| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Infotainment Market Size 2024 |

USD 6,782.0 Million |

| Electric Vehicle Infotainment Market, CAGR |

14.90% |

| Electric Vehicle Infotainment Market Size 2032 |

USD 20,602.4 Million |

Market Overview:

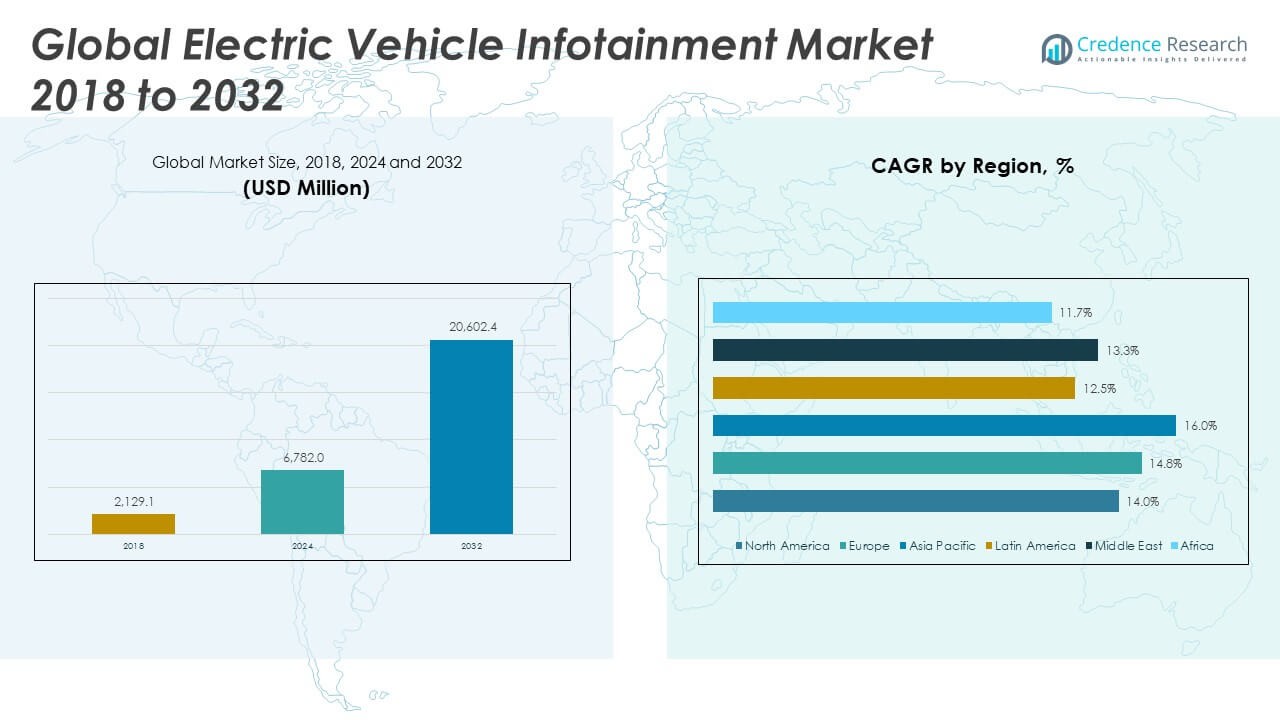

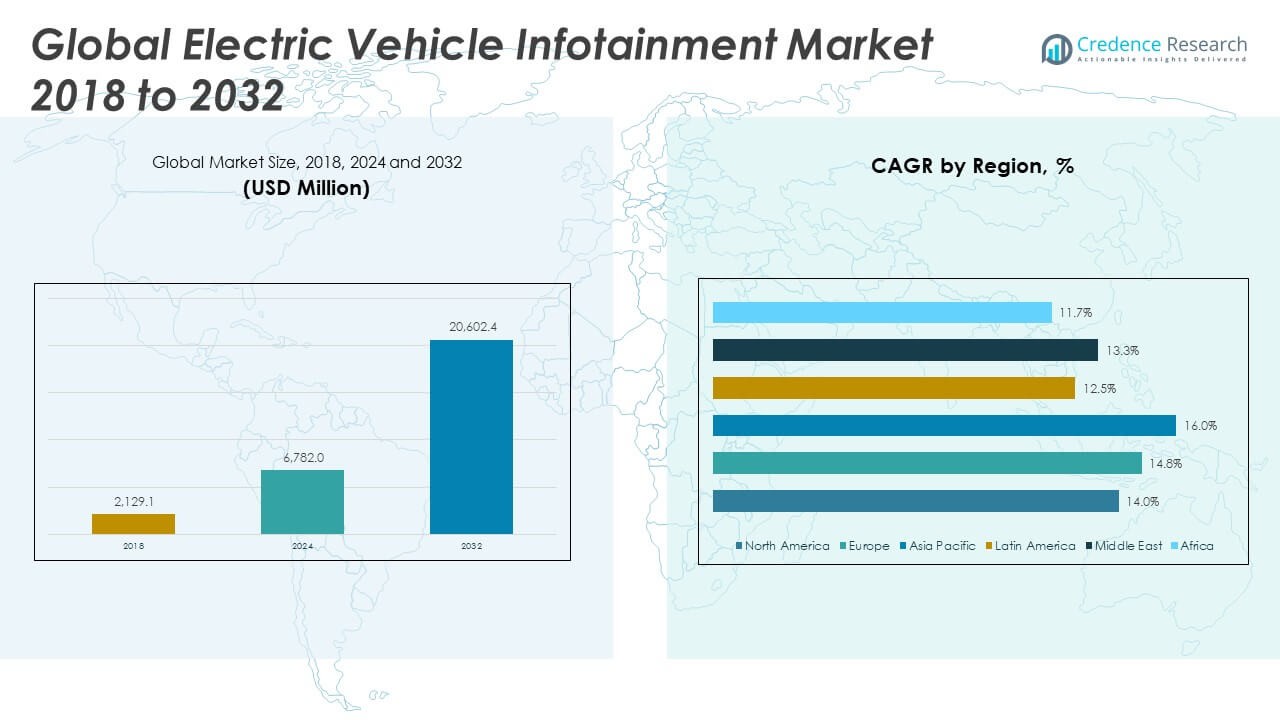

The Electric Vehicle Infotainment Market size was valued at USD 2,129.1 million in 2018 to USD 6,782.0 million in 2024 and is anticipated to reach USD 20,602.4 million by 2032, at a CAGR of 14.90% during the forecast period.

The Electric Vehicle Infotainment Market is advancing rapidly due to a combination of rising electric vehicle adoption, growing demand for in-vehicle digital experiences, and technological innovation. Consumers now expect EVs to offer not just transportation but also connectivity, entertainment, and personalized interfaces. Automakers are responding by integrating advanced infotainment systems equipped with 5G connectivity, voice recognition, real-time navigation, and seamless smartphone mirroring. Strategic partnerships between automotive OEMs and technology firms—such as Google, Apple, and Huawei—are enabling embedded platforms like Android Automotive OS and Apple CarPlay to become standard across many EV models. Features like over-the-air (OTA) updates, AI-powered assistants, and augmented reality navigation further enhance the user experience while differentiating brand value. In addition, regulatory focus on driver safety and cybersecurity is encouraging the development of secure and compliant infotainment architectures.

Regionally, the Electric Vehicle Infotainment Market is dominated by Asia-Pacific, North America, and Europe, each contributing distinct growth dynamics. Asia-Pacific, led by China, is witnessing the fastest growth due to high EV production volumes, strong government incentives, and technological advancements from domestic players like BYD, NIO, Huawei, and Xiaomi. North America is also a major contributor, with the U.S. market benefiting from advanced software integrations, robust EV infrastructure, and widespread use of Android Automotive and similar platforms in models from Ford, GM, and Tesla. Europe holds a significant share, driven by aggressive decarbonization goals, strict emissions regulations, and a mature EV market across Germany, the UK, and the Nordic countries. These regions are investing heavily in software-defined vehicles, where infotainment systems play a central role. Meanwhile, Latin America, the Middle East, and Africa are emerging markets, where gradual EV adoption and infrastructure expansion are expected to fuel moderate but steady growth in infotainment solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electric Vehicle Infotainment Market is projected to grow from USD 6,782.0 million in 2024 to USD 20,602.4 million by 2032, at a CAGR of 14.90%.

- Rising EV adoption and consumer demand for digital experiences are transforming infotainment systems into core components of vehicle value.

