Market Overview

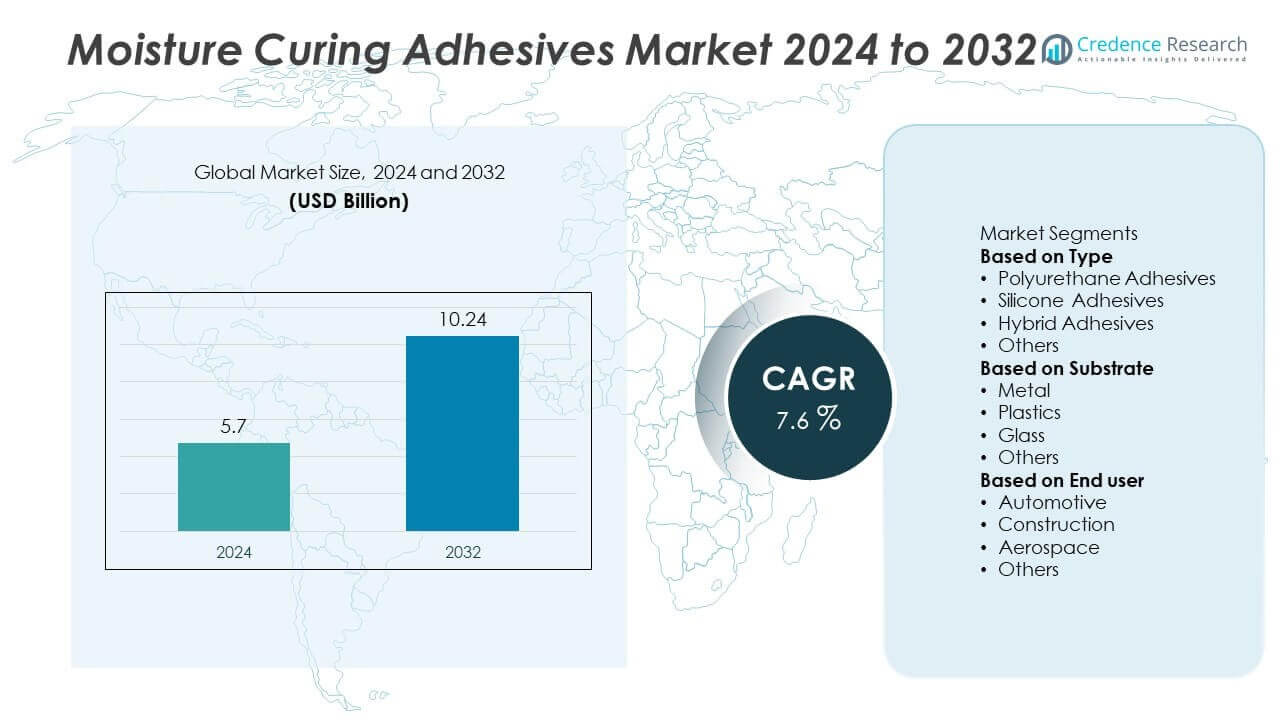

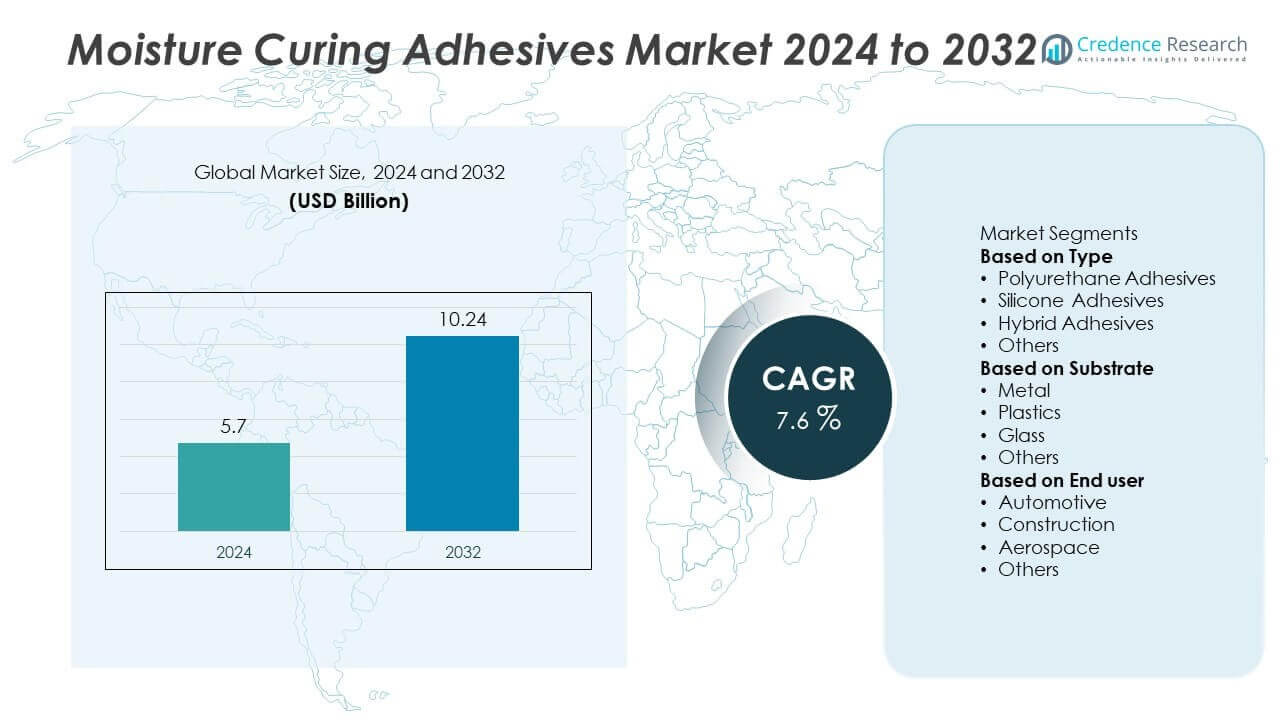

Moisture Curing Adhesives Market size was valued at USD 5.7 billion in 2024 and is anticipated to reach USD 10.24 billion by 2032, expanding at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Moisture Curing Adhesives Market Size 2024 |

USD 5.7 Billion |

| Moisture Curing Adhesives Market, CAGR |

7.6% |

| Moisture Curing Adhesives Market Size 2032 |

USD 10.24 Billion |

The Moisture Curing Adhesives Market grows through rising demand from construction, automotive, and packaging industries that require durable and reliable bonding solutions. Strong adoption in flooring, roofing, and panel installations supports infrastructure development, while automotive manufacturers use these adhesives to reduce vehicle weight and enhance safety.

North America leads adoption of moisture curing adhesives, supported by strong demand in construction, automotive, and packaging industries, while Europe advances with widespread use in automotive assembly and green building projects. Asia-Pacific emerges as the fastest-growing region, driven by rapid infrastructure development, large-scale manufacturing, and expanding electronics production. Latin America and Middle East & Africa also contribute with rising investments in industrial modernization and packaging solutions. Key players shaping the Moisture Curing Adhesives Market include Henkel AG & Co. KGaA, H.B. Fuller, 3M Company, and Bostik SA, each leveraging strong R&D and product portfolios to meet industry-specific requirements. Henkel leads innovation in eco-friendly adhesives for construction and automotive sectors, while H.B. Fuller focuses on high-performance bonding solutions for packaging and industrial uses. 3M Company develops versatile adhesive technologies for healthcare and electronics, and Bostik SA specializes in durable construction adhesives, reinforcing the global market through strategic product advancements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Moisture Curing Adhesives Market size was valued at USD 5.7 billion in 2024 and is projected to reach USD 10.24 billion by 2032, growing at a CAGR of 7.6%.

- Rising demand from construction, automotive, and packaging industries drives adoption of strong and durable bonding solutions.

- Market trends emphasize eco-friendly, low-VOC adhesives and advanced formulations with faster curing and improved substrate compatibility.

- Competitive landscape features leading players such as Henkel AG & Co. KGaA, H.B. Fuller, 3M Company, and Bostik SA focusing on innovation and global reach.

- High raw material costs, regulatory restrictions on VOC emissions, and performance limitations in extreme conditions act as restraints for manufacturers.

