Market Overview:

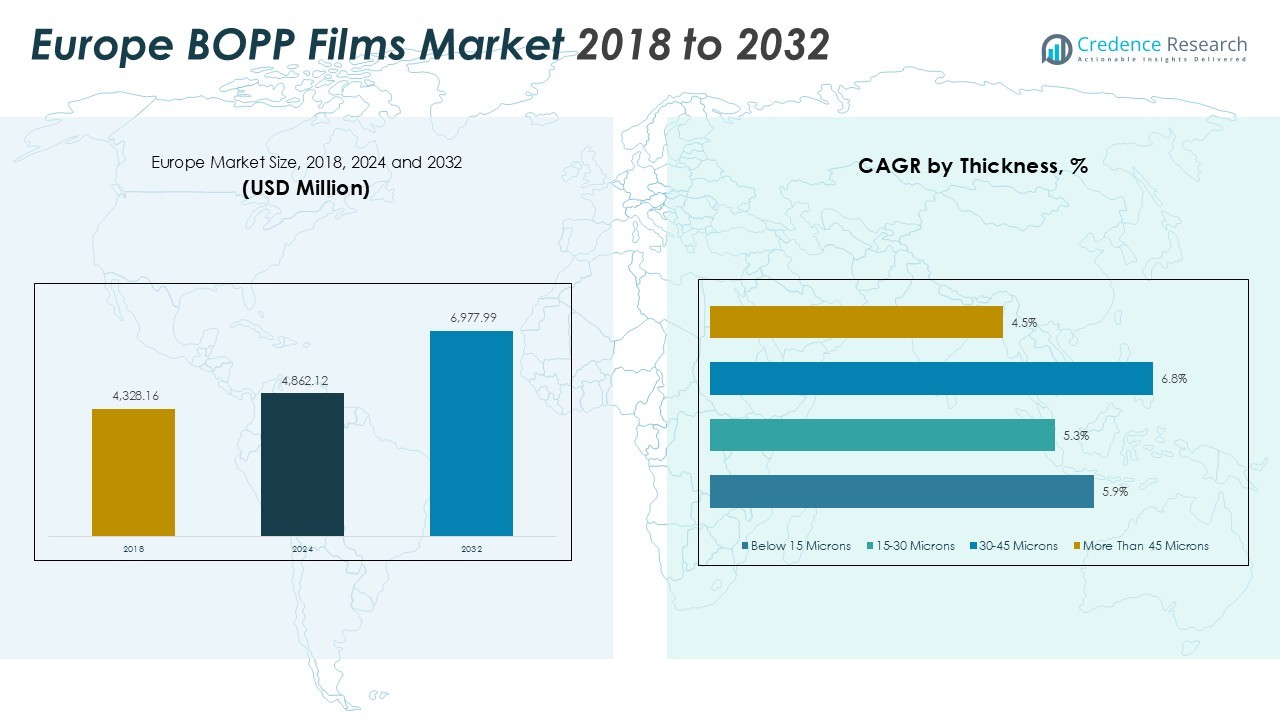

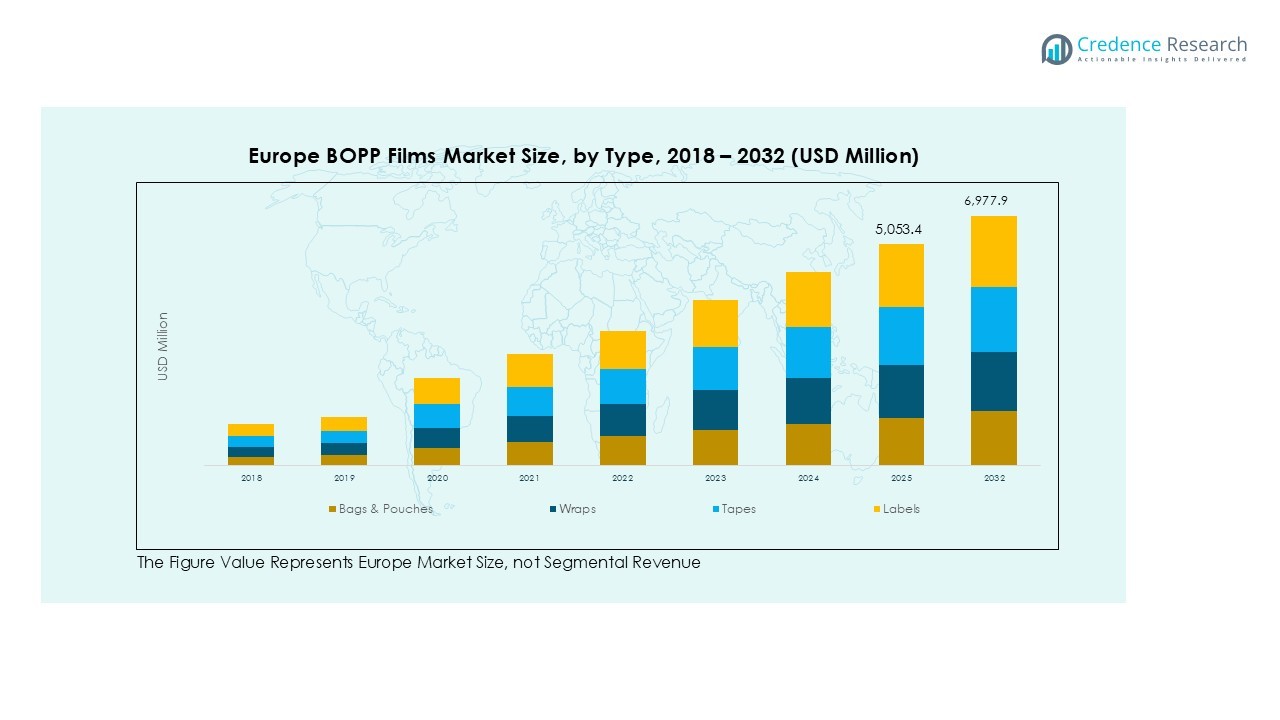

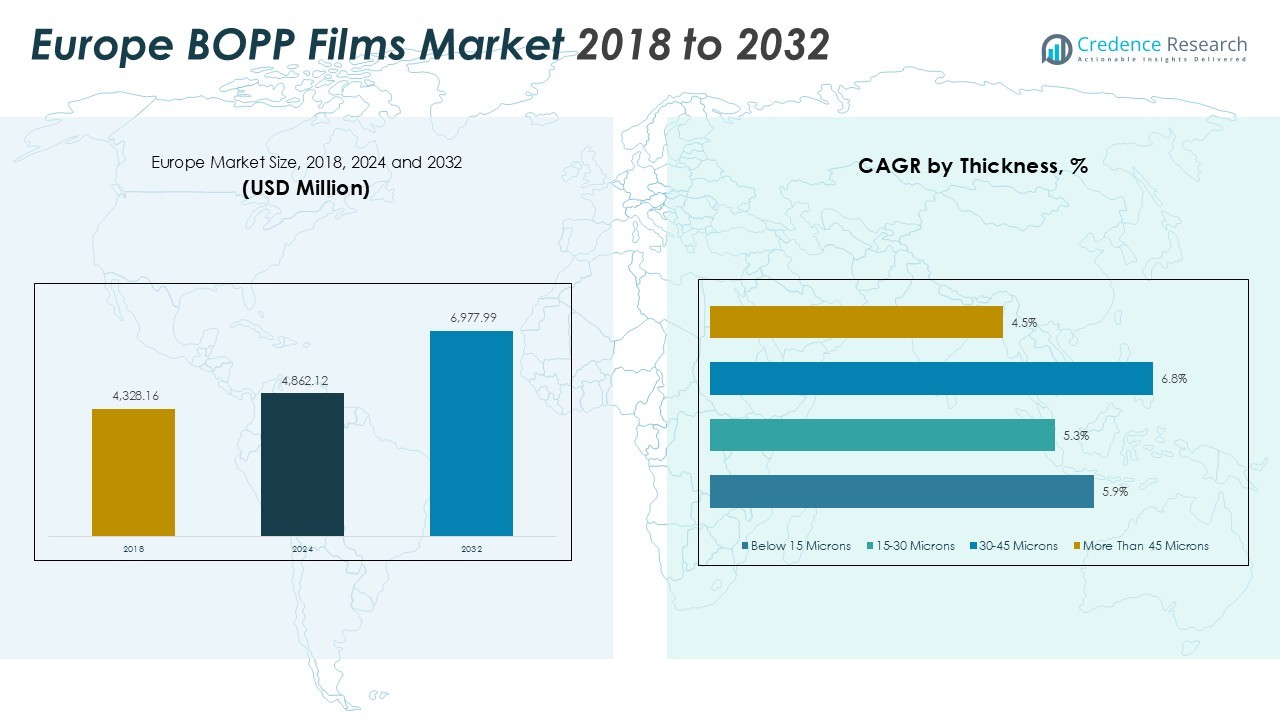

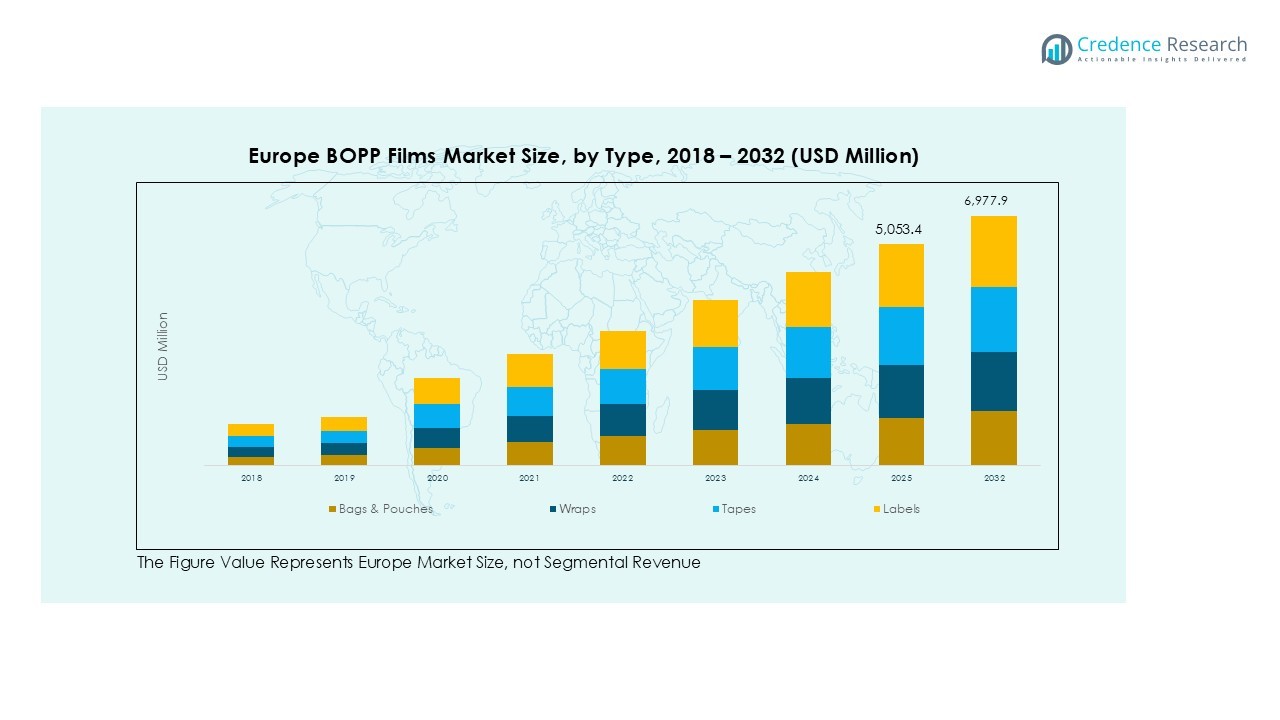

The Europe BOPP Film Market size was valued at USD 4,328.16 million in 2018 to USD 4,862.12 million in 2024 and is anticipated to reach USD 6,977.99 million by 2032, at a CAGR of 3.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe BOPP Film Market Size 2024 |

USD 4,862.12 Million |

| Europe BOPP Film Market, CAGR |

3.44% |

| Europe BOPP Film Market Size 2032 |

USD 6,977.99 Million |

The market is propelled by sustainability trends, with manufacturers focusing on bio-based and recyclable film variants to comply with the EU’s stringent packaging waste regulations. The rising preference for transparent and high-barrier films in food packaging, along with the expanding e-commerce sector, is supporting market expansion. Moreover, the increasing use of BOPP films in labeling, lamination, and wrap applications is boosting consumption across key industries. Growing adoption of circular economy practices across major packaging producers is further accelerating innovation in eco-efficient BOPP solutions.

Regionally, Western Europe dominates the market, led by Germany, France, and Italy, supported by strong industrial infrastructure and advanced packaging innovation. Central and Eastern Europe are experiencing steady growth due to rising investments in manufacturing and expanding food processing sectors. Increasing adoption of flexible packaging technologies and cross-border trade within the EU continues to enhance regional market integration and competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe BOPP Film Market was valued at USD 4,862.12 million in 2024 and is projected to reach USD 6,977.99 million by 2032, growing at a CAGR of 3.44%.

- Rising demand for sustainable and recyclable packaging materials is driving adoption of bio-based and mono-material BOPP films compliant with EU waste regulations.

- Expanding food and beverage industries are fueling consumption, supported by the films’ superior moisture barriers and extended shelf life.

- Continuous technological progress in extrusion, coating, and nano-layer film processes is improving performance, clarity, and cost efficiency.

- E-commerce expansion is creating strong demand for durable, flexible, and tamper-resistant packaging solutions across regional logistics networks.

- Western Europe leads the market with 46% share, driven by advanced packaging infrastructure and strong industrial manufacturing capabilities.

- Central and Eastern Europe hold 32% share, benefiting from manufacturing growth and automation adoption, while Northern and Southern Europe together account for 22%, focusing on high-barrier and eco-efficient packaging innovations.

Market Drivers:

Rising Demand for Sustainable and Recyclable Packaging Materials

The growing focus on environmental sustainability is driving the adoption of BOPP films across Europe. The Europe BOPP Film Market benefits from the region’s strong shift toward recyclable and bio-based packaging solutions. Manufacturers are investing in mono-material structures to ensure recyclability and compliance with EU directives on packaging waste reduction. It supports the transition toward a circular economy and minimizes the carbon footprint in packaging production. Leading brands are also adopting sustainable films to align with corporate sustainability goals and consumer expectations.

Growth of the Food and Beverage Industry Fueling Packaging Innovation

The expanding food and beverage sector in Europe is a major contributor to market growth. BOPP films offer superior moisture and aroma barriers, making them ideal for snack, confectionery, and bakery packaging. The Europe BOPP Film Market is seeing increased demand from quick-service restaurants and packaged food producers emphasizing extended shelf life. The films’ excellent printability enhances product visibility and branding effectiveness. It continues to play a key role in flexible packaging formats suited for high-volume production lines.

- For instance, SABIC developed its PP 5212P, a high-stiffness homopolymer for BOPP film extrusion, which provides a heat resistance of 10°C higher than conventional BOPP films.

Technological Advancements in Film Production and Processing

Ongoing advancements in extrusion and coating technologies are improving the performance and cost-efficiency of BOPP films. Manufacturers are adopting multi-layer and nano-coating processes to achieve better mechanical strength and optical clarity. The Europe BOPP Film Market benefits from continuous innovation in barrier technology, supporting premium and specialty applications. It allows customization for labeling, lamination, and wrapping, offering higher versatility for end-users. These improvements are enhancing product functionality and expanding application areas across industrial and consumer sectors.

- For instance, in March 2025, Innovia Films launched a new 8.8-meter-wide production line in Germany with an annual capacity to produce 35,000 tons of sustainable label and packaging films.

Expansion of E-commerce and Demand for Flexible Packaging Formats

The rapid growth of e-commerce is boosting the demand for protective and durable packaging films. BOPP films provide lightweight yet strong material properties suited for shipping, wrapping, and labeling. The Europe BOPP Film Market benefits from the surge in online retail, where flexible and tamper-resistant packaging is essential. It helps manufacturers meet logistical efficiency and branding consistency in direct-to-consumer shipments. The trend continues to influence packaging design and material innovation across the region.

Market Trends:

Growing Shift Toward Mono-Material and Recyclable BOPP Structures

The shift toward mono-material and recyclable film solutions is one of the most significant developments in the Europe BOPP Film Market. Manufacturers are redesigning packaging structures to comply with EU sustainability goals and Extended Producer Responsibility (EPR) regulations. It enables full recyclability without compromising on strength or clarity, supporting circular economy initiatives across the packaging value chain. Major producers are investing in closed-loop recycling and downgauging technologies to reduce material waste and carbon emissions. The demand for transparent, high-barrier films that maintain food freshness while meeting recyclability standards continues to grow. Retailers and brand owners are adopting recyclable BOPP laminates for flexible packaging to improve compliance with future EU waste management targets. These innovations are enhancing material efficiency and market competitiveness across Europe.

- For instance, Jindal Films enables the creation of mono-material and recycle-ready packaging by offering OPP-based barrier solutions like its Alox-Lyte™ 18AOL893 film, which has a thickness of just 18 microns and is designed to replace PET in laminates.

Integration of High-Performance Coatings and Advanced Film Technologies

Continuous technological progress is transforming BOPP film manufacturing through enhanced coatings, metallization, and orientation processes. The Europe BOPP Film Market is witnessing a surge in demand for films with improved oxygen, light, and moisture barriers to meet premium packaging needs. It supports longer shelf life and better protection for sensitive products such as dairy, confectionery, and pharmaceuticals. Companies are integrating plasma and vapor deposition coatings to replace aluminum foils while maintaining transparency and printability. Smart coating technologies are also helping optimize energy use and improve film uniformity. The introduction of high-speed extrusion lines and AI-based process monitoring is strengthening production efficiency and product consistency. These technological advancements are setting new performance benchmarks in the European flexible packaging industry.

- For instance, Jindal Films’ Alox-Lyte™ AO894 film features a vacuum-deposited Aluminum Oxide coating that provides a high barrier, achieving an Oxygen Transmission Rate as low as 0.5 cm³/m²/day, which significantly extends product shelf life.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Constraints

Volatility in polypropylene resin prices continues to challenge profitability across the Europe BOPP Film Market. Dependence on petrochemical feedstocks exposes manufacturers to cost fluctuations influenced by crude oil dynamics and geopolitical uncertainties. It impacts pricing strategies and limits flexibility for small and medium-scale producers. Supply chain disruptions, including shipping delays and limited polymer availability, further constrain production capacity. Companies are adopting long-term supplier partnerships and localized sourcing to stabilize material costs. Rising energy expenses across Europe also contribute to higher operational costs, affecting competitiveness in export markets.

Stringent Environmental Regulations and Recycling Infrastructure Gaps

Evolving European Union environmental regulations impose strict requirements on plastic waste reduction and recyclability standards. Compliance with directives such as the Packaging and Packaging Waste Regulation demands substantial investment in sustainable film development. The Europe BOPP Film Market faces challenges in aligning with varying national recycling infrastructures across member states. It increases the complexity of waste collection, sorting, and reprocessing efforts. Limited harmonization of recycling systems restricts the adoption of closed-loop solutions at scale. Companies must balance innovation costs with regulatory compliance to sustain long-term growth.

Market Opportunities:

Advancement in Circular Economy and Sustainable Film Innovation

The growing focus on circular economy principles presents significant growth potential for the Europe BOPP Film Market. Manufacturers are expanding investment in recyclable and bio-based BOPP films to meet EU sustainability targets. It enables new product lines that reduce dependency on fossil-based polymers while improving end-of-life recovery. Collaboration between packaging converters, recyclers, and brand owners is driving material innovation and recycling efficiency. Demand for eco-designed films with lower carbon footprints is rising across consumer goods and industrial applications. Governments and industry associations are supporting green manufacturing projects through funding and regulatory incentives. These initiatives are expected to strengthen the region’s leadership in sustainable packaging technologies.

Expansion in Specialty Applications and High-Barrier Packaging Solutions

The increasing adoption of high-performance films in niche sectors is creating new revenue opportunities. The Europe BOPP Film Market is gaining traction in labeling, lamination, and flexible electronics applications requiring superior mechanical and optical properties. It benefits from advancements in nanocoating, metallization, and hybrid film technologies. Growing demand for premium packaging in cosmetics, pharmaceuticals, and food products enhances the market’s diversification scope. Manufacturers are focusing on developing customized, high-barrier films to meet specific protection and branding needs. Continuous R&D investment supports the transition toward advanced, value-added applications that offer higher margins and market differentiation.

Market Segmentation Analysis:

By Type

The Europe BOPP Film Market by type is segmented into bags and pouches, wraps, tapes, and labels. Bags and pouches hold the largest share due to their wide use in food and beverage packaging for moisture and aroma protection. It benefits from strong demand in snack and confectionery segments that require durable and lightweight materials. Wraps are gaining traction in industrial and consumer packaging, supported by advances in film strength and print quality. Labels continue to grow with rising applications in branding and logistics packaging across Europe.

By Application

By application, the market includes food, beverage, tobacco, personal care, pharmaceutical, electrical and electronics, and others. The food segment leads due to the high need for extended shelf life and visual appeal in packaged goods. It supports product preservation and compliance with food safety standards. Personal care and pharmaceutical applications are expanding with the use of high-clarity, tamper-resistant films that ensure product integrity and consumer trust.

- For instance, Taghleef Industries’ EXTENDO line of high-barrier films can achieve an Oxygen Transmission Rate of less than 1 cc/m²/day, which significantly extends the shelf life of sensitive food products.

By Thickness

By thickness, the market is divided into below 15 microns, 15–30 microns, 30–45 microns, and more than 45 microns. The 15–30 microns category dominates due to its balance of flexibility, durability, and cost efficiency in packaging applications. It provides excellent machinability and barrier protection suitable for high-speed packaging lines. Thicker films above 30 microns are preferred for industrial wrapping and labeling applications requiring enhanced tensile strength and resistance.

- For instance, Innovia Films’ new multilayer co-extrusion line in Germany is 8.8 meters wide and is engineered to produce films for resource-efficient packaging within a thickness range of 15 to 50 microns.

Segmentations:

By Type:

- Bags & Pouches

- Wraps

- Tapes

- Labels

By Application:

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Electrical & Electronics

- Others

By Thickness:

- Below 15 Microns

- 15–30 Microns

- 30–45 Microns

- More Than 45 Microns

By Production Process:

By Country:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe Leading with Advanced Packaging Infrastructure and Strong Industrial Base

Western Europe held a 46% share of the Europe BOPP Film Market in 2024, maintaining its dominance through advanced packaging innovation and sustainability adoption. Germany, France, and Italy lead in film production capacity and high-barrier packaging development. It benefits from a strong manufacturing base, advanced extrusion facilities, and compliance with EU recycling directives. The presence of major film producers and converters ensures rapid deployment of recyclable and mono-material packaging. Strong demand from food, personal care, and pharmaceutical industries continues to strengthen regional consumption. Integration of digital production technologies and smart coating systems enhances operational efficiency and product quality across Western Europe.

Central and Eastern Europe Witnessing Rapid Manufacturing Expansion

Central and Eastern Europe accounted for 32% of the Europe BOPP Film Market in 2024, supported by significant industrial and manufacturing growth. Poland, the Czech Republic, and Hungary are becoming production hubs due to favorable government policies and investment incentives. It benefits from lower operating costs and rising domestic demand for packaged food and consumer goods. The region’s strategic position supports export-oriented production and cross-border trade within the EU. Increasing adoption of automation and sustainable film manufacturing is improving productivity and energy efficiency. Local manufacturers are expanding capacity to meet rising demand for flexible packaging solutions across key end-use sectors.

Northern and Southern Europe Contributing to Market Diversification

Northern and Southern Europe together accounted for 22% of the Europe BOPP Film Market in 2024, reflecting growing focus on niche and premium packaging applications. The Netherlands, Spain, and Nordic countries are emphasizing recyclable, transparent, and high-clarity films to meet sustainability targets. It supports innovation in bio-based and specialty film segments that align with circular economy objectives. Rising exports of pharmaceuticals and processed foods are fueling demand for high-barrier and tamper-evident packaging materials. Regional players are investing in R&D to develop lightweight and energy-efficient film variants. These markets continue to diversify product offerings and strengthen Europe’s overall packaging ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Taghleef Industries

- Innovia Films (CCL Industries)

- Treofan Group

- Jindal Poly Films

- Polinas

- Polibak

- Poligal S.A. (Oben Group)

- Manucor S.p.A.

- UFlex Ltd.

- Toray Films Europe

Competitive Analysis:

The Europe BOPP Film Market is highly competitive, characterized by the presence of global and regional manufacturers focusing on quality, innovation, and sustainability. Leading companies such as Taghleef Industries, Innovia Films, Jindal Poly Films, Treofan Group, and UFlex Ltd. are investing in advanced extrusion, metallization, and coating technologies to enhance product performance and recyclability. It emphasizes sustainable production practices and the development of mono-material structures to meet EU packaging regulations. Strategic collaborations, mergers, and capacity expansions are strengthening market presence and supply capabilities across Europe. Companies are also prioritizing the development of specialty and high-barrier films to serve premium food, personal care, and industrial packaging segments. Continuous R&D investment and product diversification remain central to maintaining competitive advantage in this evolving packaging landscape.

Recent Developments:

- In September 2025, Taghleef Industries launched an innovative detachable in-mold label film technology.

- In June 2025, Taghleef Industries launched Shape360 TDSW, a floatable white polyolefin shrink sleeve label film designed for opacity and recyclability.

- In June 2025, Innovia Films announced its plans to present improved and sustainable label materials at Labelexpo 2025.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Thickness, Production Process and Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will experience steady growth supported by rising demand for sustainable and recyclable packaging solutions.

- Manufacturers will increase investment in mono-material and bio-based BOPP films to align with EU circular economy goals.

- Technological advancements in multi-layer extrusion and metallization will enhance film strength and optical clarity.

- Demand for high-barrier packaging will grow across food, beverage, and pharmaceutical sectors to extend product shelf life.

- Companies will expand regional production facilities to improve supply chain resilience and reduce logistics costs.

- E-commerce growth will continue to drive the need for lightweight, tamper-resistant, and durable packaging materials.

- Regulatory reforms on plastic waste reduction will accelerate innovation in recyclable and compostable film alternatives.

- Strategic mergers and acquisitions will strengthen market consolidation and global competitiveness among key producers.

- Integration of digital monitoring systems in production will improve process efficiency and material optimization.

- Increased collaboration between packaging converters and brand owners will foster innovation in design and sustainable applications across Europe.