Market Overview

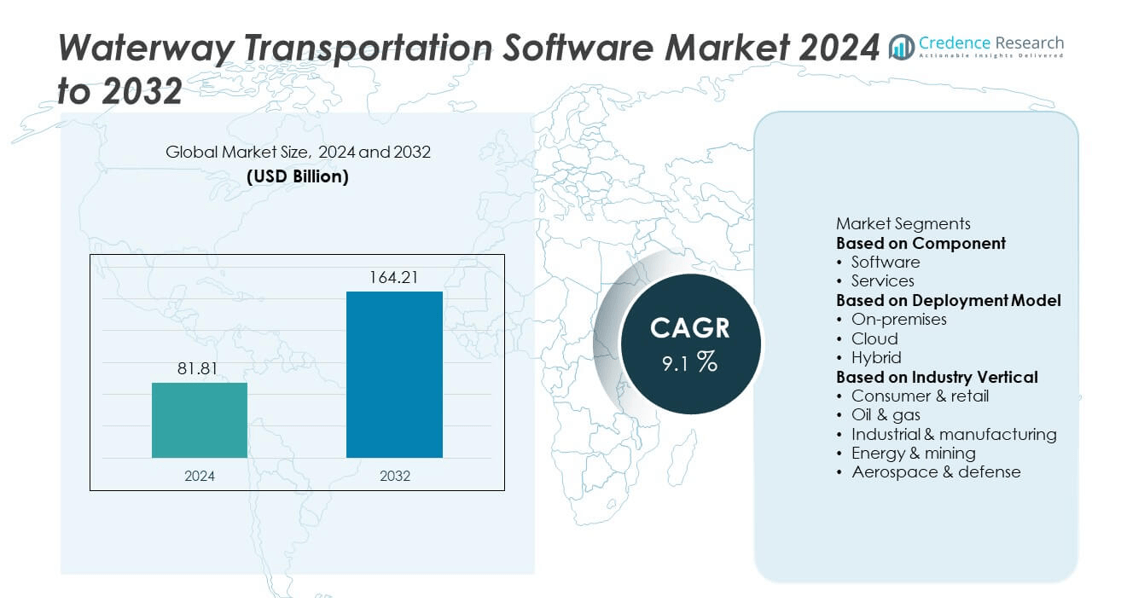

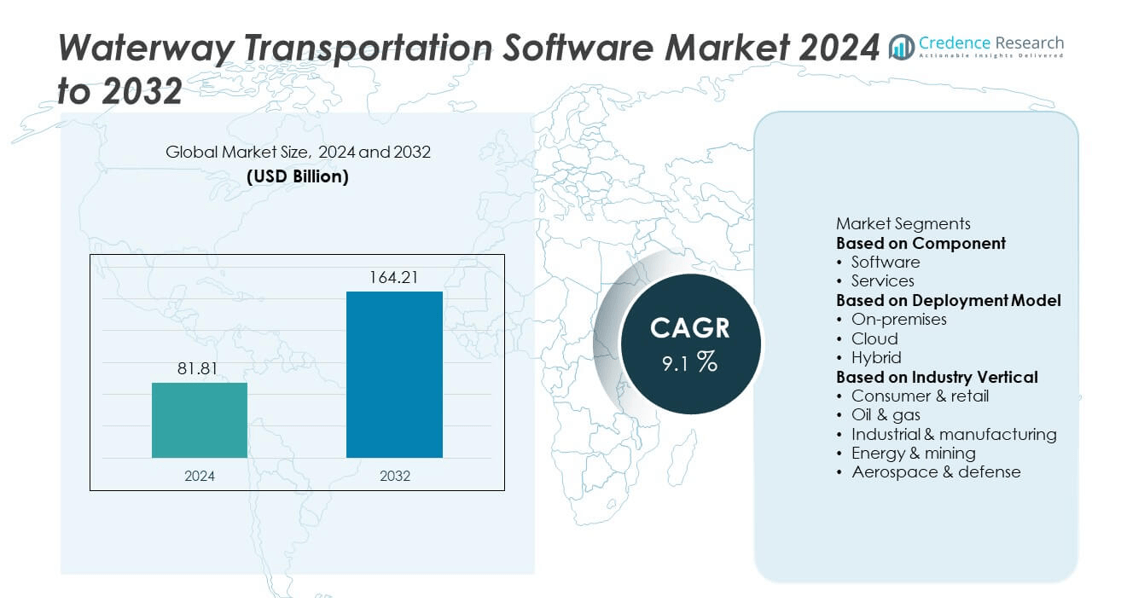

The Waterway Transportation Software Market was valued at USD 81.81 billion in 2024 and is projected to reach USD 164.21 billion by 2032, expanding at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waterway Transportation Software Market Size 2024 |

USD 81.81 billion |

| Waterway Transportation Software Market, CAGR |

9.1% |

| Waterway Transportation Software Market Size 2032 |

USD 164.21 billion |

The Waterway Transportation Software Market grows with rising global trade, stricter compliance needs, and demand for efficient logistics. Companies adopt advanced platforms to optimize fleet management, cargo scheduling, and route planning, reducing costs and delays.

