Market Overview

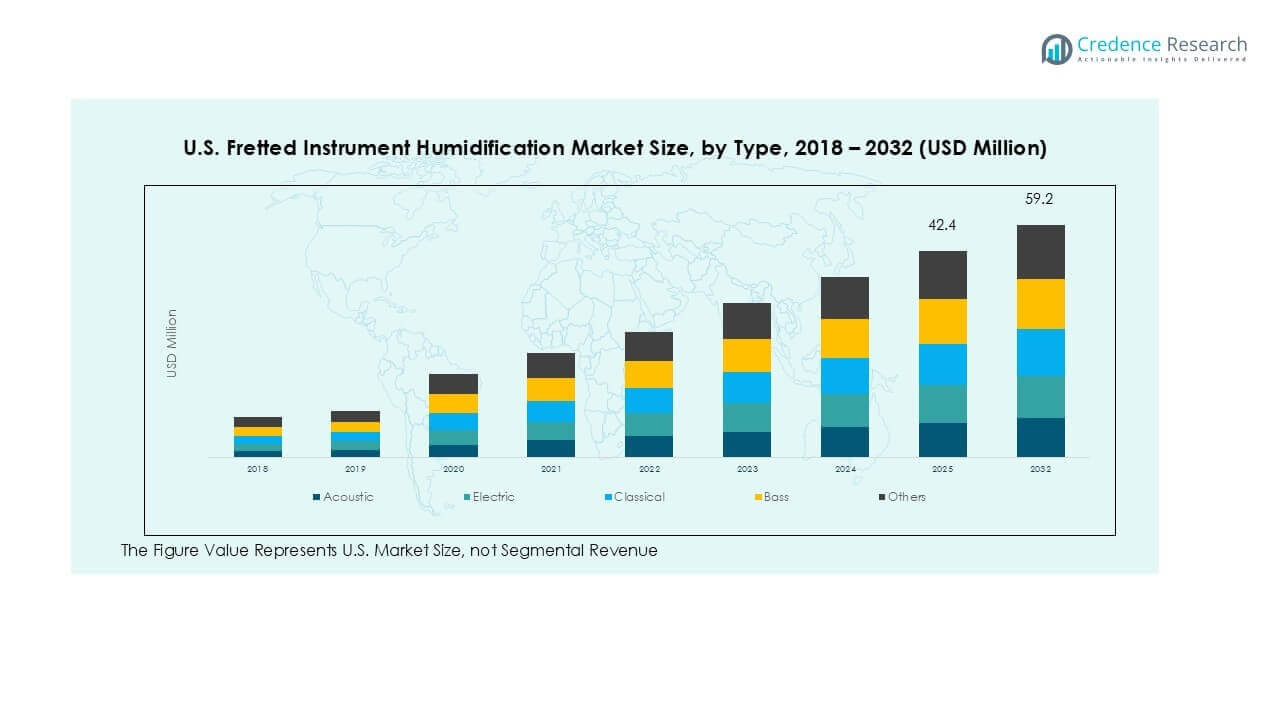

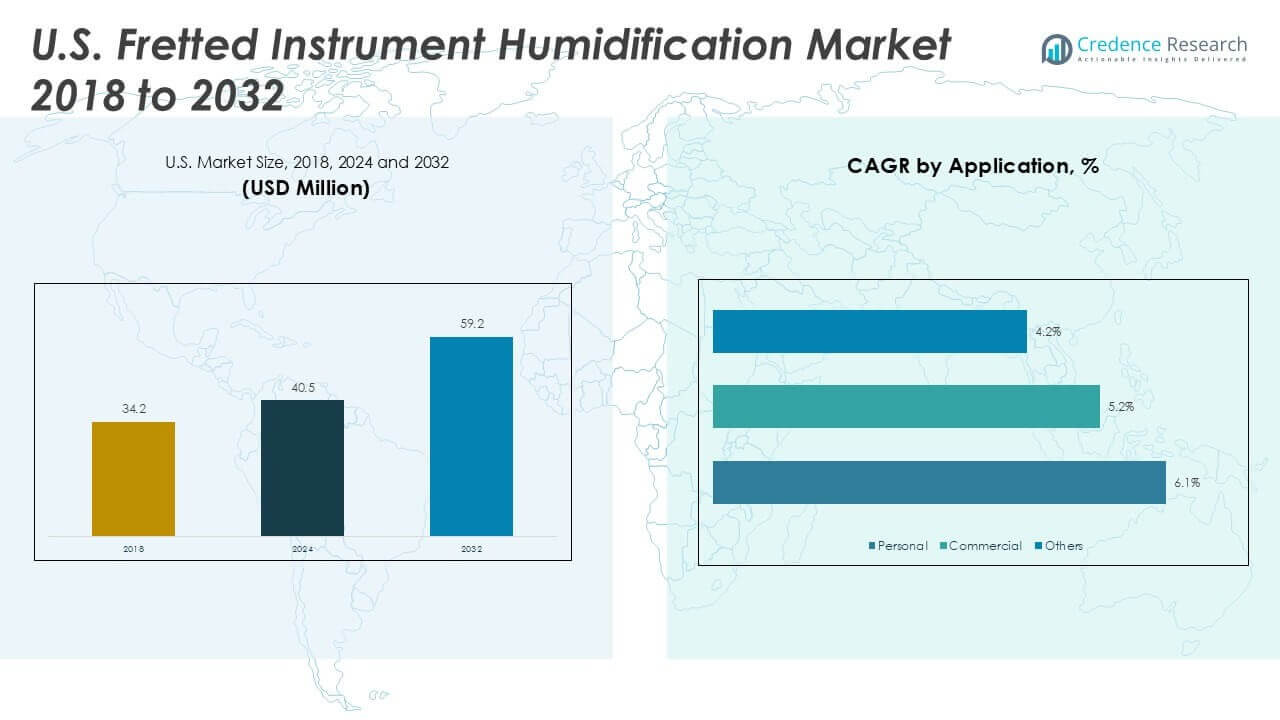

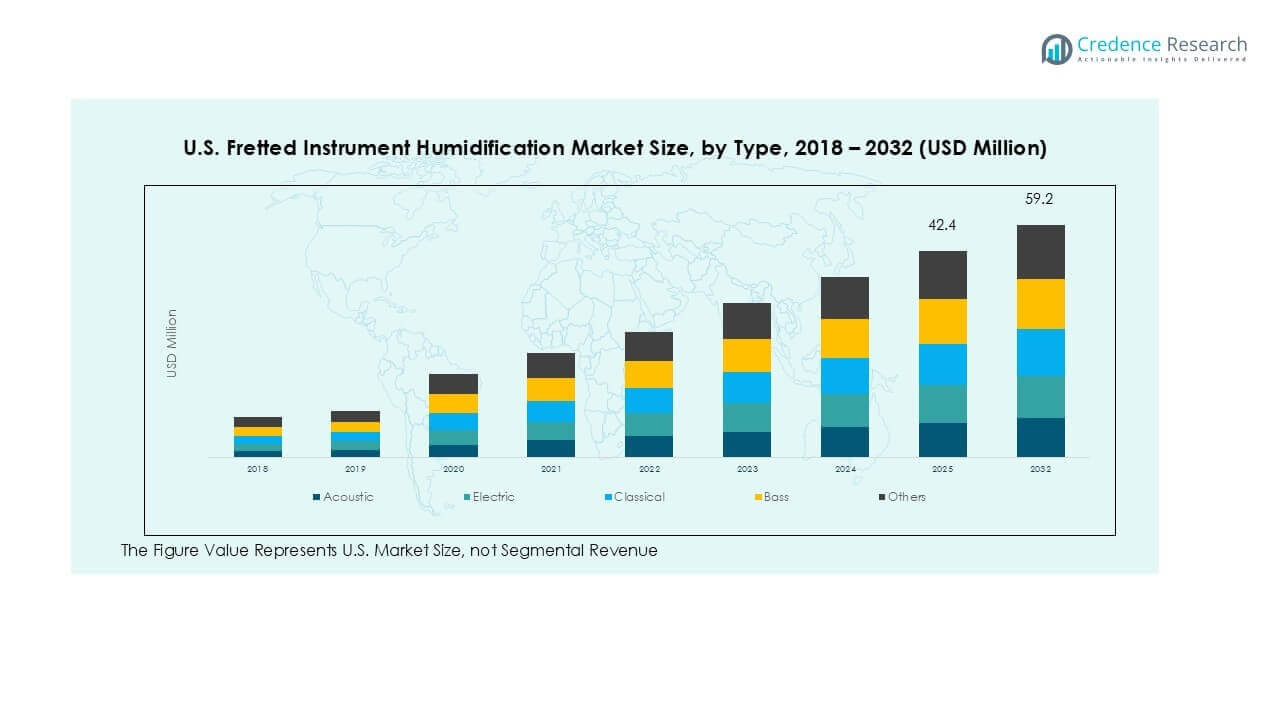

