Market Overview

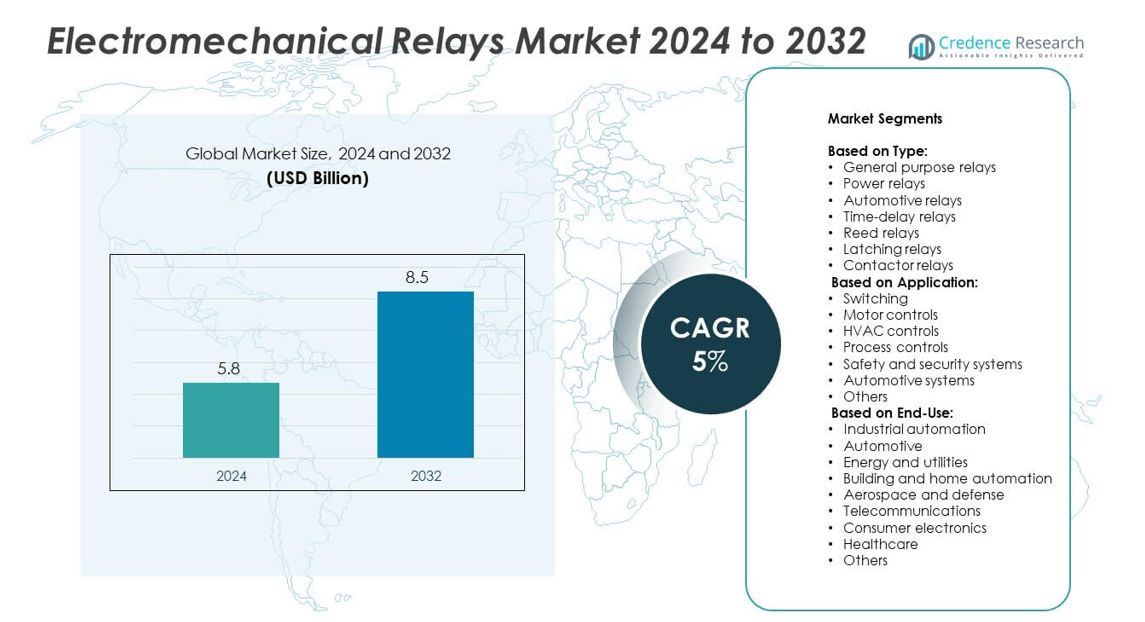

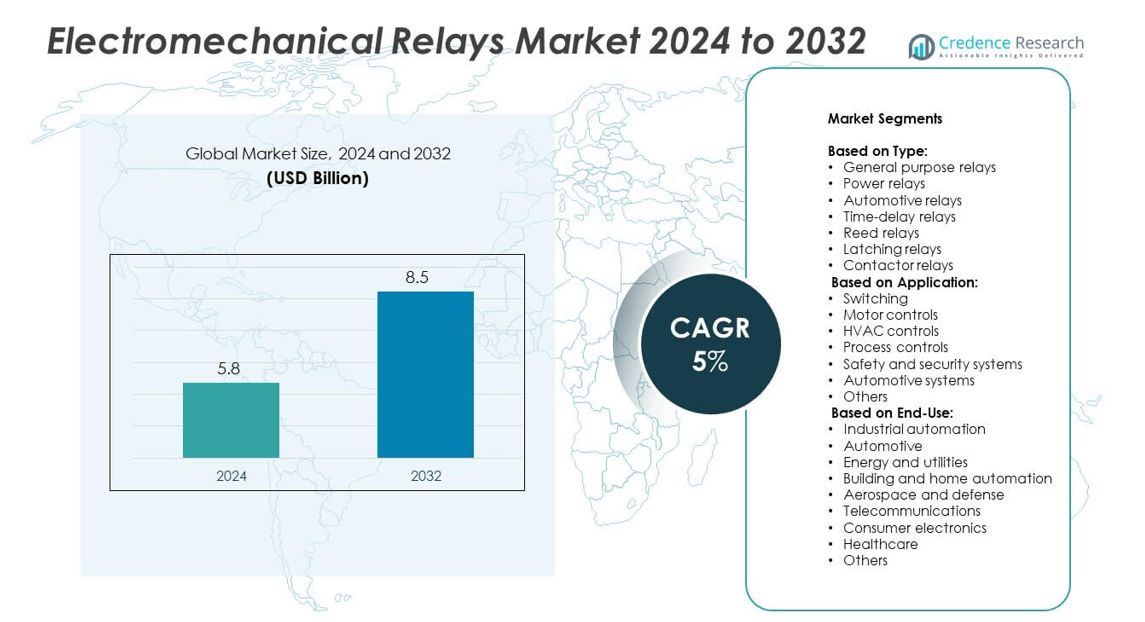

Electromechanical Relays Market size was valued at USD 5.8 billion in 2024 and is anticipated to reach USD 8.5 billion by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electromechanical Relays Market Size 2024 |

USD 5.8 billion |

| Electromechanical Relays Market, CAGR |

5% |

| Electromechanical Relays Market Size 2032 |

USD 8.5 billion |

The Electromechanical Relays market grows with rising demand from industrial automation, EV systems, and smart grid projects. Manufacturers rely on relays for reliable load switching, circuit isolation, and safety control in high-voltage environments. Advancements in miniaturized, silent, and energy-efficient designs support adoption in medical, telecom, and building systems. Trends also include integration with IoT platforms, predictive diagnostics, and relay customization for sector-specific needs. These factors position relays as essential components across evolving industrial and consumer technologies.

North America leads the Electromechanical Relays market due to strong automation, smart infrastructure, and EV adoption. Europe follows with demand from renewable energy, rail systems, and industrial upgrades. Asia-Pacific shows rapid growth driven by large-scale manufacturing, electronics production, and energy sector expansion. Latin America and Middle East & Africa gain traction through infrastructure and power distribution projects. Key players active across these regions include Omron Corporation, Schneider Electric, Siemens AG, and ABB Ltd., all offering region-specific relay solutions for varied end-use sectors.

Market Insights

- The Electromechanical Relays market was valued at USD 5.8 billion in 2024 and is projected to reach USD 8.5 billion by 2032, growing at a CAGR of 5%.

- Strong demand from industrial automation, electric vehicles, and smart grid applications drives consistent relay adoption.

