Market Overview

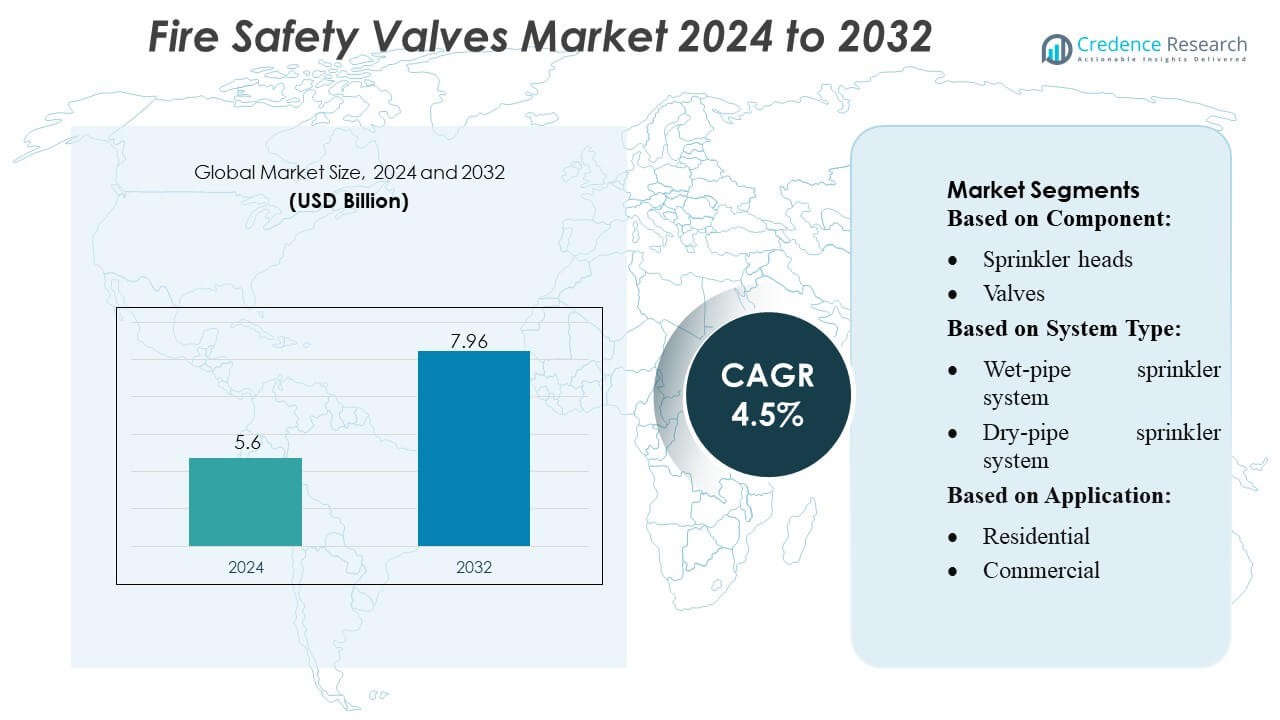

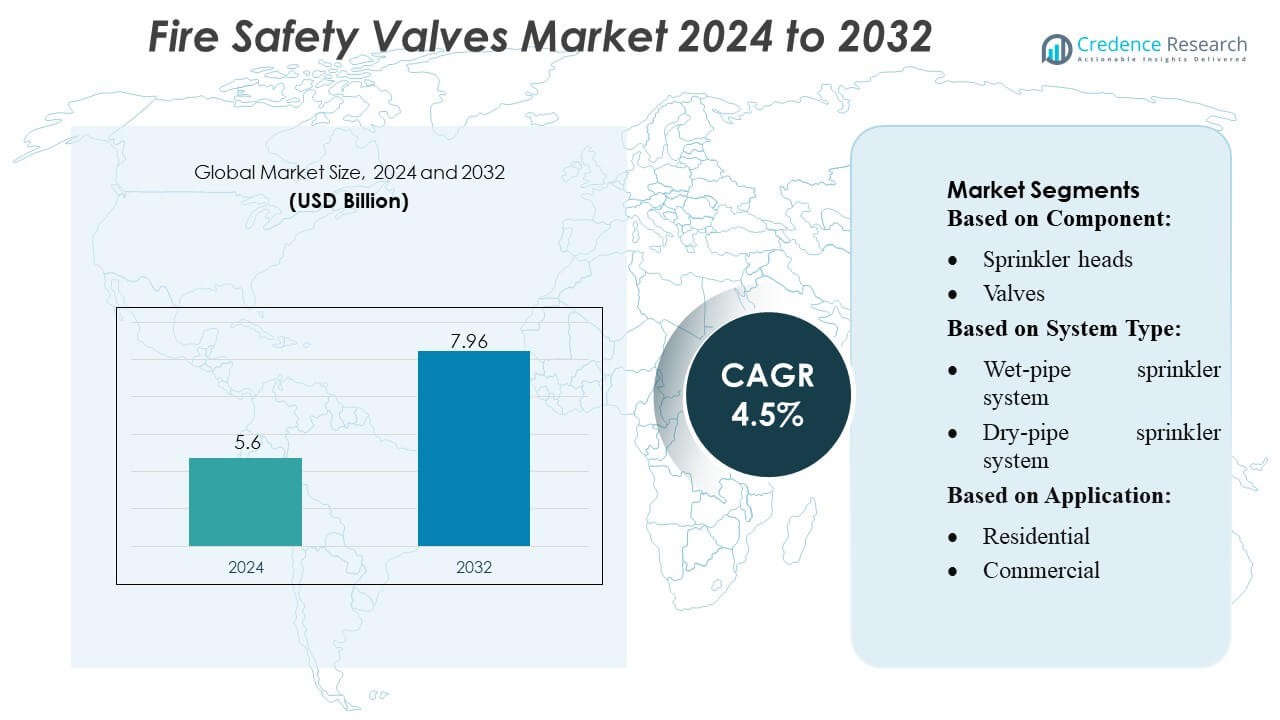

Fire Safety Valves Market size was valued USD 5.6 billion in 2024 and is anticipated to reach USD 7.96 billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fire Safety Valves Market Size 2024 |

USD 5.6 Billion |

| Fire Safety Valves Market, CAGR |

4.5% |

| Fire Safety Valves Market Size 2032 |

USD 7.96 Billion |

The Fire Safety Valves Market is shaped by a group of globally established manufacturers that focus on high-performance flow-control technologies, certified safety standards, and advanced system integration capabilities. These players compete through innovation in automated valve mechanisms, corrosion-resistant materials, and smart monitoring features that support modern fire suppression networks across commercial, industrial, and residential facilities. Their strategies emphasize product reliability, regulatory compliance, and expansion into fast-growing construction and industrial hubs. Asia-Pacific leads the global market with approximately 38–40% share, driven by rapid urbanization, large-scale infrastructure development, and tightening fire safety regulations across high-density regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fire Safety Valves Market was valued at USD 5.6 billion in 2024 and is projected to reach USD 7.96 billion by 2032, registering a CAGR of 4.5%, supported by ongoing upgrades in global fire protection infrastructure.

- Market growth is driven by increasing construction activities, stricter safety regulations, and rising adoption of automated valve systems with corrosion-resistant designs and intelligent monitoring capabilities.

