Market Overview:

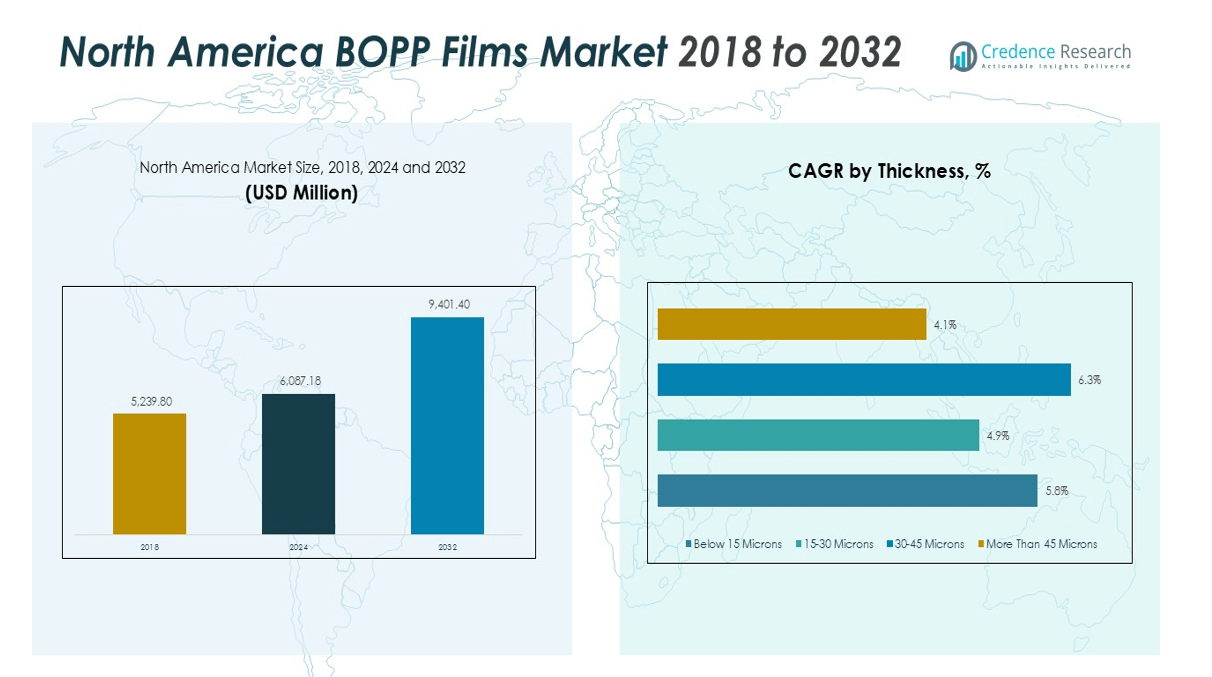

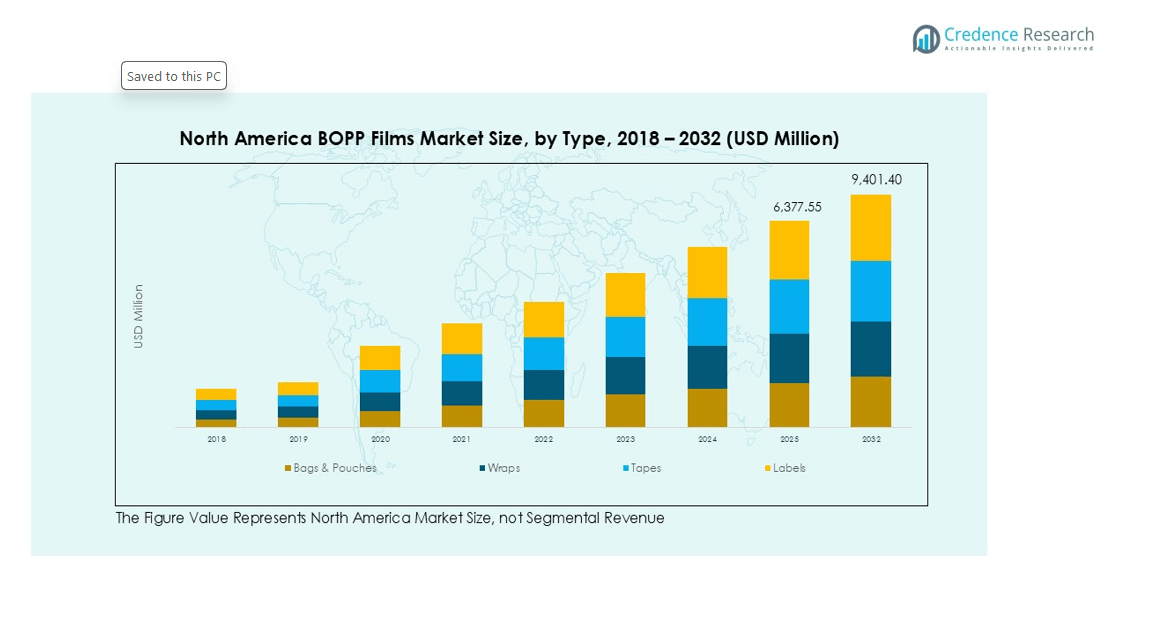

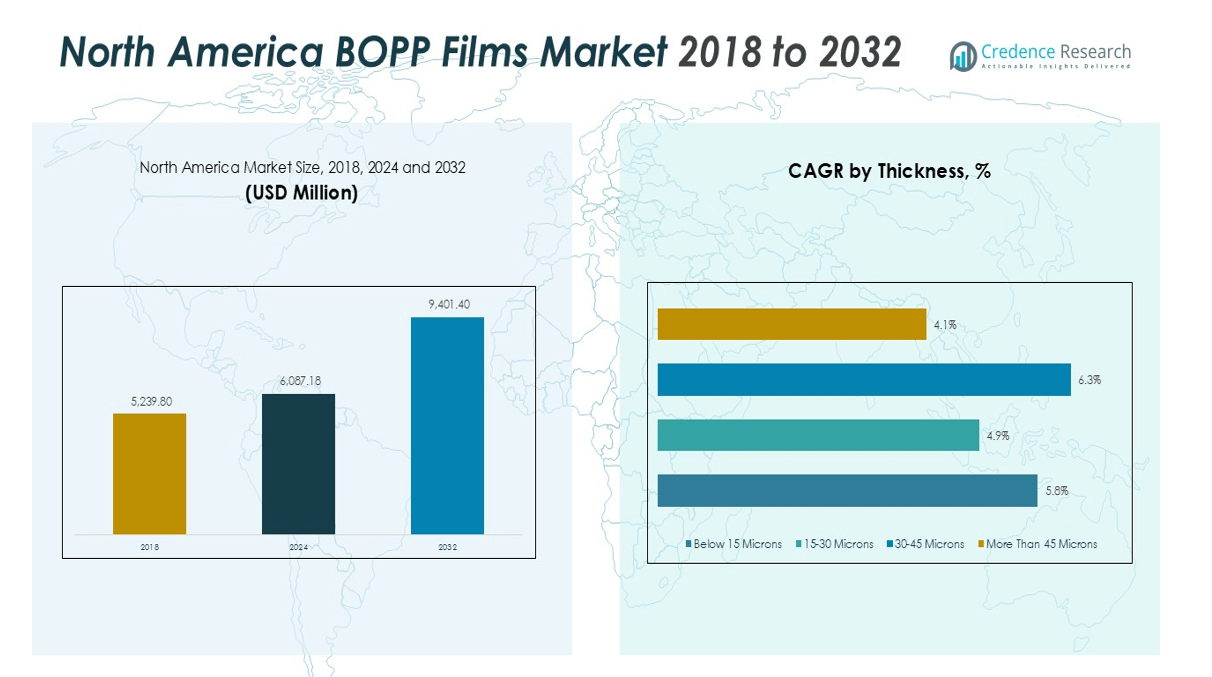

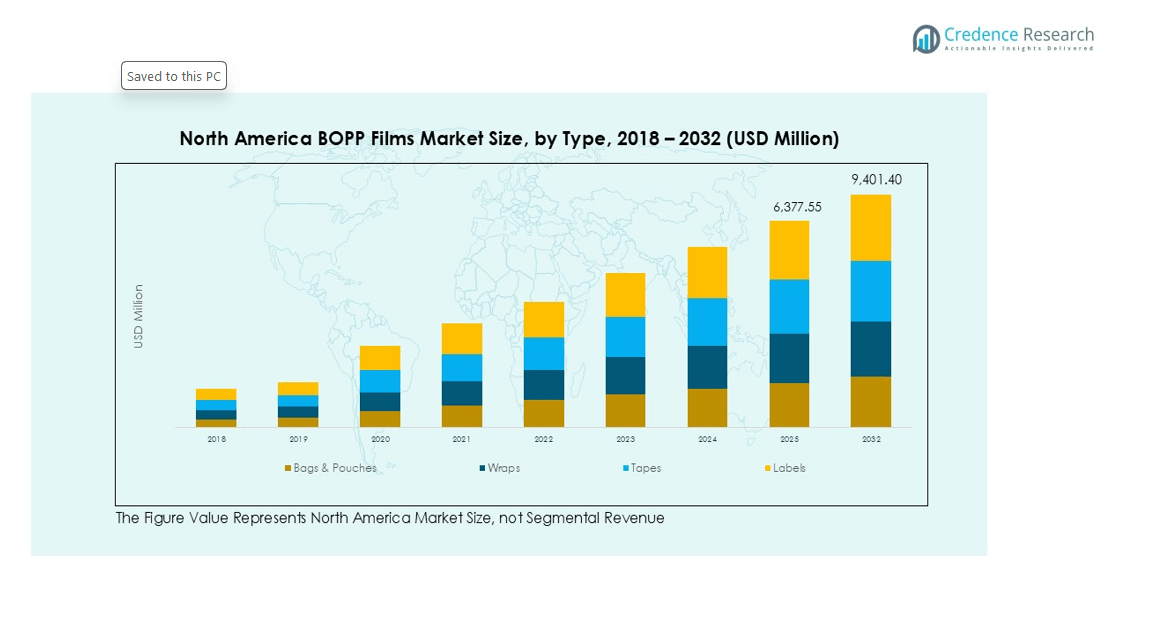

The North America BOPP Film Market size was valued at USD 5,239 million in 2018 to USD 6,087 million in 2024 and is anticipated to reach USD 9,401 million by 2032, at a CAGR of 5.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America BOPP Film Market Size 2024 |

USD 6,087 million |

| North America BOPP Film Market, CAGR |

5.66% |

| North America BOPP Film Market Size 2032 |

USD 9,401 million |

The market is driven by increasing consumer demand for lightweight and sustainable packaging materials, supported by the expanding e-commerce and retail industries. Advancements in film manufacturing technologies, including multi-layer extrusion and metallized coatings, are improving product durability, printability, and barrier performance. Major producers are focusing on expanding production capacities and developing eco-friendly polymer solutions to address shifting packaging preferences and regulatory sustainability goals.

Regionally, the United States holds the largest share of the North America BOPP Film Market, supported by its well-established packaging sector and robust food and consumer goods manufacturing base. The country’s focus on recyclable and energy-efficient materials further strengthens market growth. Canada and Mexico are also experiencing steady expansion, driven by increasing packaging exports, foreign investments in advanced production facilities, and rising demand for high-performance films in industrial and consumer packaging applications.

Market Insights:

- The North America BOPP Film Market was valued at USD 6,087 million and is projected to reach USD 9,401 million by 2032, registering a CAGR of 5.66%.

- Rising demand for flexible, lightweight, and recyclable packaging materials is driving adoption across food, beverage, and personal care sectors.

- Expansion of e-commerce and retail networks is increasing the use of durable BOPP films for labeling, wrapping, and protective packaging.

- Technological advancements in extrusion, coating, and metallization are improving clarity, barrier strength, and film durability.

- Regulatory focus on sustainability and circular economy goals is pushing manufacturers toward recyclable and bio-based polymer production.

- The United States holds 63% share, supported by a strong packaging base and major investments in recycling and production efficiency.

- Canada and Mexico collectively contribute 37% share, driven by local manufacturing expansion, rising exports, and eco-friendly packaging initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Flexible and Sustainable Packaging Solutions

The North America BOPP Film Market benefits from strong growth in the flexible packaging sector. Industries such as food, beverages, and personal care are shifting toward lightweight and recyclable materials to reduce environmental impact. BOPP films offer superior moisture resistance, clarity, and printability, supporting extended shelf life and improved product presentation. The transition from rigid to flexible packaging continues to accelerate adoption, particularly among consumer goods manufacturers seeking cost efficiency and sustainability compliance.

- For instance, Innovia Films recently enhanced its production capabilities by launching a new 8.8-meter-wide line, which added an annual capacity of 35,000 tons for manufacturing sustainable BOPP films.

Expansion of E-Commerce and Retail Distribution Channels

E-commerce growth across North America drives the demand for durable and protective packaging materials. BOPP films are widely used in pouches, wraps, and labeling applications that safeguard goods during transit and storage. The market benefits from high consumption of packaged goods and increasing expectations for visually appealing, damage-resistant packaging. Continuous investment by packaging firms in advanced BOPP solutions enhances operational efficiency and supports rapid order fulfillment in logistics networks.

- For instance, addressing the needs of the e-commerce sector, PureCycle Technologies successfully produced a 50-micron thick BOPP film specifically designed for high-durability label applications.

Technological Advancements in Film Processing and Coating Techniques

Innovation in extrusion, coating, and metallization technologies strengthens the competitiveness of BOPP films. Manufacturers are developing high-barrier, heat-sealable, and printable films tailored to specific end-use requirements. It enables improved packaging performance, reducing the need for multilayer laminates. The introduction of thinner yet stronger film grades supports material savings while maintaining product integrity and quality standards across diverse applications.

Growing Focus on Circular Economy and Regulatory Compliance

Environmental regulations and corporate sustainability goals drive adoption of recyclable and bio-based BOPP films. Governments and brands are promoting eco-friendly packaging to minimize waste generation and carbon emissions. It encourages manufacturers to shift toward polymer recycling initiatives and low-carbon production methods. Partnerships across the packaging value chain are enhancing transparency, ensuring the North America BOPP Film Market aligns with regional circular economy targets and long-term sustainability commitments.

Market Trends:

Adoption of Bio-Based and Recyclable BOPP Films Across Packaging Applications

The North America BOPP Film Market is witnessing a strong shift toward bio-based and recyclable materials driven by corporate sustainability goals and government regulations. Manufacturers are investing in research to develop films derived from renewable resources such as corn and sugarcane. It helps reduce carbon emissions and dependence on petroleum-based polymers while meeting consumer expectations for eco-friendly packaging. Brand owners are increasingly specifying recyclable BOPP films for food, beverage, and personal care packaging to align with circular economy initiatives. The growing acceptance of mono-material packaging structures supports recycling efficiency and waste reduction targets. It also enhances product differentiation for companies promoting green packaging solutions across retail shelves.

- For instance, Inteplast Group received ISCC PLUS certification for its BOPP film facilities in Gray Court (South Carolina), Lolita (Texas), and Morristown (Tennessee) in March 2024, enabling the supply of ISCC-certified materials via a mass balance approach, and positioning Inteplast as one of the first North American BOPP film manufacturers to achieve this designation.

Integration of Advanced Film Technologies for Performance and Aesthetic Enhancement

The market is experiencing rapid integration of advanced film processing technologies such as nano-coating, multi-layer extrusion, and high-clarity printing. These innovations improve moisture, oxygen, and UV barrier properties, extending shelf life for perishable products. It allows brand owners to design visually attractive packaging without compromising strength or sustainability. The demand for metallized and heat-sealable films continues to grow in the food and e-commerce sectors due to improved sealing strength and cost efficiency. Automation in film production lines further enhances precision, uniformity, and throughput efficiency. It enables manufacturers to achieve high output with consistent quality, supporting competitiveness across packaging converters and large-scale distributors.

- For instance, Reifenhäuser produces modular blown film lines capable of extruding up to 12 layers, with a maximum width of 6,500mm, allowing manufacturing of multi-layer films for advanced packaging and industrial use.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Constraints

The North America BOPP Film Market faces pressure from volatile polypropylene resin prices, influenced by crude oil fluctuations and geopolitical uncertainties. Supply disruptions and logistics bottlenecks create cost instability for manufacturers and converters. It limits production efficiency and affects profit margins across the packaging value chain. Companies must secure reliable raw material sources and implement risk mitigation strategies to maintain operational continuity. High dependency on imported feedstock adds further vulnerability, especially during trade restrictions or transportation delays. It compels producers to explore local sourcing and recycling initiatives to achieve cost balance and supply resilience.

Environmental Regulations and Recycling Infrastructure Gaps

Strict environmental policies and low recycling infrastructure readiness pose significant challenges for film manufacturers. It increases compliance costs and restricts the widespread adoption of plastic-based materials in packaging. Limited collection and segregation systems reduce the recovery rate of used films, affecting sustainability targets. The need for consistent regional standards on labeling, recyclability, and polymer composition remains critical for achieving large-scale material recovery. It urges industry players to collaborate with policymakers and recyclers to close gaps in waste management frameworks and promote a circular packaging economy.

Market Opportunities:

Expansion of Sustainable and High-Performance Packaging Solutions

The North America BOPP Film Market presents strong opportunities through the growing transition toward sustainable and high-performance packaging materials. Brand owners are adopting recyclable and bio-based BOPP films to meet consumer demand for eco-friendly products. It supports brand reputation and aligns with corporate sustainability targets. Manufacturers investing in advanced resin formulations and high-barrier coatings can capture demand from food, beverage, and healthcare sectors. The focus on lightweight packaging and reduced carbon footprint strengthens prospects for innovative film solutions. It enables companies to differentiate through enhanced performance and environmental responsibility.

Rising Demand Across Emerging Industrial and Labeling Applications

The increasing use of BOPP films in industrial laminates, adhesive tapes, and labeling applications creates new market avenues. It helps improve durability, print clarity, and product branding across diverse end-use industries. The expansion of e-commerce and logistics sectors further boosts demand for protective and tamper-evident packaging solutions. Growth in digital printing technologies enhances compatibility with BOPP substrates, offering improved design flexibility. It encourages converters and packaging firms to expand product portfolios with specialized films. The rising emphasis on premium aesthetics and functionality drives continuous innovation in the regional BOPP film industry.

Market Segmentation Analysis:

By Type:

The North America BOPP Film Market is segmented into bags and pouches, wraps, tapes, and labels. Bags and pouches dominate due to rising demand for flexible packaging across food, beverage, and personal care sectors. It offers superior moisture protection, transparency, and heat-sealing capability, supporting product freshness and visual appeal. Wraps and labels also hold significant shares, driven by growing e-commerce packaging needs and brand labeling requirements in retail environments.

By Application:

The market includes food, beverage, tobacco, personal care, pharmaceutical, electrical and electronics, and others. The food segment holds the largest share, supported by increasing consumption of packaged and ready-to-eat products. It benefits from the film’s ability to extend shelf life and resist oil and moisture. The beverage and personal care sectors are expanding due to high adoption of transparent and printable packaging solutions for branding and protection.

- For instance, Jindal Films launched its Bicor MBH568 films, which are clear barrier films designed to run as a single web on high-speed Horizontal Form Fill Seal (HFFS) packaging machines for food applications.

By Thickness:

Based on thickness, the market is categorized into below 15 microns, 15–30 microns, 30–45 microns, and more than 45 microns. The 15–30 microns segment dominates, supported by high usage in labeling, wrapping, and pouches. It balances durability, flexibility, and cost efficiency, making it suitable for a wide range of consumer and industrial packaging. Thicker films above 45 microns are preferred for industrial wrapping and lamination, ensuring superior strength and puncture resistance.

- For instance, Vacmet India increased its production capabilities by commissioning a new, fully automated 10.4-meter BOPP film line capable of producing films with a thickness ranging from 12 to 60 microns.

Segmentations:

By Type:

- Bags & Pouches

- Wraps

- Tapes

- Labels

By Application:

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Electrical & Electronics

- Others

By Thickness:

- Below 15 Microns

- 15–30 Microns

- 30–45 Microns

- More Than 45 Microns

By Production Process:

By Country:

- United States

- Canada

- Mexico

Regional Analysis:

United States: Dominant Market Driven by Strong Packaging Demand

The United States accounted for 63% share of the North America BOPP Film Market. The country’s well-developed packaging industry and strong manufacturing base drive steady product demand. It benefits from innovations in extrusion and coating technologies that enhance clarity, strength, and print performance. Growing investments by packaging firms in recyclable and lightweight BOPP films support the shift toward sustainable materials. It also gains support from advanced logistics networks and corporate sustainability programs focused on waste reduction and closed-loop recycling systems.

Canada: Growing Focus on Eco-Friendly Packaging and Recycling Efforts

Canada held a 22% share of the North America BOPP Film Market. The country’s focus on sustainable packaging solutions and stringent plastic regulations drives increased film adoption. It encourages manufacturers to expand local production and recycling capacities to comply with environmental goals. The demand for BOPP films rises in food, beverage, and healthcare sectors supported by urban population growth and rising packaged goods consumption. It benefits from government incentives and partnerships that promote circular economy models and enhance material recovery infrastructure.

Mexico: Expanding Manufacturing and Export Opportunities

Mexico accounted for 15% share of the North America BOPP Film Market. The nation is emerging as a key manufacturing hub supported by trade agreements and cost-effective production facilities. It benefits from rising exports of flexible packaging materials to the United States and Latin American markets. Industrial modernization and investments in advanced film lines strengthen Mexico’s competitive position. It continues to attract foreign investment as global firms expand capacity to meet regional demand for high-performance and sustainable BOPP films.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The North America BOPP Film Market features strong competition among leading players focusing on innovation, sustainability, and capacity expansion. Key companies include Cosmo Films Limited, Taghleef Industries, CCL Industries, Sibur Holdings, Inteplast Group, Uflex Ltd., and Toray Industries. It emphasizes product differentiation through high-barrier coatings, recyclable polymers, and enhanced clarity films for premium packaging applications. Companies are strengthening regional presence through mergers, acquisitions, and new production facilities to meet growing demand from food, beverage, and personal care sectors. It also focuses on developing bio-based and energy-efficient manufacturing solutions to align with environmental standards. Continuous investment in R&D and advanced processing technologies helps maintain competitive advantage and long-term customer partnerships across North America.

Recent Developments:

- In June 2025, Cosmo First (formerly Cosmo Films) announced the commissioning of a new Biaxially Oriented Polypropylene (BOPP) film line in Aurangabad, Maharashtra, with an annual rated capacity of 81,200 metric tons.

- In March 2025, Taghleef Industries launched SHAPE360® TDSW, a high-performance, floatable white polyolefin TD shrink sleeve film designed for optimal recyclability.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Thickness, Production Process and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America BOPP Film Market will experience steady growth driven by expanding packaging demand in food and personal care sectors.

- It will benefit from the rapid shift toward sustainable, recyclable, and bio-based packaging materials across industries.

- Growing adoption of advanced extrusion and coating technologies will enhance film strength and clarity.

- It will see rising investments in high-barrier and specialty BOPP films to serve premium product segments.

- The focus on lightweight packaging solutions will support logistics efficiency and reduce transportation costs.

- It will gain momentum through digital printing compatibility, improving customization and brand visibility.

- Regulatory initiatives promoting circular economy practices will encourage recycling infrastructure development.

- It will witness strategic collaborations among producers, converters, and brand owners to accelerate eco-friendly innovations.

- Increased regional manufacturing capacity will reduce supply dependence and improve cost efficiency.

- It will continue evolving toward energy-efficient production processes, aligning with long-term sustainability goals and consumer preferences.