- Miniaturized, low-noise, and energy-efficient relays gain traction in medical devices, telecom systems, and smart buildings.

- Key players such as Omron Corporation, ABB Ltd., Siemens AG, and Schneider Electric focus on compact designs, customization, and relay diagnostics.

- Rising competition from solid-state relays and limitations in high-speed switching environments challenge traditional relay use.

- North America leads due to automation and energy investments, while Asia-Pacific shows fast growth through electronics manufacturing and EV infrastructure.

- Europe supports steady demand with industrial upgrades and clean energy expansion, while Latin America and the Middle East & Africa grow through power distribution and infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Industrial Automation and Control Systems

The Electromechanical Relays market benefits from the growing adoption of industrial automation. Modern manufacturing units use relays in PLCs, motor control centers, and safety systems. These components enable precise switching in high-load environments with electrical isolation. Factories rely on relay-based control systems to improve reliability and protect sensitive circuits. Rapid adoption of Industry 4.0 drives new installations in discrete and process industries. Smart factories increase the integration of relay-based controls for robotics, conveyors, and sensors. The Electromechanical Relays market grows as industrial sites seek cost-effective and dependable switching solutions.

- For instance, Schneider Electric’s Harmony RPF2BBD panel-mount power relay operates on a 24V DC coil and features two changeover (DPDT) contacts. While the normally open contacts are rated for switching currents of up to 30 A (on AC loads), the normally closed contacts have a lower rating. The relay can be mounted on DIN rails and is suitable for a wide range of industrial control applications.

