| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Cyber Physical Systems Market Size 2024 |

USD 43938.91 Million |

| North America Cyber Physical Systems Market, CAGR |

10.08% |

| North America Cyber Physical Systems Market Size 2032 |

USD 94744.42 Million |

Market Overview:

The North America Cyber Physical Systems Market is projected to grow from USD 43938.91 million in 2024 to an estimated USD 94744.42 million by 2032, with a compound annual growth rate (CAGR) of 10.08%from 2024 to 2032.

Key drivers fueling the CPS market in North America include the integration of Internet of Things (IoT) devices, advancements in artificial intelligence (AI), and the pursuit of smart manufacturing and automation solutions. These technologies enhance real-time data processing, predictive analytics, and operational efficiency across sectors such as manufacturing, healthcare, transportation, and energy. The emphasis on cybersecurity also plays a crucial role, ensuring the integrity and reliability of CPS implementations. Government initiatives and substantial investments in research and development further bolster the adoption of CPS technologies, aiming to foster innovation and maintain a competitive edge in the global market.

Regionally, North America leads the CPS market, with projections indicating the region will account for 30% of the global market share in 2024. This dominance is underpinned by a combination of factors, including advanced technological infrastructure, significant investments in IoT and AI, and a strong focus on digital transformation across various industries. The presence of major CPS solution providers and a collaborative ecosystem between industry and research institutions contribute to the region’s leadership. While North America currently holds the largest share, the Asia-Pacific region is anticipated to exhibit the highest growth rate, driven by rapid industrialization, urbanization, and increasing investments in smart infrastructure. Countries like China, India, and Japan are actively adopting CPS technologies to enhance manufacturing capabilities, transportation systems, and energy management, thereby contributing to the dynamic evolution of the global CPS landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Cyber Physical Systems is projected to grow from USD 43938.91 million in 2024 to an estimated USD 94744.42 million by 2032, with a compound annual growth rate (CAGR) of 10.08%from 2024 to 2032.

- The Global Cyber Physical Systems is projected to grow from USD 1,25,271.30 million in 2024 to an estimated USD 2,71,668.59 million by 2032, with a compound annual growth rate (CAGR) of 10.16% from 2024 to 2032.

- Key drivers include the integration of IoT devices, advancements in AI, and the increasing shift towards smart manufacturing and automation solutions.

- Government initiatives and investments in R&D, particularly for smart cities and infrastructure, are fueling CPS adoption in the region.

- The healthcare sector is expanding its use of CPS for real-time monitoring, predictive health analytics, and personalized care solutions.

- Strong cybersecurity measures are essential, as CPS systems in critical infrastructure sectors face increasing threats from cyberattacks and data breaches.

- Despite growth, the high initial investment and complexity of system integration remain significant barriers to widespread CPS adoption.

- North America continues to lead the global CPS market, with a 30% market share in 2024, though the Asia-Pacific region is poised for rapid growth.

Market Drivers:

Technological Advancements and Innovation

The rapid evolution of technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning, is one of the primary drivers of the Cyber-Physical Systems (CPS) market in North America. For example, real-time data processing capabilities enable CPS to swiftly analyze information from sensors and actuators, facilitating instant responses to changing physical conditions. These innovations enable real-time data processing, predictive analytics, and automated decision-making, which are fundamental components of CPS. With industries such as manufacturing, healthcare, and transportation increasingly integrating CPS solutions, the demand for smarter, more efficient systems continue to grow. Furthermore, the continuous improvements in sensors, embedded systems, and connectivity protocols further accelerate the adoption of CPS technologies, enhancing operational efficiency across sectors.

Industry 4.0 and Smart Manufacturing

The shift toward Industry 4.0 is significantly contributing to the expansion of the CPS market in North America. Industry 4.0, characterized by the fusion of digital, physical, and biological systems, has led to the widespread implementation of CPS in manufacturing processes. CPS allows for real-time monitoring, predictive maintenance, and automated control of production systems, driving down costs and improving quality. As manufacturers seek to modernize and enhance productivity, the integration of CPS becomes crucial. The ability to automate processes and collect actionable insights from operational data helps companies maintain a competitive edge in a fast-evolving market.

Government Initiatives and Investment

Government policies and funding play a pivotal role in fostering the growth of the CPS market in North America. In both the United States and Canada, significant investments have been directed towards research, development, and implementation of CPS technologies, particularly within smart cities and infrastructure projects. For instance, the U.S. Department of Energy awarded CPS Technologies Corporation a grant for research on modular radiation shielding for microreactors, showcasing the government’s commitment to advancing CPS applications. Federal and state-level programs, such as the Smart Cities Initiative and various grants for digital transformation, support the adoption of CPS solutions. These investments not only drive innovation but also encourage public-private partnerships, enabling a faster and more effective roll-out of cyber-physical systems in diverse sectors.

