Market Overview:

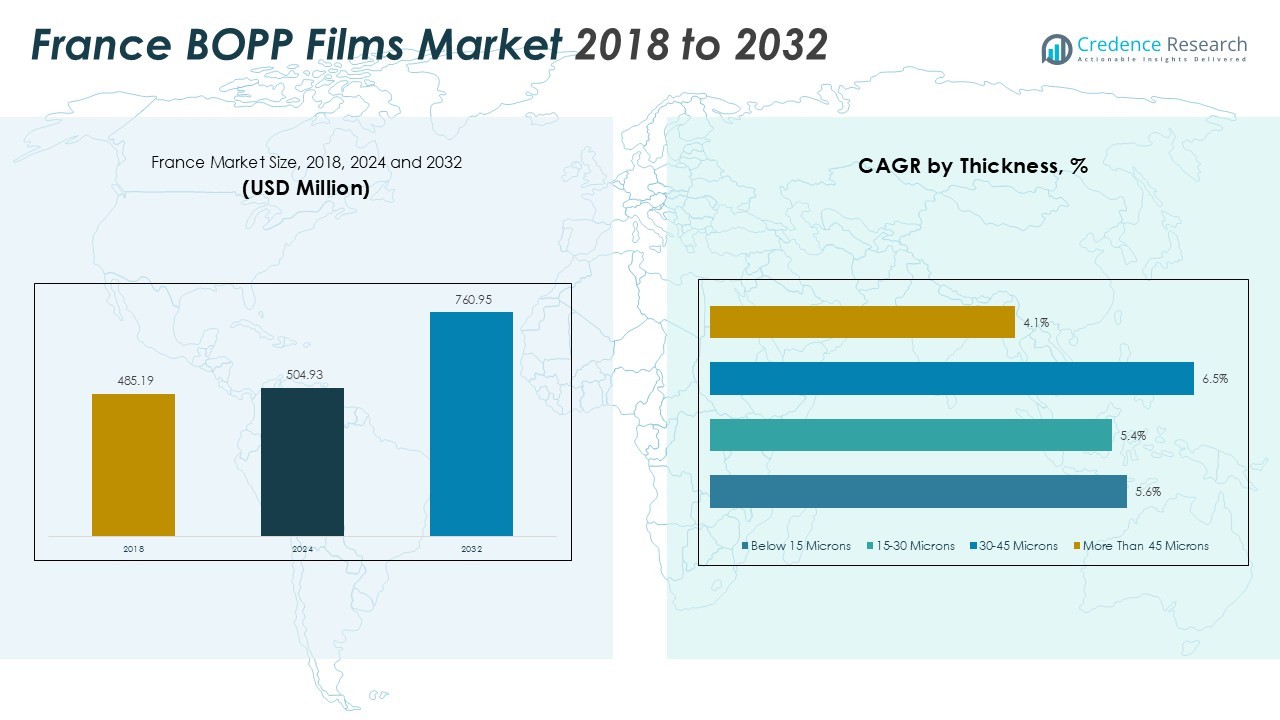

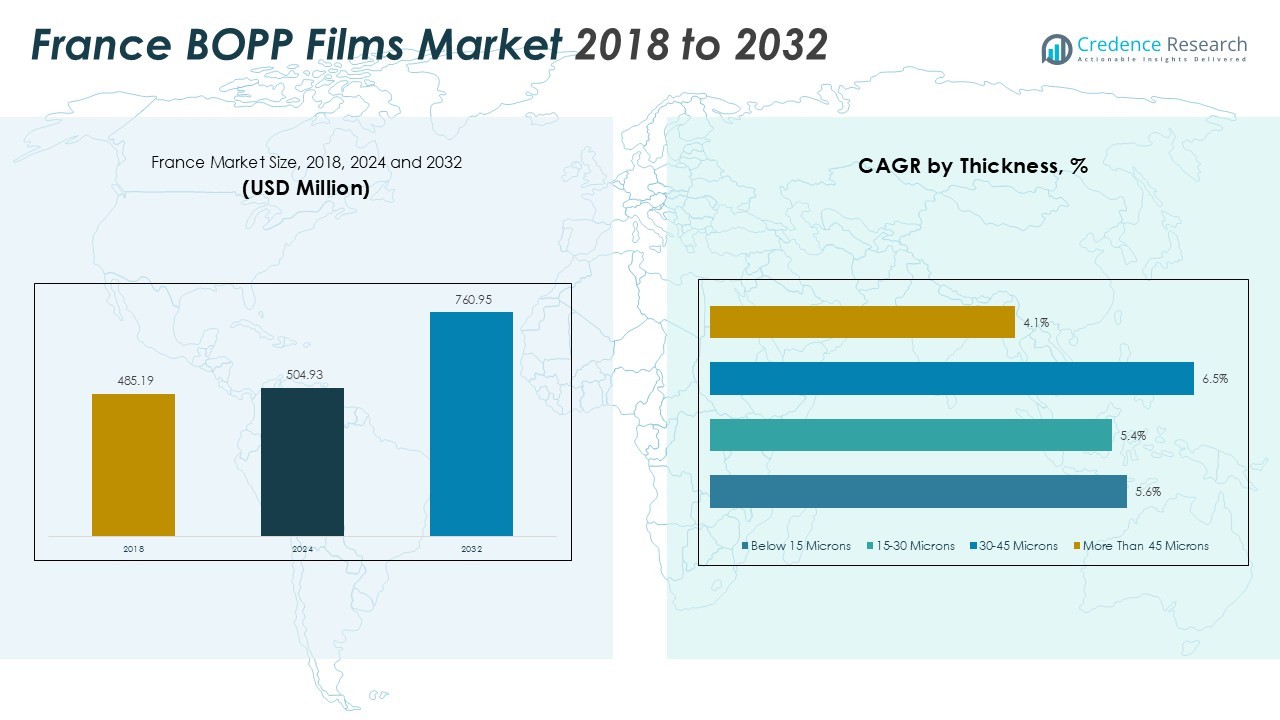

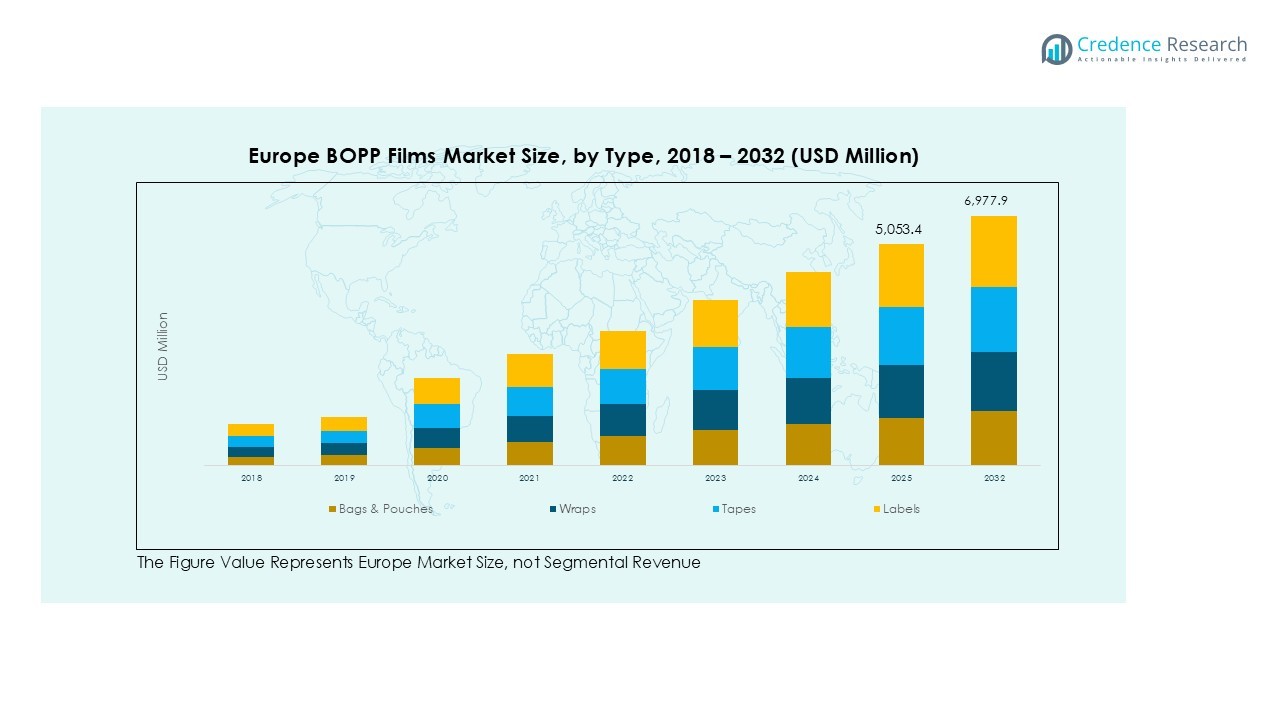

The France BOPP Films Market size was valued at USD 485.19 million in 2018 to USD 504.93 million in 2024 and is anticipated to reach USD 760.95 million by 2032, at a CAGR of 5.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France BOPP Films Market Size 2024 |

USD 504.93 Million |

| France BOPP Films Market, CAGR |

5.26% |

| France BOPP Films Market Size 2032 |

USD 760.95 Million |

Growth in packaged food, beverages, and personal care industries is a key driver of the France BOPP Films Market. Increasing consumer preference for lightweight and recyclable packaging aligns with France’s circular economy initiatives. Additionally, advances in multi-layer co-extrusion and metallized coatings are improving product durability and sustainability, supporting the packaging sector’s transition toward eco-friendly solutions.

Regionally, Île-de-France leads the market due to the strong presence of packaging manufacturers and large FMCG production facilities. Other regions, such as Auvergne-Rhône-Alpes and Nouvelle-Aquitaine, are witnessing rising demand driven by expanding logistics and e-commerce networks. Government support for sustainable material development and stringent environmental regulations further enhance the regional adoption of recyclable BOPP films in both industrial and retail packaging applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France BOPP Films Market was valued at USD 504.93 million in 2024 and is projected to reach USD 760.95 million by 2032, growing at a CAGR of 5.26%.

- Strong growth in packaged food, beverage, and personal care industries continues to drive BOPP film demand across key manufacturing hubs.

- Rising preference for recyclable and lightweight packaging aligns with France’s circular economy and sustainability mandates.

- Technological advancements in multi-layer co-extrusion and metallization improve film barrier strength, printability, and cost efficiency.

- Île-de-France dominates with 41% market share, supported by its robust FMCG production base and leading packaging converters.

- Fluctuating polypropylene resin prices and high transportation costs remain key challenges impacting profit margins and supply stability.

- Expanding e-commerce networks and regional recycling investments are expected to create long-term opportunities for eco-friendly BOPP film adoption across France.

Market Drivers:

Rising Demand from Packaged Food and Beverage Industry

The France BOPP Films Market experiences strong demand from the food and beverage sector, where BOPP films are used for wrapping, labeling, and sealing. Their excellent moisture resistance, optical clarity, and durability make them ideal for preserving freshness and visual appeal. Growth in processed and convenience food consumption further strengthens market adoption. Companies are focusing on sustainable packaging formats, increasing the use of recyclable and bio-based BOPP films.

- For instance, a collaboration involving Innovia Films and Prevented Ocean Plastic has introduced a food-safe recycled polypropylene, an initiative projected to prevent 500 million polypropylene cups from entering the ocean within its first year.

Advancements in Film Manufacturing Technologies Enhancing Performance

Technological improvements in multi-layer co-extrusion, metallization, and coating processes are boosting film quality and efficiency. These innovations provide enhanced barrier protection, improved printability, and greater heat resistance. The France BOPP Films Market benefits from such advancements, as converters aim to meet strict packaging standards and reduce material waste. Automation and digital monitoring in film production also ensure consistency and reduced production costs.

- For instance, Innovia Films’ Propafilm™ REF, a high-speed film, was tested on an SPS Italiana Pack Systems Modulo machine, where it achieved a substantial performance improvement of 30 meters per minute.

Growing Focus on Sustainability and Circular Economy Compliance

Government emphasis on reducing plastic waste and promoting recyclable materials supports the transition toward eco-friendly BOPP films. Manufacturers are developing mono-material structures that improve recyclability without compromising performance. It aligns with France’s extended producer responsibility (EPR) regulations and EU packaging directives. This sustainability-driven demand encourages producers to expand green production lines and invest in energy-efficient technologies.

Expanding E-commerce and Logistics Sector Driving Flexible Packaging Demand

The rapid expansion of e-commerce platforms across France fuels the need for lightweight and durable packaging materials. BOPP films provide high tensile strength, tear resistance, and superior sealing capabilities suited for shipping and storage. The France BOPP Films Market gains traction from online retail packaging that requires strong yet eco-conscious materials. Continuous investment in logistics infrastructure further supports flexible packaging consumption in the country.

Market Trends:

Shift Toward Sustainable and Recyclable Packaging Materials

The France BOPP Films Market is witnessing a strong transition toward sustainable and recyclable packaging solutions. Brands are prioritizing eco-friendly films to comply with France’s single-use plastic restrictions and EU sustainability goals. Manufacturers are investing in mono-material and bio-based BOPP films to support circular economy models. It enables packaging producers to reduce carbon footprints and enhance recyclability rates without affecting material performance. Demand for low-density, energy-efficient films is increasing, driven by consumer awareness and corporate sustainability commitments. Partnerships between film producers and FMCG companies are focusing on developing closed-loop recycling systems and lightweight flexible packaging. These initiatives are helping manufacturers maintain competitiveness while aligning with national waste reduction objectives.

- For instance, Taghleef Industries successfully processed post-consumer recycled polypropylene to produce a thin 40µ white voided film.

Integration of Advanced Manufacturing and Coating Technologies

Innovations in film extrusion, metallization, and coating technologies are reshaping production efficiency and product functionality. The France BOPP Films Market benefits from high-barrier films that offer superior moisture, oxygen, and light resistance. It supports applications across food, beverage, and personal care industries requiring longer shelf life and enhanced visual appeal. Producers are integrating plasma and vacuum deposition systems to improve metallized film quality and reduce energy use. Adoption of digital control systems and AI-driven process monitoring enhances precision and production throughput. Leading firms are expanding their R&D investments in nanocoating and high-performance additives to achieve improved thermal and optical properties. These technological advancements ensure consistent film quality while meeting regulatory and consumer demands for advanced flexible packaging solutions.

- For instance, on June 1, 2025, Cosmo First commissioned a new Biaxially Oriented Polypropylene (BOPP) film production line, this new line added an annual rated capacity of 81,200 metric tons, enhancing the company’s ability to produce specialty films.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Disruptions

The France BOPP Films Market faces challenges from volatile polypropylene resin prices, influenced by global crude oil fluctuations. Unstable supply conditions and high transportation costs increase production expenses for manufacturers. It affects profit margins and pricing flexibility in a competitive market. Dependence on imported feedstock makes the industry vulnerable to geopolitical tensions and trade disruptions. Supply chain inefficiencies also impact lead times and inventory management. Companies are seeking long-term supplier partnerships and localized sourcing to reduce exposure to such risks. Stabilizing raw material procurement remains a critical priority for maintaining consistent output and cost control.

Stringent Environmental Regulations and Recycling Limitations

Tightening EU and national packaging waste laws create operational and compliance challenges for producers. The France BOPP Films Market must adapt to strict recycling and labeling standards under extended producer responsibility (EPR) frameworks. It requires costly investment in new recycling technologies and sustainable product design. Limited recycling infrastructure for flexible films restricts collection and reuse rates. Manufacturers face growing pressure to innovate while meeting performance and cost targets. High regulatory compliance costs and certification requirements also slow smaller firms’ market entry. Developing efficient closed-loop recycling models is essential to meet France’s environmental and circular economy goals.

Market Opportunities:

Growing Adoption of Bio-Based and Recyclable Film Solutions

The France BOPP Films Market presents strong opportunities in bio-based and recyclable material development. Rising consumer preference for sustainable packaging is encouraging producers to innovate in biodegradable polymer blends. It supports compliance with France’s environmental targets and boosts brand credibility among eco-conscious buyers. Manufacturers investing in closed-loop recycling technologies can gain competitive advantage in public tenders and FMCG contracts. Collaboration with packaging converters to design mono-material solutions enhances product recyclability and reduces waste. Government funding for green innovation also supports the establishment of advanced recycling plants. Expanding adoption of bio-based BOPP films creates new growth avenues across food, retail, and personal care sectors.

Expansion in E-Commerce and Smart Packaging Applications

Rapid e-commerce growth in France increases the demand for durable and lightweight packaging materials. The France BOPP Films Market benefits from the need for films with superior strength, sealability, and visual appeal. It enables efficient logistics and product protection during transport. Integration of smart packaging technologies, such as QR codes and printed sensors, further enhances market value. Manufacturers focusing on functional coatings and digital printing can capture demand from premium brands. Partnerships with logistics providers and online retailers also create long-term supply opportunities. Rising investments in digital packaging innovation will help BOPP film producers diversify applications and strengthen market position.

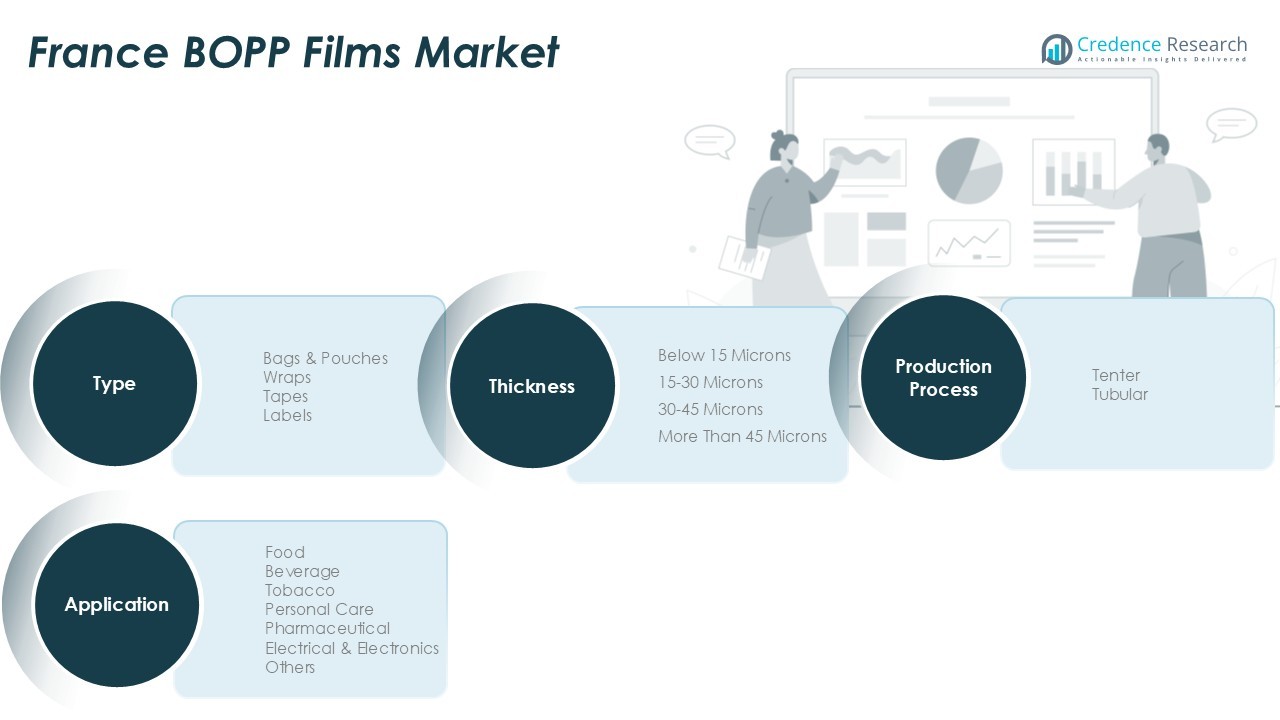

Market Segmentation Analysis:

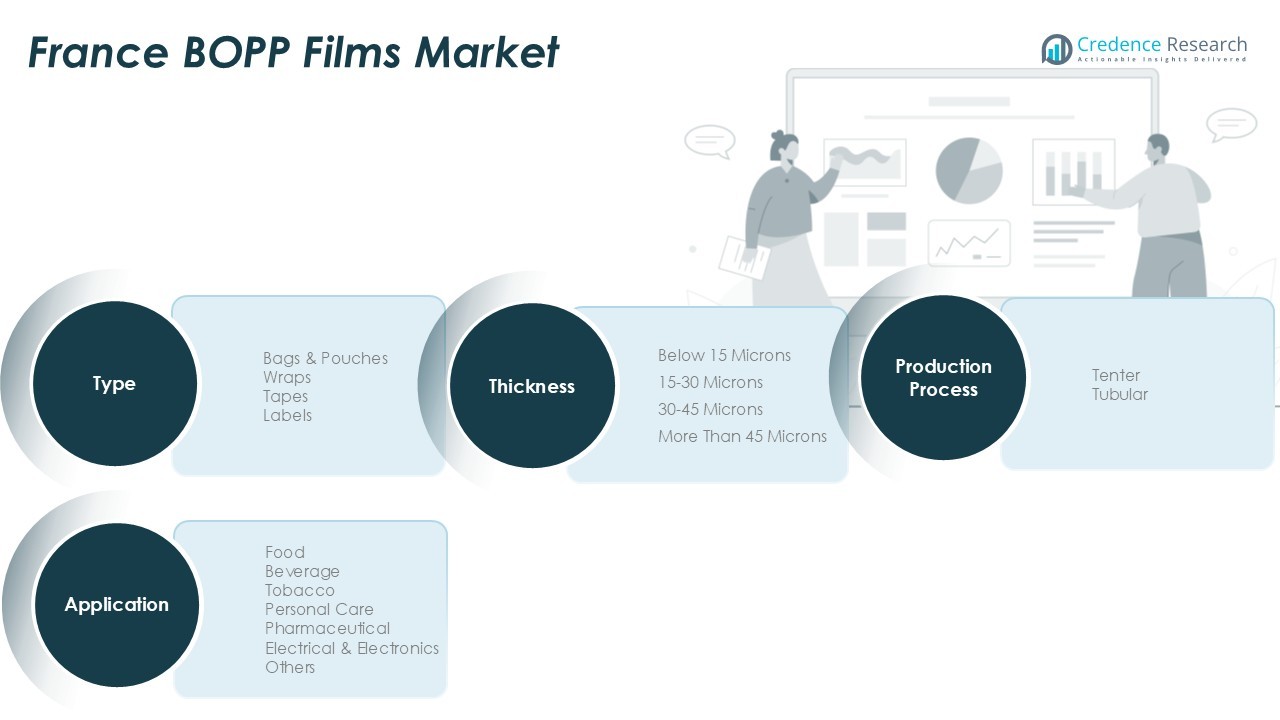

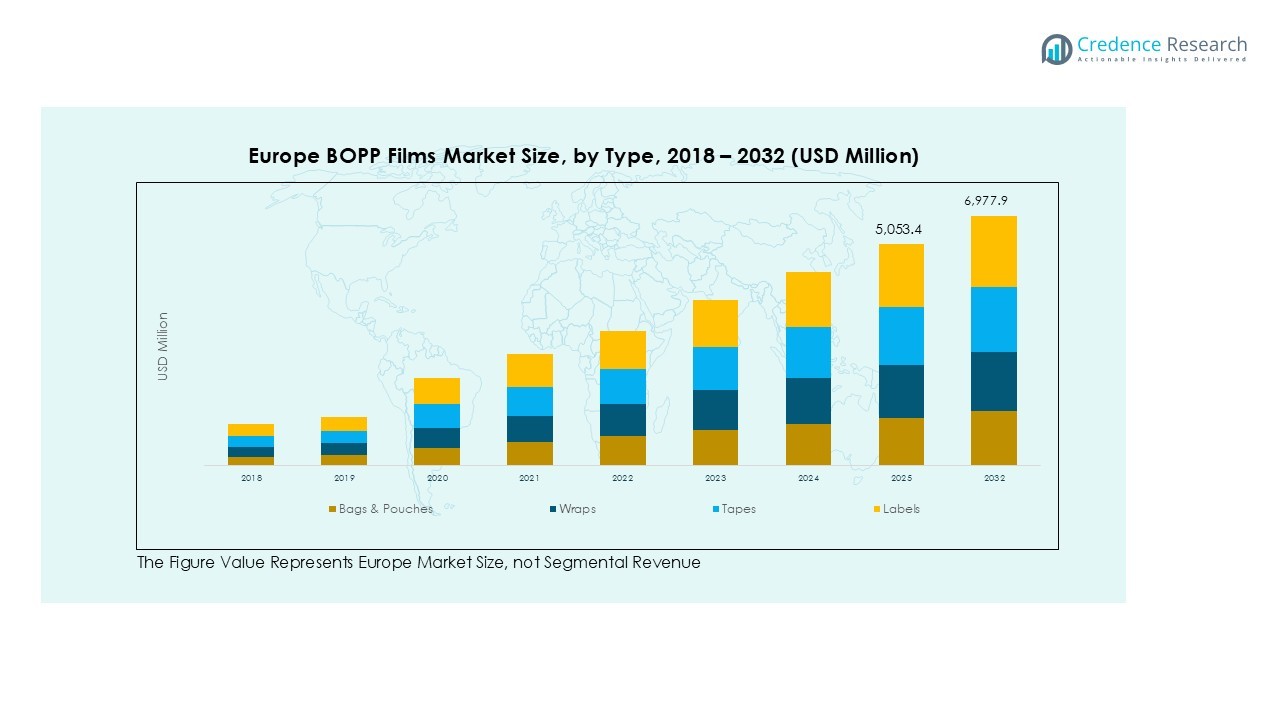

By Type

The France BOPP Films Market is segmented into bags & pouches, wraps, tapes, and labels. Bags & pouches dominate due to their extensive use in food and beverage packaging, supported by strong demand for flexible and recyclable solutions. Wraps hold a major share in retail and industrial packaging, offering superior clarity and barrier protection. Tapes and labels are witnessing steady growth, supported by rising e-commerce and logistics activity that require durable and printable films. It continues to benefit from technological advancements in film extrusion and coating processes.

- For instance, Innovia Films launched a new 8.8-meter-wide production line in Germany which has an annual output capacity of 35,000 tons, significantly boosting the production of high-performance BOPP films for the European market.

By Application

The market is categorized into food, beverage, tobacco, personal care, pharmaceutical, electrical & electronics, and others. Food and beverage applications account for the largest share, driven by the need for safe, lightweight, and moisture-resistant packaging. It supports longer shelf life and enhanced visual presentation for branded products. Personal care and pharmaceutical segments are expanding, supported by consumer awareness and regulatory packaging standards. Electrical and electronic applications are also growing due to the film’s insulation and barrier properties.

By Thickness

The market is divided into below 15 microns, 15–30 microns, 30–45 microns, and more than 45 microns. The 15–30 micron category leads due to its versatility, durability, and cost-effectiveness across packaging applications. It offers optimal mechanical strength and print quality for food and industrial packaging. Thicker films above 30 microns are favored for heavy-duty and multilayer packaging, providing enhanced strength and puncture resistance in demanding environments.

- For instance, Mondi introduced its Functional Barrier Paper Ultimate, a high-performance paper-based packaging solution. This material delivers an exceptional oxygen transmission rate of below 0.5 cm³/m²d, providing superior protection for products like instant coffee and dried foods.

Segmentations:

By Type

- Bags & Pouches

- Wraps

- Tapes

- Labels

By Application

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Electrical & Electronics

- Others

By Thickness

- Below 15 Microns

- 15–30 Microns

- 30–45 Microns

- More Than 45 Microns

By Production Process

Regional Analysis:

Île-de-France Leading with Strong Industrial and Packaging Infrastructure

Île-de-France holds 41% share of the France BOPP Films Market in 2024, making it the largest regional contributor. The region benefits from strong FMCG, food, and pharmaceutical manufacturing bases that drive continuous packaging demand. Its advanced logistics networks and access to raw materials support efficient film production and distribution. It also leads in sustainable packaging adoption, supported by strict environmental standards and corporate green commitments. Leading packaging converters and polymer manufacturers operate in this region, ensuring high product quality and rapid innovation. Continuous investments in automation and material recycling enhance competitiveness and long-term production stability.

Auvergne-Rhône-Alpes Emerging as a Hub for Flexible Packaging

Auvergne-Rhône-Alpes accounts for 27% share of the France BOPP Films Market in 2024, ranking second in national output. The region’s strong industrial ecosystem and strategic location near key logistics corridors support large-scale packaging operations. It is home to multiple mid-sized converters supplying films to food, pharmaceutical, and industrial sectors. Local authorities encourage investment in energy-efficient production systems and recyclable material technologies. The region’s innovation-driven approach helps meet sustainability targets while ensuring competitive production costs. Strong partnerships between raw material suppliers and film processors enhance technological advancement and capacity expansion.

Nouvelle-Aquitaine and Other Regions Driving Eco-Friendly Adoption

Nouvelle-Aquitaine holds 18% share of the France BOPP Films Market in 2024, supported by rising use of sustainable packaging solutions. It caters to regional demand from organic food, beverage, and personal care producers emphasizing recyclable materials. Regional initiatives promote circular economy practices through bio-based polymer innovation and improved recycling infrastructure. It benefits from local R&D funding aimed at enhancing film quality and processing efficiency. Smaller converters are upgrading extrusion and coating lines to meet growing eco-friendly packaging demand. Strong policy support and local manufacturing collaborations are further boosting regional production and adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The France BOPP Films Market is characterized by intense competition among established domestic and international manufacturers. Leading companies such as SP Sac France, Rexor S.A. (Jindal France), Toray Films Europe, Novacel S.A., and Armor SAS focus on product innovation, sustainable material development, and operational efficiency. It emphasizes advanced extrusion and coating technologies to enhance film strength, printability, and recyclability. Strategic initiatives include mergers, regional expansions, and investments in green production to align with France’s circular economy goals. Companies are also strengthening partnerships with FMCG and packaging firms to deliver customized film solutions. The growing demand for high-barrier and recyclable packaging continues to drive R&D investment, enabling manufacturers to maintain a competitive edge through superior quality and environmental compliance.

Recent Developments:

- In January 2025, Novacel S.A. introduced Vegetal+, a new line of eco-friendly films formulated with over 80% renewable raw materials.

- In July 2025, Novacel is scheduled to participate in INDOBUILD TECH, the largest trade show for building and architecture in Indonesia.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Thickness and Production Process. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France BOPP Films Market is expected to witness steady growth driven by sustainable packaging adoption.

- Rising demand from the food, beverage, and personal care sectors will continue to fuel film consumption.

- Manufacturers will focus on expanding production capacity for recyclable and bio-based BOPP films.

- Technological progress in co-extrusion and metallization will enhance barrier performance and print quality.

- Integration of digital monitoring and automation will improve production efficiency and reduce waste.

- Government regulations promoting circular economy practices will accelerate the use of eco-friendly materials.

- Strategic collaborations between film producers and packaging companies will strengthen value chain resilience.

- Expansion in e-commerce packaging applications will create consistent opportunities for lightweight and durable films.

- Increased R&D investments will drive innovation in high-clarity, low-density, and high-barrier film solutions.

- Growing regional investments in recycling infrastructure will support long-term sustainability and market competitiveness.