| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Commercial Vehicle Battery Market Size 2024 |

USD 16,755.73 Million |

| Electric Commercial Vehicle Battery Market, CAGR |

11.24% |

| Electric Commercial Vehicle Battery Market Size 2032 |

USD 41,683.10 Million |

Market Overview

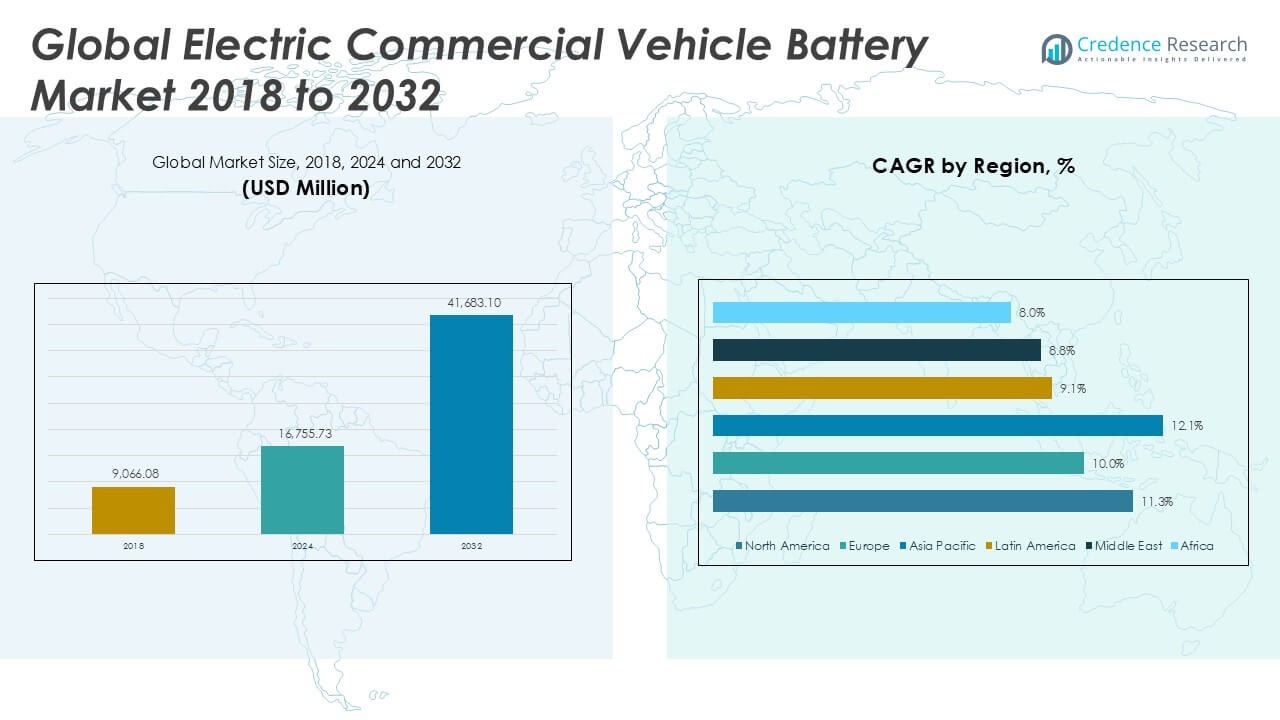

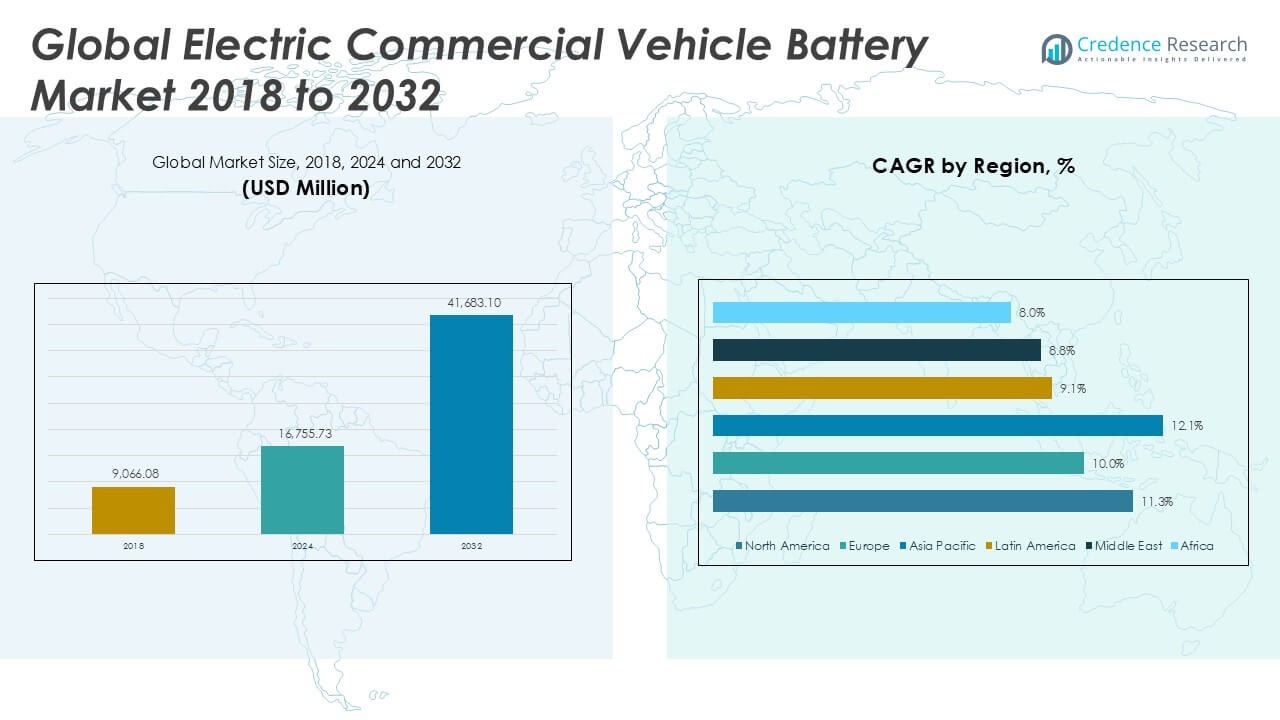

The Electric Commercial Vehicle Battery Market was valued at USD 9,066.08 million in 2018, grew to USD 16,755.73 million in 2024, and is anticipated to reach USD 41,683.10 million by 2032, reflecting a compound annual growth rate (CAGR) of 11.24% during the forecast period.

The Electric Commercial Vehicle Battery Market is experiencing robust growth due to increasing demand for zero-emission transportation, supported by stringent environmental regulations and ambitious government initiatives promoting fleet electrification. The rapid expansion of e-commerce and urban logistics has intensified the need for electric commercial vehicles, driving investments in advanced battery technologies that offer higher energy density, longer range, and faster charging capabilities. Market players are focusing on cost reduction, improved battery lifespan, and enhanced safety features to meet the evolving requirements of commercial operators. Additionally, trends such as the integration of smart battery management systems and second-life battery applications are gaining momentum, further optimizing fleet operations and sustainability. As charging infrastructure expands and battery recycling technologies advance, the market is set to witness continued innovation and adoption, positioning electric commercial vehicle batteries as a critical enabler of the global shift toward sustainable and efficient commercial transportation.

