Market Overview

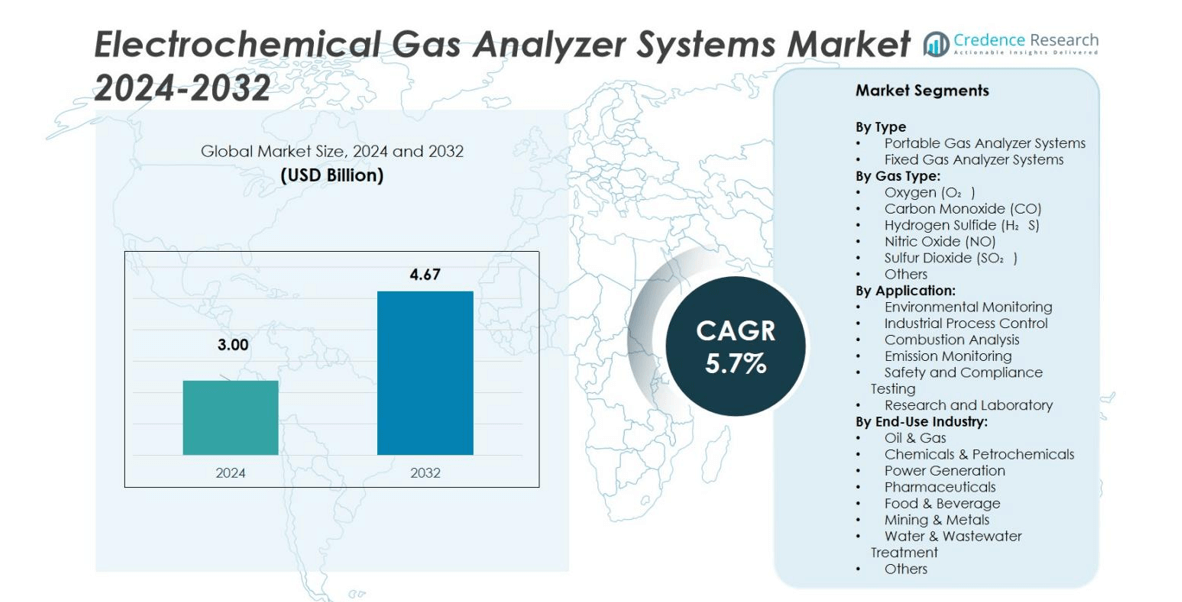

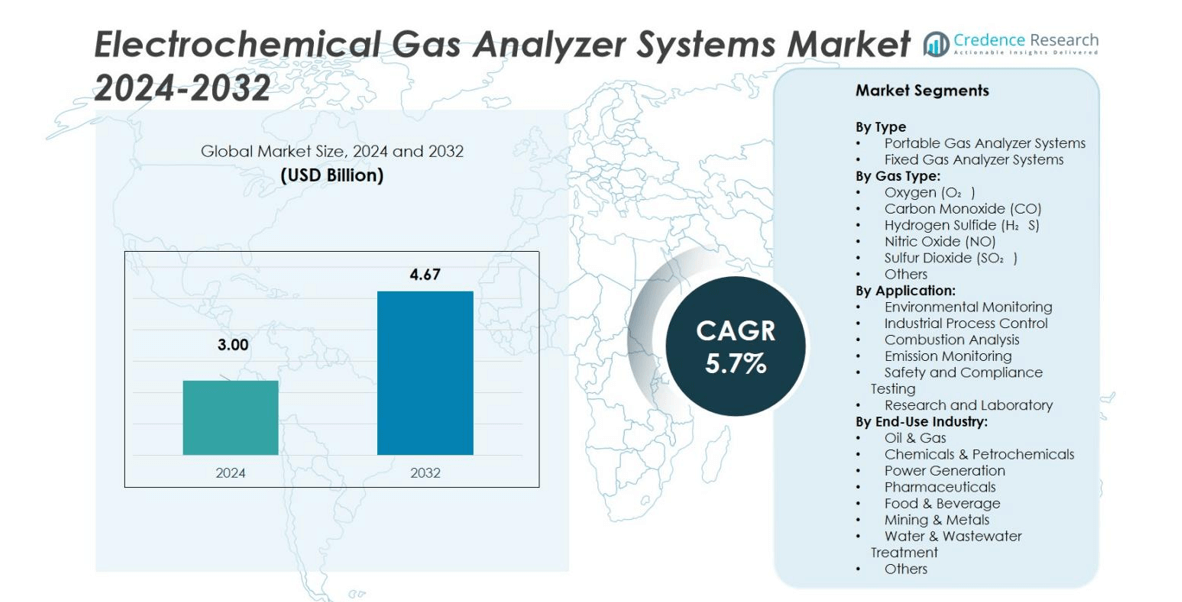

The Electrochemical Gas Analyzer Systems Market size was valued at USD 3.00 billion in 2024 and is anticipated to reach USD 4.67 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrochemical Gas Analyzer Systems Market Size 2024 |

