Market Overview

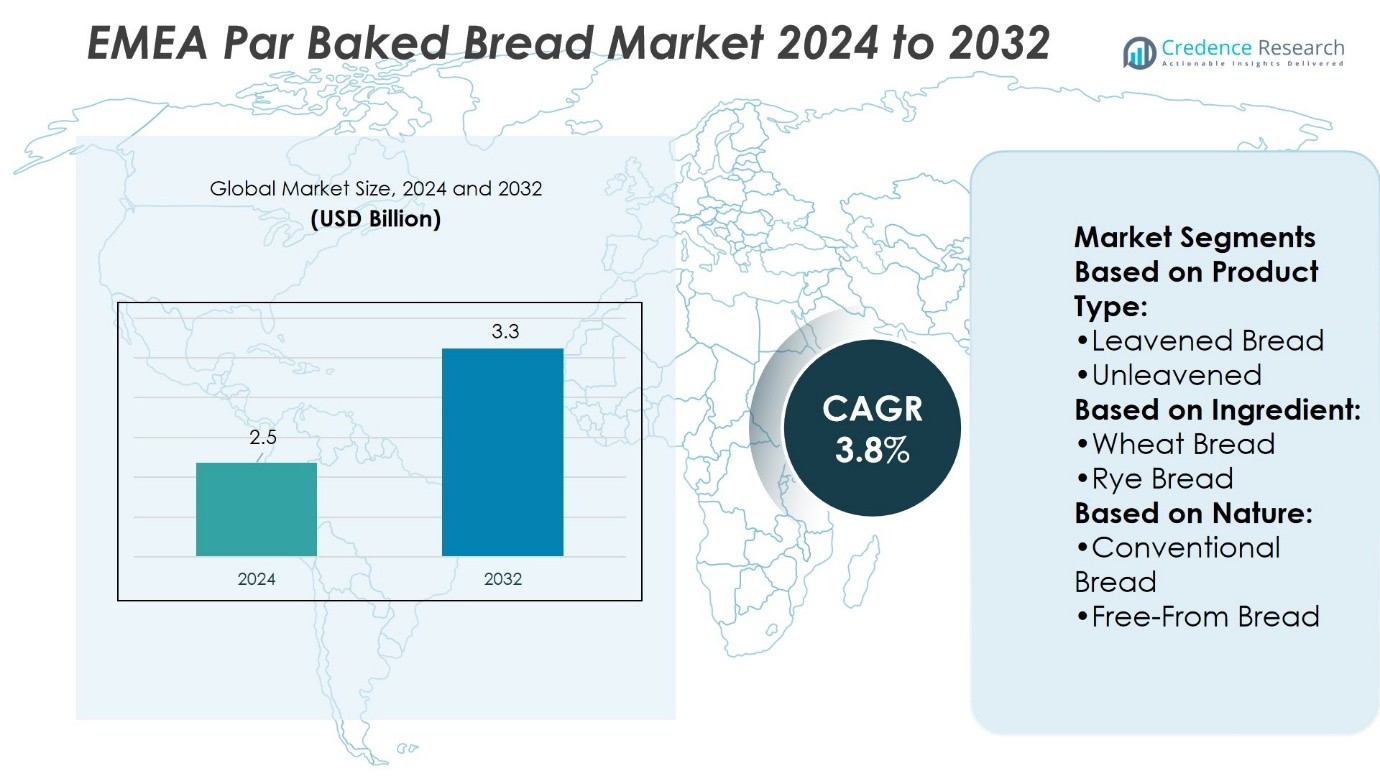

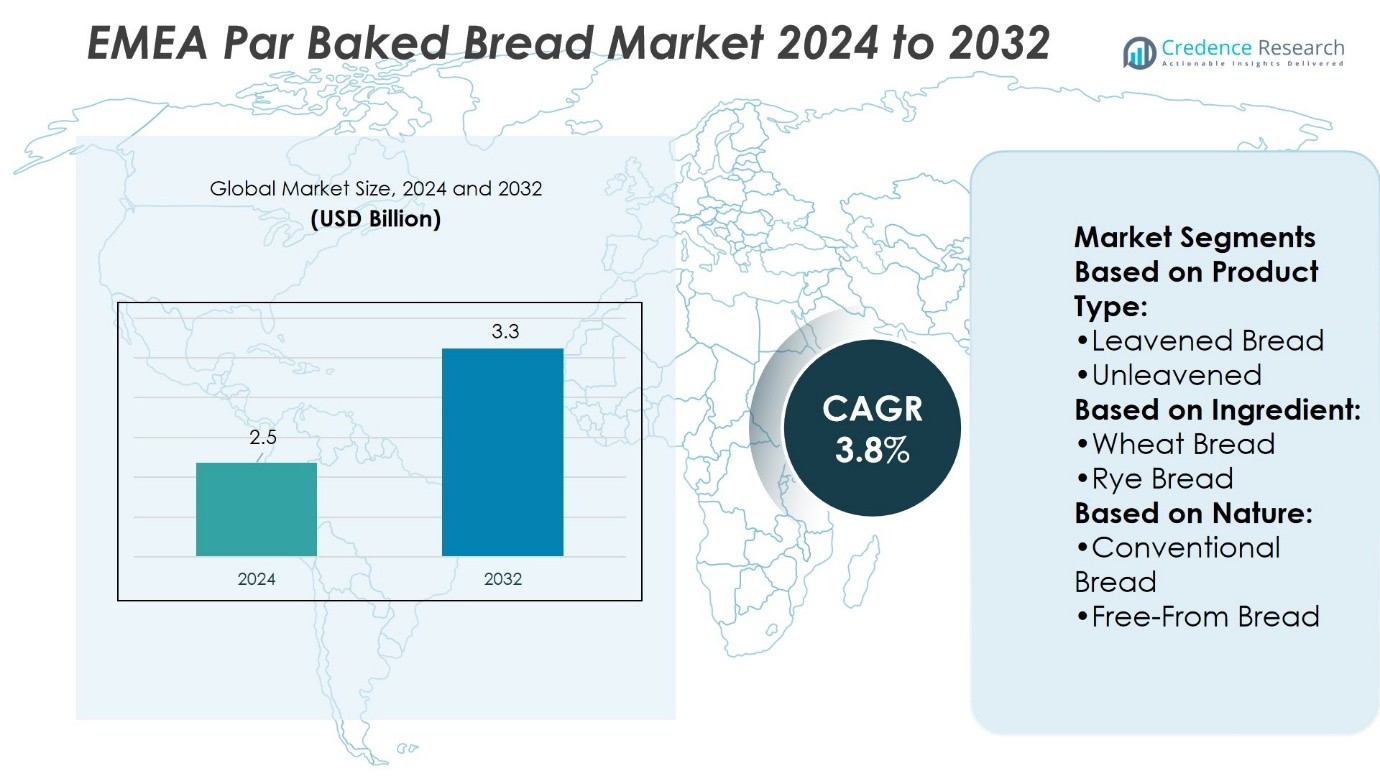

EMEA Par Baked Bread Market size was valued at USD 2.5 billion in 2024 and is anticipated to reach USD 3.3 billion by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EMEA Par Baked Bread Market Size 2024 |

USD 2.5 Billion |

| EMEA Par Baked Bread Market, CAGR |

3.8% |

| EMEA Par Baked Bread Market Size 2032 |

USD 3.3 Billion |

The EMEA Par Baked Bread Market grows with rising demand for convenience, supported by expanding retail and foodservice channels. Urban consumers seek ready-to-bake bread that saves time while ensuring freshness and quality. Supermarkets, hypermarkets, and quick-service restaurants rely on par baked formats to optimize operations and reduce waste. Health-focused trends, including clean-label, gluten-free, and wholegrain options, strengthen product appeal among wellness-driven buyers. Innovation in artisan-style and specialty breads enhances variety and supports premium positioning. Advancements in freezing technologies and logistics infrastructure further improve shelf life and distribution efficiency, driving sustained adoption across diverse regional markets.

Europe holds the largest share of the EMEA Par Baked Bread Market, driven by strong bakery traditions, advanced cold chain infrastructure, and widespread retail penetration. North Africa and the Middle East show growing demand, supported by cultural preference for flatbreads and expanding foodservice sectors. Asia within EMEA contributes through rising urban consumption and modern retail growth. Key players such as Kerry Group plc, Archer Daniels Midland Company, Cargill, Corbion, Associated British Foods plc, and Dawn Food Products, Inc. strengthen market competitiveness through innovation and distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- EMEA Par Baked Bread Market size was valued at USD 2.5 billion in 2024 and is expected to reach USD 3.3 billion by 2032, at a CAGR of 3.8%.