The Waterway Transportation Software Market demonstrates strong adoption across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each region influenced by unique drivers. North America leads with early adoption of digital logistics platforms, driven by large-scale maritime trade and investments in smart ports. Europe emphasizes sustainability and compliance, with software adoption supporting emission reduction and efficiency across busy shipping routes. Asia Pacific records the fastest growth due to high shipping volumes, expanding port infrastructure, and strong government initiatives in China, India, and Southeast Asia. Latin America and the Middle East & Africa gradually expand adoption through infrastructure modernization and cross-border trade growth. Key players such as SAP SE, Oracle Corporation, Accenture Plc, and DNV GL strengthen the market with global platforms, advanced analytics, and integrated solutions that enhance fleet performance, compliance management, and supply chain transparency, ensuring reliable software support for global maritime operations.

Market Insights

- The Waterway Transportation Software Market was valued at USD 81.81 billion in 2024 and is projected to reach USD 164.21 billion by 2032, growing at a CAGR of 9.1%.

- Rising global trade and maritime activities drive adoption of waterway transportation software, as it improves route planning, cargo tracking, and fleet management.

- The Waterway Transportation Software Market reflects strong trends in digitalization, with advanced analytics, IoT integration, and AI-based tools enhancing visibility, safety, and real-time decision-making.

- Competitive activity remains high, with leading players such as SAP SE, Oracle Corporation, ABS Wavesight, and Accenture Plc focusing on software upgrades, partnerships, and global expansion to strengthen service offerings.

- High costs of implementation, complex integration with legacy systems, and cybersecurity concerns restrain wider adoption, particularly for small and mid-sized shipping operators.

- North America leads with early adoption and advanced port infrastructure, while Europe focuses on compliance and sustainable shipping. Asia Pacific records the fastest growth due to expanding trade corridors, industrial exports, and government-backed port modernization.

- Latin America and the Middle East & Africa show gradual adoption supported by cross-border trade expansion, port digitalization projects, and increasing reliance on maritime routes for energy and commodities transport.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Efficient Maritime Logistics Solutions

The Waterway Transportation Software Market grows with increasing demand for efficient maritime logistics management. Shipping companies rely on software platforms to optimize cargo handling, reduce turnaround times, and improve route planning. It helps operators manage complex schedules and minimize operational disruptions. Integration of real-time tracking enhances visibility across supply chains, ensuring timely deliveries. The push for operational efficiency strengthens software adoption among ports and carriers. This demand highlights the role of technology in reshaping maritime logistics.

- For instance, Maersk’s TradeLens platform, developed with IBM, processed millions of container events and documents during its operation. However, the reported 40% reduction in port stay time was based on a specific 2018 pilot test.

Growing Global Trade and Containerized Shipping Activities

The Waterway Transportation Software Market benefits from expanding international trade volumes and rising container traffic. Software solutions support large-scale cargo movement across ports and help streamline customs clearance. It ensures compliance with trade regulations while maintaining faster throughput. Increasing reliance on digital systems reduces manual errors in documentation and billing. Global shipping operators adopt software to handle rising transaction volumes with accuracy. Strong trade flows continue to fuel growth in maritime technology adoption.

- For instance, CMA CGM, a leading global shipping and logistics company, operates in 160 countries, and handles millions of TEUs annually. The company invests significantly in artificial intelligence, digital transformation, and logistics technology to optimize its operations.

Increasing Focus on Safety, Security, and Compliance

The Waterway Transportation Software Market expands through the growing need for safety and regulatory compliance. Software platforms assist operators in meeting international maritime regulations, including emissions standards and security protocols. It improves monitoring of vessel performance, crew management, and environmental impact. Features such as risk assessment tools reduce accidents and operational delays. Companies invest in compliance-focused software to avoid penalties and safeguard reputations. This focus on safety enhances trust among stakeholders in the maritime ecosystem.

