Market Overview:

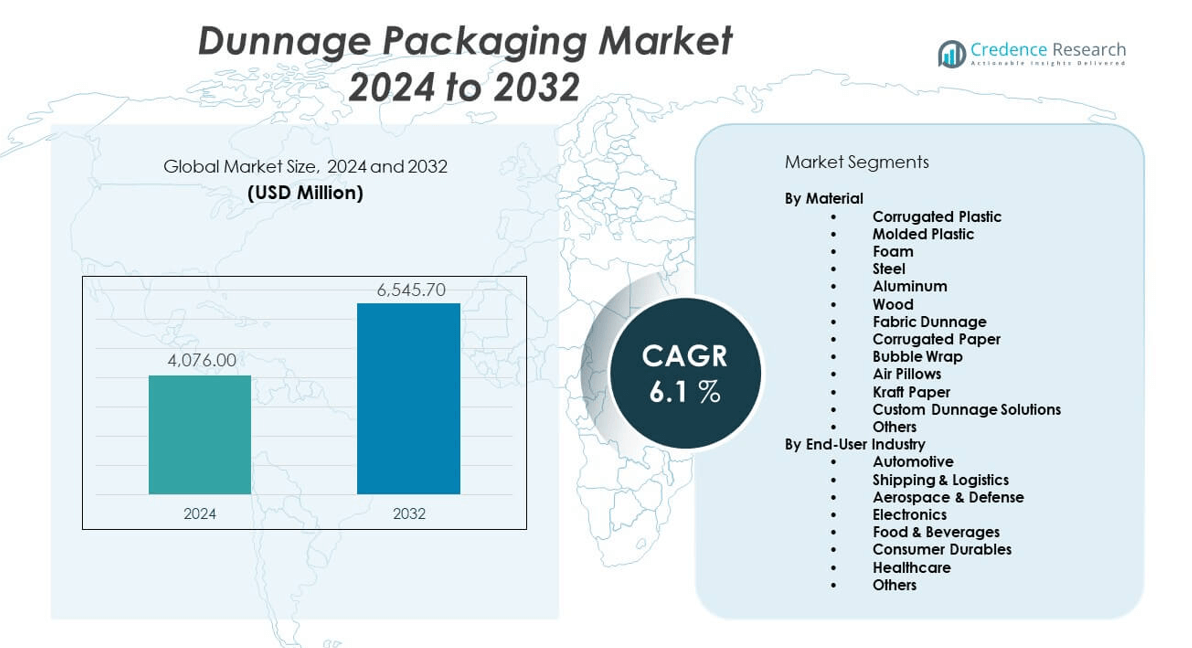

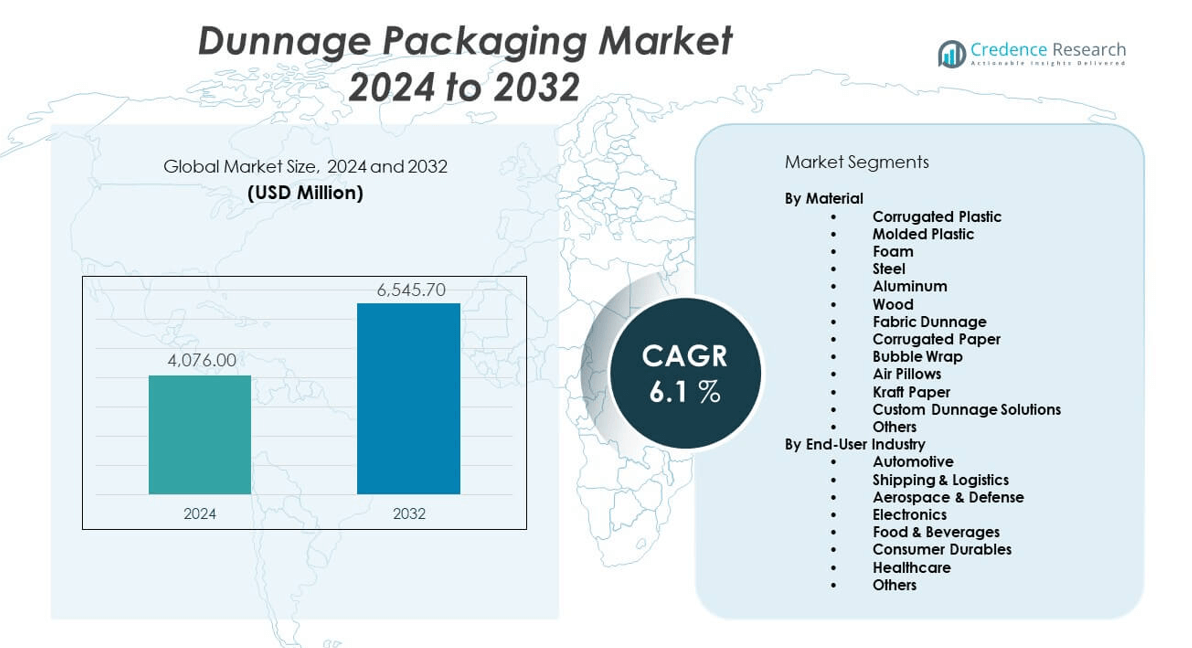

The Dunnage packaging market is projected to grow from USD 4,076 million in 2024 to an estimated USD 6,545.7 million by 2032, with a compound annual growth rate (CAGR) of 6.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dunnage Packaging Market Size 2024 |

USD 4,076 million |

| Dunnage Packaging Market, CAGR |

6.1% |

| Dunnage Packaging Market Size 2032 |

USD 6,545.7 million |

The market is expanding as manufacturers and logistics companies prioritize efficient product protection and sustainable packaging. Demand rises due to increased global trade, the need for cost-effective damage prevention during shipping, and growth in e-commerce. Innovation in materials, such as recyclable and biodegradable options, further supports market expansion. As supply chains become more complex, businesses adopt advanced dunnage solutions to reduce product loss and optimize transportation efficiency.

North America leads the dunnage packaging market, supported by its advanced logistics sector and high adoption of automated packaging systems. Europe also shows strong market presence due to sustainability regulations and growing focus on eco-friendly materials. The Asia Pacific region is emerging as a high-growth area, driven by rapid industrialization, expanding manufacturing bases, and a significant rise in cross-border e-commerce, especially in countries like China and India.

Market Insights:

- The Dunnage packaging market is projected to grow from USD 4,076 million in 2024 to USD 6,545.7 million by 2032, at a CAGR of 6.1%.

- Demand for dunnage packaging rises due to increased e-commerce activity and the need for efficient product protection in shipping.

- Companies focus on adopting sustainable and recyclable dunnage materials to meet regulatory and consumer expectations.

