% of the paraffin wax equipment market, supported by high adoption of therapeutic heat treatments across physiotherapy clinics, wellness centers, and dermatology practices. Strong consumer engagement in at-home pain-relief and skincare routines also contributes to steady retail demand. The region benefits from advanced product availability, strong e-commerce penetration, and a mature healthcare ecosystem that frequently integrates paraffin therapy for arthritis and musculoskeletal rehabilitation. Manufacturers gain additional traction through professional endorsements and stringent safety compliance standards that encourage faster transition from conventional units to digitally controlled, energy-efficient systems.

Europe

Europe holds roughly 26% of the market, driven by widespread clinical use of heat-therapy modalities and strong demand from beauty salons, spas, and rehabilitation centers. The region’s aging population fuels consistent adoption for joint-mobility improvement and chronic pain relief. Dermatology clinics across Western Europe increasingly integrate paraffin treatments for skin hydration and pre-procedure conditioning. Regulatory emphasis on device safety and hygiene also encourages purchases of premium units with advanced temperature control and sterilization features. Robust distribution networks and the popularity of professional wellness services further support Europe’s stable and diversified market position.

Asia-Pacific

Asia-Pacific leads the global market with approximately 32% share, driven by rapid expansion of physiotherapy clinics, rising disposable incomes, and growing consumer interest in at-home wellness routines. Countries such as China, Japan, and South Korea exhibit strong demand for therapeutic and cosmetic paraffin applications, while India and Southeast Asia experience accelerating adoption through affordable device availability. Expanding beauty and spa industries, combined with digital retail penetration, boosts uptake of compact and mid-priced units. Manufacturers benefit from high-volume sales opportunities and increasing acceptance of paraffin therapy as a complementary treatment across both medical and beauty ecosystems.

Latin America

Latin America captures about 8% of the market, supported by expanding spa networks, physiotherapy services, and rising awareness of non-invasive heat-therapy solutions for musculoskeletal relief. Brazil and Mexico represent the largest demand centers due to their well-developed beauty and wellness industries. Mid-priced paraffin wax equipment dominates regional purchases as clinics and consumers seek cost-effective solutions. Growing interest in dermatology and cosmetic enhancement also contributes to uptake, particularly in urban areas. However, market growth remains moderated by import dependency and unequal healthcare access, making affordability and distributor partnerships essential for wider penetration.

Middle East & Africa

The Middle East & Africa region holds approximately 6% of the global market, with demand concentrated in Gulf Cooperation Council countries where premium wellness centers, dermatology clinics, and physiotherapy facilities increasingly utilize paraffin therapy. Enhanced investment in medical rehabilitation infrastructure and the expansion of luxury spa chains support modest but steady adoption. In Africa, usage remains limited but gradually rising through hospital procurement and consumer interest in accessible home-care devices. Market growth is constrained by pricing sensitivity and limited awareness, making education initiatives and localized distribution networks crucial for long-term expansion.

Market Segmentations:

By Type

- Normal Heat Up

- Quick Heat Up

By Size

By Price

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the paraffin wax equipment market is defined by a blend of established wellness device manufacturers, physiotherapy equipment suppliers, and emerging consumer-focused brands that emphasize innovation, reliability, and user safety. Companies compete by enhancing temperature precision, reducing melt times, and integrating digital controls that deliver consistent therapeutic results across clinical, spa, and home-care settings. Mid-priced models dominate competitive positioning, as they balance durability with affordability for both professionals and consumers. Product differentiation increasingly revolves around ergonomic design, hygiene-friendly components such as disposable liners, and energy-efficient heating systems. Leading players also strengthen distribution through e-commerce expansion, salon and clinic partnerships, and targeted marketing within wellness and dermatology sectors. As digitalization and at-home therapy adoption accelerate, competitive intensity is expected to rise, motivating manufacturers to prioritize technological upgrades, stronger after-sales support, and region-specific product customization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Conair

- Mediwax

- Duomishu Kiticute

- EasyinBeauty

- K KORKUAN

- REVLON

- Toyar

- HoMedics

- Bona

- Karite

Recent Developments

- In 2025, Saudi Aramco, headquartered in Dhahran, partnered with Sinopec and SABIC to establish a refinery and petrochemical cracker complex in China and Saudi Arabia, aiming to enhance collective capabilities.

- In July 2024, The Karite Paraffin Wax Machine for hands & feet boasts a “metal heating pot for quick melt-down in 20 minutes” and other technological features.

- In November 2022, Eneos Corporation, a Japan-based company, and Niigata Public Corporation of Agriculture and Forestry partnered to achieve a decarbonized society through forest conservation, aiming to reduce Scope 1 and 2 CO₂ emissions by 46% by 2030.

Report Coverage

The research report offers an in-depth analysis based on Type, Size, Price and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of paraffin wax equipment will grow steadily as physiotherapy, dermatology, and wellness centers integrate heat therapy into routine treatment protocols.

- Home-use devices will expand rapidly, driven by rising consumer preference for convenient, non-invasive pain relief and skincare therapies.

- Digital temperature control, faster melt cycles, and smart-safety features will become standard across most new product launches.

- Compact 3-pound units will continue to dominate due to portability, lower wax requirements, and suitability for home and light professional settings.

- Manufacturers will increasingly target emerging markets through localized pricing, distribution partnerships, and awareness programs.

- Cosmetic and skin-conditioning applications will offer strong growth potential as spas and salons enhance treatment menus.

- Improved hygiene-focused features such as disposable liners and purified low-melting wax blends will see wider adoption.

- Competition will intensify as new consumer-wellness brands enter the market with design-focused innovations.

- Regulatory focus on device safety and clinical hygiene standards will influence product engineering and certification.

- Sustainability trends will encourage development of energy-efficient heating systems and environmentally responsible wax formulations.