- Advancements in smart suppression technologies, integration with building automation systems, and demand for high-efficiency valves in industrial facilities shape emerging market trends.

- Competitive intensity remains high as global manufacturers focus on certified product lines, system compatibility, and expansion across fast-growing commercial and industrial sectors, while cost barriers and maintenance requirements act as notable restraints.

- Asia-Pacific leads with 38–40% share, followed by North America and Europe, while the sprinkler pipe and fittings segment dominates with over 30% share, driven by extensive installation across large-scale infrastructure and high-density urban developments.

Market Segmentation Analysis:

By Component

The component segment is led by sprinkler pipe and pipe fittings, accounting for around 30–32% of the market, supported by their essential role in establishing robust fire suppression networks across residential, commercial, and industrial infrastructures. Their dominance stems from increased construction activity, higher compliance with fire safety mandates, and rising adoption of automated sprinkler systems. Sprinkler heads and valves follow, driven by upgrades in detection precision and flow control. Compressors and pumps with controllers gain traction in high-risk environments requiring stable pressure systems, while the “others” category grows with sensor-enabled accessories and smart monitoring components.

- For instance, Honeywell’s fire‑life‑safety business includes waterflow detectors compatible with steel pipes sized 2″ through 8″ — e.g. their WFD20 detector supports 2″ steel pipe — highlighting their direct involvement in piping and fittings for sprinkler networks.

