Market Overview:

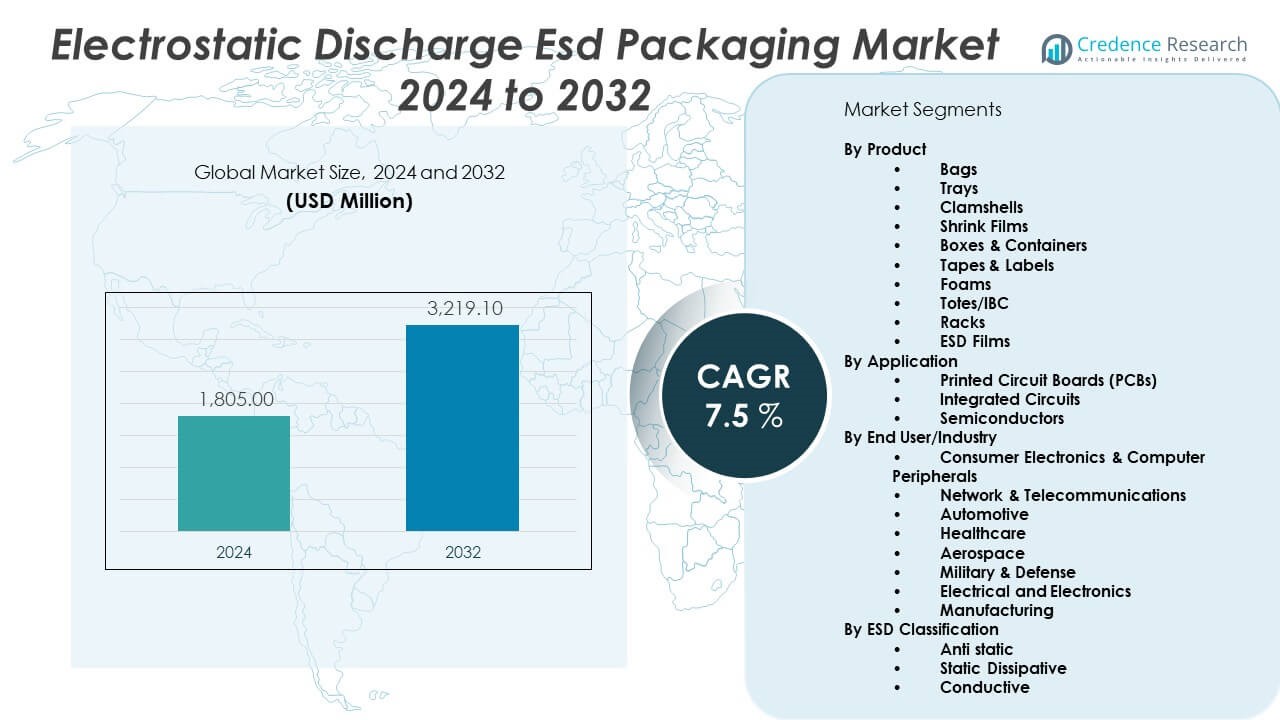

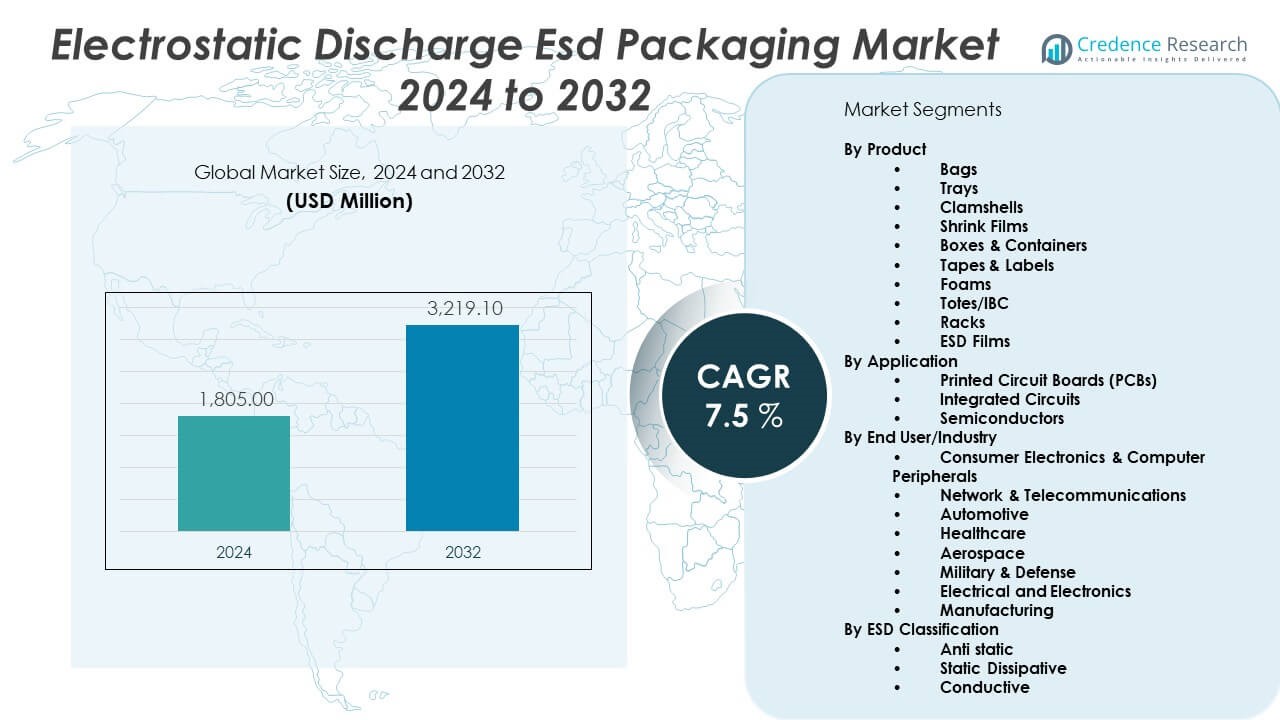

The Electrostatic Discharge ESD Packaging Market is projected to grow from USD 1805 million in 2024 to an estimated USD 3219.1 million by 2032, with a compound annual growth rate (CAGR) of 7.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrostatic Discharge ESD Packaging Market Size 2024 |

USD 1805 Million |

| Electrostatic Discharge ESD Packaging Market, CAGR |

7.5% |

| Electrostatic Discharge ESD Packaging Market Size 2032 |

USD 3219.1 Million |

Manufacturers drive adoption of ESD packaging by prioritizing protection for sensitive electronic components. Rapid expansion in consumer electronics and automotive sectors amplifies demand for safe transport solutions. Stricter regulatory standards compel original equipment manufacturers (OEMs) to integrate advanced polymer and metalized barrier materials that dissipate static. Growth in IoT and wearable devices stimulates innovation in flexible, lightweight ESD packaging formats. Market players accelerate research into recyclable ESD solutions to align with sustainability goals. Rising e‑commerce volumes push logistics providers to enhance packaging designs that prevent electrostatic damage throughout distribution.

North America dominates the ESD packaging market with robust semiconductor manufacturing hubs and extensive R&D investments. Europe follows, leveraging strict environmental and safety regulations that foster adoption of advanced ESD materials. The Asia Pacific region exhibits rapid growth, driven by expanding electronics production in China, South Korea, and Japan. Emerging markets in Southeast Asia and Latin America show growing interest as local OEMs upgrade packaging standards. Manufacturers establish regional production facilities to optimize supply chains and reduce lead times. They collaborate with logistics providers to address evolving distribution challenges in dynamic markets across the globe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electrostatic Discharge ESD Packaging Market is projected to grow from USD 1805 million in 2024 to USD 3219.1 million by 2032 at a 7.5% CAGR.

- Rising consumer electronics and electric vehicle production drive demand for reliable ESD protection.

- Stricter regulatory standards compel adoption of certified ESD materials and rigorous quality control.

- High cost of advanced conductive polymers and metalized films limits adoption among smaller manufacturers.

