Market Overview:

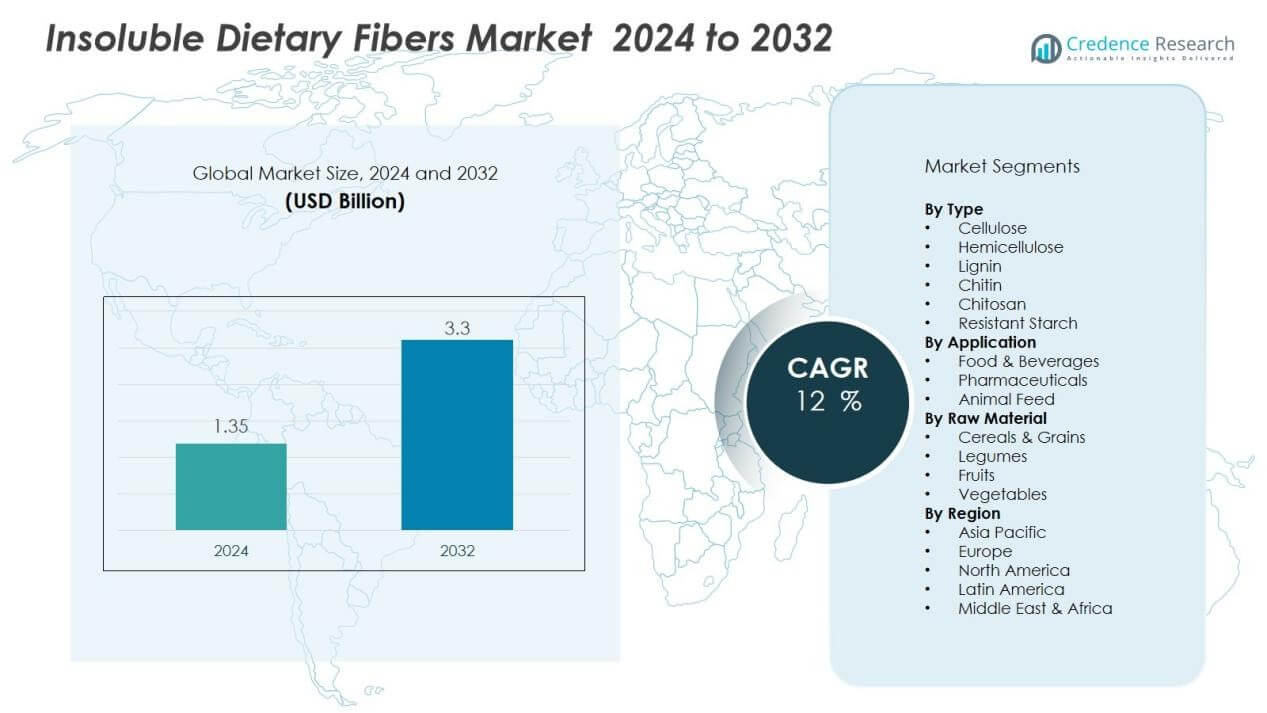

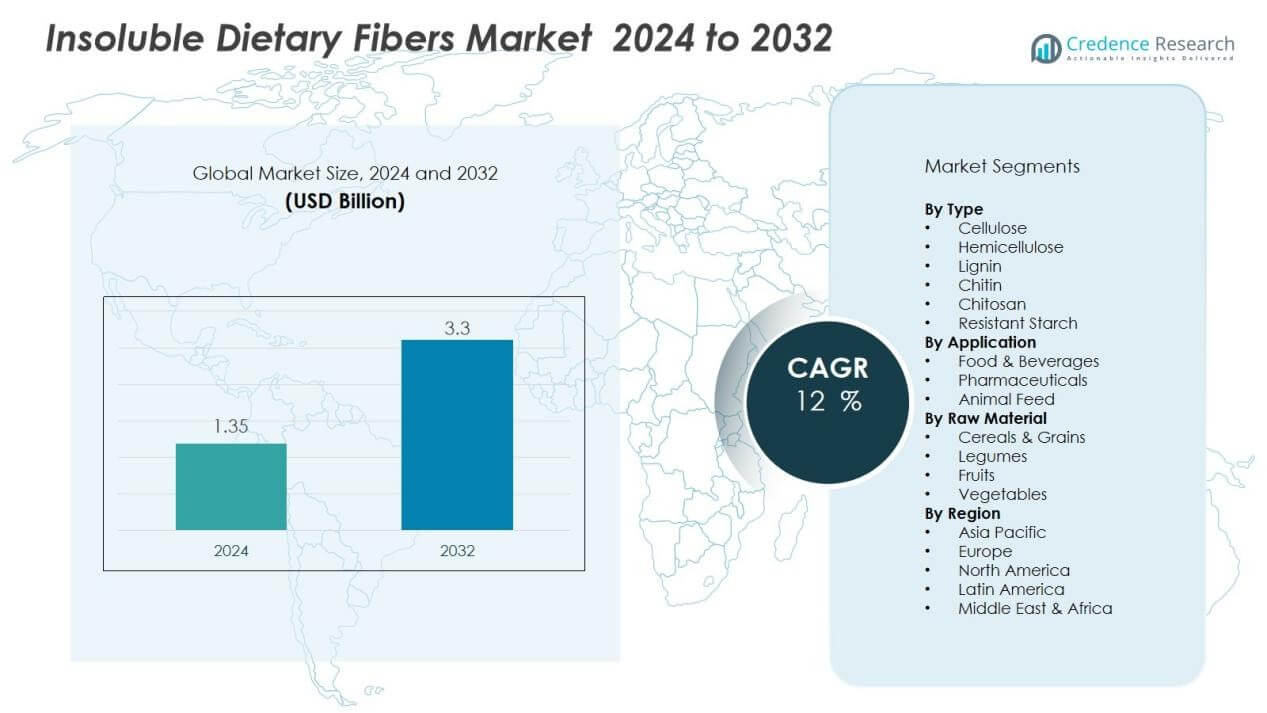

The insoluble dietary fibers market size was valued at USD 1.35 billion in 2024 and is anticipated to reach USD 3.3 billion by 2032, at a CAGR of 12 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Insoluble Dietary Fibers Market Size 2024 |

USD 1.35 Billion |

| Insoluble Dietary Fibers Market, CAGR |

12 % |

| Insoluble Dietary Fibers Market Size 2032 |

USD 3.3 Billion |

Growth is driven by multiple factors, including a rising focus on preventive healthcare and higher consumption of fiber-rich diets. Food manufacturers are integrating insoluble fibers such as cellulose, hemicellulose, lignin, and chitin into bakery, cereals, and snacks to enhance nutritional value. Growing cases of lifestyle-related disorders like obesity, diabetes, and cardiovascular disease further encourage consumers to adopt fiber-enriched foods. The clean-label movement and plant-based product demand also push innovation in fiber formulations.

Regionally, North America leads the market with strong adoption of functional food products and well-established health-conscious consumer bases. Europe follows, supported by stringent regulatory frameworks promoting dietary health. The Asia-Pacific region is the fastest-growing, driven by rising disposable incomes, expanding urban populations, and increasing penetration of fortified food products in China, India, and Southeast Asia. This regional growth outlook highlights broad opportunities for manufacturers to diversify product portfolios and strengthen global market presence.

Market Insights:

- The insoluble dietary fibers market was valued at USD 1.35 billion in 2024 and is projected to reach USD 3.3 billion by 2032 at a CAGR of 12%.

- Growth is fueled by rising focus on preventive healthcare, digestive wellness, and fiber-rich diets across demographics.

- Food manufacturers integrate cellulose, hemicellulose, lignin, and chitin into bakery, cereals, and snacks to boost nutrition.

- Increasing cases of obesity, diabetes, and cardiovascular diseases drive demand for fiber-enriched and functional food products.

- The clean-label and plant-based movement supports innovation with natural, minimally processed fiber formulations.

