Market Overview

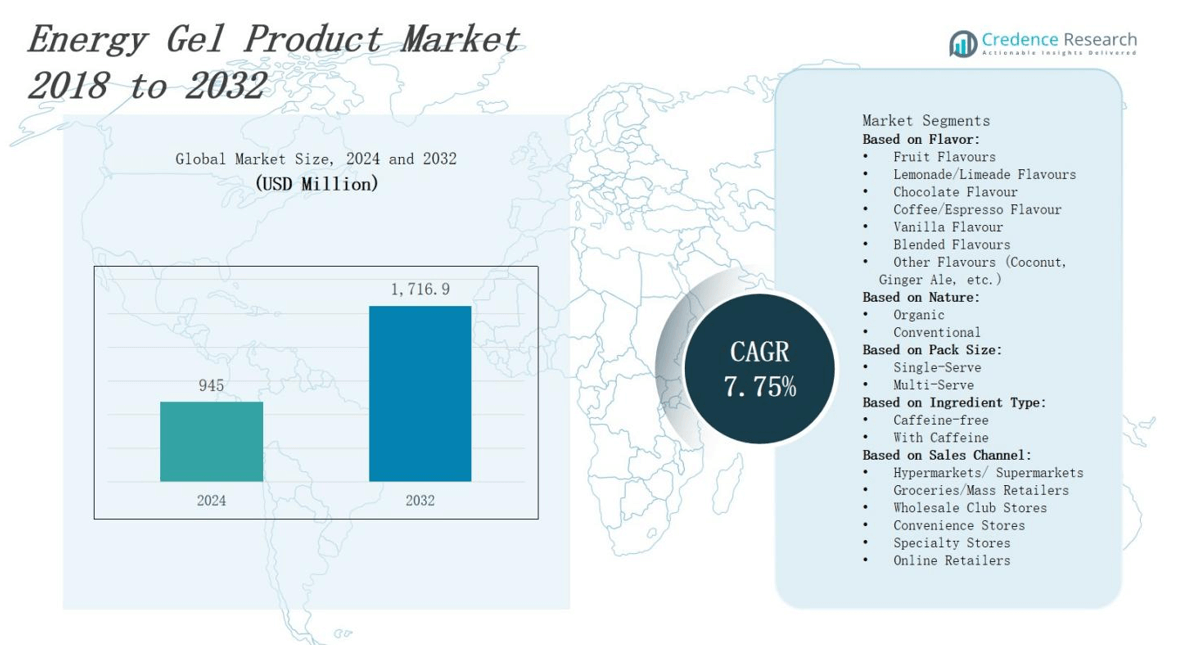

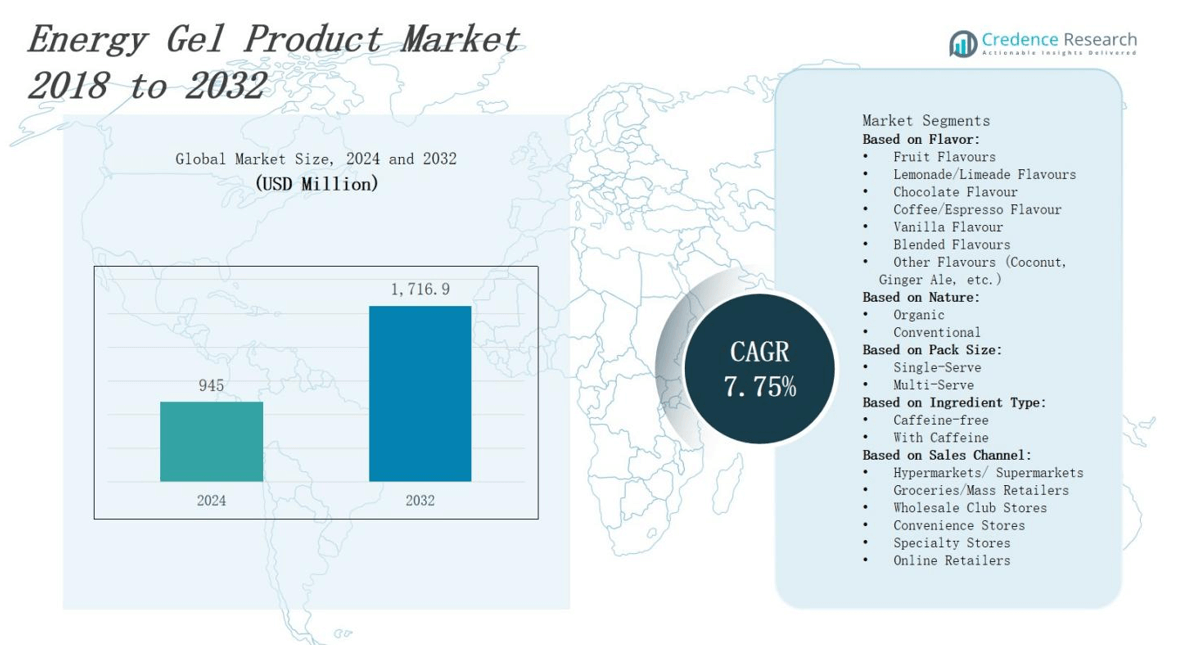

The energy gel product market is projected to expand from USD 945 million in 2024 to USD 1,716.9 million by 2032, reflecting a CAGR of 7.75%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Energy Gel Product Market Size 2024 |

USD 945 million |

| Energy Gel Product Market, CAGR |

7.75% |

| Energy Gel Product Market Size 2032 |

USD 1,716.9 million |

Manufacturers develop advanced energy gel formulations to meet rising demand from endurance athletes and fitness enthusiasts. Brands invest in research to enhance nutrient profiles with carbohydrates, electrolytes and natural caffeine sources. They introduce diverse flavors and organic ingredients to appeal to health‑conscious consumers. Companies expand distribution through e‑commerce platforms and specialty sports retailers to improve accessibility. They adopt sustainable, biodegradable packaging to address environmental concerns. Market participants integrate smart labeling and QR codes to deliver real‑time nutritional data and training guidance. They collaborate with sports nutritionists and professional teams to validate product efficacy and strengthen brand credibility among target audiences.

The energy gel product market in North America dominates with 36% share, driven by endurance events. Europe holds 29% share, fueled by clean‑label demand. Asia Pacific accounts for 24% share and benefits from growing middle‑class incomes. Latin America registers 7% share while Middle East & Africa capture 4% share. Key players include Clif Bar & Company, Gatorade Company, Powerbar Inc., Zipvit Ltd. and EN‑R‑G Foods. They invest in distribution, trial campaigns and partnerships to strengthen regional presence.

Market Insights

- The energy gel product market expands from USD 945 million in 2024 to USD 1,716.9 million by 2032 at a CAGR of 7.75%.

- Manufacturers develop advanced gel formulations with carbohydrates, electrolytes and natural caffeine to meet endurance athlete demand.