- Complex ESD standardization across regions creates compliance challenges and extends lead times.

- North America and Europe lead adoption with established semiconductor and automotive sectors.

- Asia Pacific shows rapid growth on expanding electronics manufacturing and localized ESD packaging facilities.

Market Drivers:

Surging Demand from Electronic and Automotive Industries:

The Electrostatic Discharge Esd Packaging Market experiences rapid growth driven by expanding consumer electronics production. It supports manufacturers in protecting sensitive semiconductors and circuit boards during transportation. Automotive OEMs integrate smart sensors and electric vehicle components that require reliable ESD protection. Industry giants invest in advanced barrier films and conductive polymers to address static risks. Rising adoption of wearables and IoT devices intensifies pressure on packaging suppliers to enhance performance. It prompts companies to scale up production of custom ESD trays and shielding bags. Collaboration between packaging innovators and electronics firms accelerates development cycles. Suppliers respond by broadening product portfolios to meet diverse industry specifications.

- For instance, Texas Instruments reported integrating advanced ESD protection in its automotive sensors, achieving reduction in warranty-related electrical failures in new EV components.

Stringent Regulatory Compliance and Safety Requirements:

Regulators enforce strict standards to prevent electrostatic damage across electronics supply chains. It compels OEMs and packaging vendors to certify products under ISO and ANSI ESD guidelines. Companies implement quality control protocols that include charge decay testing and material resistivity measurements. It drives adoption of specialized materials such as metalized laminates and antistatic coatings. Product liability concerns push organizations to document ESD handling procedures meticulously. Industry associations offer training programs that increase awareness of static hazards. It influences procurement strategies, leading buyers to prioritize certified ESD solutions. Packaging firms integrate compliance checks into manufacturing workflows to reduce recall risks.

- For instance, Organizations certified under these standards must document full compliance as part of ISO 9001:2015-based Quality Management Systems.

Innovation in Material Science and Sustainable Solutions:

Research teams develop next‑generation biodegradable ESD materials that combine static dissipation with environmental benefits. It aligns with corporate sustainability agendas and extended producer responsibility policies. Biopolymer blends and recycled-content composites enter pilot production lines. It enables packaging providers to reduce carbon footprints without compromising performance. Academic collaborations yield novel conductive inks and biodegradable foam substrates. It accelerates the commercialization of compostable ESD liners. Startups attract venture capital by demonstrating scalable green packaging technologies. It encourages incumbents to invest in circular economy initiatives and closed‑loop recycling schemes.

Growth of E‑commerce and Complex Supply Chains:

Global e‑commerce platforms increase shipment volumes of high‑value electronics that face heightened ESD exposure. It forces logistics providers to adopt reinforced protective packaging solutions. Last‑mile delivery networks encounter diverse environmental conditions that aggravate static risks. It prompts manufacturers to design packaging that retains static shielding performance under variable humidity and temperature. Multi‑channel distribution strategies require flexible packaging formats compatible with automated sorting systems. It drives growth in form‑fitting ESD pouches and cushioning inserts. Reverse logistics for returns and refurbishments create demand for reusable ESD containers. It strengthens partnerships between packaging firms and third‑party logistics operators.

Market Trends:

Adoption of Recyclable and Biodegradable ESD Materials:

The Electrostatic Discharge Esd Packaging Market shifts toward recyclable substrates that meet circular economy goals. It encourages brands to trial compostable ESD shielding films in low‑volume applications. Material scientists optimize blends of polylactic acid and conductive additives for effective charge dissipation. It reduces reliance on traditional petroleum‑based polymers. Pilot programs test closed‑loop collection and reprocessing of ESD bags. It drives packaging vendors to certify products under eco‑label standards. Universities collaborate with industry to refine biodegradable foam technologies. It signals growing investor interest in sustainable packaging ventures.

- For instance, 3M’s static shielding bags are tested to comply with ANSI/ESD S541, ANSI/ESD S20.20, and are RoHS compliant. These bags feature a multilayer Faraday shield, providing robust static protection while meeting modern compliance and sustainability requirements.