Expanding Applications in Automotive Electronics and EV Infrastructure

Automotive advancements support strong relay demand across powertrain, lighting, infotainment, and safety systems. Electric vehicles (EVs) and hybrid vehicles require high-voltage relays for battery management, charging, and drive circuits. OEMs rely on durable and heat-resistant relay models to meet performance standards. Electromechanical relays support load switching in 12V, 24V, and high-voltage platforms across EVs. It plays a key role in managing current flow, preventing reverse polarity, and ensuring user safety. The Electromechanical Relays market responds to this surge by offering compact, lightweight, and sealed variants tailored for mobility.

- For instance, TE Connectivity’s EVC 250 automotive contactor supports a continuous current of 250 A at 85 °C and handles peak currents up to 6,000 A for 20 ms—ensuring reliable switching in EV power systems.

Growth in Energy, Power Distribution, and Renewable Systems

Utility grids and renewable energy projects increase the use of electromechanical relays in protection, switching, and isolation applications. Smart grid systems use relays in transformers, distribution panels, and switchgear. Wind, solar, and hydro systems depend on relays to disconnect faulty lines, prevent overload, and manage switching between sources. Power control units in substations rely on relays for phase monitoring and switching heavy electrical loads. It supports remote fault detection and improves response time in decentralized systems. The Electromechanical Relays market aligns with utility upgrades and green energy transitions.

Adoption in Consumer Electronics, Building Systems, and Transportation

Consumer appliances such as HVAC systems, microwave ovens, washing machines, and refrigerators use relays for power control and automation. Smart buildings integrate relays in lighting control panels, elevators, security systems, and access controls. Transportation systems such as railways, marine, and aviation platforms use rugged relays for critical switching. It helps maintain uninterrupted electrical supply and ensures quick response to system failures. Increasing preference for intelligent and connected systems creates steady demand across building automation and public infrastructure. The Electromechanical Relays market supports this trend with high-cycle, compact, and silent models.

Market Trends

Integration of Miniaturized and High-Performance Relay Designs

Manufacturers focus on reducing relay size without compromising switching capacity or durability. Compact designs help OEMs fit relays into densely packed enclosures across industrial, automotive, and consumer applications. High-contact reliability and extended lifecycle remain top priorities in design evolution. Demand for space-saving components rises in portable medical devices, telecom racks, and EVs. It drives innovation in materials and internal configurations to support high loads in limited footprints. The Electromechanical Relays market benefits from miniaturization trends in end-user industries.

- For instance, Fujitsu’s FTR-F1R is a low-profile power relay that measures approximately 12.8 × 29.0 × 16.5 mm, weighs about 12.0 g, and handles up to 8 A at 250 VAC. The non-latching relay provides compact and reliable switching in space-constrained applications.

Shift Toward Silent and Low-Power Consumption Models

Silent operation and low-power relays gain traction in HVAC, medical, and home automation systems. Consumers and industries seek noise-free components for applications involving repetitive switching near living or workspaces. Coil optimization reduces power draw, making relays suitable for battery-operated devices and energy-efficient setups. It supports sustainability goals while reducing thermal stress in control panels. OEMs adopt latching and bistable designs to lower coil power during hold states. The Electromechanical Relays market aligns with the trend of silent and energy-aware technology.

- For instance, Omron’s MYK magnetic latching relay offers mechanical endurance of at least 100 million operations and requires power only during brief set/reset pulses—holding contact positions without continuous coil current.

Increased Use of Relays in Renewable and Backup Energy Systems

Renewable energy systems such as solar inverters and wind turbines incorporate relays for load transfer and circuit protection. Backup systems including UPS and energy storage units depend on reliable switching during outages or power fluctuations. Relays offer critical isolation during maintenance or grid instability events. It plays a role in enhancing operational safety and performance of alternative energy networks. The Electromechanical Relays market adapts to growing use in decentralized and hybrid energy systems. Relay compatibility with smart energy control platforms drives demand further.

