Market Overview

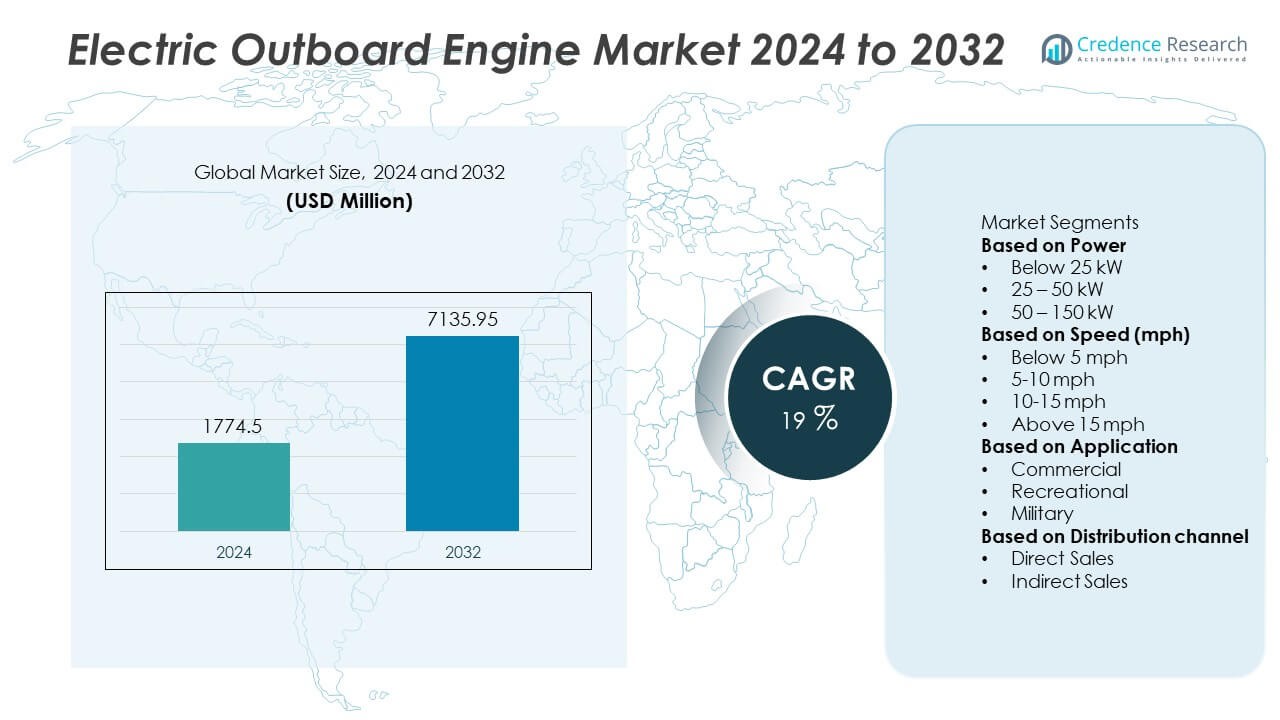

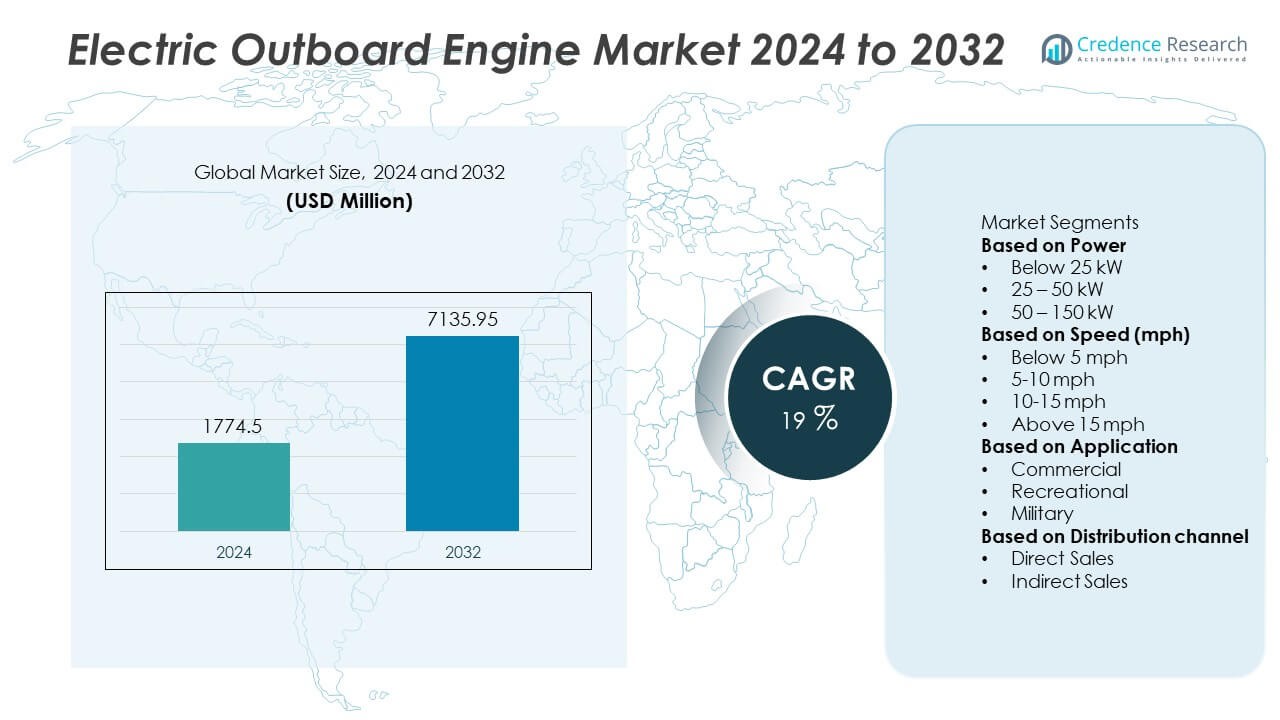

The Electric Outboard Engine Market was valued at USD 1,774.5 million in 2024 and is projected to reach USD 7,135.95 million by 2032, registering a CAGR of 19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Outboard Engine Market Size 2024 |

USD 1,774.5 Million |

| Electric Outboard Engine Market, CAGR |

19% |

| Electric Outboard Engine Market Size 2032 |

USD 7,135.95 Million |

The Electric Outboard Engine market is led by key players including Torqeedo GmbH, Mitsubishi Electric Corporation, Pure Watercraft, Golden Motors, MINN KOTA, Schindler, Evoy, Parsun Power, Hitachi Ltd., and KONE. These companies dominate through advancements in battery-powered propulsion, energy efficiency, and low-noise marine technology. North America emerged as the leading region in 2024, holding a 35% share of the global market, driven by strong adoption in recreational boating and environmental compliance initiatives. Europe followed with a 30% share, supported by strict emission norms and expanding electric boating infrastructure, while Asia-Pacific accounted for 27%, boosted by growing domestic production and increasing demand for eco-friendly marine systems across coastal regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electric outboard engine market was valued at USD 1,774.5 million in 2024 and is projected to reach USD 7,135.95 million by 2032, growing at a CAGR of 19% during the forecast period.

- Rising demand for zero-emission marine propulsion and efficient electric systems is driving market expansion across recreational and commercial boating sectors.

- The market is witnessing trends such as the integration of lithium-ion batteries, digital control systems, and modular propulsion units to enhance performance and range.

- Leading companies like Torqeedo GmbH, Pure Watercraft, and MINN KOTA focus on innovation, strategic partnerships, and regional expansion to strengthen competitiveness.

- North America leads with 35% share, followed by Europe with 30% and Asia-Pacific with 27%, while the below 25 kW power segment holds 46% of total demand, driven by its widespread use in small and mid-size boats.

Market Segmentation Analysis:

By Power

The 25–50 kW segment dominated the electric outboard engine market in 2024, holding a 44% share. This range offers an ideal balance between power efficiency and performance for mid-sized boats used in both recreational and commercial applications. These engines deliver strong thrust and longer operating hours, making them suitable for fishing vessels, pontoons, and small ferries. Advancements in lithium-ion battery technology and improved motor efficiency are driving wider adoption. The below 25 kW segment follows due to its use in lightweight boats, while the 50–150 kW range caters to high-performance marine applications.

