| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Communication Controllers Market Size 2024 |

USD 154.6 Million |

| Electric Vehicle Communication Controllers Market, CAGR |

32.10% |

| Electric Vehicle Communication Controllers Market Size 2032 |

USD 1,433.6 Million |

Market Overview:

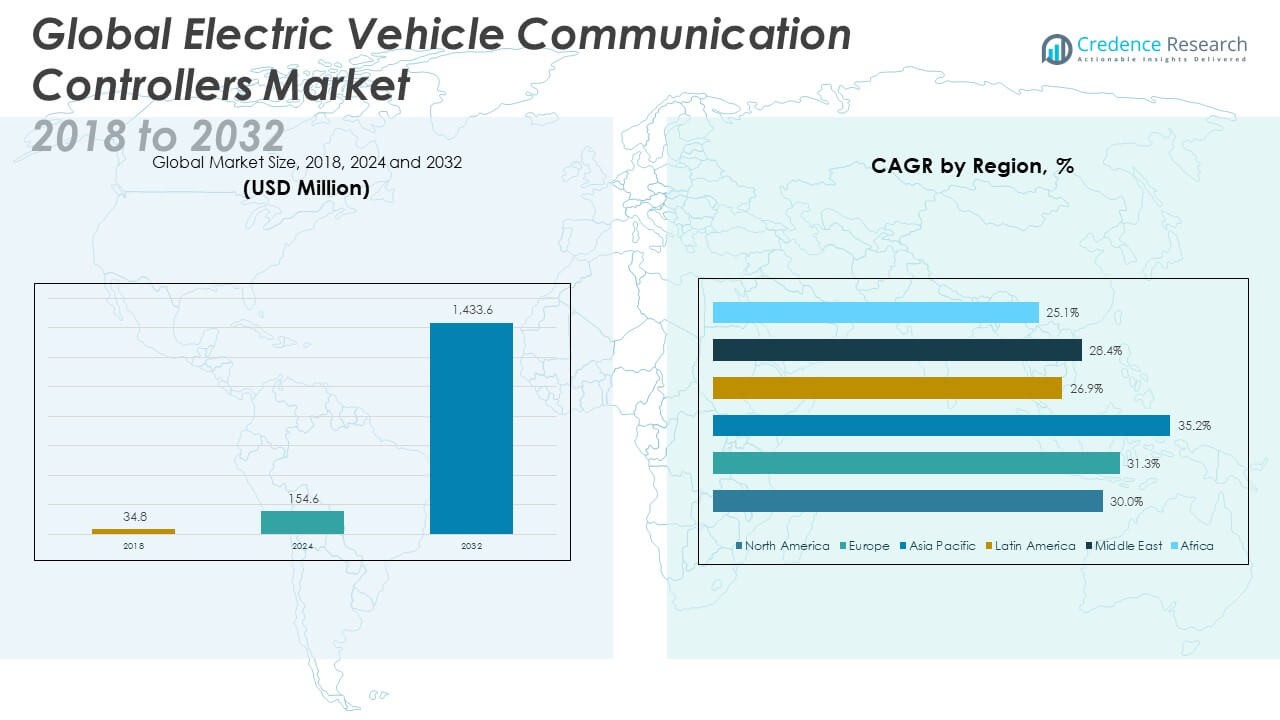

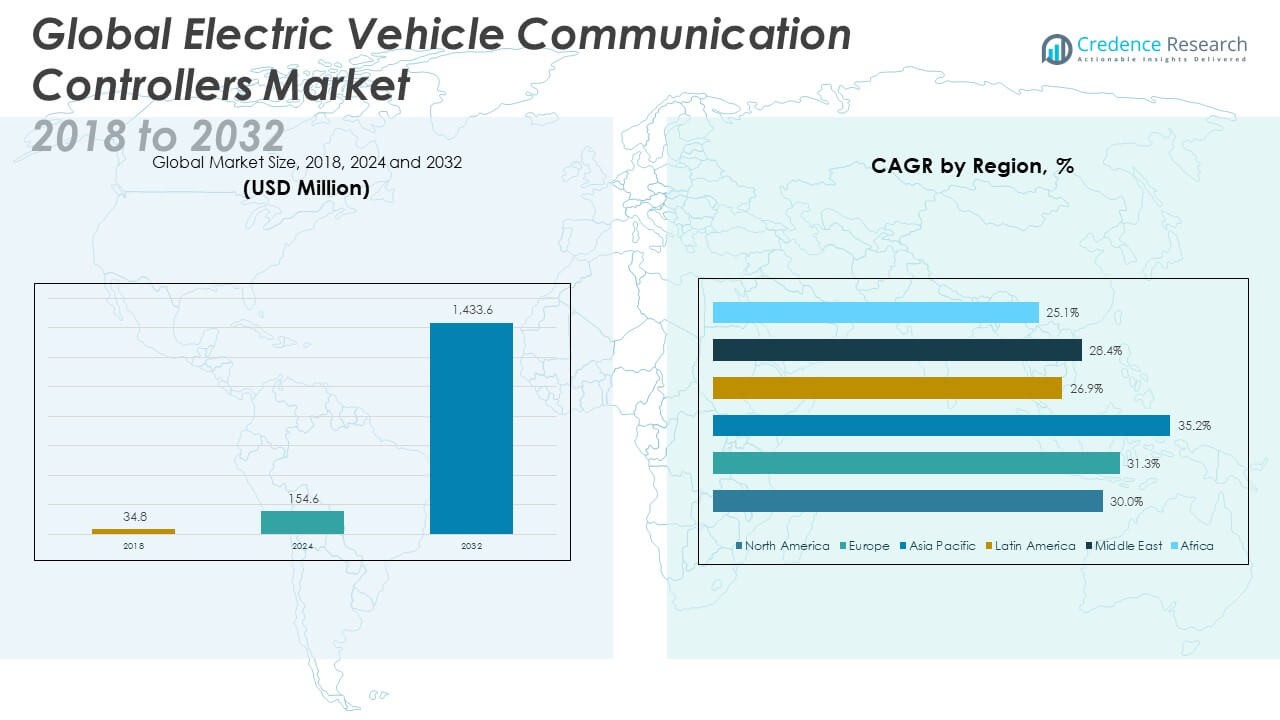

The Electric Vehicle Communication Controllers Market size was valued at USD 34.8 million in 2018 to USD 154.6 million in 2024 and is anticipated to reach USD 1,433.6 million by 2032, at a CAGR of 32.10% during the forecast period.

The Electric Vehicle Communication Controllers (EVCC) Market is experiencing robust growth driven by several converging factors. One of the primary drivers is the rapid adoption of electric vehicles (EVs) worldwide, propelled by stringent emission regulations, government incentives, and growing environmental consciousness. As EV adoption accelerates, the need for seamless communication between EVs and charging infrastructure becomes essential. This has placed EVCCs at the center of smart charging ecosystems. Moreover, the increasing adoption of fast-charging stations and the standardization of communication protocols—particularly ISO 15118—are pushing manufacturers to deploy advanced controllers that support plug-and-charge, bidirectional charging, and secure authentication. These technologies enhance user convenience and grid compatibility, making them a priority in new EV models. Technological advancements in electric drivetrains, battery management systems, and V2G (vehicle-to-grid) integration further amplify the demand for EVCCs.

Asia Pacific dominates the global Electric Vehicle Communication Controllers Market and is expected to maintain its lead throughout the forecast period. China, the world’s largest EV market, is a key contributor due to its aggressive electrification targets, expansive charging infrastructure, and supportive government policies. Japan and South Korea are also investing heavily in EV communication technology, focusing on V2X integration and fast-charging capabilities. Europe follows closely, driven by strong environmental regulations, high EV penetration, and standardized charging protocols across member states. Countries like Germany, Norway, and the Netherlands are actively implementing smart charging projects, enhancing the region’s EVCC deployment. North America represents a rapidly evolving market, with the United States investing in a national charging network and vehicle-to-grid pilots. Meanwhile, the Middle East & Africa and Latin America remain emerging markets, gradually adopting EV infrastructure through pilot projects and policy reforms, signaling potential future growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electric Vehicle Communication Controllers Market grew from USD 34.8 million in 2018 to USD 154.6 million in 2024 and is projected to reach USD 1,433.6 million by 2032, registering a CAGR of 32.10%.

- Increasing EV adoption, backed by regulatory mandates and subsidies, is driving demand for smart communication controllers that ensure secure, real-time data exchange during charging.