USD 3.00 billion |

| Electrochemical Gas Analyzer Systems Market, CAGR |

5.7% |

| Electrochemical Gas Analyzer Systems Market Size 2032 |

USD 4.67 billion |

The Electrochemical Gas Analyzer Systems Market is dominated by key players such as ABB Ltd., AMETEK MOCON, Bruker Corporation, Horiba Ltd., Mettler-Toledo International Inc., Fuji Electric Co. Ltd., Cambridge Sensotec Limited, Hiden Analytical Ltd., Advanced Micro Instruments Inc., and California Analytical Instruments Inc. These companies lead through continuous innovation, advanced sensor technology, and strong global distribution networks. They focus on developing compact, IoT-enabled analyzers that offer high accuracy and efficiency. Asia Pacific emerged as the leading region with a 34% market share in 2024, driven by rapid industrialization, emission control mandates, and increasing investment in environmental monitoring technologies across China, Japan, and India.

Market Insights

- The Electrochemical Gas Analyzer Systems Market was valued at USD 3.00 billion in 2024 and is projected to reach USD 4.67 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

- Rising industrial automation and strict emission control regulations are driving strong demand across oil & gas, power, and chemical industries.

- The market is witnessing trends like IoT integration, smart sensors, and portable analyzers enhancing real-time monitoring and data accuracy.

- Competition remains intense among leading players such as ABB Ltd., AMETEK MOCON, Bruker Corporation, and Horiba Ltd., focusing on compact, energy-efficient, and multi-gas systems.

- Asia Pacific holds 34% share, followed by North America with 31% and Europe with 29%, while portable analyzers dominate by 58% share due to their flexibility and field-use advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Portable gas analyzer systems held the dominant share of 58% in 2024, driven by their flexibility and suitability for field applications. Their compact design allows rapid deployment across industries such as oil and gas, environmental monitoring, and chemical processing. Rising demand for real-time emissions tracking and safety audits supports the segment’s growth. Fixed systems, on the other hand, are widely used in continuous process monitoring, especially in manufacturing and power plants where long-term stability is essential for maintaining production efficiency and regulatory compliance.

- For instance, the INSCAN 176 Portable Gas Analyzer efficiently measures multiple gases within 20 seconds and is widely used in mining and pipeline safety operations, ensuring worker and equipment protection.

By Gas Type

The Oxygen (O₂) segment accounted for 32% of the market in 2024, making it the largest gas type category. This dominance stems from oxygen’s critical role in combustion efficiency and emissions control. Continuous oxygen monitoring is essential in power generation, wastewater treatment, and metallurgy for process optimization. Demand for carbon monoxide and hydrogen sulfide analyzers is also growing due to industrial safety norms and pollution monitoring. Companies increasingly adopt multi-gas analyzers to reduce equipment costs and improve operational efficiency across diverse applications.

- For instance, Baker Hughes launched the XMO2pro oxygen analyzer in 2024, which enhances safety and efficiency in energy sectors by optimizing oxygen levels in processes like biogas upgrading and steel industry heat treatment.

By Application

Industrial process control dominated with 36% share in 2024, driven by the growing need for precision in chemical and petrochemical operations. These systems help maintain optimal gas compositions, enhance safety, and minimize wastage. Combustion analysis and emission monitoring also hold substantial shares as industries adopt cleaner technologies and meet tightening emission regulations. Environmental monitoring is expanding with greater emphasis on air quality assessment, while laboratory research applications grow due to advances in electrochemical sensor design and academic interest in material science and gas behavior.

Key Growth Drivers

Rising Focus on Industrial Emission Control

Stricter global emission regulations are driving demand for electrochemical gas analyzer systems across heavy industries. Governments in regions such as Europe and North America enforce limits on greenhouse gases and toxic emissions, pushing companies to adopt precise gas monitoring technologies. These systems provide real-time data that enable compliance, reduce penalties, and improve environmental performance. Growing awareness of workplace safety and sustainable manufacturing further strengthens adoption in sectors like oil and gas, power generation, and chemicals.

- For instance, GAO Tek’s gas analyzers assist power plants in North America in continuous monitoring of sulfur dioxide and nitrogen oxides, ensuring regulatory compliance and enhanced operational safety.

