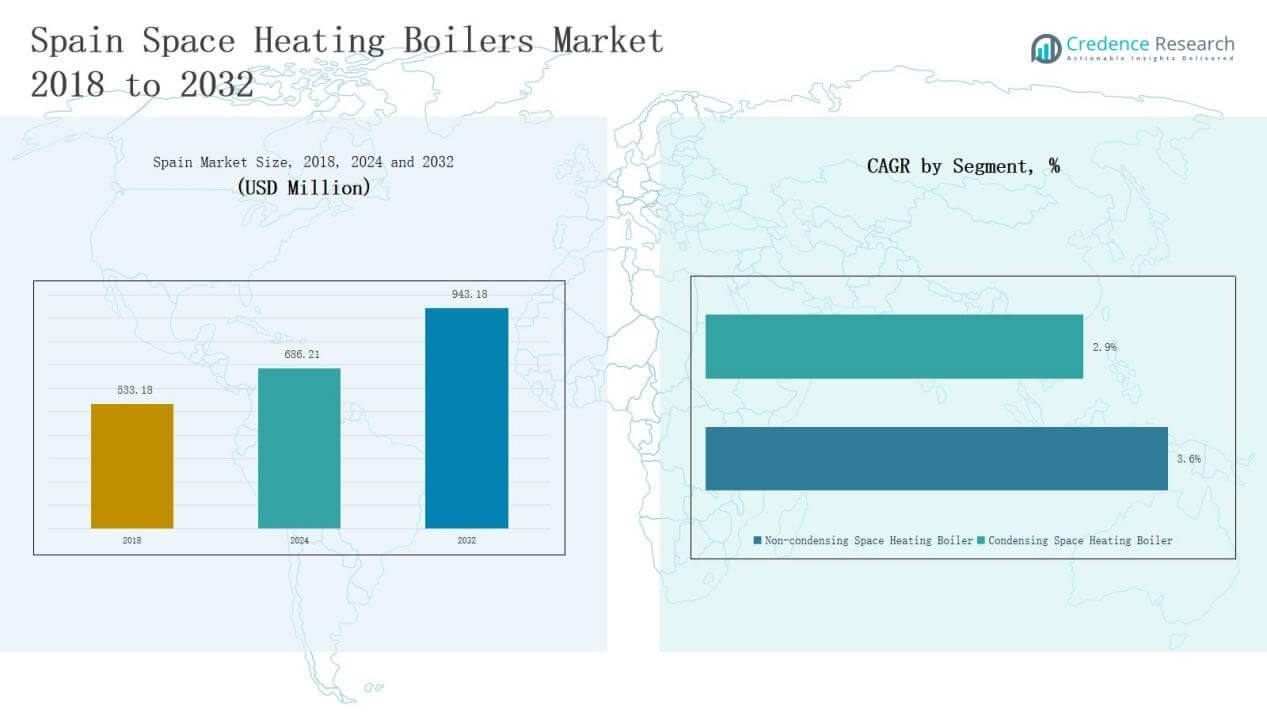

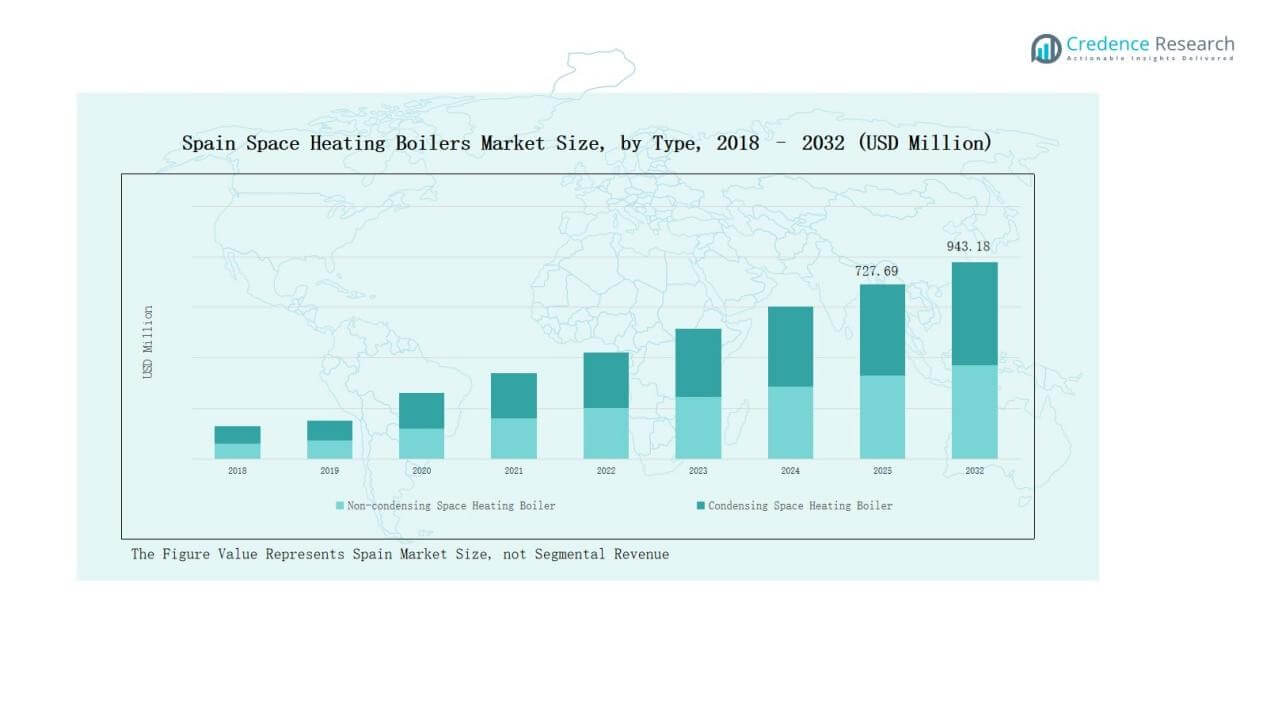

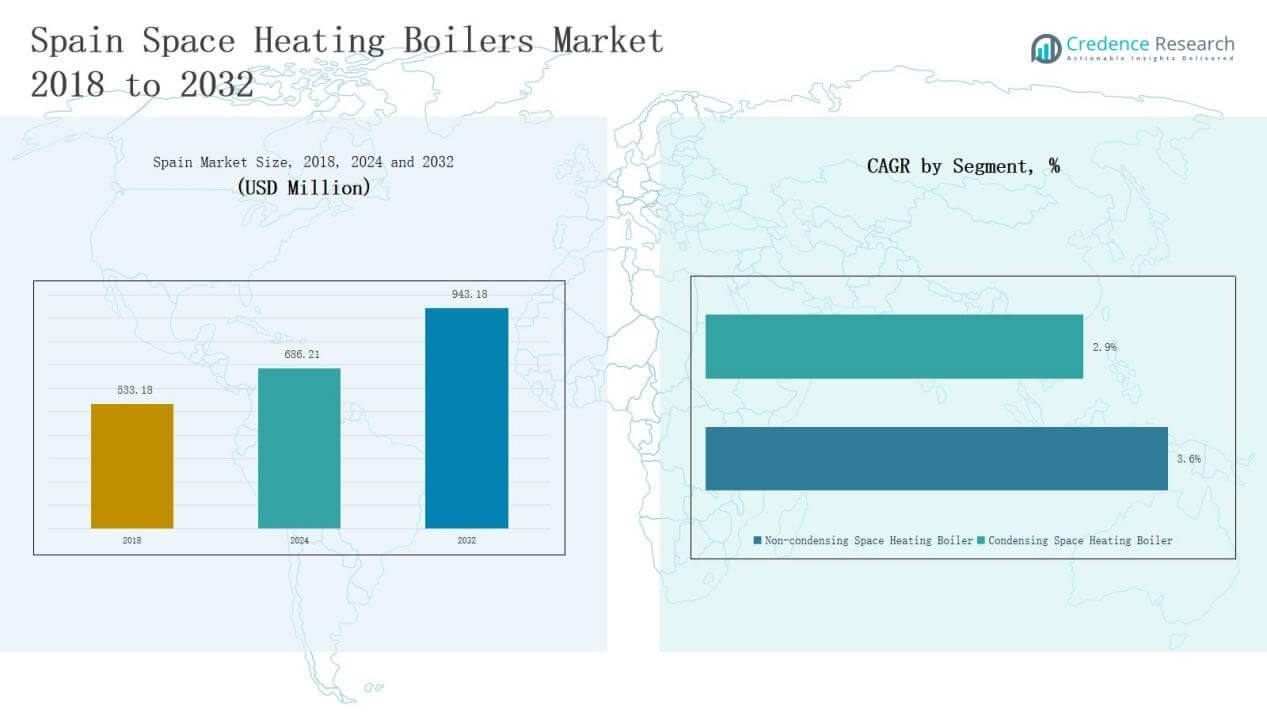

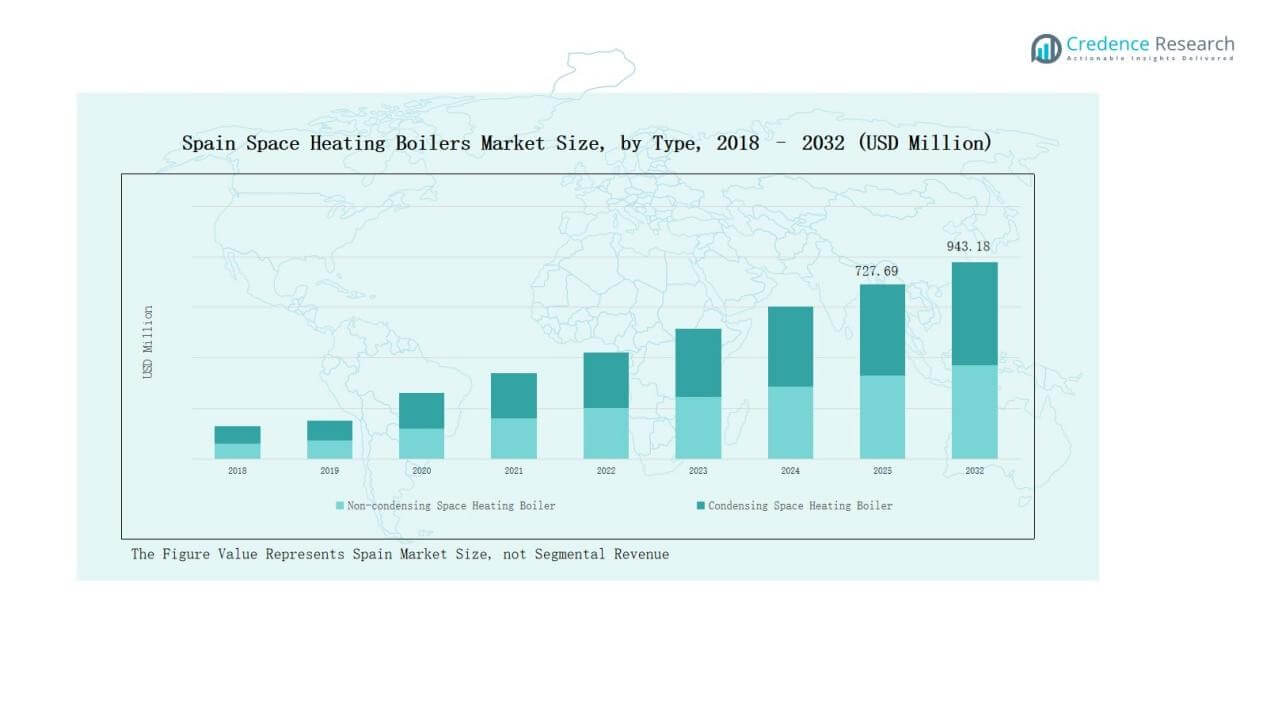

Spain Space Heating Boilers Market size was valued at USD 533.18 million in 2018 to USD 686.21 million in 2024 and is anticipated to reach USD 943.18 million by 2032, at a CAGR of 3.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Space Heating Boilers Market Size 2024 |

