Market Overview

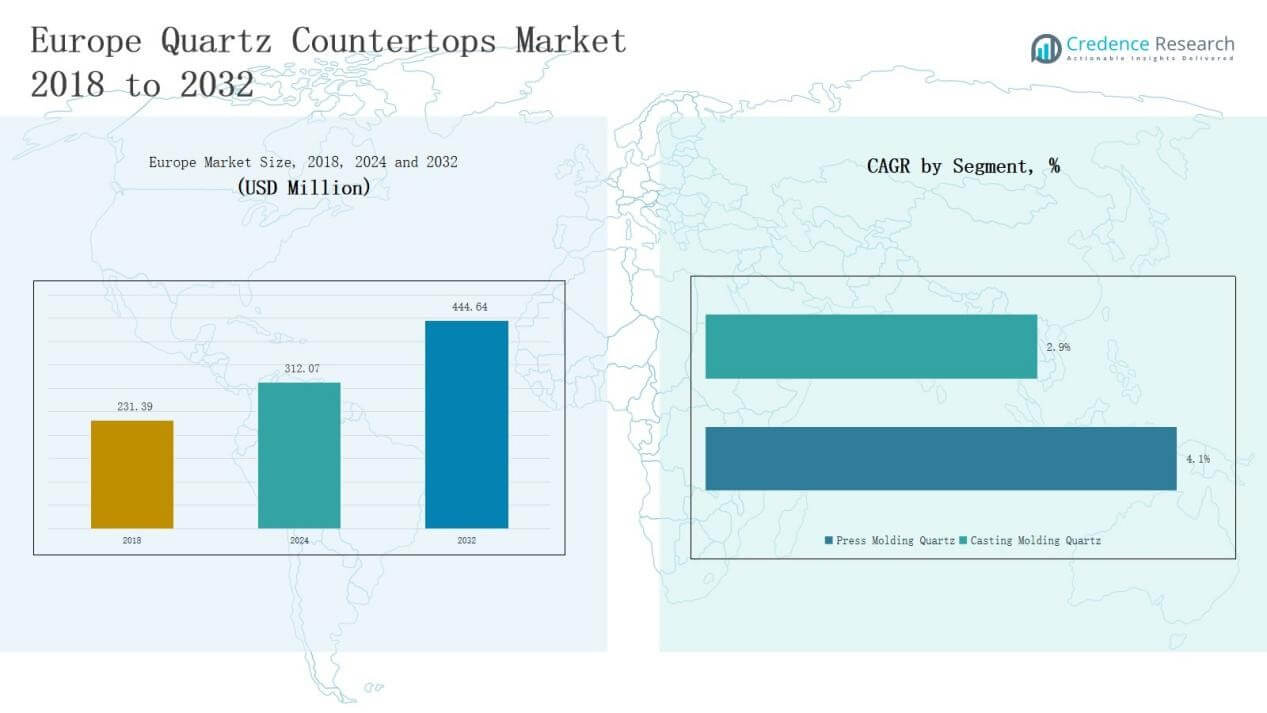

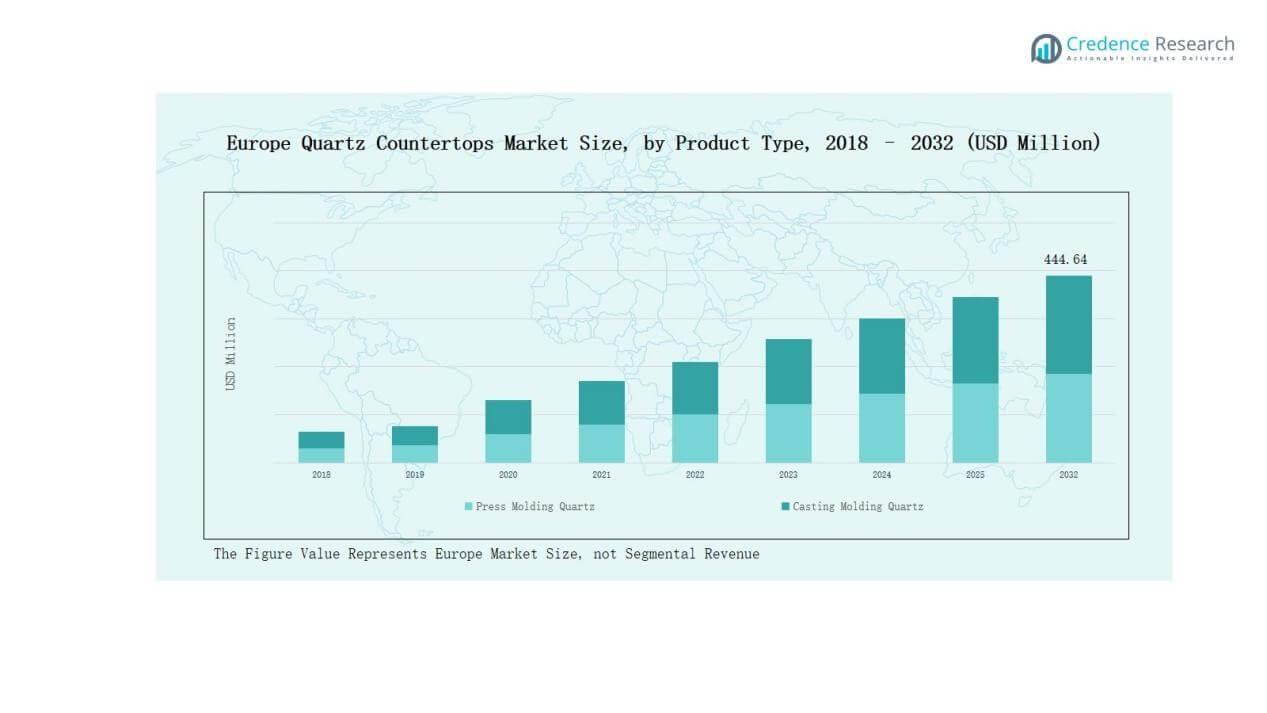

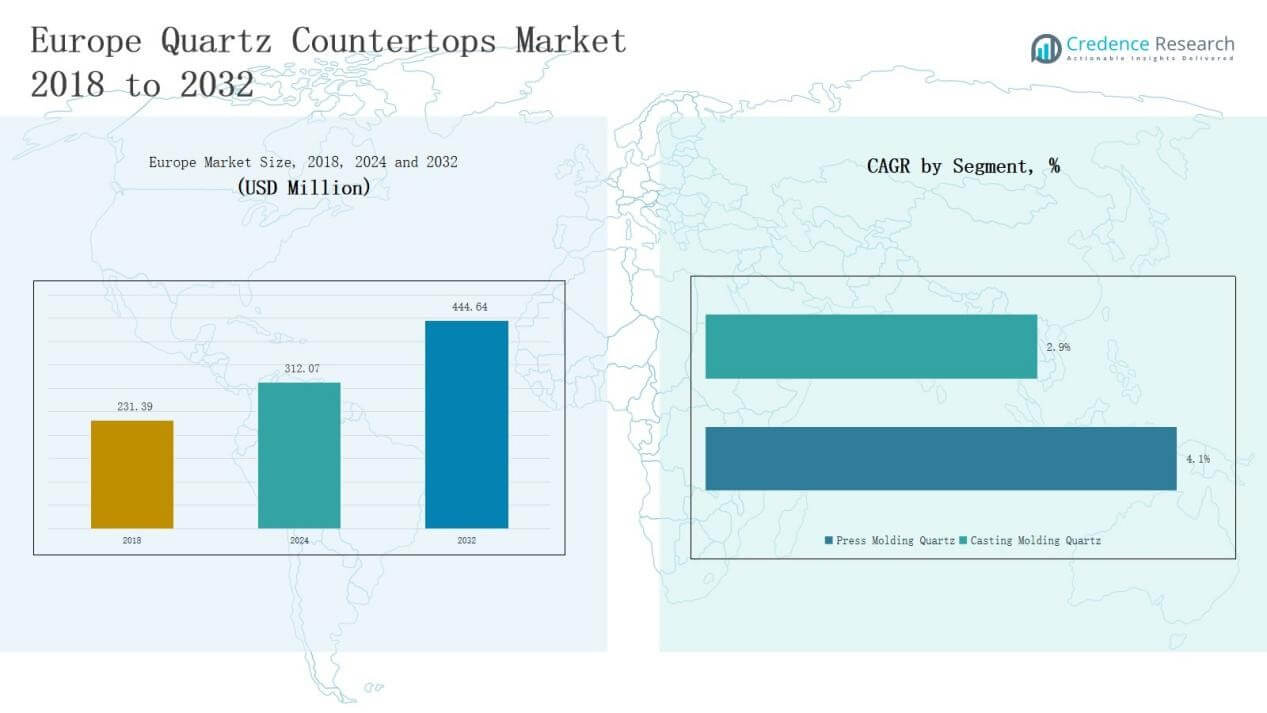

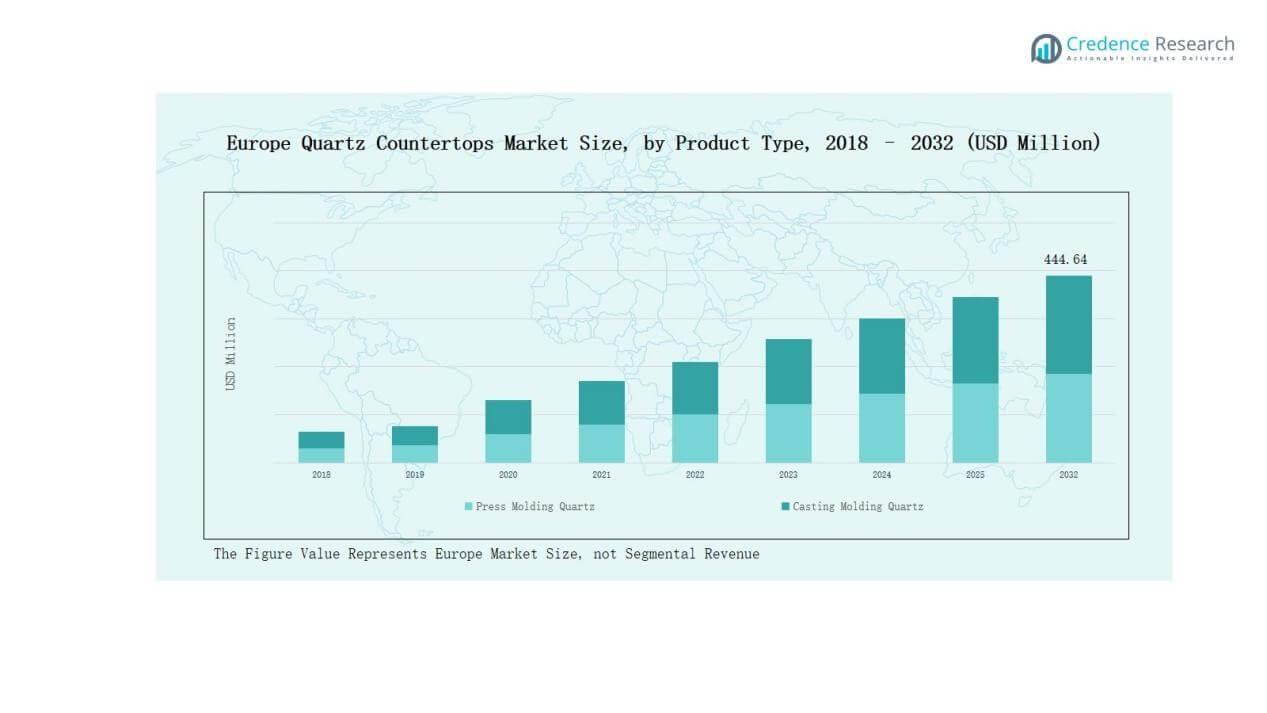

The Europe Quartz Countertops Market size was valued at USD 231.39 million in 2018, reached USD 312.07 million in 2024, and is anticipated to reach USD 444.64 million by 2032, growing at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Quartz Countertops MarketSize 2024 |

USD 312.07 Million |

| Europe Quartz Countertops Market, CAGR |

4.1% |

| Europe Quartz Countertops Market Size 2032 |

USD 444.64 Million |

The Europe Quartz Countertops Market is characterized by strong competition among leading players such as Cosentino S.A., Caesarstone Europe, Compac, Technistone, Breton S.p.A., Santa Margherita, Quarella, Lapitec, Quartzforms, and Stone Italiana. These companies focus on advanced fabrication technologies, premium finishes, and sustainable solutions to strengthen their positions across residential and commercial applications. Product innovation and wide distribution networks remain critical strategies for expanding customer reach. Regionally, the UK led the market with 22% share in 2024, driven by robust remodeling activity, consumer preference for premium interiors, and strong adoption in hospitality projects.

