Market Overview:

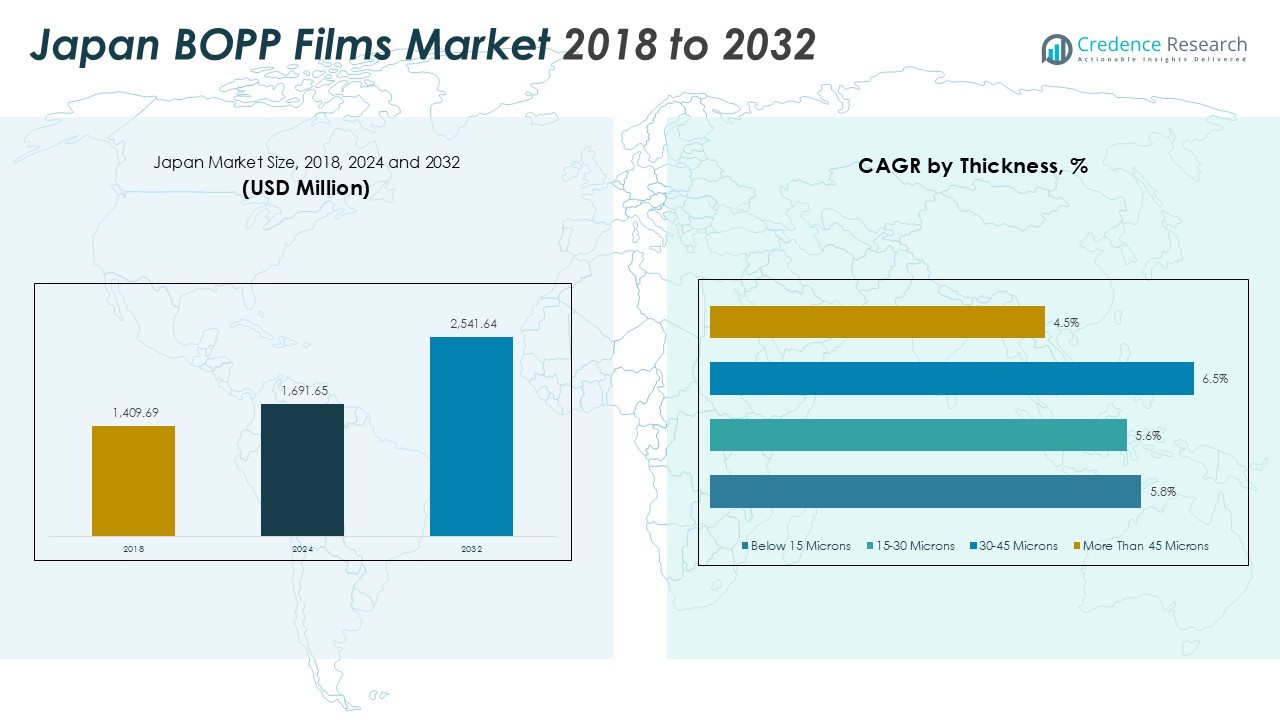

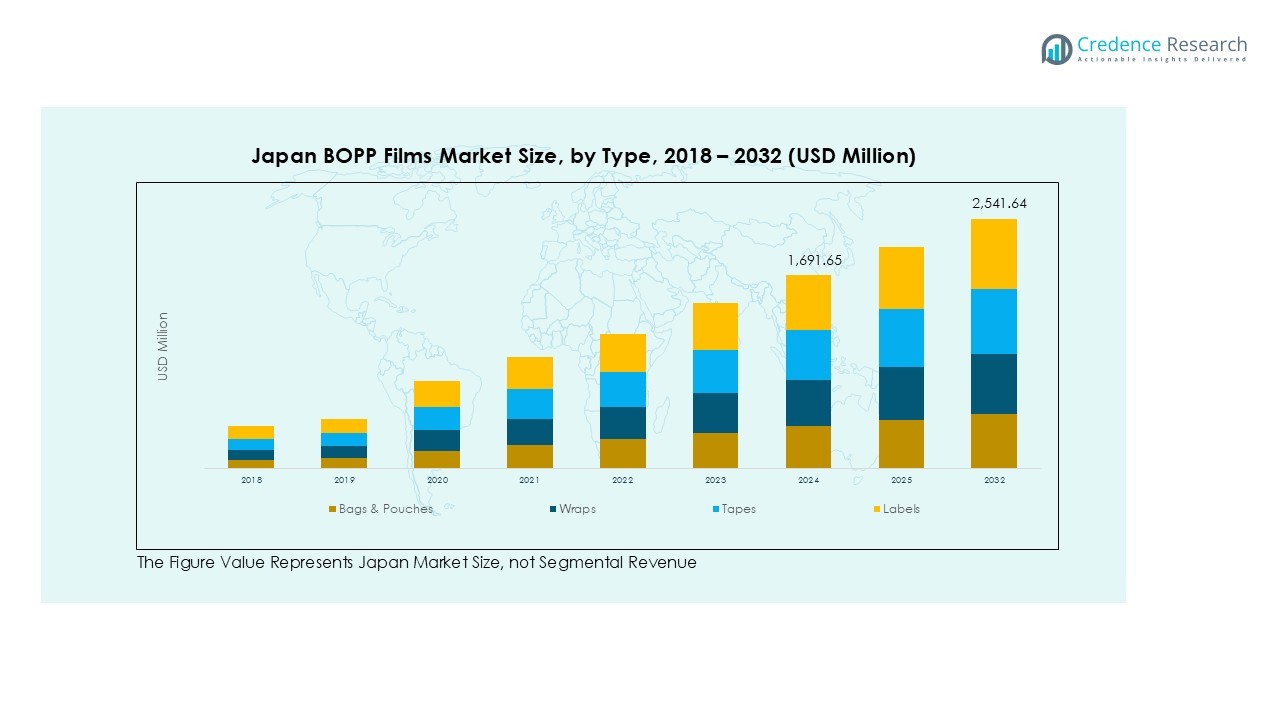

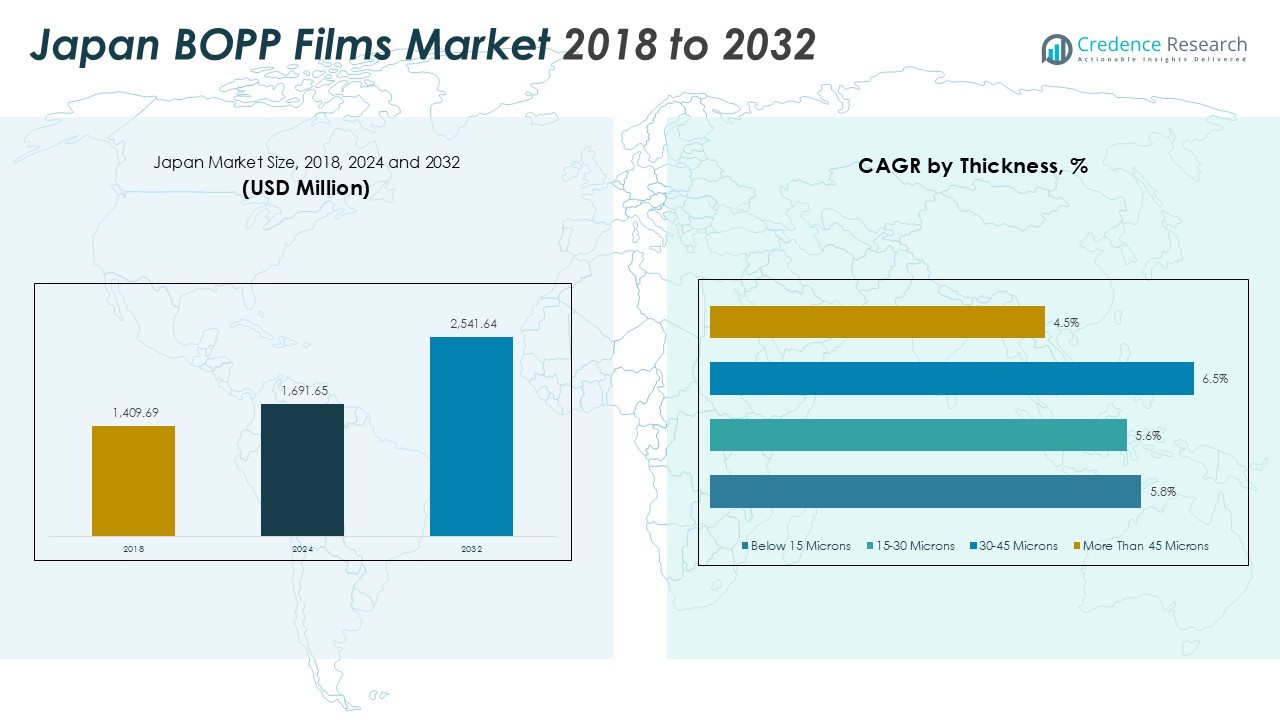

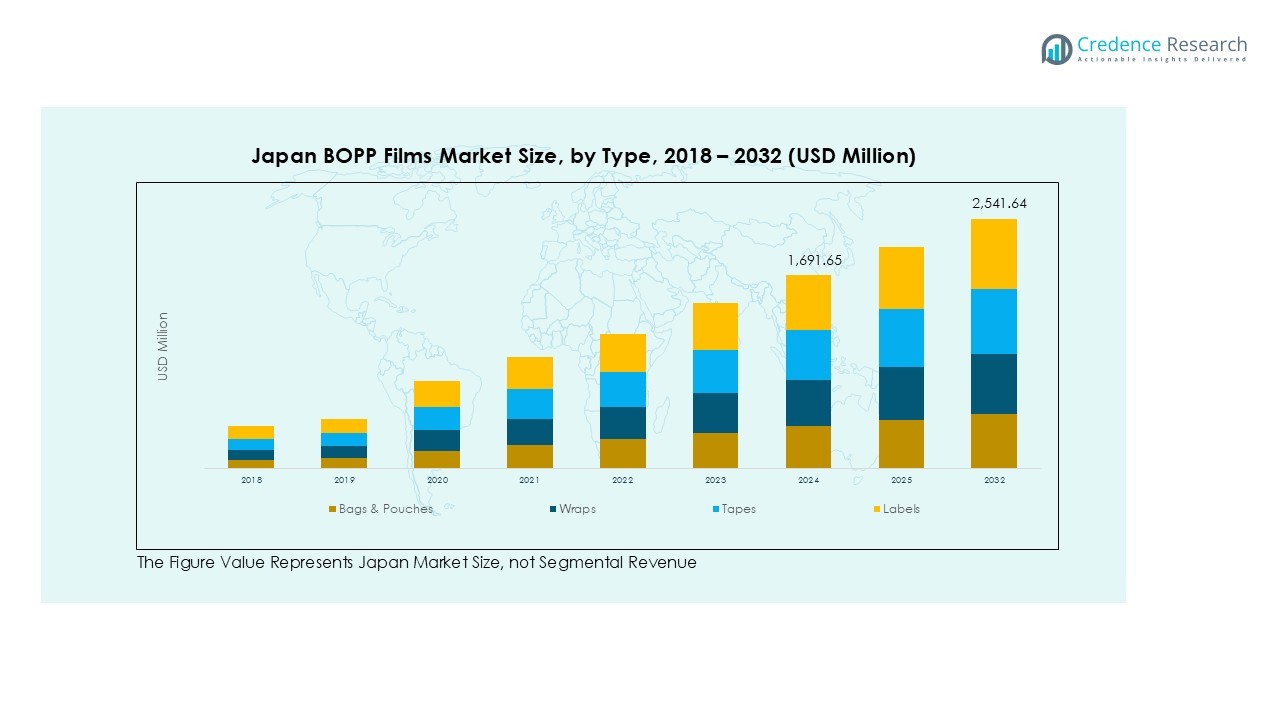

The Japan BOPP Films Market size was valued at USD 1,409.69 million in 2018 to USD 1,691.65 million in 2024 and is anticipated to reach USD 2,541.64 million by 2032, at a CAGR of 5.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan BOPP Films Market Size 2024 |

USD 1,691.65 Million |

| Japan BOPP Films Market, CAGR |

5.22% |

| Japan BOPP Films Market Size 2032 |

USD 2,541.64 Million |

Key factors propelling the market include stringent government regulations promoting recycling and sustainability, coupled with rapid growth in e-commerce and retail sectors. Manufacturers are increasingly adopting recyclable and high-barrier BOPP films that provide durability, clarity, and cost-effective packaging solutions. Additionally, rising consumer preference for convenient, ready-to-eat products continues to support the demand for innovative packaging films.

From a regional perspective, Japan remains a significant market within Asia-Pacific due to its advanced industrial base and high adoption of modern packaging technologies. Northern and eastern industrial hubs, including Tokyo, Osaka, and Nagoya, host major packaging converters and food manufacturers, ensuring consistent demand for BOPP films. Proximity to raw material suppliers and strong logistics infrastructure further support market growth, making Japan a critical contributor to the regional BOPP films industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan BOPP Films Market reached USD 1,691.65 million in 2024 and is projected to attain USD 2,541.64 million by 2032, registering a CAGR of 5.22%, reflecting steady growth in the flexible packaging sector.

- Government regulations promoting recycling and sustainability drive the adoption of BOPP films, encouraging manufacturers to produce recyclable and eco-friendly packaging solutions.

- Rapid growth in e-commerce and retail sectors fuels demand for high-performance packaging films that protect products during storage and transit.

- Japanese consumers’ preference for convenient, ready-to-eat products boosts the need for films that extend shelf life and maintain product quality.

- Technological innovations, including high-barrier coatings, metallization, and enhanced lamination, improve film durability, clarity, and barrier properties, enabling wider industrial applications.

- Eastern Japan, including Tokyo and the Kanto region, holds 42% of the market due to its dense industrial base, major food and pharmaceutical manufacturers, and advanced infrastructure supporting efficient distribution.

- Central Japan contributes 28%, driven by Nagoya’s manufacturing hubs and chemical suppliers, while Kyushu accounts for 18%, reflecting growing industrial diversity and investments in sustainable and technologically advanced BOPP film production.

Market Drivers:

Rising Demand for Sustainable Packaging Solutions

Japan’s BOPP films market is experiencing growth due to increasing consumer and regulatory demand for sustainable packaging. BOPP films, known for their recyclability and lightweight nature, align with the country’s emphasis on reducing plastic waste and promoting circular economy principles. This shift encourages manufacturers to adopt BOPP films as an eco-friendly alternative to traditional packaging materials.

- For instance, a joint project by 3 companies, TOPPAN, RM Tohcello, and Mitsui Chemicals, has developed a recycled BOPP film, with samples being made available to customers in October 2024.

Technological Advancements Enhancing Film Performance

Advancements in BOPP film technology have significantly improved product performance. Innovations such as high-barrier coatings, metallization, and enhanced clarity have expanded the applications of BOPP films in packaging, labeling, and protective films. These technological improvements meet the evolving demands of industries requiring durable, transparent, and customizable packaging solutions.

- For instance, Cosmo Films offers an Ultra High Barrier (UHB) metallized BOPP film that provides a Moisture Vapor Transmission Rate (MVTR) of less than 0.15 g/m2/day, designed to be a substitute for aluminum foil.

Growth in E-commerce and Retail Sectors

The expansion of e-commerce and retail sectors in Japan has increased the need for efficient and secure packaging solutions. BOPP films offer excellent protection against moisture, oxygen, and contaminants, making them ideal for packaging a wide range of products. Their ability to maintain product integrity during transit supports their growing adoption in these sectors.

Consumer Preference for Convenience and Ready-to-Eat Products

Japanese consumers’ preference for convenience and ready-to-eat food products drives the demand for packaging materials that extend shelf life and preserve freshness. BOPP films provide effective barriers against environmental factors, ensuring the quality and safety of food products. This trend contributes to the sustained growth of the BOPP films market in Japan.

Market Trends:

Technological Advancements in Film Properties

Japan’s BOPP films market is witnessing significant technological innovations aimed at enhancing film properties. Developments in high-barrier coatings, metallization techniques, and advanced lamination processes have improved the films’ resistance to moisture, oxygen, and light. These advancements enable BOPP films to meet the stringent requirements of various industries, including food packaging, pharmaceuticals, and consumer goods. The continuous enhancement of film performance through technology is driving the adoption of BOPP films across diverse applications.

- For instance, Toppan Inc. launched its GL-SP film in March 2024, a BOPP-based high-barrier film that achieves an oxygen barrier performance of 0.5cc/m².

Shift Towards Sustainable and Recyclable Packaging Solutions

There is a growing emphasis on sustainability within Japan’s BOPP films market. Manufacturers are increasingly focusing on producing films that are recyclable and environmentally friendly. This shift aligns with global trends towards reducing plastic waste and promoting circular economy practices. The adoption of sustainable packaging solutions is not only driven by regulatory pressures but also by consumer demand for eco-friendly products. As a result, BOPP films are becoming a preferred choice for companies aiming to meet sustainability goals while maintaining packaging performance.

- For instance, in October 2024, a partnership of three companies, TOPPAN Inc., RM Tohcello Co., Ltd., and Mitsui Chemicals, Inc., developed a recycled BOPP film suitable for mass production through the horizontal recycling of printed film waste.

Market Challenges Analysis:

Fluctuating Raw Material Prices

The Japan BOPP films market faces challenges due to volatility in raw material prices. Fluctuations in the cost of polypropylene, a key component in BOPP film production, can directly impact manufacturing expenses. Such price instability affects profitability and may lead to increased production costs, which can be challenging for manufacturers to manage effectively.

Environmental Regulations and Sustainability Pressures

Stringent environmental regulations in Japan pose significant challenges for the BOPP films market. The growing emphasis on sustainability and the reduction of plastic waste have led to stricter policies on plastic usage. Manufacturers must invest in research and development to produce recyclable and eco-friendly BOPP films, which can be resource-intensive and may require substantial capital investment. Balancing environmental compliance with cost-effectiveness remains a critical challenge for the industry.

Market Opportunities:

Expansion in Sustainable and Recyclable Packaging Solutions

The Japan BOPP films market is poised for growth driven by the increasing demand for sustainable and recyclable packaging materials. BOPP films, known for their recyclability and lightweight properties, align with Japan’s stringent environmental regulations and consumer preferences for eco-friendly products. Manufacturers are investing in developing BOPP films that meet these sustainability criteria, presenting opportunities for companies to innovate and capture market share in this segment.

Technological Innovations Enhancing Film Performance

Advancements in BOPP film technology are creating new opportunities in the market. Innovations such as high-barrier coatings, metallization, and the development of biodegradable films are enhancing the performance and functionality of BOPP films. These technological improvements cater to the evolving needs of industries requiring packaging solutions that offer superior protection, durability, and aesthetic appeal. Companies that invest in these technological advancements can differentiate themselves and meet the growing demand for high-performance packaging materials.

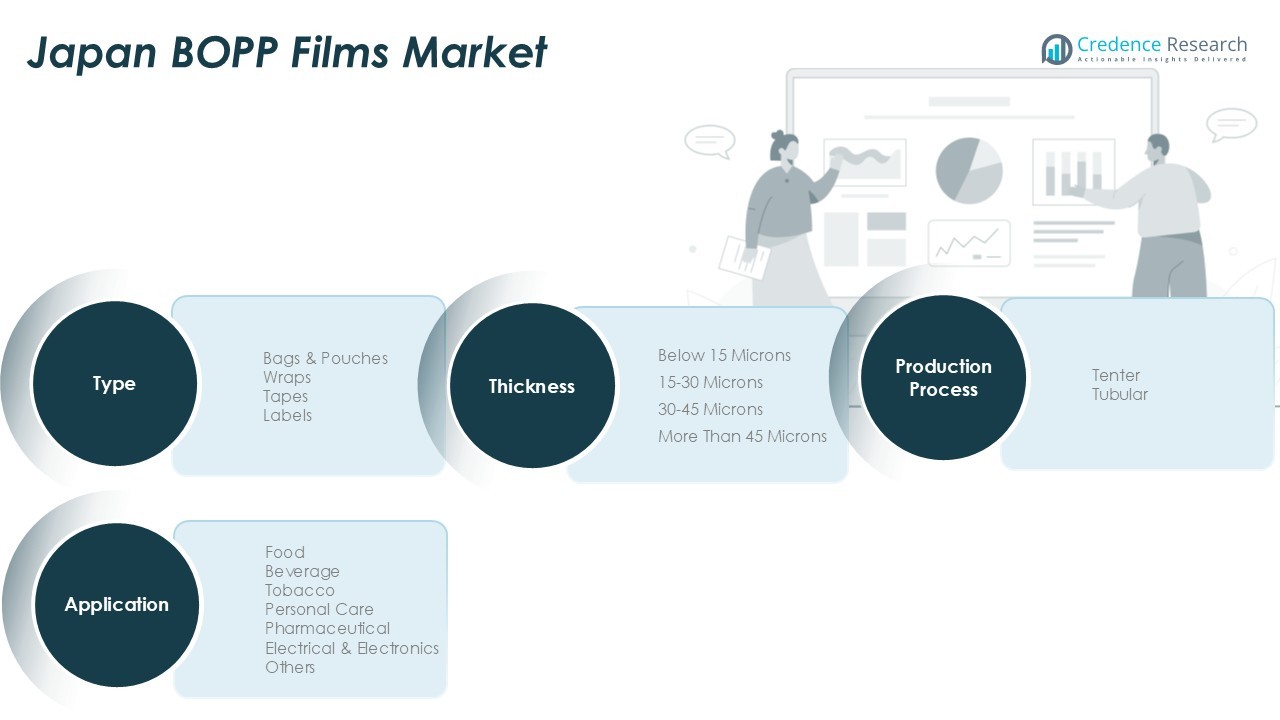

Market Segmentation Analysis:

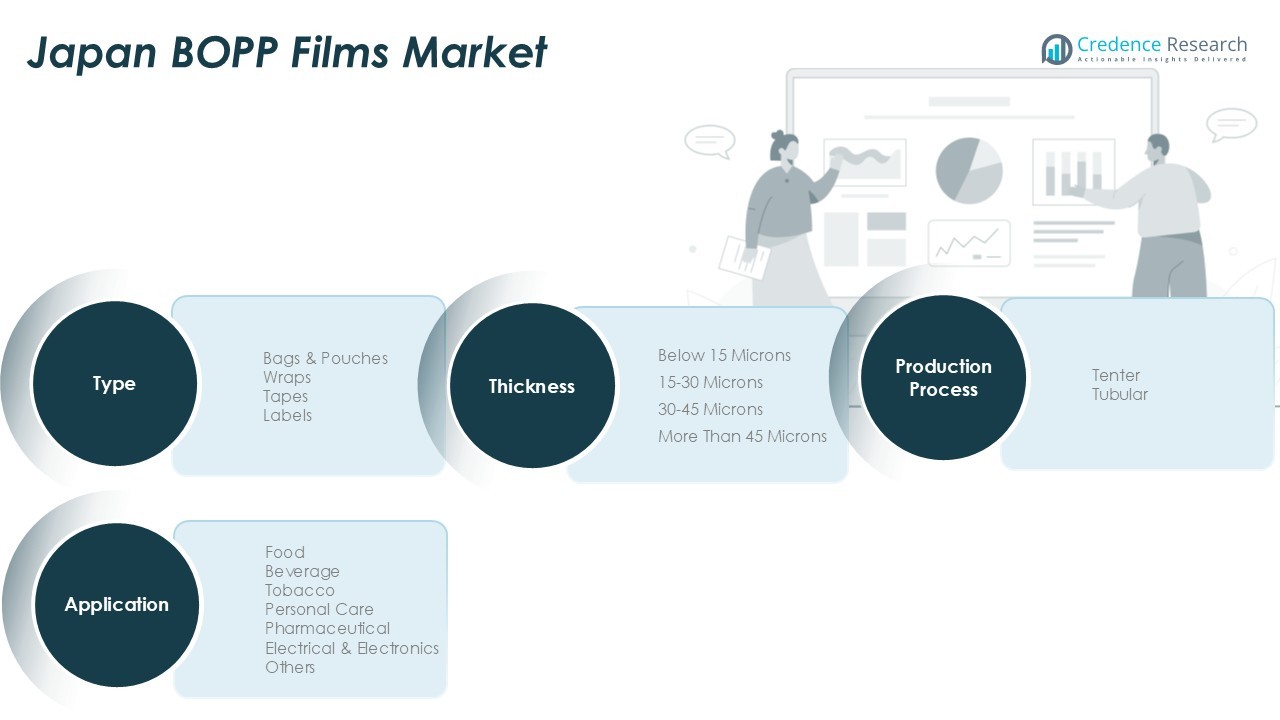

By Type

The Japan BOPP Films Market is segmented by type into bags & pouches, wraps, tapes, and labels. Bags and pouches account for the largest share due to high demand from food and beverage packaging, where durability, clarity, and barrier properties are critical. Wraps are widely used in retail and consumer goods packaging for product protection and presentation. Tapes and labels find application in industrial and consumer sectors, providing sealing, branding, and identification functions. Each type caters to specific industry needs, influencing production volumes and technological requirements.

- For instance, Mitsui Chemicals is advancing plastic recycling through its Pla-chain Consortium, which has successfully formed a partnership with 51 participating companies as of June 2024 to promote the use of recycled materials.

By Application

The market is divided by application into food, beverage, tobacco, personal care, pharmaceutical, electrical & electronics, and others. Food packaging dominates due to the rising consumer preference for convenience and ready-to-eat products, which require extended shelf life and effective barrier protection. Beverage packaging follows closely, utilizing BOPP films for durability and moisture resistance. Pharmaceuticals and personal care products increasingly adopt BOPP films for hygiene, protection, and branding purposes. Electrical and electronics sectors use it for insulation, wrapping, and protective applications.

By Thickness

Segments by thickness include below 15 microns, 15-30 microns, 30-45 microns, and more than 45 microns. Films between 15-30 microns hold the largest market share, offering an optimal balance of strength, flexibility, and cost-effectiveness for multiple applications. Thicker films above 45 microns are used in industrial and heavy-duty packaging, while films below 15 microns cater to lightweight, flexible packaging requirements. Thickness selection depends on product protection needs and application specifications, driving diverse demand across industries.

- For instance, the widely used tenter production process is capable of manufacturing BOPP films with a thickness starting from as low as 8 micrometers, catering to a wide variety of industrial and consumer needs.

Segmentations:

By Type

- Bags & Pouches

- Wraps

- Tapes

- Labels

By Application

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Electrical & Electronics

- Others

By Thickness

- Below 15 Microns

- 15-30 Microns

- 30-45 Microns

- More Than 45 Microns

By Production Process

Regional Analysis:

Eastern Japan: Tokyo and Greater Kanto Region

Eastern Japan accounts for 42% of the Japan BOPP Films Market, reflecting its position as the primary industrial and economic hub. The Tokyo and Kanto region hosts major food, beverage, and pharmaceutical manufacturers that drive strong demand for flexible packaging solutions. The region’s advanced infrastructure and technology capabilities enable efficient production and distribution. Manufacturing facilities benefit from proximity to logistics networks and a concentration of end-user industries. It also serves as a testing ground for innovative packaging materials due to high consumer expectations. The dense industrial ecosystem supports collaboration between film producers and converters, enhancing product development.

Central Japan: Chubu Region’s Manufacturing Strength

The Chubu region contributes 28% to the Japan BOPP Films Market, driven by Nagoya’s industrial base and surrounding manufacturing hubs. It benefits from strong demand in automotive, electronics, and industrial packaging sectors. Local chemical and polymer suppliers ensure steady raw material availability, supporting continuous production. Companies in the region focus on developing recyclable and high-barrier BOPP films to meet sustainability requirements. It also serves as a strategic link between eastern and western industrial regions for efficient distribution. Investment in advanced manufacturing technologies enhances production efficiency and product quality.

Southern Japan: Kyushu Region’s Emerging Role

Kyushu represents 18% of the Japan BOPP Films Market, emerging due to its diversified industrial activities and growing packaging needs. Cities like Fukuoka and Kitakyushu host automotive, electronics, and consumer goods industries that increasingly adopt BOPP films. The region emphasizes sustainability, encouraging production of eco-friendly and recyclable films. It benefits from ongoing investments in manufacturing capabilities and technological upgrades. Regional logistics networks support effective distribution across southern Japan and neighboring areas. The combination of industrial diversity and focus on innovation positions Kyushu for continuous growth in the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis:

Competitive Analysis:

The Japan BOPP Films Market features a highly competitive landscape driven by key players focusing on innovation, sustainability, and strategic expansion. Leading companies such as Toray Industries, Toppan Printing, Toyobo, Mitsubishi Chemical Corporation, Jindal Poly Films, and UFlex Ltd. dominate through diversified product portfolios, advanced manufacturing capabilities, and strong distribution networks. It faces competition based on product quality, technological advancements, and ability to meet regulatory standards for recyclable and eco-friendly films. Companies invest in research and development to enhance barrier properties, clarity, and film durability, catering to food, beverage, pharmaceutical, and industrial applications. Strategic initiatives include acquisitions, joint ventures, and regional expansions to strengthen market presence and access new customer segments. It also competes through operational efficiency, cost optimization, and responsiveness to evolving market demands, maintaining a balance between performance, sustainability, and profitability.

Recent Developments:

- In September 2025, Mitsubishi Chemical Corporation introduced new sustainable polymer solutions specifically for the Asian market.

- In July 2025, Mitsubishi Chemical Corporation, in partnership with ENEOS, launched an advanced recycling facility in Ibaraki, Japan, utilizing Mura’s Hydro-PRT® technology.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Thickness and Production Process. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan BOPP Films Market will continue to grow due to increasing demand for sustainable and recyclable packaging solutions.

- Manufacturers will focus on developing high-barrier films with enhanced durability and clarity to meet evolving industry requirements.

- Expansion of e-commerce and retail sectors will drive the adoption of protective and efficient packaging materials.

- Technological innovations, including metallization and advanced lamination, will enhance film performance across multiple applications.

- The food and beverage sectors will remain key consumers, requiring films that extend shelf life and preserve product quality.

- Pharmaceutical and personal care industries will increasingly adopt BOPP films for hygiene, protection, and branding purposes.

- Regional growth will be supported by industrial hubs in eastern and central Japan, providing access to raw materials and robust logistics.

- Companies will invest in research and development to deliver eco-friendly and biodegradable film options.

- Strategic collaborations, acquisitions, and regional expansions will strengthen competitive positioning in the market.

- Sustainability and regulatory compliance will remain central, guiding product innovation and shaping industry standards.