- Fast-charging network expansion and the rise of vehicle-to-grid (V2G) applications are pushing the development of high-speed, bidirectional communication systems.

- Standardization initiatives like ISO 15118 are improving system interoperability and encouraging OEMs to adopt unified, future-ready EVCC architectures.

- Asia Pacific holds the largest market share, led by China, Japan, and South Korea, due to large-scale EV production, policy support, and infrastructure growth.

- The market faces challenges from inconsistent global standards, high development costs, and cybersecurity risks tied to connected vehicle ecosystems.

- Leading companies are investing in R&D and forming strategic alliances to offer modular, secure, and scalable EVCC solutions for global deployment.

Market Drivers:

Surging Electric Vehicle Adoption Reinforces Demand for Intelligent Charging Infrastructure

The Electric Vehicle Communication Controllers Market is expanding due to the rapid rise in electric vehicle (EV) adoption across both passenger and commercial segments. Governments in major economies are enforcing stringent carbon emission regulations and offering financial incentives that are accelerating EV production and sales. This growth requires scalable and efficient charging solutions, where communication controllers play a vital role in ensuring secure and seamless interaction between EVs and charging stations. EVCCs enable real-time data exchange that supports functions like authentication, billing, and load management. It becomes indispensable in managing the growing volume of connected EVs, especially in urban environments. The widespread rollout of high-speed charging networks further increases the reliance on EVCCs to handle complex communication protocols.

- Tesla’s Supercharger network has expanded to over 50,000 chargers globally as of 2025, supporting real-time data exchange for authentication and billing. Superchargers use proprietary communication protocols, with integration of ISO 15118 for plug-and-charge functionality underway.

Standardization of Charging Protocols Supports Interoperability and Secure Connectivity

The push toward global standardization of EV charging systems significantly supports the growth of the Electric Vehicle Communication Controllers Market. International protocols like ISO 15118 and CCS (Combined Charging System) are driving the need for EVCCs that can support plug-and-charge functionality, encrypted data transfer, and bidirectional energy flow. Standardized communication enhances interoperability across vehicles and charging infrastructure, reducing operational complexities for EV fleet operators and consumers. It allows original equipment manufacturers (OEMs) to integrate charging features more uniformly across markets. It also ensures consistency in user experience and grid integration. The evolution of these standards is encouraging manufacturers to invest in advanced controller technologies that support both present and future system requirements.

- For example, Ford’s Mustang Mach-E supports both CCS and ISO 15118, allowing interoperability with diverse public charging stations. The system supports encrypted data transfer and is designed for future bidirectional energy flow (V2G) applications.

Growth in Fast-Charging Networks and Smart Grid Integration Stimulates Product Innovation

Expansion of fast-charging infrastructure is reshaping vehicle-to-charger communication needs and influencing controller design and capabilities. High-power DC charging stations require controllers that can process large volumes of data with minimal latency. It drives demand for embedded communication systems that are reliable, secure, and scalable. Smart grid integration further elevates the role of EVCCs in balancing energy loads, managing peak demand, and supporting renewable energy storage via vehicle-to-grid (V2G) systems. The interaction between EVs and energy distribution networks depends on sophisticated control systems. It encourages utilities, EV manufacturers, and technology firms to develop innovative EVCC solutions tailored to smart energy ecosystems.

Strategic Collaborations and R&D Investments Advance Functional Capabilities

Technology providers and automotive OEMs are increasingly investing in research and development to improve the performance, reliability, and functionality of electric vehicle communication controllers. Collaborations between charging infrastructure companies, energy firms, and EV manufacturers are fostering the development of next-generation controller solutions. These partnerships focus on modular designs, enhanced cybersecurity, and compatibility with multi-standard charging networks. It positions EVCCs as a central enabler of automated and user-friendly charging experiences. Companies are also emphasizing software updates and AI-based diagnostics to extend system lifecycle and optimize performance. The continuous evolution of controller technology is expected to shape the trajectory of the Electric Vehicle Communication Controllers Market.

