Market Overview:

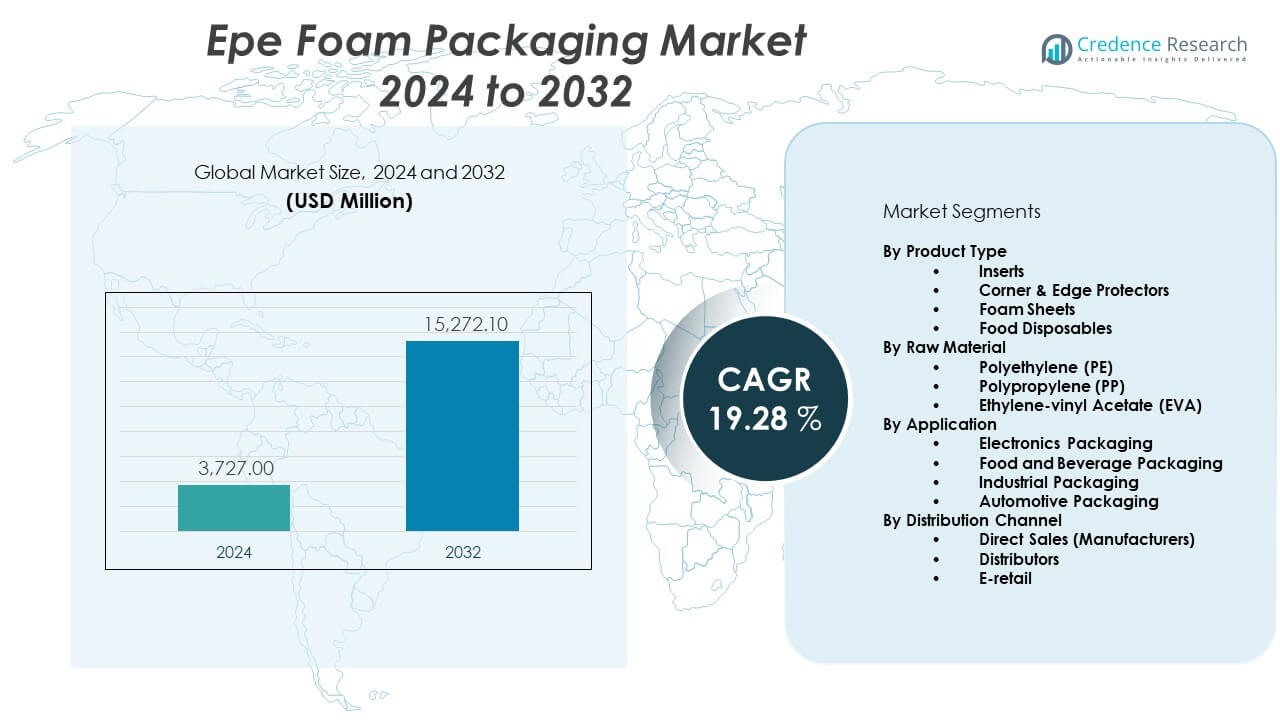

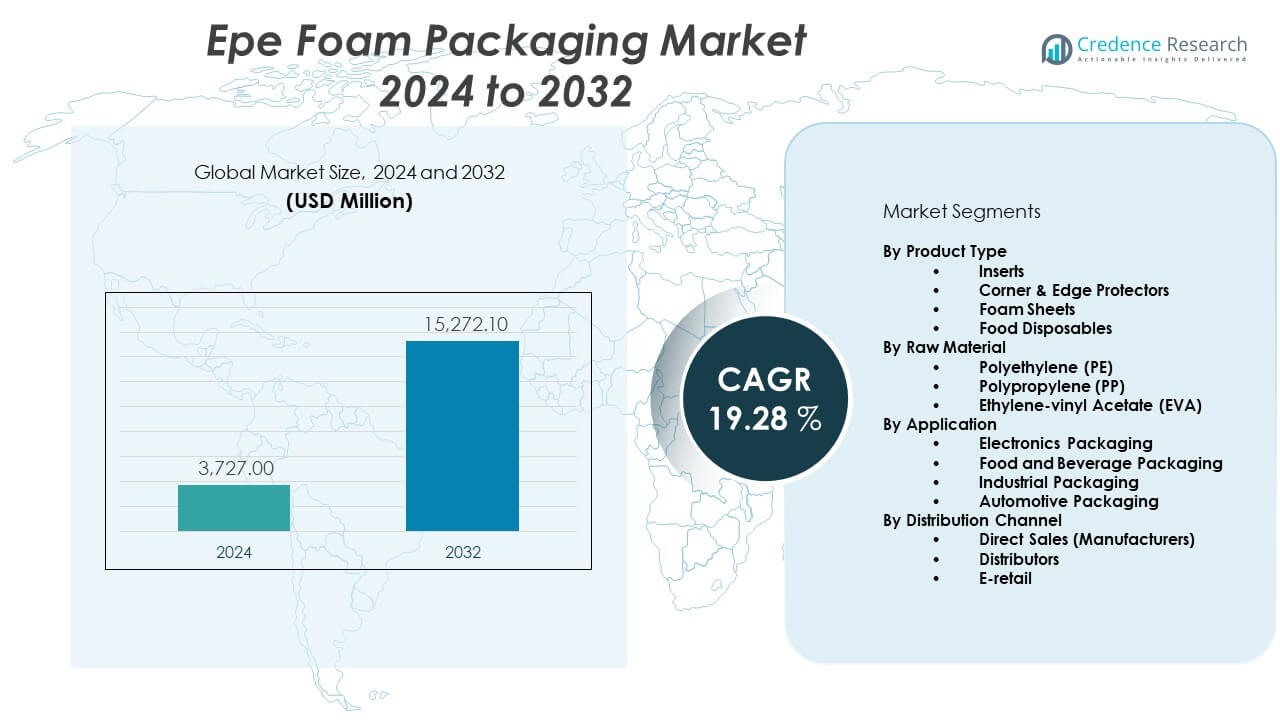

The EPE foam packaging market is projected to grow from USD 3,727 million in 2024 to an estimated USD 15,272.1 million by 2032, with a compound annual growth rate (CAGR) of 19.28% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EPE Foam Packaging Market Size 2024 |

USD 3,727 Million |

| EPE Foam Packaging Market, CAGR |

19.28% |

| EPE Foam Packaging Market Size 2032 |

USD 15,272.1 Million |

Market growth is driven by rising demand for lightweight, shock-absorbent, and cost-effective packaging solutions across multiple sectors, including electronics, automotive, consumer goods, and e-commerce. Companies favor EPE foam for its superior cushioning, moisture resistance, and flexibility, which helps reduce product damage during transit. Ongoing innovation in foam technologies, combined with heightened consumer expectations for product safety and sustainability, further accelerates adoption in both developed and emerging markets.

Asia Pacific leads the EPE foam packaging market, propelled by rapid industrialization, robust manufacturing output, and growing e-commerce activity in countries such as China and India. North America and Europe follow, benefiting from established supply chains and stringent packaging standards. Meanwhile, Latin America and the Middle East & Africa are emerging as promising markets, supported by rising investments in logistics infrastructure and expanding retail sectors. The market landscape continues to evolve as companies adapt to regional regulations and shifting consumer preferences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The EPE foam packaging market is projected to grow from USD 3,727 million in 2024 to USD 15,272.1 million by 2032, with a CAGR of 19.28%.

- Rising demand for lightweight and shock-absorbent packaging drives adoption across electronics, automotive, and e-commerce sectors.

- EPE foam’s moisture resistance and flexibility make it a preferred material for protecting fragile products during transit.

- Regulatory restrictions on non-recyclable packaging materials challenge market growth and require product innovation.

- Higher raw material prices and supply chain disruptions pose ongoing restraints for manufacturers.

- Asia Pacific leads market growth due to robust manufacturing, e-commerce expansion, and strong demand from China and India.

- North America and Europe see steady adoption, while Latin America and Middle East & Africa emerge with increasing investments in logistics and retail.