- North America leads with strong adoption in construction and automotive, Europe expands with green building initiatives, Asia-Pacific grows fastest with infrastructure and manufacturing, while Latin America and Middle East & Africa steadily advance with industrial modernization.

- Expanding opportunities in electric vehicles, aerospace, renewable energy, and healthcare applications position moisture curing adhesives as critical to future industrial and technological growth.

Market Drivers

Rising Demand from Construction and Infrastructure Development

The global expansion of construction projects drives significant demand for moisture curing adhesives. These adhesives provide strong bonding for flooring, roofing, and panel installations where durability is essential. Rapid urbanization and infrastructure investments in both residential and commercial sectors create sustained growth. Moisture Curing Adhesives Market benefits from their ability to resist extreme temperatures and moisture conditions. It offers superior performance compared to conventional adhesives in structural applications. Growing focus on green building materials also promotes adoption across modern construction projects.

- For instance, Henkel’s Loctite UR 7225 B achieves tensile shear strength over 7 MPa at –40 °C and retains over 3 MPa at 80 °C when bonding wood-to-wood substrates—highlighting its durable performance in variable climates.

Increasing Adoption in Automotive Manufacturing

The automotive sector increasingly relies on moisture curing adhesives for assembly processes. These adhesives are used in bonding glass, sealing body panels, and enhancing vibration resistance. Rising production of electric and hybrid vehicles further supports adoption due to the need for lightweight yet durable bonding solutions. It ensures long-lasting adhesion in environments exposed to high humidity and heat. Manufacturers value the quick curing capability that enhances efficiency on assembly lines. Strong performance under stress conditions reinforces their role in vehicle safety and durability.

- For instance, H.B. Fuller’s EV Therm 440 GB structural acrylic adhesive maintains a controlled bond gap of just 0.25 mm and meets UL94 V‑0 flame‑retardant standards, showcasing its suitability for demanding EV battery assemblies.

Growing Applications in Packaging and Consumer Goods

Packaging industries adopt moisture curing adhesives to improve sealing performance and extend shelf life. Their use in flexible packaging and labeling ensures resistance to water exposure and environmental stress. Consumer goods, including electronics and appliances, also incorporate these adhesives for reliable assembly. Moisture Curing Adhesives Market expands across diverse segments by offering long-term durability. It enables product manufacturers to meet rising expectations for quality and reliability. Increasing demand for advanced adhesives in high-performance packaging continues to boost market opportunities.

Technological Advancements and Product Innovation

Continuous innovation in adhesive formulations strengthens market growth. Manufacturers focus on developing low-VOC, eco-friendly adhesives to comply with regulatory standards. New technologies improve curing speed, adhesion strength, and compatibility with multiple substrates. It supports expansion into industries like aerospace and renewable energy, where performance requirements are critical. Companies investing in R&D introduce specialized adhesives that meet specific industrial needs. The trend toward innovation positions moisture curing adhesives as essential solutions for modern manufacturing challenges.

Market Trends

Shift Toward Eco-Friendly and Low-VOC Adhesives

Manufacturers are shifting toward low-VOC and environmentally sustainable formulations to meet strict regulations. These adhesives reduce harmful emissions while maintaining strength and durability. Moisture Curing Adhesives Market aligns with this trend by offering safer solutions for construction, automotive, and packaging sectors. It supports compliance with environmental standards such as REACH and EPA guidelines. Growing preference for green building materials accelerates adoption in infrastructure projects. Demand for eco-conscious adhesives continues to shape product development strategies.

- For instance, Loctite PL® Premium Fast Grab maintains VOC levels under 2 percent by weight, delivers initial tack strong enough to hold vertical panels in place within 20 minutes, and fully cures in 24 hours even in cold temperatures.

Rising Demand from Lightweight Materials in Automotive

The use of lightweight composites and advanced materials in vehicles increases reliance on moisture curing adhesives. These adhesives provide strong bonding without adding weight, supporting fuel efficiency and safety. It enables automotive manufacturers to replace mechanical fasteners with reliable adhesive solutions. Growth in electric vehicle production further strengthens demand due to the need for vibration resistance and thermal stability. Adhesives tailored for bonding glass, plastics, and composites enhance manufacturing efficiency. This trend consolidates the role of adhesives in modern automotive design.