Integration of Smart Monitoring and Diagnostic Capabilities

Modern relays include built-in diagnostics to track contact wear, switching cycles, and coil current. Relay health monitoring reduces maintenance costs and enables predictive servicing in industrial and utility sectors. It supports digital twin development and aids in remote control of complex installations. Smart relays work with IoT ecosystems and centralized SCADA systems. The Electromechanical Relays market evolves with smart trends across automation, enabling smarter failure detection and reduced downtime. These upgrades boost adoption in digitally connected environments.

Market Challenges Analysis

Growing Competition from Solid-State Relays and Advanced Switching Technologies

Solid-state relays (SSRs) pose a major challenge to the Electromechanical Relays market due to their faster switching speeds, longer operational life, and silent operation. SSRs have no moving parts, which reduces wear and improves reliability in high-frequency applications. Industries prefer them in automation, medical, and telecom sectors where precision and longevity matter. It faces pressure from evolving semiconductor-based switching devices that offer compactness and noise immunity. Miniaturization trends favor solid-state over electromechanical options in certain segments. The market must address this shift through innovation in hybrid or enhanced relay designs.

Limitations in High-Speed and High-Frequency Performance Environments

Electromechanical relays struggle in applications that demand high-speed actuation and frequent switching cycles. Mechanical contacts wear over time, leading to inconsistent performance and higher maintenance. It limits adoption in fast-paced automation lines, communication systems, and modern EV electronics. Contact bounce, arc generation, and heat buildup also reduce relay reliability under continuous use. The Electromechanical Relays market requires advancements in materials and designs to match evolving operational demands. This challenge restricts growth unless addressed through targeted product development and customization.

Market Opportunities

Expansion of Smart Grid Infrastructure and Renewable Energy Installations

The global shift toward renewable power generation and smart grid modernization creates strong opportunities for relay manufacturers. Power substations, solar farms, wind turbines, and energy storage systems require relays for load switching, fault isolation, and voltage regulation. It offers reliable performance in fluctuating environments where automated switching ensures grid stability. Governments invest in smart energy networks with decentralized control systems, where relays serve key protection roles. The Electromechanical Relays market benefits by supplying high-voltage and high-current models tailored to grid and off-grid needs. This growth opportunity aligns with energy transition policies across developed and emerging nations.

Rising Demand in EV Ecosystems and Charging Infrastructure

Electric vehicle adoption increases demand for relays in battery control units, onboard chargers, and power distribution modules. EV charging stations depend on high-voltage relays to manage AC/DC current flow, fault protection, and energy monitoring. It supports switching functions across EV platforms, from passenger cars to electric buses and two-wheelers. OEMs seek reliable and compact relay solutions to meet stringent safety and efficiency standards in transportation. The Electromechanical Relays market finds growth in supporting global EV expansion and charging infrastructure rollout. Future designs will address thermal stability, lifecycle durability, and compact integration in mobile applications.

Market Segmentation Analysis:

By Type:

General purpose relays lead the Electromechanical Relays market due to their flexibility across control panels, lighting, and signaling systems. Power relays follow with strong use in energy systems and industrial machinery where high-load switching is essential. Automotive relays gain traction due to demand from EVs, battery management, and vehicle electronics. Time-delay relays support HVAC, elevators, and control systems by providing sequential timing. Reed relays offer fast response in instrumentation, telecom, and low-voltage signal routing. Latching relays help reduce energy consumption in smart meters and lighting control. Contactor relays find strong use in motor control centers, substations, and building automation.

- For instance, Schneider Electric’s RPF2BB7 general-purpose power relay features a 2CO contact form and operates on a 24 V AC coil. It handles up to 7500 VA and is rated for switching up to 20 A at 28 V DC and 30 A at 250–277 VAC.

By Application:

Switching dominates with widespread use in industrial machines, consumer appliances, and power infrastructure. Motor control holds significant share, especially in factory automation and HVAC units requiring overload protection and soft start systems. HVAC control relays maintain temperature regulation and fan switching in residential and commercial buildings. Process control applications include relays in chemical, pharmaceutical, and food processing lines. Safety and security systems use relays in alarms, surveillance units, and emergency cutoffs. Automotive systems integrate relays for window control, engine management, and lighting. Others include battery disconnects, vending machines, and marine equipment.