The Electric Commercial Vehicle Battery Market demonstrates dynamic growth across major regions, led by Asia Pacific, North America, and Europe. Asia Pacific stands out due to robust demand from China, Japan, and South Korea, where government incentives, large-scale fleet electrification projects, and battery manufacturing capacity drive adoption. North America and Europe benefit from strong regulatory support, urban clean transport initiatives, and investments in charging infrastructure, supporting increased deployment in logistics, public transit, and last-mile delivery. The market’s competitive landscape features prominent players such as Contemporary Amperex Technology Co. Ltd. (CATL), BYD Company Ltd., and LG Energy Solution Ltd., each known for innovation, diverse product portfolios, and global supply networks. These leading companies collaborate with automakers and commercial fleet operators to advance battery technology, streamline supply chains, and accelerate the shift toward sustainable transportation solutions in the commercial vehicle sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Commercial Vehicle Battery Market was valued at USD 9,066.08 million in 2018, reached USD 16,755.73 million in 2024, and is projected to achieve USD 41,683.10 million by 2032, registering a CAGR of 11.24% during the forecast period.

- Rising demand for zero-emission commercial transport, supported by regulatory mandates and government incentives, is a primary driver behind market expansion.

- Advancements in battery technology, including higher energy density, improved lifespan, and rapid charging solutions, are shaping fleet operator preferences and expanding applications in long-haul and urban logistics.

- The market is witnessing strong collaboration among battery manufacturers, vehicle makers, and technology firms, with leading players such as CATL, BYD, and LG Energy Solution focusing on innovation and global supply chain integration.

- High initial investment, raw material price volatility, and supply chain complexities restrain faster adoption, particularly among smaller fleet operators and in regions with limited infrastructure.