Market Insights

Market Insights

- The Europe Quartz Countertops Market grew from USD 231.39 million in 2018 to USD 312.07 million in 2024 and is projected to reach USD 444.64 million by 2032, at 4.1% CAGR.

- Leading companies such as Cosentino S.A., Caesarstone Europe, Compac, Technistone, Breton S.p.A., and others focus on innovation, sustainable production, and premium finishes to strengthen their market positions.

- By product type, press molding quartz held 61% share in 2024, driven by durability, uniform design, and low maintenance, while casting molding quartz captured the remaining share.

- By application, the residential segment dominated with 68% share in 2024, followed by commercial at 23% and others at 9%, reflecting strong demand in housing and hospitality sectors.

- Regionally, the UK led with 22% share in 2024, followed by Germany at 20% and France at 18%, supported by remodeling activity, luxury housing, and commercial real estate investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Press molding quartz led the Europe Quartz Countertops Market with 61% share in 2024, driven by its durability, uniform appearance, and wide suitability across residential and commercial spaces. Its low maintenance and strong performance against stains made it the preferred option in modern designs. Casting molding quartz held the remaining share, supported by flexibility in patterns and cost competitiveness. Increasing consumer focus on premium finishes and sustainable surfaces continues to strengthen the position of press molding quartz.

For instance, Cosentino introduced Silestone collections under its HybriQ+ technology, enhancing stain resistance and sustainability in press molding quartz countertops.

By Application

The residential segment dominated with 68% share in 2024, supported by robust home renovation projects, urban housing growth, and consumer preference for durable, low-maintenance countertops. Quartz’s stain resistance and long lifespan made it highly attractive for kitchens and bathrooms. The commercial segment accounted for 23% share, with strong adoption in hotels, restaurants, and offices, while the others segment held 9% share, mainly across healthcare and institutional projects where hygiene and durability are critical.

For instance, Cambria expanded its quartz surface portfolio with new designs such as Brittanicca Gold Cool, targeting premium home renovation projects.

Key Growth Drivers

Rising Residential Renovation Projects

The Europe Quartz Countertops Market is experiencing strong growth from increasing residential renovations. Homeowners are prioritizing premium surfaces that combine durability and design flexibility. Quartz countertops meet this demand with their stain resistance, ease of maintenance, and wide range of finishes. Rising urbanization and growing disposable income across major European cities have amplified investments in kitchens and bathrooms. This has positioned quartz as a preferred material over natural stones like granite or marble, further driving consistent adoption in the residential sector.

For instance, Cosentino Group expanded its Dekton line in Europe to include countertops with enhanced heat and scratch resistance, gaining traction in premium renovations.

Expanding Commercial Construction and Hospitality Sector

The expansion of commercial spaces, including hotels, restaurants, and retail outlets, is fueling quartz countertop demand. The material’s long lifespan, hygiene benefits, and design versatility make it a top choice for high-traffic commercial areas. Europe’s thriving hospitality industry is investing in modern interiors to attract customers, with quartz becoming the surface of choice for durability and style. Growth in office and retail construction projects also supports this trend, positioning the commercial sector as a significant driver of revenue growth across the region.

For instance, HanStone installed quartz countertops in a high-traffic commercial space, where the brand’s nonporous surfaces offered stain resistance and easy maintenance, proving essential for busy hospitality environments.

Shift Toward Sustainable and Low-Maintenance Materials

Sustainability and performance are becoming essential purchase factors in Europe’s construction market. Consumers increasingly prefer quartz due to its engineered composition, which offers consistent quality and eco-friendly features compared to natural stone. Its non-porous structure ensures resistance to bacteria and chemicals, reducing long-term maintenance needs. With rising awareness of sustainable building practices, quartz countertops align with green certifications and energy-efficient construction trends. These advantages position quartz as a sustainable alternative that appeals to both residential buyers and large commercial developers.