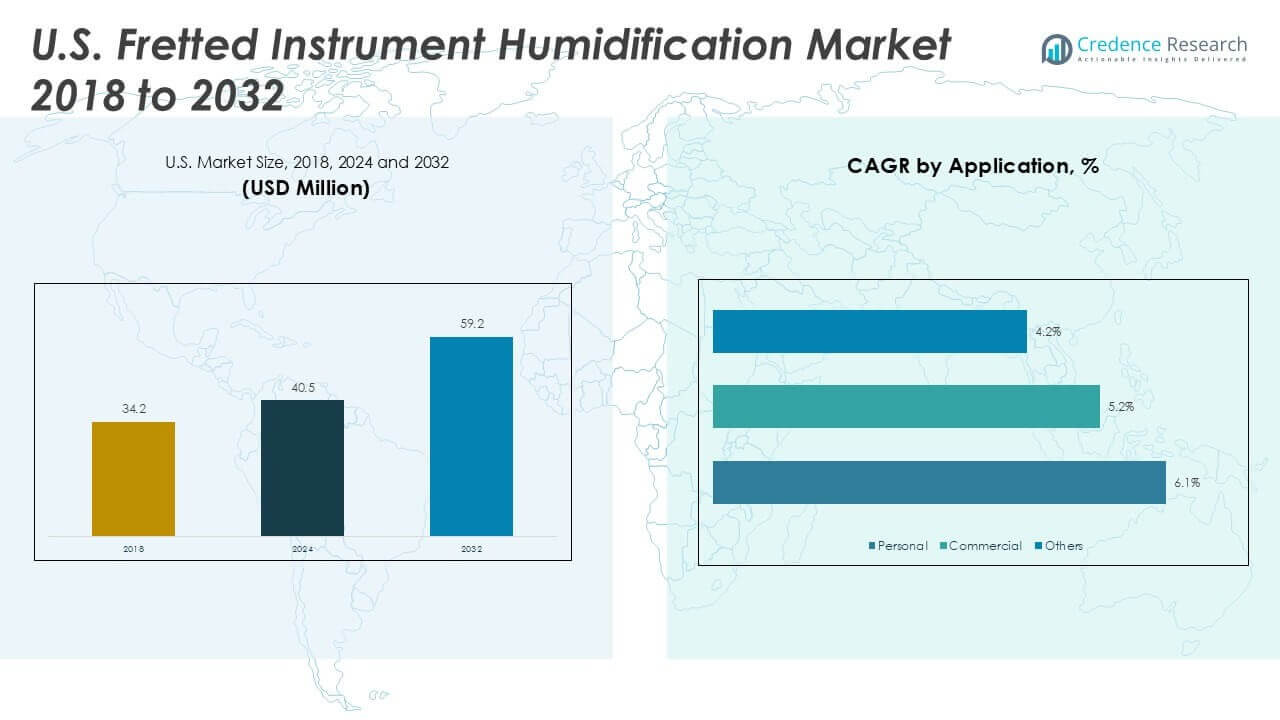

U.S. Fretted Instrument Humidification Market size was valued at USD 34.2 million in 2018, increased to USD 40.5 million in 2024, and is anticipated to reach USD 59.2 million by 2032, at a CAGR of 4.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Fretted Instrument Humidification Market Size 2024 |