Rising Adoption of Digitalization and Smart Port Initiatives

The Waterway Transportation Software Market benefits from digital transformation across global ports and shipping lines. Governments and port authorities promote smart port initiatives powered by software and IoT solutions. It enables automated scheduling, predictive maintenance, and advanced data analytics. Cloud-based platforms allow seamless collaboration between shipping companies, freight forwarders, and port operators. Rising investments in digital infrastructure strengthen the demand for integrated maritime software solutions. This digital shift drives modernization and positions software as a core enabler of competitive advantage.

Market Trends

Integration of Artificial Intelligence and Predictive Analytics

The Waterway Transportation Software Market reflects strong adoption of artificial intelligence and predictive analytics. Operators use AI-driven tools to forecast demand, optimize routes, and anticipate maintenance needs. It reduces downtime and improves asset utilization across fleets. Predictive analytics helps ports and carriers manage congestion more effectively. Companies also leverage machine learning models to detect risks in cargo and vessel operations. This trend highlights the value of data-driven decision-making in maritime logistics.

- For instance, DNV’s maritime software and data analytics platforms analyze fleet data to optimize vessel performance and maintenance. By leveraging these tools, clients can achieve significant fuel savings and emission reductions, with potential savings ranging up to 16% through various energy efficiency measures.

Expansion of Cloud-Based and SaaS Deployment Models

The Waterway Transportation Software Market benefits from rising demand for cloud-based platforms and SaaS models. These solutions allow seamless access to real-time data across ports and vessels. It enhances scalability while lowering upfront infrastructure costs for operators. Cloud integration supports collaboration among shippers, freight forwarders, and port authorities. SaaS-based tools provide regular updates, improving security and performance. This trend reinforces the shift toward flexible and cost-efficient deployment models.

- For instance, SAP’s Transportation Management (TM) is a leading software solution used by a wide range of logistics customers to manage and optimize complex freight operations. It provides end-to-end visibility across all modes of transportation, from planning and execution to freight settlement.

Adoption of IoT and Real-Time Tracking Solutions

The Waterway Transportation Software Market grows with increasing use of IoT devices and real-time monitoring. Connected sensors track vessel location, cargo condition, and fuel consumption. It improves operational transparency and supports compliance with international standards. Real-time tracking also strengthens supply chain visibility, enhancing customer confidence. IoT-based solutions reduce risks linked to cargo damage and delivery delays. This trend accelerates the integration of smart technologies into global maritime systems.

Emphasis on Green Shipping and Sustainability Goals

The Waterway Transportation Software Market expands with rising focus on green shipping initiatives. Software platforms now include modules for emissions tracking and fuel optimization. It helps companies comply with stricter environmental regulations while lowering carbon footprints. Ports adopt eco-efficient systems to manage vessel arrivals and reduce idle times. Shipping operators integrate sustainability metrics into performance dashboards. This trend underscores the industry’s alignment with global sustainability commitments.

Market Challenges Analysis

High Implementation Costs and Integration Complexities

The Waterway Transportation Software Market faces significant challenges from high implementation costs and integration hurdles. Many shipping companies and port operators struggle with the financial burden of upgrading legacy systems. It requires investments in hardware, training, and cybersecurity measures that smaller operators often cannot afford. Integration with existing enterprise resource planning systems and port management tools adds further complexity. Companies also face difficulties in aligning new solutions with regional regulations and compliance frameworks. These challenges slow adoption in cost-sensitive and developing regions.

Cybersecurity Risks and Limited Skilled Workforce

The Waterway Transportation Software Market also encounters risks linked to cybersecurity and a shortage of skilled professionals. Rising digitization increases exposure to cyberattacks targeting vessel management systems, cargo data, and financial transactions. It creates vulnerabilities that threaten both operational continuity and customer trust. Maritime companies often lack adequate IT expertise to manage advanced platforms effectively. Shortages of trained professionals hinder proper use of predictive analytics, IoT, and AI-driven tools. Limited workforce readiness restricts the full potential of advanced waterway software adoption. These issues highlight the pressing need for investment in digital security and workforce training.

Market Opportunities

Rising Demand for Real-Time Visibility and Predictive Analytics

The Waterway Transportation Software Market presents strong opportunities through increasing demand for real-time tracking and predictive insights. Shipping companies prioritize visibility to optimize routes, monitor cargo conditions, and improve safety. It enables operators to respond quickly to disruptions such as weather events or port congestion. Predictive analytics also supports fuel optimization and vessel maintenance, reducing costs for operators. The growing adoption of IoT devices and connected sensors strengthens the value of such platforms. Vendors offering integrated visibility and forecasting tools can capture long-term growth opportunities.