- Asia Pacific leads in adoption due to robust manufacturing capacity and aggressive government policies, while North America and Europe follow with regulatory support and infrastructure investment; Latin America, the Middle East, and Africa show emerging potential.

- Regional disparities in charging infrastructure, regulatory frameworks, and local manufacturing impact the pace and scale of electric commercial vehicle battery deployment worldwide.

Market Drivers

Rising Regulatory Pressure and Environmental Mandates Drive Market Expansion

Government regulations targeting carbon emissions and air quality improvement have become key catalysts for the Electric Commercial Vehicle Battery Market. Strict emission standards, coupled with city-level bans on diesel vehicles, compel fleet operators and manufacturers to adopt electric alternatives. Policymakers across North America, Europe, and Asia-Pacific offer generous incentives, tax breaks, and subsidies to accelerate commercial vehicle electrification. These measures reduce upfront investment barriers and improve long-term cost competitiveness. Cities focus on building low-emission zones and setting electrification targets, motivating logistics providers and public transport agencies to invest in battery-powered fleets. The regulatory momentum ensures sustained demand for high-performance batteries that comply with evolving standards.

- For instance, BYD Company delivered over 1,800 electric buses to Colombia’s capital Bogotá, one of the largest single-city electric bus fleets globally.

Advancements in Battery Technology Fuel Performance and Cost Improvements

Continuous research and innovation in battery chemistry and manufacturing processes elevate the performance profile of electric commercial vehicles. Lithium-ion and next-generation solid-state batteries deliver higher energy density, lighter weight, and extended range, making them suitable for long-haul and urban delivery applications. Manufacturers deploy advanced battery management systems for improved safety, thermal control, and operational efficiency. Cost per kilowatt-hour continues to decline due to economies of scale and breakthroughs in material science. These improvements make electric commercial vehicles viable for a broader range of applications, propelling the Electric Commercial Vehicle Battery Market forward. The industry’s focus on battery durability and rapid charging solutions further attracts commercial operators.

- For instance, CATL’s Qilin Battery achieved a record-breaking energy density of 255 Wh/kg and powers commercial vehicles such as Zeekr’s 001 with a range of up to 1,000 kilometers on a single charge.

Growth of E-Commerce and Last-Mile Delivery Accelerates Battery Demand

The rapid expansion of e-commerce platforms and urban logistics networks stimulates investment in electric commercial vehicle fleets. Delivery companies and retailers require reliable, low-emission vehicles to meet customer expectations for same-day and next-day shipping. Batteries that provide longer operational hours between charges and support fast-charging infrastructure become essential for minimizing downtime. It addresses the operational challenges of high-frequency, stop-and-go routes common in urban centers. Fleet operators prioritize battery technologies with proven track records in range, longevity, and safety. The Electric Commercial Vehicle Battery Market benefits from this structural shift in retail and distribution patterns.

Charging Infrastructure Expansion and Circular Economy Initiatives Support Market Growth

Public and private sector investments in fast-charging networks and depot charging facilities have removed key obstacles to widespread electric fleet adoption. Battery manufacturers and utilities collaborate to ensure reliable grid integration and charging availability for commercial users. Circular economy initiatives such as battery recycling and second-life applications enhance the sustainability profile of electric fleets. These programs create new value streams and reduce total cost of ownership for fleet operators. The Electric Commercial Vehicle Battery Market capitalizes on infrastructure development and sustainability commitments, positioning battery solutions at the core of next-generation commercial mobility strategies.

Market Trends

Integration of Advanced Battery Management Systems Enhances Operational Efficiency

Smart battery management systems (BMS) are gaining traction within the Electric Commercial Vehicle Battery Market, with manufacturers and fleet operators prioritizing real-time data and predictive analytics. The latest BMS platforms enable proactive maintenance, early fault detection, and improved safety, which directly reduces vehicle downtime and total cost of ownership. Data-driven monitoring optimizes energy use, extending both daily range and overall battery lifespan. Integration with telematics platforms provides operators with granular insights into charging patterns, usage habits, and battery health. It enables fleet managers to make informed decisions on deployment and maintenance schedules. The focus on intelligent battery control is shaping procurement preferences and operational standards for commercial fleets.

- For instance, LG Energy Solution introduced a BMS capable of monitoring over 500 data points per second, significantly improving diagnostic accuracy and battery longevity for commercial vehicle clients.

