Market Overview

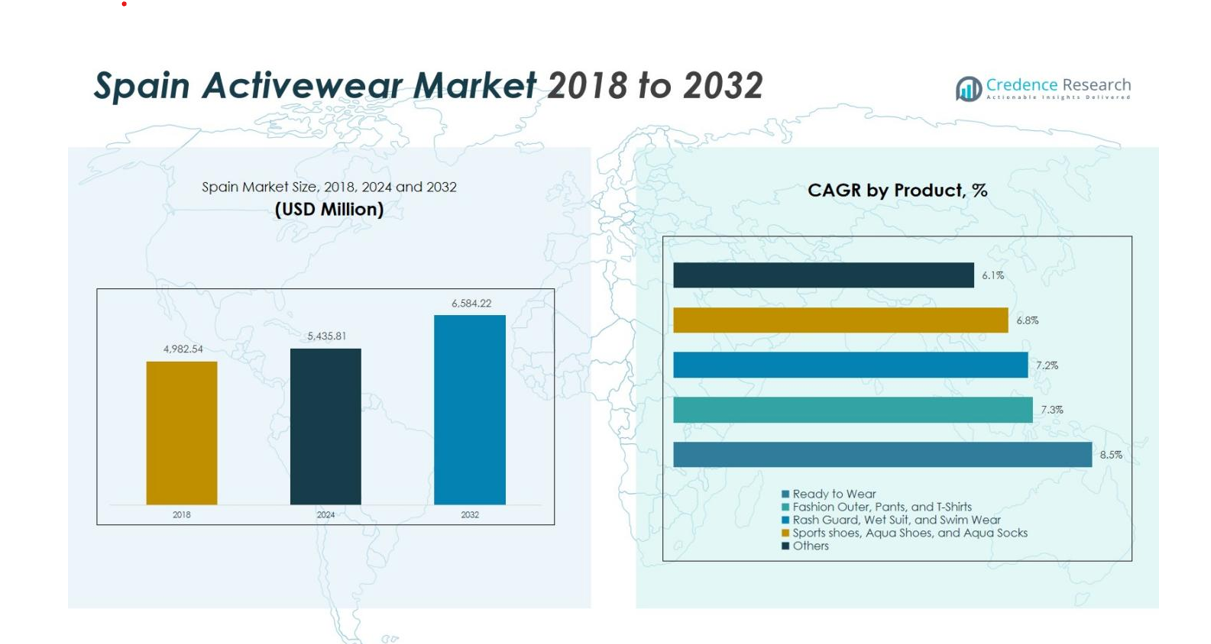

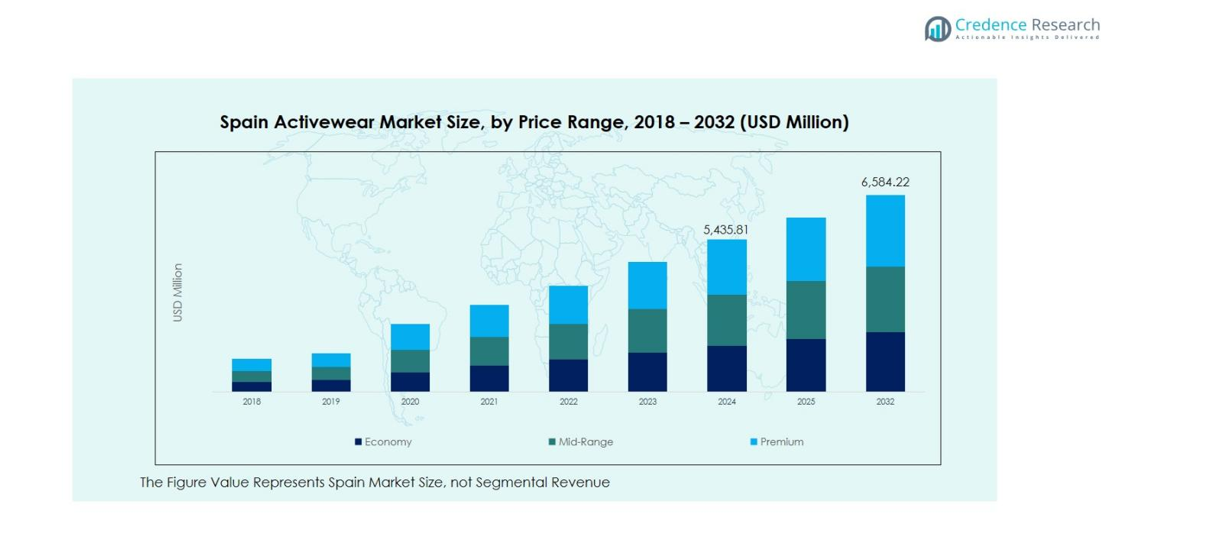

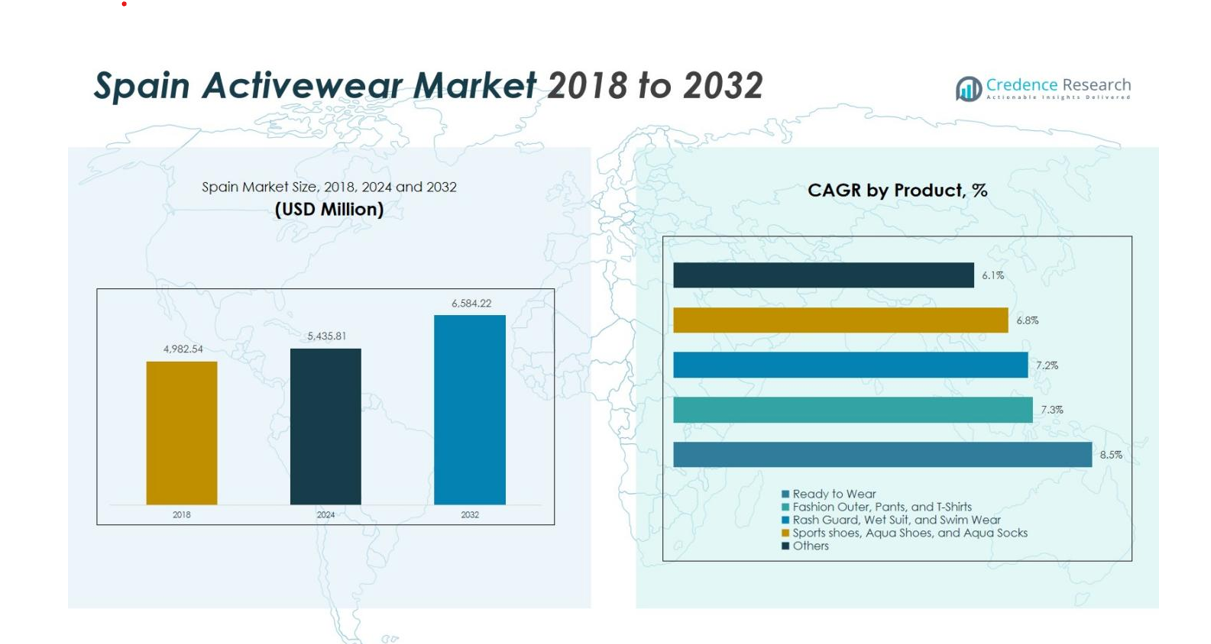

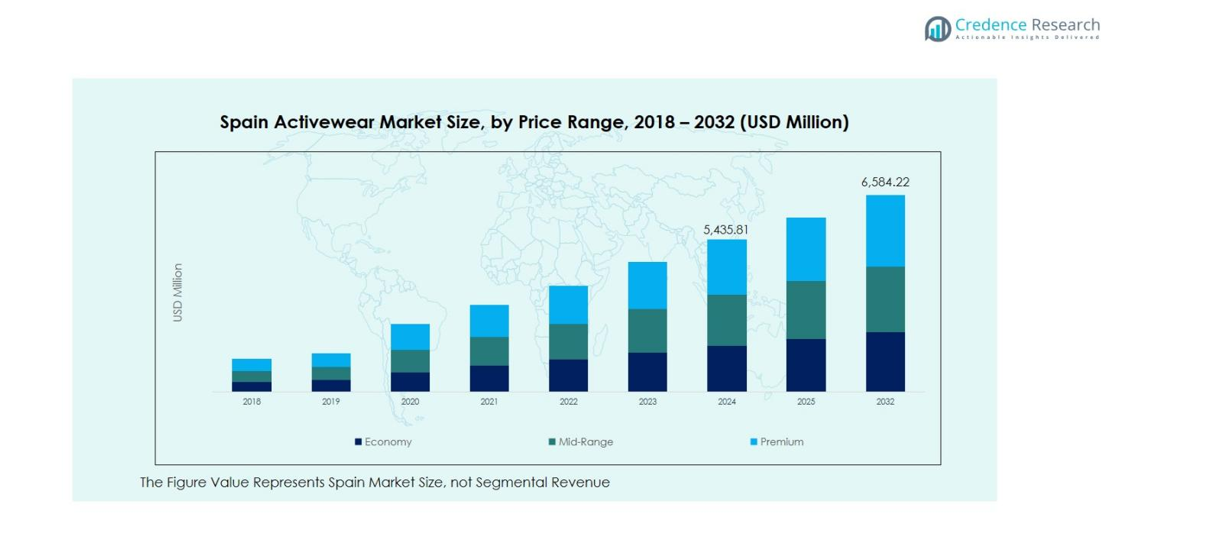

Spain Activewear Market size was valued at USD 4,982.54 Million in 2018 and increased to USD 5,435.81 Million in 2024. It is anticipated to reach USD 6,584.22 Million by 2032, at a CAGR of 2.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Activewear Market Size 2024 |

USD 5,435.81 Million |

| Spain Activewear Market, CAGR |

2.42% |

| Spain Activewear Market Size 2032 |

USD 6,584.22 Million |

Spain Activewear Market is driven by the strong presence of leading brands such as Joma, Oysho, Fumarel, Meyba, XTG Extreme Game, The Running Republic, Believe Athletics, Gobik, and EcoChic Activewear Solutions, each strengthening their position through innovation, performance-focused designs, and sustainability-led product lines. These companies continue to expand their collections to meet rising demand for athleisure, high-performance