Market Drivers:

Strong Demand for Protective and Lightweight Packaging Solutions Across Multiple Industries:

The EPE foam packaging market benefits from the growing need for reliable and lightweight protective packaging in electronics, automotive, and home appliances sectors. Companies look for materials that can cushion products effectively while reducing overall shipping weight. It stands out due to its ability to absorb shocks, resist moisture, and maintain its structural integrity under stress. Manufacturers select EPE foam to minimize breakage rates and improve customer satisfaction. E-commerce growth further supports the market, as online retailers require packaging that protects goods throughout complex distribution chains. Sustainability concerns drive companies to consider recyclable foam options, expanding the appeal of EPE materials. Government initiatives targeting reduced material waste also support adoption. Its versatility for both industrial and consumer applications strengthens its position in the global packaging landscape.

- For instance, Sealed Air’s fabricated polyethylene (PE) foam planks provide superior damage protection and help reduce package weight, supporting high-performance cushioning and smaller shipping footprints.

Technological Advancements and Product Customization Drive Adoption in the EPE Foam Packaging Market:

Manufacturers in the EPE foam packaging market invest in advanced production techniques and machinery to achieve greater precision and efficiency. Automation in fabrication allows for consistent quality and rapid scaling to meet large orders. Companies use new molding processes to create custom-fit inserts and packaging forms tailored to specific product shapes. This flexibility enables brands to improve product presentation and reduce excess material usage. Innovations such as anti-static and flame-retardant EPE foams appeal to sectors with stringent safety standards. Supply chains integrate digital tools to track material sourcing, streamline logistics, and optimize inventory. These advances enhance the overall reliability and sustainability profile of EPE foam packaging. Its ability to adapt to changing client requirements reinforces its relevance for future-ready packaging operations.

- For instance, JSP’s official 2024 corporate documentation highlights their role as a manufacturer of foamed products for a wide range of applications, such as food packaging and automotive components. JSP continually develops products using original technologies and advanced manufacturing capabilities.

Heightened Focus on Cost Optimization and Supply Chain Efficiency in Global Markets:

The EPE foam packaging market experiences strong demand from manufacturers seeking cost-effective protection for goods without compromising safety. Businesses prioritize materials that offer a balance of low cost, durability, and ease of handling. It delivers on these metrics by enabling bulk production and simplified packaging designs. Large-scale adoption reduces per-unit costs and supports faster turnaround times for high-volume orders. Supply chains benefit from reduced transportation expenses due to the lightweight nature of EPE foam. Distribution networks rely on this material to meet just-in-time delivery schedules. Many companies select EPE foam to streamline warehousing and inventory management. Such efficiencies help organizations remain competitive in fast-moving markets. EPE foam’s contribution to cost and logistics management continues to fuel its rapid expansion.

Regulatory Support and Environmental Awareness Fuel Transition Toward Recyclable and Safe Packaging Materials:

Government regulations promoting recyclable and non-toxic packaging materials influence decision-making in the EPE foam packaging market. Authorities across regions establish standards for safe handling, transport, and disposal of packaging foams. It aligns with these requirements by offering non-toxic and recyclable options. Companies adopt EPE foam to comply with environmental mandates and corporate social responsibility goals. Awareness of plastic pollution increases scrutiny of packaging choices, prompting the industry to emphasize material recovery and circular economy principles. Organizations invest in collection and recycling programs to close the loop on EPE foam waste. Public policy and consumer advocacy encourage manufacturers to improve transparency in sourcing and labeling. It positions the market for sustained growth while aligning with global sustainability objectives.

Market Trends:

Rapid Growth in Customized and Branded Packaging Solutions Enhances Consumer Experience:

The EPE foam packaging market witnesses a notable trend toward highly customized and branded packaging formats that elevate the unboxing experience. Companies invest in bespoke inserts and printed EPE foam elements that reinforce brand identity. Personalized packaging appeals to both high-end electronics and luxury consumer goods sectors. It fosters greater brand loyalty and differentiation in crowded markets. Retailers leverage EPE foam’s moldability to create intricate designs that showcase product features. Demand for limited-edition packaging supports innovation in colors, textures, and finishing techniques. E-commerce platforms also use visually distinct packaging to create memorable first impressions. These trends reflect a strategic focus on packaging as a marketing tool. EPE foam’s adaptability keeps it at the forefront of branded packaging innovation.