- Brands expand distribution via e‑commerce and specialty sports retailers and adopt direct‑to‑consumer channels with subscriptions.

- Clean‑label and organic ingredients drive product differentiation, with eco‑friendly, biodegradable packaging that addresses sustainability concerns.

- Digital integrations such as QR codes, mobile apps and NFC chips enhance consumer engagement and allow real‑time nutrition guidance.

- North America holds 36% share, Europe 29%, Asia Pacific 24%, Latin America 7% and Middle East & Africa 4%, informing regional strategies.

- Key players like Clif Bar & Company, Gatorade Company, Powerbar Inc., Zipvit Ltd. and EN‑R‑G Foods validate efficacy through clinical trials and athlete partnerships.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Endurance Sports Demand

The energy gel product market responds to growing endurance events and fitness challenges worldwide. It meets athlete needs with quick carbohydrate delivery and muscle fuel. Brands target marathon runners, cyclists and triathletes through sponsored events. Companies research nutrient timing to boost performance and recovery. They tailor formulations to match sport intensity and duration. Manufacturers collaborate with coaches and medical professionals to validate efficacy and build trust. Brands monitor feedback to refine strategies.

- For instance, Maurten invests heavily in athlete feedback and scientific validation to tailor their carbohydrate gels for cyclists enduring intense, prolonged exertion, ensuring effectiveness and trust among competitors.

Advanced Nutrient Formulation

Manufacturers develop specialized blends that combine carbohydrates, electrolytes and natural stimulants to optimize energy release. The energy gel product market experiences high demand for clean‑label and organic ingredients. Companies invest in research to adjust osmolarity and improve absorption rates. They test new flavor profiles to satisfy diverse tastes. Partnerships with ingredient suppliers enable rapid formula updates. It distributes product samples at trade shows and athletic expos to drive trials regularly.