fabrics, and versatile sportswear. Regionally, Central Spain leads with 31.4% market share, supported by dense urban populations, high fitness participation, and strong retail infrastructure, while Eastern and Northern Spain also contribute significantly due to active lifestyles and diverse sporting cultures.

Market Insights

- The Spain Activewear Market reached USD 5,435.81 Million in 2024 and is projected to grow at a CAGR of 2.42%, supported by steady demand across performance and lifestyle categories.

- Rising health consciousness, growth in gym memberships, and increasing adoption of athleisure continue to drive demand for ready-to-wear activewear, which leads the market with a 42.7% share.

- Sustainability-focused trends, including recycled polyester, organic cotton, and eco-friendly manufacturing, are influencing product innovation and shaping consumer purchasing behavior.

- Key players such as Joma, Oysho, Fumarel, Meyba, XTG Extreme Game, The Running Republic, Believe Athletics, Gobik, and EcoChic Activewear Solutions strengthen market expansion through fabric innovation and digitally integrated retail strategies.

- Central Spain leads regionally with a 31.4% share, followed by Eastern Spain at 22.7% and Northern Spain at 18.6%, supported by strong sports culture, urban demand, and active outdoor lifestyles across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Spain Activewear Market demonstrates strong performance across diverse product categories, with Ready to Wear emerging as the dominant sub-segment, accounting for 42.7% of the market share in 2024. Its leadership is driven by rising demand for athleisure, increasing participation in fitness and outdoor activities, and growing consumer preference for versatile apparel suitable for both sports and daily wear. Fashion Outer, Pants, and T-Shirts continue to gain momentum, while sports shoes and swim wear segments expand with advancements in comfort, durability, and moisture-management technologies, supporting broader product diversification across the market.

- For instance, Nike’s introduction of its “Move To Zero” Fashion Outer series incorporated recycled polyester in jackets and pants designed for all-weather outdoor training, aligning with consumer demand for both sustainability and performance wear.

By Fabric

Fabric selection plays a crucial role in Spain’s activewear demand, with Polyester holding the dominant share at 38.4% in 2024 due to its superior durability, sweat-wicking capability, and cost-effective production. Consumers increasingly favor high-performance fabrics that offer breathability, elasticity, and quick-dry properties, driving the adoption of nylon, spandex, and polypropylene blends. The popularity of specialized sports such as swimming and cycling boosts the uptake of neoprene and spandex, while cotton-based activewear grows in lifestyle and athleisure segments for its comfort and skin-friendly attributes, ensuring balanced fabric diversification.

- For instance, Adidas incorporates recycled polyester microfiber extensively in its sportswear lines, optimizing durability and breathability while supporting sustainability efforts

By Material

The material composition of activewear in Spain reflects a strong shift toward performance-enhancing synthetics, with Synthetic materials dominating the market with a 64.1% share in 2024. Their popularity stems from superior stretch, durability, moisture resistance, and easy maintenance attributes crucial for high-intensity and outdoor activities. Natural materials maintain demand within premium and lifestyle athleisure categories, supported by rising interest in sustainable and skin-friendly textiles. The growing emphasis on comfort, long-lasting quality, and versatile performance continues to reinforce synthetic dominance while encouraging brands to innovate with eco-modified fibers and recycled blends.

Key Growth Drivers

Rising Adoption of Athleisure and Active Lifestyles

The rapid shift toward athleisure continues to be a major growth driver in the Spain Activewear Market. Consumers increasingly prefer apparel that blends comfort, functionality, and everyday style, boosting purchases across ready-to-wear and performance categories. Urban professionals, students, and fitness-oriented consumers are adopting activewear for daily use, supported by rising participation in gyms, yoga, cycling, and running. Brands are expanding versatile collections with breathable fabrics, minimalist designs, and multi-use clothing, reinforcing the strong adoption of athleisure across both men and women.

- For instance, Spanish brand Buff has developed performance-driven designs using advanced microfiber Polygiene® fabric, which is lightweight, odor-resistant, and quick-drying, perfectly suited for runners and cyclists.

Expansion of Sports Participation and Fitness Engagement

Growing engagement in sports, wellness routines, and recreational activities significantly fuels market demand. Spain’s increasing focus on fitness culture supported by gym memberships, sports clubs, and outdoor training environments directly elevates the consumption of performance apparel, footwear, and swimwear. Government initiatives promoting physical activity and the popularity of events such as marathons, cycling tours, and community fitness programs enhance consumer spending on durable and high-performance gear. This expanding fitness ecosystem encourages continuous product innovation and boosts overall market penetration.

- For instance, the Spanish government published the “National Strategy for the Promotion of Sport against Sedentarism and Physical Inactivity (2025‑2030)” allocating €87 million to broaden access and participation in physical activity.

Advancements in High-Performance and Sustainable Fabrics

Innovation in functional fabrics plays a pivotal role in accelerating market growth. Advanced materials offering moisture management, stretchability, UV protection, and odor control are increasingly sought-after for gym workouts, outdoor sports, and water activities. Spain’s rising focus on sustainability also encourages the use of recycled polyester, organic cotton, and eco-engineered fibers, enabling brands to align with environmental expectations while delivering improved comfort and durability. These advancements create strong differentiation for manufacturers and enhance consumer confidence in long-lasting, performance-oriented products.

Key Trends & Opportunities

Emergence of Eco-Friendly and Circular Activewear

Sustainability is emerging as a major trend, offering robust opportunities for brands to differentiate through eco-conscious sourcing, production, and packaging. Spanish consumers increasingly prefer recycled fibers, biodegradable materials, and low-impact dyes, driving demand for circular fashion solutions. Brands adopting waste-reduction models, garment recycling programs, and carbon-neutral manufacturing gain competitive advantage. This evolving preference for sustainable activewear encourages product innovation and creates new market opportunities, especially among environmentally aware millennials and Gen Z consumers who prioritize ethical purchasing behavior.

- For instance, Lagaam, another Spanish brand, has achieved carbon neutrality across its operations and offers a zero-stock, on-demand model to minimize textile waste.

Growth of E-Commerce and Omnichannel Retail Integration

The rapid expansion of e-commerce continues to reshape the Spain Activewear Market, providing opportunities for wider product access and personalized shopping experiences. Online platforms deliver convenience, competitive pricing, and extensive product variety, supported by AI-driven recommendations and virtual try-on tools. Brands are increasingly investing in omnichannel strategies that integrate physical stores, digital storefronts, and mobile apps to streamline consumer journeys. Faster delivery options, subscription models, and seamless returns further enhance consumer engagement, strengthening online channel adoption across the market.

- For instance, Inditex (owner of Zara) has integrated augmented reality try-ons within its digital platform and connects online orders with physical stores for efficient inventory management and faster delivery services.

Key Challenges

Intense Competition and Price Sensitivity

The Spain Activewear Market faces strong competitive pressure from global brands, regional manufacturers, and fast-fashion retailers. This intensifies price sensitivity among consumers, challenging premium and mid-range brands striving to maintain margins. With similar designs and functional features available across various price points, differentiation becomes difficult without significant investment in innovation or branding. Smaller companies often struggle to compete with large players offering attractive discounts, extensive product lines, and strong marketing campaigns, creating long-term sustainability challenges for emerging brands.

Volatility in Raw Material Costs and Supply Chain Disruptions

Fluctuating prices of synthetic and natural fibers pose a major challenge for manufacturers operating in Spain. Variability in polyester, nylon, and cotton costs impacts production stability and increases procurement risks, particularly for smaller brands with limited supplier leverage. Global supply chain disruptions, shipping delays, and dependency on imported materials further complicate inventory planning. These uncertainties risk product shortages, slower delivery, and reduced profit margins. Companies must adopt flexible sourcing strategies and strengthen local partnerships to mitigate long-term operational constraints.

Regional Analysis

Northern Spain

Northern Spain shows strong demand for activewear driven by high participation in outdoor sports and fitness activities, especially in regions like the Basque Country, Navarre, and Galicia. The region accounts for 18.6% market share, supported by a well-developed sports culture that encourages running, cycling, hiking, and water sports. Consumers prefer high-performance, weather-resistant fabrics suited for colder climates and coastal conditions. Branded apparel, thermal layers, and technical footwear gain traction as lifestyle shifts toward health-conscious routines. Retail and specialty sports stores remain key distribution channels, while online sales continue to expand across younger demographics.

Central Spain

Central Spain represents the largest regional market with 31.4% market share, driven by dense urban populations in Madrid and surrounding provinces. Rising gym memberships, increased adoption of athleisure, and a strong preference for premium and mid-range sportswear support robust market expansion. Consumers actively seek versatile apparel suitable for both fitness and daily wear, boosting demand for ready-to-wear activewear and performance footwear. Central Spain benefits from a well-established retail landscape, including flagship brand stores, malls, and specialty outlets, while e-commerce penetration accelerates through fast delivery options and expanded digital offerings.

Eastern Spain

Eastern Spain maintains significant traction in the activewear industry, holding 22.7% market share and benefiting from a strong sports tourism ecosystem. Regions such as Catalonia and Valencia demonstrate high engagement in running, football, gymnastics, and beach-related activities, driving consistent demand for technical apparel and swimwear categories. Warmer climates enhance uptake of lightweight, quick-dry, and breathable fabrics. Consumers increasingly favor stylish yet functional athleisure, supported by active retail innovation and brand collaborations. The growth of cycling and triathlon sports further increases demand for compression wear and high-performance materials across the region.

Southern Spain

Southern Spain contributes 17.3% market share, supported by an active outdoor lifestyle and favorable weather that promotes year-round sports engagement. Andalusia and Murcia see rising participation in fitness activities, running clubs, and water sports, enhancing demand for versatile and climate-adapted activewear. Swimwear, rash guards, and quick-dry fabrics show strong momentum due to coastal influence and tourism-driven consumption. Price-sensitive buyers drive growth in economy and mid-range apparel, while premium categories expand gradually. Online channels gain importance as consumers seek broader variety and competitive pricing across performance apparel and footwear.

Balearic and Canary Islands

The Balearic and Canary Islands account for 10.0% market share, influenced by strong demand from tourism, water sports, and leisure activities. Warmer climates and coastal environments boost sales of swimwear, lightweight performance apparel, and moisture-resistant footwear. Sports such as surfing, diving, paddleboarding, and beach volleyball continue to expand, driving preference for neoprene, spandex, and UV-protective fabrics. Active lifestyle trends, coupled with high tourist footfall, support retail sales across both branded stores and specialty shops. Online adoption rises as residents seek wider product access beyond seasonal store availability.

Market Segmentations:

By Product

- Ready to Wear

- Fashion Outer, Pants, and T-Shirts

- Rash Guard, Wet Suit, and Swim Wear

- Sports Shoes, Aqua Shoes, and Aqua Socks

- Others

By Fabric

- Polyester

- Nylon

- Neoprene

- Polypropylene

- Spandex

- Cotton

- Others

By Material

By Price Range

- Economy

- Mid-Range

- Premium

By Distribution Channel

By Region

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

- Balearic and Canary Islands

Competitive Landscape

Competitive landscape in the Spain Activewear Market is shaped by the presence of key players such as Joma, Oysho, Fumarel, Meyba, XTG Extreme Game, The Running Republic, Believe Athletics, Gobik, and EcoChic Activewear Solutions. These companies compete through product innovation, sustainable materials, and expanding athleisure collections tailored to evolving consumer preferences. Leading brands focus on moisture-wicking fabrics, ergonomic designs, and versatile apparel suited for both fitness and lifestyle use. Domestic players emphasize eco-friendly production and locally inspired designs to strengthen their appeal, while international sports labels continue to influence market standards through performance-driven technologies. The competitive environment increasingly rewards brands that integrate digital retail strategies, customization options, and enhanced online shopping experiences. As sustainability expectations rise, companies adopting recycled fibers and low-impact manufacturing gain a stronger market position. Continuous investments in branding, athlete partnerships, and retail footprint expansion further intensify competition across the Spanish activewear landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Joma

- Oysho

- Fumarel

- Meyba

- XTG Extreme Game

- The Running Republic

- Believe Athletics

- Gobik

- EcoChic Activewear Solutions

Recent Developments

- In July 2023, Flexdev Group acquired the Spanish sports‑wear‑personalisation firm Aneyron.

- In June 2025, the Swiss brand On opened its first flagship retail store in Madrid at Calle Serrano 17, Spain.

- In July 2025, Columbia Sportswear (US outdoor gear & performance apparel) opened a new store in San Sebastián, northern Spain, expanding its Spanish retail footprint.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Fabric, Price Range, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Spain Activewear Market will continue to grow as consumers increasingly adopt fitness-oriented and athleisure lifestyles.

- Rising participation in sports, outdoor activities, and gym routines will strengthen demand for performance-driven apparel.

- Sustainable and eco-friendly activewear will gain momentum as brands invest in recycled fibers and low-impact manufacturing.

- Digital retail expansion will accelerate market penetration through faster delivery, wider assortments, and enhanced customization tools.

- Technological innovations in fabrics, including moisture control and compression support, will shape product differentiation.

- Premium activewear will expand as consumers seek durable, stylish, and multi-functional designs.

- Local brands focusing on sustainability and lifestyle-driven collections will gain stronger competitive positioning.

- Increasing sports tourism in coastal and urban regions will boost demand for swimwear and outdoor-performance gear.

- Collaboration between fitness influencers and brands will enhance visibility and consumer engagement.

- Omnichannel strategies will support long-term growth by integrating seamless online and offline shopping experiences.