Key Trends & Opportunities

Growing Preference for Customized Designs

Customization is emerging as a major trend, with consumers demanding unique colors, finishes, and patterns for countertops. European buyers are seeking marble-look and matte finishes that enhance premium interiors while maintaining quartz’s durability. Manufacturers are expanding product portfolios with advanced fabrication techniques and digital printing technologies to meet this rising preference. This trend presents an opportunity for companies to differentiate offerings, attract design-focused consumers, and strengthen their market presence in an increasingly competitive countertop landscape.

For instance, Compac introduced its Ice of Genesis collection crafted with a unique digital printing technique, offering dramatic veined quartz surfaces designed in collaboration with renowned artist Arik Levy.

Increasing Adoption in Public Infrastructure Projects

Beyond residential and commercial applications, quartz countertops are finding opportunities in public infrastructure projects such as healthcare, educational institutions, and government facilities. The material’s hygiene benefits, low maintenance, and long-lasting performance suit high-traffic environments. With governments investing heavily in modern infrastructure across Europe, demand for durable and aesthetic surfaces is set to rise. This trend creates new opportunities for suppliers to expand their customer base, diversify applications, and capture growth in segments previously dominated by alternative surface materials.

For instance, Caesarstone launched a new line containing up to 40% recycled stone and glass, combining sustainability with long-lasting performance.

Key Challenges

Key Challenges

High Cost Compared to Alternatives

The premium pricing of quartz countertops remains a significant barrier to adoption in price-sensitive markets within Europe. While durability and low maintenance justify the investment, natural stones and laminates often attract cost-conscious buyers. This challenge is particularly strong in Eastern and Southern European countries where disposable incomes are lower. To overcome this, manufacturers must focus on offering mid-range quartz solutions without compromising quality. Pricing pressure continues to limit faster penetration in certain residential and small-scale commercial projects.

Strong Competition from Substitute Materials

Quartz countertops face strong competition from granite, marble, and engineered laminates that remain popular across Europe. Natural stones appeal to consumers seeking authenticity and luxury, while laminates provide cost-effective solutions with improved designs. This competitive landscape challenges quartz producers to continuously innovate and highlight unique value propositions such as sustainability, uniformity, and hygiene benefits. Without strong differentiation, the market risks losing share to substitutes that may appeal to different consumer groups or project requirements.

Supply Chain and Raw Material Constraints

The quartz countertop industry in Europe relies heavily on raw material imports, making it vulnerable to supply chain disruptions and price volatility. Rising energy costs and stricter environmental regulations in production hubs further challenge manufacturers. Delays in raw material supply can affect timely deliveries, increasing costs for producers and end-users. This challenge is amplified during periods of global trade instability, forcing companies to secure local sourcing options, optimize logistics, and explore recycling practices to maintain steady production capacity.

Regional Analysis

UK

The UK accounted for 22% share in 2024 of the Europe Quartz Countertops Market, supported by strong adoption in residential remodeling and new housing projects. Rising consumer preference for premium interiors has accelerated quartz usage in kitchens and bathrooms. The hospitality industry also contributes significantly with demand from hotels and restaurants. Consumers prefer quartz for its durability, stain resistance, and wide design choices. It continues to replace natural stone in mid to high-end projects. Sustainable construction practices further strengthen its market position in the country.

France

France held 18% share in 2024, driven by luxury housing developments and significant investments in commercial real estate. The quartz countertops market in France benefits from growing consumer interest in stylish, low-maintenance surfaces. Demand is strong across metropolitan regions with high spending on kitchen and bathroom upgrades. Developers choose quartz for its long lifespan and modern aesthetics. The market also gains momentum from increasing use in premium hotels and retail spaces. It is supported by suppliers offering eco-friendly and design-rich product lines.

Germany

Germany represented 20% share in 2024, supported by robust construction activity and consumer focus on high-quality materials. The Europe Quartz Countertops Market in Germany is strengthened by demand from both residential and commercial segments. Rising adoption of sustainable surfaces aligns with the country’s emphasis on green building practices. Quartz is preferred over granite due to its consistency and durability. Growth in office and retail infrastructure also adds to demand. It benefits from a strong distribution network that ensures broad accessibility.