- For instance, Evoy’s Breeze 120+ electric outboard system delivers a continuous output of 90+ kW (120+ hp) and a peak power of 137+ kW (185+ hp), providing propulsion for vessels up to 25 feet in length.

By Speed (mph)

The 5–10 mph segment led the market in 2024 with a 40% share, driven by its strong suitability for fishing boats, pontoons, and short-distance water transport. These engines deliver reliable cruising speeds while maintaining low noise and zero emissions, appealing to eco-conscious users. Improved torque delivery and extended battery life make them ideal for calm-water operations. The 10–15 mph range, with 32% share, is gaining momentum for performance boating and commercial ferry use. Growing demand for efficient, medium-speed propulsion systems continues to support the dominance of the 5–10 mph category.

- For instance, Torqeedo’s Cruise 10.0 R outboard produces 12 kW peak power (comparable to a 20 HP combustion engine), operates on a 48V architecture with optional 5,000 Wh Power 48-5000 batteries, and includes an integrated GPS-based control for precise speed regulation and range tracking, ensuring optimal energy consumption during low-speed cruising.

By Application

The recreational segment accounted for 52% of the electric outboard engine market in 2024, driven by increasing adoption among leisure boaters, anglers, and sailing enthusiasts. Rising preference for silent, low-maintenance engines and environmental regulations on fuel-powered boats are accelerating demand. Manufacturers are introducing compact, lightweight models optimized for ease of use and portability. The commercial segment, with 36% share, is growing due to electric propulsion in water taxis and ferries. Expanding recreational boating activities and coastal tourism continue to strengthen the recreational segment’s market leadership worldwide.

Key Growth Drivers

Rising Demand for Eco-Friendly Marine Propulsion

Growing environmental awareness and strict emission regulations are driving the shift toward electric outboard engines. Consumers and commercial operators prefer these systems for their zero-emission operation, low noise, and reduced maintenance. Governments are enforcing policies to limit marine pollution, promoting electric alternatives to gasoline-powered motors. Rising coastal tourism and recreational boating activities further enhance market demand. The increasing adoption of electric propulsion aligns with global sustainability goals and supports the marine industry’s transition to cleaner, greener energy solutions.

- For instance, Pure Watercraft’s Pure Outboard system delivers 25 kW continuous power using a direct-drive motor and a 66 kWh lithium-ion battery pack co-developed with General Motors. The system can achieve speeds up to 23 miles per hour with dual outboards, emits zero exhaust, and operates quietly.

Advancements in Battery and Motor Efficiency

Continuous improvements in lithium-ion batteries and brushless electric motors are enhancing performance, range, and power output. Higher energy density, fast charging, and lightweight designs enable longer operating times with reduced energy loss. Manufacturers are integrating intelligent power management and regenerative charging systems to improve efficiency. These advancements make electric outboard engines suitable for both recreational and commercial applications. As costs decline and charging technologies evolve, these innovations are propelling rapid market expansion across the marine sector.

- For instance, Torqeedo’s Deep Blue 50R electric outboard features a 48.5 kW continuous (55 kW peak) motor with up to 54% overall efficiency.

Government Incentives and Regulatory Support

Supportive policies, subsidies, and environmental regulations are accelerating the adoption of electric propulsion systems in the maritime sector. Governments across Europe, North America, and Asia-Pacific are offering financial incentives for electric vessel purchases and infrastructure development. Restrictions on internal combustion engines in lakes and coastal waters are further boosting demand. Regulatory frameworks promoting carbon neutrality and sustainable water transport continue to attract both manufacturers and consumers toward electrification. This favorable policy landscape is expected to sustain long-term growth in the electric outboard engine market.

Key Trends & Opportunities

Integration of Smart and Connected Technologies

Digital connectivity and IoT integration are transforming electric outboard engine operations. Manufacturers are introducing smart control systems that monitor performance metrics such as speed, power consumption, and battery health in real time. Bluetooth and mobile app integration enable remote diagnostics and predictive maintenance, improving reliability. Smart features enhance user convenience and operational safety for both personal and commercial users. This trend toward intelligent propulsion systems presents major opportunities for companies investing in software-enabled marine technologies.

