Market Overview

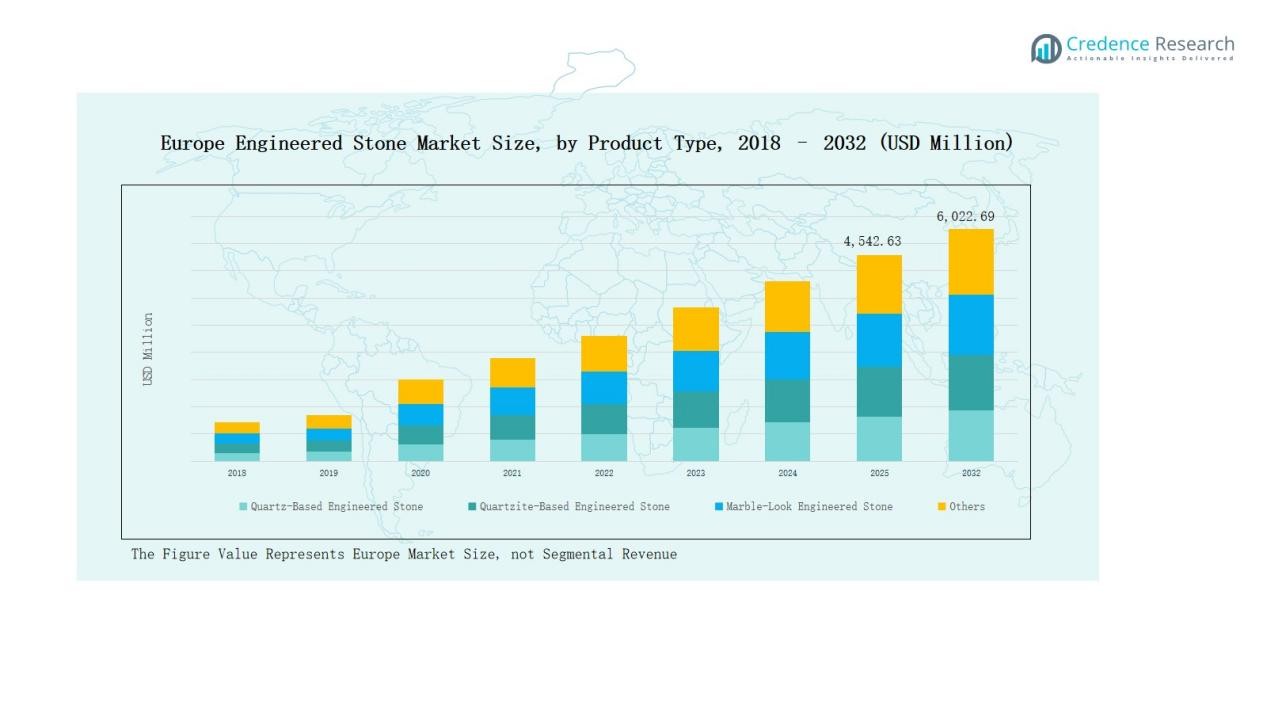

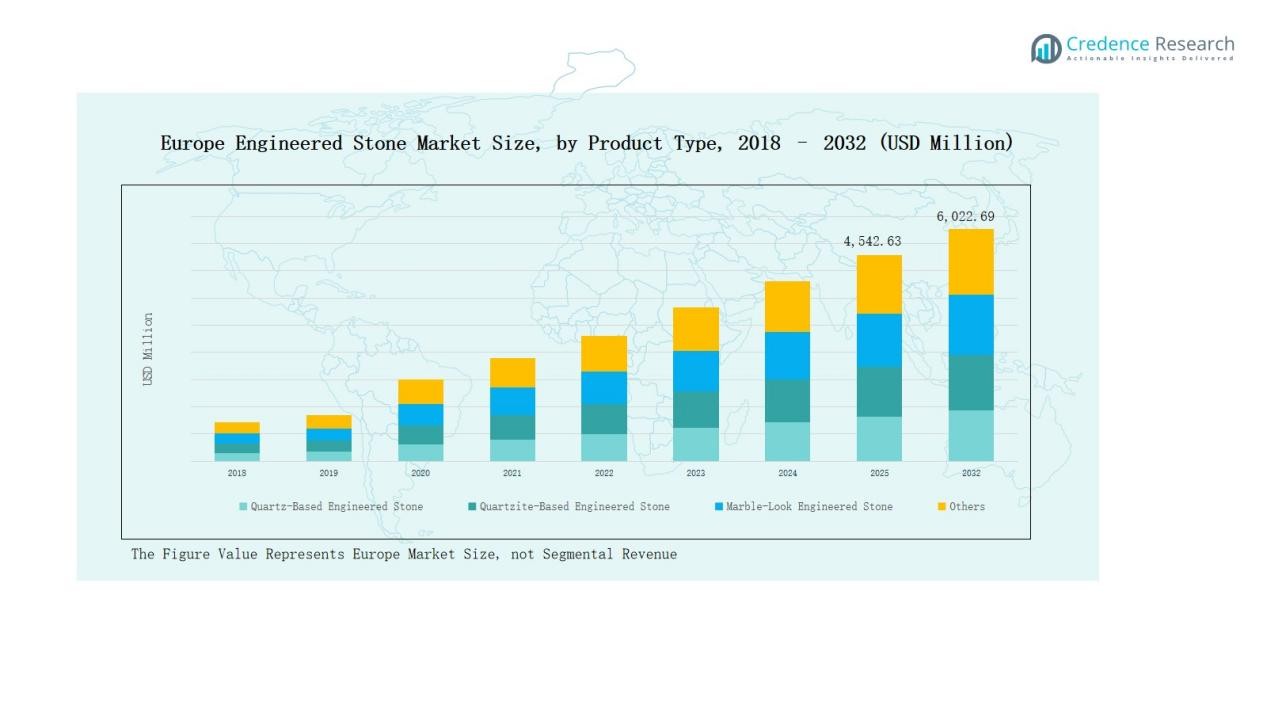

Europe Engineered Stone Market size was valued at USD 3,177.30 million in 2018, reached USD 4,231.22 million in 2024, and is anticipated to reach USD 6,022.69 million by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Engineered Stone Market Size 2024 |

USD 4,231.22 Million |

| Europe Engineered Stone Market, CAGR |

4.1% |

| Europe Engineered Stone Market Size 2032 |

USD 6,022.69 Million |

The Europe Engineered Stone Market is shaped by leading players including Cosentino Group, Compac The Surfaces Company, Santa Margherita, Breton S.p.A., Lapitec, Quartzforms, Technistone, Levantina, Quarella, and Franchi Umberto Marmi. These companies compete through broad product portfolios, sustainable manufacturing, and advanced design innovations that cater to both residential and commercial demand. Cosentino and Compac lead with extensive distribution and premium product offerings, while Italian firms like Lapitec and Quarella focus on luxury finishes. Regionally, the United Kingdom dominated with 22% share in 2024, supported by strong residential remodeling activity, government sustainability initiatives, and growing adoption of quartz-based engineered stone in high-demand interior applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Engineered Stone Market reached USD 4,231.22 million in 2024 and is projected to hit USD 6,022.69 million by 2032, growing steadily at 4.1%.

- Quartz-Based Engineered Stone led with 57% share in 2024, driven by durability, stain resistance, and eco-friendly production, making it the preferred choice for interiors.

- The residential segment held 61% share in 2024, fueled by remodeling activity, urban housing projects, and strong demand for stylish, low-maintenance kitchen and bathroom applications.

- Construction and Infrastructure accounted for 54% share in 2024, supported by large-scale projects, while interior design gained momentum through luxury customization and premium renovation demand.

- Regionally, the United Kingdom led with 22% share in 2024, followed by Germany at 20%, France at 16%, Italy at 14%, Spain at 10%, Russia at 9%, and Rest of Europe at 9%.

Market Segment Insights

By Product Type

Quartz-Based Engineered Stone dominated the Europe market with over 57% share in 2024. Its leadership stems from superior durability, stain resistance, and versatile design options suited for both residential and commercial interiors. The rising demand for sustainable, low-maintenance surfaces further supports adoption. Quartzite-based and marble-look engineered stones attract premium buyers seeking natural aesthetics, while the “Others” category, including hybrid composites, gains niche traction in specialty applications. Continued innovations in eco-friendly production strengthen quartz’s competitive edge across Europe.

