Market Overview

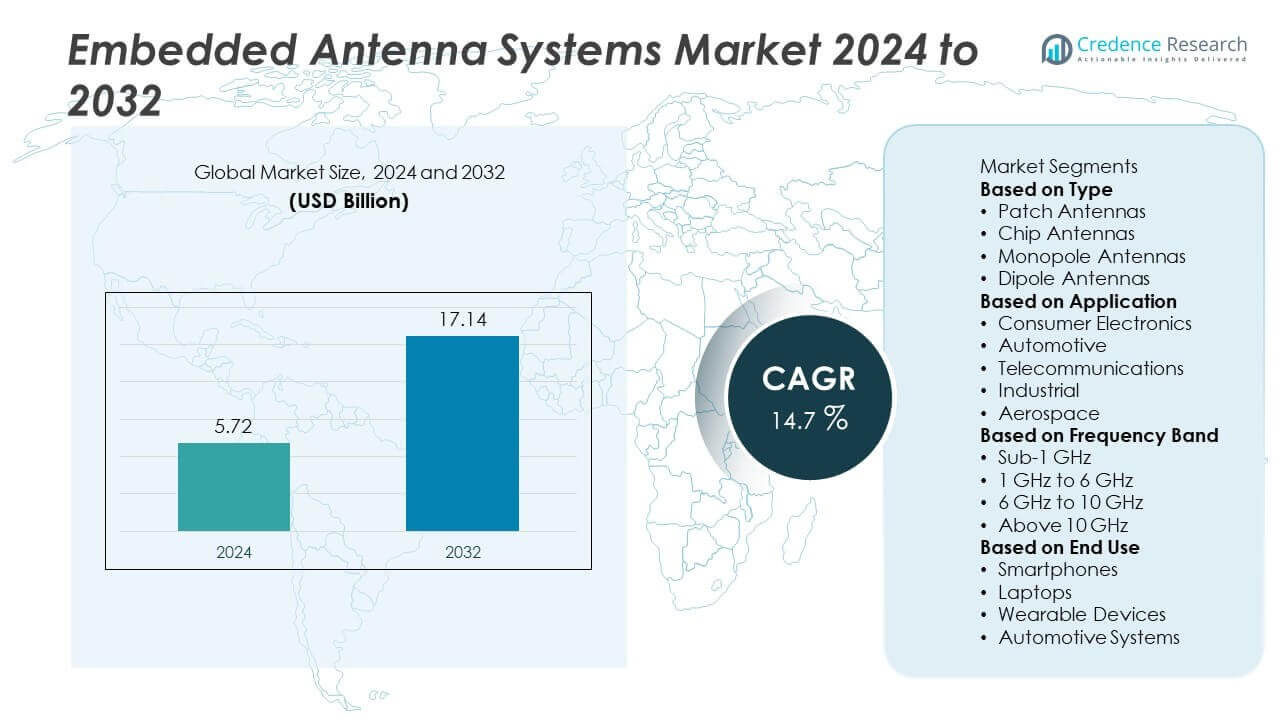

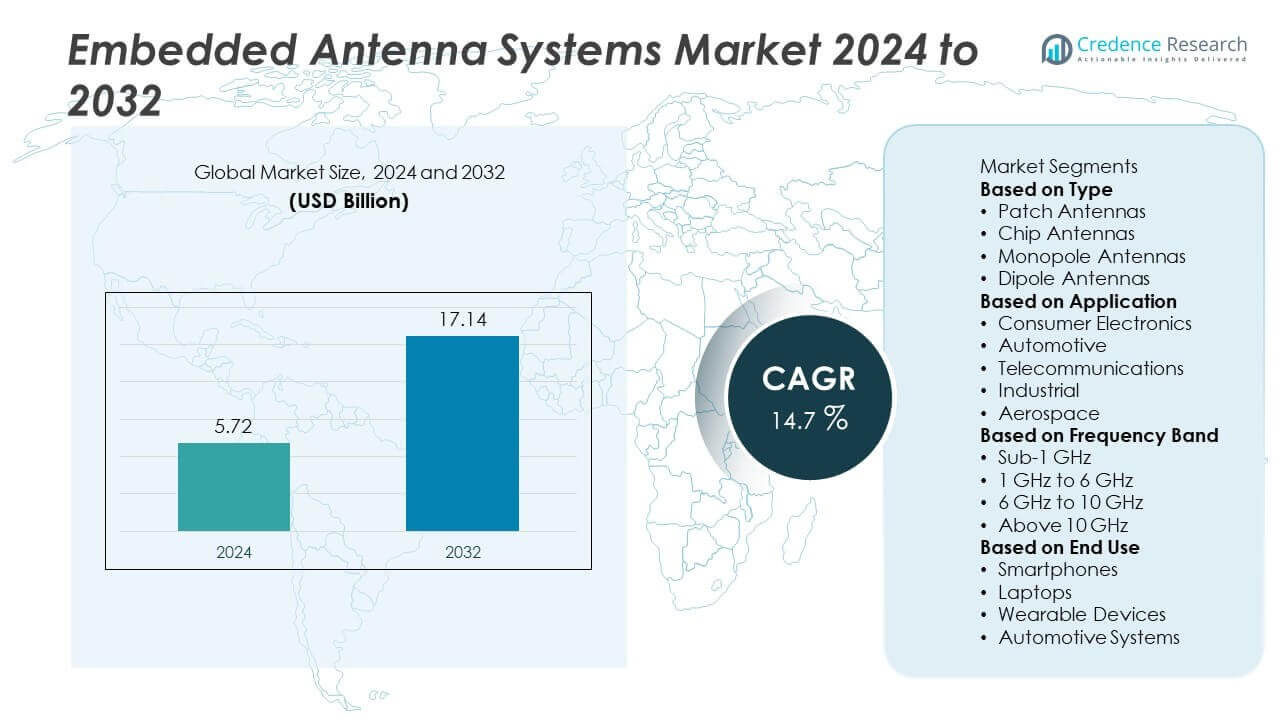

Embedded Antenna Systems Market size was valued at USD 5.72 billion in 2024 and is anticipated to reach USD 17.14 billion by 2032, expanding at a CAGR of 14.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Embedded Antenna Systems Market Size 2024 |

USD 5.72 Billion |

| Embedded Antenna Systems Market, CAGR |

14.7% |

| Embedded Antenna Systems Market Size 2032 |

USD 17.14 Billion |

The Embedded Antenna Systems Market grows through rising adoption of connected devices, IoT, and 5G networks. Compact and high-performance antennas support smartphones, wearables, automotive telematics, and industrial IoT applications. Demand increases with the shift toward miniaturization and multi-band functionality, enabling seamless connectivity across Wi-Fi, Bluetooth, LTE, and millimeter-wave frequencies.

North America leads adoption of embedded antenna systems, supported by strong demand in consumer electronics, automotive, and healthcare sectors, while Europe follows with robust integration in smart manufacturing and connected vehicles. Asia-Pacific records the fastest growth due to rapid urbanization, large-scale 5G deployment, and strong presence of global electronics manufacturers. Latin America and Middle East & Africa also progress steadily with rising investments in digital transformation and smart city initiatives. Key players shaping the Embedded Antenna Systems Market include Qualcomm, Amphenol, Wistron NeWeb Corporation, and Laird Connectivity, each focusing on innovation, compact design, and multi-standard solutions. Qualcomm drives R&D in advanced connectivity, while Amphenol delivers high-performance components for diverse industries. Wistron NeWeb Corporation plays a vital role in large-scale electronics manufacturing, and Laird Connectivity specializes in IoT-focused antenna solutions. Together, these companies strengthen the market with advanced technologies and global reach across multiple applications and end-user industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Embedded Antenna Systems Market size was valued at USD 5.72 billion in 2024 and is projected to reach USD 17.14 billion by 2032, growing at a CAGR of 14.7%.

- Rising demand for IoT devices, connected vehicles, and consumer electronics drives adoption of compact and efficient antenna solutions worldwide.

- Market trends highlight miniaturization, integration of multi-band antennas, and strong alignment with 5G and future 6G technologies.

- Competitive landscape features players such as Qualcomm, Amphenol, Wistron NeWeb Corporation, and Laird Connectivity, who focus on advanced designs and global partnerships.

- Design complexity, high development costs, and regulatory compliance create restraints that challenge smaller manufacturers and limit rapid market entry.