By System Type

The wet-pipe sprinkler system holds the dominant position with approximately 40–45% market share, driven by its reliability, low maintenance requirements, and widespread acceptance across commercial and residential buildings. Its ability to provide immediate response without complex activation mechanisms strengthens its adoption in regions with stable temperatures. Dry-pipe and pre-action systems witness growth in cold-storage facilities, data centers, and high-value asset environments where accidental discharge avoidance is crucial. Deluge systems expand in heavy industrial zones requiring rapid water flow for large-area suppression. The “others” category includes emerging hybrid systems integrating mist and smart-controlled suppression technologies.

- For instance, Siemens AG’s boiler control solution for industrial fire-tube applications incorporates a burner management system (BMS) built on a PLC platform, which supports features such as flame-scanner redundancy, applications up to SIL 3 safety rating, and real-time diagnostics via HMI with remote access.

By Application

The commercial segment leads with around 45–48% market share, driven by stringent safety regulations across offices, malls, hospitality buildings, hospitals, and educational institutions. Growing investments in infrastructure modernization and the integration of smart fire suppression solutions further support dominance in this category. The industrial segment follows, benefiting from heightened safety requirements in manufacturing plants, oil & gas facilities, and logistics warehouses where risk exposure is high. The residential segment shows increasing adoption due to rising awareness, government mandates for multi-unit dwellings, and improved affordability of integrated sprinkler and valve systems.

Key Growth Drivers

1. Expansion of Commercial and Industrial Infrastructure

The rapid expansion of commercial complexes, industrial facilities, and large public infrastructure projects significantly drives demand for fire safety valves. Governments worldwide continue strengthening fire safety codes, making sprinkler systems and high-performance valve assemblies mandatory in new construction. Industrial sectors such as oil & gas, chemicals, manufacturing, and warehousing require advanced suppression systems due to higher fire risk exposure. This broad-based infrastructure growth, combined with compliance pressure, accelerates installation rates and pushes manufacturers to supply durable, certified, and performance-tested fire safety valves across diverse building environments.

- For instance, MHI-INC’s industrial electric steam generator line features standard units capable of producing superheated steam at 1,300 °C with flow rates up to 200 kg/h in specialized configurations.

2. Rising Emphasis on Workplace and Public Safety Compliance

Growing awareness of fire hazards and the rising frequency of industrial and residential accidents reinforce the need for stringent safety compliance. Regulatory authorities now enforce tighter inspection processes, certification standards, and periodic system upgrades, boosting replacement and modernization demand for fire safety valves. Organizations prioritize life-safety systems to mitigate liability and ensure operational continuity, leading to greater adoption of advanced flow-control valves and automated sprinkler networks. This regulatory shift encourages manufacturers to innovate high-reliability components tailored to evolving safety frameworks across developed and emerging markets.

- For instance, Thermax Ltd. supplied a packaged firetube boiler with a working pressure of 10.54 kg/cm² and steam temperature range of 184–215 °C, specifically for chemical‑industry use on natural gas, enabling improved combustion control and reduced emissions under stringent norms.

3. Technological Advancements in Fire Suppression Systems

Continuous advancements in sensor integration, automated activation mechanisms, corrosion-resistant materials, and intelligent water-flow control enhance the performance of modern fire safety valves. Smart valves capable of real-time monitoring, remote diagnostics, and predictive maintenance appeal to data centers, logistics hubs, and high-value industrial environments. These innovations improve response accuracy, reduce false activations, and extend system lifespan, driving strong replacement demand. The shift toward IoT-enabled safety infrastructure and the rising adoption of high-efficiency suppression systems contribute to stable, long-term market growth.

Key Trends & Opportunities

1. Growing Adoption of Smart and Connected Fire Safety Systems

The integration of IoT, AI-driven alerts, and real-time pressure monitoring creates significant opportunities for next-generation fire safety valves. Smart valves help detect anomalies early, optimize water usage, and reduce system downtime. Commercial buildings, data centers, and industrial plants increasingly adopt connected suppression networks for predictive maintenance and compliance reporting. This trend aligns with the broader shift toward digital building management systems, enabling manufacturers to offer value-added features such as automated diagnostics, remote testing, and seamless integration with smart fire panels.

- For instance, Cheema Boilers Limited offers a range of high-capacity Gas PAC and Oil PAC models have an operating capacity range from 1 TPH to 16 TPH (1,000 kg/hr to 16,000 kg/hr). Other sources indicate the range for both Oil PAC and Gas PAC can go up to 20 TPH in some configurations.