- Automakers are embedding AI, 5G, and augmented reality to enhance navigation, voice control, and real-time services in EV infotainment platforms.

- Over-the-air (OTA) updates support continuous software improvements and unlock subscription-based infotainment revenue models.

- Collaborations between OEMs and tech giants like Google, Apple, and Huawei are accelerating innovation in infotainment ecosystems.

- High development costs and system integration challenges across diverse EV models remain barriers for smaller manufacturers.

- Asia-Pacific leads the market, followed by North America and Europe, while Latin America, the Middle East, and Africa show emerging potential.

Market Drivers:

Rising Consumer Expectations for In-Vehicle Connectivity and Personalization

Consumers increasingly demand digital experiences within their vehicles, transforming infotainment systems from optional features to core components. The Electric Vehicle Infotainment Market benefits from this trend as users seek seamless smartphone integration, voice assistants, real-time navigation, and high-definition displays. Infotainment platforms now support personalized profiles, adaptive interfaces, and curated content based on user behavior. Automakers are investing in software capabilities that mirror the functionality of smartphones, enabling a unified digital environment. This shift aligns with the growing importance of user experience in vehicle purchase decisions. It compels manufacturers to integrate intuitive, responsive infotainment systems that enhance satisfaction and brand loyalty.

- For example, BMW’s upcoming Panoramic iDrive, set to launch in late 2025, features a Panoramic Vision display that spans the entire dashboard, projecting critical vehicle data, navigation, and climate controls in high resolution across the windshield. This system integrates with a central touchscreen and a 3D head-up display, offering drivers and passengers a unified, immersive digital interface.

Integration of Advanced Technologies such as AI, 5G, and Augmented Reality

Emerging technologies are redefining the capabilities of infotainment systems in electric vehicles. Artificial intelligence enables proactive user interactions, smart routing, predictive maintenance alerts, and natural voice recognition. The rollout of 5G enhances real-time data transmission, supporting cloud-based apps, streaming services, and live updates with minimal latency. Augmented reality is becoming a key feature in navigation systems, offering heads-up displays with contextual alerts. These innovations elevate the functionality of infotainment systems, making them central to driver engagement and operational efficiency. The Electric Vehicle Infotainment Market gains momentum as automakers embed these features to compete in a software-driven ecosystem.

Automotive Industry Shift Toward Software-Defined Vehicles and OTA Capabilities

The transition to software-defined vehicles is reshaping the automotive industry and strengthening the role of infotainment platforms. Manufacturers now design vehicles with updatable software architectures, where over-the-air (OTA) updates regularly enhance infotainment features without requiring dealership visits. This allows for continuous improvements in interface design, app integration, and system performance. Automakers use OTA updates to introduce new services, fix bugs, and roll out subscription-based features, generating recurring revenue. It also reduces customer frustration and enhances post-purchase value. The Electric Vehicle Infotainment Market evolves within this framework, reinforcing the importance of scalable and modular infotainment solutions.

Collaborations Between Automotive OEMs and Tech Giants Driving Innovation

Strategic partnerships between traditional automakers and technology firms are accelerating infotainment advancements. Collaborations with companies like Google, Apple, and Baidu allow seamless integration of Android Automotive OS, CarPlay, and other software ecosystems. These alliances bring robust app ecosystems, voice control, and navigation tools directly into the vehicle’s operating system. Automakers benefit from reduced development time and enhanced consumer trust in familiar digital interfaces. These joint efforts also ensure compatibility with third-party services and devices. The Electric Vehicle Infotainment Market reflects this collaborative trend, where cross-industry expertise drives competitive differentiation and continuous innovation.

- For instance, in China, Apple is partnering with Baidu to bring generative AI to in-car systems, with Siri expected to leverage Baidu’s Ernie 4.0 model for enhanced voice interaction and search.

Market Trends:

Growing Adoption of Integrated Infotainment Platforms Over Standalone Systems

Automakers are increasingly shifting from fragmented infotainment components to fully integrated platforms that centralize control and user experience. These platforms combine navigation, media, telematics, climate control, and voice assistants into a unified interface. The Electric Vehicle Infotainment Market is embracing this trend to meet rising expectations for seamless interaction and minimal driver distraction. Integrated platforms also simplify software updates and improve system reliability across functions. Centralized architecture enables smoother integration of third-party apps and services, enhancing value for end-users. Automakers gain competitive advantage by offering a streamlined, customizable experience aligned with digital lifestyle preferences.

