Market Overviews

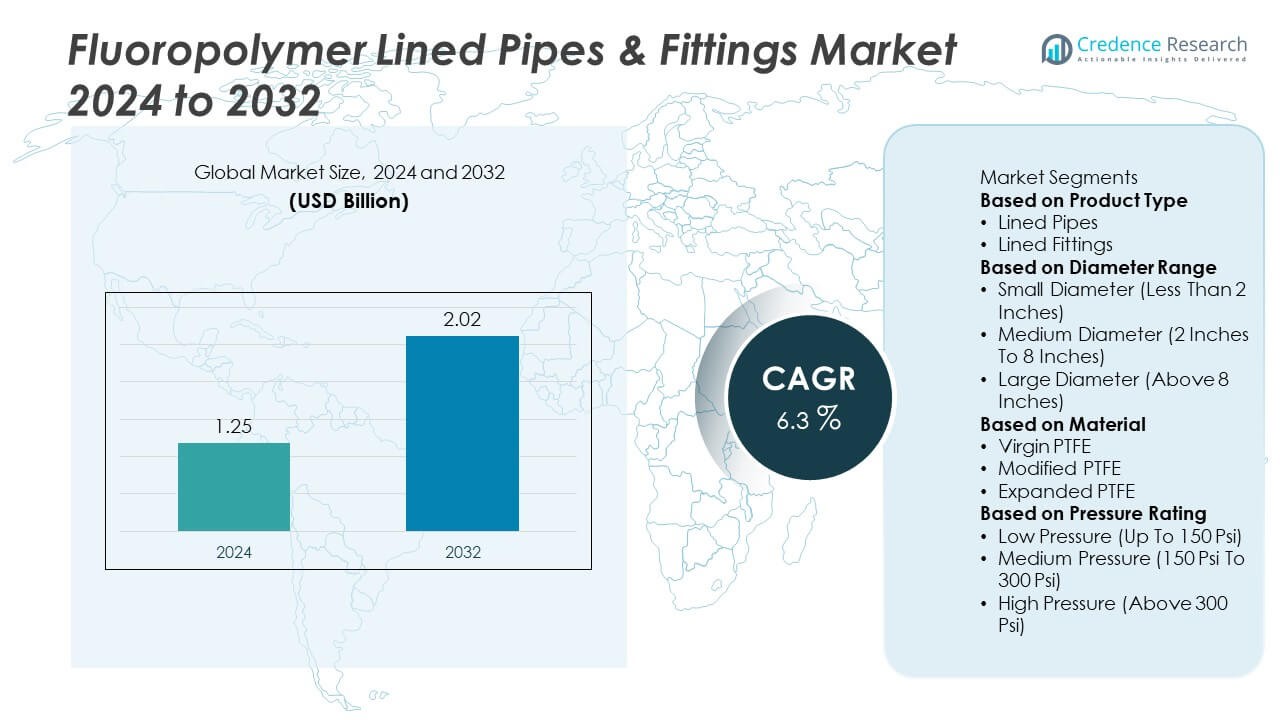

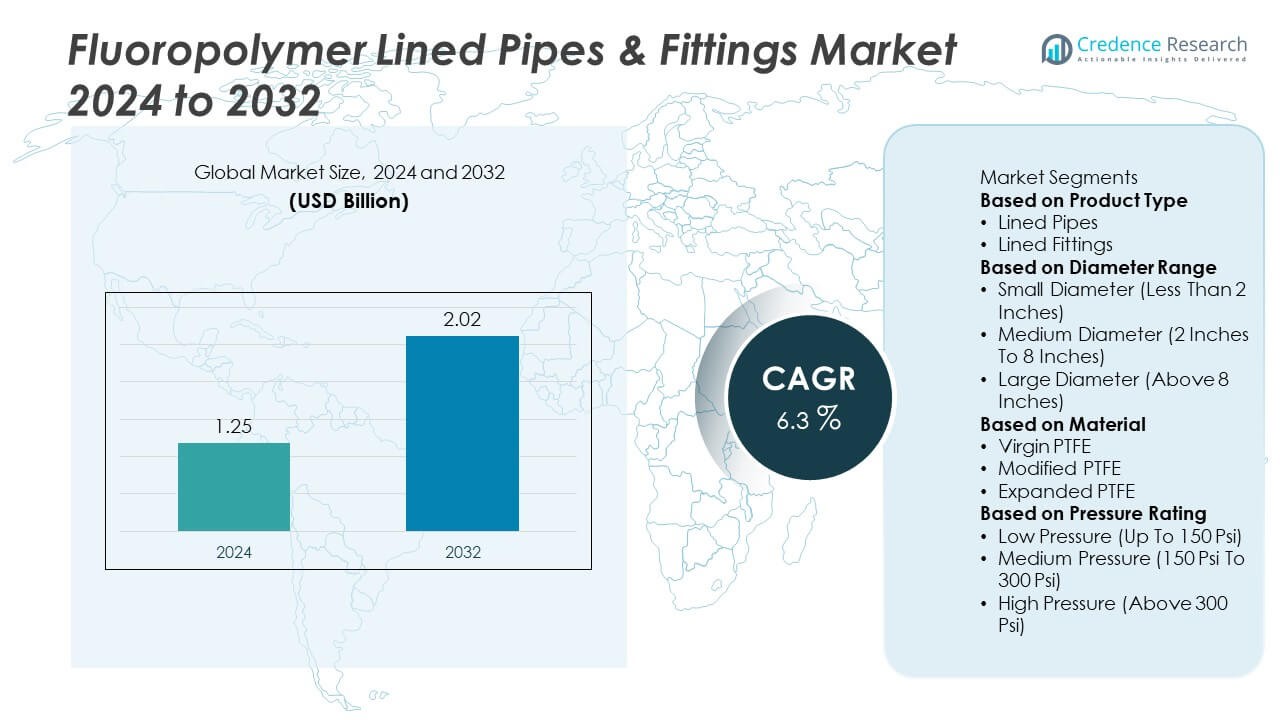

The fluoropolymer lined pipes & fittings market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.02 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluoropolymer Lined Pipes & Fittings Market Size 2024 |

USD 1.25 Billion |

| Fluoropolymer Lined Pipes & Fittings Market, CAGR |

6.3% |

| Fluoropolymer Lined Pipes & Fittings Market Size 2032 |

USD 2.02 Billion |

The fluoropolymer lined pipes & fittings market is led by key players including Bonde LPS GMBH & CO. KG, Mersen, UNP Polyvalves, Faab Industries, Sigma Polymers Engineering Company, CRP, Arconi S.A, Baum Lined Piping GMBH, Suflon Industries, and Crane Company (Crane Chempharma & Energy Corp.). These companies focus on high-performance PTFE, modified PTFE, and expanded PTFE solutions for chemical, pharmaceutical, and water treatment industries. North America leads the market with 33% share in 2024, driven by chemical processing and strict environmental standards, followed by Europe with 28% share due to strong regulatory compliance, while Asia-Pacific holds 27% share fueled by rapid industrialization and infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The fluoropolymer lined pipes & fittings market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.02 billion by 2032, registering a CAGR of 6.3% during the forecast period.