- For instance, Honeywell’s ST82 time-delay relay combines an electronic timer with a relay for use in HVAC systems operating on 24 VAC circuits. The relay has a coil input of 0.55 A when energized and offers a range of delay timings from 30 seconds to 10 minutes depending on the specific model.

By End-Use:

Industrial automation leads due to rising investments in smart manufacturing, robotics, and PLC-driven systems. Automotive follows with growing adoption of relay modules in EVs, hybrid vehicles, and connected cars. Energy and utilities use relays in protection systems, transformers, and distribution networks. Building and home automation relies on relay-based lighting, HVAC, and access controls. Aerospace and defense use rugged relays in avionics, radar systems, and communication devices. Telecommunications require relays in switching stations, repeaters, and data centers. Consumer electronics apply relays in home appliances and smart devices. Healthcare applications include imaging equipment, diagnostic devices, and ventilators. Others include railways, marine, and agricultural systems.

Segments:

Based on Type:

- General purpose relays

- Power relays

- Automotive relays

- Time-delay relays

- Reed relays

- Latching relays

- Contactor relays

Based on Application:

- Switching

- Motor controls

- HVAC controls

- Process controls

- Safety and security systems

- Automotive systems

- Others

Based on End-Use:

- Industrial automation

- Automotive

- Energy and utilities

- Building and home automation

- Aerospace and defense

- Telecommunications

- Consumer electronics

- Healthcare

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share in the Electromechanical Relays market, accounting for 31.2% of global revenue in 2024. The region benefits from a strong industrial base, widespread automation, and early adoption of control systems across sectors. Relays play a central role in programmable logic controllers (PLCs), HVAC systems, industrial robots, and energy grid modernization projects. The United States remains the core contributor, driven by the integration of smart building infrastructure, electric vehicle assembly, and oil & gas automation systems. Canada and Mexico also contribute through expanding manufacturing hubs and OEM relay sourcing for automotive and energy applications. Demand from aerospace and defense sectors, which use high-performance relays for avionics and ground support systems, further supports growth. The region shows consistent procurement by utilities and industrial operators for maintenance, replacement, and upgrades of relay banks in legacy systems.

Europe

Europe represents 27.6% of the global Electromechanical Relays market, supported by its advanced manufacturing base and adoption of green energy technologies. Countries such as Germany, France, and the UK lead in using relays within factory automation, renewable energy systems, and transportation infrastructure. The growing emphasis on electric mobility also fuels relay deployment in charging infrastructure and EV components. European manufacturers focus on high-efficiency, compact relay designs compliant with stringent EU energy and safety regulations. Railways, shipbuilding, and HVAC segments continue to procure electromechanical relays for onboard power control and environmental systems. Integration of relays in smart meters, lighting automation, and energy-efficient buildings also contributes to regional market expansion. Continuous investment in process automation and recycling facilities further drives demand.

Asia-Pacific

Asia-Pacific captures 29.4% of the global market share in 2024, making it a highly competitive and fast-expanding region. China, Japan, South Korea, and India serve as major production and consumption hubs for electromechanical relays. The region benefits from the presence of leading relay manufacturers, robust consumer electronics production, and the rapid expansion of EV and battery assembly lines. Industrial growth, infrastructure expansion, and smart grid deployment all contribute to significant relay demand. In Southeast Asia, relays are increasingly adopted in HVAC, building automation, and energy management systems. Telecom and healthcare sectors also show rising use of high-precision and compact relays. The push for automation across low-cost economies encourages further relay integration in motor controls, switching units, and programmable logic applications.