- For example, BMW’s latest iDrive 8 system, deployed in the iX electric SUV, features a pair of curved displays a 12.3-inch instrument cluster and a 14.9-inch control screen spanning nearly half the dashboard. This system leverages 40 onboard sensors and 30 antennae, using a 5G connection capable of transmitting a DVD’s worth of data in less than a second.

Increased Use of Voice Recognition and Natural Language Processing in Infotainment Systems

Voice recognition technology is evolving rapidly to support hands-free control and improve user safety while driving. Advanced infotainment systems now feature natural language processing (NLP) that interprets complex commands and responds contextually. This trend is reshaping user interaction in the Electric Vehicle Infotainment Market, allowing drivers to access entertainment, maps, and communication tools without touching the screen. Voice assistants, such as Amazon Alexa and Google Assistant, are being embedded directly into EV infotainment ecosystems. These tools enhance user convenience and reduce cognitive load while enabling deeper personalization. OEMs continue to invest in speech-driven technology to align with global safety standards and tech-savvy user behavior.

- The Kia EV9’s infotainment system, for instance, uses AI-driven NLP to accurately interpret complex voice commands, moving beyond rigid, pre-set phrases.

In-Vehicle Entertainment Expands to Include Streaming, Gaming, and Productivity Tools

Infotainment systems in electric vehicles are no longer limited to radio and navigation. Market leaders now integrate streaming platforms, gaming consoles, and productivity applications to cater to a wider range of user needs. The Electric Vehicle Infotainment Market is experiencing rapid diversification of content services tailored for both drivers and passengers. Long EV charging times and autonomous driving features are encouraging the development of immersive entertainment options. OEMs are embedding high-performance chips and robust connectivity features to support multimedia experiences. These developments enhance the perceived value of EVs and transform them into mobile digital hubs.

Focus on Augmented Reality and Head-Up Displays for Enhanced Driver Assistance

Infotainment systems are integrating augmented reality (AR) and advanced head-up displays (HUDs) to deliver real-time, visual driver assistance. These features project critical information—such as navigation prompts, speed, and hazard alerts—onto the windshield or dashboard. The Electric Vehicle Infotainment Market is evolving to support these visual tools, improving safety and situational awareness. AR-enabled displays reduce the need for eye movement and help drivers maintain focus on the road. Automakers are using this technology to differentiate premium EV models and enhance the overall driving experience. Continued improvements in hardware and user interface design are accelerating its mainstream adoption.

Market Challenges Analysis:

High Development Costs and Integration Complexity Across Diverse Vehicle Platforms

The integration of advanced infotainment systems in electric vehicles demands significant investment in hardware, software, and testing. Automakers must coordinate across multiple suppliers, interface protocols, and regional compliance standards, increasing development time and cost. The Electric Vehicle Infotainment Market faces challenges in achieving uniform system performance across various models and trims. Differences in vehicle architecture often require customized solutions, which reduce scalability and delay time-to-market. Ensuring seamless compatibility with multiple operating systems and mobile platforms adds to the engineering burden. Smaller OEMs and emerging EV startups may struggle to match the infotainment sophistication offered by established players due to resource constraints.

Cybersecurity Risks and Data Privacy Concerns in Connected Infotainment Systems

As vehicles become more connected, infotainment systems expose users to new cybersecurity threats and privacy risks. Real-time data exchange between the vehicle, cloud, and personal devices increases vulnerability to hacking and unauthorized access. The Electric Vehicle Infotainment Market must address these concerns by developing secure platforms that comply with global data protection regulations. Infotainment systems store and transmit sensitive information, including location data, user preferences, and payment credentials, making them attractive targets for cyberattacks. Building robust encryption, firewalls, and authentication protocols is critical but adds complexity to system design. OEMs must continuously invest in cybersecurity infrastructure to maintain consumer trust and regulatory compliance.