- For instance, Cosentino Group expanded its Silestone Sunlit Days collection in Europe, noting it as the first carbon-neutral quartz surface certified under its sustainable production program.

By Application

The residential segment led with 61% share in 2024, supported by high remodeling activity and rising consumer preference for stylish, durable kitchen countertops and bathroom vanities. Growth in urban housing projects, coupled with strong adoption of engineered stone in flooring and wall cladding, sustains dominance. The commercial segment, while smaller, is expanding rapidly across retail, hospitality, and office spaces, driven by the need for long-lasting surfaces with modern finishes that reduce maintenance costs and enhance aesthetic appeal.

- For instance, Caesarstone introduced its new Porcelain Collection in North America, offering premium surfaces for kitchen and bathroom applications with higher heat and scratch resistance.

By End-Use Industry

Construction and Infrastructure accounted for 54% share in 2024, positioning it as the leading end-use industry. Engineered stone is increasingly used in large-scale residential and commercial projects, where architects and contractors value its cost efficiency and sustainability. Interior design and decoration follow closely, driven by demand for customized aesthetics in luxury projects and high-end renovations. The “Others” category, including furniture and niche design elements, contributes modestly but benefits from rising use of engineered stone in bespoke applications.

Key Growth Drivers

Rising Residential Remodeling and Renovation Activities

The Europe Engineered Stone Market benefits from surging residential renovation projects, especially in urban centers across the UK, Germany, and France. Homeowners prefer engineered stone for kitchen countertops, vanities, and flooring due to durability, stain resistance, and modern aesthetics. Government incentives for energy-efficient and sustainable housing upgrades further fuel demand. Growing consumer preference for premium interiors with eco-friendly materials ensures strong adoption. This trend reinforces engineered stone as a cost-effective alternative to natural stone, supporting sustained revenue growth.

- For instance, Cosentino Group launched its Dekton Ukiyo collection across Europe, offering carbon-neutral engineered stone surfaces with ribbed textures tailored for modern interiors.

Expansion of Commercial Infrastructure Projects

Large-scale commercial developments across Europe drive strong demand for engineered stone in hotels, offices, and retail complexes. Builders and architects choose these surfaces for their long lifespan, minimal maintenance, and ability to replicate premium natural stone finishes. Engineered stone also aligns with sustainability standards, making it a favored choice for LEED-certified and green building projects. The rising pipeline of hospitality and commercial real estate investments in markets like Spain, Italy, and Central Europe adds momentum to this growth driver.

- For instance, Corian introduced new collections for their Corian Quartz surfaces, featuring designs inspired by natural stone and quartzite to meet aesthetic and functional demands in both residential and commercial projects across Europe.

Shift Toward Sustainable and Eco-Friendly Surfaces

Sustainability has emerged as a critical growth driver in the Europe Engineered Stone Market. Manufacturers are adopting recycled raw materials, low-silica formulations, and water-efficient production techniques to reduce environmental footprints. Consumers increasingly prioritize eco-friendly products, driving demand for quartz surfaces with reduced crystalline silica and hybrid composites. This aligns with stringent EU environmental regulations, encouraging innovation. Green certifications and growing awareness of health and safety benefits enhance adoption across residential and commercial applications, positioning engineered stone as a sustainable interior solution.

Key Trends & Opportunities

Advancements in Design and Customization

Design flexibility has become a defining trend in the Europe Engineered Stone Market. Manufacturers now offer marble-look, textured, and matte finishes to meet diverse consumer tastes. Advanced fabrication techniques enable customized patterns, larger slab sizes, and improved edge detailing, which appeal to premium residential and commercial buyers. Growing demand for bespoke interiors in luxury projects across France and Italy creates significant opportunities for innovative surface solutions. The ability to balance aesthetics with durability positions customized engineered stone as a high-value offering.