- For instance, H.B. Fuller’s EV Seal 200—an MS‑polymer moisture‑curing sealant—achieves a lap shear strength of 3.2 MPa, maintains elasticity of 400 percent elongation, and cures to a thickness of 3 mm per day under standard lab conditions

Expansion in High-Performance Industrial Applications

Industries such as aerospace, renewable energy, and electronics drive new applications for moisture curing adhesives. Their resistance to moisture and ability to bond dissimilar materials make them valuable in high-stress environments. Moisture Curing Adhesives Market benefits from adoption in wind turbine assembly, circuit boards, and aerospace components. It ensures longevity and reliability under demanding conditions. Manufacturers develop specialized grades to meet sector-specific performance requirements. This diversification broadens the market scope across multiple industries.

Integration with Advanced Application Technologies

Advances in dispensing and curing technologies improve the efficiency of adhesive application. Automated systems enhance precision in industries where bonding strength is critical. It allows manufacturers to reduce material waste and production time while ensuring consistent results. Integration with smart manufacturing and robotic assembly processes reinforces adoption. Companies are investing in digital tools to monitor adhesive performance and curing rates. These advancements highlight how technology integration supports the next phase of adhesive innovation.

Market Challenges Analysis

High Costs and Raw Material Dependency

Moisture curing adhesives often rely on specialty chemicals and polyurethane-based formulations that increase production costs. Fluctuations in raw material supply chains create pricing instability for manufacturers. Moisture Curing Adhesives Market faces pressure to balance performance with affordability in cost-sensitive industries. It challenges smaller companies that lack the scale to absorb material price swings. Import dependency in certain regions further exposes manufacturers to supply disruptions. High costs remain a barrier for wider adoption across developing economies where alternatives are still favored.

Regulatory and Performance Limitations

Stringent regulations on VOC emissions and chemical content restrict product formulations in many regions. Meeting compliance standards requires continuous investment in research and testing, which raises operational costs. Moisture curing adhesives must also overcome performance challenges in extreme environmental conditions such as very low humidity or cold climates. It creates risks of delayed curing or reduced adhesion strength. Manufacturers need advanced technologies to ensure consistent results across diverse applications. These regulatory and technical constraints slow down market penetration in sectors with high performance demands.

Market Opportunities

Expansion in Green Construction and Sustainable Materials

The global shift toward sustainable construction materials creates strong opportunities for moisture curing adhesives. Their low-VOC and eco-friendly formulations align with growing demand for green building practices. Moisture Curing Adhesives Market benefits from their ability to bond wood, tiles, and composites in energy-efficient structures. It supports compliance with certifications like LEED, which strengthen their use in both residential and commercial projects. Increasing investment in infrastructure modernization across developed and emerging economies accelerates growth. Adoption in flooring, roofing, and panel bonding enhances long-term durability while reducing environmental impact.

Growing Role in Advanced Automotive and Industrial Applications

Automotive and industrial sectors provide new opportunities for moisture curing adhesives due to the shift toward lightweight materials. These adhesives replace welding and mechanical fasteners, improving efficiency and reducing overall weight. It enables strong adhesion in electric vehicles, where vibration resistance and thermal stability are critical. Expansion into aerospace, wind energy, and electronics sectors opens new avenues for growth. Manufacturers focusing on specialized formulations can target high-performance applications with strict durability requirements. This diversification ensures steady demand across mobility, renewable energy, and precision engineering industries.

Market Segmentation Analysis:

By Type

Moisture curing adhesives can be segmented into polyurethane, silicone, and cyanoacrylate formulations. Polyurethane adhesives dominate usage due to their versatility in construction, automotive, and industrial applications. Silicone-based adhesives are widely preferred for their flexibility and resistance to temperature extremes, making them suitable for electronics and sealing applications. Cyanoacrylate adhesives provide fast curing and strong bonds in smaller assemblies, supporting consumer electronics and medical devices. Moisture Curing Adhesives Market continues to expand across all types as manufacturers develop formulations that balance strength, curing time, and compliance with environmental regulations. It ensures that end users can select solutions tailored to specific operational requirements.