Market Opportunities:

Growing Demand for Personalized and Subscription-Based Infotainment Services

The shift toward personalized digital experiences opens new revenue streams for automakers through subscription-based infotainment services. Consumers are willing to pay for features such as premium navigation, streaming content, live traffic updates, and advanced driver assistance tools. The Electric Vehicle Infotainment Market can capitalize on this trend by offering modular service plans tailored to user preferences. This model enables continuous engagement with customers beyond the point of sale and supports recurring revenue generation. OEMs can use data analytics to refine offerings and deliver targeted upgrades through over-the-air updates. Personalization enhances brand loyalty and strengthens the user-vehicle relationship.

Expansion of Infotainment Features in Mid-Range and Entry-Level EV Segments

Infotainment features are rapidly moving beyond premium EVs into mid-range and entry-level models, unlocking growth in volume markets. As component costs decline and software platforms become more scalable, automakers can introduce advanced infotainment capabilities across broader price points. The Electric Vehicle Infotainment Market has an opportunity to increase penetration by delivering cost-effective, user-friendly systems without compromising functionality. Regional markets in Asia, Latin America, and Africa present strong potential for infotainment growth aligned with rising EV adoption. Expanding digital infrastructure in these regions supports the rollout of cloud-based features and connected services. This shift allows OEMs to attract tech-savvy, value-conscious buyers.

Market Segmentation Analysis:

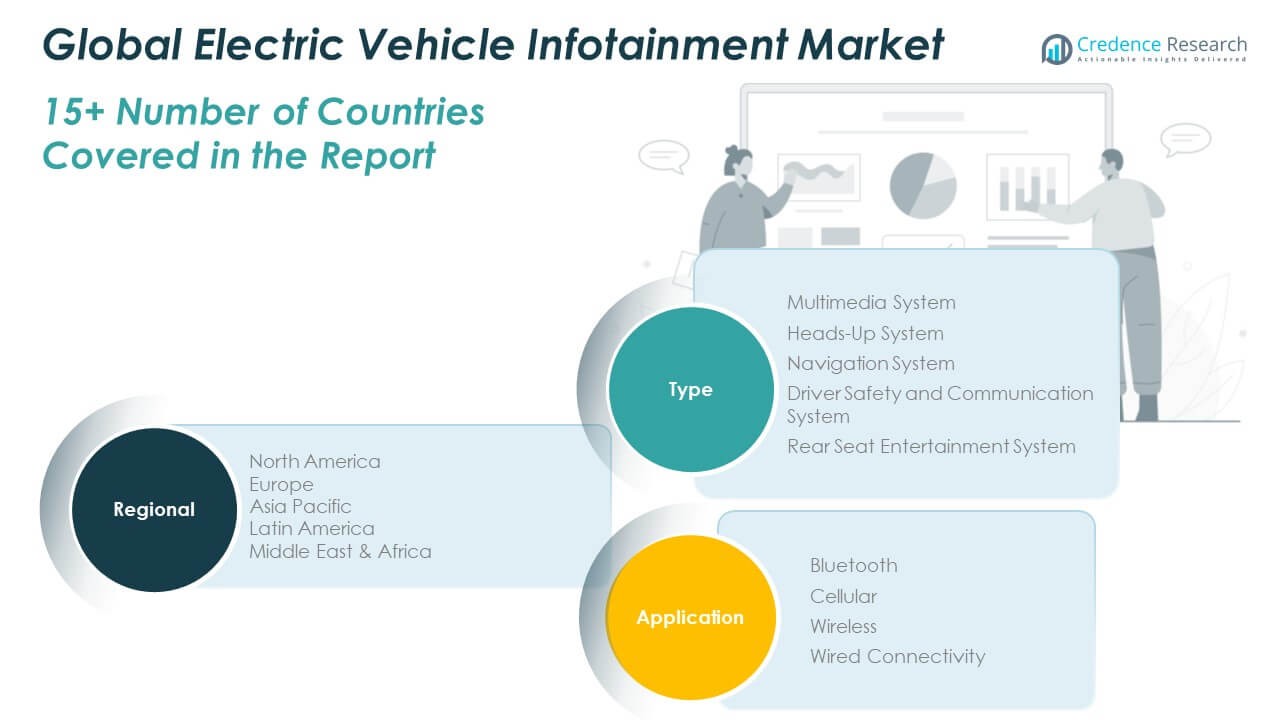

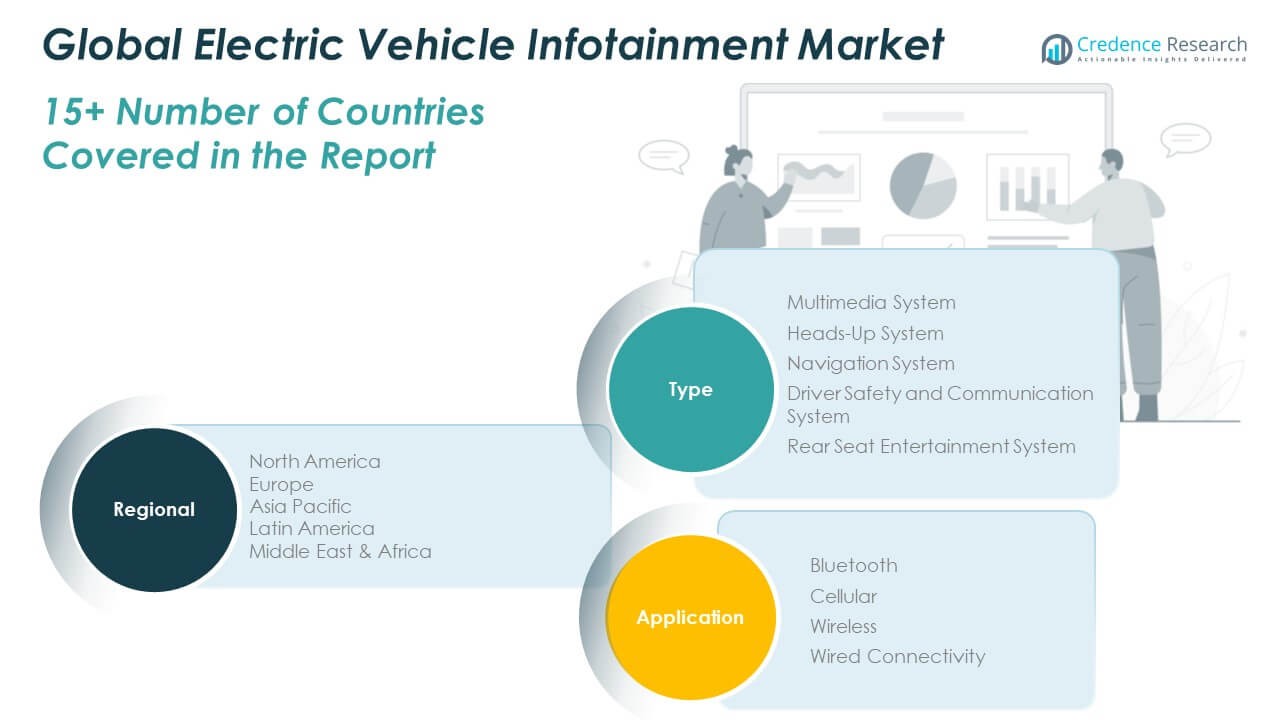

The Electric Vehicle Infotainment Market is segmented by system type and connectivity application, each contributing distinct value to user experience and technological performance.

By type, the multimedia system holds a substantial share due to high consumer demand for entertainment, navigation, and smartphone integration. The navigation system segment continues to grow as real-time mapping and AI-based route optimization become standard across EV models. Heads-up systems are gaining traction in premium vehicles, offering augmented reality overlays that improve driver safety and reduce distraction. Driver safety and communication systems are critical for compliance and user confidence, integrating voice commands and real-time vehicle alerts. Rear seat entertainment systems support growing family-oriented and luxury EV adoption.

- For example, Tesla’s Model 3 and Model Y feature a 15-inch high-definition touchscreen that consolidates multimedia, navigation, and vehicle controls, enhancing usability and reducing driver distraction.

By application, Bluetooth dominates due to its ease of use and compatibility with mobile devices. Cellular connectivity supports real-time data transfer, enabling cloud services and over-the-air updates. Wireless systems provide flexibility in hardware integration and reduce cabling requirements. Wired connectivity remains relevant for high-speed data transmission and power stability in specific modules. The Electric Vehicle Infotainment Market reflects this diverse segmentation through continued innovation and targeted feature deployment.