USD 40.5 Million |

| U.S. Fretted Instrument Humidification Market, CAGR |

4.90% |

| U.S. Fretted Instrument Humidification Market Size 2032 |

USD 59.2 Million |

The U.S. fretted instrument humidification market is led by key players such as Condair Group, D’Addario & Co., Humistat, Aprilaire, Boveda, and Music Nomad, who collectively account for a significant share through their diverse product offerings and nationwide distribution. These companies focus on in-case humidifiers, room-based systems, and smart monitoring solutions, targeting both professional musicians and institutional buyers. Regionally, the Northeast leads the market with nearly 30% share, driven by its cold winters and strong concentration of music schools and conservatories. The Midwest follows with about 25% share, supported by robust school music programs and community bands, while the South and West regions capture 24% and 21%, respectively, reflecting rising demand from touring musicians, retailers, and collectors seeking effective humidity control solutions.

Market Insights

Market Insights

- The U.S. fretted instrument humidification market was valued at USD 40.5 million in 2024 and is projected to reach USD 59.2 million by 2032, growing at a CAGR of 4.90%.

- Growth is driven by rising sales of acoustic and classical instruments, increasing awareness of preventive maintenance, and expanding music education programs and studios that demand consistent humidity control for large instrument inventories.

- Key trends include adoption of smart, app-enabled humidifiers offering real-time humidity monitoring, subscription-based refill kits, and bundled sales with premium guitar purchases, ensuring consistent product use throughout the year.

- Leading players such as Condair Group, D’Addario & Co., Humistat, Aprilaire, Boveda, and Music Nomad compete through innovation, distribution partnerships, and direct-to-consumer strategies, with smaller brands focusing on cost-effective solutions.

- Regionally, Northeast leads with nearly 30% share, followed by Midwest at 25%, South at 24%, and West at 21%, while acoustic segment dominates by type, supported by high sensitivity to humidity fluctuations.

Market Segmentation Analysis:

By Type

Acoustic segment dominated the U.S. fretted instrument humidification market in 2024, holding the largest share driven by its extensive use among professional and hobbyist players. Acoustic guitars are more sensitive to humidity changes compared to electric instruments, requiring regular maintenance to prevent warping and cracking. Rising sales of premium acoustic guitars and the popularity of fingerstyle and unplugged music sessions have fueled demand for effective humidification solutions. Electric, classical, and bass segments follow, serving musicians seeking tone preservation, while “others” include niche instruments such as mandolins and banjos with smaller but steady adoption.

- For instance, in 2024, Martin Guitar continued its legacy of crafting acoustic instruments and released several new models for players of all levels.

By Application

Personal application led the market in 2024, supported by growing awareness among individual players about the impact of humidity on instrument longevity. Musicians increasingly invest in in-case humidifiers and room humidifiers to maintain consistent moisture levels, particularly in regions with seasonal dryness. Commercial applications, including music schools, recording studios, and retail stores, represent a growing segment as institutions adopt centralized humidity control to protect multiple instruments. The “others” category includes orchestras and touring groups, where portable humidification solutions ensure instruments remain performance-ready across varied climate conditions.

- For instance, Berklee College of Music, like other leading conservatories, has rigorous policies and climate-controlled facilities to protect the thousands of valuable stringed instruments used by its students and faculty. Maintaining a stable humidity level is a critical component of instrument preservation.

Key Growth Drivers

Key Growth Drivers

Growing Demand for Acoustic Instruments

The rising popularity of acoustic guitars and classical instruments is a major driver for the U.S. fretted instrument humidification market. These instruments are highly sensitive to humidity fluctuations, which can cause cracks, fret sprout, and tonal imbalance. Increasing interest in genres such as country, folk, and indie music is boosting acoustic guitar sales, particularly among young players and professionals. This growth directly supports the demand for in-case and room humidifiers. Retailers and manufacturers are actively promoting humidification products as essential accessories, further increasing awareness and adoption across different customer groups.