- For instance, UFP Technologies (now part of UFP Industries) specializes in high-quality, custom-engineered foam products, including EPE foam. They offer advanced die-cutting, compression molding, vacuum forming, and CNC routing.

Digitalization and Data-Driven Supply Chain Management Transform Market Operations:

The integration of digital technologies shapes a key trend in the EPE foam packaging market, optimizing efficiency at every stage. Companies deploy IoT devices and sensors to monitor product conditions during transit. Real-time tracking enables manufacturers to assure quality and minimize losses. Supply chain partners utilize advanced data analytics to forecast demand and manage inventory levels. Cloud-based platforms connect suppliers and customers for seamless communication and faster order fulfillment. Automation in warehousing and logistics further accelerates operations. Blockchain adoption improves traceability, strengthening compliance and transparency. It supports the trend of building smarter, more resilient supply networks. Digital transformation establishes EPE foam packaging as a critical component in efficient, data-driven logistics ecosystems.

- For instance, Sonoco has implemented SAP S/4HANA as part of its ongoing efforts to digitalize and streamline its supply chain, improving operational visibility and traceability. SAP S/4HANA 2023 includes capabilities for advanced scheduling, analytics, and supply chain management, used by major clients.

Increasing Focus on Aesthetic and Sustainable Packaging Design Drives Innovation:

A shift toward attractive and eco-friendly packaging design sets the tone for recent trends in the EPE foam packaging market. Brands explore unique shapes, textures, and colors to enhance shelf appeal and customer engagement. Sustainability initiatives influence the adoption of biodegradable and recycled EPE foam alternatives. Packaging designers prioritize both functional and visual elements to meet changing consumer preferences. Innovative foams with reduced carbon footprints gain popularity in premium product segments. Retailers respond to the trend by demanding packaging that meets sustainability certifications and green labeling requirements. It provides opportunities for new market entrants specializing in eco-conscious solutions. The focus on design and sustainability redefines packaging as both a protective and promotional asset.

Expanding Applications in Healthcare, Pharma, and Cold Chain Logistics Support Market Diversification:

The EPE foam packaging market expands beyond traditional sectors into healthcare, pharmaceuticals, and cold chain logistics. Medical device and vaccine manufacturers select EPE foam for its insulation and cushioning properties. It protects temperature-sensitive goods during extended transit and storage. Growth in the pharmaceutical sector drives demand for tamper-evident and hygienic packaging formats. Cold chain providers use EPE foam to meet strict regulatory requirements and ensure product integrity. The trend toward specialized packaging for critical goods supports the development of advanced EPE foam products. It positions the market to serve a wider array of industries with tailored solutions. Diversification strengthens the market’s resilience and opens new avenues for growth.

Market Challenges Analysis:

Regulatory Pressures and Environmental Concerns Intensify Industry Scrutiny:

Regulatory frameworks place mounting pressure on the EPE foam packaging market to comply with evolving safety and environmental standards. Governments around the world tighten restrictions on single-use plastics and non-biodegradable materials. Companies face rising costs for compliance, certification, and waste management. It must adapt to rules that vary across regions, which can complicate cross-border trade. Environmental advocacy groups increase consumer awareness about the ecological impact of foam packaging waste. Public demand for sustainable alternatives challenges manufacturers to innovate at a rapid pace. Legacy production processes require upgrades to reduce emissions and improve recyclability. Managing these compliance burdens while maintaining profitability poses a significant challenge for industry players.

Cost Volatility, Raw Material Supply, and Market Fragmentation Create Operational Barriers:

The EPE foam packaging market contends with volatile raw material prices, especially for polyethylene resins. Unpredictable supply chain disruptions impact production schedules and raise procurement costs. Small and mid-sized manufacturers struggle to secure consistent material supplies, limiting their ability to scale. High competition in regional markets leads to price wars and shrinking margins. It must also address the risk of substitution by newer sustainable materials, which gain traction with eco-conscious clients. Capital investment in new technologies and recycling infrastructure stretches financial resources. Operational inefficiencies can slow time-to-market for innovative packaging solutions. These combined challenges test the resilience and agility of market participants.

