Market Overview

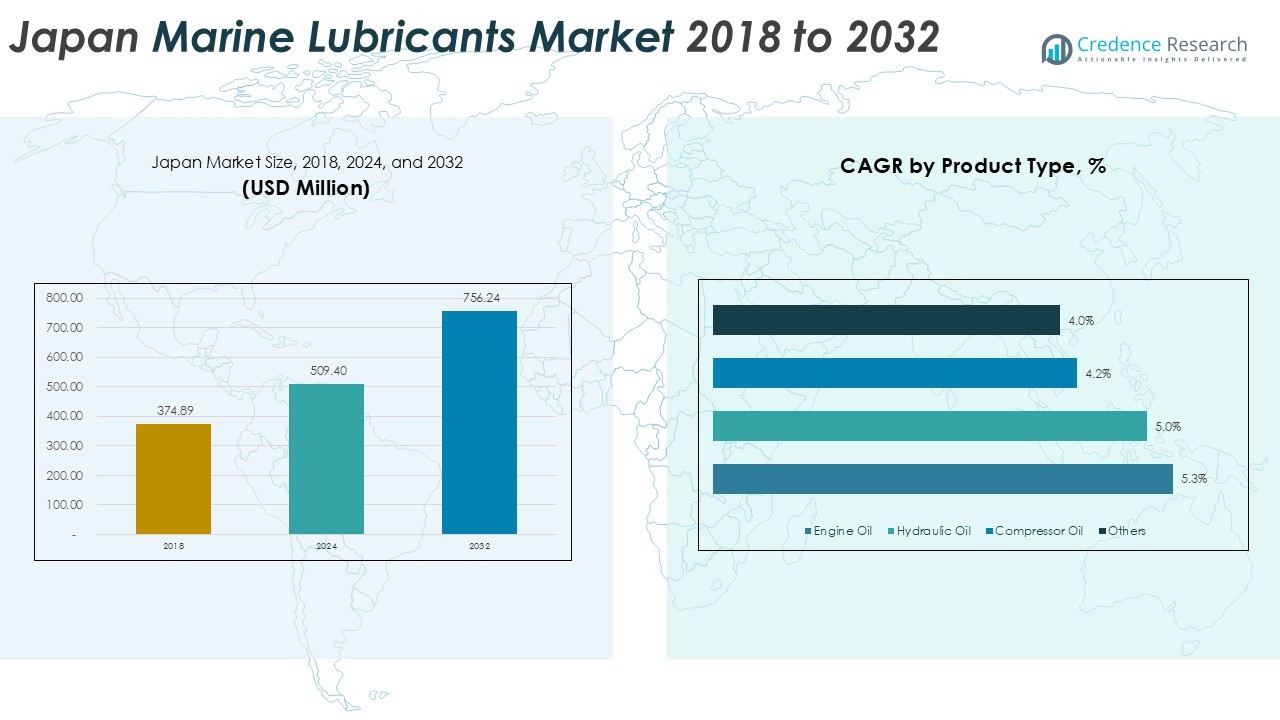

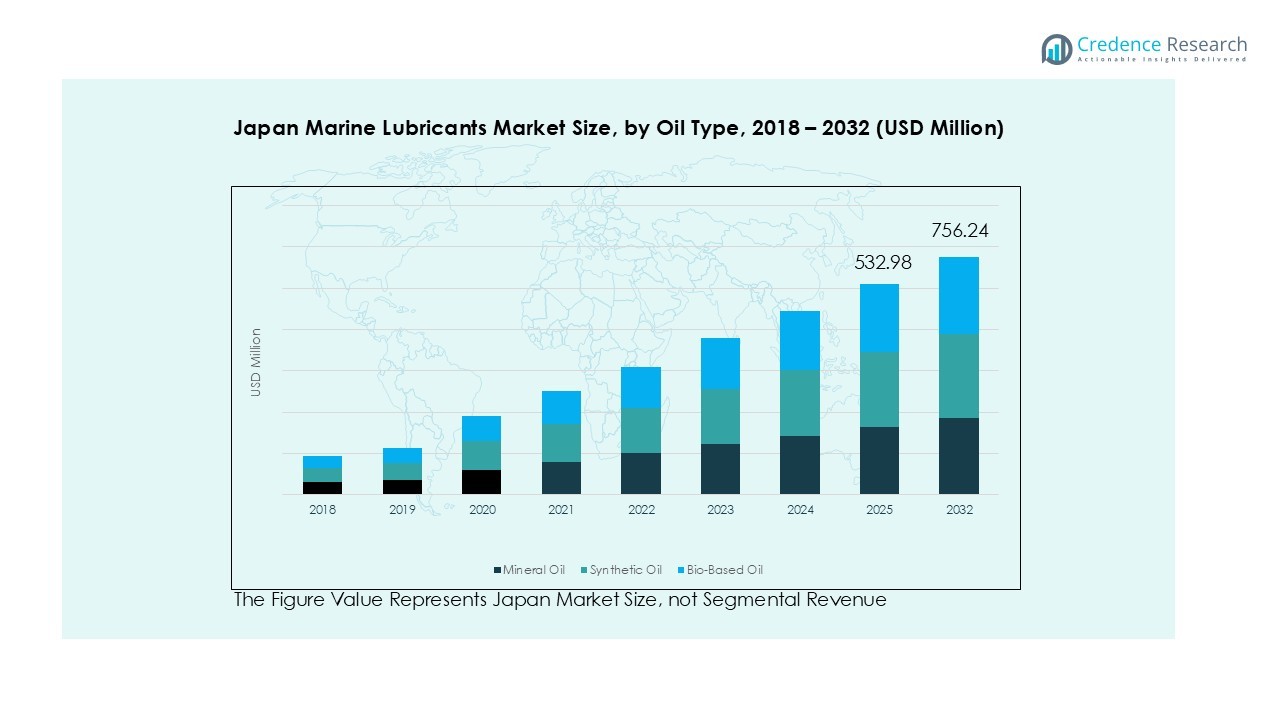

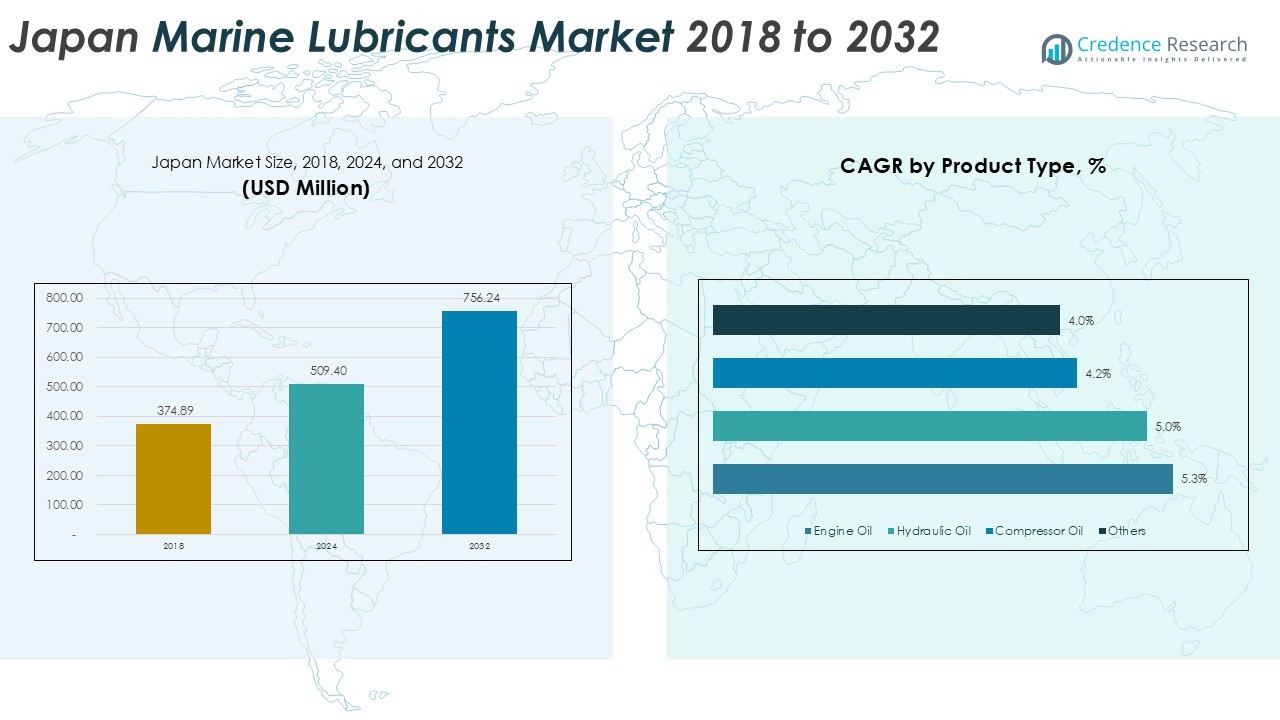