2. Increased Demand for High-Performance Valves in Harsh Environments

Industries operating in extreme conditions—such as petrochemical plants, offshore rigs, power facilities, and cold-storage warehouses—are driving demand for corrosion-resistant, high-strength, and quick-response valve systems. Manufacturers invest in advanced alloys, epoxy-coated interiors, and specialized sealing technologies to meet these application needs. The growing complexity of industrial operations and rising emphasis on operational resilience expand the opportunity for premium-grade valves. This trend supports higher margins and encourages innovation across pressure-sustaining, deluge, and pre-action system valves tailored for high-risk environments.

- For instance, BHEL’s distributed digital control, monitoring & information system (DDCMIS) enables boiler ramp‑up at a rate of 3% per minute for loads between 70‑100% TMCR, and 2% per minute for 55‑70% TMCR.

3. Expansion of Retrofitting and Upgradation Activities

Aging infrastructure across developed countries presents a major opportunity for retrofitting and system upgrades. Many commercial buildings, factories, and public facilities still operate outdated fire suppression systems that fail to meet modern safety standards. As insurance companies enforce stricter risk-assessment criteria, facility managers increasingly invest in replacing legacy valves with certified, efficient models. Government-sponsored building revitalization programs and sustainability-driven facility upgrades further boost this trend, creating long-term revenue streams for manufacturers and service providers.

Key Challenges

1. High Installation and Maintenance Costs

The cost-intensive nature of installing and maintaining advanced fire safety valves poses a challenge, particularly for small enterprises and residential buildings. Complex systems require skilled technicians, periodic inspection, and regulatory certification, raising overall lifecycle expenses. Many property owners postpone upgrades or choose lower-cost alternatives, slowing adoption of high-performance valves. Additionally, integrating new valves into older infrastructure may demand significant system overhauls, further increasing costs. This financial barrier limits market penetration in cost-sensitive regions.

2. Regulatory Variations and Certification Complexities

Fire safety regulations vary widely across countries and regions, creating a complex compliance landscape for manufacturers. Valves must meet different certification standards—such as UL, FM, CE, and local codes—before entering specific markets, resulting in higher testing costs and extended product development cycles. Frequent updates to safety norms and inconsistent enforcement across emerging markets add operational uncertainty. These regulatory discrepancies hinder streamlined global expansion and require companies to maintain multi-standard production lines, increasing operational and documentation burdens.

Regional Analysis

North America

North America holds a 28–30% share of the Fire Safety Valves Market, supported by stringent building codes, advanced fire safety standards, and high adoption of automated suppression systems. The U.S. leads due to extensive commercial infrastructure, strong emphasis on workplace safety, and continual modernization of industrial facilities. Robust insurance regulations and mandatory compliance certifications accelerate the installation of high-performance valves across residential towers, data centers, manufacturing plants, and logistics hubs. Growing investment in smart building technologies further drives replacement demand, while Canada contributes steadily through infrastructure expansion and strict enforcement of provincial fire protection regulations.

Europe

Europe accounts for 24–26% of the global market, driven by rigorous fire safety legislation, rapid urban redevelopment, and widespread integration of advanced sprinkler systems. Countries such as Germany, the U.K., and France lead adoption due to strict compliance frameworks, insurance mandates, and high awareness of fire risk mitigation. The region’s strong industrial base—including chemicals, automotive, and energy sectors—supports demand for high-performance, corrosion-resistant valves. Ongoing renovations in aging infrastructure and the push for intelligent fire monitoring systems enhance market growth. Additionally, EU directives promoting safety standardization encourage consistent product upgrades across commercial and industrial facilities.

Asia-Pacific

Asia-Pacific dominates the market with the largest share of 38–40%, driven by rapid urbanization, large-scale commercial construction, and expanding manufacturing activity. China and India remain key contributors as government-led safety regulations tighten across high-rise buildings, industrial clusters, and public infrastructure. The region’s booming logistics, electronics, and petrochemical industries demand advanced suppression systems with reliable valve performance. Increasing adoption of smart fire safety technologies and rising safety awareness in emerging economies further accelerate market penetration. Strong investments in industrial parks, airports, and smart cities reinforce APAC’s leadership, making it the fastest-growing region for fire safety valves.