- For instance, Huma Nutrition developed a USDA-certified organic energy gel range that appeals to consumers seeking natural and clean-label options, aligning with market demand for organic ingredients.

Expanded Distribution Channels

The energy gel product market sells via retailers and online platforms across sporting goods stores, pharmacies and e‑commerce sites. It leverages direct‑to‑consumer models to gather customer insights. Companies negotiate shelf space at gyms and health clubs to improve visibility. They launch subscriptions with customized shipments. Wholesale partnerships with distributors accelerate regional expansion. Brands optimize digital marketing campaigns to reach niche athlete communities and boost sales and monitor performance metrics monthly.

Sustainable Packaging Initiatives

Manufacturers replace single‑use plastics with biodegradable pouches and recyclable materials to meet consumer preferences. The energy gel product market adopts eco‑friendly packaging designs to reduce waste. Companies test compostable film and plant‑based inks to minimize environmental impact. They source materials from certified suppliers to ensure traceability. Packaging engineers refine pouch seals to prevent leaks and extend shelf life. Brands actively promote sustainability efforts through labels and social media campaigns worldwide regularly.

Market Trends

Personalized Nutrition and Customized Formulations

Manufacturers tailor energy gel product market offerings to individual athlete profiles. They analyze training data to optimize carbohydrate ratios. Brands incorporate customer feedback to refine nutrient timing. They collaborate with sports scientists to validate personalization protocols. It supports improved endurance and reduced fatigue during events. Companies deploy online questionnaires to capture diet preferences and adjust formulations accordingly. These trends drive stronger engagement with target audiences.

Shift Toward Clean Label and Natural Ingredients

Consumers demand pure formulas free from artificial components. Manufacturers replace synthetic sweeteners with fruit extracts and natural caffeine. They pursue organic certification to meet regulatory standards. Brands highlight ingredient transparency on labels and marketing. The energy gel product market registers high sales for products that feature plant‑based compounds. Companies adopt renewable supply chains to secure sustainable sources and reinforce brand integrity. It reduces consumer skepticism and fosters loyalty.

- For instance, Tate & Lyle has focused on introducing clean-label sweeteners derived from natural fibers and plant extracts, supporting both health and environmental goals.

Integration of Digital Tools and Smart Packaging

Brands integrate QR codes to share real‑time nutrition guidance. They launch mobile apps that track gel consumption and performance metrics. Manufacturers embed near‑field communication chips in pouches to monitor freshness and usage. It enhances consumer interaction and data collection. The energy gel product market embraces digital channels to foster direct relationships with athletes. Companies refine digital campaigns based on user analytics. They secure partnerships with fitness platforms for cross‑promotion efforts.

- For instance, Whiskas includes QR codes on its cat food packaging that redirect users to comprehensive nutrition, grooming, and health information, boosting customer interaction and education.

Expansion of Variant Offerings and Functional Benefits

Manufacturers offer caffeinated, electrolyte‑enhanced and protein‑infused gels to serve diverse requirements. Brands develop vegan and keto‑friendly options to reach niche segments. The energy gel product market experiences growth in specialty formulations tailored to altitude and heat conditions. Companies test flavor combinations that support quicker recovery phases. It leverages clinical studies to substantiate health claims and regulatory compliance. Firms coordinate promotional events to showcase new products and gather immediate feedback.

Market Challenges Analysis

High Ingredient Sourcing Costs and Supply Chain Constraints

Manufacturers face rising costs for raw materials like carbohydrates and natural extracts. It strains profit margins for producers in the energy gel product market. Supply chain disruptions cause inventory shortages and production delays. Companies negotiate long‑term contracts with ingredient suppliers to secure consistent prices. They invest in alternative sourcing strategies, explore local ingredient partnerships, and manage rising packaging expenses tied to sustainability requirements. Fluctuating consumer demand increases forecasting challenges and heightens inventory risks, while retailers demand flexible pricing models. Firms monitor logistics performance and implement buffer stocks to prevent future disruptions.

Regulatory Compliance and Consumer Skepticism

Regulatory agencies tighten rules on labeling claims and health certifications. The energy gel product market must adjust formulas to meet diverse regional standards. It increases development time and requires comprehensive documentation. Consumers scrutinize ingredient lists amid growing interest in clean labels. Brands invest in third‑party testing to validate product safety and quality and mitigate risk of negative publicity. Global variations in permitted nutrient levels add complexity to cross‑border distribution. Companies implement robust quality control systems and digital traceability tools to rebuild consumer trust.