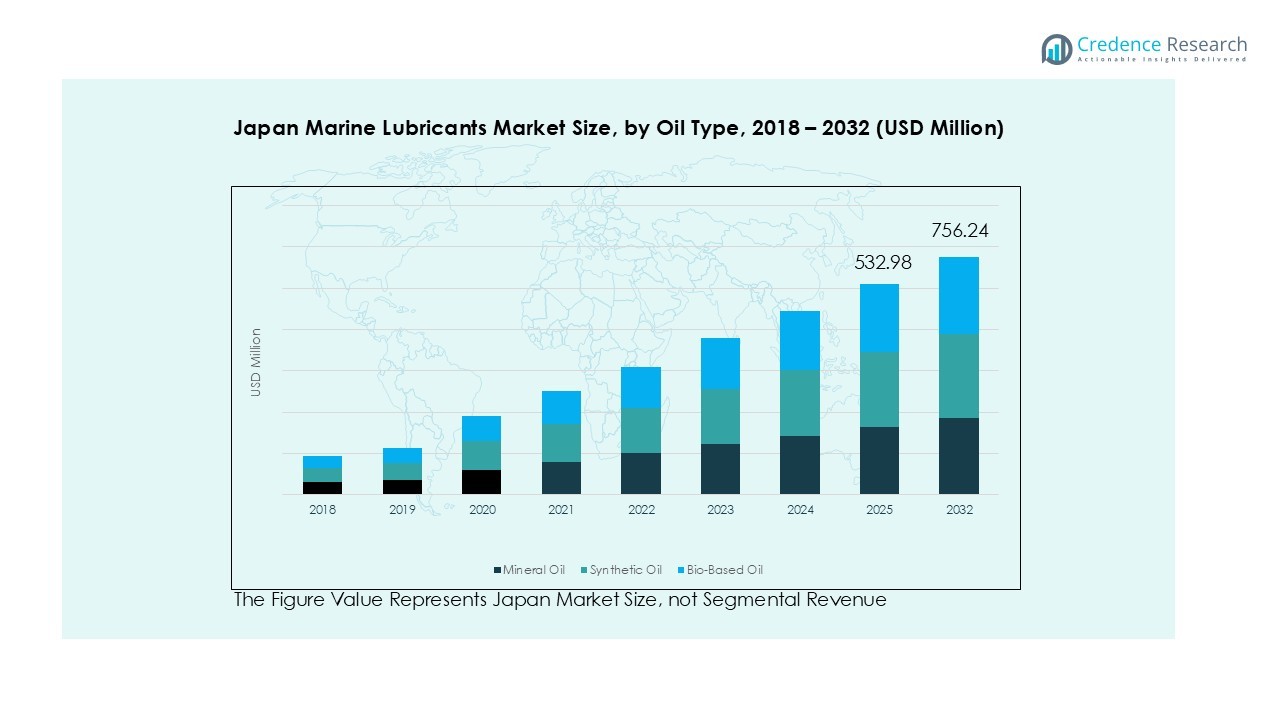

Japan Marine Lubricants Market size was valued at USD 374.89 million in 2018, growing to USD 509.40 million in 2024, and is anticipated to reach USD 756.24 million by 2032, at a CAGR of 5.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Marine Lubricants Market Size 2024 |