Second-Life Battery Applications and Recycling Initiatives Gain Momentum

Second-life battery programs and comprehensive recycling initiatives are emerging as a major trend in the Electric Commercial Vehicle Battery Market, aligning with global sustainability goals. Companies are repurposing used batteries for stationary energy storage, extending the value chain beyond vehicle applications. Battery recycling infrastructure is expanding, driven by regulatory mandates and the need to recover valuable raw materials such as lithium, nickel, and cobalt. It reduces environmental impact and helps stabilize long-term battery supply. Leading market players invest in closed-loop systems, integrating end-of-life battery management into their business models. These initiatives create new revenue streams while supporting environmental responsibility.

- For instance, Panasonic operates a recycling facility in Japan capable of processing 3,000 tons of lithium-ion batteries annually, recovering high-value metals for reuse in new battery production.

Collaborations Across the Value Chain Strengthen Innovation and Scale

Strategic collaborations between automakers, battery producers, charging solution providers, and technology firms are shaping the innovation landscape in the Electric Commercial Vehicle Battery Market. Joint ventures and technology-sharing agreements accelerate product development and standardize charging interfaces, benefitting end users with interoperable solutions. These partnerships reduce development costs, increase production scale, and facilitate rapid market entry for new battery technologies. It also enables faster deployment of charging networks and integration with smart grid infrastructure. The market is experiencing increased investment in research and co-development projects, positioning collaboration as a cornerstone of industry progress.

Growth in High-Capacity and Fast-Charging Solutions Transforms Fleet Operations

Fleet operators and vehicle manufacturers are demanding batteries with higher capacity and rapid charging features to improve turnaround times and maximize asset utilization. The Electric Commercial Vehicle Battery Market is seeing the introduction of battery packs supporting ultra-fast charging, enabling commercial vehicles to recharge during short breaks and resume operations quickly. Higher energy density cells are allowing for longer ranges, meeting the needs of intercity transport and logistics applications. It supports continuous operations with less reliance on frequent charging stops. Adoption of high-voltage architectures is further driving advances in charging speeds, helping commercial fleets achieve greater efficiency and cost savings.

Market Challenges Analysis

High Initial Costs and Supply Chain Constraints Impact Market Scalability

The Electric Commercial Vehicle Battery Market faces significant challenges related to the high upfront costs of battery packs and supporting technology. Capital expenditures required for large-scale fleet electrification often strain the budgets of logistics providers and public transport agencies. Fluctuations in the prices of critical raw materials such as lithium, cobalt, and nickel introduce volatility into production costs and affect long-term planning. It complicates procurement strategies and can slow the adoption pace for smaller operators. Complex and sometimes fragmented supply chains can lead to delays in battery delivery, impacting vehicle rollout schedules. The need for consistent quality and timely access to advanced batteries remains a persistent concern.

Infrastructure Gaps and Technical Limitations Restrain Market Growth

Widespread adoption of electric commercial vehicles depends on the availability of reliable charging infrastructure, which remains uneven across many regions. The Electric Commercial Vehicle Battery Market must address the limited presence of high-capacity charging stations, especially in rural or developing areas. Technical barriers such as limited energy density, battery degradation over time, and the challenge of maintaining consistent performance in extreme temperatures can restrict operational flexibility for commercial fleets. It increases the total cost of ownership due to more frequent replacements or maintenance interventions. Regulatory uncertainty and evolving industry standards further add complexity for fleet operators planning long-term investments.

Market Opportunities

Emergence of Next-Generation Battery Technologies Creates New Growth Avenues

The Electric Commercial Vehicle Battery Market stands to benefit from advancements in battery chemistry, such as solid-state, lithium-sulfur, and other high-capacity solutions. These next-generation technologies promise higher energy density, faster charging times, and improved safety, which can transform commercial fleet operations. The shift toward alternative chemistries reduces dependence on scarce materials and can stabilize long-term supply. It positions battery manufacturers to offer products that better address the needs of long-haul and heavy-duty applications. Continuous investment in research and development unlocks the potential for lower cost per kilowatt-hour, expanding access for small and mid-sized fleet operators. Adoption of innovative battery designs supports the trend toward lighter, more efficient commercial vehicles.

Expansion of Charging Infrastructure and Digital Fleet Management Solutions Drives Adoption

Growing public and private investment in fast-charging networks and depot-based charging solutions presents a significant opportunity for the Electric Commercial Vehicle Battery Market. Improved accessibility and reliability of charging facilities lower operational barriers and increase fleet uptime. Digital fleet management platforms that integrate real-time battery monitoring and predictive analytics can optimize charging schedules and maintenance planning. It enables commercial operators to extend battery life and reduce total cost of ownership. Partnerships with utilities and infrastructure developers accelerate the rollout of advanced charging ecosystems. This evolving landscape encourages rapid fleet electrification and market penetration across diverse commercial segments.