Market Opportunities

Expansion into Emerging Markets and Niche Segments

Manufacturers can enter emerging markets where endurance sports grow. The energy gel product market can expand in Asia and Latin America. Brands can develop regional flavors and nutritional profiles to match local tastes. It can partner with local distributors and sports organizations to increase brand awareness. Companies can target recreational athletes and corporate wellness programs to broaden customer base. Firms can launch entry‑level product lines to attract casual consumers. Retailers can offer bundled packs with event registrations to stimulate trial and adoption.

Innovation in Functional Ingredients and Technology Integration

Companies can innovate with plant‑derived adaptogens and nootropic compounds to enhance focus. They can integrate smart packaging features to track usage and serve personalized recommendations. The energy gel product market can leverage subscription models with AI‑driven nutrition guidance. It can introduce hybrid products that blend gels with hydration tablets for convenience. Brands can collaborate with wearable device manufacturers and fitness apps for cross‑promotion. Firms can pursue eco‑certifications and carbon‑neutral manufacturing to appeal to sustainability advocates. Retailers can host experiential events and virtual training workshops to deepen customer engagement.

Market Segmentation Analysis:

By Flavor

The energy gel product market segments by fruit, lemonade/limeade, chocolate, coffee/espresso, vanilla, blended and other flavours. It caters to consumer taste diversity to match product portfolios to preferences. Brands introduce limited‑edition fruit blends and seasonal coffee roasts to sustain interest. Companies conduct flavor trials and gather feedback from athletes. It drives repeat purchases and supports premium pricing strategies. Manufacturers track flavor trends through social media and launch targeted campaigns.

- For instance, Clif Bar launched seasonal fruit blends like mixed berry and tropical mango, incorporating real fruit extracts for a natural flavor experience that appeals to health-conscious consumers.

By Nature

The energy gel product market divides between organic and conventional offerings. It addresses clean‑label demand with certified organic gels free from synthetic additives. Brands secure USDA and EU organic approvals to strengthen credibility. Companies maintain traceable supply chains and audit supplier compliance. It appeals to health‑conscious consumers willing to pay premium. Conventional variants remain cost‑effective for entry‑level athletes. Manufacturers balance ingredient sourcing and price positioning to optimise market coverage.

- For instance, AlpenPower’s Bio Energy Gel Natural uses certified organic farming ingredients, combines short- and long-chain carbohydrates for fast and sustained energy, and is free from artificial additives, making it gentle on the stomach for endurance athletes.

By Pack Size

The energy gel product market segments into single‑serve and multi‑serve formats. It meets varied consumption patterns with on‑the‑go sachets and bulk pouches. Companies target competitive athletes with single‑serve convenience and team‑based usage with multi‑serve packs. It reduces packaging waste through concentrate refills in multi‑serve jars. Brands deploy subscription plans that blend both sizes. Manufacturers collaborate with event organizers to distribute trial packs and strengthen brand loyalty.

Segments:

Based on Flavor:

- Fruit Flavours

- Lemonade/Limeade Flavours

- Chocolate Flavour

- Coffee/Espresso Flavour

- Vanilla Flavour

- Blended Flavours

- Other Flavours (Coconut, Ginger Ale, etc.)

Based on Nature:

Based on Pack Size:

Based on Ingredient Type:

- Caffeine-free

- With Caffeine

Based on Sales Channel:

- Hypermarkets/ Supermarkets

- Groceries/Mass Retailers

- Wholesale Club Stores

- Convenience Stores

- Specialty Stores

- Online Retailers

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America commands 36% share of the global [energy gel product market]. It benefits from high endurance sport participation and widespread health‑conscious culture. Companies secure shelf space in specialty retailers and mainstream supermarkets to meet strong demand. It integrates digital marketing to engage athlete communities via social media. Brands collaborate with professional events and sports teams to boost visibility. It offers single‑serve sachets and multi‑serve formats tailored to urban and rural consumers. Manufacturers leverage direct‑to‑consumer channels with subscription services to sustain growth.

