Market Overview

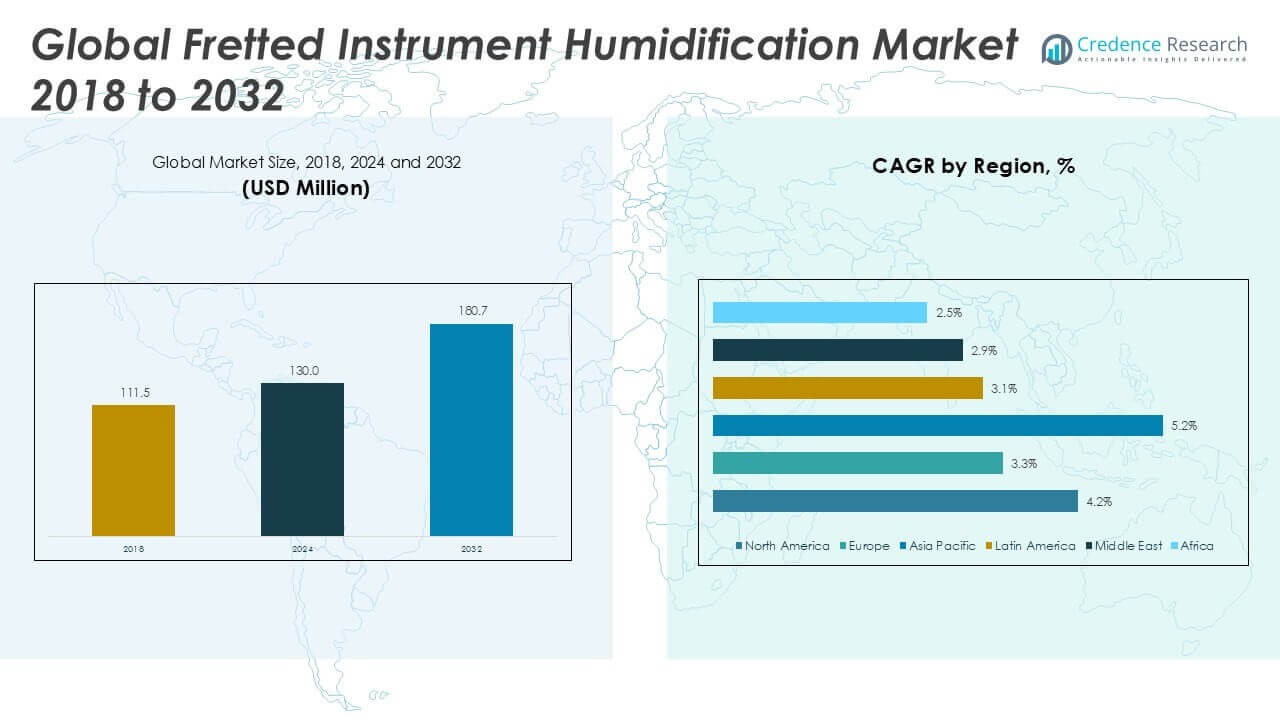

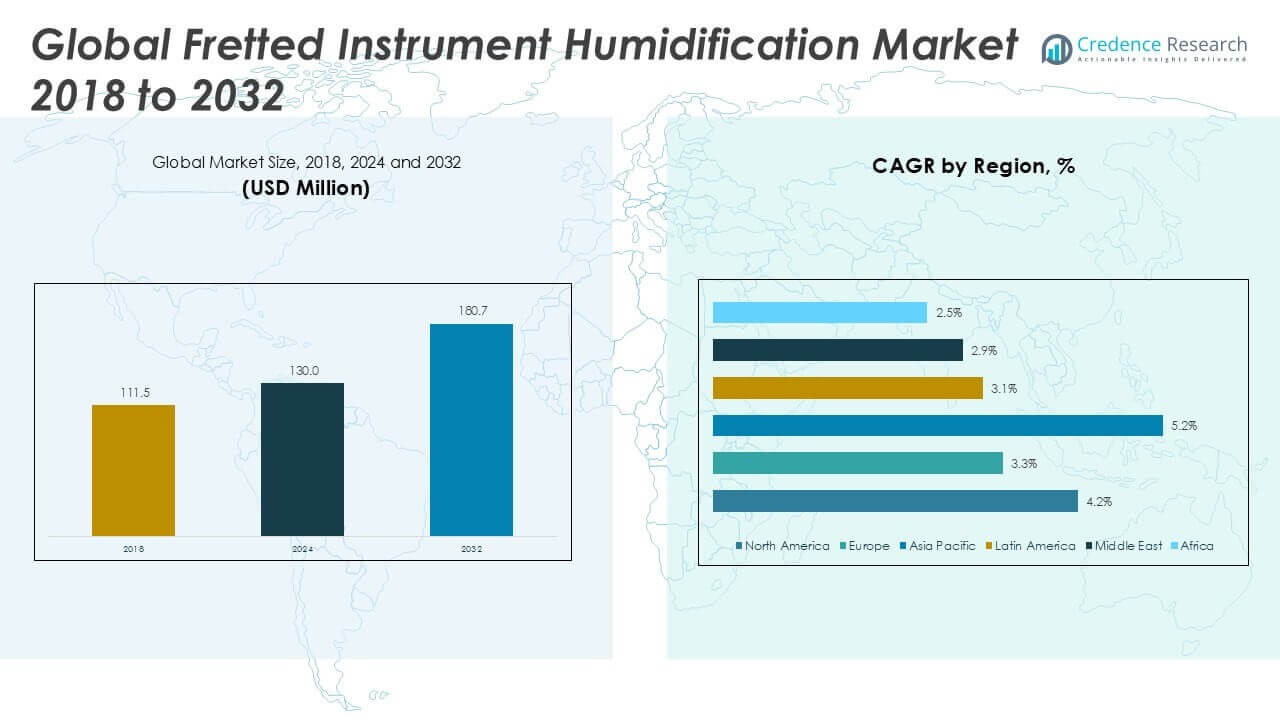

Fretted Instrument Humidification Market size was valued at USD 111.5 million in 2018, reached USD 130.0 million in 2024, and is anticipated to reach USD 180.7 million by 2032, at a CAGR of 4.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fretted Instrument Humidification Market Size 2024 |

USD 130.0 Million |

| Fretted Instrument Humidification Market, CAGR |

4.21% |

| Fretted Instrument Humidification Market Size 2032 |

USD 180.7 Million |

The fretted instrument humidification market is driven by key players including Condair Group, D’Addario & Co., Humistat, Aprilaire, Boveda, and Music Nomad. These companies focus on delivering reliable solutions to prevent damage caused by humidity fluctuations, with innovations such as D’Addario’s Humidipak two-way control system and Boveda’s precise humidity packs gaining strong adoption among acoustic guitar users. North America leads the market with 34.2% share in 2024, supported by strong sales of acoustic instruments and well-established retail networks. Asia Pacific follows closely with 32.3% share, fueled by rising disposable incomes and growing interest in Western musical instruments.

Market Insights

Market Insights

- The fretted instrument humidification market was valued at USD 130.0 million in 2024 and is projected to reach USD 180.7 million by 2032, growing at a CAGR of 4.21% during the forecast period.

- Rising adoption of acoustic guitars and increased awareness about wood preservation are driving demand for humidification systems. Educational campaigns by instrument brands and music schools are boosting product penetration among beginners and professionals.

- Smart, app-enabled humidifiers and eco-friendly refillable systems are gaining traction, catering to premium users seeking convenience and sustainability. Online retail channels are expanding access to low-cost and advanced solutions.

- The market is moderately fragmented, with key players including Condair Group, D’Addario & Co., Boveda, Aprilaire, and Music Nomad competing through product innovation and distribution partnerships.

- North America leads with 34.2% share, followed by Asia Pacific at 32.3%. Acoustic instruments dominate by type, while the personal segment leads by application with over 60% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Acoustic instruments held the largest share of the fretted instrument humidification market in 2024, accounting for over 40% of total sales. Acoustic guitars and similar wooden instruments are highly sensitive to humidity changes, which can lead to warping and cracking, driving demand for effective humidification solutions. Electric instruments follow, supported by rising adoption among hobbyists and professionals seeking long instrument life. Classical and bass instruments also contribute steadily, with players focusing on tone quality preservation. The “others” segment, including niche fretted instruments, is growing due to increased interest in specialty and folk music instruments.

- For instance, as of late 2024, D’Addario’s Players Circle loyalty program had nearly 500,000 members, a figure that is sometimes mistaken for a product sales total.

By Application

The personal segment dominated the market with over 60% share in 2024, driven by individual musicians and enthusiasts investing in affordable, easy-to-use humidification systems for home use. Growing awareness about instrument care, combined with rising sales of premium guitars, is fueling this demand. The commercial segment, including music schools, studios, and retailers, follows as bulk solutions are used for instrument storage and maintenance. The “others” segment includes institutional users and orchestras, where adoption is rising to prevent costly instrument damage and ensure consistent sound quality in performance settings.

- For instance, Planet Waves, a brand of D’Addario, provides instrument humidification products to many musicians and educational institutions for the care of fretted instruments. The company is known for its Humidipak system, among other accessories.