USD 686.21 Million |

| Spain Space Heating Boilers Market, CAGR |

3.77% |

| Spain Space Heating Boilers Market Size 2032 |

USD 943.18 Million |

The Spain Space Heating Boilers Market is characterized by strong competition between domestic and international manufacturers. Key players include ATTSU Térmica, Cointra, Hermann Saunier Duval, Saunier Duval Spain, Baxi Spain, Chaffoteaux, Fagor Ederlan, Calefacciones Beretta, Roca, and Elbi Calefacción, alongside global brands such as Bosch Thermotechnology, Viessmann Group, Vaillant Group, Ariston Thermo Group, Ferroli S.p.A., De Dietrich Thermique, Wolf GmbH, Ideal Boilers, Atlantic Group, and Buderus. These companies strengthen their positions through advanced condensing technologies, hybrid solutions, and localized service networks. Among regions, Northern Spain leads the market with 39% share in 2024, driven by colder winters, dense urban housing, and established natural gas infrastructure that supports higher adoption of energy-efficient boilers. This leadership consolidates Northern Spain as the primary hub for innovation and replacement demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Spain Space Heating Boilers Market grew from USD 533.18 million in 2018 to USD 686.21 million in 2024 and will reach USD 943.18 million by 2032.

- Condensing boilers dominate with 68% share in 2024, supported by EU energy efficiency directives, rebate schemes, and consumer demand for cost-effective heating solutions.

- Residential applications hold 61% share in 2024, driven by replacement demand, dense housing, and incentives, while commercial and industrial sectors account for 26% and 13% respectively.

- Gas-fired boilers lead operations with 64% share, followed by electric at 18%, oil-fired at 10%, coal-based at 5%, and hybrid or others at 3%.

- Northern Spain leads regionally with 39% share in 2024, followed by Central at 28%, Southern at 21%, and Eastern at 12%, reflecting climatic and infrastructure differences.

Market Segment Insights

By Type

Condensing space heating boilers dominate the Spain market with nearly 68% share in 2024. Their growth is driven by strict EU energy efficiency directives, rebate schemes, and consumer preference for lower operational costs. Non-condensing models maintain a smaller 32% share, primarily in older housing stock and cost-sensitive segments, though their adoption continues to decline due to regulatory pressures.

- For instance, BDR Thermea Group, a major European heating player with operations in Spain, has intensified focus on hydrogen-ready condensing boilers, aligning with Spain’s longer-term energy transition goals.

By Application

The residential segment holds the largest share at 61% in 2024, supported by strong replacement demand, urban housing density, and government incentives for energy-efficient home heating. The commercial sector captures around 26% share, benefiting from installations in offices, schools, and hospitality. Industrial applications contribute 13% share, largely from small and medium enterprises requiring localized heating solutions.

By Operation

Gas-fired boilers lead the market with 64% share in 2024, supported by Spain’s established gas infrastructure and consumer familiarity with gas-based heating. Electric boilers account for 18% share, gaining traction in urban apartments and eco-conscious households. Oil-fired boilers hold 10% share, mostly in rural regions with limited gas access. Coal-based units are now marginal with 5% share, reflecting declining demand due to emission concerns. Other alternatives, including hybrid solutions, comprise the remaining 3% share, driven by gradual adoption of renewable-compatible systems.

- For instance, Baxi’s hybrid heating systems that combine heat pumps with condensing boilers are seeing interest among households aiming to reduce reliance on fossil fuels.

Market Overview

Key Growth Drivers

Rising Adoption of Condensing Technology

The Spain Space Heating Boilers Market benefits from the rising shift toward condensing boilers, which deliver higher efficiency and lower emissions. These units account for the majority of installations due to compliance with EU directives promoting energy-efficient appliances. Consumers prefer them for reduced fuel costs and eligibility for rebates. This trend is reinforced by strong urban demand, where households and commercial buildings increasingly replace outdated systems with condensing models to meet both performance and regulatory requirements.

- For instance, Baxi, a leading boiler manufacturer in Spain, promotes condensing units like its Platinum+ line, which achieves up to 94% seasonal efficiency while complying with EU ErP (Energy-related Products) legislation.

Government Incentives and Energy Policies

Government support plays a major role in driving market growth. Spain enforces strict building efficiency codes and offers subsidies for energy-efficient heating systems, making condensing boilers more attractive to both households and businesses. These initiatives align with broader EU climate goals and accelerate the replacement of older, inefficient units. Local municipalities also promote incentive programs to encourage adoption, thereby sustaining steady market demand across residential, commercial, and industrial segments in Spain.