- Rising demand for convenience fuels market growth, supported by retail expansion and foodservice adoption.

- Trends include clean-label, gluten-free, wholegrain, and artisan-style breads gaining strong consumer interest.

- Competition intensifies as leading players focus on innovation, product variety, and distribution partnerships.

- High operational costs and supply chain limitations act as restraints for consistent growth.

- Europe leads the market with strong bakery traditions and advanced cold chain infrastructure.

- North Africa, Middle East, and Asia within EMEA show rising demand supported by cultural bread preferences, modern retail, and foodservice expansion.

Market Drivers

Rising Demand for Convenient Bakery Solutions Across Retail and Foodservice

The EMEA Par Baked Bread Market benefits from the growing preference for convenience in retail and foodservice. Supermarkets and quick-service restaurants increase adoption to shorten preparation times. It allows retailers to provide fresh bread on demand without full-scale baking facilities. Hotels and catering services use it to improve menu variety and reduce waste. The ability to bake small batches supports consistent quality across locations. Rising urban lifestyles encourage reliance on ready-to-bake bakery formats that align with fast-paced consumption patterns.

- For instance, Bimbo Solar’ initiative, Grupo Bimbo has implemented a wide range of renewable energy projects, including solar roofs, to support self-supply operations at its facilities. A report confirmed that 97% of the electricity used globally comes from renewable sources, and the company has achieved a 100% renewable electricity supply in 28 of the 35 countries where it operates.

Expansion of Frozen Supply Chains Supporting Product Availability

The growth of cold storage and logistics infrastructure strengthens the reach of par baked bread across EMEA. It ensures consistent supply to both developed and emerging markets. Producers expand frozen lines to extend product shelf life and minimize inventory risks. Retailers benefit from stable quality during long transport distances. Foodservice distributors rely on frozen formats to guarantee year-round supply. Advanced freezing technologies maintain texture and flavor integrity, increasing consumer acceptance. The EMEA Par Baked Bread Market gains stability from these distribution efficiencies.

- For instance, Armstrong’s Ultima LEC ceiling panels—introduced with 54% recycled content—deliver a 43% reduction in embodied carbon compared to standard Ultima panels, incorporating USDA‑verified 100 % bio‑based content and participate in the company’s Ceiling‑to‑Ceiling recycling program.

Product Innovation in Healthier and Specialty Bread Varieties

Innovation in healthier formulations drives strong interest in par baked bread across regional markets. It includes the introduction of wholegrain, gluten-free, and high-fiber variants. Producers respond to consumer demand for wellness-oriented diets. Specialty flavors, ethnic recipes, and artisan-style loaves add differentiation in crowded bakery aisles. Manufacturers highlight clean-label ingredients to attract health-conscious buyers. These innovations support brand loyalty and premium positioning in competitive retail channels. The EMEA Par Baked Bread Market benefits from evolving consumer preferences.

Growing Adoption by Quick-Service and Institutional Catering Segments

Institutional buyers increase reliance on par baked bread to streamline operations. Schools, hospitals, and airline catering units use it to optimize meal preparation. Quick-service restaurants improve turnaround speed while maintaining product consistency. It reduces labor dependency in kitchens with limited staff. Chain operators leverage standardized par baked bread for uniformity across outlets. This trend strengthens partnerships between bakery manufacturers and institutional distributors. Expanding catering demand underpins steady growth for the EMEA Par Baked Bread Market.

Market Trends

Rising Popularity of Artisan-Style and Premium Bread Varieties

The EMEA Par Baked Bread Market sees strong traction from artisan-style and premium options. Consumers prefer loaves with rustic textures, seeded toppings, and authentic recipes. It aligns with a broader move toward craft and authenticity in food products. Retailers expand premium bakery sections to capture higher-margin sales. Foodservice operators adopt artisan variants to attract customers seeking upscale dining. Producers invest in developing unique flavor profiles that differentiate from mass-market bread. This trend supports value-driven growth across both retail and horeca channels.

- For instance, Mondelez International deployed an AI-powered recipe development platform starting in 2019. The system has been utilized across over 70 separate product projects, including launches like the Gluten-Free Golden Oreo and subtle upgrades to classic recipes.