Key Growth Drivers

Rising Sales of Premium Fretted Instruments

Growing demand for high-quality acoustic and electric guitars is driving the market. Premium instruments require consistent humidity control to maintain structural integrity and tonal quality. Rising disposable incomes and interest in music education are encouraging consumers to invest in reliable humidification products. Manufacturers are developing innovative, low-maintenance systems that appeal to both beginners and professionals. This increased awareness of instrument care is boosting the adoption of humidifiers globally, especially in regions with extreme seasonal humidity fluctuations.

- For instance, Taylor Guitars introduced its V-Class bracing system in 2018, which is now featured in many of its acoustic guitars.

Growing Popularity of Home Studios and Amateur Musicians

The rise of home studios and online music content creation is expanding the user base. Hobbyists and independent musicians are investing in affordable humidification systems to protect instruments used for recording and streaming. Online tutorials and music communities are also educating users about proper instrument care. This grassroots awareness drives steady demand across markets. Subscription-based sales of humidification packs and smart sensors with mobile app integration further attract tech-savvy users.

- For instance, D’Addario’s Humiditrak system uses Bluetooth-enabled sensors to provide remote monitoring for musicians worldwide. Each sensor sends a constant stream of temperature, humidity, and impact data to a user’s smartphone app, allowing musicians to track the environmental conditions of their instruments in real time.

Expansion of Music Education and Retail Channels

Music schools, conservatories, and private instructors are emphasizing proper instrument maintenance as part of their curriculum. This education is increasing adoption rates of humidification devices among students and parents. Retailers and e-commerce platforms are promoting bundled kits that include humidifiers with new instrument purchases. Such initiatives ensure long-term instrument protection and generate repeat purchases of replacement humidifier cartridges. The growing presence of organized music retail chains in emerging economies is also expanding the market reach.

Key Trends & Opportunities

Adoption of Smart Humidification Technology

IoT-enabled humidification systems are emerging as a key trend. These devices monitor real-time humidity levels and send alerts to users via smartphones. Integration with digital hygrometers and Bluetooth sensors ensures accurate moisture control, preventing cracks and bridge lifting in fretted instruments. Companies are focusing on compact, refillable designs with longer service life. The trend creates opportunities for premium product lines and subscription-based filter replacements, strengthening aftermarket revenues for manufacturers.

- For instance, D’Addario’s Bluetooth-enabled Humiditrak system allows users to track the humidity, temperature, and impact data of their instruments through a smartphone app. The app provides push notifications for hazardous conditions and can support multiple devices.

Eco-Friendly and Low-Maintenance Solutions

Sustainability is becoming an important purchasing factor for musicians and retailers. Manufacturers are introducing eco-friendly humidifiers made from biodegradable materials and refillable designs to reduce waste. Longer-lasting humidification packs and water-less technology reduce maintenance frequency, appealing to busy users. Retailers highlight these products as green solutions, aligning with consumer demand for environmentally responsible instrument care. This shift opens new opportunities for companies to differentiate their offerings in a competitive market.

Key Challenges

Limited Awareness in Emerging Markets

Despite growth in instrument sales, awareness about humidification remains low in many developing regions. Musicians often neglect instrument maintenance due to limited knowledge of humidity damage or the perception that humidifiers are non-essential accessories. Retailers in these markets may not actively promote humidification products, limiting exposure to new buyers. This lack of education results in higher instrument damage rates, reducing customer satisfaction and lifetime value for brands. Expanding educational campaigns and retailer training programs is essential to overcome this barrier and drive adoption.

Seasonal Demand Fluctuations and Cost Sensitivity

The market experiences strong seasonality, with higher sales during dry winter months and lower demand in humid seasons. Manufacturers and retailers face inventory management challenges to meet peaks without oversupply. Price sensitivity among amateur musicians can also limit adoption, as many rely on low-cost DIY solutions rather than branded humidifiers. Balancing affordability while maintaining performance and durability remains a challenge. Companies must invest in cost-efficient production and flexible distribution models to stay profitable while catering to price-conscious markets.

Regional Analysis

North America

North America led the fretted instrument humidification market with a 2024 share of 34.2%. The region grew from USD 38.67 million in 2018 to USD 44.50 million in 2024 and is projected to reach USD 61.76 million by 2032, at a CAGR of 4.2%. Strong demand is driven by the popularity of acoustic guitars and professional instrument collections in the U.S. and Canada. Well-established music education systems and retail distribution channels encourage regular purchases of humidification systems. Manufacturers in this region focus on smart, automated humidifiers to cater to professionals and collectors seeking long-term instrument protection.

Europe

Europe accounted for 21.4% of the market in 2024, growing from USD 25.09 million in 2018 to USD 27.91 million in 2024, with a projected value of USD 36.27 million by 2032 at a CAGR of 3.3%. Demand is concentrated in countries with strong classical and acoustic music traditions, including Germany, the U.K., and France. Rising interest in sustainable, eco-friendly humidification systems is shaping product innovation. Retailers and e-commerce platforms in Europe are expanding distribution networks, making advanced maintenance kits more accessible. The region is also witnessing growth in premium humidification products used by professional orchestras and music schools.