Integration of Smart Packaging Technologies:

Manufacturers incorporate RFID and NFC tags into ESD packaging to monitor environmental exposure in real time. It enables stakeholders to track humidity, temperature and electrostatic events throughout transit. Data analytics platforms ingest sensor outputs to trigger alerts when thresholds exceed safe limits. It improves supply chain visibility and reduces risk of component failure. Collaborative projects between packaging and IoT firms accelerate deployment of smart shielding trays. It encourages adoption of cloud‑based dashboards for consolidated quality assurance. Early adopters report reduction in field returns and warranty claims. It positions ESD packaging as a value‑added service rather than a commodity.

- For instance, Avery Dennison’s TT Sensor Plus uses an NFC-enabled sensor label that logs and stores temperature data throughout the supply chain. Supply chain stakeholders can access real-time environmental data via NFC-enabled smartphones, ensuring optimal protection and documentation during transit.

Customization for High‑precision Component Protection:

Growth in miniaturized electronics and advanced semiconductors demands tailored ESD packaging designs. It drives packaging engineers to create bespoke foam inserts and conductive cavities that match device geometries. Rapid prototyping technologies facilitate quick iteration of packaging layouts. It reduces development lead times and minimizes static-related damage during handling. OEMs specify voltage breakdown requirements that influence material selection. It fosters tighter collaboration between design teams and ESD material suppliers. Surge in defense and aerospace applications further emphasizes precision requirements. It elevates ESD packaging into a strategic asset for product protection.

Regional Manufacturing Hubs and Localized Production:

Companies establish ESD packaging facilities in key electronics clusters to shorten supply chains. It boosts responsiveness to sudden demand fluctuations in Asia Pacific, North America and Europe. Localized production minimizes transit distances and associated static risks. It allows rapid customization based on regional industry standards. Government incentives in semiconductor hubs encourage investment in dedicated ESD packaging plants. It supports just‑in‑time delivery models for high‑volume electronics manufacturers. Partnerships between global packaging firms and local converters strengthen market presence. It enhances scalability and cost efficiency across diverse geographic markets.

Market Challenges Analysis:

High Cost of Advanced ESD Packaging Materials:

Rising prices of conductive additives and metalized films strain packaging budgets. It forces SMEs to weigh performance benefits against cost increases. Procurement teams negotiate bulk contracts to secure favorable pricing, yet market volatility persists. It compels packaging vendors to absorb price fluctuations or pass them to customers. Limited availability of specialized resins creates supply bottlenecks in peak seasons. It drives research into alternative materials, but development cycles extend time to market. Quality control protocols for advanced materials require significant capital investment. It places smaller suppliers at a competitive disadvantage when entering high‑precision segments.

Complexity in Standardization and Supply Chain Management:

Diverse ESD standards across regions complicate product certification processes. It challenges global vendors to maintain multiple product variants for compliance. Cross‑border shipments face delays due to inconsistent testing requirements and documentation. It increases lead times and inventory carrying costs. Fragmented supply chains expose packaging firms to material scarcity and logistic disruptions. It necessitates robust vendor management systems that track provenance and quality metrics. Integration of digital traceability solutions demands IT investments and staff training. It amplifies operational complexity, particularly for companies with limited technical resources.

Market Opportunities:

Expansion into Emerging Electronics Segments:

The Electrostatic Discharge Esd Packaging Market can capture growth by targeting nascent sectors such as flexible displays and wearable medical devices. It aligns packaging performance with stringent biocompatibility and miniaturization requirements. Early engagement with startups in these fields fosters co‑development of specialized ESD materials. It encourages pilot programs that validate packaging efficacy under clinical and consumer testing conditions. Partnerships with device manufacturers enable iterative refinement of packaging designs. It opens channels in medical device distribution networks that prioritize safety and reliability. Collaborative ventures with academia generate innovations transferrable across multiple electronics verticals. It positions ESD packaging vendors at the forefront of next‑generation device protection.