- Rising demand from chemical processing, pharmaceuticals, and water treatment industries drives growth, with lined pipes holding over 60% share due to superior corrosion resistance and reliability.

- Trends include adoption of modified PTFE with higher mechanical strength, seamless lining technology, and increased use of medium-diameter pipes (2 to 8 inches) that account for about 50% share.

- Key players such as Bonde LPS GMBH & CO. KG, Mersen, UNP Polyvalves, CRP, and Crane Company focus on product innovation, capacity expansion, and partnerships with EPC contractors to secure projects.

- North America leads with 33% share, followed by Europe at 28% and Asia-Pacific at 27%, supported by infrastructure upgrades and stricter compliance in chemical handling and wastewater treatment.

Market Segmentation Analysis:

By Product Type

Lined pipes dominate the fluoropolymer lined pipes & fittings market, holding over 60% share in 2024. Their widespread use in chemical processing, water treatment, and pharmaceutical industries is driven by superior corrosion resistance and leak prevention. Lined pipes are preferred for transferring aggressive acids, alkalis, and solvents, ensuring system reliability and lower maintenance costs. Growing investment in industrial infrastructure and stricter compliance standards for chemical handling support their demand. Lined fittings complement pipe systems, but their adoption remains secondary, mainly for complex pipeline layouts and high-performance flow control applications.