- North America leads growth with strong telecom infrastructure, Europe advances with connected automotive and industrial systems, Asia-Pacific grows fastest with large-scale electronics manufacturing, while Latin America and Middle East & Africa record steady progress through digital initiatives.

- Expanding opportunities in healthcare devices, smart homes, autonomous vehicles, and smart city infrastructure ensure long-term demand for embedded antenna systems, supported by constant innovation and evolving connectivity standards.

Market Drivers

Rising Demand for Connected Devices and IoT Expansion

The growth of connected devices drives strong adoption of embedded antenna systems. Smartphones, wearables, and IoT-enabled devices depend on compact, efficient antenna designs for seamless connectivity. Expanding industrial IoT applications in manufacturing, logistics, and healthcare create constant demand for reliable wireless performance. Embedded antennas support multiple frequencies, enabling smooth integration across 5G, Wi-Fi, Bluetooth, and LPWAN technologies. It ensures that connected devices maintain stable communication while reducing design complexity. The increasing reliance on IoT ecosystems reinforces market growth worldwide.

- For instance, Antenova’s Inpai cellular antenna measures 35 × 8 × 3.3 mm and achieves 68.7 percent efficiency at 2.3–2.4 GHz, making it ideal for compact telematics and IoT devices.

Advancements in 5G Technology and Network Expansion

The rollout of 5G networks significantly influences demand for embedded antenna systems. 5G requires high-performance antennas capable of handling faster speeds and lower latency. Industries such as automotive, smart cities, and telecommunications rely on compact antenna modules for advanced connectivity solutions. It provides efficient support for high-frequency millimeter-wave bands and massive device connectivity. Antenna integration helps optimize device space without sacrificing performance. The growing number of 5G-enabled devices creates a strong push for innovative embedded antenna solutions.

- For instance, Qualcomm’s X85 modem‑to‑antenna system supports up to six receive antennas and delivers 12.5 Gbps download and 3.7 Gbps upload speeds in lab tests

Automotive Applications and Smart Mobility Growth

The automotive sector increasingly incorporates embedded antenna systems to power advanced features. Connected vehicles rely on antennas for GPS, V2X communication, telematics, and infotainment services. Embedded Antenna Systems Market benefits from rising demand for electric and autonomous vehicles that depend on continuous connectivity. It ensures that safety applications like collision avoidance and traffic monitoring remain accurate and responsive. Automakers seek compact antenna designs that fit seamlessly into vehicle architecture. Smart mobility initiatives continue to reinforce adoption of these solutions globally.

Integration with Consumer Electronics and Wearable Devices

Consumer electronics remain a major growth driver for embedded antenna systems. Compact designs enable manufacturers to create slimmer, lighter, and more powerful devices. Wearables, smart home products, and portable gadgets require antennas with low power consumption and high reliability. Embedded antennas ensure consistent performance across multiple wireless standards in limited space. It supports seamless user experiences while enabling device miniaturization. Growing consumer preference for advanced electronics reinforces steady demand for these antenna systems in everyday applications.

Market Trends

Miniaturization and Integration in Device Design

Manufacturers focus on compact and integrated antenna solutions to meet design requirements of modern electronics. Slimmer smartphones, wearables, and IoT sensors depend on antennas that occupy minimal space. Embedded Antenna Systems Market benefits from this trend by offering innovative low-profile solutions. It enables device makers to integrate advanced wireless capabilities without compromising form factor. Growing demand for lightweight and portable devices reinforces this design shift. Antenna miniaturization remains a critical trend shaping the market direction.

- For instance, Antenova’s Silvai ceramic antenna measures just 1.0 × 0.5 × 0.5 mm, with 55 percent efficiency at 863–870 MHz and 902–928 MHz bands, fitting into very tight device layouts.

Adoption of Multi-Band and Multi-Standard Antennas

The rising need for devices to support multiple connectivity standards drives innovation in antenna technology. Multi-band antennas allow seamless switching between Wi-Fi, Bluetooth, GPS, LTE, and 5G networks. It improves user experience by ensuring uninterrupted performance across applications. Industries including automotive, healthcare, and consumer electronics adopt these systems to simplify integration. Embedded antennas supporting multi-standard connectivity reduce design costs and complexity for manufacturers. This trend strengthens demand for versatile antenna solutions across global markets.

