| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Cyber Physical Systems Market Size 2024 |

USD 3159.09 Million |

| Mexico Cyber Physical Systems Market, CAGR |

8.69% |

| Mexico Cyber Physical Systems Market Size 2032 |

USD 6152.46 Million |

Market Overview:

The Mexico Cyber Physical Systems Market is projected to grow from USD 3159.09 million in 2024 to an estimated USD 6152.46 million by 2032, with a compound annual growth rate (CAGR) of 8.69% from 2024 to 2032.

The growth of Cyber-Physical Systems (CPS) in Mexico is driven by several key factors that are reshaping various industries. One of the primary drivers is the increasing focus on industrial automation. As manufacturers seek to improve efficiency, reduce downtime, and enhance production quality, CPS technologies are becoming essential for integrating physical systems with real-time data and computational algorithms. Another significant factor is the advancements in technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and machine learning. These innovations enhance the capabilities of CPS, enabling smarter, more efficient systems that are being widely adopted across sectors such as manufacturing, healthcare, and transportation. Furthermore, the growing emphasis on smart infrastructure is a catalyst for CPS adoption, as urban areas in Mexico are increasingly transitioning to smart cities and buildings, requiring intelligent systems to manage energy, traffic, and resources more effectively.

Mexico’s Cyber-Physical Systems market is primarily concentrated in its urban centers, with Mexico City standing out as a key driver of adoption due to its role as the country’s financial and technological hub. The dense concentration of data centers, corporate headquarters, and technological infrastructure in Mexico City fosters an environment conducive to the deployment of CPS technologies. Additionally, the city’s increasing push towards smart infrastructure and its growing focus on sustainability are accelerating the demand for these advanced systems. Other regions, such as Querétaro, are also gaining traction in the CPS market. The city’s strategic location, coupled with its modern infrastructure, makes it an attractive destination for both local and international companies seeking to implement CPS solutions. Furthermore, government initiatives and stricter security regulations are fueling the growth of the CPS market in these regions, as industries look to meet compliance standards while enhancing operational efficiency through intelligent, integrated systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Mexico Cyber Physical Systems is projected to grow from USD 3159.09 million in 2024 to an estimated USD 6152.46 million by 2032, with a compound annual growth rate (CAGR) of 8.69% from 2024 to 2032.

- The Global Cyber Physical Systems is projected to grow from USD 1,25,271.30 million in 2024 to an estimated USD 2,71,668.59 million by 2032, with a compound annual growth rate (CAGR) of 10.16% from 2024 to 2032.

- Industrial automation is a primary driver, with CPS technology becoming essential for manufacturing industries seeking efficiency, reduced downtime, and enhanced quality.

- The integration of IoT, AI, and machine learning significantly enhances CPS capabilities, leading to smarter, more efficient systems across multiple sectors.

- Government initiatives focused on modernizing infrastructure and supporting smart city development are accelerating CPS adoption, with a particular emphasis on energy efficiency and urban mobility.

- CPS is increasingly used to optimize energy distribution, particularly through the implementation of smart grids and renewable energy solutions.

- While the market presents growth opportunities, high initial investment costs and integration complexities remain key challenges for businesses, especially SMEs.

- Regional concentration of CPS technologies is evident in urban centers like Mexico City and Querétaro, which serve as hubs for technological infrastructure and adoption.

Market Drivers:

Industrial Automation and Smart Manufacturing

In Mexico, the increasing push for industrial automation is a significant driver of the Cyber-Physical Systems (CPS) market. As manufacturing industries strive for greater efficiency and precision, the need for advanced technologies to integrate physical and computational systems has become paramount. CPS plays a crucial role in automating production processes, enabling real-time monitoring, control, and optimization. This transformation leads to reduced downtime, improved quality control, and enhanced operational efficiency. As industries such as automotive, electronics, and consumer goods continue to expand in Mexico, the demand for CPS solutions to streamline manufacturing processes is expected to grow significantly.