- For instance, Mersen’s Armylor® PTFE-lined pipes deliver continuous service temperatures ranging from –50°C up to +230°C and provide full-vacuum and high-pressure resistance in chemical plant operations. Seamless liners for these pipes are available in various lengths, with some standard pipes manufactured in lengths up to 6 meters, depending on the diameter.

By Diameter Range

Medium diameter pipes (2 to 8 inches) lead the market with around 50% share in 2024. This range offers the best balance between flow capacity, flexibility, and cost-effectiveness, making it ideal for chemical plants and process industries. Rising installation of medium-scale chemical reactors and fluid transport systems drives adoption. Small diameter pipes serve specialized applications like laboratory setups and precision chemical dosing, while large diameter pipes above 8 inches are used in high-volume applications, including bulk chemical transfer and wastewater management in large facilities.

- For instance, UNP Polyvalves manufactures PFA, FEP, and PTFE lined pipes in a size range of ½” to 24″, including sizes such as 2″, 4″, 6″, and 8″. A maximum length of 3 meters per spool is standard, and the lining is certified to meet ASTM F1545 standards.

By Material

Virgin PTFE accounts for over 55% share in 2024, dominating the material segment due to its superior chemical resistance, low friction, and high purity. It is widely used in industries requiring contamination-free flow, such as pharmaceuticals and food processing. Modified PTFE is gaining traction where enhanced mechanical strength and stress-crack resistance are needed, particularly in high-pressure systems. Expanded PTFE finds applications in gasketing and sealing solutions, but its use in lined pipes remains limited. Increased demand for high-performance, long-lasting materials continues to drive innovation in PTFE variants.

Key Growth Drivers

Rising Demand from Chemical Processing Industry

The chemical processing industry drives the largest demand for fluoropolymer lined pipes & fittings. These systems offer superior resistance to corrosion, scaling, and chemical attack, ensuring safe transport of acids, alkalis, and solvents. Expanding production capacities in petrochemicals and specialty chemicals further boost adoption. Stringent safety and emission norms are encouraging industries to replace traditional metallic pipelines with lined alternatives to prevent leaks and contamination. This shift reduces downtime, lowers maintenance costs, and improves operational reliability, making lined pipes a preferred choice in highly corrosive industrial environments.

- For instance, CRP manufactures PTFE-lined piping and fittings rated for continuous operation at temperatures from as low as -40°C, and with vacuum capabilities up to 200°C for smaller diameters, with pipe spools and fittings available in nominal diameters up to DN600.

Growing Adoption in Water and Wastewater Treatment

Water and wastewater treatment plants increasingly use fluoropolymer lined pipes & fittings due to their ability to handle aggressive chemicals such as chlorine and caustic soda. Rising global focus on safe water infrastructure and reuse of industrial effluents supports this growth. Municipal and industrial projects demand reliable, long-life piping systems that can minimize failures and contamination risks. Government investments in upgrading treatment facilities and implementing strict discharge regulations are fueling large-scale adoption, particularly in emerging economies with growing urban populations and industrialization.

- For instance, Suflon Industries supplies PTFE-lined pipes in various diameters for chemical and industrial applications. These pipes offer excellent corrosion resistance and a long service life, making them suitable for use in water treatment plants and large-scale effluent recycling systems where chemicals like sodium hypochlorite and ferric chloride are dosed for effective water purification.

Expansion in Pharmaceutical and Food Industries

The pharmaceutical and food processing industries are adopting fluoropolymer lined pipes to maintain product purity and meet stringent hygiene standards. Virgin PTFE’s non-stick and non-reactive properties make it ideal for preventing contamination during fluid transfer. Increasing demand for sterile production lines in pharmaceuticals and clean-in-place (CIP) systems in food manufacturing drives market growth. Regulatory requirements from agencies like FDA and EMA are pushing companies to invest in high-performance lined systems that ensure compliance, reduce maintenance downtime, and extend pipeline life in critical production environments.

Key Trends & Opportunities

Technological Advancements in Lining Materials

The market is witnessing innovations in modified and expanded PTFE, offering improved mechanical strength, permeation resistance, and durability. These advancements allow lined pipes to operate under higher pressures and temperatures, broadening their use in challenging industrial environments. Manufacturers are also developing seamless liners and automated lining processes to enhance reliability and production efficiency. This trend creates opportunities for suppliers to offer tailored solutions for high-value industries such as semiconductors, where ultra-pure fluid handling is critical, opening new avenues for growth.