Enhanced Cybersecurity Measures

As CPS systems become more integrated into critical infrastructure and industries, ensuring the security and reliability of these systems has become a major concern. North America has seen a surge in the demand for robust cybersecurity solutions tailored to CPS, driven by the increasing threat of cyberattacks and data breaches. This growing focus on cybersecurity is a key market driver, as businesses and governments alike seek to protect sensitive information and ensure system integrity. The integration of advanced security protocols within CPS frameworks is critical to preventing disruptions in services and maintaining trust among users and stakeholders. The push for cybersecurity advancements continues to fuel the growth of the CPS market, ensuring that these systems remain safe and dependable as they become more ubiquitous.

Market Trends:

Integration of Artificial Intelligence and Edge Computing

The convergence of artificial intelligence (AI) and edge computing with Cyber-Physical Systems (CPS) is a notable trend in North America. For example, edge computing reduces latency to under 5 milliseconds, a critical improvement for real-time applications such as autonomous vehicles and industrial automation. By processing data closer to its source, edge computing reduces latency, which is crucial for real-time applications such as autonomous vehicles and industrial automation. This integration enhances the responsiveness and efficiency of CPS, enabling more sophisticated data analytics and decision-making processes. As AI algorithms become more advanced, their deployment at the edge facilitates immediate data processing, leading to improved system performance and reliability.

Expansion in Healthcare Applications

In the healthcare sector, CPS technologies are increasingly utilized for patient monitoring and management. Wearable devices equipped with sensors collect vital health data, which CPS platforms analyze to detect anomalies and predict health events. This proactive approach allows for early intervention and personalized treatment plans. The integration of CPS in healthcare not only enhances patient outcomes but also optimizes operational efficiencies within medical facilities. The growing adoption of telemedicine and remote patient monitoring further drives the demand for CPS solutions tailored to healthcare needs.

Advancements in Autonomous Transportation

The transportation industry in North America is witnessing significant advancements through the adoption of CPS technologies. Autonomous vehicles rely heavily on CPS for real-time data processing from sensors and communication systems to navigate safely and efficiently. For instance, autonomous vehicles generate approximately 1 GB of data per second, requiring immediate processing to ensure safety and efficiency. This technology integration enhances vehicle-to-vehicle and vehicle-to-infrastructure communication, leading to improved traffic management and reduced congestion. As regulatory frameworks evolve to accommodate autonomous transportation, the implementation of CPS is expected to become more widespread, transforming mobility and logistics sectors.

Development of Smart Grids and Energy Management

The energy sector is embracing CPS to develop smart grids that enhance the distribution and consumption of electricity. CPS-enabled smart grids facilitate real-time monitoring of energy usage, integration of renewable energy sources, and dynamic response to demand fluctuations. This technology supports the efficient management of energy resources, reduces waste, and improves the resilience of power systems against disruptions. As North America transitions towards more sustainable energy solutions, CPS plays a critical role in optimizing energy infrastructure and supporting the integration of smart technologies in the grid.

Market Challenges Analysis:

High Initial Costs and Investment Requirements

One of the key challenges facing the adoption of Cyber-Physical Systems (CPS) in North America is the high initial investment required for implementation. The integration of advanced technologies such as IoT, AI, and edge computing into existing systems can be costly. Many organizations face financial barriers, especially small and medium-sized enterprises, that struggle to justify the upfront costs of CPS infrastructure, including sensors, hardware, software, and skilled personnel. While CPS can offer long-term operational savings and efficiency gains, the initial investment remains a significant restraint.

Complexity in System Integration

Integrating CPS technologies into legacy systems presents technical hurdles for many organizations. Legacy systems often lack compatibility with modern CPS components such as sensors, controllers, and communication networks. For example, adapting infrastructure to accommodate CPS technologies requires substantial resources and can lead to operational disruptions during the transition3. Furthermore, ensuring seamless data interoperability between various CPS components remains a major challenge, as organizations must address compatibility issues across diverse systems while maintaining efficiency

Data Privacy and Security Concerns

As CPS systems collect vast amounts of sensitive data, the risks associated with data breaches and cyberattacks become a growing concern. Cybersecurity threats pose significant challenges to the integrity and functionality of CPS solutions, particularly when they are deployed in critical sectors such as healthcare, manufacturing, and transportation. Ensuring robust data privacy and security protocols is essential but can be complex and costly. Companies must invest in continuous security measures and compliance with regulations, which can slow the adoption of CPS, particularly in industries with stringent security requirements.