Technological Advancements and Connectivity

Technological advancements in the fields of the Internet of Things (IoT), Artificial Intelligence (AI), and machine learning are key drivers of CPS adoption in Mexico. These technologies empower CPS to function as intelligent systems capable of analyzing large amounts of data and making real-time decisions. The integration of IoT allows devices and machines to communicate with one another, facilitating seamless operations and process optimization. For instance, companies like Flexbaze are leveraging IoT devices and Industry 4.0 expertise to enhance real-time data collection and analysis in manufacturing. Additionally, AI and machine learning algorithms enable CPS to predict potential system failures, optimize resource usage, and improve decision-making. As Mexico continues to invest in digital infrastructure, these advancements will play an increasingly central role in the widespread adoption of CPS across various sectors.

Government Initiatives and Regulatory Support

Government initiatives aimed at modernizing infrastructure and encouraging digital transformation are another important driver of the CPS market in Mexico. In recent years, the Mexican government has launched various programs to support the development of smart cities and the digitalization of key industries. These initiatives often include investments in digital infrastructure, energy efficiency, and urban mobility, which directly align with the capabilities of CPS. Furthermore, stricter regulatory requirements regarding data security, energy consumption, and sustainability are driving businesses to adopt CPS technologies to ensure compliance. As regulations become more stringent, CPS offers an effective solution for businesses to meet legal requirements while improving operational efficiency.

Energy Efficiency and Sustainability Goals

Energy efficiency and sustainability are major concerns in Mexico, prompting the adoption of CPS to optimize energy use and reduce environmental impact. With the growing demand for renewable energy sources and smart grid solutions, CPS technologies are critical for monitoring, controlling, and optimizing energy distribution in real time. For instance, programs like the National Programme for Sustainable Use of Energy (PRONASE) aim to reduce energy intensity through measures such as smart grids that rely on CPS for real-time electricity distribution management. Smart grids, which rely on CPS to manage the flow of electricity and integrate renewable sources, are becoming increasingly prevalent in Mexico. Additionally, CPS facilitates energy-saving measures in manufacturing facilities, buildings, and urban infrastructure, aligning with global sustainability efforts. As Mexico focuses on reducing its carbon footprint and improving energy efficiency, the demand for CPS technologies in the energy sector is expected to rise, driving market growth.

Market Trends:

Adoption of Smart Cities and Infrastructure

A key market trend driving the adoption of Cyber-Physical Systems (CPS) in Mexico is the increasing focus on smart cities and intelligent infrastructure. The government, along with private entities, is investing in projects to modernize urban areas by integrating digital solutions for traffic management, energy optimization, and public services. For example, Mexico City has implemented the “Connectivity Master Plan,” which focuses on expanding digital infrastructure and fostering sustainable growth. These smart city initiatives aim to create more sustainable, efficient, and livable environments. CPS technologies enable real-time monitoring and control of urban systems, improving traffic flow, reducing energy consumption, and enhancing safety. In cities like Mexico City, Guadalajara, and Monterrey, the integration of CPS for urban management is expected to increase in the coming years, as demand for modern, interconnected systems continues to rise.

Growth in the Industrial Internet of Things (IIoT)

The Industrial Internet of Things (IIoT) is another significant trend driving the CPS market in Mexico. The increasing interconnectivity of machines, devices, and sensors within manufacturing and industrial environments is transforming traditional operations. CPS technologies enable real-time data collection and analysis, providing companies with the ability to monitor performance, detect anomalies, and optimize resource utilization. Mexico’s industrial sectors, particularly automotive and manufacturing, are increasingly adopting IIoT solutions to streamline operations, reduce costs, and improve product quality. This trend is expected to continue as the country’s manufacturing sector grows, with CPS playing an essential role in the evolution of smart factories and production facilities.

Integration with Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) with Cyber-Physical Systems is becoming a defining trend in Mexico. These technologies allow CPS to go beyond simple monitoring and control to offer predictive analytics and autonomous decision-making capabilities. AI algorithms can analyze vast amounts of data collected by CPS devices to predict system failures, optimize processes, and enhance efficiency. In industries such as healthcare, automotive, and energy, the combination of CPS with AI and ML is helping businesses make data-driven decisions that improve operations and drive innovation. As the demand for more intelligent and adaptive systems increases, the adoption of AI-integrated CPS is set to rise significantly in Mexico.