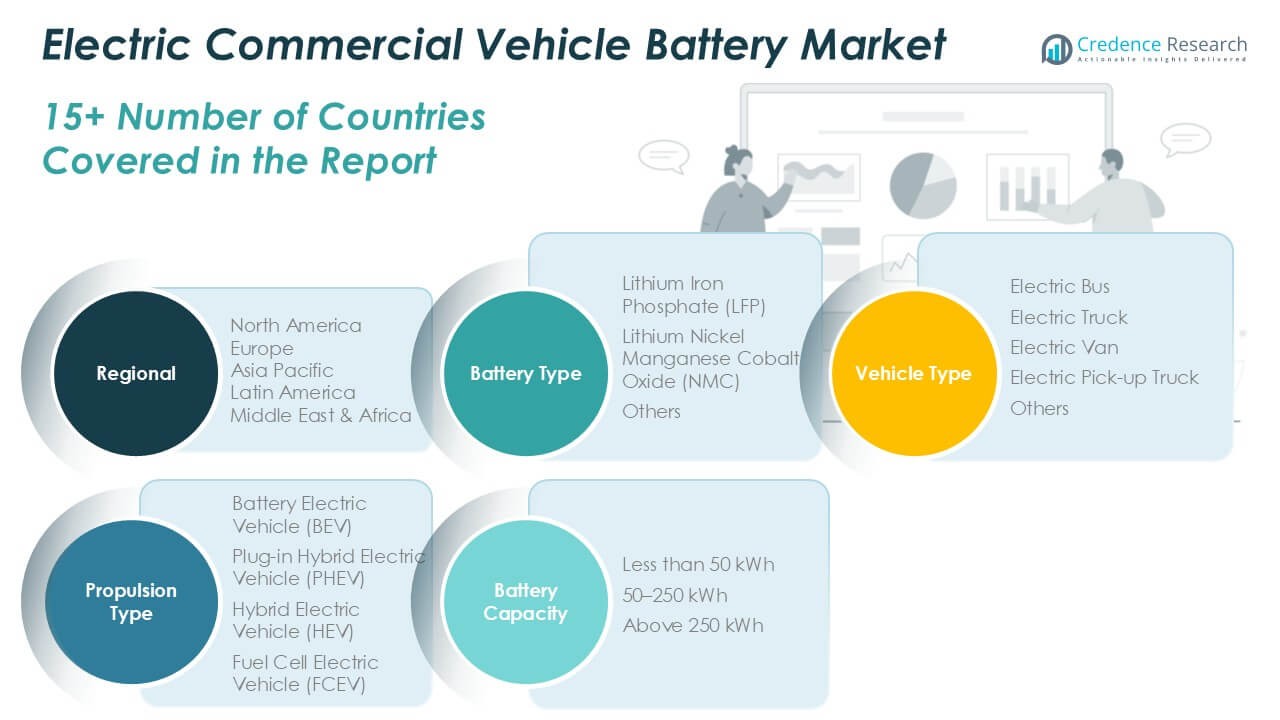

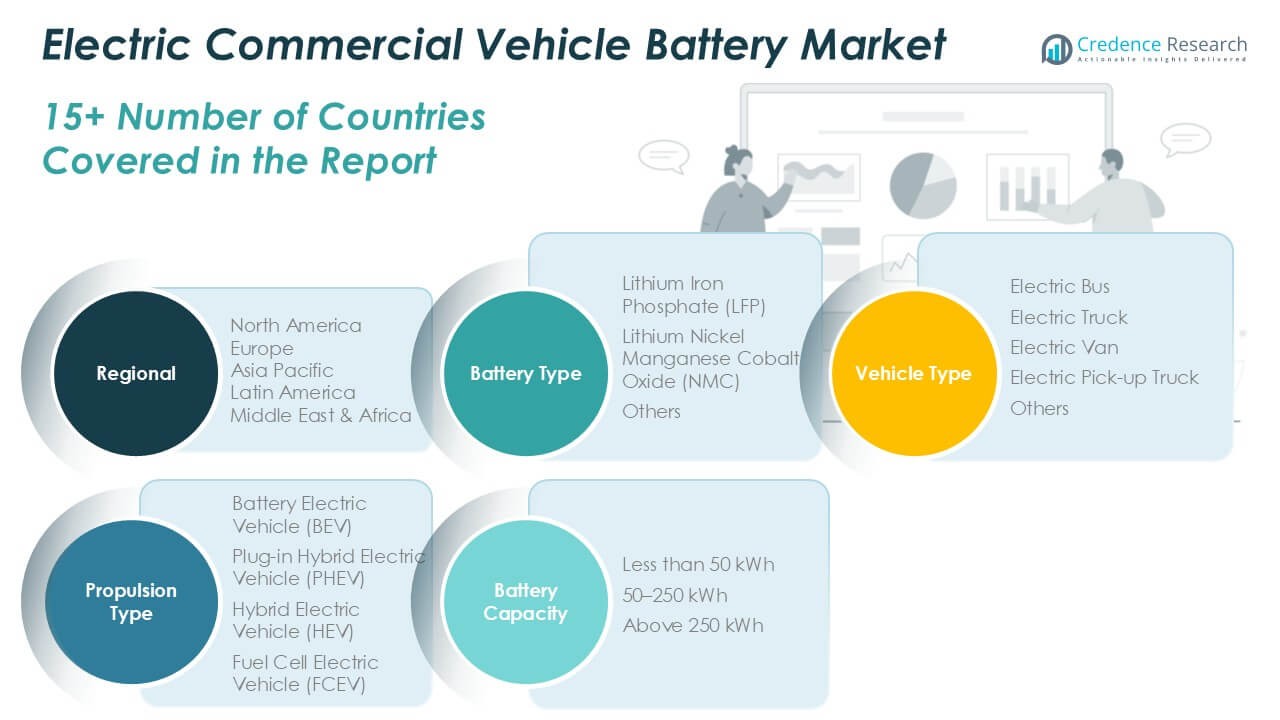

Market Segmentation Analysis:

By Battery Type:

The Electric Commercial Vehicle Battery Market can be segmented by battery type into Lithium Iron Phosphate (LFP), Lithium Nickel Manganese Cobalt Oxide (NMC), and others. LFP batteries remain popular due to their thermal stability, long cycle life, and safety profile, making them suitable for buses and vehicles requiring consistent, reliable power. NMC batteries lead the market in terms of energy density, supporting longer ranges and higher performance, which appeals to logistics providers operating long-haul fleets. The “others” segment includes emerging chemistries such as solid-state and lithium-sulfur batteries, offering new opportunities for improved efficiency and reduced reliance on critical minerals. It allows manufacturers to tailor battery choices to different commercial applications based on performance needs and cost considerations.

- For instance, BYD’s Blade Battery (LFP) is used in more than 70,000 commercial vehicles globally and is tested for over 1.2 million kilometers in extreme conditions.

By Vehicle Type:

Market segmentation by vehicle type covers electric buses, electric trucks, electric vans, electric pick-up trucks, and others. Electric buses account for a substantial share, driven by public sector investments and adoption in urban transit systems. Electric trucks gain momentum as freight operators seek to decarbonize supply chains and comply with emission standards. Electric vans and pick-up trucks serve last-mile delivery and utility applications, with rising demand linked to the growth of e-commerce and service-based industries. The “others” category covers specialty and niche vehicles, including refuse collection trucks and construction equipment. The Electric Commercial Vehicle Battery Market benefits from broadening vehicle electrification strategies across both public and private sectors.

- For instance, Daimler Trucks has delivered over 1,000 all-electric FUSO eCanter light-duty trucks to customers in Europe, Japan, and the U.S., collectively surpassing 8 million kilometers in real-world operation.

By Propulsion Type:

By propulsion type, the Electric Commercial Vehicle Battery Market comprises Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), Hybrid Electric Vehicles (HEV), and Fuel Cell Electric Vehicles (FCEV). BEVs dominate, offering zero tailpipe emissions and minimal maintenance, which attracts urban operators and fleets focused on sustainability. PHEVs and HEVs combine internal combustion engines with electric powertrains, providing flexibility for operators in regions with limited charging infrastructure or demanding mixed-use duty cycles. FCEVs, although less widespread, are emerging as viable solutions for heavy-duty and long-range applications due to fast refueling and high energy efficiency. It reflects an evolving market landscape where fleet managers select propulsion systems aligned with operational needs, infrastructure readiness, and environmental targets.

Segments:

Based on Battery Type:

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Others

Based on Vehicle Type:

- Electric Bus

- Electric Truck

- Electric Van

- Electric Pick-up Truck

- Others

Based on Propulsion Type:

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

Based on Battery Capacity:

- Less than 50 kWh

- 50–250 kWh

- Above 250 kWh

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Electric Commercial Vehicle Battery Market

North America Electric Commercial Vehicle Battery Market grew from USD 2,821.67 million in 2018 to USD 5,138.97 million in 2024 and is projected to reach USD 12,834.18 million by 2032, reflecting a compound annual growth rate (CAGR) of 11.3%. North America is holding a 31% market share. The United States dominates regional growth, supported by aggressive fleet electrification targets, large-scale investments in charging infrastructure, and favorable regulatory frameworks. Canada contributes with clean energy policies and incentives for electric commercial vehicles in urban transit and logistics sectors. Leading manufacturers continue to invest in advanced battery plants and technology partnerships to strengthen local supply chains. It benefits from strong government support and a mature market ecosystem, fostering high adoption rates among both public and private fleet operators.