USD 509.40 Million |

| Japan Marine Lubricants Market, CAGR |

5.0% |

| Japan Marine Lubricants Market Size 2032 |

USD 756.24 Million |

The Japan Marine Lubricants Market is dominated by prominent players such as ENEOS Corporation, ExxonMobil Marine Limited, Chevron Corporation, Shell, TotalEnergies, PetroChina Co. Ltd., Klüber Lubrication, Goldenstone Oils, and Gulf Oil International. These companies lead through strong distribution networks, advanced product innovation, and compliance with evolving environmental regulations. ENEOS and ExxonMobil hold a significant domestic presence, supported by OEM partnerships and extensive port coverage, while global brands like Shell and TotalEnergies emphasize synthetic and eco-friendly lubricants. Regionally, the Kanto region remains the market leader with a 38% share in 2024, driven by its major ports Tokyo and Yokohama alongside robust shipping, maintenance, and logistics operations that sustain the highest lubricant consumption nationwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Marine Lubricants Market was valued at USD 509.40 million in 2024 and is projected to reach USD 756.24 million by 2032, growing at a CAGR of 5.0% during the forecast period.

- Growing maritime trade, expanding fleet size, and rising maintenance requirements for commercial and naval vessels are driving consistent demand for marine lubricants across Japan.

- Increasing adoption of synthetic and bio-based lubricants reflects a strong trend toward sustainable and high-performance marine operations, supported by IMO 2020 emission regulations.

- The market is moderately consolidated, with key players such as ENEOS Corporation, Shell, ExxonMobil, Chevron, and TotalEnergies focusing on product innovation, port service expansion, and eco-friendly lubricant formulations.

- The Kanto region dominates the market with a 38% share, driven by major port operations in Tokyo and Yokohama, while the mineral oil segment holds a 72% share due to its affordability and wide application in bulk carriers.

Market Segmentation Analysis:

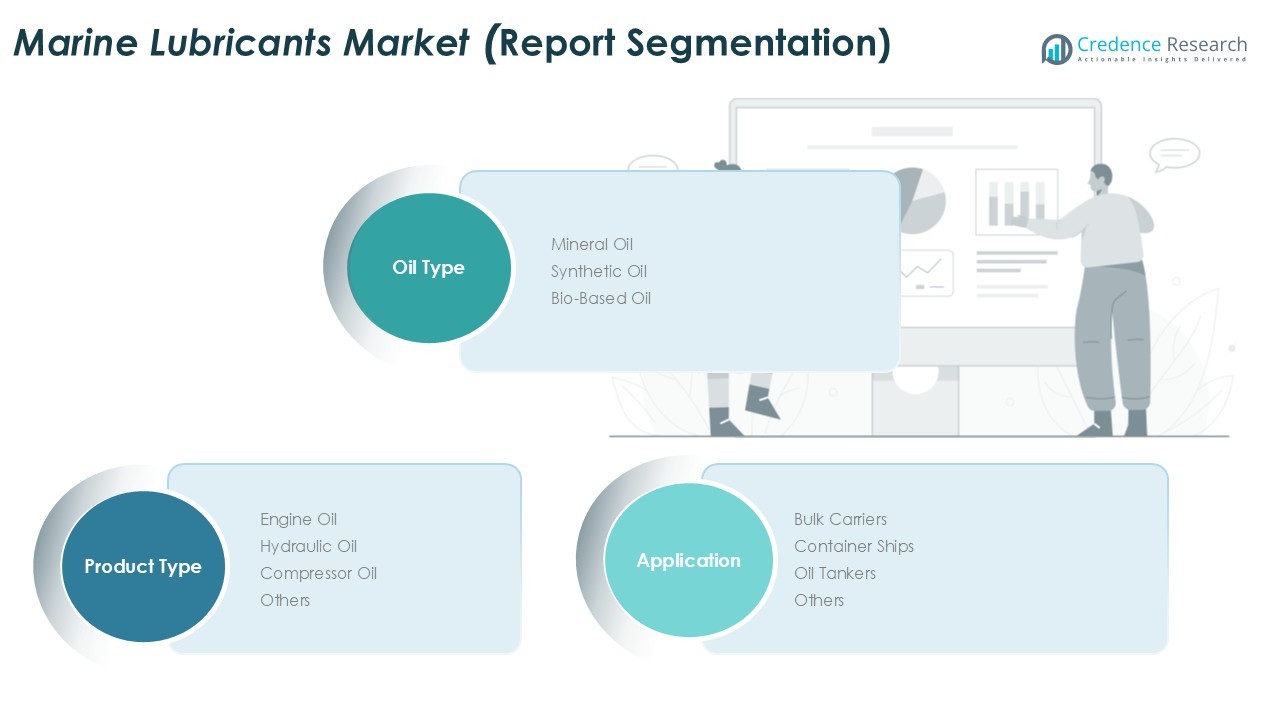

By Oil Type

Mineral oil dominates the Japan marine lubricants market with around 72% share in 2024, owing to its affordability, wide availability, and compatibility with conventional marine engines. Synthetic oils account for nearly 23%, supported by rising adoption in high-performance and dual-fuel engines requiring enhanced thermal stability and longer drain intervals. Bio-based oils hold a small but growing 5% share, driven by environmental regulations and the shift toward eco-friendly lubricants compliant with vessel discharge norms.

For example, ExxonMobil Corporation’s “Mobilgard™ 540 X” cylinder oil is explicitly formulated for two-stroke marine diesel engines using LNG or low-sulphur fuel, and offers extended drain intervals under extreme conditions.

By Product Type

Engine oil leads the product-type segment, representing over 50% share, driven by high consumption in main propulsion and auxiliary engines. Hydraulic oils contribute about 18%, benefiting from growing automation in deck machinery and offshore operations. Compressor oils hold nearly 12%, driven by expanding use in refrigeration and inert-gas systems, while the remaining 20% share belongs to other specialty lubricants such as greases and gear oils, crucial for vessel reliability and compliance.

For instance, Gulf Oil Marine Ltd. offers its “GulfSea Hydraulic HVI Plus 46” marine hydraulic oil (viscosity grade 46) explicitly for lubrication of hydraulic and power-transmission systems in marine environments.

By Application

Bulk carriers dominate the application landscape with nearly 57% market share, supported by Japan’s strong role in dry-bulk trade and extensive long-haul operations. Container ships account for 25%, driven by frequent voyages, high-speed engines, and demand for premium lubricants. Oil tankers represent around 15%, fueled by stringent emission and reliability requirements, while other vessel types including LNG carriers and offshore support ships capture the remaining 10%, showing steady growth in specialized maritime services.

Key Growth Drivers

Expansion of Maritime Trade and Fleet Modernization

Japan’s robust maritime trade and ongoing fleet modernization serve as primary growth drivers for the marine lubricants market. The country’s strong export-oriented economy and participation in global shipping routes fuel steady demand for high-performance lubricants. Increasing investments in advanced vessels with larger engine capacities and improved fuel efficiency further stimulate lubricant consumption. Additionally, the replacement of aging fleets with modern, low-emission ships requires specialized lubricants, reinforcing consistent market growth across commercial and industrial maritime segments.

For instance, Mitsui O.S.K. Lines operated 97 LNG carriers as of March 2024, underlining the high-capacity, specialized fleet being maintained.

Stringent Environmental and Emission Regulations

The implementation of the IMO 2020 sulphur cap and Japan’s national maritime emission standards are compelling ship operators to adopt cleaner, high-quality lubricants. These regulations drive demand for low-sulphur, environmentally acceptable lubricants (EALs) and synthetic alternatives designed to reduce emissions and improve engine performance. Lubricant manufacturers are focusing on formulating eco-friendly solutions to meet these evolving norms. This regulatory push not only enhances sustainability but also accelerates innovation and product diversification in the Japanese marine lubricants industry.

For instance, one Japanese product catalogue lists a “TBN 40” cylinder lubricant designed for slow-speed 2-stroke engines using IMO 2020-compliant fuels.

Rising Adoption of Advanced Engine Technologies

The growing shift toward LNG, hybrid, and dual-fuel propulsion systems is driving the need for specialized lubricants that can operate efficiently under higher temperatures and pressures. Japan’s leading shipbuilders and operators are increasingly integrating next-generation engines to improve operational efficiency and meet decarbonization targets. This transition supports higher lubricant demand tailored for advanced engine designs, extended drain intervals, and optimized performance. As a result, lubricant producers are focusing on innovation and technical collaboration to cater to these evolving requirements.

