Market overview

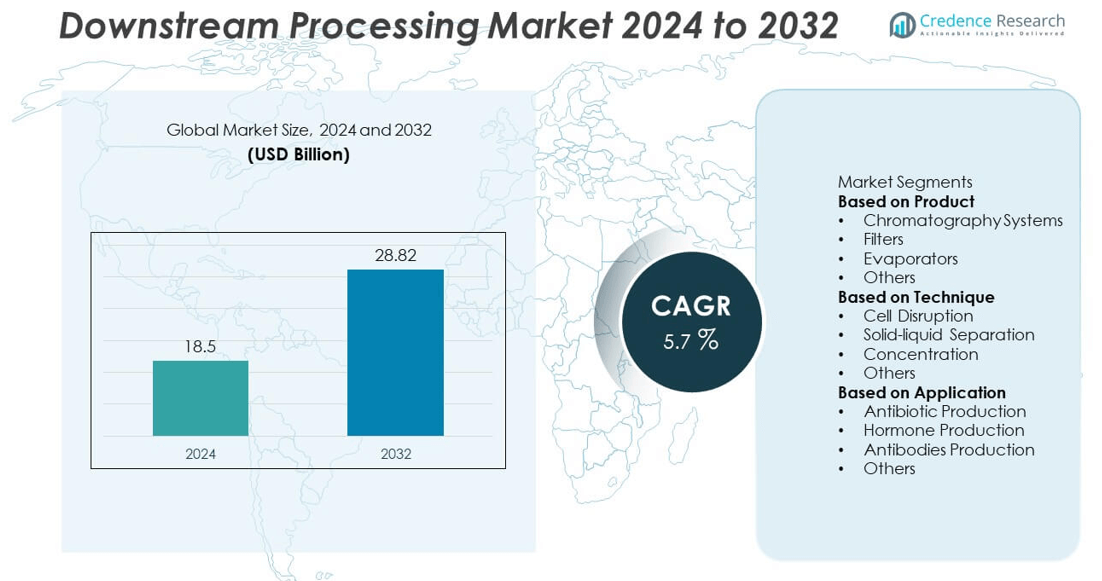

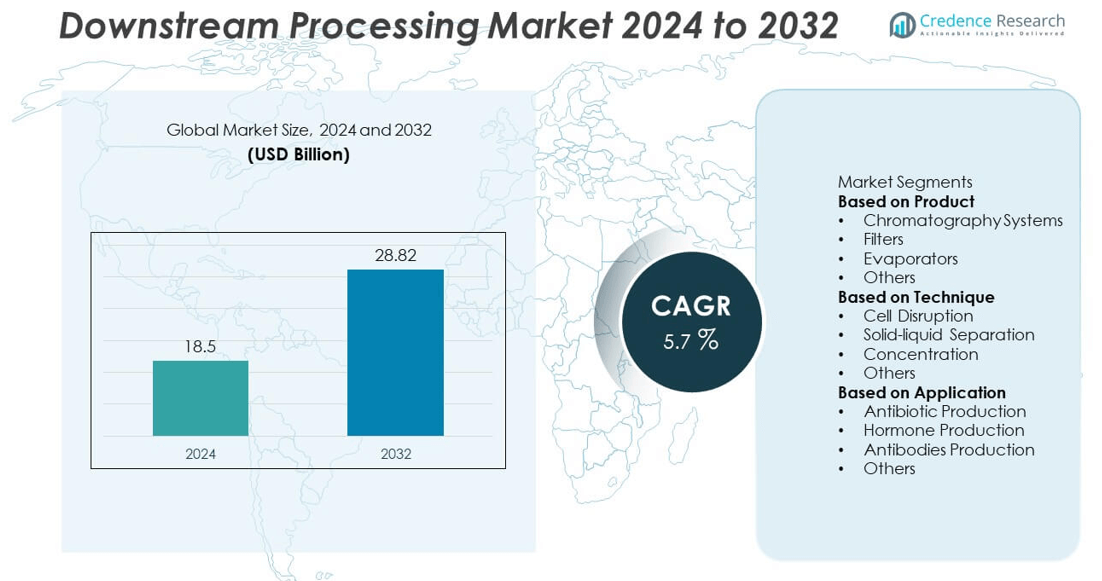

The Downstream Processing market was valued at USD 18.5 billion in 2024 and is projected to reach USD 28.82 billion by 2032, expanding at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Downstream Processing Market Size 2024 |

USD 18.5 billion |

| Downstream Processing Market, CAGR |

5.7% |

| Downstream Processing Market Size 2032 |

USD 28.82 billion |

The downstream processing market is led by major companies such as Lonza Group Ltd, Repligen, 3M Company, Eppendorf AG, Sartorius Stedim Biotech S.A, Corning Corporation, Danaher, Merck KGaA, Dover Corporation, and Thermo Fisher Scientific Inc. These players dominate through strong product portfolios covering chromatography systems, filtration technologies, and integrated bioprocess solutions. North America leads the global market with a 38% share, supported by advanced biopharmaceutical infrastructure and continuous technology innovation. Europe follows with 30%, driven by biosimilar production and automation adoption, while Asia-Pacific holds 24%, emerging as the fastest-growing region due to expanding vaccine and antibody manufacturing capacity.