Expansion of Process Automation in Industries

Rapid automation in industrial operations has boosted the use of electrochemical analyzers for continuous monitoring and process optimization. Advanced analyzer systems integrate with IoT and SCADA networks, providing instant feedback and predictive alerts. This integration supports higher operational efficiency and lower maintenance costs. Industries such as petrochemicals, food processing, and wastewater management increasingly depend on automated gas analysis to maintain accuracy and safety. The shift toward smart manufacturing is expected to accelerate market growth in the coming years.

- For instance, in the petrochemical industry, HORIBA provides explosion-protection-certified analyzers enabling safe and efficient monitoring in hazardous environments, improving process control and safety.

Growing Demand for Portable Gas Analyzers

The rising preference for portable gas analyzers is a key driver, particularly in field inspection and environmental monitoring. Their compact size, rapid response time, and ease of transport make them ideal for on-site analysis. These systems are widely adopted by regulatory agencies and industrial maintenance teams for periodic emission checks and leak detection. Technological improvements, such as longer battery life and enhanced sensor accuracy, are increasing their reliability. The portability advantage directly supports real-time decision-making and reduces downtime in operations.

Key Trends & Opportunities

Integration of Digital Technologies and Smart Sensors

The integration of AI, IoT, and cloud-based platforms in gas analysis is transforming data collection and interpretation. Smart sensors now offer self-calibration, fault detection, and remote monitoring capabilities. These advancements help industries automate compliance reporting and predictive maintenance. Companies are investing in smart electrochemical analyzers to enhance data accuracy and connectivity. This trend is expected to open new opportunities in energy, utilities, and environmental sectors that demand intelligent and networked monitoring systems.

- For instance, Honeywell deployed its Connected Plant solution with embedded IoT sensors for real-time gas leak detection and automated compliance tracking, enabling refineries to reduce manual reporting and enhance predictive maintenance workflows.

Shift Toward Sustainable and Low-Cost Manufacturing

Manufacturers are focusing on developing sustainable and cost-effective electrochemical sensors that reduce energy use and waste. The adoption of recyclable components and eco-friendly materials aligns with global sustainability goals. Miniaturization and modular design also lower production and replacement costs, attracting small and medium enterprises. As environmental awareness and green regulations expand, companies offering sustainable solutions are expected to capture a larger market share, especially in emerging economies seeking low-cost compliance technologies.

- For instance, the research on natural fiber-based substrates like SugarcaneSens has demonstrated significantly reduced environmental impact compared to conventional materials, promoting biodegradable and eco-friendly sensors.

Key Challenges

High Maintenance and Calibration Costs

Electrochemical gas analyzers require frequent calibration and sensor replacement to maintain accuracy, increasing operational costs. Exposure to extreme conditions such as high temperature or humidity can shorten sensor life. Industries operating under tight budgets often face challenges in maintaining large-scale systems. These factors restrict adoption, especially among small manufacturers. Development of self-calibrating and durable sensors could mitigate this challenge and improve overall system reliability.

Data Accuracy and Cross-Sensitivity Issues

Cross-sensitivity to multiple gases can impact the accuracy of electrochemical sensors, posing reliability challenges in complex industrial environments. Interference from temperature changes, humidity, or background gases may distort readings. This limitation can lead to false alarms or compliance errors. Manufacturers are investing in multi-layered membrane technologies and advanced signal processing to overcome these issues. However, ensuring long-term precision across variable conditions remains a major technical barrier for widespread deployment.

Regional Analysis

North America

North America held a 31% market share in 2024, driven by strict environmental regulations and strong industrial automation adoption. The United States dominates regional demand due to the presence of major oil, gas, and chemical facilities requiring continuous emission monitoring. The Environmental Protection Agency (EPA) mandates strict air quality compliance, pushing industries to deploy high-precision electrochemical analyzers. Canada and Mexico are also experiencing steady growth, supported by industrial expansion and increasing investments in renewable energy projects that require advanced gas detection and safety systems.

Europe

Europe accounted for 29% of the market share in 2024, supported by stringent EU emission norms and sustainability initiatives. Countries such as Germany, the U.K., and France lead due to strong regulatory enforcement and advanced industrial infrastructure. The region’s focus on reducing carbon footprint across automotive, manufacturing, and power sectors boosts adoption. European companies invest heavily in smart analyzers with digital connectivity and self-diagnosis features. The growing emphasis on achieving net-zero emissions and workplace safety continues to strengthen market penetration across industrial and environmental applications.

Asia Pacific

Asia Pacific dominated the market with a 34% share in 2024, fueled by rapid industrialization and urbanization. China, Japan, India, and South Korea are key contributors, with large-scale investments in energy, manufacturing, and process industries. Government initiatives to monitor air pollution and improve worker safety have accelerated adoption. The region’s expanding power generation and petrochemical sectors further support market growth. Rising R&D spending in sensor miniaturization and cost-effective analyzers enhances accessibility for small and medium enterprises, positioning Asia Pacific as the fastest-growing regional market during the forecast period.

