Market Overview

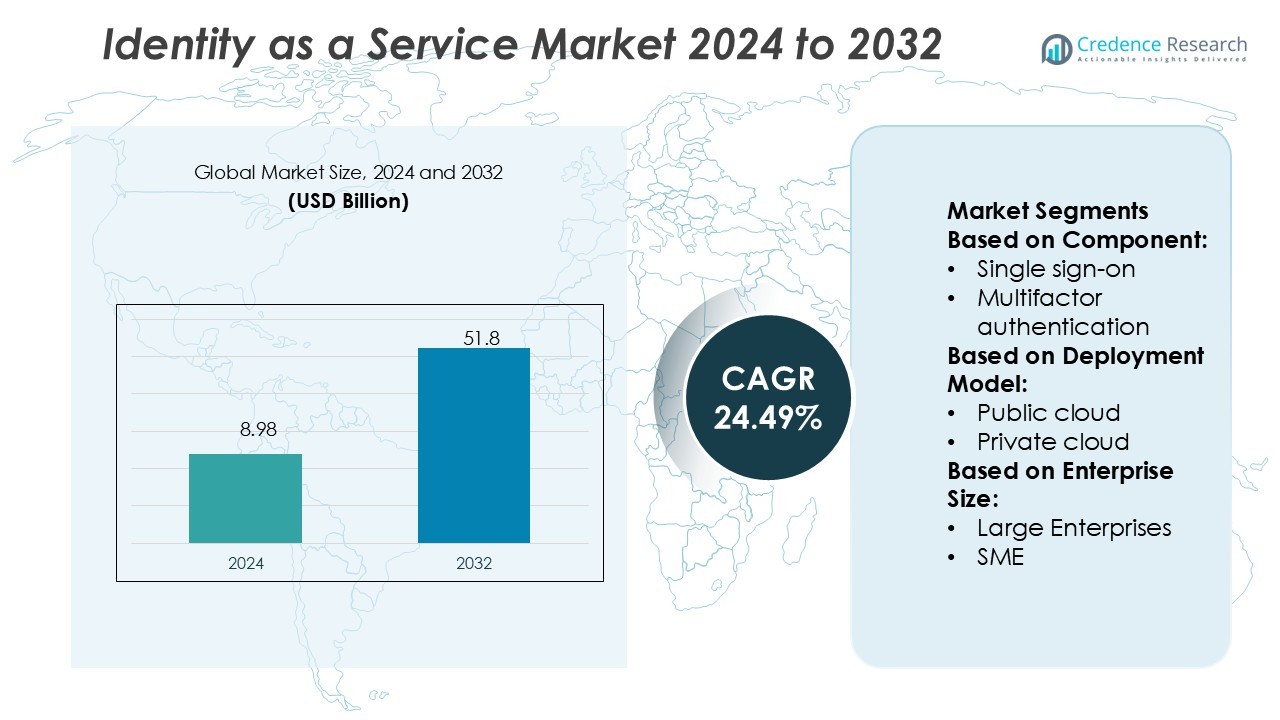

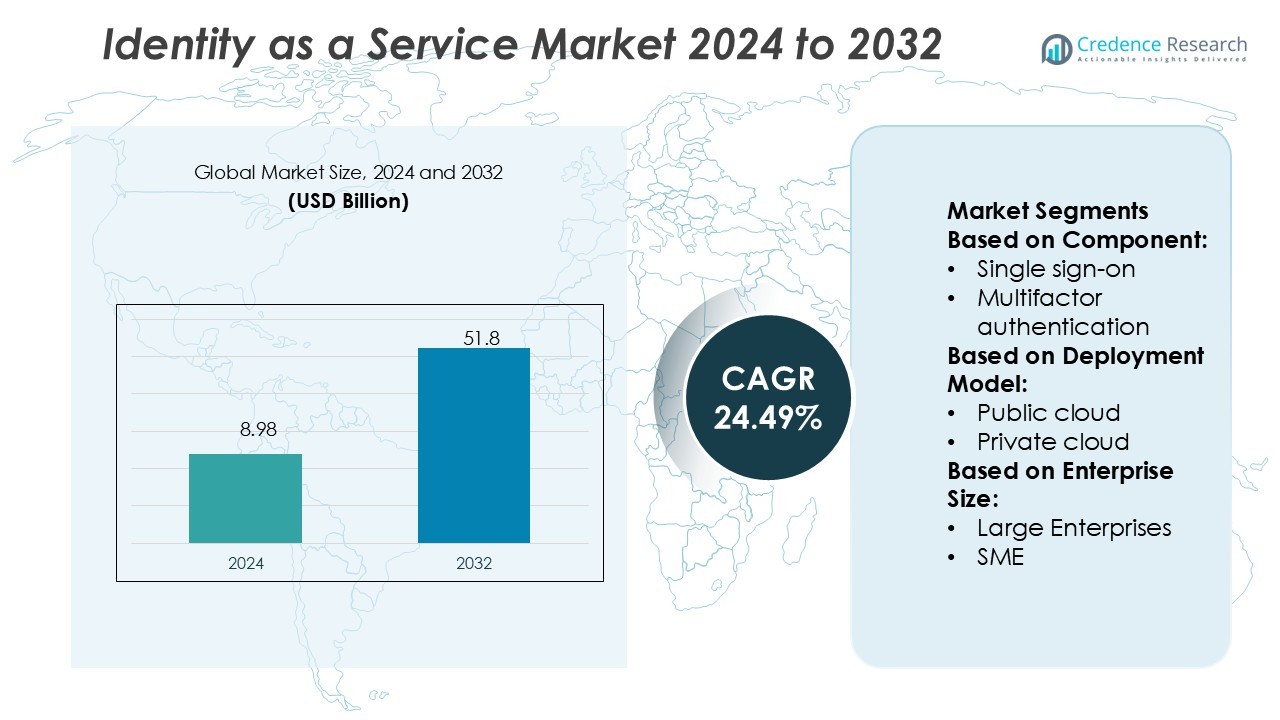

Identity as a Service Market size was valued USD 8.98 billion in 2024 and is anticipated to reach USD 51.8 billion by 2032, at a CAGR of 24.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Identity as a Service Market Size 2024 |

USD 8.98 Billion |

| Identity as a Service Market, CAGR |

24.49% |

| Identity as a Service Market Size 2032 |

USD 51.8 Billion |

The Identity as a Service (IDaaS) market is highly competitive, with top players including Microsoft Corporation, IBM Corporation, Google LLC, Oracle Corporation, Okta, Inc., Ping Identity Corporation, OneLogin, Inc., ForgeRock, Inc., SailPoint Technologies, Inc., and Capgemini. These companies focus on expanding authentication, compliance, and governance capabilities through advanced cloud platforms and AI-driven security solutions. Strategic investments in Zero Trust frameworks, biometrics, and seamless integration strengthen their market positioning. Regionally, North America leads the global market with a 38% share, driven by strong regulatory frameworks, high cloud adoption, and the presence of leading technology providers supporting large-scale enterprise deployments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Identity as a Service Market size was USD 8.98 billion in 2024 and is projected to reach USD 51.8 billion by 2032, registering a CAGR of 24.49% during the forecast period.

- Rising cybersecurity threats, regulatory compliance mandates, and cloud migration initiatives are the primary drivers fueling widespread adoption of IDaaS solutions across industries.

- The market is witnessing strong trends in Zero Trust security, multifactor authentication, and AI-driven adaptive authentication, which are reshaping identity and access management practices.

- Competition remains intense, with leading players focusing on innovation in authentication, governance, and integration capabilities, while high integration complexity with legacy systems and concerns over data privacy act as restraints.

- North America leads the global market with 38% share, supported by mature digital infrastructure, while the single sign-on segment dominates by component with 34% share, highlighting strong enterprise demand for streamlined authentication solutions.

