Market Overview

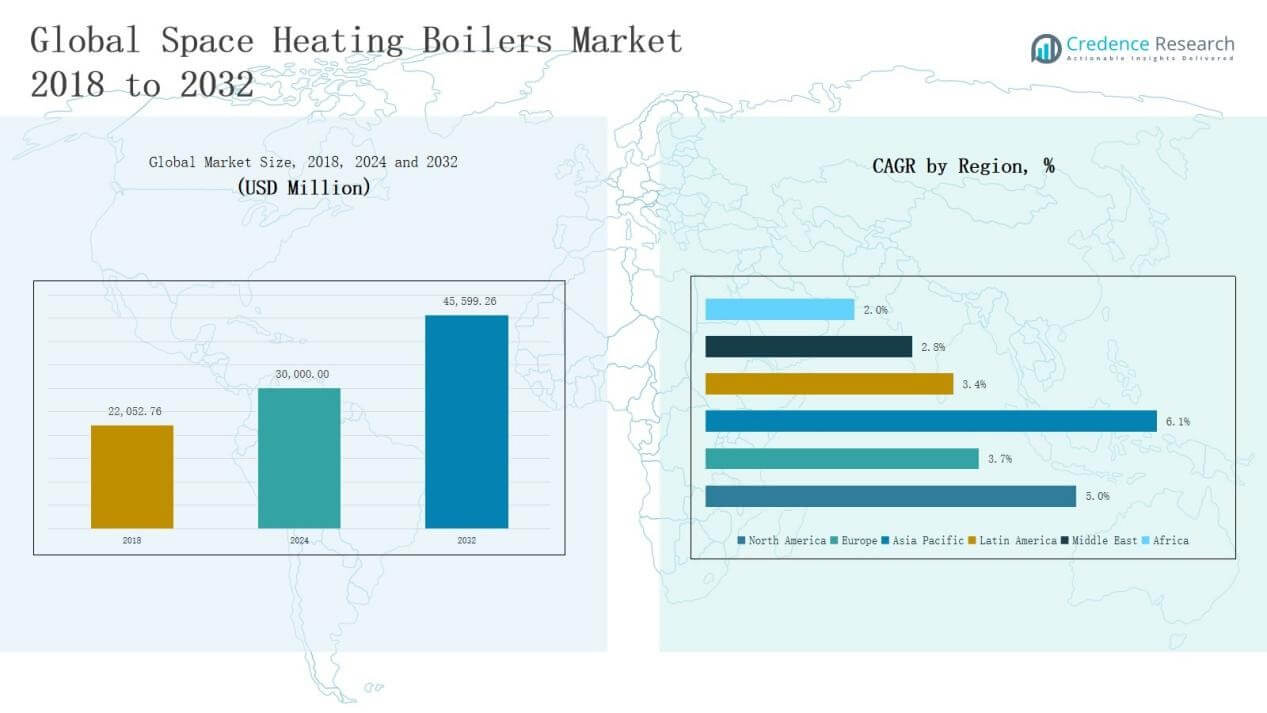

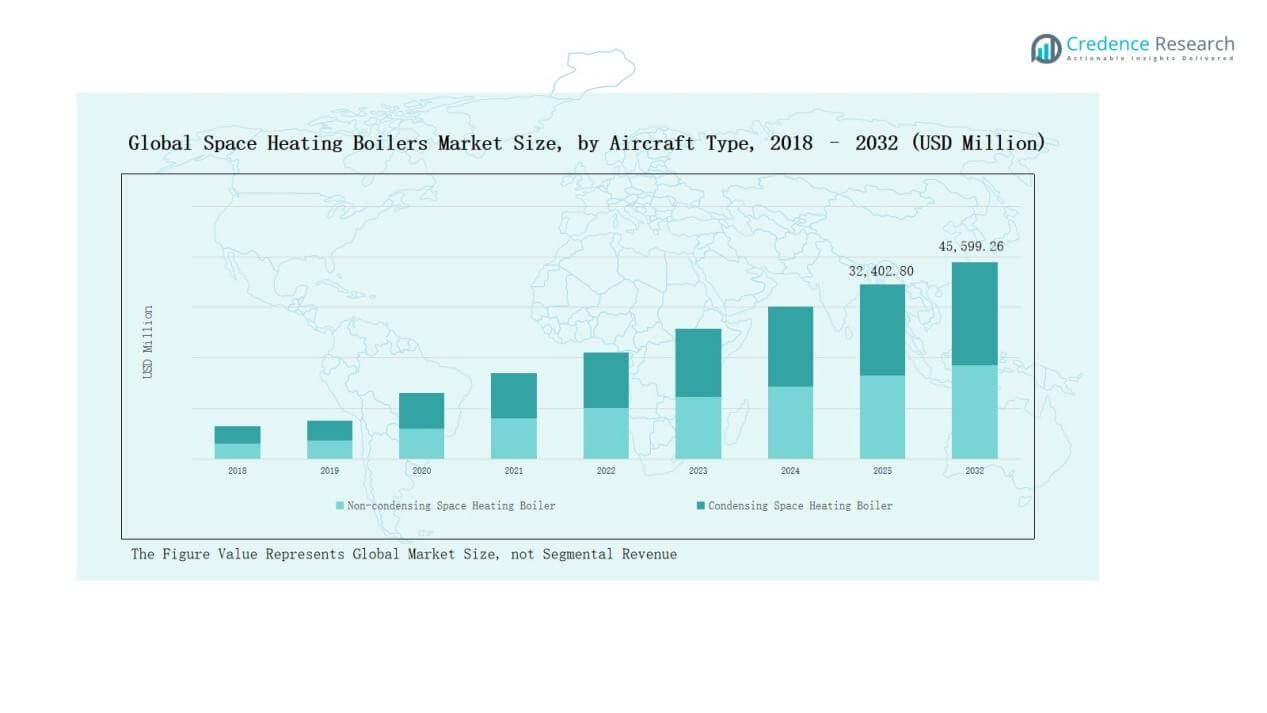

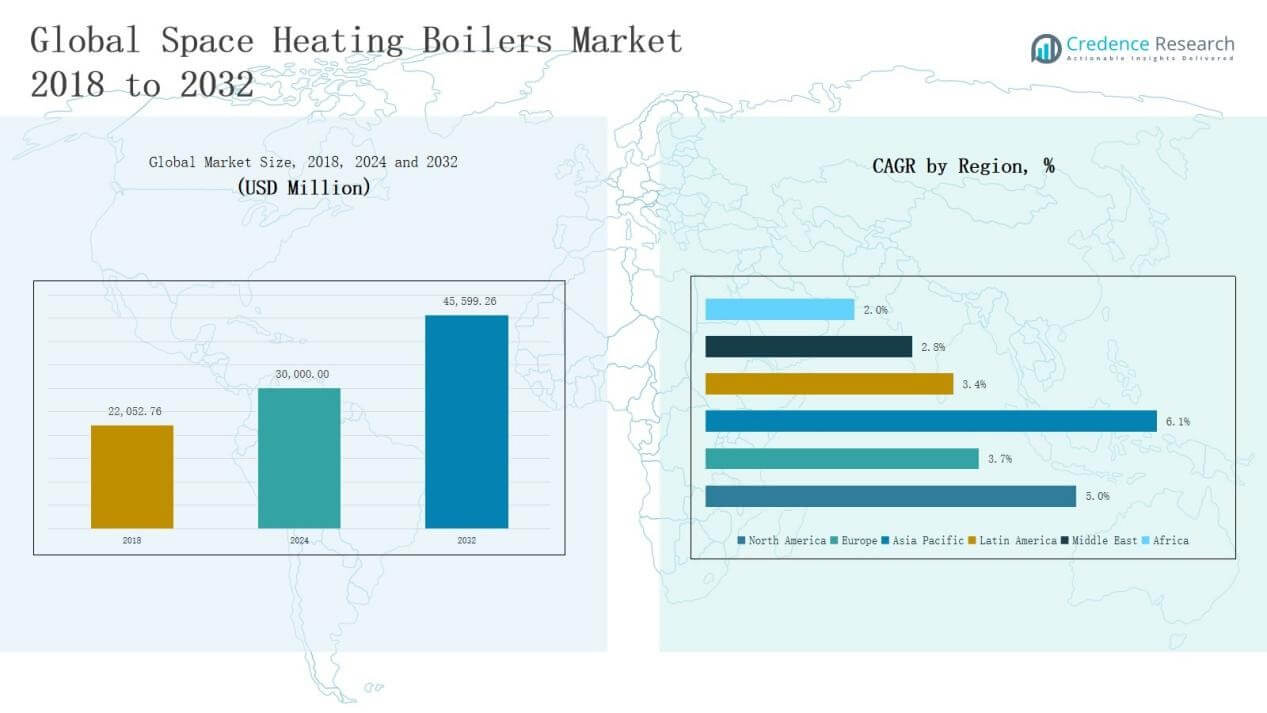

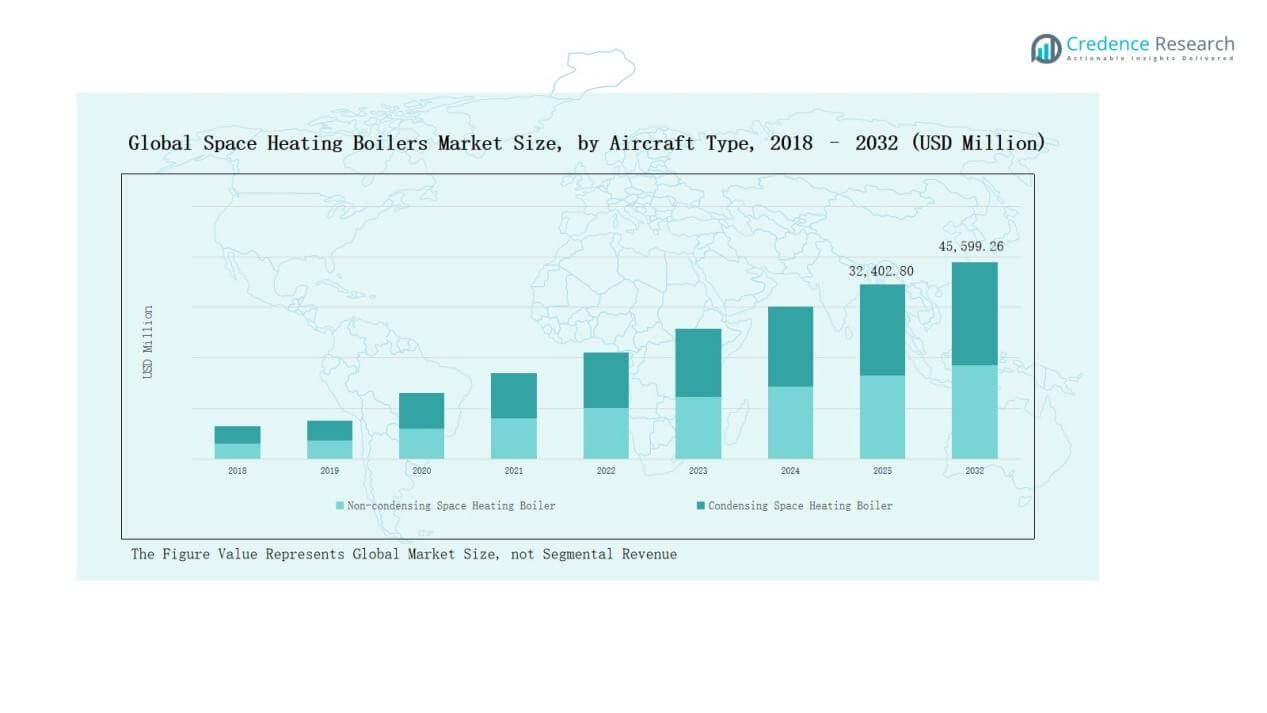

Space Heating Boilers Market size was valued at USD 22,052.76 million in 2018 to USD 30,000.00 million in 2024 and is anticipated to reach USD 45,599.26 million by 2032, at a CAGR of 5.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Space Heating Boilers Market Size 2024 |

USD 30,000.00 Million |

| Space Heating Boilers Market, CAGR |

5.00% |

| Space Heating Boilers Market Size 2032 |

USD 45,599.26 Million |

The Space Heating Boilers Market is shaped by strong competition among global leaders such as Rheem Manufacturing, Viessmann Group, Vaillant Group, Lennox International, Daikin Industries, Mitsubishi Electric, Ariston Group, Lochinvar, Baxi, Navien, and Ideal Heating. These companies focus on energy-efficient technologies, digital integration, and strategic partnerships to strengthen their positions across residential, commercial, and industrial segments. Product innovation in condensing and smart boilers remains central to their growth strategies, aligning with global decarbonization goals. Regionally, North America leads the market with a 5.0% share in 2024, supported by advanced gas infrastructure, strong replacement demand, and government-backed energy efficiency initiatives, making it the dominant hub for adoption.

Market Insights

- The Space Heating Boilers Market grew from USD 22,052.76 million in 2018 to USD 30,000.00 million in 2024, and will reach USD 45,599.26 million by 2032.