Latin America

Latin America captured 4% of the global market share in 2024, driven by increasing industrial safety standards and environmental monitoring initiatives. Brazil and Mexico lead regional demand, supported by expanding oil and gas operations and stricter emission regulations. Growing adoption of portable gas analyzers in mining and manufacturing sectors enhances regional uptake. Governments are introducing air quality monitoring frameworks that promote advanced sensing technologies. The demand for affordable and energy-efficient systems is increasing, creating opportunities for local and international manufacturers to expand their presence.

Middle East & Africa

The Middle East & Africa held a 2% market share in 2024, primarily led by oil and gas exploration and power generation industries. Countries such as Saudi Arabia, the UAE, and South Africa are investing in process safety and emission monitoring infrastructure. The region’s growing focus on energy diversification and compliance with international safety norms drives adoption. Industrial modernization projects and refinery expansions also boost demand for continuous gas analysis solutions. The development of smart city and environmental monitoring projects is expected to further enhance regional growth potential.

MarketSegmentations:

By Type

- Portable Gas Analyzer Systems

- Fixed Gas Analyzer Systems

By Gas Type:

- Oxygen (O₂)

- Carbon Monoxide (CO)

- Hydrogen Sulfide (H₂S)

- Nitric Oxide (NO)

- Sulfur Dioxide (SO₂)

- Others

By Application:

- Environmental Monitoring

- Industrial Process Control

- Combustion Analysis

- Emission Monitoring

- Safety and Compliance Testing

- Research and Laboratory

By End-Use Industry:

- Oil & Gas

- Chemicals & Petrochemicals

- Power Generation

- Pharmaceuticals

- Food & Beverage

- Mining & Metals

- Water & Wastewater Treatment

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electrochemical Gas Analyzer Systems Market features leading players such as ABB Ltd., AMETEK MOCON, Bruker Corporation, Horiba Ltd., Mettler-Toledo International Inc., Fuji Electric Co. Ltd., Cambridge Sensotec Limited, Hiden Analytical Ltd., Advanced Micro Instruments Inc., and California Analytical Instruments Inc. These companies focus on product innovation, sensor accuracy, and system integration to strengthen their market presence. Continuous R&D efforts emphasize developing compact, energy-efficient, and IoT-enabled analyzers that support real-time monitoring. Strategic partnerships and mergers enhance global distribution networks and service capabilities. For instance, several companies are integrating cloud-based data management to improve predictive maintenance and regulatory reporting. Regional players compete by offering cost-effective solutions tailored to specific industrial needs, while global leaders maintain dominance through technological expertise and strong brand reliability. The competition remains intense, with emphasis on innovation, accuracy, and compliance with evolving environmental standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bruker Corporation

- Hiden Analytical Ltd.

- Mettler-Toledo International, Inc.

- ABB Ltd.

- AMETEK MOCON

- Horiba Ltd.

- Cambridge Sensotec Limited

- Advanced Micro Instruments, Inc.

- California Analytical Instruments, Inc.

- Fuji Electric Co., Ltd.

Recent Developments

- In October 2025, Hiden Analytical Ltd. launched its ECL Series electrochemical toolkit, designed to enhance precision and performance in gas analysis applications.

- In August 2025, Advent Technologies announced a strategic partnership with a global semiconductor and wireless technology company to develop advanced ion-pair membranes for next-generation gas sensing solutions.

- In June 2024, Interlink Electronics, Inc. introduced a new range of electrochemical gas sensors capable of detecting NO₂, CO, SO₂, and O₃ for outdoor air-quality monitoring.

- In June 2023, Interlink Electronics, Inc. introduced electrochemical gas sensors to detect accurately harmful gases including NOX, ammonia and hydrogen

Report Coverage

The research report offers an in-depth analysis based on Type, Gas Type, Application, End User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise due to stricter emission regulations and workplace safety standards.

- Integration of IoT and AI will enhance real-time data accuracy and predictive maintenance.

- Portable analyzers will see wider use in field monitoring and inspection applications.

- Growth in renewable energy and hydrogen industries will drive gas detection adoption.

- Manufacturers will focus on compact, low-power, and cost-efficient analyzer designs.

- Asia Pacific will remain the fastest-growing region due to industrial expansion.

- Partnerships between sensor developers and automation firms will increase innovation speed.

- Development of multi-gas analyzers will reduce operational costs and maintenance time.

- Advancements in electrochemical sensors will improve durability and lifespan.

- Digital connectivity and cloud integration will strengthen remote monitoring capabilities.