Strategic Partnerships for Innovation and Market Expansion:

Packaging suppliers can accelerate product development by forming alliances with conductive polymer developers and sustainability experts. It creates integrated solutions that combine static protection with eco‑friendly credentials. Joint ventures with logistics providers offer turnkey ESD packaging services, reducing complexity for end users. It grants access to broader distribution networks and technical expertise. Collaborative R&D projects under government grants can offset development costs and de‑risk emerging technologies. It helps companies enter new geographic markets by leveraging local partner capabilities. Cross‑industry consortia enable standardization of best practices and shared testing protocols. It strengthens competitive positioning through combined innovation and market reach.

Market Segmentation Analysis:

By Product

The Electrostatic Discharge Esd Packaging Market splits across ten product types that address diverse protection needs. Bags and trays deliver cost‑effective bulk handling. Clamshells and shrink films secure consumer electronics in automated lines. Boxes, containers and totes/IBC support heavy semiconductor modules. Tapes, labels and foams provide added cushioning and clear identification. Racks and specialized ESD films serve high‑precision component storage.

- For instance, The global market demonstrates millions of ESD trays being manufactured and sold annually, particularly for electronics manufacturing, which consumes over 70% of global volumes.

By Application

Printed circuit boards require the most robust ESD solutions due to high sensitivity. Integrated circuits follow with tailored shielding requirements. Semiconductor wafers demand tight resistivity control and custom fit. Suppliers develop products that match voltage breakdown specifications for each application.

- For example, surface resistance values for static dissipative materials must fall between 1.0×10^4 and 1.0×10^11 ohms—standards maintained and validated globally for advanced semiconductor applications.

By End‑User/Industry

Consumer electronics and computer peripherals lead demand through smartphones, laptops and gaming consoles. Network and telecommunications firms rely on ESD packaging for routers and server components. Automotive OEMs use these materials in electric drive modules and safety sensors. Healthcare, aerospace, military & defense, electrical and electronics, and general manufacturing sectors select specialized options to protect mission‑critical parts.

By ESD Classification

Anti‑static materials account for broad usage in basic charge prevention. Static dissipative variants gain preference in applications requiring controlled discharge rates. Conductive products serve niche needs where rapid charge removal proves critical to component integrity.

Segmentation:

By Product

- Bags

- Trays

- Clamshells

- Shrink Films

- Boxes & Containers

- Tapes & Labels

- Foams

- Totes/IBC

- Racks

- ESD Films

By Application

- Printed Circuit Boards (PCBs)

- Integrated Circuits

- Semiconductors

By End‑User/Industry

- Consumer Electronics & Computer Peripherals

- Network & Telecommunications

- Automotive

- Healthcare

- Aerospace

- Military & Defense

- Electrical and Electronics

- Manufacturing

By ESD Classification

- Anti‑static

- Static Dissipative

- Conductive

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America and Europe: Established Demand:

North America leads the Electrostatic Discharge Esd Packaging Market with 36% market share, supported by extensive semiconductor fabrication and advanced automotive electronics production. It benefits from robust R&D investments and stringent ESD safety standards enforced by industry bodies. Regulatory compliance drives manufacturers to adopt certified ESD films and conductive materials. It fosters collaboration between packaging firms and electronics OEMs to develop tailored solutions. Europe accounts for 28% market share, underpinned by strong manufacturing hubs in Germany, France and the UK. It leverages comprehensive environmental regulations that encourage sustainable ESD material development. Partnerships among converters and technology providers streamline product certification and distribution across the region.

Asia Pacific: Rapid Expansion and Localization:

Asia Pacific captures 24% market share amid fast‑growing electronics and electric vehicle manufacturing in China, South Korea and Japan. It attracts major packaging suppliers to establish local production facilities near key OEM plants. High-volume consumer electronics demand prompts vendors to scale up capacity for custom ESD trays and shielding bags. It enhances responsiveness to lead‑time pressures and cost sensitivities. Government incentives for semiconductor and automotive sectors encourage packaging innovation. It drives adoption of advanced antistatic coatings and metalized barrier films. Collaboration between regional converters and global material scientists accelerates new product launches tailored to local requirements.