Expansion of Global Trade and Smart Port Development

The Waterway Transportation Software Market gains opportunities from expanding global trade and investment in smart port infrastructure. Governments and private operators continue to modernize ports with automation, digital twin technologies, and cloud-based solutions. It creates demand for software platforms that integrate cargo handling, customs clearance, and scheduling functions. Expanding international trade corridors, such as Asia-Europe and trans-Pacific routes, further drive adoption. Maritime operators benefit from systems that improve efficiency and compliance with international standards. These developments create favorable conditions for providers to expand their reach in both developed and emerging regions.

Market Segmentation Analysis:

By Component

The Waterway Transportation Software Market divides into solutions and services. Solutions dominate due to strong demand for route optimization, freight management, and real-time vessel tracking systems. It enables companies to enhance operational efficiency while ensuring compliance with international trade regulations. Services, including consulting, integration, and maintenance, also hold importance as businesses require continuous support to manage complex software platforms. Vendors focus on providing end-to-end offerings that integrate cargo visibility, predictive analytics, and performance monitoring. This balance between software innovation and service delivery highlights how both segments support growth across the maritime sector.

- For instance, Descartes Systems Group processes over 9 billion messages annually through its Global Logistics Network, enabling real-time cargo tracking for more than 200,000 connected parties worldwide.

By Deployment Model

The Waterway Transportation Software Market includes on-premise and cloud-based models. On-premise platforms remain relevant for large shipping companies and port operators that demand full control over sensitive operational data. It ensures security and compliance in regions with strict regulatory requirements. Cloud-based models record rapid adoption, driven by flexibility, lower upfront costs, and easy scalability. Small and medium-sized enterprises favor cloud deployment for its real-time access and reduced IT burden. Hybrid models are also gaining momentum, blending control with agility. This variety of deployment options allows companies to align software use with operational priorities and budget needs.

- For instance, Oracle and SAP are leaders in the transportation management and logistics software market, with products that help large global enterprises optimize and manage complex supply chains. Both platforms provide advanced capabilities like artificial intelligence (AI) for planning and automation, extensive integration, and real-time analytics to manage a wide range of logistics tasks.

By Industry Vertical

The Waterway Transportation Software Market caters to shipping, oil and gas, manufacturing, defense, and others. Shipping companies remain the largest adopters due to the need for efficient vessel scheduling, fuel optimization, and cargo management. It helps operators handle rising global trade volumes while reducing risks linked to delays. Oil and gas companies rely on maritime logistics software for transporting bulk energy resources with high safety and compliance requirements. Manufacturing sectors integrate these platforms to streamline import-export processes and track raw material shipments. Defense applications emphasize security, fleet monitoring, and strategic readiness. The wide application base demonstrates how the market supports both commercial and government maritime operations.

Segments:

Based on Component

Based on Deployment Model

Based on Industry Vertical

- Consumer & retail

- Oil & gas

- Industrial & manufacturing

- Energy & mining

- Aerospace & defense

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds around 31% share of the Waterway Transportation Software Market, supported by advanced maritime infrastructure and strong adoption of digital platforms. The United States leads demand with major ports such as Los Angeles, New York, and Houston deploying advanced vessel tracking, scheduling, and cargo optimization tools. It benefits from strict regulatory standards that encourage digitization and compliance-driven operations across the maritime industry. Canada also contributes, focusing on real-time monitoring and cold-chain shipping solutions for cross-border trade. Mexico expands adoption through logistics upgrades at Gulf and Pacific ports to strengthen trade efficiency. Continuous investment in automation and data-driven platforms reinforces the region’s leadership in maritime software adoption.

Europe

Europe accounts for nearly 27% share of the Waterway Transportation Software Market, reflecting its strong maritime heritage and advanced digitalization efforts. Countries such as Germany, the Netherlands, and the UK lead adoption due to their role as major shipping and logistics hubs. It benefits from European Union programs that prioritize smart port development, digital supply chains, and sustainable logistics. France and Italy expand adoption across container and energy trade, supported by advanced freight visibility platforms. Scandinavia further strengthens the market with a focus on eco-friendly shipping and integration of IoT-based fleet management solutions. Europe’s regulatory alignment and sustainability goals drive steady demand for advanced software platforms across the region.

Asia Pacific

Asia Pacific dominates with about 33% share of the Waterway Transportation Software Market, making it the largest regional segment. China leads with significant investments in port automation, handling more than 280 million TEUs annually across major hubs such as Shanghai and Ningbo. It benefits from smart software solutions that optimize scheduling and container tracking for massive shipping volumes. India shows rapid adoption, supported by government-led port modernization and trade digitalization initiatives. Japan and South Korea integrate AI-based navigation and fleet management solutions to reduce operational risks and improve safety. Southeast Asian nations, including Singapore, play a key role, with Singapore emerging as a global leader in digital bunkering and maritime trade platforms. This strong demand base cements Asia Pacific as the central hub for waterway software adoption.