Market Trends:

Rising Integration of Plug-and-Charge Functionality and ISO 15118 Compliance

The industry is moving toward seamless charging experiences through plug-and-charge capabilities enabled by ISO 15118 standards. These features allow EVs to automatically authenticate and initiate charging sessions without user intervention, streamlining operations for drivers and charging network operators. The Electric Vehicle Communication Controllers Market is witnessing strong demand for systems that support encrypted communication and user identification protocols. Automakers and infrastructure providers are prioritizing ISO 15118 compliance to improve interoperability and enhance the overall efficiency of EV charging systems. It also improves cybersecurity, making it an essential standard for public charging infrastructure. EVCCs are evolving to support these functions while remaining adaptable to future protocol upgrades.

- For instance, General Motors (GM), in partnership with EV Connect, has enabled Plug and Charge across nearly 200 compatible DC fast chargers in the U.S., with plans for further expansion throughout 2024.

Shift Toward Bidirectional Charging and Vehicle-to-Grid (V2G) Applications

Bidirectional charging is emerging as a transformative trend in the electric vehicle ecosystem, enabling energy to flow both to and from EVs. This capability supports vehicle-to-grid (V2G) technology, which allows EVs to store energy and discharge it to the grid during peak demand periods. The Electric Vehicle Communication Controllers Market is adapting to this trend by integrating hardware and software capabilities that enable dynamic energy exchange. It creates new opportunities for energy arbitrage, grid stabilization, and renewable energy support. EVCCs must manage more complex communication scenarios and ensure secure data transmission between EVs and energy providers. This trend is reshaping controller architectures and opening new commercial models for fleet operators and utilities.

- For example, SolarEdge’s upcoming DC-coupled bidirectional charger, set for release in late 2024, offers a 12 kW charge rate and a 24 kW discharge rate, supporting both 400V and 800V EV powertrains via standard CCS connectors.

Accelerated Deployment of High-Power DC Fast Charging Infrastructure

The rollout of high-power DC fast charging stations is influencing the design requirements of communication controllers. These advanced charging stations require low-latency, high-bandwidth communication to coordinate energy transfer efficiently and safely. The Electric Vehicle Communication Controllers Market is seeing increased demand for controllers that can support real-time diagnostics, thermal monitoring, and adaptive load balancing. It enables fast-charging systems to operate reliably while protecting battery health and ensuring user safety. High-speed communication protocols and robust cybersecurity measures are critical in this context. Manufacturers are investing in controller systems that can integrate with fast-charging networks and maintain compatibility across EV models.

Growing Emphasis on Over-the-Air (OTA) Updates and Software-Defined Features

The adoption of over-the-air (OTA) update functionality is gaining momentum as EV manufacturers aim to extend system capabilities post-deployment. Communication controllers now support remote diagnostics, performance tuning, and software upgrades without physical intervention. The Electric Vehicle Communication Controllers Market is aligning with this trend by incorporating secure and scalable firmware management features. It enhances controller flexibility and reduces long-term maintenance costs for OEMs and charging network operators. The shift toward software-defined vehicle architectures makes it essential for EVCCs to remain adaptable and upgradable. This trend supports continuous innovation and accelerates the rollout of new features in response to market needs.

Market Challenges Analysis:

Complexities in Standardization and Interoperability Across Global Charging Ecosystems

The Electric Vehicle Communication Controllers Market faces a critical challenge in achieving seamless standardization across regions, vehicle types, and charging protocols. Despite the growing adoption of ISO 15118 and Combined Charging System (CCS), significant disparities exist in regional standards and infrastructure compatibility. Automakers and charging solution providers often encounter integration issues when deploying controllers that must work across varied networks. It complicates global product rollouts and slows down the deployment of universal plug-and-charge systems. Interoperability issues also hinder user experience, especially for cross-border EV drivers in Europe and Asia. The absence of consistent regulatory frameworks makes it difficult for OEMs to ensure uniform controller functionality across markets.

High Development Costs and Evolving Cybersecurity Threats Impact Adoption Rates

High initial development costs and continuous investment in R&D present barriers to entry for smaller players in the Electric Vehicle Communication Controllers Market. Designing controllers that meet performance, safety, and compliance requirements demands advanced engineering and costly certification processes. It limits the pace of innovation and delays time-to-market for new solutions. Cybersecurity is another major concern, with increasing risks tied to connected EV infrastructure. Communication controllers must defend against unauthorized access, data tampering, and energy theft, requiring constant updates and resilience against emerging threats. The cost of maintaining robust security features while keeping controller prices competitive puts additional pressure on manufacturers. This dynamic creates a competitive gap between established players and new entrants.