Focus on Sustainability and Green Technologies

Sustainability is increasingly becoming a key trend in Mexico’s CPS market. As global and national environmental concerns grow, industries are focusing on reducing their carbon footprints and optimizing energy usage. CPS technologies are central to this transformation by enabling more efficient energy management, integrating renewable energy sources, and reducing waste. For example, CPS-enabled smart grids allow for real-time monitoring of energy consumption, facilitating the integration of solar and wind power into the national grid. Additionally, manufacturing facilities are adopting CPS solutions to minimize their environment. The growing adoption of smart grids, energy-efficient buildings, and sustainable manufacturing processes is a testament to this trend. In Mexico, there is a notable shift toward adopting CPS solutions that support sustainability, especially within the energy, manufacturing, and urban development sectors. As the country aims to meet its environmental targets, CPS will play a crucial role in driving the adoption of green technologies and sustainable practices.

Market Challenges Analysis:

High Initial Investment Costs

One of the primary challenges facing the adoption of Cyber-Physical Systems (CPS) in Mexico is the high initial investment required for their implementation. The integration of advanced technologies such as sensors, real-time data analytics, and automation tools can be capital-intensive, especially for small and medium-sized enterprises (SMEs). For many companies, the upfront costs of deploying CPS, along with the expenses associated with training personnel and maintaining systems, may pose a significant financial burden. While the long-term benefits of CPS, such as improved efficiency and reduced operational costs, are clear, the initial investment remains a barrier for businesses with limited budgets.

Technological Complexity and Integration

The complexity of CPS technologies and the challenges associated with their integration into existing systems is another key restraint in Mexico. Many industries in the country still rely on legacy systems that are not compatible with the latest CPS solutions. The process of integrating new technologies with older infrastructure can be time-consuming, costly, and technically challenging. Additionally, ensuring the seamless communication and coordination between physical devices and digital platforms is crucial for the effective functioning of CPS. This technological complexity can deter businesses from adopting CPS solutions, especially when they lack the expertise or resources to manage the integration process.

Data Security and Privacy Concerns

Data security and privacy concerns are significant challenges for the widespread adoption of CPS in Mexico. As CPS relies heavily on the collection, processing, and sharing of sensitive data, the risk of cyberattacks, data breaches, and unauthorized access becomes a critical issue. For example, Mexico’s cybersecurity landscape has faced setbacks, with incidents like the Guacamaya hack in 2022 exposing vulnerabilities in critical systems. The Mexican government has introduced regulations to address cybersecurity, but businesses may still face challenges in securing their CPS infrastructure. Protecting sensitive data and ensuring the privacy of individuals within these systems remains an ongoing challenge for organizations looking to adopt CPS technologies.

Lack of Skilled Workforce

A shortage of skilled professionals with expertise in CPS, IoT, AI, and related fields presents another barrier to growth in Mexico. As demand for these technologies increases, there is a growing need for workers who can design, implement, and maintain complex CPS systems. The limited availability of qualified professionals in the local market may delay the adoption and successful deployment of CPS in various industries across the country. Addressing this skills gap through education and training will be crucial for fostering the continued growth of CPS in Mexico.

Market Opportunities:

The Cyber-Physical Systems (CPS) market in Mexico presents significant opportunities, driven by the country’s growing industrial sector and urbanization trends. As Mexico continues to enhance its manufacturing capabilities, particularly in automotive, electronics, and consumer goods, there is an increasing demand for automation and real-time system monitoring. CPS technologies are poised to play a central role in modernizing industrial processes, enhancing efficiency, and reducing downtime. With industries shifting towards smart factories and automation, Mexico presents a fertile ground for the adoption of CPS solutions that streamline operations, optimize resource utilization, and improve production quality. Furthermore, Mexico’s proximity to the United States and its participation in global supply chains offers an opportunity for local businesses to adopt advanced CPS technologies to remain competitive in the international market.