- For example, 5G-enabled infotainment platforms support instantaneous updates and enhanced streaming capacity, with 5G subscriptions in Asia-Pacific alone forecasted to exceed 270 million by 2024.

Segmentation:

By Type

- Multimedia System

- Heads-Up System

- Navigation System

- Driver Safety and Communication System

- Rear Seat Entertainment System

By Application

- Bluetooth

- Cellular

- Wireless

- Wired Connectivity

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America

The North America Electric Vehicle Infotainment Market size was valued at USD 553.6 million in 2018 to USD 1,458.1 million in 2024 and is anticipated to reach USD 3,749.6 million by 2032, at a CAGR of 14.0% during the forecast period. North America holds a significant share of the global Electric Vehicle Infotainment Market, accounting for 18.8% in 2024. The region benefits from high EV penetration, advanced digital infrastructure, and the presence of leading automakers integrating cutting-edge infotainment solutions. Strategic collaborations with tech firms, particularly for Android Automotive and Apple CarPlay integration, are enhancing system capabilities. Consumers demand seamless digital experiences, prompting OEMs to prioritize infotainment innovation. The U.S. market dominates regional adoption, supported by strong R&D investment and early adoption of over-the-air updates.

Europe

The Europe Electric Vehicle Infotainment Market size was valued at USD 542.9 million in 2018 to USD 1,627.7 million in 2024 and is anticipated to reach USD 4,450.1 million by 2032, at a CAGR of 14.8% during the forecast period. Europe accounts for 21.0% of the global Electric Vehicle Infotainment Market in 2024. The region’s leadership in EV adoption, driven by stringent emission norms and subsidies, strengthens demand for high-end infotainment systems. German, Swedish, and French OEMs are leveraging infotainment to differentiate EV offerings and enhance driver experience. Integration of augmented reality displays and voice assistants is becoming common in premium EV models. Europe’s emphasis on user safety and compliance ensures advanced infotainment features are aligned with regulatory standards.

Asia Pacific

The Asia Pacific Electric Vehicle Infotainment Market size was valued at USD 734.5 million in 2018 to USD 2,834.9 million in 2024 and is anticipated to reach USD 9,951.0 million by 2032, at a CAGR of 16.0% during the forecast period. Asia Pacific holds the largest share of the Electric Vehicle Infotainment Market, capturing 36.5% in 2024. China leads regional growth, supported by strong EV manufacturing, domestic demand, and government subsidies. Local tech companies like Huawei and Baidu are advancing infotainment innovation through AI-powered platforms. Japan and South Korea contribute with high-tech components and software platforms that integrate cloud-based services. Rapid urbanization, 5G expansion, and rising consumer expectations continue to boost demand for smart infotainment solutions.

Latin America

The Latin America Electric Vehicle Infotainment Market size was valued at USD 95.8 million in 2018 to USD 305.2 million in 2024 and is anticipated to reach USD 1,091.9 million by 2032, at a CAGR of 12.5% during the forecast period. Latin America represents 3.9% of the global Electric Vehicle Infotainment Market in 2024. The region is witnessing gradual EV adoption, led by Brazil, Mexico, and Chile, where governments are expanding EV incentives and charging networks. Infotainment systems in Latin America are evolving from basic media units to connected platforms with navigation and smartphone integration. Cost-effective solutions and mid-range EV models drive market expansion. OEMs are tailoring infotainment features to suit regional needs, focusing on user-friendly interfaces and localized content.

Middle East

The Middle East Electric Vehicle Infotainment Market size was valued at USD 127.7 million in 2018 to USD 406.9 million in 2024 and is anticipated to reach USD 1,071.3 million by 2032, at a CAGR of 13.3% during the forecast period. The Middle East contributes 5.2% to the global Electric Vehicle Infotainment Market in 2024. The market benefits from rising interest in electric mobility across the UAE, Saudi Arabia, and Qatar, supported by sustainability goals and premium EV imports. Infotainment systems are integrated with features such as GPS-based navigation, bilingual interfaces, and advanced display panels. Luxury EV brands dominate the segment, offering immersive digital experiences to tech-savvy consumers. Increasing investment in EV infrastructure and digital connectivity supports the market’s long-term growth.