Market Insights

- The downstream processing market was valued at USD 18.5 billion in 2024 and is projected to reach USD 28.82 billion by 2032, growing at a CAGR of 5.7%.

- Increasing production of biopharmaceuticals, monoclonal antibodies, and vaccines drives strong demand for advanced purification and filtration technologies.

- The market trends highlight rapid adoption of single-use systems, automation, and continuous bioprocessing for improved efficiency and scalability.

- Key players such as Lonza Group Ltd, Sartorius Stedim Biotech S.A, and Thermo Fisher Scientific Inc. lead through innovation and global manufacturing expansion.

- North America holds a 38% share, followed by Europe at 30% and Asia-Pacific at 24%, while chromatography systems lead the product segment with a 41% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The chromatography systems segment dominated the downstream processing market in 2024 with a 41% share. Chromatography remains essential for purifying biologics, monoclonal antibodies, and vaccines with high precision and yield. Its strong adoption across biopharmaceutical manufacturing and contract research organizations drives growth. Advancements in high-pressure liquid chromatography and automated purification systems enhance throughput and reduce processing time. Filters accounted for a significant secondary share due to rising demand for sterile filtration in vaccine production. The need for efficient separation and purification in large-scale biologics manufacturing continues to propel this segment.

- For instance, Sartorius offers the Octet Bio-Layer Interferometry (BLI) platform, which uses real-time, label-free analysis to measure biomolecular interactions. The Octet RH96 system, a high-throughput model, can analyze up to 96 samples simultaneously.

By Technique

The solid-liquid separation segment led the market in 2024 with a 37% share. This dominance is attributed to its critical role in removing cell debris and clarifying fermentation broth before purification steps. Centrifugation and membrane-based separation technologies are widely deployed in large bioprocess facilities to ensure high-quality output. Growing demand for automation and continuous bioprocessing has further supported adoption. Cell disruption techniques follow closely, driven by their importance in extracting intracellular proteins. The shift toward high-efficiency, closed-loop separation systems enhances process consistency and operational efficiency across biopharmaceutical production.

- For instance, Repligen Corporation commercialized its XCell® ATF 10 alternating tangential flow system, installed in over 450 biomanufacturing plants worldwide. The unit processed up to 2,500 liters of cell culture per batch, improving clarification and harvest yield in continuous processing setups while maintaining cell viability above 98% during perfusion-based production cycles.

By Application

The antibodies production segment held the largest share of 46% in 2024. The rising prevalence of chronic diseases and increasing use of monoclonal antibodies in targeted therapies have accelerated demand. Pharmaceutical companies are expanding production capacities for therapeutic antibodies, driving investment in advanced purification and filtration systems. Downstream processes optimized for antibody recovery and purity are crucial for regulatory compliance and commercial success. Antibiotic and hormone production applications also showed steady growth, supported by modernization of biomanufacturing plants and the need for high-yield, contamination-free processing environments.

Key Growth Drivers

Rising Biopharmaceutical Production

The rapid expansion of the biopharmaceutical industry is a major driver of the downstream processing market. Increasing production of monoclonal antibodies, recombinant proteins, and vaccines fuels demand for advanced purification and separation technologies. Companies are scaling up manufacturing capacities to meet growing healthcare needs. This surge in biologics manufacturing requires efficient downstream processes to ensure product purity and regulatory compliance. The trend is further strengthened by increasing investments in biologics R&D and growing global approvals of biosimilar drugs.

- For instance, Lonza Group Ltd is constructing a new large-scale mammalian drug substance facility in Visp, Switzerland, which will expand its capacity with six 20,000L bioreactors dedicated to producing biologics, including monoclonal antibodies.

Advancements in Chromatography and Filtration Technologies

Technological progress in chromatography systems and filtration methods is driving market growth. Modern single-use and continuous chromatography solutions enhance yield, reduce contamination, and cut operational costs. Membrane filtration systems are increasingly replacing traditional methods due to faster processing times and improved scalability. These innovations support flexible bioprocessing and align with regulatory standards. The growing shift toward automated and digitalized purification systems enables real-time monitoring and process optimization, making downstream operations more efficient and cost-effective for large-scale biologics production.

- For instance, Merck KGaA introduced its Pellicon® Capsule with Ultracel® Membrane designed for single-use tangential flow filtration in GMP environments. The unit achieved processing volumes up to 1,200 liters per cycle, reducing buffer consumption by 35% and enabling scalability from 2 to 500 liters of feed stream. This innovation streamlined high-purity protein concentration workflows in both clinical and commercial bioprocessing applications.

Growing Demand for Monoclonal Antibodies and Vaccines

The rising global use of monoclonal antibodies and therapeutic vaccines significantly boosts the downstream processing market. Biopharma firms are investing heavily in scalable purification systems to meet demand for high-quality biologics. The pandemic-driven expansion of vaccine manufacturing accelerated innovation in filtration and separation systems. Additionally, the shift toward personalized and precision medicine requires improved purification workflows. The increasing number of approvals for antibody-based treatments and recombinant vaccines continues to create strong growth opportunities for downstream processing equipment and consumables.

Key Trends & Opportunities

Adoption of Continuous and Single-Use Bioprocessing

Continuous and single-use bioprocessing technologies are transforming downstream operations. These systems minimize cross-contamination, reduce cleaning requirements, and improve flexibility in small-batch production. Pharmaceutical manufacturers favor them for faster turnaround times and cost efficiency. Single-use technologies enable seamless scaling for clinical and commercial production, supporting biopharma’s shift toward flexible manufacturing. As more companies integrate these systems, the downstream processing market is expected to gain efficiency and sustainability benefits, aligning with global initiatives for greener, modular biomanufacturing facilities.

- For instance, Thermo Fisher Scientific Inc. offers the HyPerforma™ DynaDrive single-use bioreactor system, with models available up to 5,000 liters, which supports high-density cell cultures and offers superior performance compared to legacy single-use systems.

Integration of Automation and Digitalization

Automation and digital tools are increasingly integrated into downstream processing to enhance precision and productivity. Advanced analytics, sensors, and process control software allow real-time monitoring of purification and filtration systems. This ensures consistent product quality and compliance with regulatory standards. Digital twins and AI-based process optimization are emerging trends improving yield prediction and operational control. The growing adoption of Industry 4.0 frameworks in biopharmaceutical manufacturing presents new opportunities for smart, data-driven downstream workflows.

- For instance, Danaher Corporation, through its subsidiary Cytiva, utilizes digital bioprocessing solutions that incorporate AI and digital twin technologies. These tools are used in biomanufacturing to enable predictive operations and optimize processes for speed, efficiency, and yield across operations like chromatography and filtration.

Key Challenges

High Capital Investment and Operating Costs

Implementing downstream processing systems involves significant capital expenditure. Equipment such as chromatography columns, filtration units, and bioreactors require substantial investment. Additionally, operating costs remain high due to consumables, maintenance, and skilled labor requirements. Small and mid-sized biopharma firms often face financial constraints in adopting advanced purification systems. Balancing cost efficiency while maintaining high-quality output remains a persistent challenge, driving the need for more affordable, scalable downstream technologies that ensure long-term operational sustainability.

Process Complexity and Product Loss

Downstream processing involves multiple purification and separation steps, often leading to material loss and reduced yield. Maintaining product integrity throughout filtration, concentration, and drying stages requires precise process control. Inadequate optimization can cause contamination or yield fluctuations, impacting commercial viability. Complex biologics like antibodies and vaccines demand highly controlled environments and continuous process validation. Overcoming these technical challenges requires advancements in integrated system design and robust automation solutions to enhance reproducibility and minimize product wastage.

Regional Analysis

North America

North America held the largest share of 38% in the downstream processing market in 2024. The region’s leadership is driven by strong biopharmaceutical production, advanced R&D infrastructure, and favorable regulatory frameworks. The U.S. dominates due to high biologics demand, significant FDA approvals, and the presence of leading companies investing in continuous and single-use technologies. Rising adoption of advanced purification systems in large biomanufacturing facilities supports market expansion. Canada also contributes through increasing investments in vaccine and antibody manufacturing, supported by public–private collaborations to enhance biologics production efficiency.

Europe

Europe accounted for 30% of the global downstream processing market in 2024. Strong government support for biotechnology innovation and established pharmaceutical infrastructure fuel regional growth. Countries such as Germany, Switzerland, and the U.K. lead in implementing advanced purification and filtration technologies. The growing focus on biosimilars and personalized medicine strengthens the region’s biomanufacturing base. European biopharma companies are increasingly investing in automation and sustainable processing technologies. The region’s strict regulatory environment ensures high-quality biologics production, further enhancing its competitive advantage in downstream processing solutions.