Market Segmentation Analysis:

By Component

The single sign-on segment dominates the Identity as a Service market with a 34% share. Organizations adopt it widely to reduce password fatigue, streamline authentication, and improve user experience. Demand is rising as businesses handle multiple cloud applications and need efficient access management. Multifactor authentication also grows quickly, driven by data security regulations and cyberattack risks. Together, these solutions enhance identity security, compliance, and operational efficiency, positioning single sign-on as the most critical component in modern digital identity frameworks.

- For instance, Microsoft’s Identity Threat Detection and Response system blocked over 600 million identity attacks per day across its cloud services. Also, in randomized trials, Microsoft’s Security Copilot improved administrators’ accuracy by 34.53 % and reduced task time by 29.79 % across IT tasks.

By Deployment Model

Public cloud deployment leads the market with 48% share, supported by cost savings, scalability, and rapid implementation. Enterprises increasingly prefer cloud-hosted identity solutions to handle remote workforces and global operations efficiently. Vendors deliver advanced tools through subscription models, reducing infrastructure costs for businesses. Private cloud and hybrid models are gaining traction, especially in highly regulated industries where data residency and compliance are essential. However, public cloud remains dominant due to its accessibility, agility, and integration with enterprise SaaS ecosystems.

- For instance, Oracle’s distributed cloud allows customers to deploy 150+ AI and cloud services at the edge, in their datacenter, or across clouds—not just in public cloud.

By Enterprise Size

Large enterprises hold the largest market share at 62%, driven by complex IT infrastructures and stringent security requirements. They invest heavily in identity solutions to manage diverse workforces, contractors, and third-party partners. High compliance standards, including GDPR and HIPAA, accelerate adoption of advanced authentication and governance features. SMEs are increasingly adopting Identity as a Service due to lower upfront costs and simplified management through cloud-based platforms. Despite growing SME interest, large enterprises remain the dominant segment due to scale and regulatory needs.

Key Growth Drivers

Rising Cybersecurity Threats and Compliance Mandates

The surge in cyberattacks and data breaches has made identity security a priority. Regulatory mandates such as GDPR, HIPAA, and CCPA drive organizations to adopt Identity as a Service (IDaaS) for compliance. Enterprises rely on IDaaS for secure authentication, access governance, and monitoring. Strong cybersecurity frameworks reduce risks while meeting audit and reporting requirements. This driver accelerates market adoption across industries handling sensitive customer and enterprise data, positioning IDaaS as a critical tool for protecting digital assets and ensuring regulatory alignment.

- For instance, OneLogin claims 6,000+ pre-integrated applications in its App Catalog, enabling rapid secure connectivity across systems.It also reports reducing 50% of helpdesk tickets related to login issues for many clients.

Cloud Adoption and Digital Transformation Initiatives

The shift toward cloud-based ecosystems is significantly boosting IDaaS adoption. Organizations migrating workloads to SaaS, PaaS, and IaaS platforms require secure identity and access management. IDaaS offers scalable, subscription-based solutions that fit digital-first strategies while reducing infrastructure costs. It supports global workforces with seamless access to multiple applications. Enterprises embracing digital transformation increasingly deploy IDaaS to unify authentication across systems, simplify provisioning, and enhance operational agility, making cloud integration one of the strongest growth catalysts in the market.

- For instance, Ping Identity now secures over 8 billion user accounts across its IAM platform. SaaS revenue grew over 30 % year-over-year, reflecting strong traction in cloud identity.

Growing Demand for Seamless User Experience

User convenience is driving the adoption of identity solutions that reduce password fatigue and login friction. Single sign-on (SSO) and multifactor authentication provide employees, partners, and customers with streamlined access. IDaaS enhances productivity by enabling fast, secure logins across diverse applications. Enterprises view improved user experience as a competitive advantage, especially in customer-facing industries like banking, retail, and healthcare. Balancing security and usability has become a strategic driver, positioning IDaaS as a central enabler of trust and efficiency in digital interactions.