Latin America

Latin America represents 8–10% of the market, supported by growing enforcement of fire protection standards in commercial buildings and industrial facilities. Brazil and Mexico lead adoption with infrastructure expansion, modernization of public spaces, and rising investment in oil & gas, mining, and manufacturing sectors that require robust fire suppression systems. Although budget constraints limit high-end system installations, increasing collaboration with global safety equipment manufacturers enhances market accessibility. The development of shopping malls, warehouses, and residential complexes accelerates demand, while government-driven safety campaigns gradually strengthen penetration of certified fire safety valves across the region.

Middle East & Africa

The Middle East & Africa region holds 6–8% market share, driven by large-scale infrastructure development, especially in the UAE, Saudi Arabia, and Qatar. High-value construction projects, including commercial towers, airports, and industrial zones, require advanced fire suppression systems equipped with durable valves capable of performing in extreme temperatures. The oil & gas sector further contributes to demand, given its strict safety requirements and reliance on deluge and high-pressure systems. In Africa, growth remains gradual but improves with rising urban development and adoption of modern building codes. Increasing reliance on international standards boosts demand for certified valve solutions.

Market Segmentations:

By Component:

By System Type:

- Wet-pipe sprinkler system

- Dry-pipe sprinkler system

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Fire Safety Valves Market features leading players such as Honeywell International, Inc., Iteris, Inc., Robert Bosch GmbH, Siemens AG, Halma plc, GENTEX CORPORATION, Raytheon Technologies Corporation, Eaton, Johnson Controls, and Hitachi Ltd. the Fire Safety Valves Market is characterized by continuous innovation, strong regulatory alignment, and expanding adoption of smart suppression technologies. Companies in this space prioritize developing high-reliability valves with advanced flow control, corrosion resistance, and automated monitoring features to meet stringent global safety standards. Market competition intensifies as manufacturers invest in R&D, upgrade production capabilities, and form partnerships with construction firms, system integrators, and industrial operators. The shift toward IoT-enabled fire protection systems, modernization of aging infrastructure, and rapid growth in industrial and commercial construction further drive differentiation, pushing vendors to deliver certified, performance-tested solutions across diverse end-use environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell International, Inc.

- Iteris, Inc.

- Robert Bosch GmbH

- Siemens AG

- Halma plc

- GENTEX CORPORATION

- Raytheon Technologies Corporation

- Eaton

- Johnson Controls

- Hitachi Ltd.

Recent Developments

- In October 2025, Honeywell announced the introduction of NOTIFIER INSPIRE which features the latest generation self-testing smoke detectors and fire alarms compliant with EN standards. This solution reduces configuration, automatic and manual testing workload alongside streamlining system maintenance, thus eliminating procedures for manual verification and active compliance with fire and life safety systems.

- In July 2025, Pye-Barker Fire & Safety announced they had acquired 12 companies since the beginning of 2025, specializing in fire alarm, sprinkler, and security services. This expansion strategy was reported by the company’s news release and covered by outlets like Security Systems News.

- In December 2024, Siemens Smart Infrastructure proclaimed the acquisition of Denmark Danfoss Fire Safety, a company specializing in fire suppression technologies. It receives access to high-pressure water mist and low-pressure CO2 fire extinguishing solutions for their existing fire safety portfolio.

- In October 2024, Johnson Controls launched the Tyco ESFR-25 Dry-Type Pendent Sprinkler aimed at providing comprehensive fire protection for refrigerated and frozen storage facilities. It is specifically engineered for use in settings where water is sourced from a wet system in an adjacent temperature-controlled space.

Report Coverage

The research report offers an in-depth analysis based on Component, System Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance toward wider adoption of smart, sensor-integrated fire safety valves.

- Manufacturers will increasingly invest in corrosion-resistant materials to improve durability.

- Emerging economies will accelerate installations as fire safety regulations strengthen.

- Automated and remotely monitored suppression systems will gain traction across commercial spaces.

- Industrial facilities will drive demand for high-pressure and rapid-response valve technologies.

- Aging buildings will create significant opportunities for retrofitting and system upgrades.

- Digital compliance tracking and predictive maintenance will influence procurement decisions.

- Sustainability initiatives will promote eco-efficient valve designs with lower energy use.

- Collaboration between insurers and regulatory bodies will push higher adoption of certified valves.

- Integration of fire safety valves with building management systems will expand rapidly.