Europe Electric Commercial Vehicle Battery Market

Europe Electric Commercial Vehicle Battery Market grew from USD 1,780.08 million in 2018 to USD 3,118.54 million in 2024 and is forecasted to reach USD 7,091.03 million by 2032, registering a CAGR of 10.0%. Europe is holding a 17% market share. Germany, France, and the United Kingdom lead the transition, leveraging ambitious emissions targets, urban clean transport initiatives, and robust incentive programs. The European Union’s stringent environmental mandates drive the adoption of electric buses and trucks, with logistics and public transit sectors showing strong momentum. Investments in cross-border charging corridors and battery recycling infrastructure further enhance the regional landscape. It continues to set benchmarks in technology integration and policy-driven adoption.

Asia Pacific Electric Commercial Vehicle Battery Market

Asia Pacific Electric Commercial Vehicle Battery Market grew from USD 3,728.28 million in 2018 to USD 7,160.88 million in 2024 and is projected to reach USD 18,966.19 million by 2032, delivering the highest CAGR at 12.1%. Asia Pacific is holding a 46% market share. China dominates global production and consumption, with strong support from government incentives, urban air quality mandates, and massive investments in domestic battery manufacturing. Japan and South Korea contribute through leadership in battery innovation, export-oriented manufacturing, and deployment of electric fleets in logistics and public transport. It benefits from high-volume adoption, vertical integration, and continuous advances in battery technology across the region.

Latin America Electric Commercial Vehicle Battery Market

Latin America Electric Commercial Vehicle Battery Market grew from USD 349.59 million in 2018 to USD 636.26 million in 2024 and is anticipated to reach USD 1,359.40 million by 2032, at a CAGR of 9.1%. Latin America is holding a 3% market share. Brazil and Mexico are driving regional adoption, supported by government-led pilot projects and urban public transport electrification. The focus remains on reducing urban emissions and increasing cost competitiveness for commercial fleet operators. Key cities in Chile and Colombia have launched electric bus initiatives, accelerating market penetration in public transit. It benefits from growing collaboration between public agencies and international manufacturers to expand infrastructure and financing solutions.

Middle East Electric Commercial Vehicle Battery Market

Middle East Electric Commercial Vehicle Battery Market grew from USD 248.86 million in 2018 to USD 419.62 million in 2024 and is expected to reach USD 877.16 million by 2032, with a CAGR of 8.8%. The Middle East is holding a 2% market share. The United Arab Emirates and Saudi Arabia spearhead investments in green mobility, smart city initiatives, and zero-emission public transport. Regional governments focus on aligning with global sustainability goals, resulting in pilot projects for electric trucks and buses in major metropolitan areas. It benefits from increasing interest in renewable energy and innovative transport solutions, although charging infrastructure development remains an ongoing challenge.

Africa Electric Commercial Vehicle Battery Market

Africa Electric Commercial Vehicle Battery Market grew from USD 137.60 million in 2018 to USD 281.46 million in 2024 and is forecasted to reach USD 555.14 million by 2032, reflecting a CAGR of 8.0%. Africa is holding a 1% market share. South Africa and Egypt lead market adoption, propelled by urban mobility reforms and commitments to clean energy. Infrastructure limitations and high upfront costs present challenges, yet opportunities exist through partnerships for off-grid charging solutions and localized assembly. Key government and private sector collaborations aim to accelerate electrification of municipal and commercial fleets. It remains an emerging market, with growth potential driven by long-term urbanization and sustainability trends.

Key Player Analysis

- Contemporary Amperex Technology Co. Ltd. (CATL)

- BYD Company Ltd.

- LG Energy Solution Ltd.

- Panasonic Holdings Corporation

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- CALB (China Aviation Battery Co. Ltd.)

- EVE Energy Co. Ltd.

- Farasis Energy (Ganzhou) Co. Ltd.

- Guoxuan High-tech Co. Ltd.