Asia-Pacific

Asia-Pacific captured a 24% share of the downstream processing market in 2024, emerging as the fastest-growing region. Rapid expansion of biopharmaceutical manufacturing in China, India, South Korea, and Japan drives demand for efficient purification technologies. Government initiatives promoting biotechnology and growing domestic production of vaccines and biosimilars strengthen market development. Increasing foreign investments and collaborations with Western biopharma firms accelerate technology transfer and process standardization. The rise of contract manufacturing organizations (CMOs) in the region also enhances production capacity and boosts adoption of advanced downstream systems.

Latin America

Latin America accounted for a 5% share of the downstream processing market in 2024. The market is growing steadily due to expanding pharmaceutical production and rising healthcare investments. Brazil and Mexico lead regional growth, supported by biomanufacturing projects focused on vaccine and recombinant protein production. Governments are promoting local biologics manufacturing to reduce import dependency. Partnerships with global biotech firms are improving process efficiency and product quality. However, limited technical expertise and high equipment costs still constrain faster adoption of advanced downstream processing systems.

Middle East & Africa

The Middle East & Africa region held a 3% share of the downstream processing market in 2024. Growth is supported by increasing focus on local vaccine production, biopharma research, and healthcare infrastructure development. Countries such as the United Arab Emirates and South Africa are investing in bioprocessing facilities to strengthen pharmaceutical self-sufficiency. Rising demand for affordable biologics and government-led biotechnology initiatives create emerging opportunities. However, limited skilled workforce and infrastructure challenges remain barriers. Gradual technology adoption and international collaborations are expected to accelerate regional participation in the global downstream processing sector.

Market Segmentations:

By Product

- Chromatography Systems

- Filters

- Evaporators

- Others

By Technique

- Cell Disruption

- Solid-liquid Separation

- Concentration

- Others

By Application

- Antibiotic Production

- Hormone Production

- Antibodies Production

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The downstream processing market is highly competitive, with leading players including Lonza Group Ltd, Repligen, 3M Company, Eppendorf AG, Sartorius Stedim Biotech S.A, Corning Corporation, Danaher, Merck KGaA, Dover Corporation, and Thermo Fisher Scientific Inc. These companies dominate through strong portfolios of chromatography systems, filtration solutions, and integrated bioprocessing platforms. Continuous innovations in single-use technologies, automated purification, and digital monitoring systems define the competitive dynamics. Major players focus on strategic acquisitions, capacity expansions, and collaborations to strengthen global reach and product offerings. For instance, firms are investing in advanced membrane technologies and modular systems to enhance process scalability and yield. The growing demand for high-purity biologics and biosimilars encourages partnerships between equipment manufacturers and biopharma producers. Competitive differentiation increasingly relies on process efficiency, regulatory compliance, and customized solutions tailored for large-scale and flexible biomanufacturing environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lonza Group Ltd

- Repligen

- 3M Company

- Eppendorf AG

- Sartorius Stedim Biotech S.A

- Corning Corporation

- Danaher

- Merck KGaA

- Dover Corporation

- Thermo Fisher Scientific Inc.

Recent Developments

- In August 2025, Lonza partnered with Excellos and Akadeum to integrate downstream / separation technologies (e.g. cell separation, purification) for advanced therapies within a modular workflow.

- In June 2025, Sartorius Stedim Biotech expanded its manufacturing and R&D capacities in Aubagne, France, nearly doubling cleanroom space and upgrading production lines for single-use bags used in fluid management and downstream operations.

- In November 2024, Sartorius Stedim Biotech opened a new Center for Bioprocess Innovation in Marlborough, USA, with labs supporting upstream and downstream process development and plans to equip two GMP suites for early clinical manufacturing

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Continuous bioprocessing will become the standard for large-scale biologics manufacturing.

- Adoption of single-use downstream systems will grow across small and mid-sized facilities.

- Automation and digital monitoring will enhance process efficiency and reduce human error.

- Demand for high-purity biologics and biosimilars will drive technology upgrades.

- Integration of AI and data analytics will support predictive process optimization.

- Chromatography and filtration innovations will focus on higher yield and reduced processing time.

- Emerging economies will expand local biopharmaceutical production capacity.

- Strategic partnerships between equipment suppliers and biopharma firms will increase.

- Sustainable processing technologies will gain priority to lower environmental impact.

- Regulatory alignment across regions will accelerate technology adoption and market expansion.