- High raw material costs and supply chain disruptions act as key restraints, impacting manufacturer profitability.

- North America leads the market, driven by advanced logistics networks and strong adoption of automation in packaging.

- Europe demonstrates robust growth, supported by strict sustainability regulations and eco-friendly packaging initiatives.

- Asia Pacific emerges as a high-growth region, propelled by rapid industrialization and expansion of cross-border e-commerce.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Product Protection and Supply Chain Optimization:

Companies across industries prioritize reliable protection for products during transit, fueling adoption of advanced dunnage solutions. The Dunnage packaging market gains momentum from heightened e-commerce activity and increasing global trade, as businesses need cost-effective ways to prevent damage and minimize returns. Manufacturers seek solutions that enhance operational efficiency and reduce transportation costs, supporting wider usage of tailored dunnage. The rise in just-in-time delivery models underscores the necessity of precision in packaging to maintain product integrity. Automation and supply chain digitalization create a favorable landscape for innovative packaging materials and configurations. Sustainability pressures accelerate the transition toward recyclable and reusable dunnage, driven by regulations and consumer preferences. Rapid industrialization in emerging economies creates new avenues for market penetration, with automotive, electronics, and FMCG sectors acting as key demand sources. The Dunnage packaging market continues to benefit from its essential role in safe, efficient, and sustainable product handling.

- For instance, Nefab collaborated with a global food industry leader to implement its EdgePak Straw dunnage solution, which doubled the number of boxes per sea container, reduced transportation costs by 56%, and cut CO2 emissions by 7%.