- Condensing boilers dominated with over 65% share in 2024, supported by energy efficiency, emission reduction, and regulatory compliance across developed markets.

- The residential segment led with 55% share in 2024, driven by replacement demand, housing growth, and energy-saving programs, followed by commercial and industrial applications.

- Gas-fired boilers held over 50% share in 2024, while electric systems gained momentum with 20% share, reflecting the global shift toward electrification.

- North America remained the leading region with a 0% share in 2024, followed by Asia Pacific at 6.1%, and Europe at 3.7%, highlighting mature and emerging market dynamics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Condensing space heating boilers dominate the market with over 65% share in 2024, driven by higher energy efficiency, reduced carbon emissions, and compliance with tightening environmental regulations. Their ability to recover latent heat and lower fuel consumption makes them the preferred choice across developed regions. Non-condensing boilers, holding around 35% share, continue to serve in older buildings where retrofitting constraints limit upgrades, but their demand is steadily declining as governments incentivize efficiency standards.

- For instance, Bosch’s Greenstar condensing boilers reduce CO2 emissions by around 30% compared to older, non-condensing systems

By Application

The residential segment leads with nearly 55% share in 2024, supported by strong replacement demand, rising housing construction, and energy-saving initiatives for households. Commercial applications account for about 30% share, benefiting from heating needs in offices, educational institutes, and healthcare facilities. Industrial applications capture close to 15% share, with steady use in facilities requiring space heating for worker comfort and light process needs, although growth is relatively slower compared to other segments.

- For instance, The University of Rochester worked with Carrier and EOS Climate to destroy ozone-depleting refrigerant and modernize two aging chillers at its Central Utilities Plant.

By Operation

Gas-fired space heating boilers hold the dominant position with over 50% share in 2024, attributed to their cost-effectiveness, reliability, and wide availability of natural gas networks. Electric boilers capture around 20% share, expanding with the shift toward electrification and renewable energy integration, particularly in Europe. Oil-fired boilers account for close to 15% share, mainly in regions lacking gas infrastructure, while coal-based systems hold less than 8% share due to stricter emission controls. The remaining 7% share belongs to other technologies, including hybrid and biomass-based boilers, which are gaining niche adoption in sustainable heating projects.

Market Overview

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Solutions

The push toward sustainability has significantly boosted the adoption of energy-efficient space heating boilers. Governments worldwide enforce strict efficiency standards and carbon reduction goals, creating strong incentives for consumers and businesses to choose condensing boilers. These systems lower fuel consumption by up to 30% compared to traditional units, making them cost-effective over the long term. Growing awareness of climate change and supportive rebate programs further strengthen demand, positioning high-efficiency boilers as the market’s preferred choice.

- For instance, Worcester Bosch’s Greenstar 4000 combi boiler achieves an energy efficiency rating of up to 94%, offering flexible installation and low emissions for larger homes.

Urbanization and Residential Construction Growth

Rapid urbanization and new housing developments drive demand for reliable heating systems across cold regions. Residential construction growth, particularly in Europe, North America, and parts of Asia Pacific, creates a steady replacement and installation cycle for boilers. Homeowners seek compact, efficient, and low-emission solutions to meet stricter building codes. The growing trend of smart homes also complements advanced boiler adoption, as integration with digital thermostats and remote monitoring enhances both convenience and energy savings for households.

- For instance, the integration of smart thermostats such as Nest and Hive with boilers allows homeowners to control heating remotely via smartphone apps, optimizing energy use and reducing costs.

Fuel Availability and Gas Infrastructure Expansion

The expansion of natural gas distribution networks has fueled growth in gas-fired boilers, the leading operational segment. Gas availability ensures lower operating costs compared to oil or electricity, making it the preferred heating solution in many regions. Ongoing pipeline projects and investments in gas infrastructure across Asia and Europe strengthen accessibility. This expansion allows manufacturers to target untapped rural markets while aligning with government goals for cleaner heating alternatives, further driving adoption of gas-based space heating boilers.

Key Trends & Opportunities

Shift Toward Electrification and Renewable Integration

The transition to electrification offers a promising opportunity for the market, particularly in regions with ambitious net-zero targets. Electric boilers, supported by renewable electricity grids, provide carbon-free heating solutions. Countries such as Germany and the UK promote low-emission technologies through subsidies, encouraging adoption. This trend creates opportunities for manufacturers to innovate hybrid systems that integrate solar or heat pumps, enhancing efficiency while meeting future sustainability goals. Growing emphasis on green buildings further accelerates this electrification shift.

