Market Overview

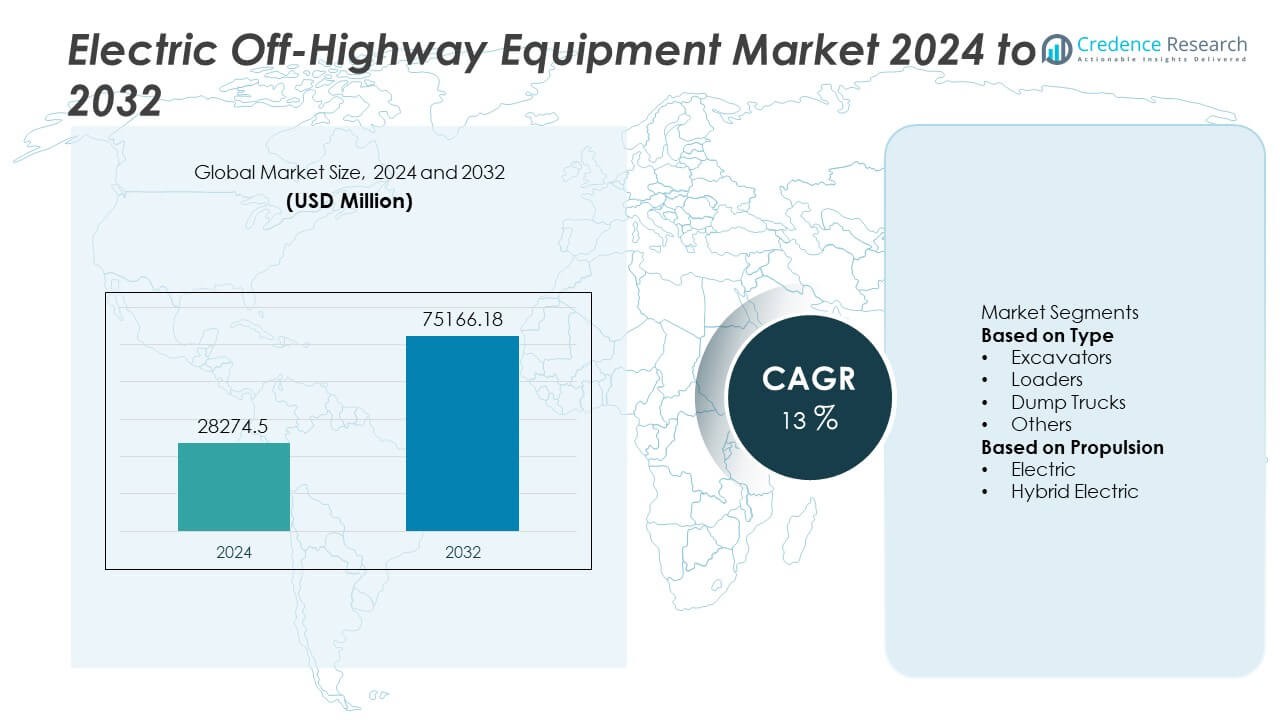

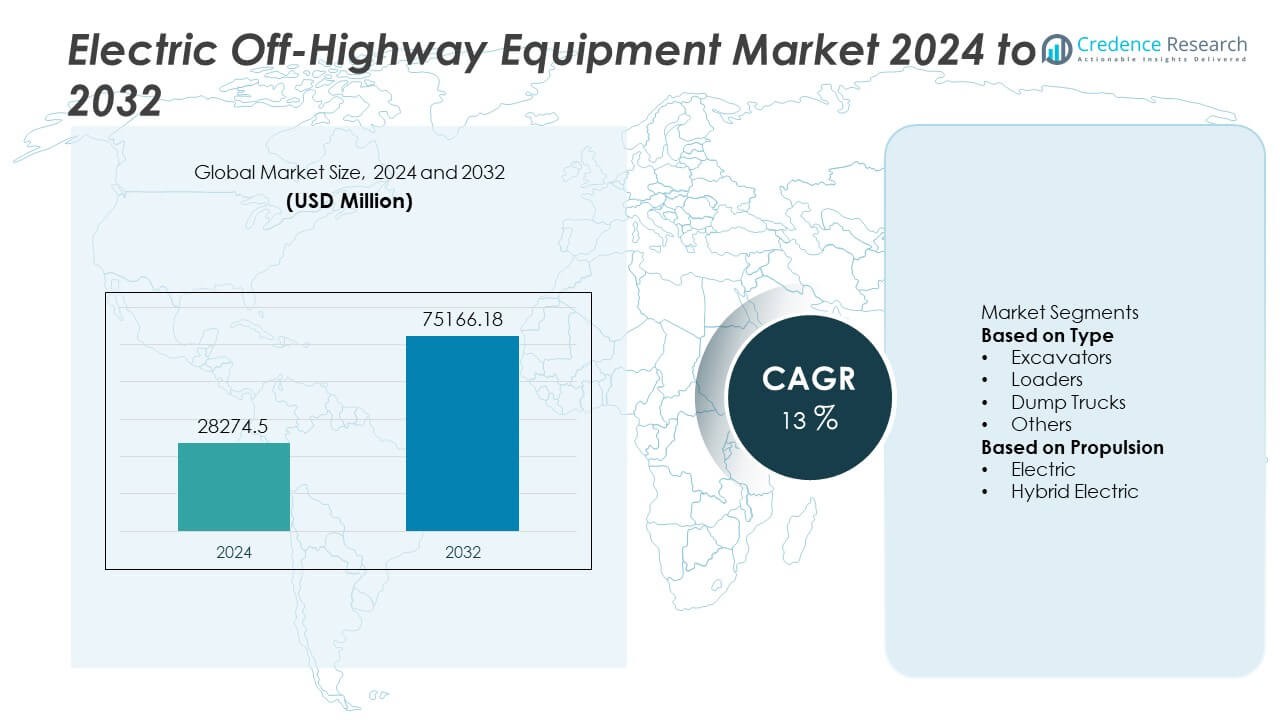

The Electric Off-Highway Equipment Market was valued at USD 28,274.5 million in 2024 and is projected to reach USD 75,166.18 million by 2032, registering a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Off-Highway Equipment Market Size 2024 |

USD 28,274.5 Million |

| Electric Off-Highway Equipment Market, CAGR |

13% |

| Electric Off-Highway Equipment Market Size 2032 |

USD 75,166.18 Million |

The Electric Off-Highway Equipment market is led by key players such as Komatsu Ltd., Hitachi Construction Machinery, SANY Group, BYD Company LTD, AB Volvo, Deere & Company, BEML Limited, Liebherr-International AG, Deutz Fahr, and Sennebogen Maschinenfabrik GmbH. These companies dominate through technological advancements in electric powertrains, energy-efficient components, and autonomous operation systems. North America emerged as the leading region in 2024, holding a 33% share of the global market, driven by infrastructure investments and emission reduction policies. Asia-Pacific followed with a 31% share, supported by rapid urbanization and local equipment production, while Europe accounted for 27%, emphasizing sustainability and electrified construction initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electric off-highway equipment market was valued at USD 28,274.5 million in 2024 and is projected to reach USD 75,166.18 million by 2032, growing at a CAGR of 13% during the forecast period.

- Rising demand for zero-emission and energy-efficient machinery across construction, mining, and agriculture sectors is driving market growth, supported by strict global emission regulations.

- The market is witnessing trends such as the adoption of lithium-ion battery systems, automation, and hybrid-electric drivetrains to improve efficiency and reduce fuel dependency.

- Key players including Komatsu Ltd., Hitachi Construction Machinery, Deere & Company, and SANY Group focus on electrification, product innovation, and smart equipment integration to strengthen competitiveness.