Latin America

Latin America represents nearly 6% share of the Waterway Transportation Software Market, driven by expanding port modernization projects in Brazil, Mexico, and Panama. Brazil dominates with heavy investment in container and energy exports, using digital platforms to track shipments and streamline operations. Panama plays a strategic role, where the Panama Canal creates steady demand for vessel scheduling and cargo optimization tools. Mexico supports regional growth through digital integration at ports along the Gulf of Mexico and Pacific trade routes. Other nations such as Chile, Argentina, and Colombia gradually expand adoption, focusing on transparency and efficiency in cross-border shipping. Latin America’s growth depends on modernization and international partnerships with global software providers.

Middle East & Africa

The Middle East and Africa together account for about 3% share of the Waterway Transportation Software Market. The United Arab Emirates leads with its role as a logistics hub, where Dubai’s Jebel Ali Port integrates AI-driven cargo and scheduling platforms. Saudi Arabia also invests in smart maritime technologies to support Vision 2030 and diversify its logistics capabilities. In Africa, South Africa remains the largest contributor, with Durban and Cape Town ports adopting digital platforms for better efficiency. Nigeria and Egypt also record progress, focusing on transparency and fleet management for oil and bulk trade. While challenges in infrastructure persist, growing trade corridors and government-backed modernization projects create opportunities for digital maritime solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SAP SE

- Flexport Inc.

- Cognizant Technology Solutions Corp.

- ABS Wavesight

- Bass Software Ltd.

- IBS Software

- Oracle Corporation

- Accenture Plc

- DNV GL

- Descartes Systems Group

Competitive Analysis

The competitive landscape of the Waterway Transportation Software Market features major players such as ABS Wavesight, Accenture Plc, Bass Software Ltd., Cognizant Technology Solutions Corp., Descartes Systems Group, DNV GL, Flexport Inc., IBS Software, Oracle Corporation, and SAP SE. These companies compete by offering advanced digital platforms that enhance cargo visibility, optimize fleet operations, and improve compliance with international maritime regulations. Their focus remains on integrating technologies such as artificial intelligence, IoT, and cloud-based systems to deliver real-time insights and predictive analytics for shipping companies and port authorities. Large players invest in scalable solutions designed for global shipping operators, while niche firms emphasize specialized modules tailored for smaller fleets or regional logistics providers. Strategic collaborations with port authorities, logistics companies, and ship operators allow these firms to expand market presence and build long-term client relationships. Emphasis on sustainability, data security, and automation further defines the competitive edge, ensuring solutions align with evolving demands for efficiency, cost reduction, and regulatory compliance across global waterways.

Recent Developments

- In June 2025, Flexport Inc. also rolled out the Flexport Tariff Simulator, enabling shipment cost and tariff forecasts based on live data and evolving regulations—enhancing clarity and decision-making in logistics pricing.

- In May 2025, IBS Software joined forces with Air France‑KLM by deploying its iFlight platform across more than 500 aircraft to reduce inefficiencies and delays via a unified operations control system.

- In April 2025, SAP SE earned recognition as a Leader in the 2025 Gartner Magic Quadrant for Transportation Management Systems for the 11th consecutive year, underscoring its strength in delivering supply chain resilience and logistics management solutions.

- In February 2025, Flexport Inc. launched Flexport Control Tower, a next-gen platform providing end-to-end visibility across global logistics networks. Early users reduced freight costs by 10%, while real‑time pricing capabilities replaced quote timelines of hours with results in seconds.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for unified platforms that merge fleet management, cargo tracking, and compliance will grow steadily.

- Adoption of AI-driven predictive models will strengthen route planning, maintenance scheduling, and risk mitigation.

- Cloud-based and hybrid deployments will expand, giving maritime operators more flexibility and scalability.

- Real-time IoT integration will enhance visibility into vessel locations, cargo conditions, and environmental metrics.

- Digital twin and simulation technologies will advance autonomous vessel operations and smart port logistics.

- Cybersecurity will become a critical requirement, pushing for risk monitoring and intrusion-prevention solutions.

- Regulatory focus on sustainability will increase demand for fuel optimization and emissions-tracking software.

- Standardized data exchange and interoperability across systems will expand under international maritime protocols.

- Emerging markets in Asia Pacific, Latin America, and Africa will drive faster adoption of digital maritime solutions.

- Collaborations between technology firms and shipping operators will create integrated packages of software, hardware, and services.