- For instance, Levantina introduced its Techlam® large-format engineered stone slabs in France, designed to support customized wall cladding and flooring applications in luxury apartments and retail interiors.

Growth of Online and Specialty Distribution Channels

Evolving distribution networks present a key opportunity in the market. Specialty stores and online platforms have expanded their reach, providing homeowners and contractors with easy access to a wide variety of engineered stone products. Online visualization tools and digital catalogs enhance purchasing decisions, particularly in the residential segment. Partnerships with retailers and e-commerce platforms also improve market penetration. This channel diversification strengthens brand visibility, widens consumer choice, and supports growing adoption across Europe’s fragmented residential and commercial markets.

- For instance, Compac expanded its collaboration with Leroy Merlin in Spain, strengthening its e-commerce presence and enabling wider distribution of sustainable engineered stone ranges.

Key Challenges

High Competition from Natural and Low-Cost Alternatives

The Europe Engineered Stone Market faces competition from natural stone, ceramics, and laminates that offer lower upfront costs or traditional appeal. Many consumers in price-sensitive regions continue to favor alternatives such as granite or porcelain for large-scale projects. This competitive pressure restricts engineered stone’s penetration in certain markets. Manufacturers must focus on highlighting durability, sustainability, and long-term value to differentiate products. Without effective positioning, market share risks erosion from cheaper substitutes and shifting consumer preferences toward traditional surface options.

Supply Chain Volatility and Rising Raw Material Costs

Raw material price fluctuations pose a significant challenge to engineered stone manufacturers. Dependence on quartz aggregates, resins, and pigments exposes companies to global supply chain disruptions and cost variability. Energy-intensive production processes further amplify cost pressures, especially during periods of high energy prices in Europe. These factors reduce profitability and limit pricing flexibility. To mitigate risks, manufacturers are increasingly exploring local sourcing, recycling initiatives, and alternative raw materials, but cost volatility remains a persistent challenge for the industry.

Stringent Regulations and Silica-Related Health Concerns

Regulatory frameworks around crystalline silica use create challenges for engineered stone manufacturers in Europe. Growing awareness of health risks such as silicosis has led to stricter workplace safety requirements and compliance costs. Some regions are considering bans or restrictions on high-silica engineered stone products. Compliance with EU environmental and occupational health regulations also adds to production complexity. These regulatory pressures necessitate innovation in low-silica or silica-free formulations, but the transition may require significant investment and increase operational challenges for market players.

Regional Analysis

United Kingdom

The United Kingdom accounted for 22% share of the Europe Engineered Stone Market in 2024. Strong demand arises from residential remodeling and high adoption of engineered stone in kitchen countertops and bathrooms. The market benefits from government support for sustainable housing upgrades and a thriving interior design sector. Commercial applications in offices and retail also strengthen growth. Local distributors and specialty retailers expand accessibility. It maintains steady momentum with innovations in quartz-based surfaces supporting consumer preference for durability and modern aesthetics.

Germany

Germany held 20% share in 2024, supported by its robust construction industry and emphasis on green building standards. Residential projects drive consumption, while large-scale commercial developments in cities like Berlin and Munich contribute to strong adoption. Consumers value engineered stone for durability, low maintenance, and alignment with sustainability goals. It benefits from close collaboration between manufacturers and architects in premium design projects. Innovation in low-silica products further supports market resilience under strict EU regulations. Germany remains a key growth hub.

France

France captured 16% share of the regional market in 2024. Residential renovation, particularly in urban housing, drives demand. Strong cultural preference for elegant interiors supports adoption of marble-look and premium quartz surfaces. Commercial expansion in hospitality and retail adds momentum. It benefits from strong local distribution networks and growing interest in eco-certified building materials. France continues to evolve into a style-focused market, where design customization and sustainability drive purchasing decisions. Market players target this segment with tailored product portfolios.

Italy

Italy represented 14% share in 2024, leveraging its strong tradition in stone processing and interior design. Demand is led by luxury residential projects and bespoke commercial spaces. Consumers favor marble-look engineered stone due to its aesthetic appeal and versatility. It also benefits from rising adoption in high-end hotels and retail environments. Local manufacturers emphasize design innovation and premium finishes, supporting market leadership. Italy’s heritage in stone-based materials enhances consumer trust in engineered alternatives with modern performance benefits.