Italy

Italy captured 12% share in 2024, driven by its design-centric culture and emphasis on premium home interiors. Consumers favor quartz for its ability to replicate marble-like finishes with better durability. The Europe Quartz Countertops Market in Italy is supported by hospitality projects, especially in luxury hotels and resorts. Residential renovation demand also strengthens sales. Domestic producers play a vital role in supplying innovative finishes. It continues to gain preference in both modern and traditional interior styles.

Spain

Spain held 10% share in 2024, supported by residential construction recovery and growing tourism infrastructure. The quartz countertops market in Spain benefits from demand in coastal areas with high renovation activity. Local and international suppliers compete strongly by offering cost-effective designs. Residential buyers prefer quartz due to its easy maintenance and durability in high-use kitchens. Commercial spaces such as restaurants and hotels also contribute to steady growth. It shows rising adoption among younger consumers investing in modern homes.

Russia

Russia accounted for 9% share in 2024, with demand driven by urban housing projects and rising disposable income. The Europe Quartz Countertops Market in Russia is growing with increasing consumer preference for stylish yet durable surfaces. Imported products dominate due to limited domestic production. Demand is also visible in commercial spaces such as offices and retail outlets. Quartz is chosen over laminates for its premium look and long-term performance. It continues to expand despite challenges in supply chain logistics.

Rest of Europe

The Rest of Europe region represented 9% share in 2024, covering countries such as Poland, Netherlands, and the Nordic nations. Demand is supported by expanding residential construction and rising awareness of quartz’s benefits. Consumers value its non-porous structure, hygiene, and customization options. The Europe Quartz Countertops Market in this region benefits from supportive government housing programs. Increasing hospitality and office projects also create opportunities for suppliers. It shows strong potential for future growth across both premium and mid-range segments.

Market Segmentations:

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Molding Quartz

By Application

- Residential

- Commercial

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Quartz Countertops Market is highly competitive, with global and regional players focusing on innovation, design variety, and sustainability to strengthen their positions. Leading companies such as Cosentino S.A., Caesarstone Europe, Compac, Technistone, Breton S.p.A., Santa Margherita, Quarella, Lapitec, Quartzforms, and Stone Italiana dominate the landscape with extensive product portfolios and established distribution networks. These players emphasize advanced fabrication technologies, marble-look finishes, and eco-friendly production to cater to rising consumer demand for premium surfaces. Strong competition has driven investments in digital printing, custom designs, and energy-efficient manufacturing processes. Many companies are also expanding their presence through strategic partnerships and acquisitions to enhance market reach across key European countries. The market benefits from a blend of multinational corporations offering scale and local manufacturers providing design-focused, region-specific solutions. It remains dynamic, with continuous product launches and innovation shaping competitive strategies and positioning quartz as a leading surface material in Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In January 2025, Caesarstone launched its ICON™ Advanced Fusion surface in Europe. This innovative quartz product is crystalline silica-free and comprises approximately 80% recycled materials, including post-industrial glass.

- In October 2023, Classic Marble Company, an India-based company, launched a line of white quartz products called KalingaStone Quartz, which includes seven white quartz variations with grey, brown, and black veins.

- In 2025, Technistone introduced the La Natura 2025 Collection, comprising five new designs inspired by nature. The collection emphasizes sustainable manufacturing using recycled materials and eco-friendly production processes. The designs aim to evoke warmth, elegance, and tranquility in interior spaces.

- In 2024, Breton introduced Bioquartz®, a crystalline silica-free quartz technology. This innovation aims to improve the safety and sustainability of engineered quartz surfaces.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz countertops will increase with rising residential renovation activities across Europe.

- Commercial adoption will expand, supported by investments in hospitality, office, and retail spaces.

- Sustainable and eco-friendly quartz products will gain stronger preference among European consumers.

- Advanced fabrication technologies will drive innovation in design and surface finishes.

- Customization options in colors, textures, and marble-look designs will boost product appeal.

- Local production capacity will grow to reduce reliance on imported raw materials.

- Strong competition will push companies to differentiate through premium finishes and durability.

- Public infrastructure projects will create opportunities for quartz applications in institutional spaces.

- Expansion of distribution networks will improve accessibility across emerging European markets.

- Strategic partnerships and acquisitions will shape market consolidation and long-term growth strategies.

Market Insights

Market Insights Key Challenges

Key Challenges Market Segmentations:

Market Segmentations: