Market Overview

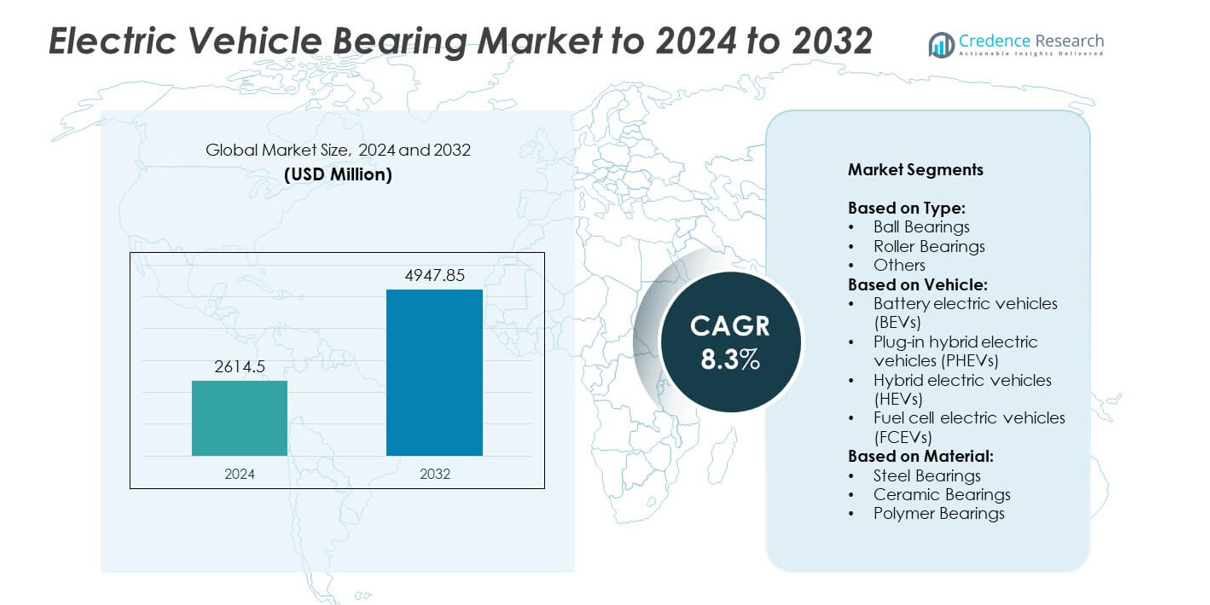

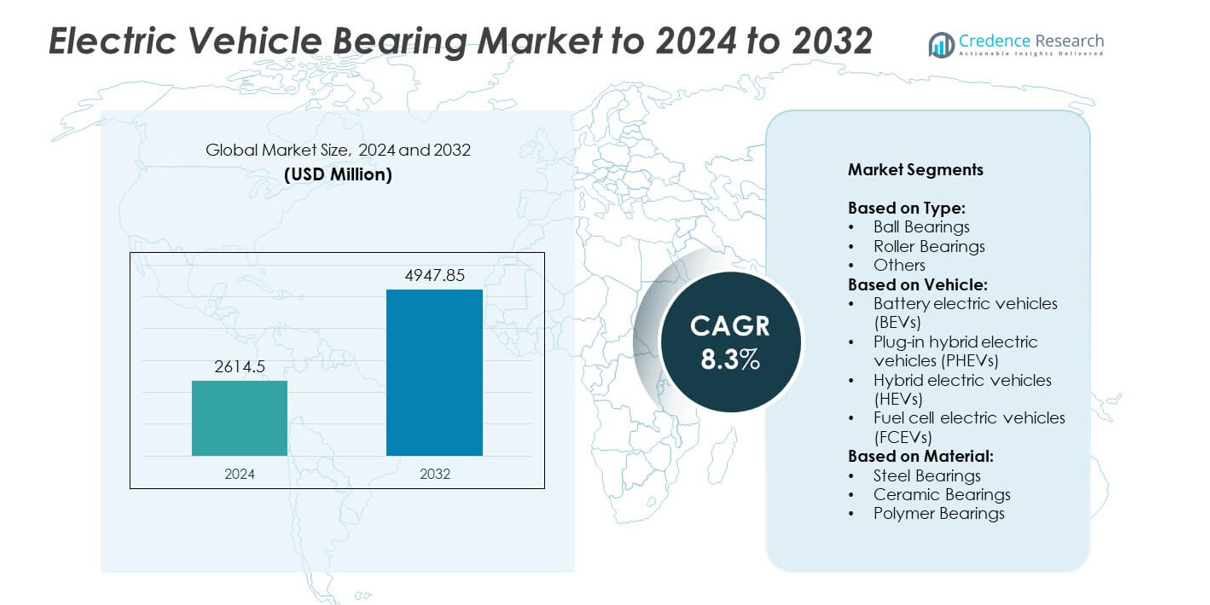

The Electric Vehicle Bearing Market size was valued at USD 2,614.5 million in 2024 and is anticipated to reach USD 4,947.85 million by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Bearing Market Size 2024 |