Key Trends & Opportunities

Integration of Artificial Intelligence in IDaaS

Artificial intelligence is transforming identity verification and access management. Machine learning models enable real-time anomaly detection, adaptive authentication, and automated threat response. AI-driven IDaaS enhances security while reducing manual intervention and operational costs. Enterprises deploying AI-enabled solutions can better detect unusual behavior patterns and prevent account compromise. This trend opens opportunities for vendors to differentiate through advanced analytics, predictive insights, and automation features. As AI adoption scales, it is expected to redefine identity management practices across industries and geographies.

- For instance, Okta blocked over 3 billion identity attacks monthly across its platform.It also reports a 90 % reduction in credential stuffing incidents for many large customers.

Expansion of Zero Trust Security Models

The adoption of Zero Trust principles is a significant opportunity for IDaaS providers. With remote work and hybrid networks becoming standard, businesses require strict verification for every user and device. IDaaS supports Zero Trust by offering continuous authentication, least privilege access, and governance. Vendors developing identity frameworks aligned with Zero Trust can capture growing demand from enterprises modernizing security architectures. This trend is especially relevant in industries like BFSI, healthcare, and government, where data sensitivity requires advanced verification frameworks.

- For instance, Salesforce is embedding Zero Trust across its platform to protect human users and AI agents alike. Its Security Center 2.0 lets admins monitor 60+ security metrics and generate alerts when permission changes risk policy violations.

Key Challenges

High Integration Complexity in Legacy Systems

Integrating IDaaS with existing legacy infrastructures poses significant challenges for enterprises. Many organizations still rely on outdated identity management systems that lack compatibility with modern cloud-based tools. Transitioning to IDaaS requires restructuring processes, retraining staff, and ensuring interoperability. The complexity increases implementation timelines and costs, discouraging some enterprises from full-scale adoption. Vendors must address integration gaps with flexible, interoperable solutions to overcome this barrier. Without seamless migration paths, legacy dependence continues to limit the speed of IDaaS adoption in several industries.

Concerns Around Data Privacy and Vendor Dependence

Enterprises adopting cloud-based IDaaS face concerns regarding data sovereignty and vendor lock-in. Sensitive identity data stored in external environments raises risks tied to privacy, compliance, and cross-border data transfers. Vendor dependence may limit flexibility in customizing identity frameworks or switching providers. These concerns slow adoption, particularly in regulated sectors such as healthcare and government. To mitigate the challenge, providers must offer transparent data handling practices, compliance certifications, and flexible service models. Addressing these issues remains essential for wider market confidence and growth.

Regional Analysis

North America

North America dominates the Identity as a Service market with a 38% share, driven by strong cloud adoption and stringent data protection regulations such as HIPAA and CCPA. The presence of major technology providers and high investment in cybersecurity strengthen the region’s leadership. Large enterprises lead adoption, supported by early integration of advanced authentication and Zero Trust frameworks. Growing demand across banking, healthcare, and government sectors further expands market penetration. Continuous innovation in AI-driven identity solutions and regulatory compliance makes North America the most mature and revenue-generating market for IDaaS globally.

Europe

Europe holds a 27% share of the Identity as a Service market, supported by robust regulatory frameworks such as GDPR. Countries like Germany, the UK, and France drive demand through advanced digital security initiatives and cloud transformation programs. Enterprises focus heavily on compliance-driven adoption of multifactor authentication, SSO, and governance tools. The region’s growth is further accelerated by the expansion of financial services and e-commerce industries requiring strong identity protection. Increasing cross-border data compliance and investment in AI-driven IDaaS create sustained opportunities, reinforcing Europe as a critical market hub for identity security solutions.

Asia Pacific

Asia Pacific accounts for 22% of the Identity as a Service market, with the fastest growth rate. Rising cloud adoption, rapid digital transformation, and government-led cybersecurity initiatives fuel demand across China, India, Japan, and Australia. SMEs and large enterprises alike invest in IDaaS to secure expanding digital ecosystems and mobile workforces. The growing fintech and e-commerce sectors, coupled with strong investment in Zero Trust models, enhance regional adoption. With expanding IT infrastructure and surging digital transactions, Asia Pacific is expected to significantly increase its global market contribution over the forecast period.