- For instance, Henkel’s Loctite UR 7225 B provides wood-to-wood bonds with tensile shear strengths over 7 MPa at -40°C and over 6 MPa at 20°C. While sufficient strength develops in approximately 30 minutes, it takes one day to achieve final bond strength.

By Substrate

Moisture curing adhesives find applications across diverse substrates, including plastics, metals, wood, and composites. Adhesion to plastics supports consumer electronics and packaging, where durability and sealing performance are critical. Metal bonding applications extend across automotive and aerospace, requiring adhesives that can withstand vibration and mechanical stress. Wood substrates dominate construction uses, where adhesives provide long-lasting bonds in flooring and panel installation. Composites are increasingly relevant in lightweight automotive and industrial products, driving demand for specialized adhesives. It strengthens market penetration by enabling consistent performance across both traditional and advanced substrates.

- For instance, 3M’s Polyurethane Adhesive Sealant Fast Cure 550 forms a paintable skin in 60–90 minutes, bonds substrates like aluminum and FRP, and performs reliably across –40 °C to 90 °C environments.

By End User

End-user industries for moisture curing adhesives include construction, automotive, packaging, electronics, and healthcare. Construction leads adoption with strong demand for adhesives in flooring, roofing, and insulation applications. Automotive follows closely, with adhesives enabling lightweight vehicle designs, strong bonding, and durability in electric and autonomous vehicles. Packaging industries adopt moisture curing adhesives for sealing and labeling applications that require resistance to environmental stress. Electronics and healthcare sectors leverage these adhesives for compact device assembly and reliable bonding in medical equipment. Moisture Curing Adhesives Market grows steadily across these sectors, supported by innovation in formulation and alignment with performance demands. It secures relevance across diverse industries with expanding applications.

Segments:

Based on Type

- Polyurethane Adhesives

- Silicone Adhesives

- Hybrid Adhesives

- Others

Based on Substrate

- Metal

- Plastics

- Glass

- Others

Based on End user

- Automotive

- Construction

- Aerospace

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 33% share of the Moisture Curing Adhesives Market in 2024, supported by extensive adoption in construction, automotive, and packaging industries. The region benefits from strong infrastructure development in the United States and Canada, where flooring, panel bonding, and roofing adhesives are in constant demand. Automotive production, including the growth of electric vehicles, fuels further adoption of advanced adhesives for lightweight designs and vibration resistance. It also gains momentum from packaging sectors that require moisture-resistant adhesives for food and beverage applications. Stringent environmental regulations encourage manufacturers to develop low-VOC, sustainable formulations, which strengthens long-term market prospects. Presence of major producers and robust R&D activity ensure North America continues to dominate technological advancements in adhesive applications.

Europe

Europe accounts for a 28% share of the Moisture Curing Adhesives Market, with strong demand in automotive, construction, and industrial applications. Countries such as Germany, France, and the U.K. lead adoption due to their advanced automotive industries and emphasis on green building practices. The European Union’s strict regulatory framework drives the use of eco-friendly adhesives, aligning with sustainability goals. It supports growth in applications such as flooring, insulation, and façade construction. Automotive manufacturers across Germany and Italy increasingly replace mechanical fasteners with high-performance adhesives, improving efficiency and durability. Rising demand in healthcare and electronics further contributes to expansion. Innovation hubs across Europe maintain the region’s position as a leader in sustainable adhesive technologies.

Asia-Pacific

Asia-Pacific commands a 30% share of the Moisture Curing Adhesives Market, making it the fastest-growing region globally. Rapid urbanization, rising construction projects, and large-scale infrastructure development in China, India, and Southeast Asia fuel strong adoption. The region benefits from its role as a global hub for automotive manufacturing, particularly in China, Japan, and South Korea. It also records significant uptake in packaging industries, driven by high demand for consumer goods. Healthcare and electronics sectors adopt adhesives for device assembly and precision bonding. It gains further momentum from government-backed investments in smart city projects and industrial modernization. Asia-Pacific’s robust production capacity and expanding customer base secure its role as a growth engine for the market.