- North America held 38% share in 2024, Europe followed with 30%, while Asia Pacific reached 22% with the fastest growth outlook.

- Challenges include high production costs, complex processing requirements, and limited consumer awareness in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus on Digestive Health and Preventive Nutrition:

The insoluble dietary fibers market benefits from growing awareness of digestive wellness and preventive nutrition. Consumers link fiber intake to reduced risks of constipation, obesity, and chronic diseases. This shift encourages higher adoption of fiber-enriched food and beverages. It also drives manufacturers to position products as functional and health-supporting.

- For instance, Kellogg’s All-Bran Original cereal, a high-fiber product, contains 11g of fiber per 40g serving in some markets like the UK, and 12g of fiber per 2/3-cup serving in the US. The product is marketed to support digestive health, as its wheat bran fiber contributes to intestinal transit.

Expansion of Functional Food and Beverage Applications:

Food and beverage manufacturers integrate insoluble fibers into bakery, snacks, cereals, and fortified drinks. The market gains traction as brands highlight added fiber content for daily nutrition. It creates opportunities to innovate with cellulose, lignin, and hemicellulose in mainstream products. The insoluble dietary fibers market strengthens as functional offerings align with consumer health goals.

- For instance, Cargill has developed soluble fiber ingredients launched in major bakery and snack applications, demonstrating successful commercialization in products enabling at least a 30% reduction in sugar content while achieving fiber enrichment

Rising Prevalence of Lifestyle-Related Disorders:

The increasing rates of obesity, diabetes, and cardiovascular conditions drive demand for fiber-based solutions. Insoluble fibers aid in satiety, weight management, and blood sugar control, making them vital in balanced diets. Healthcare professionals promote fiber as part of preventive care strategies. It positions insoluble fibers as essential ingredients in nutritional products.

Growth of Plant-Based and Clean-Label Movements:

The shift toward plant-based foods and clean-label products reinforces fiber adoption. Consumers value natural, sustainable, and minimally processed ingredients in their diets. Insoluble fibers derived from whole grains, fruits, and vegetables meet these expectations. The insoluble dietary fibers market leverages this trend to expand product portfolios and reach health-conscious buyers.

Market Trends:

Growing Integration of Fibers into Everyday Food and Beverage Products:

The insoluble dietary fibers market is witnessing strong integration into bakery, cereals, snacks, and ready-to-eat meals. Food companies highlight fiber-enriched claims to attract health-conscious consumers seeking functional benefits. It supports better digestive health, weight management, and balanced nutrition, creating consistent demand across demographics. Global brands introduce reformulated products with added cellulose and hemicellulose to expand their functional food lines. The trend aligns with consumer interest in affordable health solutions within daily diets. It also strengthens partnerships between ingredient suppliers and food manufacturers to develop innovative fiber-based applications.

- For instance, General Mills’ Fiber One Original Bran cereal delivers 17 g of insoluble fiber (primarily cellulose) per 40 g serving, representing 65% of the daily value for fiber without added sugar.

Increasing Demand for Plant-Based, Clean-Label, and Sustainable Ingredients:

Clean-label demand shapes the direction of the insoluble dietary fibers market, with emphasis on transparency and natural sources. Manufacturers focus on fibers from fruits, vegetables, and whole grains to align with plant-based trends. It meets consumer expectations for minimal processing and environmentally friendly production practices. Sustainability becomes a major differentiator, encouraging investment in eco-efficient fiber extraction methods. Market participants promote fibers not only for health but also for environmental responsibility. The rise of plant-forward lifestyles, combined with growing trust in natural labels, drives continuous innovation in this space.

- For instance, CEAMSA’s CEAMFIBRE is upcycled from citrus peel and is certified gluten-free and vegan-friendly, supplying functional dietary fiber for processed snacks and sauces, with applications demonstrating texture improvements in over 120 commercial products.