Latin America

Latin America captures 7% of the Identity as a Service market, with growth led by Brazil and Mexico. The region is witnessing rising digital banking, e-commerce expansion, and cloud migration, creating demand for secure identity solutions. Enterprises are adopting IDaaS to comply with local data protection laws and counter increasing cyber threats. While adoption is slower compared to developed regions, rising investment in IT modernization and cloud infrastructure supports market growth. Strategic partnerships between global vendors and regional providers are improving accessibility, positioning Latin America as an emerging growth market for identity services.

Middle East & Africa

The Middle East & Africa hold a 6% share of the Identity as a Service market, supported by growing government digitalization programs and enterprise security investments. Countries such as the UAE, Saudi Arabia, and South Africa are leading adoption, focusing on compliance and cyber defense initiatives. Demand is rising in sectors like banking, oil and gas, and telecom, where secure identity frameworks are essential. While infrastructure limitations remain in some areas, regional cloud adoption and regulatory reforms are expanding opportunities. The market is expected to strengthen further as enterprises accelerate digital security modernization.

Market Segmentations:

By Component:

- Single sign-on

- Multifactor authentication

By Deployment Model:

- Public cloud

- Private cloud

By Enterprise Size:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Identity as a Service (IDaaS) market features key players including ForgeRock, Inc., SailPoint Technologies, Inc., Capgemini, Microsoft Corporation, Oracle Corporation, OneLogin, Inc., Ping Identity Corporation, Google LLC, IBM Corporation, and Okta, Inc.The Identity as a Service (IDaaS) market is shaped by rapid innovation, strategic partnerships, and growing demand for secure digital identity solutions. Vendors focus on enhancing authentication, governance, and compliance features to meet enterprise needs across industries such as banking, healthcare, retail, and government. Competition is driven by investments in AI-based anomaly detection, multifactor authentication, and Zero Trust frameworks, which improve both security and user experience. Providers also emphasize flexible deployment models, including hybrid and multi-cloud integration, to address diverse customer requirements. As organizations expand digital ecosystems, competition intensifies around scalability, regulatory compliance, and the ability to deliver seamless identity management at a global level.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ForgeRock, Inc.

- SailPoint Technologies, Inc.

- Capgemini

- Microsoft Corporation

- Oracle Corporation

- OneLogin, Inc.

- Ping Identity Corporation

- Google LLC

- IBM Corporation

- Okta, Inc.

Recent Developments

- In March 2024, Securden, Inc., a leading provider of privileged access and identity security solutions, announced the launch of Unified PAM MSP, a first-in-class, unique offering for Managed service providers.

- In February 2024, AU10TIX, an identification service provider, launched a new KYB solution that helps businesses determine exactly who they are doing business with and mitigate potential financial and reputational losses. AU10TIX integrates KYB with KYC processes to cater to every KYB business need.

- In January 2024, Onfido, a technology company unveiled its new all-in-one ID verification solution that enables enterprises to expand into new markets and address local regulatory requirements for customer onboarding.

- In March 2023, ID-Pal, an Irish-based ID verification service provider has expanded their footprint in the U.S. market to address the growing ID verification demands from both SMEs and large enterprises.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, Enterprise Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see stronger adoption of Zero Trust security models across enterprises.

- Artificial intelligence will enhance adaptive authentication and real-time threat detection.

- Cloud-native identity solutions will dominate as digital transformation accelerates.

- Multifactor authentication will expand with biometric and behavioral technologies.

- SMEs will adopt IDaaS rapidly due to cost efficiency and scalability.

- Regulatory compliance will continue to drive investment in governance solutions.

- Integration with IoT and edge devices will broaden identity management applications.

- Hybrid and multi-cloud deployments will gain momentum for flexible security models.

- User experience improvements will remain a critical differentiator for providers.

- Strategic partnerships and acquisitions will reshape the competitive market structure.