Market Opportunities:

Expansion of Vehicle-to-Grid (V2G) and Smart Energy Integration Creates New Growth Channels

The Electric Vehicle Communication Controllers Market is well-positioned to capitalize on the global shift toward smart energy management and grid modernization. Vehicle-to-grid (V2G) integration enables electric vehicles to supply energy back to the grid, creating opportunities for dynamic load balancing and energy arbitrage. It increases demand for advanced communication controllers that support bidirectional energy flow and real-time grid interaction. Utilities and energy providers are actively investing in EV infrastructure that aligns with distributed energy systems. This trend supports the development of intelligent controllers with capabilities beyond traditional charging. EVCC manufacturers can leverage this opportunity to offer solutions that align with utility-grade communication and energy optimization frameworks.

Emergence of Public and Commercial Charging Networks in Untapped Regions

Developing markets in Latin America, the Middle East, and Southeast Asia offer significant potential for EVCC deployment. Governments in these regions are introducing EV incentives and initiating infrastructure projects to reduce reliance on fossil fuels. The Electric Vehicle Communication Controllers Market can benefit from early-stage partnerships with public and private stakeholders driving charger rollouts. It enables companies to establish footholds and shape region-specific standards. The rise of fleet electrification in logistics, public transport, and last-mile delivery services further drives demand. These expanding applications create opportunities for modular and scalable controller solutions tailored to diverse operational environments.

Market Segmentation Analysis:

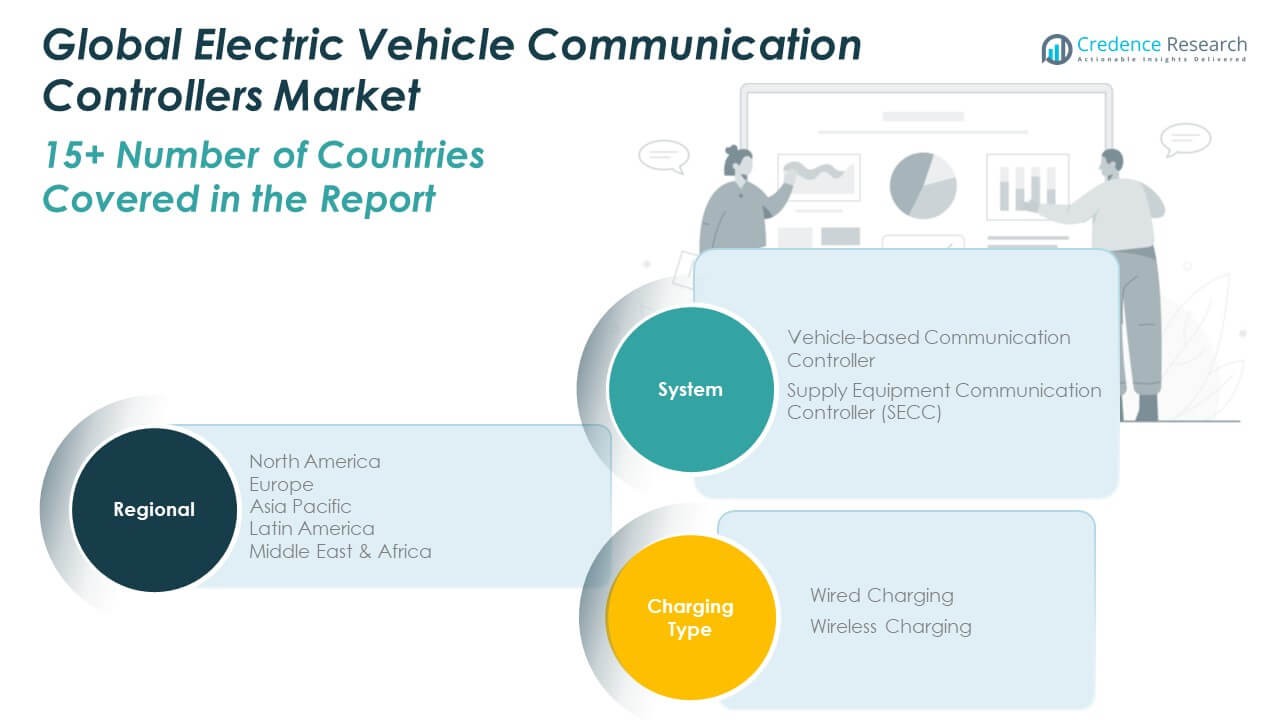

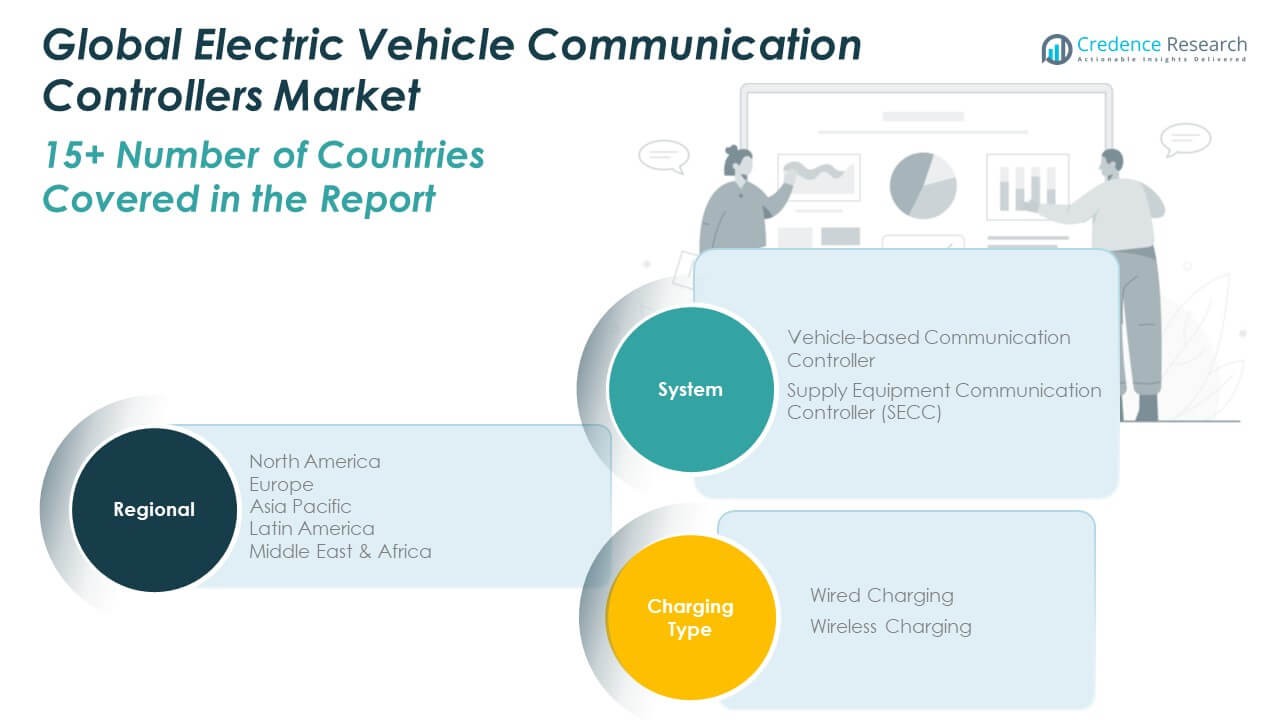

The Electric Vehicle Communication Controllers Market is segmented

By system into Vehicle-based Communication Controllers and Supply Equipment Communication Controllers (SECC). Vehicle-based controllers are embedded within the electric vehicle and manage communication with external charging stations. They hold a significant share due to widespread integration in both passenger and commercial EVs. SECCs, located within the charging infrastructure, handle external communication and ensure secure and accurate data exchange during the charging process. SECC demand is growing with the expansion of public and commercial fast-charging networks.

- For instance, ABB’s the Plug N Charge Controller is integrated into ABB’s DC fast chargers, supporting ISO 15118 for secure communication and automated billing. ABB has deployed this technology in over 20,000 chargers globally.

By charging type, the market is classified into Wired Charging and Wireless Charging. Wired charging dominates the segment, driven by established infrastructure, lower costs, and compatibility with standard connectors such as CCS and CHAdeMO. It remains the preferred method across residential and commercial applications. Wireless charging is an emerging segment gaining interest due to its convenience and potential for autonomous vehicle integration. It is still at a nascent stage but expected to grow as efficiency improves and deployment costs decline. The market is evolving to support both modes through advanced controller designs that ensure safe, efficient, and reliable energy transfer.