Market Challenges Analysis:

High Production Costs and Complex Processing Requirements:

The insoluble dietary fibers market faces challenges related to cost-intensive production and complex processing. Extracting fibers from natural sources requires advanced technologies and strict quality standards, raising operational expenses. It limits affordability for smaller manufacturers and restricts widespread application in price-sensitive regions. Maintaining consistency in fiber quality further adds to the burden for producers. These factors make large-scale commercialization difficult and reduce competitiveness for new entrants. High costs also discourage innovation in product diversification.

Limited Consumer Awareness and Taste Acceptance Issues:

Consumer awareness of insoluble fibers remains uneven across emerging economies, creating adoption barriers. Many consumers prioritize taste and texture, where fiber-enriched foods often face resistance. The insoluble dietary fibers market struggles when products alter sensory appeal or lack clear health communication. It becomes necessary for brands to invest heavily in consumer education and targeted marketing. Limited knowledge about long-term benefits hinders stronger demand growth. Overcoming perception and acceptance issues is essential for achieving sustained market expansion.

Market Opportunities:

Expansion into Functional Foods, Nutraceuticals, and Dietary Supplements:

The insoluble dietary fibers market presents strong opportunities in functional foods, nutraceuticals, and dietary supplements. Rising demand for preventive healthcare supports wider use of fiber-enriched formulations across product categories. It creates scope for introducing new fiber-based ingredients in sports nutrition, fortified snacks, and meal replacements. Nutraceutical companies can leverage insoluble fibers to improve digestive health and support weight management. Growing interest in natural and plant-based diets further expands the appeal of fiber-rich offerings. These opportunities encourage collaboration between ingredient suppliers and health-focused food manufacturers.

Rising Potential in Emerging Economies and Personalized Nutrition:

Emerging economies provide untapped potential for the insoluble dietary fibers market due to rapid urbanization and changing lifestyles. Increasing disposable incomes and higher awareness of balanced nutrition create strong growth opportunities. It allows global players to expand through localized products and affordable solutions. Advances in personalized nutrition open new avenues, where fiber-based products align with individual dietary needs. Digital health platforms and customized diet plans can integrate insoluble fibers to improve adherence. This trend accelerates global market expansion and supports long-term growth prospects.

Market Segmentation Analysis:

By Raw Material:

The insoluble dietary fibers market is segmented by raw material into cereals and grains, legumes, fruits, and vegetables. Cereals and grains dominate due to their high cellulose and hemicellulose content, making them a preferred source for fiber enrichment. Fruits and vegetables also contribute strongly, driven by clean-label demand and consumer interest in natural ingredients. Legumes provide sustainable options with growing acceptance in plant-based diets.

- For instance, Archer Daniels Midland’s concentrated wheat bran fraction contains 44.6 g of insoluble fiber per 100 g, derived from the aleurone layer, making it a leading ingredient for high-fiber formulations.

By Type:

By type, the market includes cellulose, hemicellulose, lignin, chitin, chitosan, and resistant starch. Cellulose leads the segment owing to its widespread use in food formulations and functional benefits for digestive health. Hemicellulose and lignin gain traction with applications in bakery and fortified snacks. Resistant starch shows strong growth potential in weight management and satiety-focused products. It reflects the shift toward multifunctional fibers with targeted health benefits.

- For instance, JRS Pharma’s Vivapur® 102 microcrystalline cellulose has an average particle size of 130 µm, enabling consistent tablet compression and uniform flow in dry food premixes.

By Application:

By application, the market spans food and beverages, pharmaceuticals, and animal feed. Food and beverages hold the largest share, supported by strong demand for fortified bakery, cereals, and dairy alternatives. Pharmaceuticals use insoluble fibers in digestive health products and dietary supplements. Animal feed applications expand with rising interest in improving livestock nutrition. It creates a balanced contribution across industries while food and beverages remain the core driver.