Lack of Skilled Workforce

The shortage of professionals with the required expertise in CPS technologies is another challenge. As demand for CPS solutions grows, organizations face difficulties in recruiting and retaining skilled workers capable of designing, implementing, and maintaining these systems. This skills gap impedes the pace of innovation and adoption in various industries, slowing down the widespread implementation of CPS.

Market Opportunities:

The North American Cyber-Physical Systems (CPS) market presents significant opportunities driven by advancements in automation, IoT, artificial intelligence, and smart infrastructure. As industries across manufacturing, healthcare, transportation, and energy continue to prioritize digital transformation, CPS offers the potential to streamline operations, reduce costs, and enhance efficiency. The increasing demand for smart manufacturing solutions and the rise of Industry 4.0 create a fertile environment for CPS applications, especially in the industrial sector. These systems enable real-time data analytics, predictive maintenance, and automated decision-making, providing organizations with the tools to improve productivity and operational agility. Moreover, the growing focus on sustainability and energy efficiency in North America presents opportunities for CPS solutions to optimize energy use and integrate renewable sources within smart grids, enhancing energy management and reducing waste.

Additionally, the healthcare sector presents a notable opportunity for CPS growth, as the demand for remote monitoring, telemedicine, and personalized care continues to rise. CPS technologies enable better patient care management, with systems that provide real-time health data monitoring and predictive analytics. The shift towards autonomous transportation further opens new avenues, as the integration of CPS in vehicles supports safer, more efficient transportation networks. With ongoing investments in research and development, and increasing government initiatives supporting the adoption of smart technologies, CPS solutions are positioned to play a pivotal role in North America’s digital future. The continued evolution of these systems, coupled with enhanced cybersecurity measures, provides vast growth potential in both established and emerging sectors.