- For instance, Evatran’s Plugless Wireless Charging is commercially deployed, supports up to 7.7 kW, and is compatible with multiple EV models, emphasizing convenience and autonomous vehicle integration.

Segmentation:

By System

- Vehicle-based Communication Controller

- Supply Equipment Communication Controller (SECC)

By Charging Type

- Wired Charging

- Wireless Charging

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

The North America Electric Vehicle Communication Controllers Market size was valued at USD 6.5 million in 2018 to USD 33.2 million in 2024 and is anticipated to reach USD 281.0 million by 2032, at a CAGR of 30.0% during the forecast period. North America holds a market share of approximately 13.5% in the global Electric Vehicle Communication Controllers Market. It benefits from expanding electric vehicle adoption supported by federal incentives, infrastructure investments, and strong OEM presence. The United States is at the forefront with widespread charging initiatives and vehicle-to-grid pilot programs. Canada is also advancing its electrification goals through public-private partnerships focused on grid integration. It offers a conducive regulatory environment for technology providers to scale operations and develop compliant communication systems. Strong demand for high-performance EVCCs that support secure, fast-charging protocols continues to drive regional growth.

The Europe Electric Vehicle Communication Controllers Market size was valued at USD 8.3 million in 2018 to USD 37.1 million in 2024 and is anticipated to reach USD 312.5 million by 2032, at a CAGR of 31.3% during the forecast period. Europe accounts for around 15% of the global Electric Vehicle Communication Controllers Market. It benefits from aggressive climate policies, EV mandates, and an integrated regulatory framework favoring standardization. Countries such as Germany, Norway, the Netherlands, and the UK are investing heavily in ISO 15118-compliant infrastructure and smart charging corridors. The region supports wide-scale interoperability across public and private charging stations. It enables the adoption of advanced controller technologies that streamline energy management and improve vehicle-grid communication. Increasing collaboration between utilities and automotive manufacturers further accelerates regional EVCC deployment.

The Asia Pacific Electric Vehicle Communication Controllers Market size was valued at USD 14.3 million in 2018 to USD 64.6 million in 2024 and is anticipated to reach USD 669.5 million by 2032, at a CAGR of 35.2% during the forecast period. Asia Pacific dominates the Electric Vehicle Communication Controllers Market with a leading share of over 47%. China plays a pivotal role, driven by large-scale EV production, aggressive government incentives, and extensive fast-charging infrastructure. Japan and South Korea are advancing intelligent charging systems, while India is emerging as a key market through supportive EV policies. It represents the most dynamic region with rapid urbanization and strong demand for scalable controller systems. Investment in grid infrastructure and V2G pilot programs further expands commercial potential. EVCC suppliers see Asia Pacific as the most lucrative and fast-growing regional market.

The Latin America Electric Vehicle Communication Controllers Market size was valued at USD 1.9 million in 2018 to USD 7.0 million in 2024 and is anticipated to reach USD 57.3 million by 2032, at a CAGR of 26.9% during the forecast period. Latin America holds a modest 4% share in the global Electric Vehicle Communication Controllers Market. Countries such as Brazil, Chile, and Mexico are spearheading EV adoption through urban transit electrification and public charging investments. The market is gradually embracing communication controllers to support growing e-mobility infrastructure. It presents early-stage opportunities for players offering cost-effective, modular solutions compatible with evolving standards. Limited charging interoperability and high system costs pose initial adoption barriers. Still, government-led initiatives and international collaboration are expected to drive momentum in the coming years.

The Middle East Electric Vehicle Communication Controllers Market size was valued at USD 2.6 million in 2018 to USD 9.3 million in 2024 and is anticipated to reach USD 74.5 million by 2032, at a CAGR of 28.4% during the forecast period. The Middle East contributes around 5% to the global Electric Vehicle Communication Controllers Market. The region is witnessing growing investment in EV infrastructure, particularly in the UAE and Saudi Arabia, as part of broader sustainability and smart city initiatives. Governments are partnering with global EV and charging solution providers to deploy interoperable, high-speed networks. It creates favorable conditions for EVCC integration into new infrastructure projects. High per capita income and luxury EV adoption support advanced communication features. The market remains in early stages but shows strong long-term potential.