Technological Advancements and Material Innovation:

The Dunnage packaging market experiences a surge in technological integration as companies seek smarter solutions to enhance logistics performance. Adoption of digital tracking, RFID tags, and IoT-enabled dunnage products improves transparency and traceability. Customization becomes a standard expectation, with companies developing bespoke designs to address unique shipping challenges. It supports material innovation by facilitating lighter yet more durable options, which improve load efficiency without sacrificing protection. Research and development efforts yield eco-friendly alternatives, supporting broader sustainability goals. Regulations promoting circular economy principles prompt investment in reusable and returnable dunnage systems. Demand for packaging that aligns with automated storage and retrieval systems drives manufacturers to innovate. The market leverages these advancements to set new benchmarks in reliability and cost-efficiency.

- For instance, ORBIS Corporation recently introduced laminate-wrapped edge protection for its ORBIShield® dunnage, creating seamless, soft-edged components that improve worker safety and part protection. This technology has enabled the installation of custom dunnage in hand-held totes and bulk containers, reducing incidents of snags and scrapes, which is especially valuable in the automotive sector’s fast-paced supply chains.

Regulatory Pressures and Sustainable Practices:

Sustainability imperatives strongly influence the Dunnage packaging market, with governments enforcing regulations to reduce packaging waste and carbon footprint. Companies face mounting pressure to comply with standards targeting single-use plastics and landfill reduction. It responds by increasing the use of biodegradable, compostable, or recyclable materials in dunnage products. Regulatory scrutiny accelerates the adoption of green manufacturing processes and the development of life-cycle assessment tools. Consumer expectations for responsible sourcing further drive the shift toward transparent, ethical packaging practices. The market strengthens its value proposition by aligning product offerings with global sustainability initiatives. Collaborative partnerships between packaging suppliers and logistics providers advance circularity goals. These factors elevate the Dunnage packaging market as a model for regulatory compliance and sustainable operations.

Expansion of E-commerce and Global Supply Chains:

The global expansion of e-commerce accelerates the need for robust dunnage packaging solutions. E-retailers require reliable packaging to ensure customer satisfaction and minimize costly returns due to damage. Increased international trade and the complexity of cross-border logistics place a premium on protective solutions that withstand long shipping routes and variable conditions. The Dunnage packaging market responds by offering lightweight, adaptable systems that support diverse product categories. Multi-channel retail and direct-to-consumer models further drive demand for custom-fit packaging. Retailers and brands recognize the value of positive unboxing experiences, prompting investment in dunnage that balances protection with presentation. Strategic partnerships with third-party logistics providers create new growth channels. These trends reinforce the Dunnage packaging market’s position as a vital enabler in the modern supply chain.

Market Trends:

Circular Economy Initiatives Reshape Material Selection:

Circular economy frameworks significantly shape the Dunnage packaging market’s trajectory. Companies seek to close the loop by investing in materials that are both reusable and recyclable, which supports long-term sustainability targets. Manufacturers adopt closed-loop systems, collecting and reintroducing used dunnage into the production process. Interest grows in biodegradable options, especially among environmentally conscious brands seeking differentiation. It observes a shift from traditional foams to molded pulp, corrugated fiberboard, and other renewable materials. Collaboration with recycling partners enables end-of-life collection programs, enhancing environmental stewardship. Third-party certifications gain prominence, validating the market’s commitment to sustainable practices. Consumers and regulators increasingly scrutinize packaging life cycles, prompting proactive innovation. The Dunnage packaging market leverages these trends to establish leadership in responsible packaging.

- For instance, Nefab facilitated the recovery and reintegration of 2.1 million lbs of polypropylene resin, eliminating 123,000 transportation miles and cutting 1,006 tons of CO2 emissions. Both initiatives resulted in nearly 50% reductions in packaging costs for the client.

Smart Packaging Technologies Transform Supply Chain Management:

Adoption of smart packaging technologies marks a key trend in the Dunnage packaging market. RFID tags, QR codes, and IoT-enabled sensors integrate with dunnage systems to provide real-time data on product location, handling, and environmental conditions. It allows companies to monitor shipments, ensure compliance, and optimize logistics in response to evolving demands. Smart dunnage solutions enhance visibility and transparency, reducing theft and improving accountability. Investments in digital twins and predictive analytics enable precise tracking of dunnage asset utilization. Integration with warehouse management systems and logistics platforms accelerates the move toward data-driven decision-making. Stakeholders benefit from improved efficiency and reduced loss rates. The trend fosters a culture of continuous improvement and resilience. The Dunnage packaging market sets a benchmark for digital transformation in packaging.