- For instance, Torqeedo’s Deep Blue system integrates a CAN bus network and onboard computer that connects propulsion data directly to the Torqeedo Cloud. The system continuously monitors motor temperature, power draw, and GPS-based speed, transmitting this real-time data for remote diagnostics and fleet management.

Expansion of High-Power Electric Outboards

The introduction of high-power electric outboards, exceeding 100 kW, is reshaping marine propulsion capabilities. These systems cater to larger vessels such as ferries, patrol boats, and yachts, offering enhanced speed and performance comparable to combustion engines. Advances in motor design and water-cooling systems are enabling better thermal efficiency and power delivery. Manufacturers are targeting the premium boating segment, driven by rising consumer preference for performance and sustainability. The growing demand for high-torque, fast-charging solutions opens new opportunities in commercial and recreational marine sectors.

- For instance, Vision Marine Technologies E-Motion 180E outboard produces 135 kW (180 horsepower) of maximum power and a claimed 350 Nm torque. The propulsion system uses a standard 60 kWh lithium-ion battery pack with overnight charging capability via a 220V outlet.

Development of Hybrid and Solar-Powered Systems

Hybrid and solar-assisted propulsion systems are gaining attention as efficient alternatives for extended-range operations. Integration of solar panels and auxiliary hybrid drives allows vessels to operate longer with minimal emissions. These technologies are ideal for eco-tourism, coastal patrol, and small-scale commercial operations. Manufacturers are exploring hybrid designs that combine battery storage with renewable inputs to reduce dependency on grid charging. The rising focus on renewable-powered marine systems represents a key opportunity for sustainable innovation in the electric outboard engine market.

Key Challenges

High Initial Costs and Limited Range

Electric outboard engines currently face challenges related to high upfront costs and limited operational range compared to fuel-based systems. Expensive battery packs and electronic components contribute to higher purchase prices, restricting adoption among small-scale boat owners. Limited range and charging time also constrain long-duration use in commercial applications. While ongoing battery advancements are addressing these issues, affordability remains a barrier in emerging markets. Manufacturers are focusing on modular battery systems and scalable designs to improve accessibility and cost efficiency.

Underdeveloped Charging Infrastructure

The lack of widespread marine charging infrastructure hampers large-scale adoption of electric outboard engines. Many marinas, lakes, and coastal regions lack fast-charging or standardized charging ports, limiting usability for long-distance travel. Inconsistent power supply in remote areas further restricts operational flexibility. Although several regions are investing in marine EV charging networks, progress remains uneven. Expanding renewable-based and mobile charging solutions will be essential to overcoming infrastructure gaps and ensuring the sustained growth of electric marine propulsion systems globally.

Regional Analysis

North America

North America dominated the electric outboard engine market in 2024, holding a 34% share of the global market. The region’s growth is driven by strong adoption of sustainable marine propulsion systems and government incentives for electric boat usage. The U.S. leads demand with expanding recreational boating activities and emission reduction mandates across inland waterways. Key manufacturers are investing in high-power electric outboards suited for fishing, tourism, and commercial transport. Expanding charging infrastructure and the rising popularity of electric pontoon and leisure boats continue to strengthen North America’s position in this growing market.

Europe

Europe accounted for a 32% share of the global electric outboard engine market in 2024, supported by stringent emission standards and increasing marine electrification initiatives. Countries such as Norway, Germany, and the Netherlands are leading adopters, driven by government restrictions on combustion engines in lakes and coastal waters. The region’s strong focus on renewable energy and sustainable water transport promotes rapid electrification of recreational and commercial fleets. Investments in fast-charging ports and hybrid propulsion technologies further accelerate market growth. Europe’s early regulatory adoption continues to position it as a global leader in clean marine mobility.