Growing Role of Frozen Technology in Product Preservation

Frozen technology continues to define the market landscape for par baked bread. It extends shelf life, preserves freshness, and enables flexible distribution. It helps retailers and restaurants reduce waste while ensuring quality consistency. Innovations in freezing methods improve crumb softness and crust quality after rebaking. Producers strengthen export opportunities by using advanced cold chain solutions. Frozen formats also support seasonal demand peaks without compromising product stability. The EMEA Par Baked Bread Market leverages these advances to sustain broad availability.

- For instance,General Mills is adding a 35,000 square-foot, two-story pilot-plant wing to its James Ford Bell Technical Center in Golden Valley, Minnesota. This addition will boost pilot-plant space by over 20%, providing the scale needed to accelerate research and innovation.

Increasing Demand for Clean-Label and Health-Oriented Formulations

Consumer focus on health fuels demand for par baked bread with clean-label claims. It includes reduced additives, natural fermentation, and wholegrain ingredients. Manufacturers introduce high-protein and gluten-free variants to appeal to specific diet segments. Retail buyers highlight nutritional transparency to strengthen consumer trust. Health-oriented options gain space on supermarket shelves, especially in urban centers. Restaurants and cafes also integrate these breads to meet lifestyle-driven choices. The EMEA Par Baked Bread Market benefits from the alignment with wellness-focused consumption.

Expanding Influence of Quick-Service and On-the-Go Food Culture

The spread of quick-service and grab-and-go formats drives higher adoption of par baked bread. It offers speed, consistency, and convenience in preparation. Fast-casual chains use standardized bread bases to streamline operations. Retailers promote par baked baguettes and rolls for take-home consumption. The growing demand for snacking supports broader variety in product packaging sizes. Catering services rely on these solutions to deliver reliable output under time constraints. The EMEA Par Baked Bread Market aligns with evolving consumer dining behaviors.

Market Challenges Analysis

Rising Operational Costs and Supply Chain Constraints Impacting Market Stability

The EMEA Par Baked Bread Market faces significant pressure from rising raw material and energy costs. Wheat, yeast, and specialty ingredients often experience price volatility due to global supply shifts. It creates financial strain for manufacturers aiming to maintain competitive pricing. Energy-intensive baking and freezing processes also increase operational expenses. Supply chain disruptions across regions limit timely distribution and affect product freshness. Retailers and foodservice operators bear higher costs, influencing pricing strategies and margins. These factors challenge consistent growth and profitability across the market.

Intense Competition and Shifting Consumer Expectations Limiting Differentiation

The competitive bakery landscape poses challenges for par baked bread producers in EMEA. It competes directly with fresh bakery products that attract health-conscious and authenticity-driven buyers. Many consumers perceive fresh in-store bakery items as superior to frozen par baked options. Meeting evolving expectations for clean-label, organic, and premium bread varieties adds complexity for producers. Intense competition from local artisan bakers and multinational players heightens market pressure. Retailers demand constant innovation while maintaining cost efficiency, creating operational hurdles. The EMEA Par Baked Bread Market must balance affordability, innovation, and consumer trust to remain resilient.

Market Opportunities

Expansion into Health-Oriented and Specialty Bread Segments Driving Growth Potential

The EMEA Par Baked Bread Market holds strong opportunities in health-oriented and specialty categories. Demand for wholegrain, gluten-free, and high-protein variants continues to rise among health-conscious consumers. It allows producers to capture new customer bases and differentiate offerings in retail channels. Clean-label and organic par baked bread varieties further strengthen consumer trust and brand value. Specialty breads inspired by ethnic cuisines create new niches across urban markets. Retailers and foodservice operators both benefit from expanding product ranges aligned with wellness and lifestyle trends. This opportunity enhances long-term brand positioning in a competitive environment.

Growth in Foodservice and Quick-Service Channels Supporting Wider Adoption

Foodservice expansion across EMEA provides clear opportunities for par baked bread producers. Quick-service restaurants and catering services rely on it for consistency, speed, and reduced preparation costs. It enables standardized output across multiple outlets, improving operational efficiency for chain operators. Airlines, hotels, and institutional caterers expand menus by using frozen par baked bread formats. Rising demand for on-the-go dining strengthens the role of par baked baguettes, rolls, and sandwich bases. Export potential also grows with improvements in frozen logistics and cold chain networks. The EMEA Par Baked Bread Market is well-positioned to leverage these opportunities for sustained expansion.