USD 2,614.5 million |

| Electric Vehicle Bearing Market, CAGR |

8.3% |

| Electric Vehicle Bearing Market Size 2032 |

USD 4,947.85 million |

The electric vehicle bearing market is dominated by leading companies such as Timken Company, NSK Ltd., Schaeffler Group, SKF, NTN Corporation, MinebeaMitsumi Inc., GKN plc, RBC Bearings Incorporated, and Wafangdian Bearing Group Corporation (ZWZ). These players maintain strong positions through innovations in lightweight materials, ceramic bearing technology, and precision engineering that enhance EV performance and efficiency. Strategic partnerships with automakers and localized production expansions further strengthen their global presence. Regionally, North America led the market in 2024 with a 34% share, followed by Europe at 30% and Asia-Pacific at 28%, driven by robust EV manufacturing growth and supportive regulatory initiatives.

Market Insights

- The electric vehicle bearing market was valued at USD 2,614.5 million in 2024 and is projected to reach USD 4,947.85 million by 2032, growing at a CAGR of 8.3% during the forecast period.

- Market growth is driven by rising global EV adoption, stricter emission regulations, and growing investments in energy-efficient vehicle components and drivetrain systems.

- Key trends include the adoption of ceramic and hybrid bearings, integration of smart sensor technologies, and a shift toward lightweight, low-friction materials to enhance vehicle range and durability.

- The market is highly competitive, with leading companies focusing on innovation, automation, and localized production to strengthen supply chains and maintain cost efficiency.

- Regionally, North America led with a 34% share in 2024, followed by Europe at 30% and Asia-Pacific at 28%, while ball bearings dominated by type with over 55% share, supported by superior performance in electric drivetrains.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Ball bearings dominated the electric vehicle bearing market in 2024, capturing over 55% of the total share. Their leadership stems from superior rotational efficiency, lower friction, and compact design, which are vital for electric drivetrains and e-axles. Ball bearings support high-speed motor operations with minimal energy loss, improving vehicle range and performance. Roller bearings follow, favored in heavy-load applications such as electric SUVs and trucks, while other bearing types serve niche areas like steering systems and electric compressors.

- For instance, SKF E2 deep-groove ball bearings cut bearing friction losses by 30–50% versus standard designs.Growing demand for precision-engineered bearings in e-mobility continues to drive the dominance of ball bearings.

By Vehicle

Battery electric vehicles (BEVs) held the largest market share in 2024, accounting for more than 60% of global demand. The dominance of BEVs results from increasing adoption driven by government incentives, stricter emission regulations, and advancements in high-performance electric powertrains. Bearings in BEVs are critical for optimizing torque transmission and reducing friction losses in motors and wheel hubs. Plug-in hybrid and hybrid vehicles contribute moderately, serving transition markets where charging infrastructure is developing. Meanwhile, fuel cell vehicles represent a small but growing segment as manufacturers explore hydrogen-powered mobility solutions.

- For instance, NIO fits a 240 kW induction motor in production vehicles using high-speed ceramic bearing solutions.

By Material

Steel bearings led the market in 2024, representing nearly 70% of total share due to their high strength, cost efficiency, and proven durability. Steel bearings remain the industry standard for electric drivetrains, offering reliable performance under varying load conditions. Ceramic bearings, though more expensive, are gaining traction for their lightweight and heat-resistant properties, ideal for high-speed motors and extended vehicle range. Polymer bearings occupy niche uses in auxiliary components where low weight and corrosion resistance are prioritized. Continuous R&D toward hybrid and coated bearing materials further supports efficiency gains in EV systems.

Key Growth Drivers

Rising Adoption of Electric Vehicles

The increasing global shift toward electric mobility is the primary growth driver for the electric vehicle bearing market. Expanding government incentives, emission regulations, and consumer demand for clean transportation accelerate EV production. Automakers are investing in efficient bearing systems to enhance motor performance and reduce friction losses. As EV sales are projected to surpass 30 million units by 2030, the need for lightweight, low-noise, and high-durability bearings will continue to grow, driving steady market expansion across vehicle and motor segments.

- For instance, BYD reported 3,024,417 new-energy vehicle sales in 2023, lifting global demand for e-powertrain parts.

