Market Overview

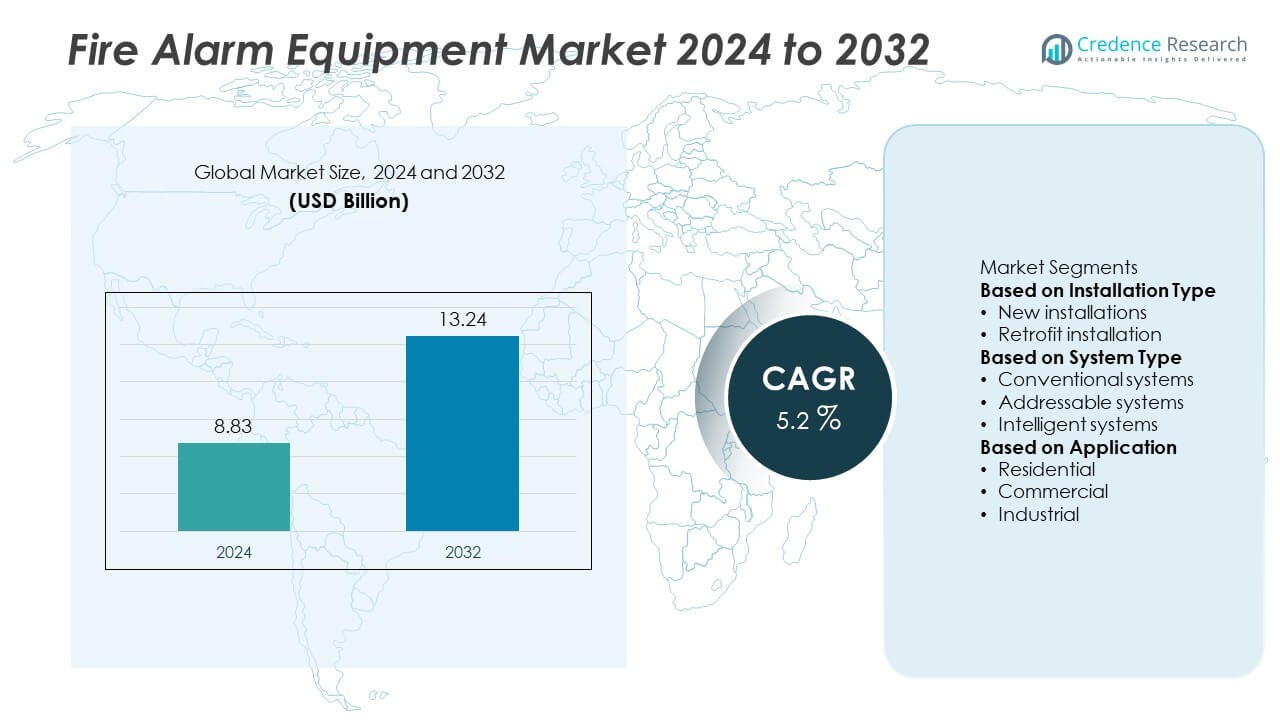

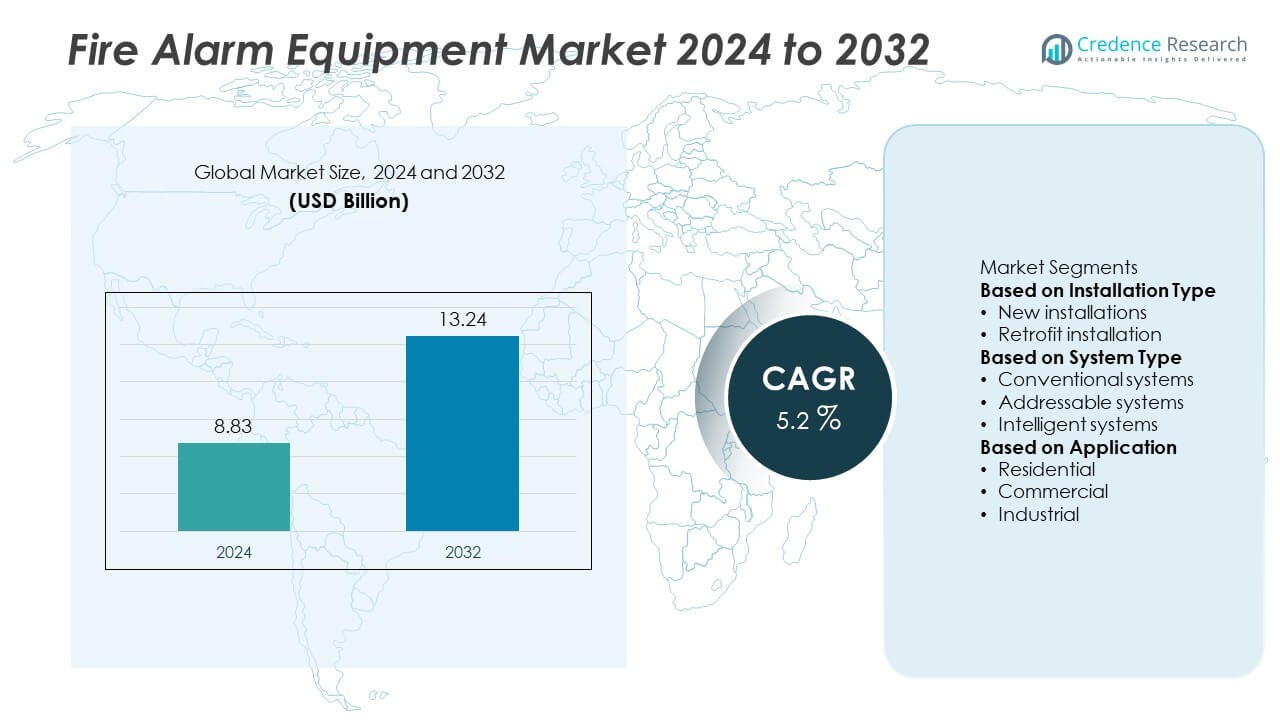

The Fire Alarm Equipment market was valued at USD 8.83 billion in 2024 and is projected to reach USD 13.24 billion by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fire Alarm Equipment Market Size 2024 |

USD 8.83 Billion |

| Fire Alarm Equipment Market, CAGR |

5.2% |

| Fire Alarm Equipment Market Size 2032 |

USD 13.24 Billion |

The Fire Alarm Equipment market is led by key players such as Apollo Fire Detectors Ltd, Nittan Company Ltd, Honeywell International Inc., Advanced Electronics Ltd, Nohmi Bosai Ltd., HOCHIKI Corporation, Fike Corporation, ABB, Gentex Corporation, and Mircom Group of Companies. These companies focus on advanced detection technologies, wireless solutions, and integration with smart building systems to maintain competitiveness. North America dominated the market with 38% share in 2024, driven by strict fire safety regulations and widespread adoption in commercial buildings. Europe held 27% share, supported by EN 54 compliance, while Asia-Pacific captured 24% share, emerging as the fastest-growing region due to rapid urbanization and government-led safety initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fire Alarm Equipment market was valued at USD 8.83 billion in 2024 and is projected to reach USD 13.24 billion by 2032, growing at a CAGR of 5.2% during 2025–2032.

- Rising construction activities, strict fire safety regulations, and government mandates are key drivers boosting adoption of fire alarm systems in residential, commercial, and industrial facilities.

- Trends include increasing demand for wireless and IoT-enabled systems, integration with building management solutions, and growing adoption of intelligent fire alarm systems for faster response and reduced false alarms.

- The market is competitive with leading players such as Apollo Fire Detectors Ltd, Honeywell International Inc., HOCHIKI Corporation, and ABB focusing on innovation, global expansion, and compliance with international safety standards to strengthen market position.

- North America led with 38% share in 2024, followed by Europe with 27% and Asia-Pacific with 24%, while commercial applications accounted for 45% of overall demand, dominating other segments.

Market Segmentation Analysis:

By Installation Type

New installations dominated the market in 2024, accounting for 60% share due to the rising construction of residential, commercial, and industrial buildings. Growing urbanization, strict fire safety regulations, and increasing government initiatives to mandate fire protection systems drive demand for new installations. The retrofit segment, holding the remaining share, is supported by modernization of existing infrastructure and replacement of outdated fire alarm systems with advanced addressable and intelligent solutions. Growth in smart city projects and renovation of commercial spaces continues to boost adoption of new fire safety installations worldwide.

- For instance, in 2024, Johnson Controls advanced its portfolio of fire and life safety technology, integrating its fire alarm control panels with its Metasys® Building Automation System (BAS) to enhance overall building performance and sustainability.

By System Type

Addressable systems led the market with more than 50% share in 2024, preferred for their ability to pinpoint fire locations and reduce response time. Their integration with building management systems makes them ideal for large commercial and industrial facilities. Conventional systems maintain usage in small-scale buildings, while intelligent systems are gaining traction for data-driven monitoring and predictive maintenance. The demand for addressable systems is fueled by stricter fire codes, enhanced reliability, and growing awareness of minimizing property damage and ensuring occupant safety.

- For instance, Siemens continued to expand its fire safety offerings in 2024, focusing on IoT-enabled hardware, digital services, and building management integration through its Building X platform. The company has extensive project experience in diverse sectors, including modernizing fire safety systems in healthcare, educational facilities, and industrial environments.

By Application

The commercial segment held the largest share at 45% in 2024, driven by strict compliance requirements for offices, malls, hospitals, and educational institutions. The residential segment is expanding steadily with rising urban housing projects and growing consumer awareness about home safety. Industrial applications contribute significantly due to mandatory fire detection systems in manufacturing plants, oil & gas facilities, and warehouses. The dominance of commercial applications is reinforced by rising investment in infrastructure development and regulatory enforcement for fire safety compliance across public and private spaces.

Key Growth Drivers

Stringent Fire Safety Regulations

Governments worldwide are implementing strict building codes and fire safety regulations, driving demand for fire alarm equipment. Commercial complexes, hospitals, and educational institutions must comply with mandatory fire protection standards. These regulations encourage installation of advanced fire alarm systems, particularly addressable and intelligent types. Rising enforcement of workplace safety rules and insurance requirements further boosts adoption. This regulatory push ensures consistent growth in both new installations and retrofit projects across developed and developing economies.

- For instance, Vetrotech Saint-Gobain manufactured and supplied certified fire-rated glazing systems for construction and retrofit projects in India during the first half of 2025, to align with evolving National Building Code standards. The company works with third-party certification bodies, like Intertek, that conduct audits of its manufacturing facilities to verify compliance with national and international standards.

Growing Urbanization and Construction Activities

Rapid urbanization and large-scale infrastructure development projects are creating strong demand for fire safety systems. New residential complexes, commercial towers, and industrial facilities increasingly integrate fire alarm equipment at the design stage. Urban housing initiatives and smart city projects further support market expansion. The focus on safety and occupant protection drives installations across high-rise buildings. Increased construction spending globally is directly contributing to rising sales of detectors, control panels, and notification devices.

- For instance, Schneider Electric supplied fire detection and alarm devices for high-rise residential towers and commercial complexes in smart city projects across Southeast Asia, meeting strict safety and building codes, as part of their ongoing involvement in the region’s sustainable urban development.

Technological Advancements in Fire Detection

The adoption of intelligent and IoT-enabled fire alarm systems is transforming the market. Modern systems offer faster response times, real-time monitoring, and remote accessibility through cloud platforms. Advanced multi-sensor detectors minimize false alarms and provide higher reliability. Integration with building automation systems allows centralized control and predictive maintenance. These innovations appeal to facility managers seeking cost-efficient and effective safety solutions, driving replacement of outdated conventional systems with next-generation equipment.

