Market Overview

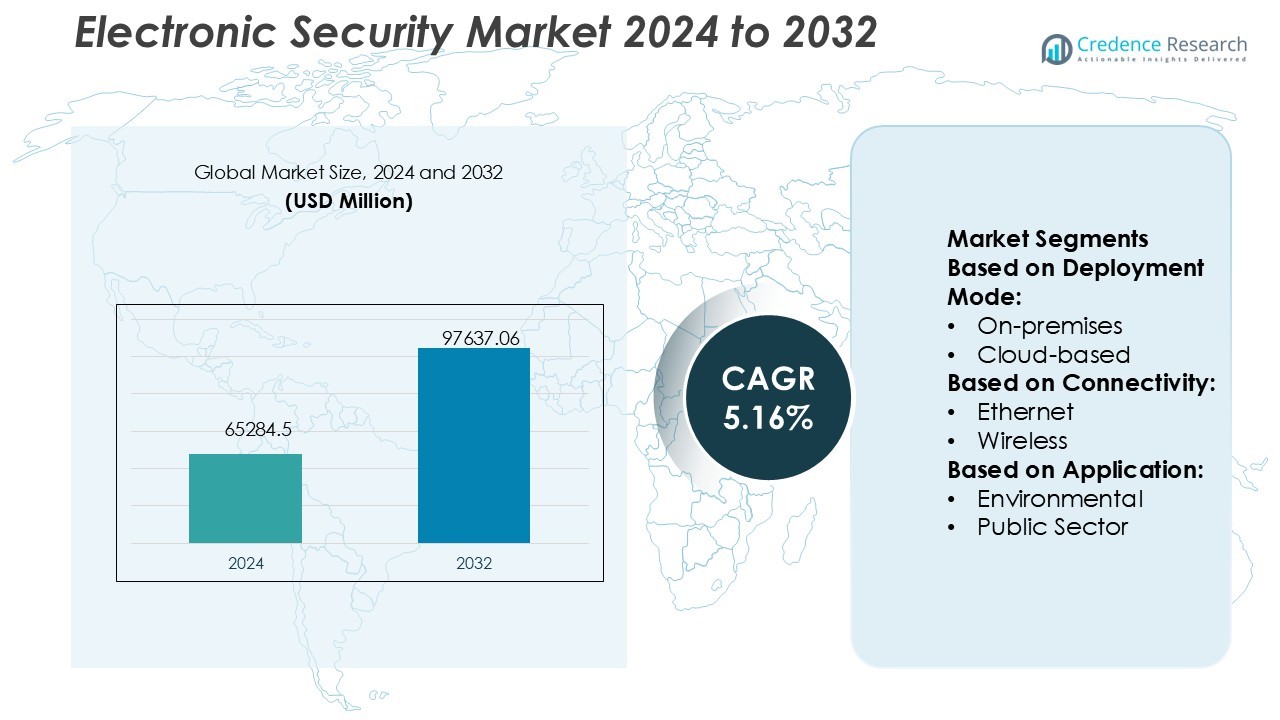

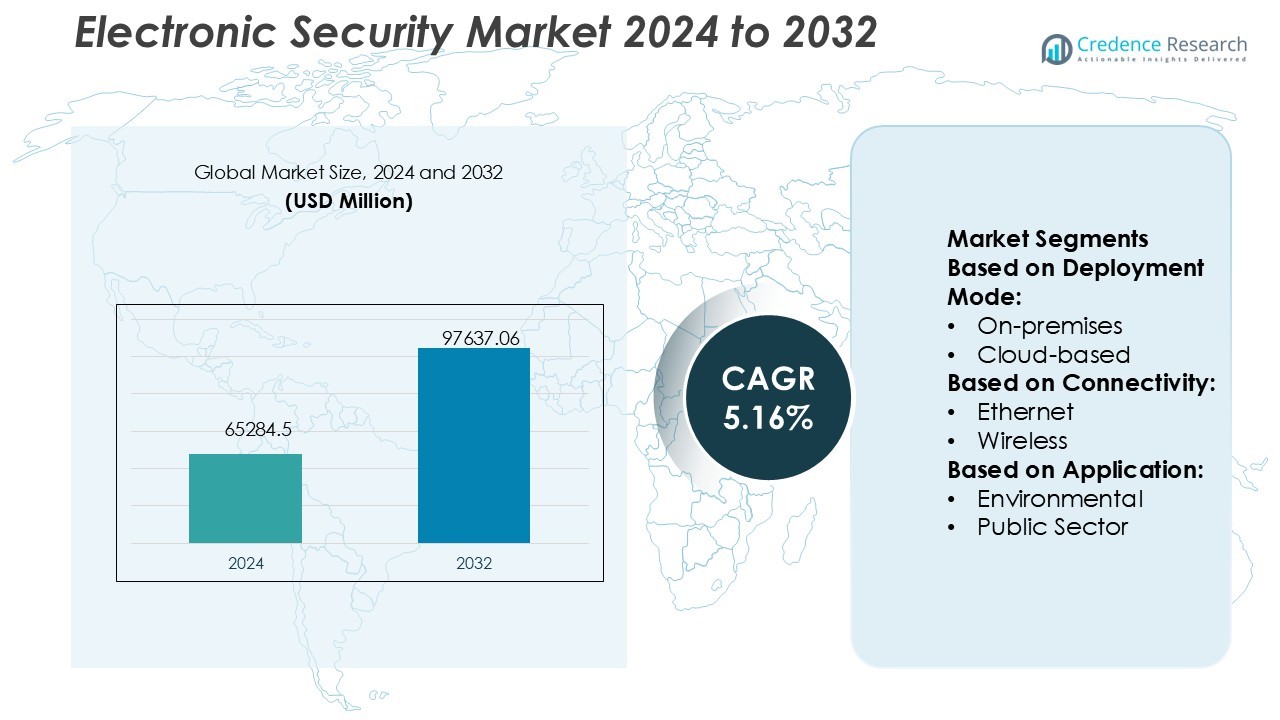

Electronic Security Market size was valued USD 65284.5 million in 2024 and is anticipated to reach USD 97637.06 million by 2032, at a CAGR of 5.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Security Market Size 2024 |

USD 65284.5 Million |

| Electronic Security Market, CAGR |

5.16% |

| Electronic Security Market Size 2032 |

USD 97637.06 Million |

The Electronic Security Market is led by prominent players such as Honeywell International Inc., Johnson Controls, Bosch Security Systems, Hikvision Digital Technology Co., Ltd., Axis Communications AB, Dahua Technology Co., Ltd., Siemens AG, ASSA ABLOY AB, Schneider Electric SE, and ADT Inc. These companies dominate through continuous innovation, advanced product portfolios, and strong global distribution networks. Their focus on AI-based surveillance, cloud-enabled monitoring, and integrated access control systems enhances operational efficiency and safety across industries. North America leads the Electronic Security Market with a 35% market share in 2024, driven by robust technological adoption, regulatory compliance, and growing investments in smart infrastructure and critical facility protection across the United States and Canada.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electronic Security Market was valued at USD 65,284.5 million in 2024 and is projected to reach USD 97,637.06 million by 2032, registering a CAGR of 5.16%.

- Market growth is driven by the increasing need for advanced surveillance, access control, and alarm systems to enhance safety across sectors.

- A key trend includes the integration of AI and cloud technologies that enable real-time monitoring, predictive analytics, and remote management of security systems.

- Leading players such as Honeywell International Inc., Johnson Controls, Bosch Security Systems, and Hikvision Digital Technology Co., Ltd. maintain dominance through innovation and strong global networks.