Latin America and Middle East & Africa: Emerging Opportunities:

Latin America holds 7% market share, driven by growing consumer electronics consumption in Brazil and Mexico. It sees rising interest in ESD protection from regional OEMs expanding their manufacturing footprints. Packaging providers invest in establishing regional warehouses to reduce import costs and lead times. It supports demand from mobile device assemblers and automotive component suppliers. Middle East & Africa accounts for 5% market share, underpinned by investments in free‑zone electronics clusters and defense applications. It encourages partnerships between local distributors and global ESD material manufacturers. Future growth hinges on infrastructure improvements and skill development in ESD handling and quality control.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF

- DowDuPont

- PPG Industries

- Avery Dennison Corporation

- Sealed Air Corporation

- Smurfit Kappa Group

- DS Smith Plc

- Huhtamaki

- Stora Enso

Competitive Analysis:

The Electrostatic Discharge Esd Packaging Market features a mix of global chemical giants and specialized converters competing on material innovation and service customization. BASF, DowDuPont and PPG Industries lead on polymer and barrier film development, investing heavily in R&D to enhance static-dissipative properties. Avery Dennison and Sealed Air leverage extensive distribution networks and sustainability credentials to secure major OEM contracts. Smurfit Kappa, DS Smith and Stora Enso capitalize on integrated paper-based ESD products, offering recyclable solutions. Huhtamaki focuses on molded fiber trays that combine strength with static protection. Niche players such as Conductive Containers Inc. and Desco Industries differentiate through tailored design services and rapid prototyping. It drives broader adoption of smart packaging features and eco‑friendly materials. Competitive dynamics hinge on speed to market, geographic reach and the ability to meet evolving environmental regulations while maintaining rigorous ESD performance.

Recent Developments:

- In July 2025, PPG Industries marked a significant milestone by completing its 100th dry docking project using its advanced electrostatic coating application. Although this achievement is rooted in the company’s legacy coatings technology, it emphasizes PPG’s leadership and continued investment in innovative ESD solutions for industrial and electronics packaging.

- In April 2025, Huhtamaki received the Gold award in the Sustainable Flexible Packaging Converter category at the Prime Awards Packaging MEA for their Omni lock™ Ultra PAPER. This fully recyclable, high-barrier paper solution, although primarily focused on sustainability, highlights Huhtamaki’s ongoing commitment to advanced protective packaging for electronics, including ESD-sensitive applications.

Market Concentration & Characteristics:

The Electrostatic Discharge Esd Packaging Market exhibits moderate concentration with leading chemical and packaging conglomerates holding approximately 40–45% share collectively. Major players invest in proprietary conductive additives and barrier technologies to command premium pricing. It balances between global suppliers that serve high‑volume OEMs and regional specialists offering customized engineering services. Economies of scale allow top firms to underwrite extensive certification programs under ISO and ANSI standards. Meanwhile, smaller converters capture niche segments through rapid prototyping and flexible production runs. Market characteristics include tight quality control, regulatory compliance demands and an increasing focus on sustainable, recyclable ESD materials.

Report Coverage:

The research report offers an in-depth analysis based on product, application, classification and end‑user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Electrostatic Discharge ESD Packaging Market will expand through tailored solutions for emerging flexible electronics.

- Rising integration of smart sensors will drive demand for sensor‑embedded ESD packaging.

- Sustainability mandates will push development of fully recyclable static‑dissipative materials.

- Growth in electric vehicle production will spur specialized packaging for high‑voltage components.

- Increased automation in assembly lines will require packaging compatible with robotic handling.

- Adoption of real‑time monitoring will foster growth of connected ESD shielded containers.

- Miniaturization trends will generate demand for ultra‑thin conductive films and foams.

- Regional nearshoring will boost local manufacturing of ESD trays and shielding bags.

- Advances in nanocoating’s will enhance barrier performance while reducing material weight.

- Cross‑industry collaborations will accelerate standardization of next‑generation ESD materials.