- For instance, Vaillant launched its aroTHERM plus heat pump system in the UK, designed to work with solar PV setups, significantly reducing household carbon emissions.

Digitalization and Smart Boiler Technologies

The rise of digital control systems and smart home integration is reshaping customer expectations. Smart boilers equipped with IoT-enabled sensors allow remote monitoring, predictive maintenance, and energy optimization, reducing downtime and operating costs. These features appeal to both residential and commercial users seeking convenience and reliability. Manufacturers investing in AI-driven diagnostics and connectivity solutions can capture new growth opportunities. This trend aligns with the broader smart home and smart building market, offering a competitive edge to early adopters.

- For instance, Miura’s IoT platform offers real-time boiler room alerts directly to technicians’ smartphones, allowing immediate reaction to issues at any hour, which enhances operational reliability.

Key Challenges

High Installation and Maintenance Costs

Despite long-term efficiency benefits, the high upfront cost of advanced boilers limits adoption, especially in price-sensitive markets. Installation requires skilled labor and often retrofitting in older buildings, further increasing expenses. Maintenance costs for condensing boilers, due to complex components, also pose barriers for consumers. This financial burden slows market penetration in emerging economies, where cheaper alternatives remain attractive despite their lower efficiency. Addressing cost challenges through subsidies and innovative financing models is critical for broader adoption.

Strict Regulatory Compliance and Certification

The market faces increasing compliance pressures from evolving environmental regulations and certification standards. Manufacturers must invest heavily in R&D and testing to meet efficiency and emission benchmarks, raising development costs. Delays in certification processes can slow product launches, especially across multiple regions with varied requirements. Non-compliance risks significant penalties and reputational damage, adding complexity for global players. Smaller companies struggle to keep pace, limiting their competitiveness in a market dominated by large multinational manufacturers.

Competition from Alternative Heating Technologies

The rise of alternative technologies such as heat pumps and district heating systems poses a significant challenge to traditional boilers. Heat pumps, in particular, gain traction in Europe due to subsidies and superior efficiency in mild climates. District heating networks, powered by renewable energy or waste heat, provide large-scale sustainable solutions that reduce reliance on individual boilers. As governments increasingly back alternatives for decarbonization, the space heating boilers market faces strong competition, pressuring growth in mature regions.

Regional Analysis

North America

North America holds a strong position in the space heating boilers market, valued at USD 12,984.30 million in 2024, and projected to reach USD 19,790.54 million by 2032. With a 5.0% market share, the region benefits from cold climate conditions, advanced gas infrastructure, and strong replacement demand for high-efficiency condensing boilers. Residential installations dominate, supported by rebates and energy-efficiency programs in the U.S. and Canada. Commercial adoption continues to rise as businesses modernize heating systems. The focus on decarbonization policies further strengthens opportunities, making North America one of the most mature markets.

Europe

Europe accounts for USD 5,133.38 million in 2024, expanding to USD 7,073.02 million by 2032, supported by high energy-efficiency standards and sustainability mandates. With a 3.7% market share, countries such as Germany, the UK, and France lead adoption due to strict regulations and incentives for condensing boiler installations. The region’s colder climate sustains consistent residential and commercial heating demand. Replacement cycles dominate market growth, while initiatives for reducing carbon footprints drive innovation in hybrid and electric boiler systems. Despite competition from heat pumps, Europe maintains steady demand for space heating boilers.

Asia Pacific

Asia Pacific leads as the fastest-growing region, reaching USD 9,221.07 million in 2024 and expected to hit USD 15,276.16 million by 2032. Holding a 6.1% market share, the region benefits from rising urbanization, industrial expansion, and infrastructure development in China, Japan, and India. Rapid economic growth, along with extreme seasonal temperature variations, further fuels adoption. Governments in Japan and South Korea encourage advanced technologies, while China’s large-scale urban housing projects strengthen the residential segment. Asia Pacific stands out as the key growth engine with both traditional and renewable-based heating solutions driving demand.

Latin America

Latin America generates USD 1,369.40 million in 2024, forecasted to grow to USD 1,837.05 million by 2032, reflecting stable but moderate demand. With a 3.4% market share, Brazil and Argentina dominate with urban development projects and increasing residential heating requirements in colder southern regions. Growth is supported by gradual improvements in building infrastructure and adoption of energy-efficient systems, though high upfront costs limit penetration in lower-income areas. Commercial and industrial sectors show rising adoption of boilers for space heating, making Latin America a developing market with potential for expansion.