Advancements in Bearing Technology

Innovations in bearing design and materials significantly boost performance and longevity in electric drivetrains. Manufacturers are adopting ceramic and hybrid bearings to handle higher rotational speeds and thermal loads while minimizing energy loss. Advanced lubrication and coating technologies further improve durability and reduce maintenance costs. These enhancements enable EVs to operate more efficiently and extend service life, making advanced bearing solutions essential components in next-generation electric powertrains and transmission systems.

- For instance, NSK Micro-UT inspects a steel volume 3,000× larger in 1/5 the time and enables life ratings up to 2× equivalent fatigue life.

Growing Investments in EV Manufacturing

Massive investments by OEMs and component suppliers in EV production lines drive the demand for high-quality bearings. Leading automakers such as Tesla, BYD, and Volkswagen are scaling up EV output, creating a surge in component sourcing. Bearing manufacturers are expanding global production capacity and automation capabilities to meet demand. The integration of smart manufacturing technologies ensures precision and reliability, helping manufacturers maintain consistent performance standards required by fast-evolving electric vehicle platforms.

Key Trends & Opportunities

Shift Toward Lightweight and Low-Friction Materials

A major trend in the market is the transition toward lightweight and low-friction materials, such as ceramic and polymer composites. These materials reduce energy losses and enhance vehicle range by improving drivetrain efficiency. OEMs are prioritizing such bearings to meet sustainability goals and regulatory standards. The growing preference for hybrid bearings that combine steel and ceramic elements offers an optimal balance of performance, durability, and cost-effectiveness, opening new growth opportunities in premium and performance EV segments.

- For instance, Schaeffler TriFinity wheel bearing uses a 3-row layout for compact, efficient hub modules in electrified platforms.

Integration of Smart and Sensor-Enabled Bearings

The emergence of smart bearings equipped with sensors and monitoring systems is transforming EV maintenance and reliability. These bearings track vibration, temperature, and load parameters in real time, allowing predictive maintenance and minimizing downtime. Integration of IoT and AI-driven diagnostics enhances operational safety and energy efficiency. This trend supports the development of intelligent EV platforms where connected components optimize performance, offering strong opportunities for bearing suppliers focused on digital transformation.

- For instance, Schaeffler FAG SmartCheck measures vibration across 0.8 Hz–10 kHz with 24-bit acquisition for continuous bearing diagnostics.

Expansion of Aftermarket and Replacement Demand

As global EV fleets expand, the aftermarket for replacement bearings is gaining importance. Bearings in EV motors, gearboxes, and wheels require periodic maintenance and replacements due to high-speed operation. Suppliers offering cost-effective, high-performance replacements stand to benefit from this growing segment. The development of specialized aftermarket networks focused on EV components presents a major business opportunity for both OEM and independent bearing manufacturers.

Key Challenges

High Production and Material Costs

One of the key challenges for the market is the high cost of producing advanced bearings. Ceramic and hybrid materials, though efficient, significantly increase manufacturing expenses due to complex processing and precision requirements. This raises overall EV production costs and limits adoption in budget vehicle categories. Balancing performance with cost efficiency remains a critical task for manufacturers aiming to expand into mass-market EV applications while maintaining profitability.

Thermal and Load Management Issues

EV bearings face unique challenges related to high rotational speeds, continuous torque, and elevated operating temperatures. Managing thermal expansion and load distribution is essential to prevent premature wear or failure. Insufficient lubrication and excessive heat can degrade bearing performance, reducing drivetrain efficiency. Manufacturers must invest in specialized designs, coatings, and cooling technologies to address these issues, as unresolved thermal management problems can compromise both vehicle safety and operational lifespan.

Regional Analysis

North America

North America held the largest share of 34% in the electric vehicle bearing market in 2024. The region’s dominance is supported by rapid EV adoption, strong government incentives, and growing infrastructure for battery manufacturing. The United States leads the regional demand, driven by high EV sales and the presence of major automakers investing in localized bearing production. Increased focus on energy-efficient vehicle components and strict emission norms further accelerate market growth. Canada and Mexico are emerging contributors as OEMs expand regional supply chains and establish manufacturing facilities to serve North American EV platforms.

Europe

Europe accounted for 30% of the electric vehicle bearing market in 2024, driven by strict emission regulations and the EU’s push for electric mobility. Germany, France, and the United Kingdom lead in manufacturing and technological advancements, emphasizing lightweight and high-performance bearing systems. The strong presence of established OEMs such as Volkswagen and BMW supports consistent demand. Additionally, the region’s focus on sustainable manufacturing practices encourages the use of recyclable bearing materials. Growing investments in EV production facilities across Central and Eastern Europe further strengthen the regional market outlook.