Market Opportunities:

Expanding E-Commerce, Direct-to-Consumer Brands, and Urbanization Create New Avenues:

The EPE foam packaging market stands to gain from the rapid growth of e-commerce and direct-to-consumer brands. Increased shipping volumes demand lightweight, protective materials that ensure safe delivery to urban and remote locations. Urbanization fuels demand for packaged goods across a range of categories, including electronics, personal care, and food. Companies seek to differentiate by using innovative EPE foam designs that combine safety with visual appeal. Growth in online shopping accelerates investment in advanced packaging solutions that meet strict performance criteria. These factors create fresh opportunities for EPE foam suppliers to expand their reach and diversify their customer base.

Circular Economy and Recycling Initiatives Open New Growth Pathways for EPE Foam Packaging Solutions:

Circular economy models present long-term opportunities for the EPE foam packaging market. Stakeholders invest in recycling technologies and closed-loop systems that recover and repurpose used foam. It responds to customer and regulatory demand for sustainable packaging by developing biodegradable and reusable solutions. Companies build brand equity by emphasizing responsible sourcing and end-of-life recovery. Collaborations with retailers and logistics providers enable large-scale recycling efforts. The move toward a circular value chain positions EPE foam packaging as a preferred solution for environmentally conscious industries seeking both performance and sustainability.

Market Segmentation Analysis:

By Product Type

The EPE foam packaging market addresses a broad spectrum of requirements through inserts, corner and edge protectors, foam sheets, and food disposables. Inserts and edge protectors remain critical for electronics and automotive industries, providing superior shock absorption and protection during shipping. Foam sheets offer flexible solutions for various packaging needs in both industrial and consumer sectors. Food disposables cater to the food and beverage industry, supporting hygiene standards and efficient product handling.

- For instance, DS Smith manufactures foam corner protectors and packaging solutions for transportation protection. While multiple companies, including DS Smith, report producing foam corners with repeatable impact protection.

By Raw Material

Polyethylene (PE) is the primary raw material in the EPE foam packaging market, known for its cost-effectiveness, flexibility, and cushioning performance. Polypropylene (PP) and ethylene-vinyl acetate (EVA) serve as alternatives where enhanced durability, temperature stability, or chemical resistance is required. This range of materials enables tailored solutions for specific industry and application needs.

By Application

Electronics packaging forms the core application, driven by the need to safeguard delicate and high-value devices. Food and beverage packaging utilizes EPE foam for maintaining product integrity and compliance with hygiene standards. Industrial and automotive packaging segments rely on EPE foam for its robust protection and versatility across diverse logistics and manufacturing environments.

By Distribution Channel

Direct sales by manufacturers ensure large-scale, consistent supply to major industrial buyers. Distributors bridge the gap for mid-sized and regional customers, offering customized service and inventory support. E-retail is gaining traction, catering to small businesses and e-commerce players who value quick procurement and flexible order sizes. This multi-channel distribution structure broadens the market reach and enhances responsiveness.

Segmentation:

By Product Type

- Inserts

- Corner & Edge Protectors

- Foam Sheets

- Food Disposables

By Raw Material

- Polyethylene (PE)

- Polypropylene (PP)

- Ethylene-vinyl Acetate (EVA)

By Application

- Electronics Packaging

- Food and Beverage Packaging

- Industrial Packaging

- Automotive Packaging

By Distribution Channel

- Direct Sales (Manufacturers)

- Distributors

- E-retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific: Leading the EPE Foam Packaging Market with Significant Share

Asia Pacific dominates the EPE foam packaging market, accounting for the largest share of 54%. Strong manufacturing infrastructure, high-volume electronics production, and booming e-commerce activity in China and India drive this regional leadership. Companies in this region benefit from cost-efficient labor, extensive raw material availability, and well-established distribution networks. The rapid urbanization and rising disposable income support greater consumption of packaged consumer goods, fueling ongoing demand for EPE foam packaging. Regulatory policies support local production and innovation in eco-friendly materials, making Asia Pacific the primary hub for market expansion. Local manufacturers invest in advanced machinery to meet evolving customer needs. It is expected to maintain its leadership due to continued growth in industrial and retail sectors.