- For instance, Fender Musical Instruments, a leading guitar manufacturer, continued to be a top-selling brand for acoustic guitars in 2024, maintaining strong market visibility on online marketplaces like Reverb. Humidification is an essential part of care for acoustic guitars, especially mid- and high-end solid-wood models, but manufacturers like Fender typically sell humidification kits separately as optional accessories.

Expansion of Music Schools and Studios

The growth of music education programs, conservatories, and recording studios is accelerating market expansion. These institutions often store multiple fretted instruments that require consistent humidity control to preserve sound quality and structural integrity. Centralized humidification systems and bulk in-case solutions are increasingly used in schools and studios to reduce long-term maintenance costs. Grants and private funding for music programs also encourage the purchase of new instruments, indirectly increasing the need for humidity management. This trend is particularly visible in urban centers with strong arts and culture infrastructure.

- For instance, in 2023, Yamaha concentrated on its “School Project” in emerging nations, including Malaysia and India. These initiatives focused on introducing instrumental music education into public school curricula, often by providing instruments like recorders and keyboards along with teacher training.

Rising Focus on Preventive Maintenance

Musicians are becoming more proactive about instrument care, leading to higher adoption of humidification products. Repair costs for warped necks, cracks, and damaged tonewoods can be significant, encouraging players to invest in preventive solutions. Online tutorials, social media influencers, and major guitar brands are educating users about ideal humidity levels. The availability of affordable digital hygrometers and portable humidifiers further supports this trend. Subscription-based humidifier kits and maintenance packages offered by music retailers are also boosting consistent product usage throughout the year.

Key Trends & Opportunities

Growth of Online Sales Channels

The rapid expansion of e-commerce and direct-to-consumer sales channels presents a significant opportunity for market players. Online music equipment retailers are bundling humidification kits with new instrument purchases, ensuring customers receive essential care products from the start. Subscription-based refill models are gaining popularity, allowing manufacturers to establish recurring revenue streams. Digital platforms also give brands the ability to provide educational content, such as videos and guides, directly to buyers, which increases awareness and long-term product loyalty. This channel expansion is particularly important for reaching players in rural or underserved regions where physical music stores are limited.

- For instance, Sweetwater sells humidification kits through its online platform, some of which are sold as part of bundled guitar purchases.

Integration of Smart Humidification Systems

Technology integration is a defining trend in the market, with smart humidification systems gaining significant traction. These devices feature app-based monitoring, allowing musicians to track humidity levels in real time and receive alerts when adjustments are needed. Some advanced systems offer automated moisture regulation, reducing manual intervention and ensuring optimal protection for valuable instruments. The integration of these devices with IoT-enabled home systems further appeals to tech-savvy users, providing a seamless solution for instrument care. Manufacturers are innovating with compact, sensor-driven designs that can fit inside cases or work for multiple instruments at once, addressing both convenience and precision.

Key Challenges

Limited Awareness Among Entry-Level Players

A major challenge is the lack of awareness about humidity control among entry-level players and casual buyers. Many beginners purchase budget instruments without receiving proper guidance on maintenance, which can lead to early damage and frustration. This segment often perceives humidification products as unnecessary or too costly, resulting in low adoption rates. Manufacturers must address this gap by offering affordable starter kits and collaborating with retailers to educate customers at the point of sale. Informational campaigns and value bundles can help convert first-time buyers into repeat customers while protecting instrument longevity.

Seasonality of Demand

The market faces a pronounced challenge due to seasonal demand fluctuations, with sales peaking in winter months when indoor air becomes significantly drier. This leads to uneven revenue cycles and complicates production planning for manufacturers. Smaller players with limited inventory capacity often struggle to meet peak-season demand, resulting in lost sales opportunities. Off-season demand generation through educational campaigns, bundled offers, and subscription-based services can help stabilize revenue streams. Larger manufacturers are also investing in predictive analytics and inventory optimization tools to better manage these cyclical variations and maintain consistent market presence year-round.

Regional Analysis

Northeast

Northeast held the largest share of the U.S. fretted instrument humidification market in 2024, accounting for nearly 30% of total demand. The region’s cold winters and indoor heating systems create low humidity levels, increasing the need for in-case and room humidifiers. High concentration of music schools, conservatories, and professional players in cities like New York and Boston drives adoption. Growth is supported by rising sales of premium acoustic instruments and awareness campaigns by retailers. The presence of specialized music stores offering bundled humidification solutions further strengthens regional sales and encourages regular maintenance practices among musicians.