Asia-Pacific

Asia-Pacific captured a 26% share of the electric outboard engine market in 2024, emerging as one of the fastest-growing regions. China, Japan, and South Korea lead production and adoption, supported by large-scale manufacturing and government incentives for low-emission marine operations. The increasing popularity of eco-friendly fishing boats and small ferries is boosting regional demand. Local companies are developing cost-effective electric propulsion systems for domestic and export markets. Rapid infrastructure development and growing coastal tourism are driving further adoption. With strong policy support and manufacturing capacity, Asia-Pacific remains a crucial hub for market expansion.

Latin America

Latin America held a 5% share of the global electric outboard engine market in 2024, driven by growing emphasis on sustainable water transportation. Brazil, Chile, and Mexico are leading markets with rising investments in eco-friendly marine tourism and public ferry electrification. Electric outboards are gaining attention for use in lakes, rivers, and protected ecosystems where noise and emissions are restricted. Limited charging infrastructure and high equipment costs currently constrain broader adoption. However, government initiatives promoting renewable energy integration and local partnerships with marine equipment manufacturers are expected to stimulate gradual regional growth.

Middle East & Africa

The Middle East and Africa accounted for a 3% share of the global electric outboard engine market in 2024, supported by rising investments in sustainable marine tourism and coastal infrastructure. The United Arab Emirates and Saudi Arabia are leading markets, adopting electric propulsion for leisure boating and marina developments. South Africa is also expanding adoption in inland and coastal waters through eco-tourism projects. Despite challenges such as high import costs and limited charging infrastructure, increasing awareness of clean marine technologies and renewable energy integration is expected to support long-term market expansion across the region.

Market Segmentations:

By Power

- Below 25 kW

- 25 – 50 kW

- 50 – 150 kW

By Speed (mph)

- Below 5 mph

- 5-10 mph

- 10-15 mph

- Above 15 mph

By Application

- Commercial

- Recreational

- Military

By Distribution channel

- Direct Sales

- Indirect Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Outboard Engine market features major players such as Torqeedo GmbH, Mitsubishi Electric Corporation, Pure Watercraft, Golden Motors, MINN KOTA, Schindler, Evoy, Parsun Power, Hitachi Ltd., and KONE. These companies compete through innovations in electric propulsion systems, battery efficiency, and motor performance to meet growing demand for sustainable marine transportation. Manufacturers are focusing on integrating lightweight materials, high-torque motors, and fast-charging battery systems to enhance vessel range and power output. Strategic collaborations with boat manufacturers and battery suppliers are expanding market presence and accelerating product development. Leading brands are also emphasizing digital monitoring, smart navigation, and modular power units to improve operational flexibility. As governments strengthen emission standards and promote electrification in marine sectors, competition is intensifying toward developing cost-efficient, high-performance electric outboard engines designed for both recreational and commercial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Torqeedo GmbH expanded its partnership with Yamaha, making its low-voltage electric outboards available in additional European regions including Scandinavia, France, and Poland.

- In 2025, Yamaha Outboards expanded its product portfolio by planning to offer select Torqeedo electric outboards through Yamaha outboard dealerships, enhancing reach of electric marine propulsion.

- In June 2024, Torqeedo sponsored Kiel Week regattas and showcased its new Travel XP electric motors on the Baltic Sea, enabling public test drives of its quiet, emission-free outboard units.

- In November 2023, Torqeedo GmbH unveiled the Travel XP (1.6 kW) version of its Travel line and introduced four modular motor + battery packages including Adventure, Essential, Range, and Power packages.

Report Coverage

The research report offers an in-depth analysis based on Power, Speed (mph), Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric outboard engine market will grow rapidly with rising demand for eco-friendly marine transport.

- Manufacturers will focus on improving battery efficiency and extending operational range.

- Integration of digital controls and smart monitoring systems will enhance navigation and performance.

- Government incentives for zero-emission marine equipment will accelerate adoption across regions.

- Hybrid propulsion systems will gain traction in larger commercial and passenger boats.

- Advances in lightweight materials will improve engine portability and durability.

- Europe will remain a key market due to strict emission standards and electrification mandates.

- Asia-Pacific will witness the fastest growth driven by expanding recreational boating and tourism.

- Strategic collaborations between OEMs and battery suppliers will strengthen technological development.

- Continuous R&D in fast-charging and modular propulsion systems will shape the next generation of electric outboard engines.