Key Trends & Opportunities

Shift Toward Wireless and Smart Solutions

Wireless fire alarm systems are gaining popularity due to easier installation, lower maintenance, and scalability. Smart alarms with IoT connectivity enable remote alerts and integration with emergency response services. This trend is particularly strong in commercial and residential sectors where minimal wiring and flexible placement are preferred. The growing adoption of smart home technology creates opportunities for manufacturers to offer connected fire detection solutions with enhanced features like mobile app notifications and self-testing capabilities.

- For instance, Honeywell offers various wireless fire and gas detection products, including both standalone and Wi-Fi-connected options with different battery life options.

Rising Demand for Integrated Safety Systems

End-users are increasingly adopting fire alarm systems integrated with access control, CCTV, and building management platforms. Integrated solutions improve emergency response and streamline facility management operations. This approach is gaining traction in large commercial and industrial sites where centralized monitoring enhances safety and efficiency. Vendors offering complete fire and security packages are well-positioned to capture market share. This trend also opens opportunities for data analytics and AI-driven predictive fire risk assessment tools.

- For instance, Bosch Building Technologies, through its systems integration business, has implemented large-scale, integrated fire and security solutions with AI-enabled analytics for numerous industrial campuses in Europe and North America.

Key Challenges

High Installation and Maintenance Costs

The significant upfront cost of advanced fire alarm systems can limit adoption, particularly in small and medium-sized enterprises. Installation of addressable and intelligent systems involves expensive control panels, wiring, and skilled labor. Ongoing maintenance, regular testing, and compliance audits add to operating expenses. Price sensitivity in developing markets can delay adoption, leading to reliance on cheaper but less reliable conventional systems.

False Alarms and System Reliability Issues

Frequent false alarms caused by dust, smoke from cooking, or system malfunctions can lead to user frustration and costly disruptions. In some cases, false alarms result in system disconnection, increasing fire risks. Manufacturers face challenges in designing detectors that balance sensitivity with selectivity. Ensuring consistent performance across diverse environments, such as industrial plants or humid areas, remains a technical hurdle for the industry.

Regional Analysis

North America

North America held 38% share of the fire alarm equipment market in 2024, making it the leading region. The United States drives demand through strict fire safety codes, NFPA standards, and high adoption of addressable and intelligent fire alarm systems in commercial and residential buildings. Growth in construction projects, modernization of infrastructure, and increasing awareness of fire safety support market expansion. Canada contributes with rising adoption of smart alarm systems and integration with building management systems. Strong presence of major manufacturers and advanced technology adoption further strengthen the region’s dominance and drive steady growth during the forecast period.

Europe

Europe accounted for 27% share in 2024, supported by stringent EU fire safety regulations and active compliance with EN 54 standards. Demand is strong in Germany, the UK, and France, where commercial buildings, healthcare facilities, and public infrastructure require advanced fire alarm systems. The region is experiencing steady retrofit demand as outdated conventional systems are replaced with addressable and wireless solutions. Growing emphasis on energy-efficient and integrated safety systems drives technological upgrades. Eastern Europe is witnessing gradual adoption as investments in infrastructure and fire safety awareness continue to grow, creating new opportunities for global and regional equipment suppliers.

Asia-Pacific

Asia-Pacific captured 24% share of the global market in 2024 and is the fastest-growing region. China leads with rapid urbanization, construction of high-rise buildings, and government-mandated fire protection standards. Japan, South Korea, and India are also contributing significantly with rising smart city projects and industrial facility expansions. Adoption of intelligent and IoT-enabled fire alarm systems is increasing to meet strict safety codes. Growing population, infrastructure development, and rising awareness about fire risks are creating strong opportunities for new installations and retrofits, making Asia-Pacific a key focus area for global manufacturers seeking long-term growth.