- For instance, the European Union’s Recovery and Resilience Facility (RRF) allocates funds to Spain’s housing renovation programs, including subsidies that mandate the replacement of inefficient heating units with low-emission technologies, accelerating adoption at scale.

Replacement Demand in Residential Sector

A large proportion of Spain’s residential boiler installations stem from replacement cycles rather than new builds. The housing stock includes many older systems that are inefficient and costly to maintain, creating consistent demand for advanced condensing and gas-fired solutions. Strong replacement demand ensures recurring sales for manufacturers and distributors. Additionally, urban centers with dense populations continue to drive installations, supported by ongoing modernization of heating infrastructure and consumer awareness regarding long-term energy savings.

Key Trends & Opportunities

Growth of Electrification and Hybrid Systems

Electrification of heating is gaining momentum in Spain, particularly in urban apartments and eco-conscious households. Electric boilers are increasingly chosen where gas access is limited or emission reduction targets are prioritized. Manufacturers also introduce hybrid models that combine renewable sources such as solar thermal with gas or electric boilers, offering flexible and efficient solutions. This trend represents a strong opportunity for innovation and product differentiation in the evolving heating market.

- For instance, Baxi introduced its Platinum iPlus range in 2022, enabling hybrid configurations that pair condensing boilers with renewable energy inputs, optimized via smart thermostats for efficiency.

Digital Integration and Smart Controls

Smart technologies present growing opportunities in Spain’s heating market. Manufacturers are embedding connectivity features, enabling remote monitoring, predictive maintenance, and integration with home automation platforms. These systems appeal to consumers seeking convenience, energy optimization, and lower utility bills. As Spain’s younger demographic becomes more accustomed to digital solutions, adoption of smart boilers and connected devices is expected to rise, creating additional revenue streams for leading players and reinforcing market competitiveness.

- For instance, Bosch Thermotechnology introduced its EasyControl system in Spain, allowing users to regulate heating through a smartphone app with geofencing features that help reduce energy use.

Key Challenges

High Upfront Costs for Advanced Boilers

Although condensing boilers dominate the Spanish market, their higher initial investment compared to traditional systems poses a challenge. Many cost-sensitive households, particularly in rural areas, delay replacements or choose cheaper alternatives despite long-term savings. This cost barrier slows down faster adoption and creates resistance among segments that lack access to financing schemes or government incentives, limiting overall growth potential in certain regions.

Dependence on Natural Gas Infrastructure

The Spanish heating market’s reliance on natural gas infrastructure makes it vulnerable to fuel price volatility and supply constraints. Gas-fired boilers remain dominant, but rising energy prices or geopolitical risks could negatively impact consumer adoption. Areas with underdeveloped gas networks also face barriers in installing modern boilers. This dependence creates structural challenges for the industry and underscores the need for diversification into electric and renewable-compatible solutions.

Regulatory Pressure and Sustainability Targets

Stricter EU and national emission reduction targets pose a challenge for manufacturers and users of non-condensing and fossil fuel–based boilers. Coal and oil-fired units face steep decline, while producers must invest in R&D to align with environmental standards. Compliance increases operational costs, especially for smaller domestic players. At the same time, consumers may struggle with the rapid transition away from older systems, creating market friction despite the long-term push for sustainability.

Regional Analysis

Northern Spain

Northern Spain leads the Spain Space Heating Boilers Market with 39% share in 2024. The colder climate in this region supports higher demand for residential and commercial boilers. Urban density and well-developed natural gas infrastructure further drive adoption. Replacement demand in older housing stock strengthens market activity, while condensing boilers dominate due to stricter efficiency norms. Industrial clusters in cities such as Bilbao and Santander also contribute to sales. It remains the central hub for innovation and product integration, sustaining steady growth in the forecast period.

Central Spain

Central Spain holds 28% share in 2024, supported by expanding urbanization and steady replacement demand in Madrid and surrounding areas. The region’s commercial sector plays a significant role, with offices, hospitals, and hospitality facilities requiring efficient heating systems. Gas-fired boilers are the most popular choice, benefiting from access to natural gas networks. Growth in hybrid and smart-enabled systems is emerging, reflecting shifting consumer preferences. Residential demand remains consistent, driven by modernization of older homes. It represents a balanced market, combining traditional reliance on gas with gradual adoption of electrification.