Segmentations:

By Raw Material:

- Cereals & Grains

- Legumes

- Fruits

- Vegetables

By Type:

- Cellulose

- Hemicellulose

- Lignin

- Chitin

- Chitosan

- Resistant Starch

By Application:

- Food & Beverages

- Pharmaceuticals

- Animal Feed

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America held 38% share of the insoluble dietary fibers market in 2024, leading globally. The region benefits from high consumer awareness of digestive health and preventive nutrition. It is supported by strong demand for functional foods and dietary supplements. Established players leverage advanced processing technologies to deliver consistent product quality. The United States drives growth with its robust food and beverage sector. Canada and Mexico contribute through expanding demand for fortified bakery and cereal products. Growing investments in research enhance innovation and market penetration.

Europe:

Europe accounted for 30% share of the insoluble dietary fibers market in 2024, maintaining its position as the second-largest region. Strict EU food regulations promote the use of fibers in daily diets. It supports innovation in bakery, dairy alternatives, and plant-based products. Germany, France, and the United Kingdom lead adoption with rising consumer demand for clean-label solutions. Strong partnerships between food producers and ingredient suppliers reinforce growth. Investment in sustainable sourcing aligns with regional environmental policies. Widespread availability across retail and online channels further supports regional expansion.

Asia Pacific:

Asia Pacific represented 22% share of the insoluble dietary fibers market in 2024, with the highest growth outlook. Rising disposable incomes and urbanization drive consumer preference for fortified and functional foods. It benefits from a younger population adopting healthier diets and rising awareness of fiber benefits. China, India, and Japan dominate demand through strong food processing industries. Regional players expand product lines to meet plant-based and clean-label expectations. Government initiatives promoting health and nutrition education support long-term consumption. The region’s expanding middle-class population ensures sustained opportunities for manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BENEO

- Lonza

- Archer Daniels Midland Company (ADM)

- DuPont de Nemours, Inc.

- Batory Foods

- Roquette Freres

- Ingredion Incorporated

- PURIS

- Emsland Group

- Tate & Lyle

- Cargill, Incorporated

- The Green Labs LLC

- Kerry Inc.

- Nexira

Competitive Analysis:

The insoluble dietary fibers market is highly competitive with global and regional players driving innovation and expansion. Leading companies include BENEO, Lonza, Archer Daniels Midland Company (ADM), DuPont de Nemours, Inc., Batory Foods, and Roquette Freres. These companies focus on expanding product portfolios, strengthening supply chains, and advancing fiber extraction technologies. It benefits from their strategic investments in research to deliver sustainable and high-quality fiber ingredients. Partnerships with food and beverage manufacturers support new product launches and market penetration. Strong emphasis on plant-based and clean-label solutions allows these players to align with evolving consumer preferences. Competitive intensity remains high, pushing companies to differentiate through innovation, sustainability, and customer-centric approaches.

Recent Developments:

- In July 2025, BENEO, California Natural Color, and GELITA launched a new performance drink concept aimed at supporting endurance and body composition, showcased at IFT First 2025.

- In July 2025, Lonza continued the integration of its Vacaville acquisition and initiated plans for its CHI business carve-out, further expanding its contract manufacturing operations.

- In May 2025, Archer Daniels Midland Company partnered with Air Protein to develop and launch products using novel landless proteins, including building a commercial-scale facility.

Report Coverage:

The research report offers an in-depth analysis based on Raw Material, Type, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The insoluble dietary fibers market will expand with rising demand for functional and fortified foods.

- Food manufacturers will invest in product reformulation to enhance nutritional value with fiber enrichment.

- Plant-based and clean-label product trends will continue to shape innovation and ingredient sourcing.

- Growing consumer awareness of digestive health will strengthen adoption across snacks, bakery, and beverages.

- Advances in fiber extraction technologies will improve efficiency, sustainability, and cost-effectiveness for producers.

- Nutraceutical and supplement industries will integrate insoluble fibers into new formulations for preventive healthcare.

- Emerging economies will present strong growth opportunities supported by rising disposable incomes and urbanization.

- Personalized nutrition and digital health platforms will increase targeted use of insoluble fibers in diets.

- Sustainability and eco-friendly practices will remain critical in promoting long-term competitiveness for manufacturers.

- Strategic collaborations between ingredient suppliers and food brands will drive product diversification and market expansion.