- For instance, Antenova’s Billi Wi‑Fi 6E antenna spans 2.4–7.125 GHz, covers Wi‑Fi 6E and Wi‑Fi 7 bands, and offers efficiencies of 70 percent, 60 percent, and 65 percent across its frequency ranges

Advancement of 5G and Beyond Connectivity

The expansion of 5G networks accelerates innovation in antenna systems. High-frequency millimeter-wave applications demand antennas with enhanced efficiency and low latency. Embedded Antenna Systems Market aligns with this trend by delivering compact modules suitable for advanced devices. It supports new applications such as smart factories, autonomous vehicles, and immersive AR/VR platforms. Industry players invest heavily in R&D to meet evolving 5G and future 6G requirements. The trend highlights how advanced connectivity reshapes market opportunities worldwide.

Focus on Automotive and Smart Infrastructure Applications

Automotive and smart infrastructure sectors create strong momentum for antenna adoption. Vehicles depend on antennas for infotainment, telematics, navigation, and safety systems. Embedded antennas enhance performance in connected and autonomous vehicles by supporting multiple functions. It allows integration into compact spaces while delivering reliability for V2X communication. Smart city projects also drive adoption for monitoring, traffic management, and public connectivity services. This trend positions embedded antennas as essential components in mobility and infrastructure ecosystems.

Market Challenges Analysis

Complexity in Design and Performance Optimization

The integration of antennas into compact devices creates challenges in balancing size, cost, and efficiency. Manufacturers face difficulties ensuring consistent performance across multiple frequency bands in limited space. Embedded Antenna Systems Market struggles with signal interference, reduced gain, and alignment issues during design. It requires advanced simulation tools and skilled engineering to achieve optimal performance. High demand for miniaturization further complicates antenna placement in consumer electronics and automotive systems. The challenge of delivering high reliability within tight design constraints slows adoption for some applications.

High Costs and Regulatory Compliance Barriers

Developing advanced embedded antenna solutions often involves significant research and material costs. High-performance antennas that meet 5G and multi-standard connectivity demand remain expensive for many manufacturers. It creates price pressures, particularly in cost-sensitive markets like consumer electronics. Regulatory compliance adds another layer of complexity, requiring strict testing for spectrum use and safety standards. Global differences in spectrum allocation and certification processes delay product launches across regions. These challenges limit scalability and create barriers for small and mid-sized companies entering the market.

Market Opportunities

Growth in Emerging Technologies and IoT Applications

Expanding adoption of IoT devices creates significant opportunities for embedded antenna systems. Smart homes, industrial automation, and healthcare applications demand antennas with compact size and reliable performance. Embedded Antenna Systems Market stands to benefit from this surge by offering tailored solutions for diverse environments. It supports rapid deployment of connected devices that rely on seamless wireless communication. Integration with AI-driven platforms and cloud-based ecosystems further increases antenna demand. Emerging technologies like AR/VR and smart wearables strengthen long-term growth prospects.

Expansion Across Automotive and Smart Infrastructure Sectors

The automotive industry presents strong opportunities with rising adoption of electric and autonomous vehicles. Embedded antennas enable V2X communication, telematics, and advanced driver assistance systems. It ensures vehicles remain connected to infrastructure, enhancing safety and mobility services. Smart city initiatives also create a favorable environment for antenna integration in public networks and monitoring systems. Growing investments in 5G and upcoming 6G networks expand opportunities for embedded antenna suppliers. The ability to serve both mobility and infrastructure needs secures a broad market potential.

Market Segmentation Analysis:

By Type

Embedded antenna systems can be segmented into chip antennas, patch antennas, PCB trace antennas, and flexible printed antennas. Each type caters to specific industry requirements, depending on size, efficiency, and integration needs. Chip antennas dominate consumer electronics due to their compact design and ability to support high-volume production. Patch antennas find use in applications that require directional coverage, such as GPS and satellite communication. PCB trace antennas are favored in cost-sensitive markets where simple integration is key. Flexible printed antennas gain traction in wearables and IoT devices where lightweight and adaptable designs are essential. Embedded Antenna Systems Market grows across all types, supported by demand for customized solutions.