Southern Spain

Southern Spain accounts for 21% share in 2024, where milder winters limit heating intensity but steady demand exists in urban centers such as Seville and Málaga. The residential segment dominates installations, particularly in apartments and villas. Rising adoption of electric boilers reflects growing interest in eco-friendly solutions in areas less reliant on gas networks. Seasonal tourism also supports commercial demand, with hotels and resorts upgrading systems to meet efficiency standards. Rural communities continue to use oil-fired units, though their share is declining. It shows gradual but stable growth led by consumer awareness and energy policies.

Eastern Spain

Eastern Spain captures 12% share in 2024, supported by urban and industrial activity in regions such as Valencia and Catalonia. Demand is strongest in residential and small commercial applications, where modern condensing systems are increasingly preferred. Infrastructure development and new housing projects contribute to higher adoption rates. Gas-fired systems dominate, but electric alternatives gain traction among sustainability-focused consumers. Industrial usage remains modest but steady, driven by localized heating requirements. It reflects a smaller but steadily expanding market, with opportunities linked to modernization and renewable integration.

Market Segmentations:

By Type

- Condensing Space Heating Boilers

- Non-Condensing Space Heating Boilers

By Application

- Residential

- Commercial

- Industrial

By Operation

- Gas-fired Boilers

- Electric Boilers

- Oil-fired Boilers

- Coal-based Boilers

- Others

By Region

- Northern Spain

- Central Spain

- Southern Spain

- Eastern Spain

Competitive Landscape

The Spain Space Heating Boilers Market is highly competitive, shaped by a mix of domestic and international manufacturers. Leading players such as ATTSU Térmica, Cointra, Hermann Saunier Duval, Baxi Spain, and Roca dominate with strong local presence, established service networks, and tailored product offerings. Global brands including Bosch Thermotechnology, Viessmann Group, Vaillant Group, and Ariston Thermo Group strengthen competition through advanced condensing technologies, digital integration, and hybrid solutions. Market leadership is supported by a clear shift toward energy-efficient systems, where condensing boilers hold the largest share. Companies focus on replacement demand in residential housing while also targeting commercial and industrial segments with scalable solutions. Strategic moves such as product innovation, regional expansions, and partnerships with distributors enhance competitiveness. Smaller domestic players compete through cost advantages and localized support, but they face pressure from EU energy regulations and the technological edge of global manufacturers, shaping a consolidated yet dynamic market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In June 2024, Viessmann (part of Viessmann Group) launched the Vitocal 250-A Pro, a large air-water heat pump for residential and commercial buildings with heating output up to 39.5 kW and cooling output of 21.7 kW. This highly efficient and quiet heat pump supports versatile heating and cooling needs.

- In July 2025, Valmet secured an order from Saica Group in Spain to supply a biomass Bubbling Fluidised Bed (BFB) boiler with flue gas cleaning technology for the El Burgo de Ebro site, with delivery scheduled by the end of 2026.

- In April 2025, Iberdrola España launched ATuAire, a new business line focused on aerothermal heat-pump systems, offering turnkey services, financing, and subsidy management.

- In February 2024, Carrier unveiled the AquaSnap 61AQ, a high-temperature air-source heat pump system that uses the environmentally friendly refrigerant R-290, designed for commercial applications in Spain and across Europe.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Operation and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for condensing boilers will continue to rise driven by EU efficiency regulations.

- Residential replacement cycles will remain the primary source of steady market growth.

- Gas-fired systems will dominate, but electric and hybrid boilers will gain stronger traction.

- Urban regions will see faster adoption due to dense housing and established infrastructure.

- Commercial demand will expand with modernization in offices, hospitals, and hospitality.

- Oil and coal-based boilers will steadily decline under sustainability and emission policies.

- Digital integration and smart controls will become a standard feature across new systems.

- Local players will focus on affordability and service support to compete with global brands.

- Government incentives and rebate programs will drive faster consumer adoption of efficient models.

- Rising awareness of carbon reduction will open opportunities for renewable-compatible boiler solutions.