- North America held the largest share of 35% in 2024, supported by early technology adoption and stringent safety regulations, while the commercial segment led with high adoption in offices, data centers, and critical infrastructure.

Market Segmentation Analysis:

By Deployment Mode

The on-premises segment dominates the Electronic Security Market with a 62% share in 2024. This dominance is driven by organizations prioritizing full control over security infrastructure, data privacy, and compliance with regulatory frameworks. On-premises systems offer better customization and integration with existing IT networks, which is vital for sectors such as government, defense, and banking. Despite the growing adoption of cloud-based solutions, the high reliability and data sovereignty advantages of on-premises deployment continue to make it the preferred choice for mission-critical operations.

- For instance, Epic’s new Comet system has been trained on more than 100 billion de-identified patient medical events drawn from its Cosmos data platform to simulate patient trajectories and forecast outcomes such as length of stay or readmission.

By Connectivity

Ethernet connectivity holds the largest share of 48% in the Electronic Security Market, attributed to its high data transmission speed, stability, and scalability for large-scale surveillance and access control systems. It supports real-time video streaming and centralized monitoring, which are essential for enterprises and government institutions. Ethernet-based systems also enable integration with advanced IP-based cameras and sensors, enhancing situational awareness. The growing demand for smart infrastructure and intelligent building management further strengthens Ethernet’s dominance across commercial and industrial security installations.

- For instance, Athenahealth’s athenaOne platform was migrated to the TEFCA (Trusted Exchange Framework and Common Agreement) network at scale, covering over 160,000 provider organizations, enabling seamless data exchange across hospitals, payers, public health registries, and practices.