Europe

Europe holds 29% share of the [energy gel product market]. It features robust distribution networks across fitness studios and outdoor sports outlets. Companies partner with cycling and running associations to validate product performance. It complies with stringent labeling and ingredient regulations to ensure consumer confidence. Brands highlight clean‑label credentials and secure organic certifications to appeal to discerning athletes. It uses multilingual packaging and localized flavor offerings to match regional tastes. Manufacturers pilot green logistics initiatives to reduce carbon footprint and enhance reputation.

Asia Pacific

Asia Pacific secures 24% share of the [energy gel product market]. It benefits from growing middle‑class disposable incomes and rising interest in marathons and triathlons. Companies tailor flavor profiles with local tastes like yuzu and mango. It distributes through e‑commerce platforms to reach remote regions and urban centers. Brands run targeted campaigns in China, India and Japan to drive trial and repeat purchase. Latin America holds 7% share while Middle East & Africa accounts for 4% share. Manufacturers explore partnerships in these regions to unlock new growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zipvit Ltd.

- EN‑R‑G Foods, LLC

- Clif Bar & Company

- Advanced Food Concepts, Inc.

- Boom Nutrition Inc.

- Powerbar Inc.

- Nutrition Works Ltd

- Hammer Nutrition Ltd.

- Scientific Sports Nutrition (Pty) Ltd.

- Gatorade Company, Inc.

Competitive Analysis

Leading firms in the [energy gel product market], such as Clif Bar & Company, Gatorade Company, and Powerbar Inc., dominate shelf space in retail outlets and e‑commerce platforms. Zipvit Ltd. competes by featuring regional flavor appeals and securing organic certifications. EN‑R‑G Foods and Advanced Food Concepts invest in clinical trials to demonstrate efficacy and justify premium pricing. Boom Nutrition and Nutrition Works engage professional athletes and coaches to endorse products and increase brand visibility. Scientific Sports Nutrition partners with research institutions to develop specialized formulations for high‑altitude training. Hammer Nutrition maintains direct‑to‑consumer subscriptions and bundles trial packs with event registrations. It must address price sensitivity driven by private label entrants and sports drink brands expanding gel formats. Companies differentiate through sustainable packaging initiatives and integration of QR codes for real‑time nutrition data. Competitive pressure fosters frequent product updates and targeted marketing campaigns aimed at endurance communities.

Recent Developments

- In February 2025, Chargel showcased its Snack Gel Drinks at Natural Products Expo West, highlighting fast‑acting energy gels enriched with B vitamins and hydration support.

- In January 2024, Carbs Fuel LLC introduced a new carbohydrate‑rich energy gel product positioned as a cost‑effective option compared to competing formats.

- In 2025, Science in Sport (SiS) partnered with RunThrough to serve as the Official Energy Gel Provider for all events, supplying tailored fuelling guidance to participants.

- In August 2023, Fixx Nutrition opened a new production facility in Gold Coast, Australia, expanding its capacity to manufacture energy gel products.

Market Concentration & Characteristics

The energy gel product market shows moderate concentration, with the top five participants controlling 60% of global revenues. It features a competitive landscape where major brands maintain leadership through comprehensive distribution networks, clinical validation partnerships and product portfolios that cover clean‑label, caffeinated and electrolyte‑enhanced formulations. It operates through retail, online and direct‑to‑consumer channels, where subscription models drive customer retention. It balances premium offerings with cost‑effective options to capture diverse consumer segments. It pursues sustainable packaging solutions and integrates QR codes for real‑time nutritional guidance. It invests in research with sports nutritionists to enhance product efficacy and introduces regional flavor variants to meet local preferences. It monitors supply chain resilience to mitigate raw material volatility. It leverages digital marketing and athlete ambassador programs to reinforce brand loyalty and drive trial.

Report Coverage

The research report offers an in-depth analysis based on Flavor, Pack Size, Nature, Ingredient Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Brands will adopt plant‑based adaptogens to enhance performance and wellness.

- Companies will integrate smart sensors into packaging to track consumption and freshness.

- Firms will launch hybrid formats that combine gels with hydration mixes for convenience.

- Manufacturers will partner with wearable device makers for personalized nutrition guidance.

- Producers will expand into corporate wellness programs and fitness subscription bundles.

- Brands will develop region‑specific flavors to appeal to emerging market tastes.

- Suppliers will secure sustainable raw materials to strengthen supply chain resilience.

- Companies will introduce nootropic‑infused gels to support cognitive focus during events.

- Firms will leverage virtual reality training events to showcase product benefits.

- Brands will implement carbon‑neutral manufacturing to meet sustainability commitments.