Spain

Spain accounted for 10% share in 2024. The market is driven by rising residential projects and growing adoption in flooring and wall applications. Commercial real estate development in urban centers strengthens engineered stone demand. It benefits from competitive domestic production and cost-effective product availability. Spanish consumers increasingly prefer sustainable materials, encouraging adoption of recycled and eco-friendly engineered surfaces. Spain continues to emerge as a key contributor to regional growth, supported by a balance of affordability and design innovation.

Russia

Russia captured 9% share in 2024. Demand is influenced by residential construction and steady growth in urban infrastructure projects. Engineered stone adoption is rising in kitchen and bathroom surfaces due to its affordability compared with imported natural stone. It benefits from an expanding middle-class population and growing retail presence of international brands. Local climatic conditions also increase preference for durable and low-maintenance surfaces. Russia’s market outlook is supported by rising investment in urban development and consumer demand for modern interiors.

Rest of Europe

The Rest of Europe held 9% share in 2024. Growth is driven by smaller markets in Eastern and Central Europe, where construction activity is increasing. Residential applications dominate, supported by rising demand for affordable and durable surfaces. It also benefits from growing commercial adoption in retail and office spaces. Manufacturers expand presence through partnerships with local distributors. Rising urbanization and improved consumer spending enhance adoption. Rest of Europe remains an emerging segment with high potential for future growth.

Market Segmentations:

By Product Type

- Quartz-Based Engineered Stone

- Quartzite-Based Engineered Stone

- Marble-Look Engineered Stone

- Others

By Application

By End-Use Industry

- Construction and Infrastructure

- Interior Design and Decoration

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Engineered Stone Market is highly competitive, with both multinational leaders and regional players actively shaping its growth. Cosentino Group maintains a dominant position through its wide product portfolio and innovative surfaces, including quartz-based and marble-look designs. Companies such as Compac The Surfaces Company, Santa Margherita, and Technistone strengthen the market with a focus on sustainable production, low-silica formulations, and tailored product lines for residential and commercial applications. Italian firms like Lapitec, Quarella, and Franchi Umberto Marmi leverage design heritage to capture premium segments, while Breton S.p.A. plays a crucial role as a technology supplier powering advanced fabrication processes. Quartzforms and Levantina further expand market competition through regional distribution strength and customized offerings. The competitive environment is shaped by strategies such as product innovation, green certifications, and distribution partnerships. Continuous investment in eco-friendly materials and bespoke designs ensures companies remain resilient under evolving regulatory and consumer demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cosentino Group

- Compac The Surfaces Company

- Santa Margherita

- Breton S.p.A.

- Lapitec

- Quartzforms

- Technistone

- Levantina

- Quarella

- Franchi Umberto Marmi

Recent Developments

- In February 2025, Brachot launched the Unistone UniQ quartz slab in Europe, produced using Breton Technology and featuring high quartz content.

- In January 2025, Vadara Quartz expanded into the UK through a distribution partnership with The Thomas Group, strengthening its European presence.

- In June 2025, Laminam opened a new Atelier in Paris, a multifunctional studio for co-design and showcasing its surfaces.

- In 2025, Cosentino introduced Inlayr Design Technology and its first zero-silica surface as new product lines.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz-based engineered stone will continue to dominate residential and commercial projects.

- Rising renovation activity across urban housing will drive strong adoption of durable surfaces.

- Growth in luxury interiors will increase preference for marble-look engineered stone.

- Eco-friendly and low-silica product innovations will gain wider acceptance under EU regulations.

- Commercial infrastructure projects will expand opportunities in hospitality, office, and retail spaces.

- Digital sales platforms and visualization tools will strengthen consumer engagement and distribution reach.

- Partnerships with architects and designers will enhance market penetration in premium projects.

- Eastern and Central Europe will emerge as important growth contributors in the regional market.

- Competition from natural stone and ceramics will encourage stronger differentiation through innovation.

- Sustainability certifications will become a key factor influencing purchasing decisions across Europe.