By Application

The public sector segment leads the Electronic Security Market with a 34% market share in 2024. This leadership is fueled by rising investments in smart city initiatives, critical infrastructure protection, and government facility security. Advanced surveillance, intrusion detection, and biometric authentication systems are increasingly deployed to enhance public safety and operational efficiency. Additionally, regulatory mandates for digital surveillance and the adoption of centralized command centers across municipalities drive continued demand for electronic security solutions in the public sector.

Key Growth Drivers

Rising Security Concerns and Crime Prevention Initiatives

The increasing incidents of theft, cyberattacks, and terrorism have heightened the need for advanced security systems. Governments and private organizations are investing heavily in surveillance, access control, and alarm systems to safeguard assets and personnel. The integration of analytics and AI-driven monitoring enhances response capabilities and reduces false alarms. This strong focus on safety and crime prevention continues to drive demand across commercial, industrial, and residential sectors globally.

- For instance, Greenway’s Electronic Case Reporting (eCR) automation can drop manual case reporting time from 10 minutes per case to zero by triggering automatic public health report transmissions.

Expansion of Smart Infrastructure and IoT Integration

Rapid urbanization and smart city projects are fueling the adoption of connected electronic security systems. IoT-enabled cameras, sensors, and alarms provide real-time data, enabling predictive threat detection and automated responses. These systems offer better scalability and remote monitoring capabilities, supporting public safety and traffic management. Governments worldwide are incorporating IoT-based security infrastructure to enhance situational awareness and urban resilience, driving significant growth for electronic security solutions.

- For instance, McKesson Medical-Surgical offers over 285,000 national brand medical and surgical products, as well as its own private-label products, through its distribution network, enabling providers to source supplies at scale and variety.

Stringent Government Regulations and Compliance Requirements

Regulatory mandates for security compliance across critical infrastructure, transportation, and data centers are boosting market growth. Governments in developed and developing regions enforce surveillance, data protection, and access control standards to safeguard sensitive areas. This regulatory pressure encourages organizations to adopt certified, advanced security technologies. The increasing focus on digital governance and public safety programs further supports widespread deployment of electronic security systems in both public and private sectors.

Key Trends & Opportunities

Artificial Intelligence and Machine Learning in Security Analytics

AI and machine learning are transforming electronic security by enabling intelligent video analytics and automated threat recognition. Smart surveillance systems can identify unusual patterns, track movements, and issue real-time alerts with higher accuracy. These technologies reduce human intervention and improve incident management efficiency. The growing use of AI-powered platforms in video monitoring, biometric verification, and intrusion detection creates significant opportunities for innovation and cost-effective security operations.

- For instance, CareCloud recently established a Healthcare AI Center of Excellence to build proprietary models in areas such as anomaly detection, clinical insight, and automation. The center launched with an initial team of over 50 AI professionals and is projected to scale to 500 AI professionals by the end of 2025.

Growing Adoption of Cloud-Based and Wireless Security Systems

Cloud-based and wireless systems are gaining traction due to their flexibility, cost efficiency, and ease of remote access. These systems eliminate the need for complex cabling and enable centralized control across multiple sites. Cloud integration also facilitates real-time analytics and data storage for large organizations. As enterprises transition toward digital transformation, the demand for scalable, cloud-enabled security platforms continues to rise, offering new growth opportunities for manufacturers and service providers.

- For instance, the MEDITECH Expanse 2.2 version supports the US Core FHIR R4 API for patient health data exchange, enabling interoperable data flows across systems over web/cloud protocols.

Key Challenges

High Implementation and Maintenance Costs

The high upfront investment required for advanced electronic security systems remains a major barrier for small and medium enterprises. Installation, integration, and continuous maintenance of surveillance networks, sensors, and access systems increase total ownership costs. Furthermore, upgrading to AI- and IoT-enabled solutions adds to financial strain. These expenses often delay adoption in cost-sensitive markets, limiting the overall growth potential despite rising security needs.

Cybersecurity and Data Privacy Risks

As electronic security systems become increasingly connected, they face heightened risks of hacking, data breaches, and unauthorized access. Compromised security networks can expose sensitive surveillance footage and personal data. Organizations must implement strong encryption, network security protocols, and regular vulnerability assessments. However, ensuring end-to-end cybersecurity across large, interconnected systems poses challenges, especially for sectors managing critical national infrastructure and confidential information.

Regional Analysis

North America

North America dominates the Electronic Security Market with a 35% share in 2024, supported by strong technological adoption and high security awareness. The United States leads the region due to extensive deployment of surveillance, access control, and cybersecurity systems across commercial and government sectors. Growing investments in smart city projects and critical infrastructure protection further boost demand. Canada also contributes significantly, driven by stringent building safety regulations and smart building integration. The presence of leading companies such as Honeywell, Johnson Controls, and Cisco strengthens North America’s position as a global innovation hub for electronic security.