Middle East

The Middle East market is valued at USD 778.16 million in 2024, with expectations to reach USD 1,000.38 million by 2032. Holding a 2.8% market share, demand is concentrated in Turkey and Israel, where seasonal winters drive adoption. Urban expansion and investments in modern residential complexes create opportunities for advanced heating solutions. Oil-fired and gas-fired boilers dominate due to abundant fuel supply. Growth remains steady, supported by government housing initiatives and gradual adoption of efficient systems in higher-income urban clusters.

Africa

Africa records USD 513.69 million in 2024, projected to increase to USD 622.11 million by 2032, reflecting gradual adoption. With a 2.0% market share, South Africa and Egypt lead demand, with installations in urban and commercial facilities. Limited infrastructure and high upfront costs constrain broader penetration, particularly in rural regions. However, government housing programs and infrastructure development offer growth opportunities. The residential sector is gradually expanding, with urbanization and rising middle-class incomes contributing to demand, though growth remains modest compared to other regions.

Market Segmentations:

By Type

- Non-condensing Space Heating Boiler

- Condensing Space Heating Boiler

By Application

- Residential

- Commercial

- Industrial

By Operation

- Gas-fired Space Heating Boilers

- Electric Space Heating Boilers

- Oil-fired Space Heating Boilers

- Coal

- Others

By Exchange Type

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Peer-to-Peer (P2P) Exchanges

- Hybrid Exchanges

By User Type

- Retail Investors

- Institutional Investors

- Traders

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The space heating boilers market is highly competitive, characterized by the presence of multinational corporations and regional manufacturers striving to expand market share through product innovation and strategic partnerships. Leading companies such as Rheem Manufacturing, Viessmann Group, Vaillant Group, Lennox International, and Daikin Industries focus on energy-efficient condensing boilers to align with global decarbonization goals. Many players are investing in smart boiler technologies, integrating IoT for remote monitoring and predictive maintenance to enhance customer value. Mergers, acquisitions, and collaborations remain common strategies, enabling firms to strengthen distribution networks and broaden product portfolios. European manufacturers dominate due to stringent regulatory standards, while North American and Asia Pacific players gain momentum through gas-fired and electric systems supported by infrastructure growth. Smaller regional players compete on price, often serving niche markets. Overall, the industry demonstrates moderate concentration, with innovation, compliance with energy policies, and after-sales service emerging as critical differentiators for sustaining long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Rheem Manufacturing

- Ingersoll-Rand PLC

- Daikin Industries Ltd.

- Lennox International

- Viessmann Group

- Vaillant Group

- ECR International Inc.

- AAON

- Mitsubishi Electric Corporation

- Ariston Group

- Superior Boiler

- HKS Lazar Sp. z o.o.

- Lochinvar

- Ideal Heating

- Baxi

- Navien

- Biasi UK Ltd

Recent Developments

- In June 2025, LG Electronics acquired OSO, a European provider of electric water heaters and boiler technologies, to strengthen its HVAC and thermal storage portfolio.

- In April 2025, Bradford White Corporation acquired Bock Water Heaters, expanding its range of high-efficiency commercial gas- and oil-fired heating systems.

- In May 2025, Ariston Group entered a joint venture with Lennox International to launch Lennox-branded residential water heaters, including space heating products, in North America by 2026.

- In July 2024, Bosch announced the acquisition of the global HVAC solutions business for residential and light commercial buildings from Johnson Controls, including full ownership of the Johnson Controls-Hitachi Air Conditioning joint venture.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Operation and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of condensing boilers will continue to rise due to efficiency advantages.

- Gas-fired boilers will remain the dominant choice where natural gas networks are expanding.

- Electric boilers will gain momentum as countries accelerate electrification of heating systems.

- Hybrid systems combining boilers with renewable energy will see increasing demand.

- Smart and connected boilers will become standard with IoT integration and predictive maintenance.

- Replacement demand in mature markets will sustain steady sales for advanced models.

- Emerging economies will create growth opportunities through urbanization and infrastructure development.

- Regulatory push for carbon reduction will drive innovation in low-emission boiler technologies.

- Competition from heat pumps and district heating will intensify, reshaping adoption patterns.

- Manufacturers will expand after-sales services and financing models to address cost barriers.