Asia Pacific

Asia Pacific held a 32.3% share in 2024 and is the fastest-growing region, rising from USD 34.90 million in 2018 to USD 42.09 million in 2024, and projected to reach USD 63.13 million by 2032 at a CAGR of 5.2%. Growth is fueled by rising disposable incomes and the increasing popularity of Western-style fretted instruments in China, Japan, and India. Local manufacturers are entering the market with cost-effective solutions, boosting affordability for entry-level players. Rapid expansion of music education programs and e-commerce channels supports wider adoption. Demand for portable and low-maintenance humidifiers is strong among urban and semi-urban buyers.

Latin America

Latin America represented 5.4% of the global market in 2024, increasing from USD 6.11 million in 2018 to USD 7.04 million in 2024, with a forecast of USD 8.98 million by 2032 at a CAGR of 3.1%. Growth is driven by a strong cultural connection to stringed instruments, particularly in Brazil and Mexico. Retailers are focusing on raising awareness of instrument care, as humidification adoption remains lower compared to developed markets. Local distributors are introducing affordable entry-level products to encourage adoption among hobbyists. Expansion of music education programs is also contributing to gradual market penetration in the region.

Middle East

The Middle East held a 3.5% share in 2024, rising from USD 4.21 million in 2018 to USD 4.60 million in 2024 and expected to reach USD 5.76 million by 2032, at a CAGR of 2.9%. Growth is supported by niche demand from professional musicians and collectors, particularly in the UAE and Saudi Arabia. Music retail chains and online platforms are improving product availability across the region. Rising interest in Western musical instruments and private music academies is expected to create moderate demand for humidification products. Manufacturers are targeting compact, cost-effective humidifiers to attract new buyers in this price-sensitive market.

Africa

Africa contributed 2.9% of the market in 2024, up from USD 2.52 million in 2018 to USD 3.82 million in 2024, and is projected to reach USD 4.77 million by 2032 at a CAGR of 2.5%. Growth remains slow due to limited awareness and purchasing power in several countries. However, increasing penetration of e-commerce platforms is helping improve access to instrument accessories. South Africa and Nigeria lead demand, supported by active music scenes and growing middle-class populations. Awareness campaigns and bundled humidification solutions with instrument sales are expected to gradually improve adoption rates across the continent.

Market Segmentations:

By Type

- Acoustic

- Electric

- Classical

- Bass

- Others

By Application

- Personal

- Commercial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The fretted instrument humidification market is moderately fragmented, with a mix of global players and niche brands competing for market share. Leading companies such as Condair Group, D’Addario & Co., Humistat, Aprilaire, Boveda, and Music Nomad focus on developing innovative, easy-to-use solutions tailored to acoustic and classical instruments. D’Addario’s Humidipak system, for example, remains one of the most widely adopted two-way humidity control solutions for guitar owners worldwide. Players are investing in product innovation, smart humidity monitoring, and eco-friendly designs to differentiate offerings. Partnerships with music retailers and e-commerce platforms are key to expanding distribution reach. Additionally, companies are targeting emerging markets where awareness about instrument care is growing, supported by music education programs and rising disposable incomes. Competition is based on product reliability, pricing, and brand reputation, with premium segments focusing on professional musicians and collectors seeking consistent humidity control for long-term instrument protection.

Key Player Analysis

Recent Developments

- In July 2025, Condair launched the Condair RO-E reverse osmosis water purifier, designed specifically for use with humidifiers, which can be adapted for instrument humidification where precise mineral-free moisture is required. This release focuses on supporting humidity systems’ hygiene, energy efficiency, and longer service cycles through improved water purity.

- In July 2024, the humidity control specialist Condair acquired Kuul, a US-based manufacturer of evaporative media, to enhance its evaporative cooling and humidification solutions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for acoustic instrument humidifiers will rise as musicians focus on tone preservation.

- Smart, connected humidifiers with app-based monitoring will see higher adoption among professionals.

- Growth in e-commerce will expand product accessibility in emerging and remote markets.

- Manufacturers will invest in eco-friendly, refillable, and sustainable humidification solutions.

- Rising music education programs will boost sales in schools and training institutes.

- Affordable entry-level humidifiers will target hobbyists and first-time instrument owners.

- Expansion of distribution networks will improve availability in developing regions.

- Product bundling with new instruments will become a key sales strategy for retailers.

- Growing demand from collectors will drive premium segment growth and innovation.

- Awareness campaigns on instrument care will continue to support market penetration globally.

Market Insights

Market Insights