- For instance, UFP Packaging launched the U-Loc 200, a patent-pending crate fastener system that eliminates the need for tools such as nail and staple guns—devices associated with approximately 37,000 annual emergency room visits.

Growth of Customization and Industry-Specific Solutions:

Rising complexity in global supply chains increases demand for customized dunnage solutions tailored to specific products and sectors. The Dunnage packaging market introduces advanced design tools and simulation software, enabling precise engineering for diverse applications. Automotive, electronics, and pharmaceutical companies request bespoke dunnage that matches product dimensions, fragility, and regulatory requirements. It facilitates the creation of modular and scalable systems adaptable to changing needs. Companies prioritize solutions that offer quick assembly and disassembly, supporting just-in-time manufacturing. The market expands value-added services, including design consultation and prototyping. Customer-centric approaches enhance satisfaction and loyalty. Partnerships with OEMs and logistics providers accelerate the rollout of industry-specific innovations. These factors solidify the market’s role in delivering tailored protection.

Rise of Automation-Compatible and Lightweight Solutions:

Industrial automation drives the development of dunnage packaging compatible with automated storage, retrieval, and material handling systems. The market shifts toward lightweight options that minimize shipping costs while maintaining durability. Materials such as expanded polypropylene (EPP) and corrugated plastics gain traction due to their resilience and ease of handling. It aligns with manufacturing trends favoring robotics and high-throughput distribution centers. Standardization of dunnage dimensions supports seamless integration with conveyor belts, robotic pickers, and automated guided vehicles. Focus on ergonomics improves worker safety during manual handling. The Dunnage packaging market recognizes opportunities to streamline warehouse operations and optimize logistics networks. These trends shape the next generation of efficient, automation-ready packaging systems.

Market Challenges Analysis:

Managing Cost Pressures and Material Volatility:

Manufacturers in the Dunnage packaging market face significant cost pressures due to fluctuating prices of raw materials such as plastics, paper, and specialty foams. Sourcing sustainable and high-quality materials often leads to increased expenses, impacting profitability. Supply chain disruptions and geopolitical factors contribute to uncertainties in material availability and pricing. Companies must balance the adoption of eco-friendly materials with the need to maintain competitive costs for customers. The trend toward customization, while beneficial for clients, increases complexity and operational expenses. It also requires continuous investment in research and technology, placing strain on smaller market players. Price-sensitive sectors like FMCG and automotive heighten the challenge of sustaining margins while meeting regulatory and customer expectations. The Dunnage packaging market addresses these issues by pursuing efficiency gains and exploring alternative sourcing strategies.

Addressing Sustainability Expectations and Regulatory Compliance:

Increasing regulatory requirements and consumer expectations for sustainability present ongoing challenges in the Dunnage packaging market. Governments worldwide enforce stricter standards on recyclability, waste reduction, and carbon emissions, requiring rapid adaptation from manufacturers. Meeting these mandates while maintaining product performance remains complex. Transitioning from traditional to sustainable materials demands significant investment in new technologies and supply chain processes. Companies must validate the environmental claims of their products to avoid greenwashing allegations. Certification processes introduce additional costs and operational requirements. Market fragmentation, with differing regulations across regions, complicates global compliance strategies. It must manage stakeholder pressure to demonstrate real progress on sustainability goals. These factors collectively challenge the industry’s ability to deliver both innovation and compliance efficiently.

Market Opportunities:

Expansion in Emerging Economies and New Industry Verticals:

Emerging economies present lucrative growth opportunities for the Dunnage packaging market, with industrialization and e-commerce expansion driving demand for advanced protective packaging. Companies in these regions seek cost-effective solutions to reduce product damage and improve supply chain efficiency. Rapid growth in automotive, electronics, and consumer goods manufacturing creates new revenue streams. It benefits from partnerships with local logistics providers who understand unique market needs. The ongoing digital transformation in these economies accelerates the adoption of innovative dunnage products. Government initiatives to modernize infrastructure support broader market reach. Companies able to localize production and distribution gain a strategic advantage. The Dunnage packaging market leverages these dynamics to capture new growth.

Product Innovation and Collaboration for Sustainability:

Opportunities abound for companies that invest in product innovation, focusing on lightweight, reusable, and recyclable dunnage solutions. Partnerships with material science firms enable the development of advanced composites and biodegradable options. It finds new applications in sectors prioritizing sustainability, such as pharmaceuticals and high-value electronics. Cross-industry collaborations foster shared expertise, speeding up the transition to greener packaging alternatives. Growing demand for circular economy solutions creates space for service-based business models, such as dunnage pooling and reuse platforms. Brand owners eager to showcase sustainability initiatives look for cutting-edge packaging partners. The Dunnage packaging market stands ready to capitalize on these opportunities through targeted innovation and collaboration.

Market Segmentation Analysis:

By Material:

The Dunnage packaging market covers a diverse range of materials, including corrugated plastic, molded plastic, foam, steel, aluminum, wood, fabric dunnage, corrugated paper, bubble wrap, air pillows, kraft paper, custom dunnage solutions, and other specialty materials such as glass, rubber, and anti-static products. Companies focus on offering tailored solutions that balance durability, weight, cost, and sustainability. Selection of material often depends on the end-use application and specific protection needs.

- For instance, DS Smith collaborated with Coca-Cola HBC Austria to design DS Smith Lift Up, a 100% recyclable corrugated handle that replaced plastic handles for 1.5L PET multi-packs, reducing around 200 tons of plastic annually while maintaining durability for heavy loads.

By End-User Industry:

The automotive sector represents the dominant end-user segment in the Dunnage packaging market, driven by stringent requirements for part protection and supply chain efficiency. Shipping & logistics, aerospace & defense, and electronics are also significant sectors, with electronics standing out as the fastest-growing segment due to increased global trade and the need for specialized, static-sensitive packaging. Other notable end-user industries include food & beverages, consumer durables, healthcare, and sectors such as construction, oil & lubricants, and chemicals.

- For instance, ORBIS Corporation developed precision rack dunnage trays for automotive manufacturers, supporting highly automated assembly lines with reusable designs. Through high-pressure injection molding and rapid prototyping, ORBIS delivers custom solutions—demonstrated by automotive clients’ ability to repeatedly reuse dunnage in just-in-time production environments, resulting in thousands of avoided part damages and cost savings across project lifecycles.

Segmentation:

By Material

- Corrugated Plastic

- Molded Plastic

- Foam

- Steel

- Aluminum

- Wood

- Fabric Dunnage

- Corrugated Paper

- Bubble Wrap

- Air Pillows

- Kraft Paper

- Custom Dunnage Solutions

- Others (e.g., glass, rubber, anti-static materials)

By End-User Industry

- Automotive

- Shipping & Logistics

- Aerospace & Defense

- Electronics

- Food & Beverages

- Consumer Durables

- Healthcare

- Others (e.g., construction, oil & lubricants, chemicals)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Market Leadership Driven by Advanced Logistics

North America holds the largest share in the Dunnage packaging market, accounting for approximately 35% of the global market. The region benefits from a well-established logistics infrastructure and widespread adoption of automation across supply chains. Strong e-commerce growth in the United States and Canada continues to drive demand for protective packaging solutions that ensure product safety and minimize returns. Manufacturers in North America invest in sustainable dunnage materials to meet rising regulatory and consumer expectations for eco-friendly solutions. Major market players in the region lead innovation in automated and reusable packaging. Government initiatives support the development of green logistics and recycling programs. The Dunnage packaging market in North America remains highly competitive and innovation-focused.

Europe: Sustainability and Compliance Fueling Market Expansion

Europe represents about 29% of the global Dunnage packaging market, supported by stringent environmental regulations and a mature packaging industry. The region places strong emphasis on recyclability and circular economy principles, which influences material selection and product design. Leading countries such as Germany, France, and the UK actively adopt biodegradable and returnable dunnage options. Companies in Europe align their strategies with EU directives targeting plastic reduction and landfill diversion. Investments in advanced manufacturing technologies enhance efficiency and support the region’s sustainability goals. The market benefits from high demand in automotive, electronics, and industrial sectors. It continues to grow steadily due to its commitment to regulatory compliance and environmental stewardship.