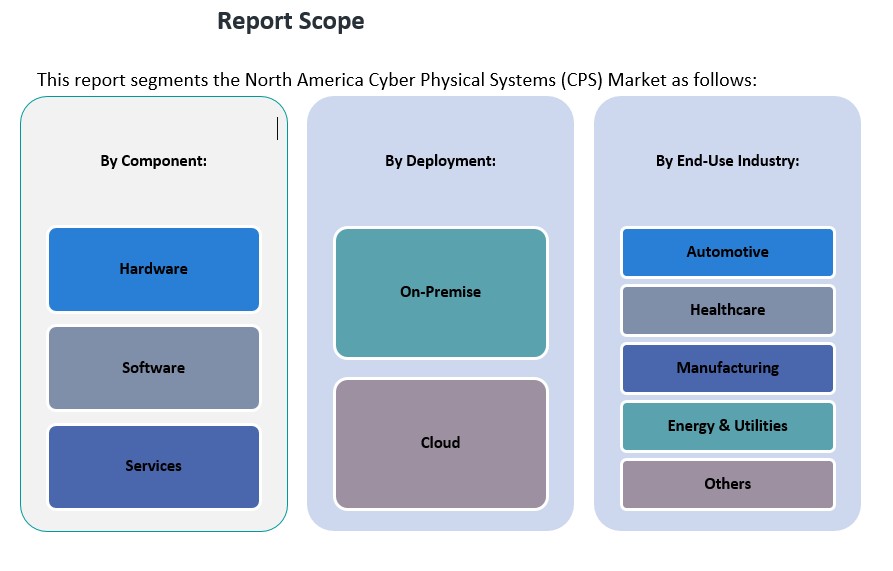

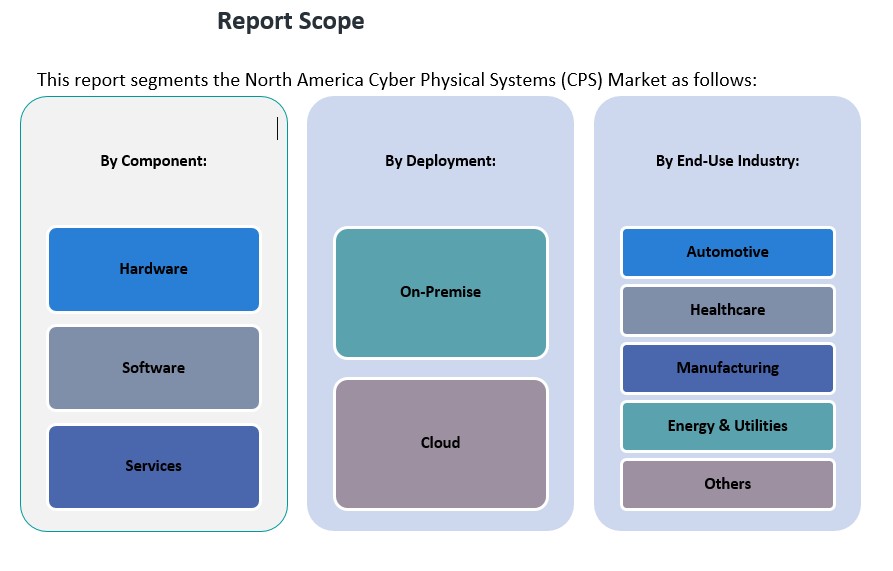

Market Segmentation Analysis:

The North American Cyber-Physical Systems (CPS) market is categorized into several key segments that drive its growth across different industries.

By Component

The CPS market is primarily divided into hardware, software, and services. Hardware holds a significant share, driven by the demand for advanced sensors, embedded systems, and processing units essential for CPS implementations. Software is another key segment, focusing on the development of IoT platforms, AI algorithms, and data analytics tools that enable real-time decision-making. Services, including system integration, maintenance, and consulting, also play a vital role, helping businesses optimize and scale their CPS solutions.

By Deployment

CPS solutions in North America are deployed either on-premise or through the cloud. On-premise deployments are common in industries where data privacy, security, and high control over operations are critical, such as manufacturing and healthcare. However, cloud-based deployments are gaining traction due to their scalability, flexibility, and reduced infrastructure costs, particularly in sectors like automotive and energy, where real-time data access and remote monitoring are essential.

By End-Use Industry

The automotive sector is rapidly adopting CPS to enhance vehicle automation, safety, and connectivity. Healthcare is another prominent sector leveraging CPS for real-time patient monitoring, telemedicine, and predictive analytics. Manufacturing, driven by Industry 4.0, is increasingly utilizing CPS for smart factories, predictive maintenance, and automated processes. The energy and utilities sector benefits from CPS for smart grid management, energy optimization, and predictive analytics. Other industries, including agriculture and transportation, are also incorporating CPS to drive efficiency and innovation.

Segmentation:

By Component:

- Hardware

- Software

- Services

By Deployment:

By End-Use Industry:

- Automotive

- Healthcare

- Manufacturing

- Energy & Utilities

- Others

Regional Analysis:

North America stands as a leader in the global Cyber-Physical Systems (CPS) market, accounting for a significant share of the overall market. As of 2023, the region is estimated to represent approximately 30% of the global CPS market, and this figure is expected to continue to grow due to technological advancements and a robust industrial infrastructure. The United States, in particular, holds the largest share within North America, driven by its substantial investments in smart manufacturing, Internet of Things (IoT), artificial intelligence (AI), and automation technologies. Canada also plays a pivotal role, with a focus on developing sustainable energy solutions and smart city projects, further contributing to the region’s growth.

The North American CPS market is primarily driven by the manufacturing, healthcare, transportation, and energy sectors. In manufacturing, CPS is a key component of Industry 4.0 initiatives, facilitating smart factories that enhance productivity, reduce downtime, and optimize production processes. The healthcare sector benefits from CPS technologies through real-time patient monitoring, predictive health analytics, and remote healthcare services, which contribute to better patient outcomes and operational efficiencies. Similarly, in transportation, the rise of autonomous vehicles and smart transportation systems is a critical driver of CPS adoption, as these systems enable safer, more efficient mobility solutions. In the energy sector, the shift towards smart grids powered by CPS technologies enables better energy distribution, integration of renewable resources, and improved management of energy consumption.

Government initiatives and funding also play a crucial role in supporting the growth of CPS technologies in North America. In both the United States and Canada, national and regional governments have introduced policies and grants to promote the development of smart technologies, including CPS. These initiatives focus on advancing digital infrastructure, enhancing cybersecurity protocols, and fostering innovation across key industries, further accelerating the adoption of CPS solutions.

Although North America is currently the largest market for CPS, other regions such as Europe and Asia-Pacific (APAC) are experiencing rapid growth. APAC, driven by countries like China, Japan, and South Korea, is expected to see the highest growth rate, fueled by industrial expansion and increasing investment in smart infrastructure. However, North America’s market leadership is likely to persist, given its strong technological capabilities, early adoption of CPS technologies, and ongoing investments in innovation.