- For instance, Mersen’s Armylor® PTFE-lined pipes are constructed using seamless liners, with a standard thickness of 4 mm for some large diameters and heavier options available, capable of handling temperatures from –50°C to +230°C and pressures up to 10 bar, supporting semiconductor and chemical plants requiring ultrapure and high-resistance fluid transport.

Growth in Asia-Pacific Industrial Infrastructure

Asia-Pacific presents significant opportunities due to rapid industrialization in China, India, and Southeast Asia. Growing chemical manufacturing hubs and water treatment projects are increasing the demand for corrosion-resistant piping systems. Regional governments are investing in expanding industrial clusters and implementing stricter environmental controls, boosting adoption. Local production capabilities and partnerships with global players are helping reduce costs and improve supply chain efficiency. This regional growth is expected to make Asia-Pacific one of the fastest-growing markets during the forecast period, attracting significant investment.

- For instance, Shandong Micflon Technology Co., Ltd. in China is an established manufacturer of high-performance fluoroplastics, including modified polytetrafluoroethylene (PTFE) products. The company supplies PTFE semi-finished and finished products, such as rods, sheets, and tubes, for demanding applications in the chemical processing industry, including industrial water treatment and chemical transfer.

Key Challenges

High Initial Investment Costs

Fluoropolymer lined pipes & fittings come with higher upfront costs compared to conventional steel or plastic piping systems. The expense of virgin PTFE, manufacturing processes, and specialized installation requirements can deter small and medium enterprises from adoption. While the systems offer lower lifecycle costs due to reduced maintenance, budget constraints in developing regions often slow replacement projects. Manufacturers must focus on cost optimization and value-engineered solutions to expand market penetration and appeal to cost-sensitive end-users.

Volatility in Raw Material Prices

Fluctuating prices of PTFE resins and other fluoropolymers pose a challenge for manufacturers, impacting profit margins and pricing stability. Raw material shortages or supply chain disruptions can delay production and project deliveries, leading to higher costs for end-users. Dependence on a limited number of global suppliers increases vulnerability. Companies are investing in backward integration, securing long-term supplier contracts, and exploring alternative fluoropolymers to mitigate this risk and maintain competitiveness in a price-sensitive market.

Regional Analysis

North America

North America holds 33% share of the fluoropolymer lined pipes & fittings market in 2024. Strong demand comes from chemical processing, pharmaceuticals, and water treatment facilities that require corrosion-resistant piping systems. The U.S. leads with major investments in chemical manufacturing capacity expansions and replacement of aging infrastructure. Stricter environmental compliance by EPA drives adoption of lined systems to prevent leaks and contamination. The pharmaceutical industry’s focus on clean, sterile production lines further boosts market demand. Continuous R&D by local manufacturers and partnerships with engineering firms enhance product availability, supporting steady growth across both industrial and municipal applications.

Europe

Europe accounts for 28% share in 2024, supported by its well-established chemical and petrochemical industries. Countries such as Germany, France, and the U.K. are upgrading pipeline systems to meet REACH and environmental safety standards. Adoption of virgin PTFE liners is growing in the pharmaceutical and food sectors due to strict hygiene regulations. Investments in wastewater treatment plants across EU nations are fueling demand for corrosion-resistant systems. Regional manufacturers focus on sustainable production processes and recyclable materials, aligning with the EU’s green initiatives. Technological innovations and local presence of key players strengthen Europe’s competitive edge in this market.

Asia-Pacific

Asia-Pacific represents 27% share of the fluoropolymer lined pipes & fittings market in 2024. Rapid industrialization, especially in China, India, and Southeast Asia, is driving demand from chemical processing, power generation, and water treatment sectors. Government-backed infrastructure projects and stricter regulations on effluent discharge are increasing adoption. Domestic manufacturers are expanding capacity through joint ventures and technology transfer agreements with global suppliers. Rising pharmaceutical production and growing food processing industries in the region also contribute to market growth. Competitive pricing and shorter delivery cycles give Asia-Pacific a strong advantage, positioning it as a key growth hub in coming years.