- For instance, Antenova’s Minima SMD cellular antenna measures 40 × 10 × 3.3 mm, covers 617–3800 MHz bands, and achieves efficiency between 35% and 60% depending on frequency, ideal for space-conscious device designs

By Application

Applications for embedded antennas span consumer electronics, automotive, healthcare, industrial, and smart infrastructure sectors. Consumer electronics lead due to the widespread use of smartphones, tablets, and wearables requiring seamless connectivity. Automotive applications expand quickly, driven by electric and autonomous vehicles that demand advanced telematics and V2X communication. Healthcare devices such as patient monitoring systems and diagnostic equipment adopt compact antennas for reliable wireless performance. Industrial IoT uses antennas for predictive maintenance, automation, and logistics optimization. It strengthens adoption across multiple verticals by addressing both connectivity and performance demands.

- For instance, Antenova’s Inca flexible antenna for the 432–434 MHz ISM band measures 101 × 20 × 0.15 mm, delivers 45% efficiency, and adapts easily to smart metering and medical device form factors.

By Frequency Band

Frequency segmentation highlights low-frequency, mid-frequency, and high-frequency bands that antennas must support. Low-frequency bands provide extended range and penetration, making them suitable for rural communication and IoT devices with wide coverage needs. Mid-frequency bands balance range and bandwidth, enabling efficient support for Wi-Fi, LTE, and Bluetooth. High-frequency bands, including millimeter waves, gain importance with 5G networks requiring high data throughput and low latency. Embedded Antenna Systems Market leverages these segments to provide tailored solutions across industries. It enables manufacturers to meet diverse connectivity requirements while aligning with global spectrum policies. This segmentation ensures flexibility in product design, supporting market expansion.

Segments:

Based on Type

- Patch Antennas

- Chip Antennas

- Monopole Antennas

- Dipole Antennas

Based on Application

- Consumer Electronics

- Automotive

- Telecommunications

- Industrial

- Aerospace

Based on Frequency Band

- Sub-1 GHz

- 1 GHz to 6 GHz

- 6 GHz to 10 GHz

- Above 10 GHz

Based on End Use

- Smartphones

- Laptops

- Wearable Devices

- Automotive Systems

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 34% share of the Embedded Antenna Systems Market in 2024, supported by strong adoption across consumer electronics, automotive, and industrial IoT. The region benefits from advanced telecommunications infrastructure and rapid 5G rollout, which requires high-performance embedded antennas. Leading technology companies in the U.S. and Canada actively integrate antenna solutions into smartphones, wearables, and connected devices. It strengthens adoption across sectors such as healthcare, where wireless monitoring devices demand reliability and compact design. The automotive industry, particularly in the U.S., also drives demand with rising integration of V2X communication and telematics in electric and autonomous vehicles. Government regulations supporting IoT standardization and funding for smart city initiatives further enhance regional growth. Continuous innovation and the presence of major antenna manufacturers position North America as a key contributor to overall market expansion.

Europe

Europe accounts for a 27% share of the Embedded Antenna Systems Market, driven by strong adoption in automotive and industrial automation applications. Countries such as Germany, France, and the U.K. lead adoption due to advanced automotive production, smart manufacturing, and healthcare modernization. The region benefits from strict regulations on connectivity standards and safety compliance, pushing manufacturers to integrate advanced antenna solutions. It supports the expansion of applications like connected cars, smart factories, and telemedicine platforms. European Union initiatives promoting digital transformation and low-power IoT deployment further accelerate market opportunities. Consumer demand for wearables and smart home products also reinforces growth in Western Europe, while Eastern Europe records steady progress through industrial modernization. With innovation hubs across major economies, Europe continues to strengthen its role in antenna development and adoption.

Asia-Pacific

Asia-Pacific commands a 30% share of the Embedded Antenna Systems Market, making it one of the fastest-growing regions. Rapid urbanization, strong consumer electronics demand, and large-scale 5G deployment drive expansion. China, Japan, South Korea, and India serve as major hubs for smartphone manufacturing, IoT adoption, and automotive innovation. It benefits from mass production capabilities, enabling cost-effective deployment of advanced antenna systems. The region also leads in the development of smart cities, supported by government-backed initiatives and investments in public connectivity infrastructure. Automotive applications grow significantly, especially in electric vehicle adoption across China and Japan. Expanding healthcare technology and industrial IoT adoption further enhance regional prospects. Asia-Pacific’s strong presence of global electronics manufacturers ensures continued leadership in embedded antenna production and innovation.