In addition to industrial applications, the adoption of CPS in the development of smart cities presents a significant market opportunity. The Mexican government is investing in urban modernization projects to improve infrastructure, traffic management, and energy efficiency. CPS technologies will be essential for managing the growing complexity of urban systems, from smart grids to intelligent transportation networks. As cities like Mexico City, Guadalajara, and Monterrey continue to expand, there is an increasing need for intelligent solutions that can optimize resource usage and improve urban living standards. With strong governmental support and a clear drive towards technological transformation, the CPS market in Mexico is well-positioned to experience substantial growth, creating opportunities across multiple sectors.

Market Segmentation Analysis:

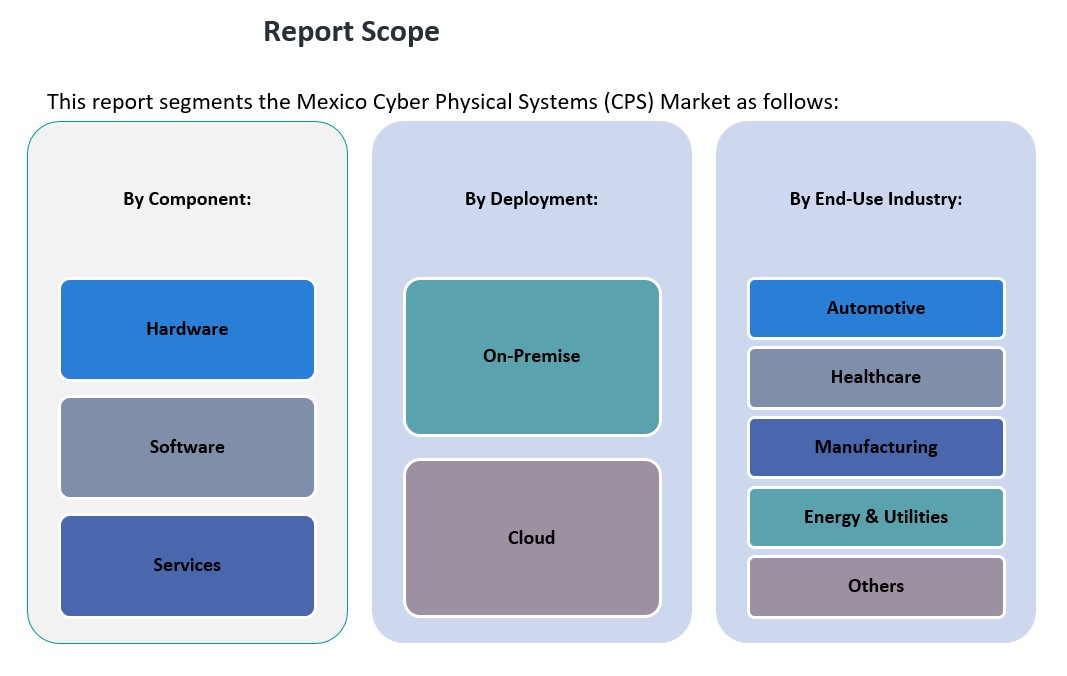

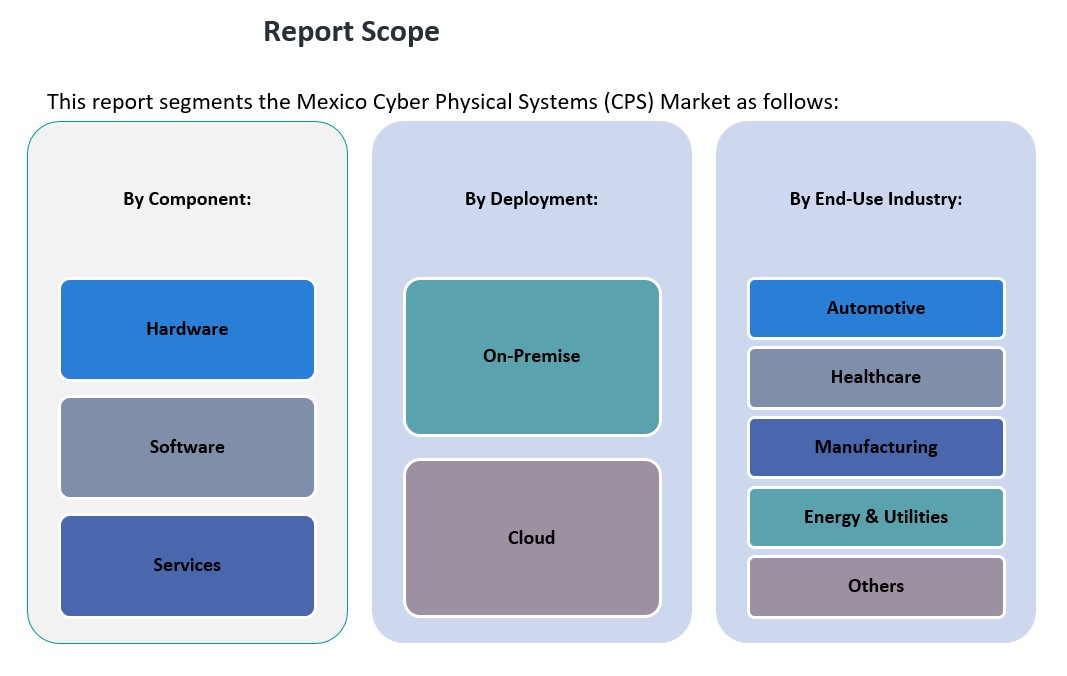

The Mexico Cyber-Physical Systems (CPS) market is segmented across various components, deployment models, and end-use industries, with each segment demonstrating unique growth opportunities and challenges.

By Component: The CPS market in Mexico is primarily divided into three components: hardware, software, and services. Hardware dominates the market, driven by the increasing need for sensors, actuators, and embedded systems essential for real-time data collection and system integration. Software, including operating systems, application software, and analytics tools, is a rapidly growing segment, driven by the need for smarter, data-driven decision-making capabilities. The services segment, which includes consulting, integration, and maintenance, is also experiencing significant growth as businesses require expert assistance in implementing and maintaining complex CPS solutions.