Key Trends and Opportunities

Shift Toward Bio-Based and Synthetic Lubricants

A notable trend in Japan’s marine lubricants market is the transition toward bio-based and synthetic formulations. Ship operators are prioritizing sustainable products that meet environmental compliance and improve overall performance. Bio-based lubricants offer biodegradability and reduced toxicity, aligning with global green shipping goals. Meanwhile, synthetic lubricants provide superior thermal stability and longer service life, helping reduce maintenance costs. This shift creates opportunities for manufacturers to expand their eco-friendly product portfolios and strengthen their presence in the environmentally driven marine sector.

For instance, ENEOS’s marine “MARINE C1005” cylinder oil carries a base-number (BN) of 100 and is developed for high-output cross-head diesel engines using high-sulphur fuel.

Integration of Digital Monitoring and Predictive Maintenance

The adoption of IoT-based lubricant monitoring and predictive maintenance technologies is transforming Japan’s marine lubricant management practices. Advanced sensors and data analytics enable real-time tracking of lubricant condition, viscosity, and contamination levels. This helps ship operators optimize maintenance schedules, extend lubricant life, and minimize downtime. The digitalization of lubricant management not only improves operational efficiency but also creates opportunities for service-based business models, allowing suppliers to offer value-added monitoring and performance optimization solutions to fleet operators.

For instance, ENEOS announced that its materials-informatics system “Matlantis™” can perform atomistic simulations in 0.3 seconds, compared to two months previously demonstrating their digital-led R&D capability that can feed into digital lubricant services.

Key Challenges

Volatility in Crude Oil Prices and Raw Material Costs

The fluctuating prices of crude oil and base stocks pose a major challenge for Japan’s marine lubricants market. Since mineral oils and additive components are petroleum-derived, volatility in global oil prices directly impacts production costs and profit margins. Manufacturers face pressure to maintain competitive pricing while managing cost fluctuations. This uncertainty can disrupt supply chains and affect long-term contracts with shipping companies, prompting the industry to explore cost-efficient formulations and diversify sourcing strategies to mitigate raw material risks.

Declining Conventional Shipbuilding and Aging Fleet Operations

Japan’s gradual decline in domestic shipbuilding activity and reliance on aging fleets pose structural challenges to lubricant demand growth. Older vessels often operate on extended maintenance cycles, reducing lubricant replacement frequency. Additionally, limited new ship orders slow down the introduction of advanced propulsion systems that require premium lubricants. These factors collectively restrain market expansion, pushing lubricant suppliers to focus more on aftermarket services, performance monitoring, and exports to sustain revenue in an increasingly competitive landscape.

Regional Analysis

Kanto

The Kanto region holds the leading position in Japan’s marine lubricants market, accounting for 38% market share in 2024. Home to the Port of Tokyo and Yokohama, it serves as the central hub for maritime trade, ship maintenance, and logistics. The region’s dense concentration of shipping companies, port operations, and shipyards drives consistent lubricant demand. Growing adoption of advanced and eco-friendly lubricants is supported by strict environmental regulations and technological advancements in vessel maintenance. Continuous fleet modernization and rising container traffic further enhance lubricant consumption in this economically vital coastal region.

Kansai

The Kansai region contributes around 24% market share, supported by major ports such as Osaka and Kobe that handle significant domestic and international cargo volumes. The region’s strong industrial base and active shipbuilding activities stimulate lubricant demand for cargo ships, bulk carriers, and support vessels. Increasing investments in LNG-powered ships and energy-efficient fleets further promote the use of premium synthetic lubricants. Furthermore, regional maritime associations and local refineries play a crucial role in ensuring product availability and supporting Japan’s broader decarbonization goals in the marine sector.

Chubu

Chubu holds a 17% share of Japan’s marine lubricants market, anchored by the Port of Nagoya, the nation’s largest trade port by volume. High cargo throughput and strong industrial exports from automotive and machinery sectors sustain lubricant consumption. Demand is concentrated in engine and hydraulic oils, particularly for cargo and container vessels. The region’s emphasis on ship efficiency, coupled with ongoing port infrastructure upgrades, encourages the adoption of modern lubricants that enhance fuel economy and reduce emissions, aligning with Japan’s maritime sustainability objectives.