Key Player Analysis:

- IBM Corporation

- Honeywell International Inc.

- Rockwell Automation, Inc.

- General Electric Company

- Microsoft Corporation

- Intel Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Cisco Systems, Inc.

- 3M Company

Competitive Analysis:

The North American Cyber-Physical Systems (CPS) market is highly competitive, characterized by the presence of both established technology giants and emerging players across various industries. Key players in the market include companies such as Intel Corporation, IBM, Siemens, Rockwell Automation, and Honeywell, which provide a range of CPS solutions catering to manufacturing, healthcare, energy, and transportation sectors. These companies leverage their extensive research and development capabilities to innovate and offer advanced CPS technologies, including IoT, AI, and edge computing, ensuring real-time data processing and operational efficiency. The market also sees competition from specialized players focusing on specific CPS applications, such as autonomous systems, smart grids, and healthcare solutions. Strategic partnerships, mergers, and acquisitions are common in this space, as companies aim to expand their product portfolios and enhance technological capabilities. With increasing demand for digital transformation across industries, competition will continue to intensify, driving innovation and efficiency within the market.

Recent Developments:

- On March 31, 2025, Siemens AG announced the formation of the Accenture Siemens Business Group at Hannover Messe 2025. This partnership aims to transform engineering and manufacturing by combining Siemens’ industrial AI and automation technologies with Accenture’s data and AI expertise. The group will employ 7,000 professionals globally to develop software-defined products and factories, leveraging Siemens Xcelerator portfolio and Accenture’s AI capabilities.

- In Oct 2024, Phosphorus Cybersecurity Inc., a leader in unified security management for xIoT devices, announced its strategic expansion into the Asia Pacific and Japan (APJ) region. This move is driven by the region’s rapid growth in cyber-physical systems and increasing cybersecurity challenges.

- On March 6, 2025, Armis, a prominent cyber exposure management company, acquired OTORIO, a leading provider of operational technology (OT) and cyber-physical system (CPS) security. OTORIO’s Titan platform will now be integrated into Armis’ Centrix™ cloud-based platform, expanding its capabilities to include on-premises CPS solutions for air-gapped environments.

- In February 2025, Nozomi Networks was recognized as a Leader in the 2025 Gartner Magic Quadrant for CPS Protection Platforms. This accolade highlights Nozomi’s expertise in OT, IoT, and CPS security, particularly its AI-powered platform for asset discovery, threat detection, and vulnerability management. The recognition underscores Nozomi’s commitment to securing critical infrastructure and enhancing resilience against evolving cyber threats.

Market Concentration & Characteristics:

The North American Cyber-Physical Systems (CPS) market exhibits moderate concentration, with a mix of dominant multinational corporations and emerging players. Large, established firms such as Intel Corporation, IBM, Honeywell, and Siemens dominate the market, leveraging their vast resources in research, development, and technological infrastructure to maintain leadership. These companies focus on providing end-to-end CPS solutions across various industries, including manufacturing, healthcare, energy, and transportation. Their offerings often combine IoT, AI, and edge computing to deliver advanced automation, data analytics, and real-time decision-making capabilities. In addition to these large players, there is a growing presence of specialized companies targeting niche sectors or offering specific CPS applications, such as autonomous systems, smart grids, and industrial automation. The market is characterized by rapid innovation, with firms investing heavily in R&D to differentiate their products and stay ahead of the competition. Strategic partnerships, acquisitions, and collaborations are also common to expand capabilities and market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Component, Deployment and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North American CPS market is expected to continue growing steadily in the coming years.

- Increased adoption of Industry 4.0 technologies will drive demand for CPS solutions in manufacturing, improving automation and efficiency.

- Healthcare applications of CPS will expand, particularly in remote monitoring, telemedicine, and predictive health analytics.

- The integration of CPS in autonomous vehicles will contribute to the development of safer and more efficient transportation systems.

- Smart grid technologies will see broader adoption, enhancing energy distribution and supporting the use of renewable energy sources.

- Rising investments in AI, IoT, and edge computing will further boost the development and deployment of CPS solutions.

- North America will maintain its leadership in CPS innovation, supported by favorable government policies and funding initiatives.

- CPS adoption will increase in urban development projects, contributing to the growth of smart cities with interconnected infrastructure.

- Advancements in cybersecurity will be crucial to ensure the secure implementation of CPS across industries dealing with sensitive data.

- Smaller companies will play an increasingly important role in specialized sectors, offering CPS solutions tailored to emerging applications.