| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Compression Sportswear Market Size 2024 |

USD 1,193.67 Million |

| Europe Compression Sportswear Market, CAGR |

6.05% |

| Europe Compression Sportswear Market Size 2032 |

USD 1,910.10 Million |

Market Overview

Europe Compression Sportswear Market size was valued at USD 1,193.67 million in 2024 and is anticipated to reach USD 1,910.10 million by 2032, at a CAGR of 6.05% during the forecast period (2024-2032).

The Europe Compression Sportswear Market is driven by increasing consumer awareness regarding performance-enhancing and recovery benefits offered by compression apparel. Athletes and fitness enthusiasts prefer compression wear for improved blood circulation, muscle stabilization, and reduced fatigue, fueling market growth. Rising participation in sports and fitness activities, coupled with a growing emphasis on health and wellness, further accelerates demand. Additionally, advancements in fabric technology, such as moisture-wicking and temperature-regulating materials, enhance comfort and functionality, attracting a broader consumer base. The market also benefits from the increasing adoption of athleisure trends, as consumers seek stylish yet functional sportswear. Furthermore, the rising penetration of e-commerce platforms and brand collaborations with athletes and influencers are expanding market reach. However, competition from counterfeit products and high product costs may pose challenges. Overall, the market is poised for steady growth, supported by continuous innovation and evolving consumer preferences toward high-performance sportswear.

The Europe compression sportswear market is expanding due to increasing health consciousness, rising participation in fitness activities, and the growing influence of athleisure trends. Countries such as the UK, Germany, France, and Italy are key markets, driven by strong sports cultures and high consumer demand for performance-enhancing apparel. Emerging markets like Spain, Russia, and Poland are also witnessing growth due to increasing disposable incomes and fitness awareness. Key players in the market include Adidas AG, Under Armour, Inc., Nike Inc., PUMA SE, BV SPORT, Medi, Triumph International Corporation, Spanx Inc., Leonisa SA, Wacoal America Inc., Skins International Trading AG, Ann Chery, and 2XU Pty Ltd. These companies focus on product innovation, sustainable materials, and digital marketing strategies to expand their market presence. The growing demand for technologically advanced fabrics and eco-friendly compression wear is shaping the competitive landscape, with brands investing in R&D and strategic partnerships to strengthen their foothold in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe compression sportswear market was valued at USD 1,193.67 million in 2024 and is projected to reach USD 1,910.10 million by 2032, growing at a CAGR of 6.05% during the forecast period.

- Increasing awareness of performance-enhancing benefits and muscle recovery is driving demand for compression apparel across various sports and fitness activities.

- The rise of athleisure trends and fashion-conscious consumers is boosting the adoption of stylish yet functional compression wear.

- Leading brands such as Adidas, Nike, Under Armour, and PUMA are focusing on innovation, sustainability, and digital marketing to strengthen their market presence.

- High product costs and counterfeit compression wear remain significant challenges, impacting brand reputation and consumer trust.

- Countries like the UK, Germany, France, and Italy dominate the market, while emerging regions like Spain and Russia show promising growth.

- Increasing investment in eco-friendly materials and smart fabric technology is shaping the future of the compression sportswear industry.

Report Scope

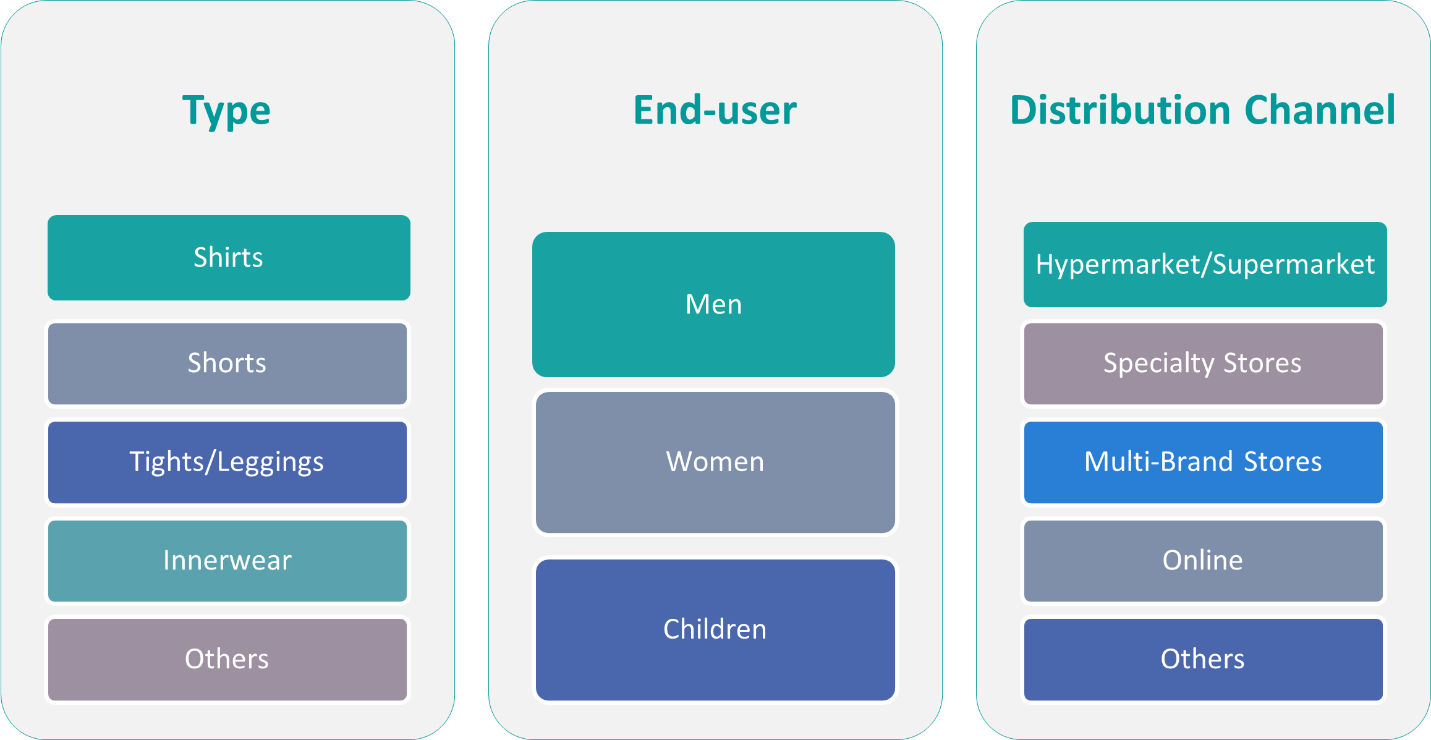

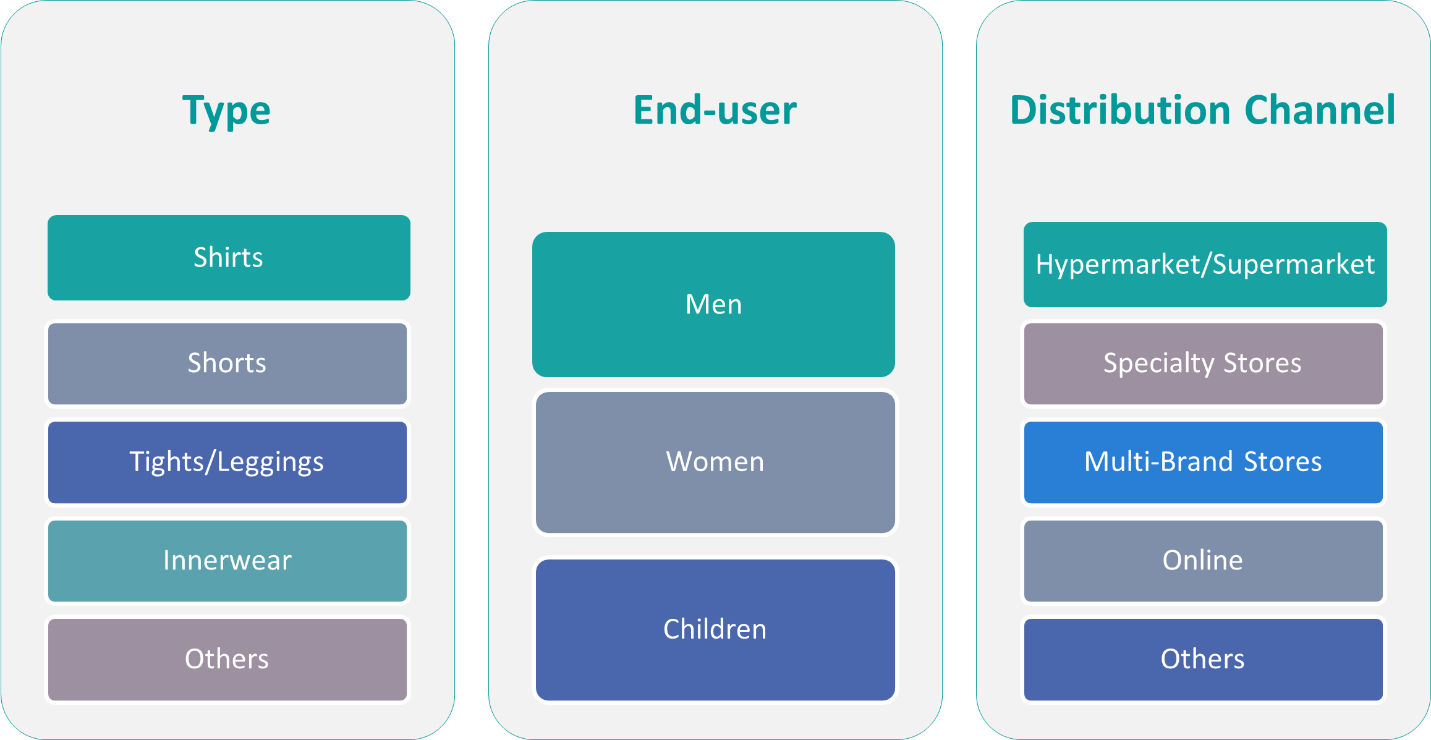

This report segments the Europe Compression Sportswear Market as follows:

Market Drivers

Rising Popularity of Sports and Fitness Activities

The increasing awareness of health and wellness has led to a surge in participation in sports and fitness activities across Europe. Consumers are becoming more inclined toward an active lifestyle, fueled by government initiatives promoting physical well-being and fitness campaigns. For instance, the European Commission’s initiatives, such as the European Week of Sport, have encouraged widespread participation in physical activities, contributing to the growing demand for compression sportswear. With more individuals engaging in running, cycling, gym workouts, and professional sports, the demand for compression sportswear is growing. These garments enhance performance by improving blood circulation, reducing muscle fatigue, and aiding in quicker recovery. Additionally, the rise in organized sports events, marathons, and fitness challenges has further encouraged the adoption of compression wear among athletes and fitness enthusiasts, supporting market expansion.

Advancements in Fabric Technology and Product Innovation

Technological advancements in fabric composition and design have significantly contributed to the growth of the compression sportswear market in Europe. Manufacturers are focusing on developing high-performance fabrics with moisture-wicking, antibacterial, and temperature-regulating properties. The incorporation of smart textiles and seamless construction enhances the comfort and functionality of compression wear, making it more appealing to consumers. Additionally, innovations such as graduated compression, UV protection, and muscle-targeting designs further improve the efficiency of these garments. Leading brands are investing in research and development to introduce compression wear with enhanced durability and breathability, catering to the evolving preferences of athletes and fitness-conscious individuals.

Growing Influence of Athleisure and E-Commerce Expansion

The increasing popularity of athleisure a trend that blends athletic and casual wear has significantly influenced the demand for compression sportswear. Consumers are now prioritizing comfortable and stylish activewear that can be worn both for workouts and daily activities. For instance, the rise of social media influencers promoting athleisure fashion has contributed to its widespread acceptance, driving demand for compression garments that offer both functionality and aesthetics. Additionally, the rapid expansion of e-commerce platforms has made high-quality compression wear more accessible to a wider consumer base. Online retail channels provide a convenient shopping experience, competitive pricing, and a variety of product options, further boosting sales. Many brands are leveraging digital marketing strategies, influencer partnerships, and targeted advertisements to enhance their market presence and attract more consumers.

Growing Demand for Recovery and Injury Prevention Solutions

Compression sportswear is widely recognized for its benefits in muscle recovery and injury prevention, driving its adoption among professional athletes and fitness enthusiasts. The increasing awareness of post-workout recovery solutions has fueled demand for compression garments that aid in reducing muscle soreness and preventing injuries. With rising concerns about sports-related injuries, both amateur and professional athletes are turning to compression wear for enhanced support and muscle stabilization. Moreover, physiotherapists and sports trainers recommend compression garments as a preventive measure for muscle strain and fatigue, further increasing their usage. As consumers prioritize recovery solutions alongside performance enhancement, the market for compression sportswear is expected to witness continued growth in the coming years.

Market Trends

Increasing Adoption of Sustainable and Eco-Friendly Materials

The shift toward sustainability is significantly shaping the Europe compression sportswear market, with brands increasingly focusing on eco-friendly materials and ethical production practices. Consumers are becoming more conscious of the environmental impact of their purchases, prompting manufacturers to incorporate recycled fabrics, organic cotton, and biodegradable materials into their product lines. For instance, the EU’s Circular Economy Action Plan emphasizes the importance of sustainable textiles, encouraging brands to adopt environmentally friendly practices such as using recycled fibers and reducing waste. Leading brands are investing in sustainable innovations such as waterless dyeing techniques and low-carbon manufacturing processes to reduce their ecological footprint. This trend aligns with the broader industry movement toward sustainable fashion, positioning eco-friendly compression sportswear as a key growth segment.

Rising Demand for Smart and High-Performance Compression Wear

The integration of smart textiles and advanced fabric technologies is transforming compression sportswear, catering to athletes and fitness enthusiasts seeking enhanced performance benefits. Wearable technology, such as embedded sensors and biometric tracking capabilities, is becoming increasingly popular, allowing users to monitor their muscle activity, hydration levels, and overall performance. For example, innovations like Hexoskin’s smart shirts, which track vital signs and movement patterns, demonstrate how wearable technology can enhance athletic performance by providing real-time data insights. Additionally, high-performance compression garments featuring temperature regulation, moisture-wicking, and antimicrobial properties are gaining traction. These innovations offer improved comfort and functionality, making them highly desirable among both professional athletes and casual users.

E-Commerce Growth and Digital-First Retail Strategies

The rapid expansion of e-commerce platforms and the rise of direct-to-consumer (DTC) brands are reshaping how compression sportswear is marketed and sold. Consumers prefer online shopping for its convenience, wider product selection, and competitive pricing. Leading brands are leveraging digital marketing strategies, including influencer collaborations, social media advertising, and personalized shopping experiences, to attract a broader audience. Additionally, advancements in AI-powered recommendation engines and virtual try-on technologies are enhancing the online shopping experience, driving higher engagement and sales in the compression sportswear segment.

Athleisure Boom Driving Everyday Use of Compression Wear

The growing athleisure trend is fueling demand for compression sportswear beyond traditional sports and fitness applications. Consumers increasingly seek versatile apparel that combines functionality with style, making compression garments a preferred choice for both active and casual wear. Brands are responding by designing compression apparel with fashion-forward aesthetics, incorporating sleek designs, bold colorways, and multi-purpose features. The rise in remote work and hybrid lifestyles has further contributed to this trend, as consumers opt for comfortable yet stylish activewear that can transition seamlessly between workouts and daily activities.

Market Challenges Analysis

High Product Costs and Market Competition

The premium pricing of compression sportswear remains a significant challenge, limiting its accessibility to price-sensitive consumers. Advanced fabric technologies, sustainable materials, and research-driven product innovations contribute to higher production costs, which, in turn, increase retail prices. For instance, the integration of smart textiles and wearable technology in compression garments enhances performance but also raises manufacturing expenses due to the complexity of these technologies. While professional athletes and fitness enthusiasts recognize the value of performance-enhancing features, casual users may hesitate to invest in expensive compression wear. Additionally, the market faces intense competition from both established sportswear giants and emerging brands, leading to pricing pressures. Companies must balance affordability with innovation to attract a broader consumer base while maintaining profitability.

Prevalence of Counterfeit Products and Quality Concerns

The increasing presence of counterfeit compression sportswear in the market poses a major challenge to both brands and consumers. Low-quality imitations, often sold at significantly lower prices, undermine brand reputation and consumer trust. These counterfeit products typically lack the performance benefits of genuine compression wear, leading to dissatisfaction among buyers. Furthermore, the rise of online marketplaces has made it easier for counterfeiters to distribute fake products, complicating brand protection efforts. To address this issue, leading manufacturers are investing in anti-counterfeiting technologies, such as QR code authentication and blockchain-based supply chain tracking, to ensure product authenticity and safeguard brand integrity.

Market Opportunities

The Europe compression sportswear market presents significant growth opportunities driven by the increasing demand for customized and specialized performance wear. Consumers are seeking tailored compression garments designed for specific sports, such as running, cycling, and weightlifting, creating opportunities for brands to offer sport-specific apparel with enhanced functionality. Additionally, the growing awareness of injury prevention and muscle recovery solutions is driving demand for medical-grade compression wear. Expanding product lines to include compression gear for rehabilitation, post-surgery recovery, and physiotherapy can attract a broader consumer base, including medical professionals and individuals recovering from injuries. Collaborations with healthcare providers, physiotherapists, and sports scientists can further validate product effectiveness and enhance consumer trust.

Moreover, the expansion of digital sales channels and direct-to-consumer (DTC) strategies offers lucrative growth prospects for compression sportswear brands. The rising popularity of e-commerce and mobile shopping provides brands with a wider reach and the ability to engage directly with consumers through personalized marketing campaigns and interactive digital experiences. Leveraging AI-driven recommendations, augmented reality (AR) fitting solutions, and influencer marketing can enhance customer engagement and drive sales. Additionally, the increasing consumer preference for sustainable and ethically produced sportswear presents an opportunity for brands to differentiate themselves by investing in eco-friendly materials and transparent supply chains. Companies that successfully integrate sustainability with high-performance compression technology can gain a competitive edge and appeal to environmentally conscious consumers, further fueling market growth.

Market Segmentation Analysis:

By Product Type:

The Europe compression sportswear market is segmented into shirts, shorts, tights/leggings, innerwear, and others. Among these, tights and leggings dominate the market, particularly among athletes and fitness enthusiasts seeking enhanced muscle support and improved circulation during workouts. The demand for compression shirts is also growing, driven by their ability to provide upper-body muscle stabilization and postural support, making them popular in activities like weightlifting, running, and high-intensity training. Compression shorts are widely adopted for their flexibility and moisture-wicking properties, particularly in sports like cycling and football. Innerwear, including compression socks and sleeves, is gaining traction due to its benefits in injury prevention and recovery. The “others” category includes accessories such as compression arm sleeves and calf guards, which are increasingly used by endurance athletes. The rising trend of athleisure is further boosting demand for compression apparel, as consumers seek versatile and stylish options for both performance and casual wear, creating growth opportunities across various product categories.

By End- User:

The market is further segmented based on end-users into men, women, and children, with men accounting for the largest market share due to their higher participation in professional sports, fitness training, and outdoor activities. However, the women’s segment is witnessing rapid growth, fueled by increasing female engagement in running, yoga, gym workouts, and sports competitions. Women are also embracing compression leggings and tops as part of the rising athleisure trend, which blends performance wear with everyday fashion. The children’s segment, although smaller, is expanding as parents prioritize performance-enhancing and injury-preventive apparel for young athletes participating in school and recreational sports. Growing awareness of the benefits of compression wear, coupled with targeted marketing and product innovations, is further driving demand across all age groups. As brands continue to introduce gender-specific and youth-oriented designs with advanced comfort and functionality, the market is expected to experience steady expansion across diverse consumer demographics.

Segments:

Based on Product Type:

- Shirts

- Shorts

- Tights/Leggings

- Innerwear

- Others

Based on End- User:

Based on Distribution Channel:

- Hypermarket/Supermarket

- Specialty Stores

- Multi-Brand Stores

- Online

- Others

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Regional Analysis

United Kingdom and Germany

The United Kingdom and Germany hold the largest market share in the Europe compression sportswear market, collectively accounting for over 35% of the regional revenue. The strong presence of major sportswear brands, high consumer awareness regarding performance-enhancing apparel, and increasing participation in fitness activities drive demand in these countries. The UK benefits from a well-established sports culture, including football, rugby, and marathon events, which fuel the adoption of compression wear among professional athletes and fitness enthusiasts. Additionally, Germany’s advanced textile industry and consumer preference for high-quality sportswear contribute to market expansion. The rising popularity of athleisure and e-commerce platforms further support growth, making these two nations key revenue generators for compression sportswear brands.

France and Italy

France and Italy collectively account for approximately 22% of the Europe compression sportswear market, driven by their strong influence in the global fashion industry and increasing adoption of athleisure trends. French consumers favor stylish yet functional activewear, encouraging brands to introduce compression apparel that blends performance with aesthetics. Italy, home to premium textile manufacturers, sees significant demand for high-end compression sportswear, particularly among fitness-conscious individuals and professional athletes. The growing influence of social media, celebrity endorsements, and fitness influencers has further propelled market growth in these countries. Additionally, the expansion of premium sportswear stores and digital retail channels is increasing product accessibility, supporting continued market expansion.

Spain and Russia

Spain and Russia together contribute nearly 18% of the regional market share, with increasing sports participation and government initiatives promoting active lifestyles playing a crucial role in market growth. Spain’s warm climate encourages outdoor sports, boosting demand for compression apparel designed for running, cycling, and football. In Russia, the rise of fitness culture and the expansion of sports infrastructure have significantly contributed to market expansion. Additionally, international brands are increasingly targeting these markets through localized marketing campaigns and strategic partnerships with sports organizations, driving consumer engagement and sales. While economic fluctuations and price sensitivity remain challenges, the growing middle-class population and rising health awareness present opportunities for sustained market growth.

Benelux, Nordic Countries, and Rest of Europe

Belgium, the Netherlands, Austria, Sweden, Poland, Denmark, and Switzerland, along with other European nations, account for the remaining 25% of the market share, with increasing consumer interest in performance-oriented sportswear. The Netherlands and Belgium benefit from a strong cycling culture, which drives demand for compression apparel designed for endurance sports. Meanwhile, Nordic countries such as Sweden and Denmark exhibit growing demand for eco-friendly and technologically advanced compression wear, aligning with their sustainability-conscious consumer base. Poland and Austria are witnessing increased adoption of compression garments due to rising disposable incomes and growing fitness trends. As brands expand their product offerings and strengthen their presence in these regions, the market is expected to experience steady growth across diverse consumer segments.

Key Player Analysis

- Adidas AG

- Under Armour, Inc.

- Nike Inc.

- PUMA SE

- BV SPORT

- Medi

- Triumph International Corporation

- Spanx Inc.

- Leonisa SA

- Wacoal America Inc.

- Skins International Trading AG

- Ann Chery

- 2XU Pty Ltd

Competitive Analysis

The Europe compression sportswear market is highly competitive, with leading players focusing on innovation, branding, and sustainability to maintain their market positions. Key companies, including Adidas AG, Under Armour, Inc., Nike Inc., PUMA SE, BV SPORT, Medi, Triumph International Corporation, Spanx Inc., Leonisa SA, Wacoal America Inc., Skins International Trading AG, Ann Chery, and 2XU Pty Ltd, compete by offering advanced compression technology, high-performance fabrics, and athlete-endorsed products. These brands invest heavily in R&D to develop moisture-wicking, breathable, and muscle-supporting compression wear, catering to both professional athletes and fitness enthusiasts. The market is also witnessing a shift towards sustainable sportswear, with companies integrating eco-friendly materials and ethical manufacturing practices. Digital marketing strategies, e-commerce expansion, and influencer collaborations further drive brand engagement and consumer reach. However, intense competition, counterfeit products, and fluctuating raw material costs pose challenges. Companies that prioritize technological advancements, personalization, and sustainability are likely to secure a stronger foothold in the evolving market landscape.

Recent Developments

- In February 2025, Adidas AG launched several new products, including the Lightblaze shoe and the Mystic Victory pack for football boots. Adidas continues to focus on innovative designs and collaborations.

- In January 2025, Nike showcased innovative recovery footwear at CES 2025, featuring compression and heat technology, and is also developing a compression and heat vest as part of its wearable line, collaborating with Hyperice to boost athlete warm-up and recovery.

Market Concentration & Characteristics

The Europe compression sportswear market exhibits a moderate to high level of market concentration, with a mix of established global brands and emerging regional players driving competition. Leading companies leverage strong brand recognition, advanced fabric technologies, and strategic collaborations with athletes and fitness influencers to maintain market dominance. The market is characterized by increasing consumer demand for performance-enhancing apparel that improves blood circulation, reduces muscle fatigue, and enhances recovery. Innovations in moisture-wicking materials, seamless construction, and eco-friendly fabrics further shape product development. Additionally, the rise of e-commerce and direct-to-consumer sales channels has intensified competition, enabling smaller brands to gain market traction. Growing awareness of fitness and sports participation, particularly in countries like Germany, the UK, and France, propels market expansion. However, fluctuating raw material costs and counterfeit products present challenges. Overall, the market continues to evolve with advancements in textile technology, sustainability initiatives, and shifting consumer preferences toward athleisure trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe compression sportswear market is expected to grow steadily, driven by increasing fitness awareness and participation in sports activities.

- Advancements in fabric technology will enhance product performance, offering better breathability, durability, and muscle support.

- The demand for eco-friendly and sustainable compression wear will rise as consumers prioritize environmentally responsible choices.

- E-commerce and direct-to-consumer sales channels will expand, providing brands with greater market reach and consumer engagement.

- Customization and personalization trends will gain traction, allowing consumers to choose tailored fits and designs.

- The integration of smart textiles and wearable technology in compression sportswear will enhance user experience and performance tracking.

- Rising disposable income and health-conscious lifestyles will fuel demand for premium and high-performance compression apparel.

- Strategic partnerships with athletes and influencers will continue to shape brand positioning and consumer preferences.

- The increasing adoption of compression wear in medical and recovery applications will create new growth opportunities.

- Market competition will intensify, prompting brands to focus on innovation, quality, and differentiation strategies.