Kyushu

The Kyushu region represents 13% market share and serves as a key maritime hub for ship repair, fishing fleets, and oil tanker operations. The ports of Fukuoka, Kitakyushu, and Nagasaki contribute to steady lubricant demand from commercial and industrial vessels. Local shipyards and offshore engineering activities drive the use of high-performance lubricants in engines and hydraulic systems. Additionally, government-backed green shipping initiatives in Kyushu are promoting the transition toward bio-based lubricants, creating new opportunities for manufacturers focusing on sustainable product lines.

Hokkaido and Other

Hokkaido and other coastal regions together account for the remaining 8% share of the Japan marine lubricants market. These areas primarily serve fishing fleets, coastal cargo vessels, and regional ferry networks. Despite their smaller market size, rising activity in offshore wind projects and local marine transport sustains steady lubricant demand. The focus is gradually shifting toward environmentally acceptable lubricants due to ecological sensitivity in northern waters. Ongoing infrastructure development and support for regional shipping routes further reinforce the need for reliable and efficient marine lubricant solutions.

Market Segmentations:

By Oil Type

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Product Type

- Engine Oil

- Hydraulic Oil

- Compressor Oil

- Others

By Application

- Bulk Carriers

- Container Ships

- Oil Tankers

- Others

By Region

- Kanto

- Kansai

- Chubu

- Kyushu

- Hokkaido

- Others

Competitive Landscape

The competitive landscape of the Japan Marine Lubricants Market is characterized by the strong presence of key players such as ENEOS Corporation, ExxonMobil Marine Limited, Chevron Corporation, PetroChina Co. Ltd., Klüber Lubrication, Goldenstone Oils, TotalEnergies, Gulf Oil International, and Shell. These companies compete on product quality, technological innovation, and compliance with environmental standards. ENEOS and ExxonMobil dominate the domestic market through extensive distribution networks and established OEM partnerships. Global players like Shell and TotalEnergies focus on advanced synthetic and bio-based lubricants to meet Japan’s sustainability targets. Strategic initiatives such as product innovation, partnerships with shipbuilders, and digital monitoring services are increasingly shaping competition. Moreover, R&D investments aimed at formulating low-sulphur and environmentally acceptable lubricants are gaining prominence. As Japan accelerates its shift toward cleaner marine operations, companies that offer performance efficiency, regulatory compliance, and lifecycle cost advantages are expected to strengthen their market positioning.

Key Player Analysis

- ENEOS Corporation

- ExxonMobil Marine Limited

- Chevron Corporation

- PetroChina Co. Ltd.

- Klüber Lubrication

- Goldenstone Oils

- TotalEnergies

- Gulf Oil International

- Shell

- Other Key Players

Recent Developments

- In September 2023, Mitsui O.S.K. Lines (MOL) entered a maritime decarbonisation partnership with Shell Marine Products Singapore to advance the use of alternative marine fuels, including bio-based and synthetic lubricants, supporting Japan’s sustainability goals.

- In March 2025, ENEOS Corporation announced plans to halt lubricant production at its Yokohama plant by March 2028, as part of a strategic restructuring aimed at optimising operations and focusing on high-performance and eco-friendly lubricant formulations in the Japanese market.

- In April 2023, Silverstream Technologies signed an agency agreement with Orient Marine Co. in Japan to represent its air-lubrication system, marking a strategic push into the Japanese maritime services market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Oil Type, Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan marine lubricants market is expected to experience steady growth driven by modernization of fleets and expansion of maritime trade.

- Rising adoption of synthetic and bio-based lubricants will accelerate as environmental compliance becomes more stringent.

- Increasing use of LNG and hybrid propulsion systems will create demand for advanced, high-performance lubricants.

- Digitalization and predictive maintenance technologies will transform lubricant monitoring and service efficiency.

- Growing investment in green shipping initiatives will promote the shift toward environmentally acceptable lubricants.

- Local refiners and global suppliers are likely to collaborate to enhance supply chain resilience and product innovation.

- The focus on energy-efficient and low-emission vessels will strengthen the market for premium lubricant formulations.

- Research and development in eco-friendly and long-drain interval lubricants will remain a key strategic priority.

- The aftermarket and maintenance service segment will expand as aging fleets require consistent lubricant support.

- Strong regulatory policies and sustainability targets will shape long-term market direction and competitive strategies.