Latin America

Latin America holds a 5% share of the Embedded Antenna Systems Market, supported by growing connectivity needs and rising adoption of smartphones and wearables. Countries like Brazil and Mexico lead demand due to expanding consumer bases and digital infrastructure projects. The region shows increasing adoption of IoT in logistics, agriculture, and manufacturing, requiring compact and reliable antenna systems. It also benefits from gradual 5G rollout, which strengthens demand for high-performance antennas across urban centers. Automotive telematics adoption in commercial fleets further contributes to growth. Challenges such as cost sensitivity and regulatory delays limit faster expansion, but government-backed digitalization projects create future opportunities. Latin America positions itself as an emerging contributor to the global market.

Middle East & Africa

Middle East & Africa capture a 4% share of the Embedded Antenna Systems Market, driven by early adoption in smart city projects and infrastructure modernization. Countries such as the UAE, Saudi Arabia, and South Africa invest heavily in digital transformation, creating demand for advanced antennas. It supports adoption in applications like transportation monitoring, healthcare, and consumer electronics. Rising investment in 5G deployment provides further opportunities for antenna integration across devices and networks. The region also demonstrates potential in automotive applications, particularly through connected vehicle initiatives in Gulf countries. Limited local manufacturing and high import reliance remain challenges, but increasing partnerships with global technology players improve access to advanced solutions. Middle East & Africa show steady progress, aligning with global connectivity trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hirschmann

- Amphenol

- Wistron NeWeb Corporation

- Laird Connectivity

- Janco Electronics

- Skycross

- Integrated Device Technology

- Qualcomm

- Antenova

- RFMW

Competitive Analysis

Competitive landscape of the Embedded Antenna Systems Market features key players such as Qualcomm, Amphenol, Wistron NeWeb Corporation, Laird Connectivity, Skycross, Antenova, Hirschmann, Janco Electronics, RFMW, and Integrated Device Technology. These companies focus on innovation, strategic collaborations, and advanced antenna designs to address diverse industry demands. Market leaders invest in R&D to develop compact, multi-band, and high-efficiency solutions that align with the requirements of 5G, IoT, and connected automotive applications. Many players strengthen their global presence through partnerships with electronics manufacturers and telecom providers, ensuring seamless integration of antenna modules into consumer devices and industrial platforms. The competitive environment is defined by continuous product development, where advancements in flexible antennas and low-profile solutions gain importance. Firms also pursue acquisitions and supply chain partnerships to expand market reach and improve technical capabilities. Strong emphasis on reliability, performance, and regulatory compliance positions these players at the forefront of shaping embedded antenna adoption across industries.

Recent Developments

- In August 2025, Amphenol agreed to acquire CommScope’s Connectivity and Cable Solutions business for $10.5 billion, expecting ACCRETIVE earnings impact.

- In June 2025, Amphenol Printed Circuits showcased its RF PCB, rigid‑flex, and backplane design and test capabilities at IEEE MTT‑S International Microwave Symposium.

- In March 2025, Antenova launched the Inpai SMD cellular antenna, designed for NB-IoT and Cat-M applications across all LTE bands, offering high performance in a compact 35 × 8 × 3.3 mm form and meeting AT&T’s Small Form Factor requirements .

- In February 2025, Amphenol completed acquisition of CommScope’s OWN and DAS businesses.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Frequency Band, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand grows for compact antennas in miniature devices across consumer and industrial sectors.

- Multi-band antennas gain traction to support seamless transitions between emerging and legacy networks.

- Integration of AI in antenna management improves wireless performance and power efficiency.

- Wider adoption of 5G and upcoming 6G technologies increases demand for high-frequency embedded antennas.

- Expanding electric and autonomous vehicle markets drive need for robust in-vehicle and V2X antennas.

- Smart city and infrastructure development stimulates deployment of embedded antennas in public installations.

- Growth in industrial automation increases demand for reliable, low-latency antenna systems in factories.

- Health monitoring devices and medical IoT applications push growth for compact, high-reliability antennas.

- Flexible and conformal antennas rise in popularity for wearable tech and non-standard form factors.

- Manufacturers emphasize cost-efficient design to meet demand in volume-sensitive and emerging markets.