Europe

Europe holds a 28% share of the Electronic Security Market, driven by strict data privacy laws and regulatory frameworks such as GDPR. Countries like Germany, the U.K., and France emphasize security modernization in industrial facilities and transportation hubs. The European Union’s focus on public safety and sustainable urban development encourages the adoption of intelligent surveillance and biometric systems. Rising terrorism threats and increased government spending on defense infrastructure continue to stimulate demand. Technological partnerships and R&D initiatives within the region further enhance Europe’s competitiveness in smart and energy-efficient security solutions.

Asia Pacific

Asia Pacific accounts for a 25% market share, emerging as the fastest-growing region in the Electronic Security Market. Strong economic expansion, rapid urbanization, and government-led smart city programs in China, India, Japan, and South Korea are key drivers. The rising need for perimeter security and intelligent monitoring in residential and commercial spaces accelerates adoption. Local manufacturers and tech startups are integrating AI and IoT into affordable solutions, expanding access to mid-tier markets. With growing investments in public infrastructure and increasing security awareness, Asia Pacific is expected to witness sustained double-digit growth through the forecast period.

Latin America

Latin America represents an 8% share of the Electronic Security Market, supported by growing investments in urban surveillance and critical infrastructure security. Brazil and Mexico are leading adopters due to rising crime rates and increased government focus on public safety initiatives. The expansion of commercial facilities and transportation systems also boosts demand for advanced access control and monitoring solutions. However, economic instability and budget constraints limit large-scale implementations in some nations. Despite these challenges, the region’s gradual digital transformation presents opportunities for cost-effective, cloud-based, and wireless security systems.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the Electronic Security Market, driven by large-scale infrastructure and smart city developments. The United Arab Emirates and Saudi Arabia are key markets, investing heavily in integrated surveillance and biometric systems for airports, government buildings, and mega-projects. Africa is witnessing gradual adoption through investments in public safety and critical infrastructure modernization. Increasing geopolitical tensions and efforts to protect energy assets are fueling regional demand. As governments prioritize national security and digital transformation, the adoption of electronic security systems is expected to accelerate steadily.

Market Segmentations:

By Deployment Mode:

By Connectivity:

By Application:

- Environmental

- Public Sector

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The key players in the Electronic Security Market include CureMD Healthcare, Epic Systems Corporation, Modernizing Medicine, Athenahealth, Inc., Greenway Health, LLC, AdvancedMD, Inc., McKesson Medical-Surgical Inc., eClinicalWorks, CareCloud, Inc., and Medical Information Technology, Inc. The Electronic Security Market is highly competitive, characterized by rapid technological advancements and continuous innovation. Companies focus on developing integrated surveillance, access control, and intrusion detection systems that leverage AI, IoT, and cloud computing to enhance performance and scalability. The market is driven by rising demand for intelligent monitoring, cybersecurity resilience, and energy-efficient systems across commercial, residential, and government sectors. Firms are expanding through strategic alliances, mergers, and R&D investments to strengthen product portfolios and global reach. Competitive differentiation increasingly depends on real-time data analytics, system interoperability, and cost-effective security solutions tailored to diverse end-user requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, the Trump Administration introduced a new initiative allowing Americans to share their medical records across various tech-managed apps, despite concerns about potential data security risks.

- In July 2025, the Delhi government introduced an expanded Health Information Management System (HIMS) to facilitate online appointment booking for patients, a significant move towards digital healthcare.

- In October 2024, Oracle launched a brand-new electronic health record, its most significant health-care product update, where the latest EHR is equipped with cloud and artificial intelligence capabilities that will make it easier to navigate and set up.

- In June 2024, Docplix, a health-tech firm in New Delhi, India, secured INR 1.2 crore in a Bridge Round spearheaded by Inflection Point Ventures. The company plans to channel the funds into product development, AI integration, and broadening its market presence. This strategy includes upgrading the EHR system with cutting-edge AI features to bolster decision-making and patient care and extending innovative healthcare solutions to larger clinics and hospitals.

Report Coverage

The research report offers an in-depth analysis based on Deployment Mode, Connectivity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by increasing demand for smart surveillance systems.

- AI and machine learning integration will enhance predictive threat detection and automated responses.

- Cloud-based security solutions will gain strong traction for remote monitoring and scalability.

- IoT-enabled devices will improve real-time data collection and networked security management.

- Governments will continue enforcing strict compliance standards for public and private security infrastructure.

- The adoption of biometric authentication will expand across corporate and residential sectors.

- Cybersecurity integration will become essential to protect connected security systems from digital threats.

- Investments in smart city and infrastructure modernization projects will boost market expansion.

- Wireless and energy-efficient systems will gain popularity for ease of installation and low maintenance.

- Partnerships and technological collaborations will drive innovation and global market penetration.