Africa

The Africa Electric Vehicle Infotainment Market size was valued at USD 74.5 million in 2018 to USD 149.2 million in 2024 and is anticipated to reach USD 288.4 million by 2032, at a CAGR of 11.7% during the forecast period. Africa holds a 1.9% share in the global Electric Vehicle Infotainment Market in 2024. EV adoption is still at a nascent stage, primarily limited to urban centers in South Africa, Kenya, and Nigeria. Infotainment systems in the region focus on basic connectivity, navigation, and energy monitoring features. Limited digital infrastructure and high vehicle import costs pose challenges to advanced infotainment integration. However, international partnerships and policy shifts toward electrification are expected to create new opportunities. Local assembly initiatives and mobile-based infotainment apps may drive future adoption.

Key Player Analysis:

- Harman International

- Panasonic Corporation

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Alpine Electronics

- Pioneer Corporation

- Clarion Co., Ltd.

- Visteon Corporation

- Garmin Ltd.

- JVCKenwood Corporation

- Aptiv

- NXP Semiconductors

- Magna International

Competitive Analysis:

The Electric Vehicle Infotainment Market features a competitive landscape shaped by a mix of global automotive OEMs and technology providers. Leading companies such as Tesla, General Motors, and BMW integrate proprietary infotainment systems, while others rely on partnerships with tech firms like Google, Apple, Baidu, and Huawei to embed operating systems and applications. It is witnessing intense competition driven by innovation in user experience, software integration, and AI capabilities. Firms are focusing on modular platforms, over-the-air update functionality, and subscription-based services to differentiate their offerings. Tier-1 suppliers such as Continental AG, Panasonic, Harman (a Samsung company), and Bosch play a vital role in delivering scalable infotainment hardware and software solutions. Regional players in Asia and Europe are also advancing aggressively through localized customization and connectivity enhancements. Competitive success depends on the ability to deliver intuitive, secure, and continuously evolving infotainment systems that enhance user engagement and vehicle value.

Recent Developments:

- In June 2025, Harman International launched the world’s first in-vehicle display powered by Samsung Neo QLED technology, debuting in the Tata Motors Harrier.ev. This marks a significant milestone, bringing home-theater quality visuals and advanced display performance to electric vehicles, thanks to a decade-long collaboration with Tata Motors.

- In January 2025, Panasonic Corporation announced an expanded partnership with Qualcomm at CES 2025, focusing on advanced in-vehicle experiences using the Snapdragon Cockpit Elite platform. This collaboration aims to deliver AI-driven, high-performance cockpit domain controllers and compute systems, promising to redefine the electric vehicle infotainment experience with cutting-edge technology.

- In May 2025, Stellantis announced it will pivot from Amazon’s in-car software to Google’s Android Automotive OS. It ends its partnership with Amazon and adopts Google’s platform across its vehicle lineup. This shift will unify infotainment systems, enable richer app ecosystems, and streamline software updates and maintenance

Market Concentration & Characteristics:

The Electric Vehicle Infotainment Market is moderately concentrated, with a few dominant players controlling a significant share of the global market. It features a blend of automotive manufacturers, Tier-1 suppliers, and technology firms that collaborate to develop advanced infotainment solutions. Leading companies focus on proprietary platforms or strategic partnerships to gain competitive advantage through software innovation, AI integration, and seamless connectivity. The market is characterized by rapid technological advancement, high R&D investment, and increasing reliance on over-the-air updates and cloud-based services. Standardization challenges and regional customization requirements shape product development strategies. Companies prioritize user-centric design, cybersecurity, and scalable architectures to meet evolving consumer expectations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- AI-driven voice assistants and gesture controls will become standard features across EV infotainment systems.

- Integration of augmented reality in head-up displays will enhance navigation and driver awareness.

- Subscription-based infotainment models will create recurring revenue streams for OEMs.

- Expansion of 5G networks will support real-time cloud services and high-speed streaming in vehicles.

- Cross-platform compatibility will drive demand for unified infotainment ecosystems across EV brands.

- Cybersecurity will gain importance as vehicles become more connected and data-intensive.

- Regional customization will increase to cater to local languages, content preferences, and regulatory needs.

- Infotainment systems will integrate with smart home and IoT devices for seamless digital experiences.

- Cost-effective infotainment solutions will accelerate adoption in mid-range and entry-level EVs.

- Collaborations between automakers and tech giants will shape future innovation and market leadership.