North America: Mature Market with Emphasis on Quality and Sustainability

North America holds a 22% share in the global EPE foam packaging market. The region’s strong focus on high-value product protection, coupled with stringent regulatory standards, supports stable demand for EPE foam solutions. Companies invest in recyclable and environmentally responsible foam packaging, responding to rising consumer awareness and policy shifts. The U.S. leads market activity, supported by advanced logistics, strong e-commerce penetration, and established automotive and electronics industries. Supply chain resilience and product innovation characterize market growth in this region. It continues to prioritize material sustainability and operational efficiency in packaging solutions. Ongoing research into biodegradable foam options positions North America as a key influencer in market trends.

Europe, Latin America, and Middle East & Africa: Emerging Growth Frontiers

Europe represents 15% of the EPE foam packaging market, with emphasis on compliance with recycling regulations and demand from the automotive, electronics, and food sectors. Companies operate in a mature regulatory environment, supporting steady growth through material innovation and efficient supply chains. Latin America and the Middle East & Africa together account for the remaining 9% market share. Growth in these regions is driven by expanding logistics networks, rising investments in infrastructure, and increased consumer product imports. Regional players in these markets adapt EPE foam solutions to meet local packaging requirements and environmental standards. It shows strong potential for higher growth as global brands increase investment in local production and distribution. These emerging regions represent vital opportunities for future market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sealed Air Corporation

- Pregis Corporation

- Sonoco Products Company

- BASF SE

- JSP Corporation

- UFP Industries (UFP Technologies)

- Knauf Industries

- DS Smith

- Pactiv Evergreen

- TekniPlex

Competitive Analysis:

The EPE foam packaging market features a competitive landscape with global leaders such as Sealed Air Corporation, Pregis Corporation, Sonoco Products Company, BASF SE, and JSP Corporation. These players invest in advanced manufacturing technologies, sustainable product development, and geographic expansion to strengthen their market position. It also includes regional manufacturers that serve specific local demands and niche applications. Competitive differentiation often relies on product innovation, price competitiveness, and supply chain efficiency. Major companies collaborate with end users to deliver customized solutions and ensure long-term business relationships. The EPE foam packaging market benefits from strong research and development activity, with established brands leveraging global distribution networks to maintain their leadership.

Recent Developments:

- In July 2025, UFP Packaging, a division of UFP Industries (UFP Technologies), unveiled the U-Loc 200, a new crate system featuring the first tool-free fastener for assembly and disassembly. The patent-pending design enhances safety and reusability, targeting high-value and sensitive shipping applications and reflecting innovation in protective packaging for the EPE foam market.

- In February 2025, BASF SE launched Basotect® EcoBalanced, a melamine-based foam for sound absorption with a product carbon footprint up to 50% lower than conventional grades. This new product, made with 100% green electricity and renewable feedstock, adds to BASF’s advanced materials for protective packaging and demonstrates quantifiable progress in sustainability for transportation and building applications.

Market Concentration & Characteristics:

The EPE foam packaging market demonstrates moderate to high market concentration, with a few multinational corporations dominating global sales and several regional firms serving specific geographies. It exhibits characteristics of high product customization, strong R&D investment, and a focus on sustainability and supply chain agility. Large players set industry benchmarks for quality, innovation, and compliance, while niche firms address specialized client requirements.

Report Coverage:

The research report offers an in-depth analysis based on product type, raw material, application, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for EPE foam packaging will rise across electronics, automotive, and e-commerce sectors.

- Product innovation will focus on eco-friendly, recyclable, and advanced cushioning solutions.

- Manufacturers will adopt automation and digital technologies for efficient production.

- Expansion in Asia Pacific will continue due to rapid industrialization and high manufacturing output.

- North America and Europe will maintain steady growth with strong regulatory and quality standards.

- Emerging markets in Latin America and the Middle East & Africa will gain traction.

- E-commerce and direct-to-consumer trends will boost the need for durable, lightweight packaging.

- Regulatory focus on sustainability will shape product development and sourcing decisions.

- Collaboration between global leaders and regional players will drive market consolidation.

- The market will evolve with changing consumer preferences and advances in material science.