Market Segmentation Analysis:

By Product Type

The EMEA Par Baked Bread Market is segmented into leavened bread and unleavened or flat bread. Leavened bread dominates due to widespread preference for baguettes, rolls, and loaves in both retail and foodservice channels. It appeals to consumers seeking freshness and convenience with minimal preparation time. Flat bread, including pita and focaccia, gains traction in markets with strong ethnic and Mediterranean food culture. It also supports menu diversification in quick-service restaurants and catering services. Producers invest in par baked formats of both types to ensure consistency and scalability for retailers and horeca distributors. The balance between traditional leavened bread and versatile flat bread provides breadth across customer segments.

- For instance,The Campbell’s Company expanded its Richmond, Utah facility — home to its Pepperidge Farm bakery products — by 100,000 sq ft, bringing the total facility space to 400,000 sq ft. The expansion included the installation of a fourth Goldfish cracker line capable of producing over 5 million units per hour, significantly ramping throughput to meet rising consumer demand.

By Ingredient

The market by ingredient includes wheat bread, rye bread, and others. Wheat bread remains the leading category due to strong consumer familiarity and versatile applications across daily meals. It supports mass demand in supermarkets, convenience stores, and institutional catering. Rye bread shows steady growth in regions such as Northern and Eastern Europe where traditional consumption patterns remain strong. It appeals to health-conscious buyers due to higher fiber content and distinct flavor. Other formulations, including multigrain and specialty blends, expand options for premium-positioned products. The EMEA Par Baked Bread Market gains strength from this ingredient diversity, meeting both mainstream and niche preferences.

- For instance, Aker Solutions 3D printed tubing hanger protectors using recycled steel powder, reducing the part’s weight from 227 kg to 13 kg, while cutting CO₂ emissions from 237 kg to 34 kg per unit. Over 80% of the recycled metal came from the company’s own Tranby facility—demonstrating both material savings and a circular production model.

By Nature

The segmentation by nature divides the market into conventional bread and free-from bread. Conventional bread accounts for the largest share, supported by affordability and strong retail presence. It remains a staple in everyday diets across EMEA. Free-from bread, including gluten-free and allergen-free variants, demonstrates rising demand in urban centers and health-oriented consumer groups. It provides opportunities for manufacturers to address dietary restrictions while differentiating product lines. Clean-label claims and natural formulations further enhance consumer trust in this category. The combination of conventional dominance and the emerging free-from trend ensures balance between volume growth and premium positioning across the market.

Segments:

Based on Product Type:

- Leavened Bread

- Unleavened

Based on Ingredient:

Based on Nature:

- Conventional Bread

- Free-From Bread

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North Africa

North Africa holds 18% of the EMEA Par Baked Bread Market. It benefits from high demand for flatbreads, including pita and khubz, which are staple foods in the region. Par baked formats provide convenience and consistent quality for both retail and foodservice channels. Supermarkets and modern retail chains in countries such as Egypt, Morocco, and Algeria drive availability of frozen bakery products. It supports quick-service restaurants, hotels, and catering providers seeking operational efficiency. Urbanization and rising household incomes further boost adoption of ready-to-bake bread. Health-focused products, including wholegrain and fortified variants, gain interest among urban consumers.

Europe

Europe accounts for the largest share of the EMEA Par Baked Bread Market at 50%. It has a strong tradition of bread consumption, with high per-capita intake in countries such as France, Germany, and Italy. Leavened breads and artisan-style variants dominate consumer preferences. Par baked bread benefits from advanced cold chain infrastructure and wide retail penetration. Supermarkets, convenience stores, and horeca channels sustain steady demand. It supports premium and clean-label offerings, appealing to health-conscious buyers. Rapid urbanization and the growth of quick-service restaurants further reinforce market dominance.

Asia

Asia holds 15% of the EMEA Par Baked Bread Market. Demand grows with expanding urban populations and modern retail penetration in countries such as Turkey and Israel. Flat breads and leavened variants coexist to meet diverse consumer needs. Supermarkets and convenience stores drive availability, while foodservice outlets rely on par baked formats for consistency. Rising exposure to Western-style bread products fuels consumer acceptance. Health-oriented formulations, including multigrain and low-sodium bread, gain traction in urban areas. It also benefits from investments in frozen logistics and cold storage.