- North America leads with 33% share, followed by Asia-Pacific with 31% and Europe with 27%, while the excavator segment dominates with 42% share and the fully electric propulsion type holds 60% of total demand.

Market Segmentation Analysis:

By Type

The excavators segment dominated the electric off-highway equipment market in 2024, accounting for over 38% of the total share. Its dominance is driven by high demand across construction, mining, and infrastructure projects, where electric excavators offer lower noise, zero emissions, and reduced operational costs. Leading manufacturers are integrating advanced battery systems and fast-charging capabilities to extend operating hours and minimize downtime. Growing government emphasis on sustainable construction practices and emission-free machinery adoption further boosts segment growth, while loaders and dump trucks follow due to their expanding use in mining and heavy industrial applications.

- For instance, the Komatsu PC210E electric excavator features a 451 kWh lithium-ion battery, which supports up to 8 hours of continuous operation per charge depending on the application. The machine delivers 123 kW of motor output and offers DC fast-charging capability, enabling it to recharge to 80% capacity in under 90 minutes. This provides a zero-emission alternative for mid-sized construction projects.

By Propulsion

The electric propulsion segment led the market in 2024 with a 62% share, driven by the shift toward fully electric machinery to reduce carbon footprints and fuel dependency. Advancements in lithium-ion batteries and high-torque electric drivetrains enable superior efficiency and performance across off-highway applications. The hybrid electric segment, with a 38% share, continues to grow in regions where grid access and charging infrastructure remain limited. Increasing investment in battery technology, energy recovery systems, and clean energy regulations is accelerating the adoption of both hybrid and fully electric propulsion in heavy-duty equipment worldwide.

- For instance, Volvo Construction Equipment’s L120 Electric wheel loader integrates a 282 kWh battery pack delivering a rated power of 228 kW and achieving 5-9 hours of operational runtime in light to medium-duty applications.

Key Growth Drivers

Growing Shift Toward Low-Emission and Sustainable Operations

The construction and mining sectors are increasingly transitioning to low-emission operations to meet global carbon reduction targets. Electric off-highway equipment eliminates diesel exhaust and reduces operational noise, aligning with sustainability goals and urban emission regulations. Governments and corporations are adopting electric excavators, loaders, and dump trucks to support net-zero commitments. Major OEMs are responding with zero-emission machinery designed for extended operation and lower maintenance. This strong regulatory and environmental push is a primary force driving the adoption of electric off-highway equipment globally.

- For instance, Hitachi Construction Machinery developed the ZE85 electric excavator equipped with a 100 kWh standard lithium-ion battery, with an optional 133 kWh capacity. The model, which is based on the ZX85US-6, delivers 40 kW of electrical power for its hydraulic system and can operate for an average of 5.5 hours on a single charge.

Advancements in Battery Efficiency and Charging Infrastructure

Rapid developments in lithium-ion and solid-state battery technology are improving energy density, runtime, and equipment reliability. Modern batteries now provide higher power output and faster charging capabilities, reducing downtime in demanding work environments. The introduction of modular battery systems allows flexible energy management across construction fleets. Additionally, the expansion of high-capacity on-site charging and hybrid energy storage infrastructure is enhancing operational feasibility. These advancements are significantly boosting the performance and practicality of electric machinery in off-highway applications.

- For instance, Liebherr-International AG’s R 976-E electric crawler excavator features a 400 kW electric motor and is configured for high-voltage grid operation via a cable connection, typically at 6000 V.

Rising Government Support and Electrification Incentives

Government-backed initiatives and financial incentives are accelerating the adoption of electric off-highway machinery. Subsidies, tax credits, and funding programs for green construction equipment encourage manufacturers and contractors to invest in electrified fleets. Public infrastructure projects increasingly include sustainability clauses, promoting the use of low-emission vehicles. Policies supporting local manufacturing and R&D in electric heavy equipment are also strengthening industry competitiveness. As national decarbonization efforts intensify, these supportive frameworks are expected to sustain market growth through the next decade.