Midwest

Midwest captured around 25% of the market share in 2024, driven by fluctuating seasonal humidity levels. The region experiences extremely dry winters and humid summers, making humidity control critical for preserving tonewoods in fretted instruments. Strong presence of community bands, school music programs, and local guitar makers drives demand for affordable humidification products. Rising participation in folk and country music events in states such as Michigan and Wisconsin also boosts adoption. Retail partnerships and online education on instrument care are encouraging more hobbyists and professionals to invest in proper humidification solutions year-round.

South

South accounted for nearly 24% of the market in 2024, supported by its large base of musicians and strong cultural association with blues, country, and gospel genres. Although the region has higher average humidity, air conditioning and changing indoor conditions make instruments prone to drying out, especially during summer. Growing disposable incomes and rising sales of acoustic and bass guitars have accelerated product demand. Music festivals and live performance venues in Texas, Tennessee, and Georgia also emphasize instrument care, prompting adoption of portable and case-based humidifiers among touring and performing artists.

West

West region represented about 21% of the U.S. market share in 2024, driven by its dry climate in states like California, Nevada, and Arizona. Low ambient humidity significantly increases the risk of cracks and warping in high-end acoustic guitars, prompting strong adoption of in-case humidifiers. Rising popularity of independent music scenes, home studios, and boutique guitar makers supports steady growth. Retailers and online platforms promote humidification kits alongside guitar purchases, raising awareness among new buyers. Adoption is further supported by environmentally controlled storage spaces offered by music schools and studios to maintain instrument quality.

Market Segmentations:

By Type

- Acoustic

- Electric

- Classical

- Bass

- Others

By Application

- Personal

- Commercial

- Others

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. fretted instrument humidification market is moderately consolidated, with a mix of global players and niche specialists offering a range of solutions. Leading companies such as Condair Group, D’Addario & Co., Humistat, Aprilaire, Boveda, and Music Nomad dominate through extensive product portfolios and strong distribution networks. These players provide in-case humidifiers, room systems, smart hygrometers, and subscription-based maintenance kits targeting both individual musicians and institutions. Strategic partnerships with music retailers, online platforms, and educational institutions are helping companies expand their reach. Product innovation is a key focus, with many players introducing IoT-enabled devices offering real-time humidity monitoring and alerts. Competitive strategies include brand collaborations, direct-to-consumer sales models, and bundled offerings with premium guitar purchases. Smaller companies compete by providing affordable and portable solutions for hobbyists, while established brands focus on premium, technology-driven products to cater to professional musicians, collectors, and studios seeking reliable long-term protection.

Key Player Analysis

Recent Developments

- In July 2025, Condair launched the Condair RO-E reverse osmosis water purifier, designed specifically for use with humidifiers, which can be adapted for instrument humidification where precise mineral-free moisture is required. This release focuses on supporting humidity systems’ hygiene, energy efficiency, and longer service cycles through improved water purity.

- In July 2024, the humidity control specialist Condair acquired Kuul, a US-based manufacturer of evaporative media, to enhance its evaporative cooling and humidification solutions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising acoustic and classical instrument sales.

- Adoption of smart, app-connected humidification devices will become more widespread among professionals.

- Subscription-based refill kits will gain traction, ensuring consistent maintenance and recurring revenue for manufacturers.

- Educational campaigns will increase awareness of humidity control among entry-level players and hobbyists.

- Music schools and conservatories will continue to invest in centralized humidification systems for instrument preservation.

- E-commerce platforms will expand market access, enabling bundled product sales with new instruments.

- Portable and travel-friendly humidifiers will see higher demand from touring musicians and collectors.

- Technological innovation will focus on compact, sensor-driven designs offering precise humidity monitoring.

- Regional demand will remain highest in the Northeast, with steady growth in Midwest and South.

- Competitive pressure will push companies to diversify portfolios and enhance direct-to-consumer sales strategies.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers