Market Overview

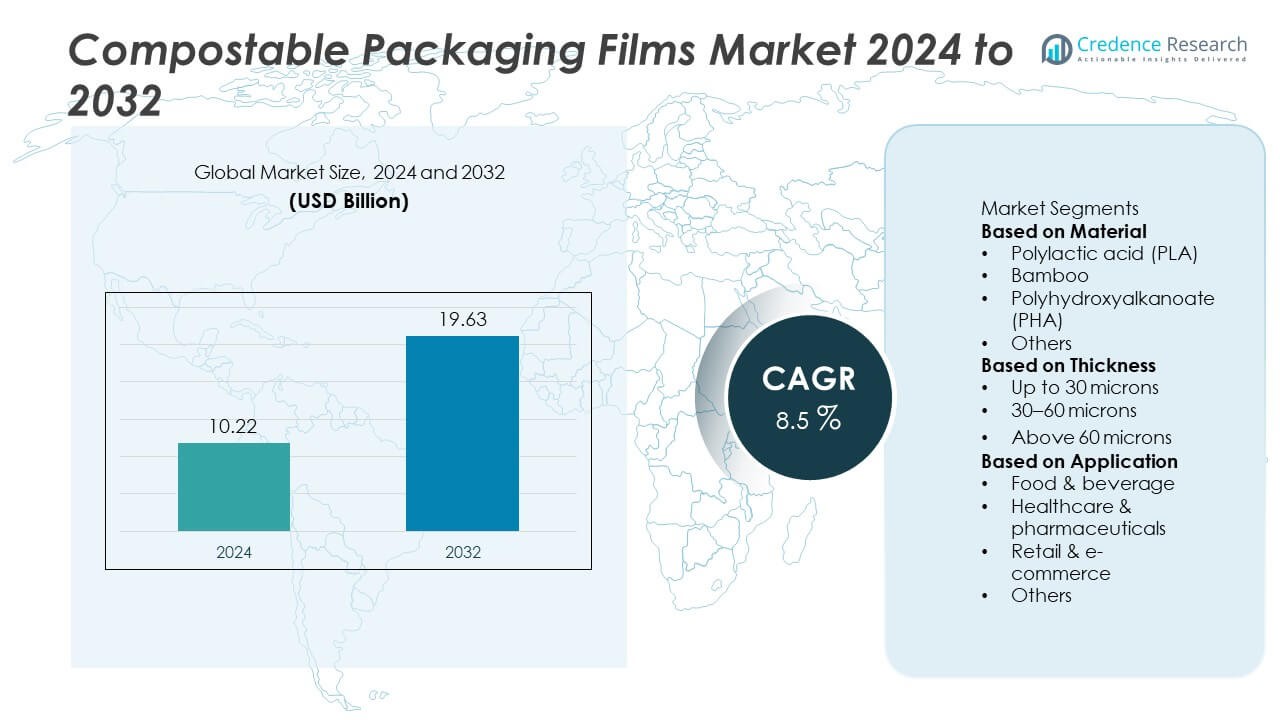

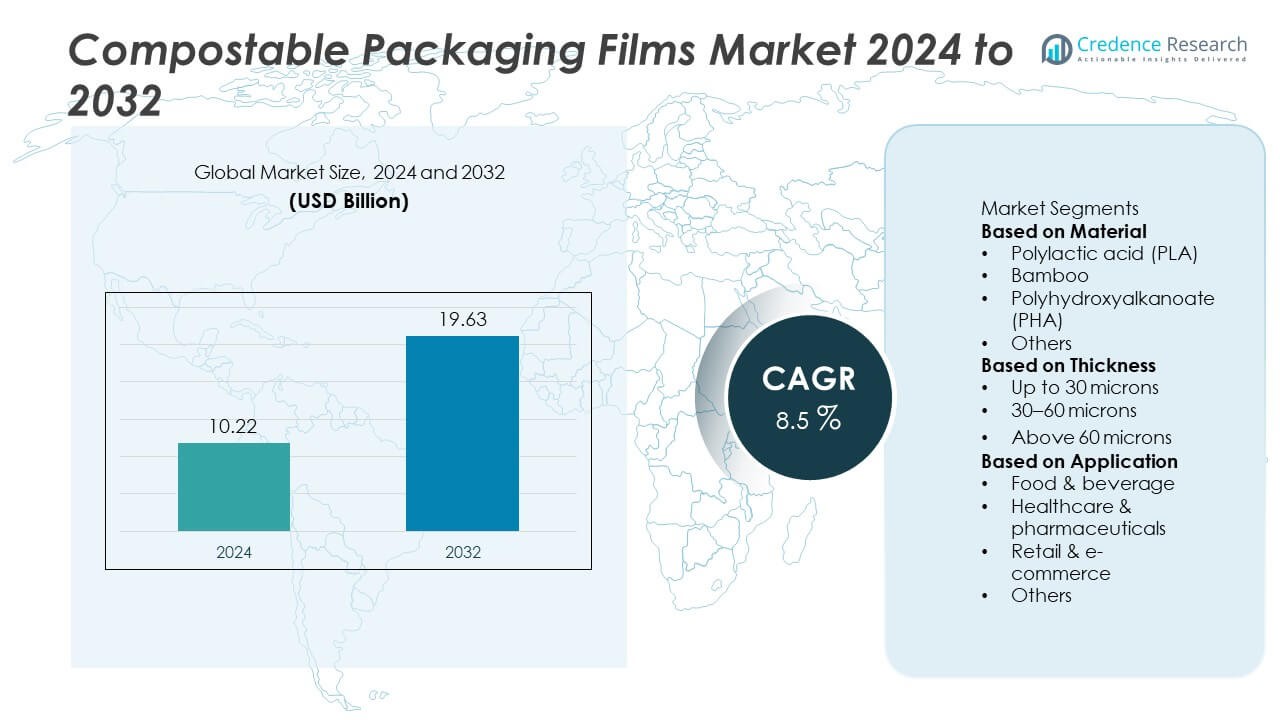

The Compostable Packaging Films market was valued at USD 10.22 billion in 2024 and is projected to reach USD 19.63 billion by 2032, expanding at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compostable Packaging Films Market Size 2024 |

USD 10.22 Billion |

| Compostable Packaging Films Market, CAGR |

8.5% |

| Compostable Packaging Films Market Size 2032 |

USD 19.63 Billion |

The compostable packaging films market is led by major players such as BASF, Baroda Rapids, BioBag International, Amtrex Nature Care, BI-AX International, Biome Bioplastics, Novamont S.p.A., NatureWorks LLC, TIPA Corp Ltd., and Futamura Chemical Co. Ltd. These companies dominate through innovations in biopolymer formulations, sustainable film processing, and global supply chain integration. Europe emerged as the leading region in 2024, holding a 34% share, supported by strict environmental regulations and advanced composting infrastructure. North America followed with 31%, driven by sustainability mandates and food packaging adoption. Asia-Pacific accounted for 27%, showing the fastest growth due to expanding bioplastic production and government incentives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Compostable Packaging Films market was valued at USD 10.22 billion in 2024 and is projected to reach USD 19.63 billion by 2032, growing at a CAGR of 8.5% during the forecast period.

- Rising demand for eco-friendly and biodegradable materials in food, beverage, and retail packaging drives market expansion, supported by regulatory bans on single-use plastics.

- Key trends include advancements in PLA and PHA film technologies, expansion of composting infrastructure, and partnerships between film producers and FMCG brands to achieve sustainability goals.

- The market is moderately consolidated, with major players such as BASF, Novamont, NatureWorks, and TIPA Corp competing through R&D and regional capacity expansion.

- Europe led the market with 34% share, followed by North America with 31%, while Asia-Pacific held 27% and recorded the fastest growth; by material, PLA accounted for 42% of the global share in 2024.

Market Segmentation Analysis:

By Material

Polylactic acid (PLA) dominated the compostable packaging films market in 2024, accounting for approximately 42% of the total share. Its leadership is driven by high transparency, flexibility, and compostability, making it ideal for food and beverage packaging. PLA’s production from renewable feedstocks such as corn starch and sugarcane also aligns with global sustainability goals. Increasing consumer demand for eco-friendly packaging and the availability of industrial composting infrastructure are accelerating its adoption. Bamboo and polyhydroxyalkanoate (PHA) films are emerging alternatives due to biodegradability and strength in specialty packaging applications.

- For instance, NatureWorks LLC operates its largest PLA biopolymer facility in Blair, Nebraska, with an annual capacity of 150,000 metric tons, producing Ingeo biopolymer used in flexible packaging films.

By Thickness

The 30–60 microns thickness segment held the largest share of about 47% in 2024. This segment’s dominance stems from its balanced mechanical strength, barrier protection, and processability, making it suitable for food wrapping, pouches, and medical packaging. Films within this range offer excellent durability while maintaining compostability standards under EN 13432 certification. Manufacturers are optimizing this thickness range to reduce material waste without compromising performance. Increasing adoption in flexible packaging and retail sectors further supports segment expansion. The up to 30 microns segment is gaining traction in lightweight, single-serve packaging solutions.

- For instance, Futamura Chemical Co., Ltd. produces NatureFlex films certified for both home and industrial composting under ASTM D6400 and EN 13432. The films are available in a variety of thicknesses.

By Application

The food and beverage segment led the market in 2024 with an estimated 58% share. The dominance is attributed to growing consumer preference for sustainable food packaging and stringent regulations limiting plastic use. Compostable films are widely used for wrapping fresh produce, snacks, and beverages due to superior breathability and moisture control. Global brands are shifting toward biodegradable films to meet sustainability targets and improve product shelf life. The healthcare and pharmaceutical segment also shows strong potential, driven by eco-friendly blister packs and sterile packaging solutions that meet safety and environmental standards.

Key Growth Drivers

Rising Demand for Sustainable Packaging Solutions

Growing environmental concerns and bans on single-use plastics are driving the shift toward compostable films. Global initiatives such as the EU Packaging and Packaging Waste Directive are promoting biodegradable alternatives. Brand owners in food, beverage, and retail sectors are replacing petroleum-based plastics with compostable films to enhance their green image. Consumers are increasingly willing to pay a premium for eco-friendly packaging, further accelerating adoption. This sustainability-driven transformation is expanding compostable film use across both developed and emerging markets.

- For instance, BASF has developed several grades of its ecovio® biopolymer, which is certified compostable according to industrial and, for some specific products, home composting standards. The company has collaborated with partners like Fabbri Group to create certified compostable cling film and offers a home-compostable extrusion coating grade, ecovio® 70 PS14H6, for use with paper-based food packaging. This supports organics recycling and extends end-of-life options for the packaging.

Expanding Food and Beverage Sector Applications

The food and beverage sector represents the largest user base for compostable films due to their excellent oxygen and moisture barrier properties. Rising consumption of ready-to-eat foods, snacks, and convenience products is increasing the need for sustainable wrapping materials. Companies such as Amcor and TIPA are investing in bio-based multilayer film technologies to replace conventional flexible packaging. The focus on shelf life extension, waste reduction, and compliance with food safety regulations continues to fuel market expansion globally.

- For instance, TIPA Corp Ltd. produces compostable multilayer films with excellent barrier performance for oxygen, which it offers as a compostable alternative to conventional plastic packaging for snacks and bakery.

Technological Advancements in Biopolymer Production

Ongoing innovation in biopolymer engineering is enhancing the mechanical and thermal properties of compostable films. New formulations of polylactic acid (PLA) and polyhydroxyalkanoates (PHA) enable higher flexibility, strength, and heat resistance for wider packaging use. Manufacturers are also developing water-resistant coatings and multilayer film structures to improve performance parity with conventional plastics. These technological upgrades lower production costs and expand application potential, supporting large-scale commercialization of sustainable films across industrial sectors.

Key Trends and Opportunities

Growth of Circular Economy and Composting Infrastructure

The compostable packaging films market is benefiting from rapid expansion in composting facilities and waste management systems. Governments and private organizations are investing in large-scale composting plants, enabling efficient biodegradation of packaging materials. This infrastructure growth supports compliance with circular economy targets and corporate net-zero goals. Opportunities exist for film producers to partner with waste management companies to create closed-loop systems, improving collection, recycling, and end-of-life management of compostable packaging.

- For instance, Novamont S.p.A. has successfully integrated its Mater-Bi films into municipal organic waste collection streams in Italy, a key tool that enhances the separate collection of organic waste and contributes to the production of high-quality compost.

Shift Toward High-Performance Bio-Based Films

Manufacturers are introducing next-generation compostable films with improved sealing, tensile, and barrier performance. These advancements make bio-based materials competitive with polyethylene and polypropylene films. Innovations in PLA-PHA blends and starch-based coatings enhance shelf stability for perishable products. The market also presents opportunities for custom-designed films tailored to specific end-use industries, such as healthcare or e-commerce, enabling value differentiation. Companies adopting advanced extrusion and co-polymer technologies are likely to gain strong competitive advantages.

- For instance, Biome Bioplastics produces a range of plant-based bioplastics that are biodegradable and compostable. These include flexible films for food packaging applications made from starch-based resins. The materials are designed to degrade at the end of their useful life, offering a sustainable alternative to conventional oil-based plastics.

Key Challenges

High Production and Material Costs

Compostable films remain costlier to produce than traditional plastics due to limited biopolymer supply and complex processing. Feedstocks like PLA and PHA involve expensive fermentation and polymerization steps. These high costs restrict mass adoption, particularly in price-sensitive markets. Small and medium-sized packaging producers often struggle to achieve economies of scale, slowing widespread deployment. Cost reduction through bio-feedstock diversification and government incentives is essential to enhance affordability and market competitiveness.

Limited Industrial Composting Infrastructure

Despite growing demand, inadequate composting and waste collection facilities limit the effective disposal of compostable films. In many regions, industrial composting access remains below 30%, causing compostable packaging to end up in landfills. This undermines sustainability claims and discourages consumer confidence. The lack of standardization in labeling and certification further complicates sorting and processing. Expanding global composting capacity and clear end-of-life guidelines are critical to unlocking the full environmental potential of compostable packaging films.

Regional Analysis

North America

North America held a 31% share of the compostable packaging films market in 2024. Growth is driven by strong regulatory action against single-use plastics and corporate sustainability commitments. The U.S. leads regional demand, supported by the food and beverage sector’s rapid adoption of bio-based flexible packaging. Companies such as BASF SE and NatureWorks LLC are expanding PLA and PHA film production to meet local demand. Rising consumer awareness and green retail initiatives across major cities continue to strengthen the regional market outlook through 2032.

Europe

Europe accounted for a 34% share of the compostable packaging films market in 2024, making it the leading region. The dominance stems from strict environmental regulations under the EU Green Deal and Packaging Waste Directive. Nations such as Germany, France, and Italy are investing heavily in compostable material research and waste management systems. High consumer preference for sustainable products drives adoption in food retail and e-commerce. Film manufacturers like Novamont S.p.A. and BioBag International are expanding their biopolymer capabilities to meet regional circular economy goals.

Asia-Pacific

Asia-Pacific captured a 27% share of the compostable packaging films market in 2024. Rapid urbanization, rising disposable incomes, and growing food delivery services are fueling strong demand for sustainable packaging. China, Japan, and India are promoting biodegradable materials through policy incentives and plastic waste reduction mandates. Domestic producers are scaling biopolymer manufacturing to meet regional consumption. Increasing awareness of eco-friendly alternatives and global brand investments in Asia’s packaging supply chain are driving robust growth. The region is projected to be the fastest-growing market during the forecast period.

Latin America

Latin America accounted for a 5% share of the compostable packaging films market in 2024. Brazil and Mexico are leading markets due to expanding food and beverage industries and government initiatives targeting plastic waste reduction. Growing collaboration between packaging converters and biopolymer suppliers is improving material accessibility. The retail and e-commerce sectors are adopting compostable films for consumer goods packaging. Despite limited composting infrastructure, ongoing sustainability campaigns and new production capacities are expected to boost regional adoption over the coming years.

Middle East & Africa

The Middle East and Africa region held a 3% share of the compostable packaging films market in 2024. Growth is driven by early sustainability initiatives in the UAE, Saudi Arabia, and South Africa. Governments are encouraging biodegradable materials to reduce landfill waste and plastic pollution. The foodservice and hospitality sectors are emerging as key adopters, supported by tourism-driven demand. While cost and infrastructure limitations persist, partnerships with global biopolymer suppliers and increasing regulatory enforcement are expected to enhance market penetration in the forecast period.

Market Segmentations:

By Material

- Polylactic acid (PLA)

- Bamboo

- Polyhydroxyalkanoate (PHA)

- Others

By Thickness

- Up to 30 microns

- 30–60 microns

- Above 60 microns

By Application

- Food & beverage

- Healthcare & pharmaceuticals

- Retail & e-commerce

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the compostable packaging films market features key players such as BASF, Baroda Rapids, BioBag International, Amtrex Nature Care, BI-AX International, Biome Bioplastics, Novamont S.p.A., NatureWorks LLC, TIPA Corp Ltd., and Futamura Chemical Co. Ltd. These companies compete through advancements in biopolymer technologies, partnerships, and expanded production capacities. Leading firms are focusing on enhancing the mechanical and barrier properties of PLA and PHA-based films to meet diverse packaging demands. Strategic collaborations with food and retail brands are accelerating market penetration. BASF and Novamont are emphasizing R&D for multilayer compostable film solutions, while NatureWorks and TIPA are scaling global distribution networks. Regional players such as Baroda Rapids and Amtrex Nature Care are strengthening presence in Asia through cost-efficient biodegradable films. The market remains moderately consolidated, with innovation, certification compliance, and product customization driving long-term competitive differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF

- Baroda Rapids

- BioBag International

- Amtrex Nature Care

- BI-AX International

- Biome Bioplastics

- Novamont S.p.A.

- NatureWorks LLC

- TIPA Corp Ltd.

- Futamura Chemical Co., Ltd.

Recent Developments

- In October 2025, BioBag International was listed as an approved compostable-bag supplier for Kenosha’s curbside collection program.

- In September 2025, BI-AX International updated EVLON information, noting industrial compostability to CO₂ and water in under 90 days.

- In May 2025, BASF partnered with Metpack to demo a home-compostable coated paper for food packaging using ecovio.

- In February 2025, TIPA launched a home-compostable metallized high-barrier film for snack packaging.

Report Coverage

The research report offers an in-depth analysis based on Material, Thickness, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth due to increasing global bans on single-use plastics.

- Demand for compostable films will rise across food, beverage, and e-commerce packaging sectors.

- Technological advances in PLA and PHA production will enhance film strength and barrier performance.

- Manufacturers will invest in cost-effective biopolymer synthesis to improve material affordability.

- Expansion of industrial composting facilities will support large-scale adoption worldwide.

- Partnerships between packaging firms and FMCG brands will accelerate innovation and product launches.

- Asia-Pacific will emerge as the fastest-growing regional market due to rising sustainability mandates.

- Government incentives and green labeling programs will encourage investment in compostable solutions.

- Circular economy initiatives will drive integration of biodegradable films into supply chains.

- Continuous R&D in multilayer and high-performance bio-films will shape the market’s long-term competitiveness.