By Deployment: The CPS market in Mexico is increasingly adopting both on-premise and cloud-based deployment models. On-premise solutions are preferred by industries requiring high security and control over their operations, such as manufacturing and energy. However, the cloud deployment model is gaining traction due to its scalability, cost-effectiveness, and flexibility, particularly for industries like healthcare and automotive that require real-time data processing and remote monitoring capabilities.

By End-Use Industry: The automotive and manufacturing sectors are the largest adopters of CPS in Mexico, driven by the need for automation, predictive maintenance, and operational efficiency. The healthcare industry is also expanding its use of CPS, leveraging real-time data to improve patient care and streamline operations. The energy and utilities sector is increasingly adopting CPS technologies to optimize grid management and resource allocation. Other industries, including agriculture and logistics, are also exploring CPS solutions to enhance productivity and reduce operational costs.

Segmentation:

By Component:

- Hardware

- Software

- Services

By Deployment:

By End-Use Industry:

- Automotive

- Healthcare

- Manufacturing

- Energy & Utilities

- Others

Regional Analysis:

Cyber-Physical Systems (CPS) are integral to Mexico’s technological advancement, enhancing sectors such as manufacturing, energy, and urban infrastructure. While comprehensive regional market share data specific to CPS adoption in Mexico is limited, available information highlights key areas of growth and investment.

Mexico City

As the nation’s capital and primary economic hub, Mexico City leads in CPS adoption. The city hosts numerous data centers and corporate headquarters, driving demand for advanced CPS solutions. In 2023, the Mexican Association of Data Centers (MEXDC) reported that Mexico City accounted for 45% of the country’s data center security investments. This concentration underscores the city’s role as a focal point for technological infrastructure and CPS integration.

Querétaro

Querétaro has emerged as a significant player in CPS development, attracting global data center operators due to its strategic location and reliable infrastructure. In 2023, MEXDC noted a 40% year-on-year increase in data center projects in Querétaro. This growth is fueling the demand for sophisticated CPS solutions, particularly in data security and management.

Key Player Analysis:

- IBM Corporation

- Honeywell International Inc.

- Rockwell Automation, Inc.

- General Electric Company

- Microsoft Corporation

- Intel Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Cisco Systems, Inc.

- 3M Company

Competitive Analysis:

The competitive landscape of Mexico’s Cyber-Physical Systems (CPS) market is evolving, with both local and international players competing to provide innovative solutions across various sectors. Key market players include multinational technology companies such as Siemens, Schneider Electric, and Honeywell, which have a strong presence in Mexico due to their advanced CPS solutions for industrial automation, energy management, and infrastructure optimization. These companies leverage their global experience and technological expertise to cater to Mexico’s growing demand for CPS technologies. Additionally, local firms specializing in automation and IoT solutions are also emerging as strong competitors, offering tailored solutions to meet the specific needs of the Mexican market. These players often focus on cost-effective, scalable systems for small and medium-sized enterprises (SMEs). The competitive advantage in this market lies in the ability to integrate advanced technologies, such as AI and machine learning, with CPS to offer more efficient, real-time solutions for diverse industries.

Recent Developments:

- In February 2025, Nozomi Networks was recognized as a Leader in the inaugural Gartner Magic Quadrant for Cyber-Physical Systems (CPS) Protection Platforms. This distinction underscores Nozomi Networks’ expertise in leveraging AI for asset discovery, threat management, and vulnerability mitigation. The company’s solutions focus on securing mission-critical infrastructure and maximizing resilience across operational technology (OT), Internet of Things (IoT), and CPS environments. CEO Edgard Capdevielle emphasized the company’s commitment to innovation and collaboration with customers to enhance infrastructure security.

- In January 2025, Claroty was also named a Leader in the Gartner Magic Quadrant for CPS Protection Platforms. Claroty’s platform offers robust solutions for CPS protection, including exposure management, secure access, network protection, and threat detection. With its cloud-based xDome solution and on-premise CTD components, Claroty provides deep asset visibility and rapid deployment capabilities. The recognition highlights Claroty’s ability to execute and its comprehensive vision for securing cyber-physical systems

Market Concentration & Characteristics:

The Cyber-Physical Systems (CPS) market in Mexico is characterized by a growing integration of digital and physical systems across various industries, including manufacturing, automotive, healthcare, and energy. This convergence enhances real-time monitoring, control, and automation, leading to increased efficiency and safety. While specific market concentration data is limited, the sector features a mix of multinational corporations and emerging local enterprises, fostering a competitive environment. The market is also influenced by technological advancements in IoT, AI, and machine learning, which are being incorporated into CPS solutions to meet the evolving demands of Mexican industries. However, challenges such as high installation costs, integration complexities, and cybersecurity risks persist, requiring ongoing innovation and strategic collaboration among market participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Component, Deployment and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Mexico’s CPS market is expected to experience significant growth in the coming years.

- The manufacturing sector will continue to be the largest adopter of CPS, driven by the need for automation and enhanced efficiency.

- The integration of IoT and AI technologies will improve real-time monitoring and decision-making capabilities.

- The adoption of smart grid technologies is likely to increase, supporting the shift to renewable energy sources.

- CPS applications in healthcare will expand, leading to improvements in patient monitoring and care.

- The automotive industry will increasingly adopt CPS, particularly for autonomous vehicle technologies.

- Cloud-based CPS solutions will gain popularity due to their scalability and flexibility.

- On-premise deployments will remain prevalent in sectors with strict data security and control requirements.

- The demand for services such as integration and maintenance will grow alongside the adoption of CPS technologies.

- Ensuring cybersecurity will remain a top priority to safeguard CPS systems and ensure their reliable operation.