Latin America

Latin America accounts for 6.1% of the Electromechanical Relays market in 2024, led by Brazil, Mexico, and Argentina. The market is supported by moderate but growing industrial automation and infrastructure development. Manufacturing hubs in Mexico integrate relays into control systems for appliances, automotive production, and power tools. Brazil shows expanding demand for relay components in hydroelectric plants, public transportation, and building automation. Regional trends also reflect growing use of relays in mining operations and renewable energy projects across Chile and Peru. Though fragmented, the region presents new opportunities with rising investments in energy efficiency and smart building technology.

Middle East & Africa

Middle East & Africa contributes 5.7% to the global Electromechanical Relays market. The demand primarily comes from energy, utilities, and infrastructure sectors, particularly in countries like Saudi Arabia, UAE, and South Africa. Relay systems are integrated in oil and gas control rooms, grid substations, and water treatment facilities. Urban development plans promote the use of relays in HVAC, lighting automation, and access control in residential and commercial buildings. Africa shows increasing relay demand in off-grid solar energy systems, telecommunications, and rural electrification programs. Limited local manufacturing leads to high reliance on imported relay units, which presents an opportunity for regional partnerships and OEM presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Omron Corporation

- Mitsubishi Electric Corporation

- Littelfuse, Inc.

- Eaton Corporation

- Finder S.p.A.

- Rockwell Automation, Inc.

- Schweitzer Engineering Laboratories (SEL)

- Fujitsu Ltd.

- Hella KGaA Hueck & Co.

- Schneider Electric

- Panasonic Corporation

- Legrand SA

- TE Connectivity

- Siemens AG

- ABB Ltd.

Competitive Analysis

The leading players in the Electromechanical Relays market include Omron Corporation, Mitsubishi Electric Corporation, Littelfuse, Inc., Eaton Corporation, Finder S.p.A., Rockwell Automation, Inc., Schweitzer Engineering Laboratories (SEL), Fujitsu Ltd., Hella KGaA Hueck & Co., Schneider Electric, Panasonic Corporation, Legrand SA, TE Connectivity, Siemens AG, and ABB Ltd. These companies maintain strong global presence through diversified product portfolios and consistent innovation in relay technology. Many focus on high-performance, compact, and energy-efficient relays to meet evolving industrial and automotive demands. Strategic investments in R&D allow them to enhance switching capacity, thermal stability, and lifecycle durability. Several players emphasize customization for application-specific relays in EVs, HVAC systems, smart grids, and industrial control systems. Collaborations with OEMs and integration into automation platforms provide a competitive edge. The shift toward digital manufacturing, smart diagnostics, and remote monitoring also shapes product development strategies. Cost competitiveness, adherence to global safety standards, and strong distribution networks help retain customer loyalty and expand market reach. Regional expansions, production scaling in Asia-Pacific, and sustainability-aligned designs further drive competitive differentiation. Each player aims to balance performance, reliability, and design innovation to stay ahead in the fast-evolving electromechanical relay landscape.

Recent Developments

- In August 2025, Omron unveiled AC/DC high-power relays for renewable energy and introduced a weather sensor at RE+25

- In 2025, Siemens’ advancements focused on building upon its established modular platforms by integrating AI capabilities and enhancing digitalization, particularly within its energy, infrastructure, and mobility businesses.

- In 2025, TE Connectivity’s major relay-related announcements and highlights were centered around specific, high-growth applications rather than new core technology platforms

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for compact, high-performance relays will rise in electric vehicles and smart devices.

- Relay manufacturers will focus on integrating diagnostics and predictive maintenance features.

- Industrial automation growth will continue to drive adoption across process control systems.

- Smart grid expansion will increase relay use in fault detection and switching operations.

- Miniaturized and low-noise relays will see strong demand in consumer electronics and medical devices.

- Adoption of relays in renewable energy projects will expand with global clean energy goals.

- Telecom infrastructure upgrades will support the need for reliable signal and power switching.

- Asia-Pacific will remain a key production hub and expand further into high-end relay applications.

- Hybrid relay solutions may emerge to bridge the gap between mechanical and solid-state performance.

- OEM partnerships will grow to develop custom relays tailored to specific industrial environments.