Asia Pacific: Rapid Growth in Manufacturing and E-Commerce

Asia Pacific commands approximately 27% market share in the Dunnage packaging market, positioning it as a key growth engine. Robust industrialization in China, India, Japan, and Southeast Asia fuels demand for cost-effective and reliable packaging. Expansion of cross-border e-commerce drives the need for advanced dunnage solutions that can handle diverse product categories and long shipping distances. Regional manufacturers focus on scaling operations and adopting innovative materials to improve competitiveness. Government investments in logistics infrastructure accelerate the market’s development. It benefits from a rising middle class and increasing consumer expectations for product quality and safe delivery. The region’s rapid economic growth and evolving supply chains support sustained market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ORBIS Corporation (Menasha Corporation)

- DS Smith

- Sonoco Products Company

- Corplex (DS Smith)

- NEFAB Group

- UFP Technologies, Inc.

- Reusable Transport Packaging

- Amatech Inc.

- Schoeller Allibert

- Myers Industries

- MJSolpac Ltd.

- Dordan Manufacturing Company, Inc.

- Packaging Corporation of America

- Ckdpack

- Buckhorn Inc.

Competitive Analysis:

The Dunnage packaging market is highly competitive, with leading players focusing on product innovation, sustainable materials, and customization to meet evolving industry demands. Major companies differentiate through investment in advanced manufacturing technologies and strategic collaborations with logistics providers and end-user industries. It exhibits a mix of established global firms and agile regional players, each leveraging unique capabilities to address specific application requirements. Innovation in recyclable and reusable dunnage continues to shape competitive positioning. Companies that align offerings with sustainability regulations and supply chain automation gain a strategic edge. The market sees frequent product launches and acquisitions, further intensifying competition and driving continuous improvement in value-added solutions.

Recent Developments:

- In June 2025, Sonoco Products Company announced the launch of a 100% paper-based can with a paper bottom, made from recycled fiber and up to 90% post-consumer materials. The all-paper container has passed stringent recyclability tests, supports circularity in packaging, and was quickly adopted in product launches by major brands. This innovative product earned the 2024 PAC Global Best in Class award for Sustainable Package Design – Package Circularity.

- In May 2025, UFP Technologies, Inc. reported strong Q1 growth and announced it had secured exclusive manufacturing rights with its second-largest customer. The company also expanded its operations in the Dominican Republic to support growing MedTech demand. UFP Technologies continues to pursue additional acquisitions to augment its capabilities and market reach, highlighting its commitment to both organic and strategic growth in engineered packaging solutions.

- In March 2025, NEFAB Group doubled its manufacturing capacity in Guadalajara, Mexico, by opening a new facility specializing in sustainable plastics packaging solutions for datacom, electronics, automotive, and battery sectors. The facility integrates design, production, and closed-loop recycling under one roof, emphasizing truly circular packaging solutions, including trays and cushioning with 100% recycled content incorporated from the start. The site is expected to employ 50 people when fully operational.

- In February 2025, International Paper completed its landmark acquisition of DS Smith, creating what is now considered the world’s leading sustainable packaging company. The unified entity is jointly headquartered in Memphis and London and is positioned with a differentiated global footprint and comprehensive suite of sustainable packaging products and services. DS Smith shareholders now own about one-third of the combined company, and operational synergies are expected to yield over $500 million in cash savings within four years.

Market Concentration & Characteristics:

The Dunnage packaging market demonstrates moderate to high market concentration, with a handful of global leaders controlling significant shares. It features a strong focus on sustainability, customization, and rapid innovation, driven by changing regulatory landscapes and the diverse needs of automotive, electronics, and logistics sectors. The presence of both large multinational corporations and specialized regional suppliers encourages innovation and competitive pricing, fostering a dynamic market environment.

Report Coverage:

The research report offers an in-depth analysis based on material type, end-user industry, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable dunnage solutions will drive material innovation and adoption of recyclable options.

- Digital transformation will boost integration of smart tracking technologies into dunnage products.

- Expansion in emerging markets will create new growth opportunities across industries.

- E-commerce and cross-border trade will remain key growth drivers for protective packaging.

- Regulatory changes will accelerate the shift toward biodegradable and reusable dunnage.

- Automation in warehouses and logistics will fuel demand for lightweight, standardized solutions.

- Partnerships and M&A will intensify as companies seek scale and global reach.

- Product customization for automotive and electronics sectors will increase market value.

- Green certifications and supply chain transparency will become critical for market access.

- Continued focus on operational efficiency will influence product design and material selection.