Key Trends & Opportunities

Integration of Autonomous and Digital Systems

Automation and connectivity are reshaping the electric off-highway equipment market. Integration of GPS, IoT, and telematics allows real-time data monitoring, predictive maintenance, and remote operation. Autonomous electric excavators and loaders enhance site productivity and safety while reducing human intervention. Manufacturers are increasingly focusing on AI-driven efficiency optimization and fleet management solutions. The convergence of digital intelligence and electrification is enabling smarter, cleaner, and more efficient operations across large-scale industrial projects.

- For instance, Deere & Company’s 850 X-Tier electric-drive dozer integrates an automated control suite with 3D GNSS guidance and SmartDetect, which uses cameras and radar for object detection, alongside real-time telematics through the JDLink platform.

Expansion of Battery Swapping and Renewable Charging Solutions

The growing use of battery-swapping systems and renewable-powered charging infrastructure presents major opportunities. Construction and mining sites are deploying portable solar or hybrid charging stations to overcome power access challenges. Battery-swapping models reduce downtime, allowing equipment to remain operational during long shifts. Partnerships between OEMs, energy providers, and governments are accelerating the rollout of such solutions. These advancements are making electric heavy machinery more viable for continuous and large-scale operations across remote or high-demand environments.

- For instance, SANY Group’s 23-tonne SY215E electric excavator employs a 422 kWh lithium-iron-phosphate battery system. The system is designed for charging via an automotive standard CCS2 DC fast-charging solution, which can achieve a full charge in around 1.5 hours.

Key Challenges

High Initial Costs and Investment Barriers

Electric off-highway equipment requires substantial upfront investment due to costly batteries and limited production scale. Compared to diesel models, electric machinery often carries a higher price tag, deterring small and medium contractors. Maintenance of advanced electronic systems also adds to ownership costs. While lower operating expenses offset some of these costs over time, initial affordability remains a key barrier. Manufacturers are addressing this challenge by offering leasing options, modular batteries, and cost-sharing models to support wider market adoption.

Limited Charging Infrastructure and Power Availability

Inadequate charging networks continue to challenge large-scale deployment of electric off-highway machinery, particularly in remote construction and mining areas. Limited grid access and inconsistent power supply hinder operational continuity. Long charging durations can reduce work efficiency, especially for high-power equipment. Although hybrid-electric models help bridge this gap, infrastructure expansion remains slow in developing economies. Strengthening fast-charging and renewable energy solutions will be crucial to overcoming this constraint and enabling long-term market growth.

Regional Analysis

North America

North America held a 29% share of the electric off-highway equipment market in 2024, driven by strong investments in sustainable infrastructure and emission-reduction initiatives. The U.S. leads regional demand due to early adoption of electric construction and mining machinery supported by federal clean energy incentives. Manufacturers are expanding product lines featuring high-capacity batteries and digital monitoring systems to meet environmental standards. Ongoing infrastructure modernization projects, such as road expansion and renewable energy development, continue to strengthen adoption. Growing partnerships between OEMs and fleet operators further promote large-scale deployment of electric off-highway equipment across the region.

Europe

Europe accounted for a 27% share of the global electric off-highway equipment market in 2024, propelled by stringent emission norms and strong government backing for zero-emission technologies. Countries such as Germany, France, and the United Kingdom are leading adoption due to green construction mandates and carbon neutrality goals. The region’s focus on electrifying public and industrial equipment fleets supports consistent market growth. European manufacturers emphasize innovation in battery-electric and hybrid systems to align with EU sustainability directives. The rise of autonomous and digitally connected machinery also reinforces Europe’s position as a key hub for electrified construction solutions.