Latin America

Latin America represented 6% share of the market in 2024, led by Brazil and Mexico where commercial and industrial sectors are driving adoption of fire safety systems. Regulatory enforcement is strengthening, creating opportunities for advanced addressable and wireless fire alarms. Urban development projects and industrial expansion are supporting new installations in residential and commercial segments. Limited local manufacturing capacity results in higher imports, benefiting global players who can offer cost-effective solutions. Market growth is expected to accelerate as governments prioritize fire protection and insurance requirements tighten for commercial properties across the region.

Middle East & Africa

Middle East & Africa held 5% share in 2024, with demand concentrated in Gulf countries and South Africa. Rapid infrastructure development, including commercial complexes, airports, and industrial facilities, is driving installations of fire alarm systems. Governments are enforcing stricter building safety codes, boosting adoption of intelligent and networked fire alarm solutions. The hospitality sector’s growth and increasing investment in smart city initiatives create significant opportunities. Limited local production results in dependency on imports, favoring international suppliers. Rising awareness of fire risks and improving regulatory frameworks are expected to support steady market growth during the forecast period.

Market Segmentations:

By Installation Type

- New installations

- Retrofit installation

By System Type

- Conventional systems

- Addressable systems

- Intelligent systems

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the Fire Alarm Equipment market is characterized by the presence of major players such as Apollo Fire Detectors Ltd, Nittan Company Ltd, Honeywell International Inc., Advanced Electronics Ltd, Nohmi Bosai Ltd., HOCHIKI Corporation, Fike Corporation, ABB, Gentex Corporation, and Mircom Group of Companies. These companies focus on developing innovative fire detection and notification systems with enhanced reliability, faster response times, and integration capabilities with building management systems. Strategic initiatives include product launches, acquisitions, and partnerships to expand global reach and strengthen distribution networks. Many players are investing in wireless and IoT-enabled fire alarm systems to cater to smart building requirements. Emphasis on compliance with international fire safety standards and energy-efficient designs is also driving product development. The competitive intensity is expected to increase as manufacturers target high-growth regions such as Asia-Pacific and the Middle East through localized production and service networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Nittan introduced an upgraded line of heat and smoke multi-criteria detectors with improved environmental tolerance and false alarm resistance, targeting commercial and industrial sectors. The new detectors include embedded wireless communication compatible with third-party building management systems.

- In July 2025, Advanced Electronics rolled out its new Vigilant SmartFire range featuring AI-powered smoke detection algorithms that reduce false alarms by over 30% in high-dust industrial environments. The range also includes integrated IoT connectivity for remote system diagnostics and control.

- In June 2025, Nohmi Bosai launched its new UL-listed multisensor detector combining photoelectric smoke, heat, and CO sensing with AI processing to enhance early fire detection in commercial buildings. The detector supports networked operation for centralized fire management.

- In May 2025, Apollo Fire Detectors officially opened a new state-of-the-art Distribution Centre near its Havant headquarters, expanding its dispatch capacity from 20,700 sq ft to over 40,000 sq ft. This doubling of processing capability has cut lead times significantly and supports faster delivery of fire detection equipment globally.

Report Coverage

The research report offers an in-depth analysis based on Installation Type, System Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced fire alarm systems will rise with stricter building safety regulations.

- Adoption of wireless and IoT-enabled fire alarms will increase across residential and commercial sectors.

- Integration with building management systems will become standard for large facilities.

- Commercial applications will remain the largest segment due to compliance requirements.

- Growth in smart city projects will drive installation of intelligent fire alarm systems.

- Asia-Pacific will witness the fastest growth with rapid urbanization and infrastructure development.

- Manufacturers will invest in R&D to improve system reliability and reduce false alarms.

- Retrofit installations will grow as older systems are replaced with modern addressable systems.

- Partnerships and acquisitions will expand global presence and distribution networks.

- Sustainability initiatives will encourage development of energy-efficient and eco-friendly fire alarm solutions.