Market Overview

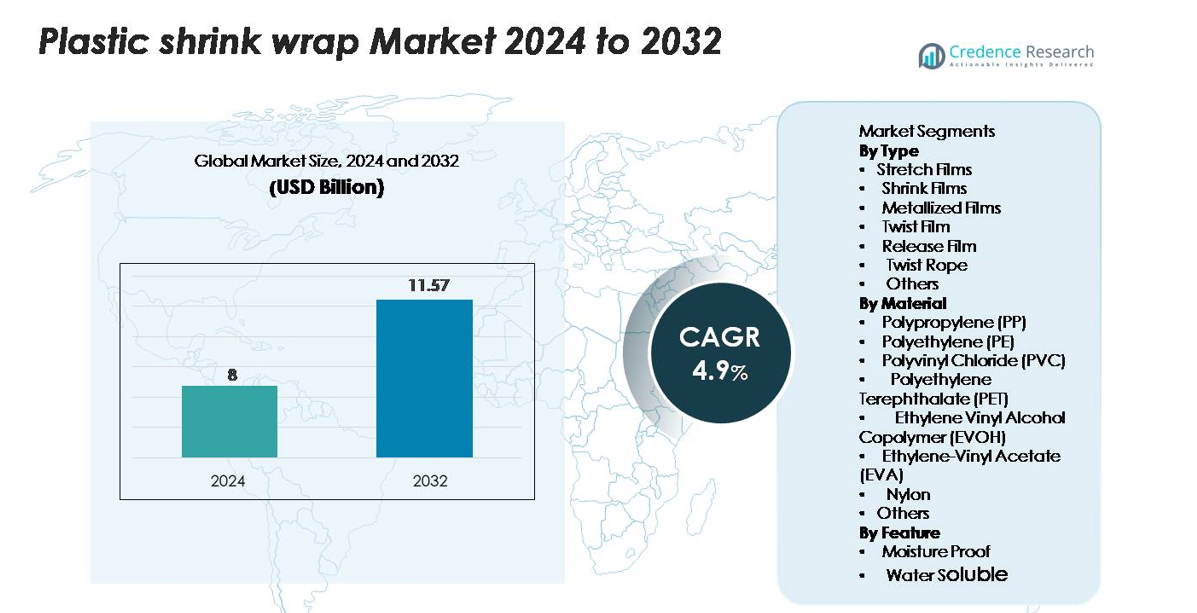

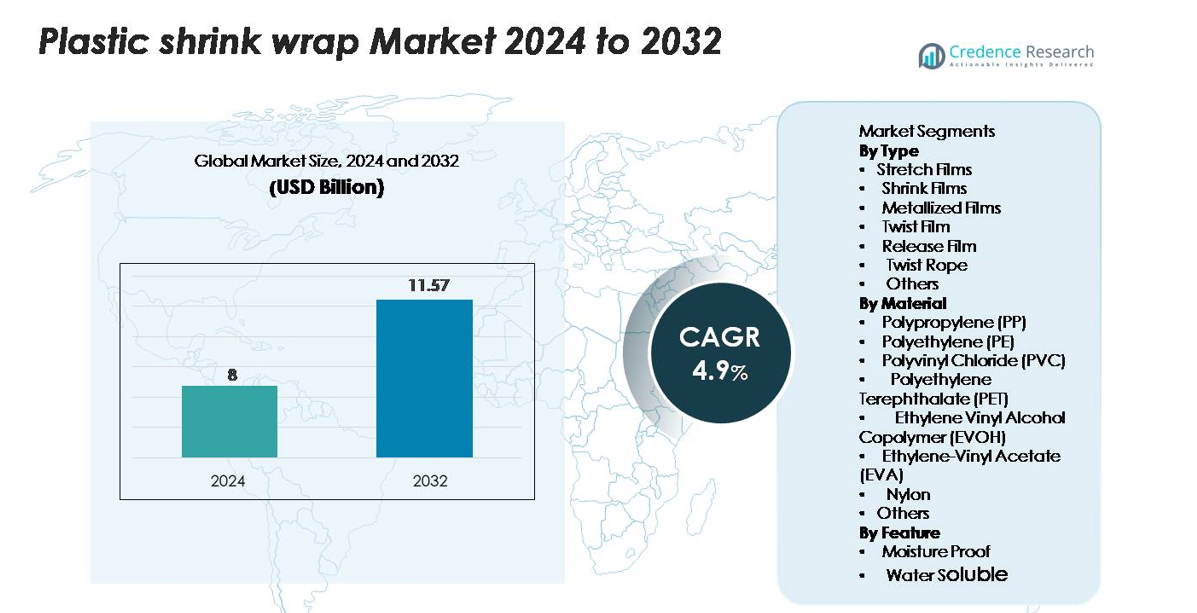

The plastic shrink wrap market was valued at USD 8 billion in 2024 and is projected to reach USD 11.57 billion by 2032, exhibiting a CAGR of 4.9% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastic Shrink Wrap Market Size 2024 |

USD 8 billion |

| Plastic Shrink Wrap Market, CAGR |

4.9% |

| Plastic Shrink Wrap Market Size 2032 |

USD 11.57 billion |

The plastic shrink wrap market is characterized by strong competition among global packaging manufacturers and regional film converters. Leading players—including Berry Global, Sealed Air Corporation, Winpak, Intertape Polymer Group (IPG), Coveris, Polyplex Corporation, and Clondalkin Group—focus on high-performance polyethylene shrink films, downgauged solutions, and recyclable mono-material structures to meet evolving sustainability and logistics demands. These companies leverage advanced extrusion technology, expanded production capacity, and partnerships with FMCG and e-commerce brands to maintain market leadership. Asia-Pacific leads the market with approximately 34% share, driven by large-scale manufacturing and retail expansion, followed by North America at around 32% and Europe at roughly 27%, supported by automation, strong supply chains, and stringent packaging standards.

Market Insights

- The plastic shrink wrap market was valued at USD 8 billion in 2024 and is projected to reach USD 11.57 billion by 2032, registering a CAGR of 4.9% during the forecast period.

- Growing demand from food, beverage, and e-commerce sectors acts as a major driver, with stretch films holding the largest segment share due to high usage in pallet unitization and logistics.

- Key market trends include the shift toward recyclable mono-material PE films, downgauged high-strength structures, and increased adoption of automated packaging lines across industries.

- Competitive dynamics are shaped by innovations in high-performance films, strategic capacity expansion, and sustainability-focused product portfolios by major players such as Berry Global, Sealed Air, Winpak, and IPG, though raw material price volatility remains a key restraint.

- Asia-Pacific leads the market with 34% share, followed by North America at 32% and Europe at 27%, driven by strong manufacturing activity, retail expansion, and advanced supply chain infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

Stretch films dominate the market, capturing the largest share due to their extensive use in pallet unitization, logistics, and bulk packaging across manufacturing, retail, and e-commerce. Their high elasticity, load stability, and cost efficiency drive widespread adoption, particularly in automated wrapping systems. Shrink films also hold significant traction in food and beverage multipack applications, while metallized films grow steadily in premium packaging for enhanced barrier performance. Twist films, release films, and twist rope remain niche segments, primarily serving confectionery, industrial bundling, and specialty wrapping applications.

- For instance, Berry Global has expanded its high-output cast stretch-film operations in the U.S. As part of these expansions, investments have included installing new lines, with one facility adding capacity expected to provide around 9,000 metric tons (20 million pounds) of additional annual production for ultra-high-performance films, supporting large-scale supply commitments.

By Material:

Polyethylene (PE) leads the segment with the highest market share, supported by its versatility, durability, and broad use in shrink and stretch film production. Its excellent tear resistance, low cost, and compatibility with both mono- and multilayer structures make it the preferred material for industrial and consumer packaging. Polypropylene (PP) and PVC follow, benefiting from clarity and rigidity advantages in retail packaging. Meanwhile, PET, EVOH, and EVA gain adoption for high-barrier applications demanding superior oxygen resistance, sealability, and product protection across food, pharmaceutical, and electronics sectors.

- For instance, Dow’s production facility in Freeport, Texas includes a dedicated PE manufacturing line known as Poly 7, capable of producing 600,000 metric tons per year of advanced polyethylene grades used in high-performance shrink and stretch films.

By Feature:

Moisture-proof films account for the dominant share, driven by strong demand from food, beverage, and personal care industries requiring extended shelf life and protection from humidity. These films support high-barrier performance, product integrity, and long-distance shipment durability, making them essential in thermoformed packs, shrink bundles, and protective wraps. Water-soluble films represent a smaller but expanding category, increasingly used in single-dose detergents, agrochemicals, and medical disposables. Their growth is accelerated by sustainability priorities, reduced plastic waste generation, and rising adoption of dissolvable packaging formats in consumer and industrial applications.

Key Growth Drivers

Rising Demand from Food & Beverage and E-commerce Packaging

The plastic shrink wrap market grows primarily due to rising consumption in food, beverage, and e-commerce sectors, where protective, lightweight, and cost-efficient packaging is essential. Manufacturers across processed foods, bottled beverages, and bakery products rely on shrink films to ensure secure bundling, tamper resistance, and extended shelf life. The rapid expansion of online retail accelerates demand for stretch and shrink films used for pallet unitization, secondary packaging, and transit protection. Shrink wrap ensures product stability during long-distance shipping while reducing material usage compared to rigid formats. Additionally, increasing adoption of automated wrapping systems in warehouses and distribution centers drives higher consumption of high-performance films optimized for load containment and durability. The shift toward efficient supply chain operations, combined with rising global trade volumes, continues to position shrink wrap as a preferred packaging solution across numerous industries.

- For instance, Sealed Air’s Cryovac shrink-pack systems are engineered to run at up to 120 packs per minute, significantly increasing throughput for large-scale food and beverage processors.

Growth of Lightweight and Cost-Efficient Packaging Solutions

The market benefits from the growing shift toward lightweight packaging solutions that reduce logistics costs and material consumption. Plastic shrink wrap offers superior cost efficiency compared to alternatives like cartons or rigid plastics, enabling brands to optimize packaging expenditure without compromising product protection. Industries increasingly adopt downgauged, high-strength polyethylene films that maintain performance while using less material, supporting both cost reduction and sustainability initiatives. Shrink films also support multipack formats widely used by beverage companies and FMCG brands to enhance portability and retail display appeal. Rising pressure on manufacturers to improve operational efficiency encourages investment in high-yield films compatible with high-speed packaging lines. Furthermore, innovations in resin formulation and multilayer extrusion provide improved strength, seal integrity, and clarity, reinforcing the adoption of thin, efficient shrink wrapping materials. This shift toward minimalistic, economical packaging remains a major contributor to market expansion.

- For instance, Amcor is committed to producing ultra-light shrink films to reduce plastic usage and environmental impact, such as its new Clear-Tite 40 shrink bag, which has a uniform 40-micron thickness and is their thinnest shrink bag in that product line.

Expansion of Industrial Applications and Automation Adoption

Industrial sectors increasingly adopt shrink and stretch films for equipment protection, pallet wrapping, and bulk load stabilization, significantly driving market growth. As manufacturing output expands globally, companies seek reliable materials that ensure safety during storage and transportation. Shrink wrap’s ability to provide a tight, tamper-evident seal makes it ideal for electronics, chemicals, automotive components, and construction materials. Additionally, the rapid automation of packaging operations boosts demand for machine-grade shrink films designed for consistent performance on high-speed lines. Automated palletizing and wrapping systems enhance productivity, reduce labor dependency, and improve packaging quality, thereby motivating businesses to adopt advanced shrink films. With industrial logistics becoming more complex and global, companies require films with superior puncture resistance, elongation, and load retention. These operational efficiencies support long-term adoption across warehousing, distribution, and export-driven industries.

Key Trends & Opportunities

Growing Adoption of Recyclable and Sustainable Shrink Films

Sustainability is emerging as a central trend, with companies increasingly transitioning to recyclable, mono-material polyethylene shrink films. Regulatory pressure to reduce plastic waste and carbon footprint encourages the adoption of eco-friendly alternatives, including recycled-content shrink films and downgauged materials. Advancements in resin technology enable production of high-clarity, high-strength recyclable films that match the performance of conventional multilayer structures. Major brands seek packaging that supports circular economy goals without compromising shelf appeal or protection, creating strong growth opportunities for manufacturers specializing in recyclable shrink film solutions. The push for environmental compliance across global markets further accelerates demand for sustainable film innovations.

- For instance, Berry Global’s closed-loop shrink film solutions incorporate up to 50% post-consumer recycled PE, validated through its 2023 manufacturing trials across fourS. facilities.

Advancement in High-Performance and Barrier Shrink Films

Technological innovations in multilayer extrusion, resin blending, and barrier enhancement create significant opportunities for market expansion. High-barrier shrink films incorporating EVOH, nylon, or PET layers provide improved oxygen and moisture resistance, supporting applications in meat, dairy, pharmaceuticals, and sensitive electronics. These films extend product shelf life and ensure product integrity in demanding supply chains. The growing preference for premium packaging with enhanced protection, visual appeal, and branding flexibility drives adoption of advanced shrink films. Furthermore, modern shrink technologies support precise fit, reduced wrinkles, and superior printability, enabling brands to combine performance with high-impact shelf presentation.

- For instance, Mitsubishi Chemical’s EVOH-based barrier films deliver oxygen transmission rates as low as 0.6 cc/m²·day under 23°C/0% RH conditions, measured through JIS Z1707 standards.

Expansion of Automated Packaging and Smart Manufacturing

The integration of automation and smart manufacturing solutions presents additional opportunities for shrink film producers. Modern high-speed shrink wrapping machines require films with consistent thickness, controlled shrink ratios, and enhanced mechanical strength. Manufacturers increasingly invest in films optimized for fully automated lines to improve consistency, reduce downtime, and support predictive maintenance. As industries adopt Industry 4.0-enabled packaging systems, demand for advanced shrink films designed for precision, reduced waste, and superior machine compatibility continues to rise. This shift supports innovation in resin formulations and film engineering, opening new possibilities for premium machine-grade shrink films.

Key Challenges

Environmental Concerns and Increasing Regulatory Compliance

The market faces challenges due to growing scrutiny around plastic waste and tightening regulatory frameworks. Several countries enforce restrictions on single-use plastics, extended producer responsibility (EPR) mandates, and recycling targets that directly affect shrink wrap consumption. Multilayer shrink films, particularly those made with mixed polymers, pose recycling difficulties, making them less favorable under evolving environmental policies. Manufacturers must invest in sustainable materials, recycling-friendly designs, and improved production processes to meet compliance requirements, which increases operational cost. Additionally, rising consumer awareness of environmental impact pressures brands to adopt alternatives, creating a barrier for traditional shrink films.

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuating prices of key raw materials such as polyethylene, polypropylene, and PVC create significant challenges for shrink film producers. These polymers are highly dependent on crude oil prices, which remain unstable due to geopolitical tensions and supply dynamics. Cost volatility affects profit margins and compels manufacturers to frequently adjust pricing strategies, impacting customer relationships and long-term contracts. Supply chain disruptions, including delays in resin availability, transportation inefficiencies, and global trade uncertainties, further complicate production planning. Companies must adopt robust procurement strategies, diversify suppliers, and invest in material-efficient formulations to mitigate these risks.

Regional Analysis

North America

North America holds around 32% of the global plastic shrink wrap market, driven by strong demand from food packaging, pharmaceuticals, and large-scale retail distribution networks. The region benefits from advanced logistics operations, high adoption of automated pallet wrapping systems, and a well-established e-commerce ecosystem. Manufacturers invest heavily in recyclable and downgauged polyethylene shrink films to meet sustainability expectations. The United States leads consumption, supported by extensive warehousing and cold-chain infrastructure. Consistent growth in bulk packaging applications across beverages, industrial goods, and consumer products continues to strengthen the region’s position in the global market.

Europe

Europe accounts for roughly 27% of the market, supported by stringent packaging regulations, rising sustainability commitments, and a strong emphasis on recyclable mono-material shrink films. Countries such as Germany, the U.K., and France lead demand across food processing, FMCG, and industrial sectors. The region’s advanced manufacturing landscape, combined with strong adoption of eco-friendly PE shrink films, drives continuous innovation. Increasing replacement of PVC with recyclable polymers further boosts market development. Growth is also supported by expanding retail chains, improved supply chain efficiency, and rapid automation across distribution centers, particularly in Western and Central Europe.

Asia-Pacific

Asia-Pacific dominates the global market with approximately 34% share, driven by large-scale manufacturing activity, growing urban consumption, and rapid expansion of retail and e-commerce sectors. China, India, Japan, and Southeast Asia significantly boost demand for cost-efficient, lightweight shrink films used in food packaging, consumer goods, and industrial transit protection. Increasing infrastructure development and rising exports strengthen palletization and bulk-wrap applications. The region also benefits from abundant raw material availability and expanding production capacities for PE and PP shrink films. Continuous investment in packaging automation and rising preference for durable, high-performance films further accelerate regional growth.

Latin America

Latin America represents about 4% of the plastic shrink wrap market, driven by rising consumption of packaged foods, beverages, and pharmaceuticals. Brazil and Mexico account for the majority of demand, supported by expanding retail chains and improving industrial logistics. Shrink wrap is widely adopted for pallet stabilization, multipack beverage bundling, and protective wrapping in export-oriented industries. Despite moderate growth, economic fluctuations and limited automation in packaging processes restrain faster expansion. However, increasing adoption of polyethylene-based recyclable films and gradual improvements in supply chain infrastructure continue to create steady opportunities in the region.

Middle East & Africa

The Middle East & Africa region holds nearly 3% of the global market, with demand primarily concentrated in the Gulf countries, South Africa, and emerging industrial hubs across East Africa. Shrink wrap is widely used in beverage bottling, construction materials, and consumer goods distribution. The region benefits from expanding manufacturing activities and improving logistics networks, particularly ports and free-trade zones. While growth remains steady, reliance on imported raw materials and limited recycling infrastructure pose constraints. However, rising investments in industrial packaging and increasing retail modernization are expected to support gradual market expansion.

Market Segmentations:

By Type

- Stretch Films

- Shrink Films

- Metallized Films

- Twist Film

- Release Film

- Twist Rope

- Others

By Material

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Ethylene Vinyl Alcohol Copolymer (EVOH)

- Ethylene-Vinyl Acetate (EVA)

- Nylon

- Others

By Feature

- Moisture Proof

- Water Soluble

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The plastic shrink wrap market features a moderately consolidated competitive landscape, with global manufacturers and regional converters competing on material innovation, cost efficiency, and sustainable product offerings. Leading companies focus on expanding polyethylene-based recyclable shrink films, downgauged high-strength films, and multilayer structures engineered for improved clarity, sealability, and load stability. Key players strengthen their position through strategic acquisitions, capacity expansions, and technological investments in advanced extrusion and printing systems. Many manufacturers collaborate with FMCG brands, beverage companies, and logistics providers to tailor application-specific film solutions that enhance performance across automated wrapping lines. Sustainability remains a defining competitive factor, prompting companies to increase the use of recycled content, develop mono-material shrink films compatible with existing recycling streams, and adopt energy-efficient production processes. Regional converters compete by offering customized, cost-effective films with faster delivery capabilities, enabling them to serve localized packaging and distribution needs effectively.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Four Star Plastics (U.S.)

- Polyvinyl Films, Inc. (U.S.)

- AVPack Plastic Manufacturers (South Africa)

- ChicWrap (U.S.)

- Polywrap India (India)

- The Clorox Company (U.S.)

- Shenzhen Chengxing Packing & Material Co. Ltd (China)

- AMERICAN Mfg COMPANY (U.S.)

- Coveris (U.K.)

Recent Developments

- In September 2025 (Sept 4), the company Coveris (U.K.) showcased its recyclable MonoFlex range at PATS UK 2025 for pet-food packaging

- In April 2024 (April 2), the company The Clorox Company (U.S.) — spotlighted a suite of sustainable packaging innovations during Earth Month 2024, including lighter-weight packaging and increased recyclable content.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Feature and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward recyclable and mono-material shrink films to meet global sustainability targets.

- Demand for high-strength downgauged films will rise as industries focus on reducing material consumption.

- Automation in pallet wrapping and packaging lines will accelerate adoption of machine-grade shrink films.

- E-commerce growth will continue to boost usage of stretch and shrink films for secure transit packaging.

- Food and beverage manufacturers will expand reliance on shrink films for multipack bundling and extended shelf-life protection.

- Innovations in resin formulations will enhance puncture resistance, clarity, and load stability.

- Manufacturers will adopt more energy-efficient extrusion technologies to optimize production costs.

- Regional converters will expand capacity to meet rising local demand and shorten delivery cycles.

- Regulatory pressure on single-use plastics will push companies to adopt recyclable and reduced-plastic alternatives.

- Growing industrialization in Asia-Pacific and Africa will create new opportunities for bulk and pallet packaging applications.