Latin America

Latin America contributes 10% of the EMEA Par Baked Bread Market. Countries such as Brazil, Argentina, and Mexico show growing demand for convenient and ready-to-bake breads. Supermarkets and retail chains drive availability, while foodservice outlets rely on it to maintain quality and reduce preparation time. Flatbreads and leavened options coexist to satisfy local preferences. Urban consumers increasingly adopt ready-to-bake formats for household use. Product innovations, including gluten-free and organic bread, enhance consumer appeal. It also supports premium and mainstream segments across major cities.

Middle East

The Middle East represents 7% of the EMEA Par Baked Bread Market. Demand is driven by urban households and quick-service restaurants requiring consistent bread quality. Flat breads dominate, but leavened options gain gradual adoption. Supermarkets and modern retail chains provide visibility for frozen par baked products. Foodservice channels, including hotels and catering, rely on it to maintain efficiency. Rising tourism and expatriate populations increase demand for ready-to-bake solutions. Health-conscious formats, such as wholegrain bread, attract urban buyers and niche segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kerry Group plc

- Archer Daniels Midland Company

- Cargill

- Dawn Food Products, Inc.

- British Bakels

- Koninklijke DSM N.V.

- IFF

- Associated British Foods plc

- AAK AB

- Corbion

Competitive Analysis

The EMEA Par Baked Bread Market players such as Kerry Group plc, Archer Daniels Midland Company, Cargill, Dawn Food Products, Inc., British Bakels, Koninklijke DSM N.V., IFF, Associated British Foods plc, AAK AB, Corbion. The EMEA Par Baked Bread Market is highly competitive, driven by demand from retail and foodservice sectors. Companies focus on expanding production capacities to ensure consistent quality and extended shelf life. It encourages investments in frozen and chilled logistics, supporting supply chain efficiency. Product diversification remains central, with leavened, flat, and specialty breads meeting evolving consumer preferences. Health-focused innovations, including fortified and clean-label options, gain traction among urban populations. Strategic collaborations with supermarkets and quick-service restaurants strengthen market presence. Continuous process optimization and flavor innovation allow companies to reduce costs and differentiate offerings. Reliable distribution networks and competitive pricing remain critical for sustaining market growth. Urbanization, rising disposable incomes, and the popularity of ready-to-bake formats further drive adoption. The market rewards companies that combine scale, operational efficiency, and responsiveness to consumer trends, positioning them for long-term expansion across the region.

Recent Developments

- In May 2025, Dawn Food Products and British Bakels are expanding their presence in the artisan and specialty bread segment in EMEA, offering customized formulations and sustainable production methods aligned with rising environmental awareness and regulatory standards. Their innovations improve baking efficiency and product consistency for retailers and foodservice providers.

- In January 2025, Schmidt Baking, part of the H&S Family of Bakeries, has rolled out a new bread line under its Old Thyme brand, named Artisan’s Choice. The lineup features three distinct varieties: Italian Rustico, crafted with olive oil, sea salt, garlic, and onion; and Rustic Brioche, a sweet, indulgent loaf that’s both dairy and egg-free.

- In December 2024, Furlani Foods announced the acquisition of Cole’s Quality Foods, a notable player in the frozen garlic bread market with two production facilities in Michigan, strengthening Furlani’s position in the frozen bread segment.

- In September 2024, Grupo Bimbo expanded its South American presence by acquiring Brazil-based Wickbold brands, enhancing its product portfolio and distribution capabilities in the region’s largest bread market.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Ingredient, Nature and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The EMEA Par Baked Bread Market will expand with growing preference for ready-to-bake products.

- Rising urbanization will increase demand from supermarkets and convenience stores.

- Health-oriented options like wholegrain and gluten-free bread will gain stronger consumer interest.

- Quick-service restaurants and catering units will boost adoption for efficiency and consistency.

- Frozen storage and logistics improvements will support long-distance distribution across the region.

- Product innovation in artisan and ethnic bread varieties will enhance market appeal.

- Clean-label formulations will strengthen consumer trust and brand positioning.

- Strategic collaborations between producers and retail chains will drive visibility and sales.

- Emerging markets in North Africa and the Middle East will contribute to future growth.

- Ongoing R&D in baking and freezing technologies will improve product quality and shelf life.