The Africa Electric Vehicle Communication Controllers Market size was valued at USD 1.2 million in 2018 to USD 3.4 million in 2024 and is anticipated to reach USD 38.7 million by 2032, at a CAGR of 25.1% during the forecast period. Africa currently holds less than 3% of the global Electric Vehicle Communication Controllers Market but represents a long-term growth region. South Africa leads in regional EV deployment with pilot programs and public-private investments. Infrastructure constraints and affordability challenges slow market expansion, yet rising interest in clean mobility supports strategic initiatives. It presents opportunities for scalable and simplified EVCC solutions tailored to local infrastructure conditions. International partnerships and donor-backed electrification efforts are expected to support market development. The region’s potential will expand in parallel with broader EV adoption across urban centers.

Key Player Analysis:

- LG Innotek

- Tesla

- BYD Auto

- Schneider Electric

- ABB

- Bosch

- Vector Informatik

- Siemens

- Mitsubishi Electric

- Efacec

- Ficosa

- Sensata Technologies

- Continental

- Delta Electronics

Competitive Analysis:

The Electric Vehicle Communication Controllers Market features a concentrated competitive landscape with key players focusing on innovation, partnerships, and compliance with evolving charging standards. Companies such as LG Innotek, Siemens AG, Tesla, ABB, Schneider Electric, and Vector Informatik dominate the space by offering ISO 15118-compliant solutions and scalable controller modules. It demands high R&D investment, driving firms to develop advanced features like plug-and-charge, V2G support, and secure data transfer. Strategic collaborations between automotive OEMs and EV infrastructure providers are reshaping product development cycles and enhancing interoperability. New entrants face high barriers due to complex certification and integration requirements. Market leaders are expanding their global footprint through regional partnerships, reinforcing their position across Asia Pacific, Europe, and North America. The market favors players that can balance technical sophistication with cost-efficiency, while continuously adapting to rapid electrification trends and evolving regulatory mandates.

Recent Developments:

- In Sep 2024, Siemens AG announced the launch of its next-generation Electric Vehicle Communication Controller (EVCC), designed to support faster charging and enhanced interoperability with global charging standards.

- In April 2024, LG Innotek entered into a strategic partnership with Hyundai Motor Company to co-develop advanced EV communication modules. This collaboration focuses on integrating LG’s cutting-edge communication technology with Hyundai’s electric vehicle platforms, aiming to improve charging efficiency and user experience for future EV models.

Market Concentration & Characteristics:

The Electric Vehicle Communication Controllers Market exhibits a moderately concentrated structure, with a few dominant players holding significant market share due to their technological capabilities and early adoption of global standards. It is characterized by rapid innovation, regulatory-driven product development, and high entry barriers linked to protocol compliance, cybersecurity, and integration complexity. The market favors companies with strong R&D infrastructure and established relationships with OEMs and charging network operators. Product differentiation centers on compatibility, speed, data security, and support for V2G and ISO 15118 protocols. It remains dynamic, with frequent upgrades and partnerships shaping competitive positioning. The need for interoperability and real-time data communication continues to influence controller architecture and industry collaboration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on system and charging type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Global adoption of electric vehicles will accelerate demand for advanced communication controllers with enhanced interoperability.

- Increasing integration of vehicle-to-grid (V2G) systems will require controllers capable of bidirectional energy transfer and smart grid coordination.

- ISO 15118 and other emerging standards will drive controller design toward universal compatibility and seamless plug-and-charge experiences.

- Expansion of ultra-fast DC charging infrastructure will fuel the need for low-latency, high-security communication modules.

- OEMs will invest in software-defined EVCC platforms to enable over-the-air updates and future functionality enhancements.

- Asia Pacific will retain its lead due to government incentives, production scale, and infrastructure rollout.

- Europe will focus on controller standardization across borders, supporting seamless EV travel and smart energy goals.

- North America will grow through infrastructure investments, fleet electrification, and V2G pilot deployments.

- Competitive pressure will increase innovation in cybersecurity, diagnostics, and predictive maintenance capabilities.

- Emerging markets will open opportunities for cost-effective, modular controller systems tailored to regional infrastructure maturity.