Asia-Pacific

Asia-Pacific captured around 28% of the global electric vehicle bearing market in 2024, led by China, Japan, and South Korea. The region benefits from strong EV production volumes, low manufacturing costs, and rapid industrial expansion. China dominates with government-backed subsidies and large-scale adoption of BEVs, while Japan and South Korea drive innovation in bearing technology. Increasing localization of EV component supply chains supports continuous growth. Expanding urbanization and rising disposable income levels also contribute to the increasing demand for efficient and reliable bearings across various electric vehicle categories.

Latin America

Latin America accounted for approximately 5% of the electric vehicle bearing market in 2024. The region’s growth is supported by emerging EV programs in Brazil, Chile, and Mexico, where governments are promoting cleaner transportation solutions. Developing charging networks and foreign investments in automotive manufacturing boost market prospects. Although EV adoption remains at an early stage, bearing suppliers are entering the region through strategic partnerships with OEMs. Rising demand for fleet electrification in logistics and public transport sectors will likely accelerate market penetration in the coming years.

Middle East & Africa

The Middle East and Africa held a 3% share of the global electric vehicle bearing market in 2024. Market growth remains gradual due to limited EV infrastructure and high vehicle import dependence. However, countries like the United Arab Emirates, Saudi Arabia, and South Africa are investing in sustainable transport projects and EV pilot programs. Government initiatives promoting renewable energy and electrification are expected to boost demand for supporting components such as bearings. The gradual establishment of local assembly and service centers will help improve accessibility and market presence across the region.

Market Segmentations:

By Type:

- Ball Bearings

- Roller Bearings

- Others

By Vehicle:

- Battery electric vehicles (BEVs)

- Plug-in hybrid electric vehicles (PHEVs)

- Hybrid electric vehicles (HEVs)

- Fuel cell electric vehicles (FCEVs)

By Material:

- Steel Bearings

- Ceramic Bearings

- Polymer Bearings

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The electric vehicle bearing market is led by key players such as Timken Company, NSK Ltd., Wafangdian Bearing Group Corporation (ZWZ), Schaeffler Group, RBC Bearings Incorporated, GKN plc, MinebeaMitsumi Inc., NTN Corporation, C&U Group, SKF, Nachi-Fujikoshi Corp., Harbin Bearing Manufacturing Co., Ltd., JTEKT Corporation, and Luoyang LYC Bearing Co., Ltd. These companies compete through advancements in precision engineering, material innovation, and energy-efficient bearing technologies designed for electric drivetrains. Strategic collaborations with automakers and EV system suppliers help enhance performance integration and expand global presence. The competitive environment is marked by increasing investment in ceramic and hybrid bearing development to support high-speed and thermal-resistant operations. Manufacturers are focusing on automation, smart production, and localized facilities to optimize costs and meet the growing demand from EV manufacturers. Continuous innovation and quality improvement remain central to maintaining long-term competitiveness in this rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Timken Company

- NSK Ltd.

- Wafangdian Bearing Group Corporation (ZWZ)

- Schaeffler Group

- RBC Bearings Incorporated

- GKN plc

- MinebeaMitsumi Inc.

- NTN Corporation

- C&U Group

- SKF

- Nachi-Fujikoshi Corp.

- Harbin Bearing Manufacturing Co., Ltd.

- JTEKT Corporation

- Luoyang LYC Bearing Co., Ltd.

Recent Developments

- In 2024, NSK unveiled its 7th generation of low-friction tapered roller bearings. These were engineered to reduce friction by 20% to enhance the efficiency of ICE, hybrid, and EV powertrains.

- In 2023, Schaeffler showcased its latest electric axle systems and 800V e-motors, highlighting solutions for sustainable mobility.

- In 2022, JTEKT announced the development of the “JTEKT Ultra Earth Bearing™,” a conductive ball bearing for e-axle motors.

Report Coverage

The research report offers an in-depth analysis based on Type, Vehicle, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric vehicle bearing market will grow steadily, driven by rising global EV adoption.

- Manufacturers will focus on lightweight, energy-efficient bearing materials to improve vehicle range.

- Ceramic and hybrid bearings will gain traction for high-speed and high-temperature applications.

- Integration of smart and sensor-enabled bearings will enhance predictive maintenance capabilities.

- Asia-Pacific will emerge as the fastest-growing region due to large-scale EV production.

- OEM partnerships will strengthen to ensure localized supply chains and cost efficiency.

- The aftermarket for EV-specific bearings will expand with growing vehicle fleets.

- Sustainability initiatives will promote recyclable and eco-friendly bearing designs.

- Automation and precision manufacturing will improve product consistency and performance.

- Continuous R&D investment will drive innovation in friction reduction and noise control technologies.