Middle East & Africa

Middle East & Africa hold 7% share in 2024, driven by the oil & gas and petrochemical sectors. Countries such as Saudi Arabia and UAE are investing in refinery upgrades and chemical production facilities, creating demand for lined pipes that can withstand highly corrosive media. Adoption is increasing in desalination plants and water treatment projects to support urban development and industrial use. African markets are gradually adopting fluoropolymer-lined systems as infrastructure modernizes. Strategic partnerships with international suppliers and government-led industrial initiatives are expected to expand market presence and accelerate growth in the coming years.

Latin America

Latin America captures 5% share of the market in 2024. Brazil and Mexico are the leading contributors, supported by investments in chemical production and mining operations that require corrosion-resistant piping solutions. Growing focus on improving water infrastructure and wastewater treatment drives additional demand. Economic recovery and increased foreign investments are fueling expansion projects in process industries. However, high installation costs and long procurement cycles slightly restrain faster adoption. Local distributors are strengthening supply networks to meet growing demand and provide cost-effective solutions, helping boost the regional share during the forecast period.

Market Segmentations:

By Product Type

- Lined Pipes

- Lined Fittings

By Diameter Range

- Small Diameter (Less Than 2 Inches)

- Medium Diameter (2 Inches To 8 Inches)

- Large Diameter (Above 8 Inches)

By Material

- Virgin PTFE

- Modified PTFE

- Expanded PTFE

By Pressure Rating

- Low Pressure (Up To 150 Psi)

- Medium Pressure (150 Psi To 300 Psi)

- High Pressure (Above 300 Psi)

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the fluoropolymer lined pipes & fittings market features key players such as Bonde LPS GMBH & CO. KG, Mersen, UNP Polyvalves, Faab Industries, Sigma Polymers Engineering Company, CRP, Arconi S.A, Baum Lined Piping GMBH, Suflon Industries, and Crane Company (Crane Chempharma & Energy Corp.). These companies focus on delivering corrosion-resistant solutions tailored for chemical processing, pharmaceuticals, and water treatment applications. Strategic initiatives include capacity expansions, product innovations in virgin and modified PTFE liners, and collaborations with EPC contractors to secure large-scale projects. Many players are investing in automation and seamless lining technology to improve reliability and reduce installation time. Partnerships and joint ventures with regional distributors are helping expand market reach, especially in Asia-Pacific and the Middle East. Competition remains strong, with companies emphasizing cost optimization, compliance with global standards, and enhanced aftersales service to strengthen their market position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bonde LPS GMBH & CO. KG

- Mersen

- UNP Polyvalves

- Faab Industries

- Sigma Polymers Engineering Company

- CRP

- Arconi S.A

- Baum Lined Piping GMBH

- Suflon Industries

- Crane Company (Crane Chempharma & Energy Corp.)

Recent Developments

- In April 2025, Faab Industries began operations in its new in-house manufacturing and processing facility for PTFE/PFA lined pipes and fittings, including comprehensive systems in SS304, SS316, and MS as per ASTM A106 standards.

- In April 2025, UNP Polyvalves reinforced its position as a global supplier with new capacity expansions for PFA, FEP, PVDF, and ETFE-lined pipes and fittings ranging from ½” to 24”.

- In August 2024, Bonde LPS GmbH & Co. KG emphasized its position as a leading international supplier of PTFE and PFA-lined piping components, announcing expanded capabilities for PTFE expansion joints and custom PTFE special components for the chemical, pharmaceutical, and food processing industries.

- In June 2024, Arconi S.A expanded its offerings with a new series of PTFE, PFA, PVDF, and PP lined pipes and fittings, targeting chemical, food, and construction sectors.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Diameter Range, Material, Pressure Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for corrosion-resistant piping systems will grow with expansion of chemical and pharmaceutical industries.

- Adoption of virgin and modified PTFE materials will increase for high-purity and high-pressure applications.

- Medium-diameter pipes will remain the most preferred option for process industries and water treatment plants.

- Integration of seamless lining technology will improve durability and reduce maintenance downtime.

- Asia-Pacific will emerge as the fastest-growing region driven by rapid industrialization and infrastructure projects.

- Manufacturers will focus on cost optimization and localized production to meet regional demand.

- Environmental compliance regulations will push industries to replace traditional metallic pipelines with lined systems.

- Partnerships with EPC contractors and turnkey solution providers will expand project-based installations.

- Investments in automation and digital monitoring will enhance reliability and lifecycle management.

- Competitive intensity will rise as global and regional players introduce innovative and sustainable product solutions.