Latin America

Latin America holds a 5% share of the Moisture Curing Adhesives Market, with demand rising across construction, automotive, and packaging industries. Brazil and Mexico lead adoption due to urban expansion, growing consumer bases, and investments in automotive production. It supports applications in flooring, roofing, and labeling solutions for packaged goods. Gradual introduction of electric vehicles creates opportunities for advanced adhesive usage in automotive manufacturing. Cost sensitivity and regulatory hurdles limit growth in some countries, but rising digitalization and industrial expansion strengthen prospects. Government initiatives promoting infrastructure modernization ensure long-term opportunities for adhesive suppliers.

Middle East & Africa

Middle East & Africa capture a 4% share of the Moisture Curing Adhesives Market, driven by investments in infrastructure and industrial projects. Countries such as the UAE, Saudi Arabia, and South Africa demonstrate strong adoption in construction and packaging applications. Smart city initiatives and large-scale development projects create demand for durable adhesive solutions in flooring, panels, and roofing. It also gains traction in automotive applications, particularly through growing assembly operations in Gulf countries. Limited local manufacturing capacity and reliance on imports challenge rapid expansion, but partnerships with global producers improve availability. Rising focus on sustainability and adoption of advanced materials position the region as an emerging growth contributor to the global market.

Key Player Analysis

Competitive Analysis

Competitive landscape of the Moisture Curing Adhesives Market features key players such as Henkel AG & Co. KGaA, H.B. Fuller, 3M Company, Bostik SA, Jowat SE, Dymax Corporation, Dow Corning, Tosoh, and Sika AG. These companies drive market growth through innovation, product diversification, and global distribution networks. Leading manufacturers focus on developing eco-friendly, low-VOC adhesives to meet rising environmental standards while maintaining strong performance across substrates like wood, metal, and composites. Strategic investments in R&D strengthen their ability to deliver advanced formulations with faster curing times and higher durability. Many players expand their market reach by forming partnerships with construction firms, automotive manufacturers, and packaging producers. Growing demand for adhesives in electric vehicles, renewable energy, and medical devices further pushes these companies to create specialized solutions for high-performance applications. Continuous efforts in sustainability, regulatory compliance, and technological innovation ensure that these leading companies remain at the forefront of the Moisture Curing Adhesives Market, reinforcing their global competitiveness.

Recent Developments

- In August 2025 Bostik SA rolled out the VSR 400A conductive seam sealant for heavy-duty truck applications in the Americas, integrating conductivity and sealing in a single SKU and targeting sheet molding compound parts.

- In July 2025 Henkel AG & Co. KGaA introduced Loctite Liofol LA 7837/LA 6265, a solvent-free aliphatic adhesive system offering high thermal resistance up to 134 °C, low monomer content (< 0.1%), and room-temperature curing ideal for retort packaging.

- In January 2025 Henkel AG & Co. KGaA launched Loctite AA 3952 and SI 5057 light cure adhesives designed for bonding flexible medical devices using TPE substrates, meeting EU MDR 2017 standards and ISO 10993 biocompatibility requirements.

- In September 2024 Bostik SA introduced Fast Glue Ultra+, a cyanoacrylate repair adhesive made with 60% bio-based materials, combining high strength and water resistance in a sustainable formulation.

Report Coverage

The research report offers an in-depth analysis based on Type, Substrate, End user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand rises for sustainable, low-VOC formulations in construction and automotive applications.

- Growth in electric and autonomous vehicle production spurs need for lightweight adhesive solutions.

- Expansion into renewable energy sectors, including wind turbine and solar panel bonding, opens new markets.

- Increasing use of composite materials in aerospace and industrial sectors boosts adhesive development.

- Packaging industries require durable, moisture-resistant adhesives to support longer shelf life and premium designs.

- Healthcare and wearable device manufacturers seek compact adhesives offering biocompatibility and fast curing.

- Automation and robotics in assembly lines drive demand for adhesives compatible with precise dispensing systems.

- Smart building initiatives and infrastructure upgrades amplify use of adhesives in modular construction.

- Emerging markets in Asia-Pacific, Latin America, and Africa drive demand through urbanization and industrialization.

- Manufacturers adopt digital tools to monitor curing quality and optimize adhesive performance across applications.