Asia-Pacific

Asia-Pacific dominated the global electric off-highway equipment market in 2024 with a 36% share, supported by large-scale construction, mining, and infrastructure investments. China, Japan, and India are major contributors, driven by government initiatives promoting low-emission industrial operations and domestic manufacturing of electric machinery. Local OEMs are introducing cost-efficient electric excavators and loaders to cater to growing urbanization needs. Expanding renewable energy infrastructure and smart city development further accelerate adoption. With supportive policies and rapid technological progress, Asia-Pacific continues to be the fastest-growing region in electric off-highway equipment deployment.

Latin America

Latin America captured a 5% share of the electric off-highway equipment market in 2024, led by increasing sustainability initiatives across the construction and mining sectors. Brazil, Mexico, and Chile are key markets adopting electric excavators and loaders to reduce emissions and operating costs. The region benefits from government-backed infrastructure development and growing private investment in renewable projects. Although high equipment costs and limited charging networks restrain faster adoption, collaborations with global OEMs and the expansion of hybrid-electric fleets are driving gradual transformation toward greener off-highway operations.

Middle East & Africa

The Middle East and Africa accounted for a 3% share of the global electric off-highway equipment market in 2024, driven by growing infrastructure development and mining activities. The United Arab Emirates and Saudi Arabia are leading markets supported by national sustainability programs and investment in clean technologies. Mining operations in South Africa are also adopting hybrid and electric machinery to improve efficiency and reduce fuel dependency. However, limited charging infrastructure and high import costs constrain adoption. Continued government support and integration of renewable energy systems are expected to strengthen market growth in the coming years.

Market Segmentations:

By Type

- Excavators

- Loaders

- Dump Trucks

- Others

By Propulsion

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Off-Highway Equipment market includes major players such as Komatsu Ltd., Hitachi Construction Machinery, SANY Group, BYD Company LTD, AB Volvo, Deere & Company, BEML Limited, Liebherr-International AG, Deutz Fahr, and Sennebogen Maschinenfabrik GmbH. These companies compete through advancements in battery technology, hybrid propulsion systems, and automation features that enhance efficiency and reduce emissions. Leading manufacturers are investing heavily in electrified excavators, loaders, and dump trucks to meet sustainability goals and regulatory standards. Strategic collaborations with battery suppliers and technology firms are strengthening product portfolios and supporting large-scale electrification projects. Companies are also emphasizing telematics integration, remote monitoring, and digital fleet management to improve productivity. Continuous R&D investment, expansion into emerging markets, and partnerships with renewable energy providers remain key strategies shaping competitiveness in the global Electric Off-Highway Equipment market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Komatsu and Cummins entered a collaboration to develop hybrid and low-emission mining trucks.

- In April 2025, Deere & Company revealed three prototype battery-electric tractors, including one for orchards and one for livestock operations, as part of its electrification roadmap.

- In April 2025, Komatsu exhibited Dimaag’s Mobile Megawatt Charging System (MWCS) for off-road equipment use, enabling high-power charging at remote sites.

- In August 2024, Komatsu Ltd. announced it would showcase its PC4000-11E electric drive hydraulic mining excavator at MINExpo 2024.

Report Coverage

The research report offers an in-depth analysis based on Type, Propulsion and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric off-highway equipment market will grow steadily with rising demand for clean energy machinery.

- Manufacturers will focus on developing high-capacity batteries for extended operating hours.

- Hybrid and fully electric models will gain traction across construction and mining sectors.

- Government emission targets will accelerate the shift toward sustainable equipment production.

- Integration of telematics and IoT systems will improve equipment efficiency and monitoring.

- Asia-Pacific will emerge as the fastest-growing region due to industrial expansion and infrastructure investment.

- Partnerships between OEMs and battery manufacturers will drive innovation in energy systems.

- Rental and leasing models for electric equipment will expand across developed markets.

- Continuous research in lightweight materials will enhance equipment performance and durability.

- Digital automation and smart controls will shape the next generation of electric off-highway machinery.