Competitive Analysis

The Electric Commercial Vehicle Battery Market is highly competitive, characterized by rapid innovation, strong global supply chains, and strategic alliances. Leading players such as Contemporary Amperex Technology Co. Ltd. (CATL), BYD Company Ltd., LG Energy Solution Ltd., Panasonic Holdings Corporation, Samsung SDI Co. Ltd., and SK Innovation Co. Ltd. maintain their dominance through continuous investment in research and development, focusing on enhancing energy density, battery lifespan, and safety features. These companies operate large-scale manufacturing facilities, ensuring robust supply to meet growing global demand, and form partnerships with major commercial vehicle manufacturers to secure long-term contracts and market presence. Companies compete on cost efficiency, leveraging advanced manufacturing processes and global supply networks to meet the demands of commercial fleet operators. Strategic partnerships with vehicle manufacturers enable suppliers to secure long-term contracts and strengthen their market positions. The competitive landscape also features investments in next-generation chemistries and battery recycling, as firms strive to comply with evolving regulatory requirements and support sustainability goals. Emphasis on after-sales support, product reliability, and localized supply chains allows companies to differentiate in a market where performance, total cost of ownership, and operational flexibility are critical to commercial adoption. Continuous innovation and collaboration remain central to maintaining a competitive edge in this evolving sector.

Recent Developments

- In January 2024, SGL Carbon entered into a technology partnership with E-Works Mobility, a German company specializing in electric vans. Under this collaboration, SGL Carbon is expected to supply the first battery cases made from glass fiber-reinforced plastic (GFRP) for E-Works’ HEERO e-transporter. The newly developed GFRP battery cases provide various advantages, such as weight reduction, battery insulation, and fire protection. With this partnership, SGL Carbon aims to leverage this partnership to enhance its product offerings, improve operational efficiency, and solidify its competitive edge in the rapidly growing electric vehicle sector.

- In August 2023, Linamar Corporation announced the completion of its acquisition of three battery enclosure manufacturing facilities from Dura-Shiloh. This acquisition, initially disclosed on May 30, 2023, involved an all-cash transaction valued at USD 325 million and was subject to customary regulatory approvals and closing conditions, all of which have now been satisfied.

- In February 2023, Magna secured a contract with General Motors (GM) to supply battery enclosures for the upcoming 2024 Chevrolet Silverado EV, which will be assembled at GM’s Factory ZERO. Production of these enclosures is set to begin in late 2023 at Magna’s Electric Vehicle Structures facility in St. Clair, Michigan, where they currently manufacture battery enclosures for the GMC HUMMER EV. To support this expansion, Magna is adding a 740,000-square-foot extension to its existing 345,000-square-foot facility, which opened in 2021. This significant investment underscores Magna’s commitment to meeting the growing demand for electric vehicle components while enhancing its production capabilities.

- In February 2023, LG Energy Solution will invest 10 trillion won this year, up 50 percent from 6.3 trillion won a year ago, and expand its global production capacity by 50 percent to 300 gigawatt hours (GWh).

Market Concentration & Characteristics

The Electric Commercial Vehicle Battery Market exhibits a moderate to high level of market concentration, with a few large manufacturers holding significant global share due to their established production capacities, technological leadership, and strong relationships with major commercial vehicle OEMs. It is characterized by rapid technological evolution, high entry barriers related to capital investment and expertise, and an ongoing focus on research and development to achieve higher energy density, improved safety, and longer lifecycle performance. The market demonstrates intense competition, where manufacturers differentiate through innovation, proprietary battery chemistries, and comprehensive after-sales support. Strategic alliances and supply chain integration play a central role in securing market position and meeting the evolving needs of commercial fleet operators. It also features a growing emphasis on localized production, recycling initiatives, and sustainability, reflecting both regulatory requirements and shifting customer expectations. Overall, the market’s dynamics favor firms that can scale production, deliver consistent quality, and adapt quickly to technological and regulatory changes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Vehicle Type, Propulsion Type, Battery Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for electric commercial vehicle batteries will continue to rise due to increasing fleet electrification across logistics and public transport sectors.

- Advancements in battery technologies will lead to improved energy density and longer driving ranges for commercial vehicles.

- Governments will strengthen emission regulations, encouraging wider adoption of electric commercial vehicles and supporting battery market growth.

- Battery manufacturers will expand production capacities to meet the surging demand from electric truck and van manufacturers.

- Strategic partnerships between OEMs and battery suppliers will become more common to ensure supply chain stability and innovation.

- The market will witness a growing focus on solid-state batteries as a long-term solution for commercial vehicle applications.

- Cost reduction in lithium-ion batteries through material optimization and economies of scale will drive further adoption.

- Integration of fast-charging infrastructure will support market growth by addressing range anxiety among commercial fleet operators.

- Second-life battery usage and recycling initiatives will emerge as crucial components of the battery value chain.

- Asia-Pacific and Europe will remain the key regions contributing significantly to market expansion due to strong EV policy support.