Market Overview

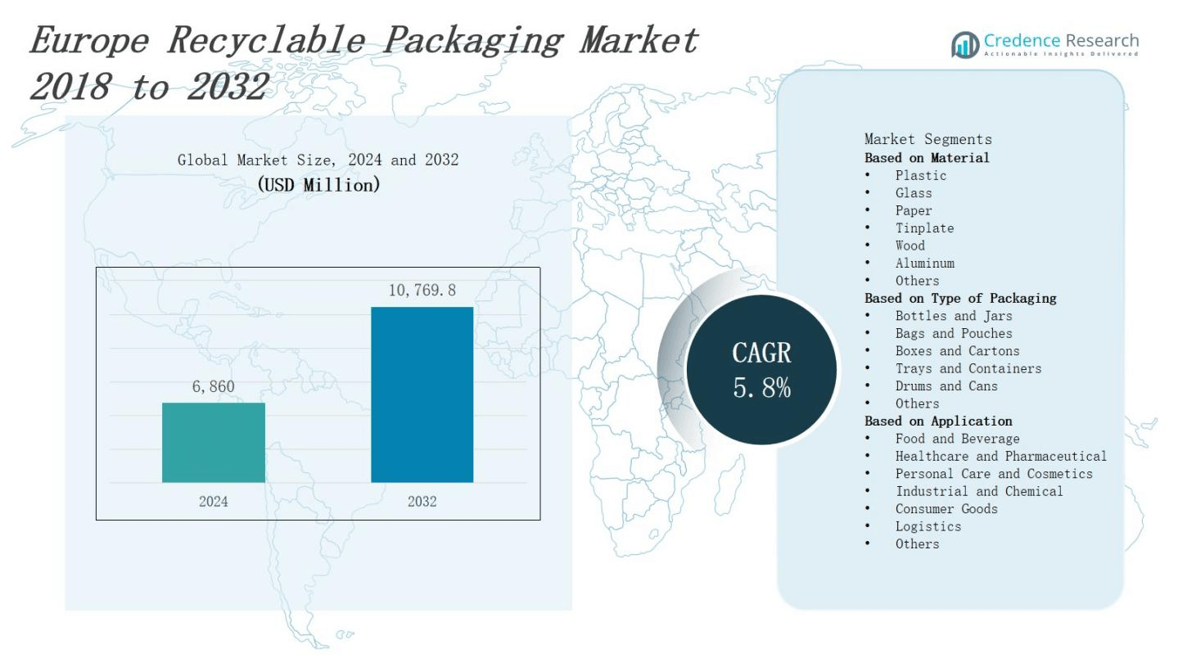

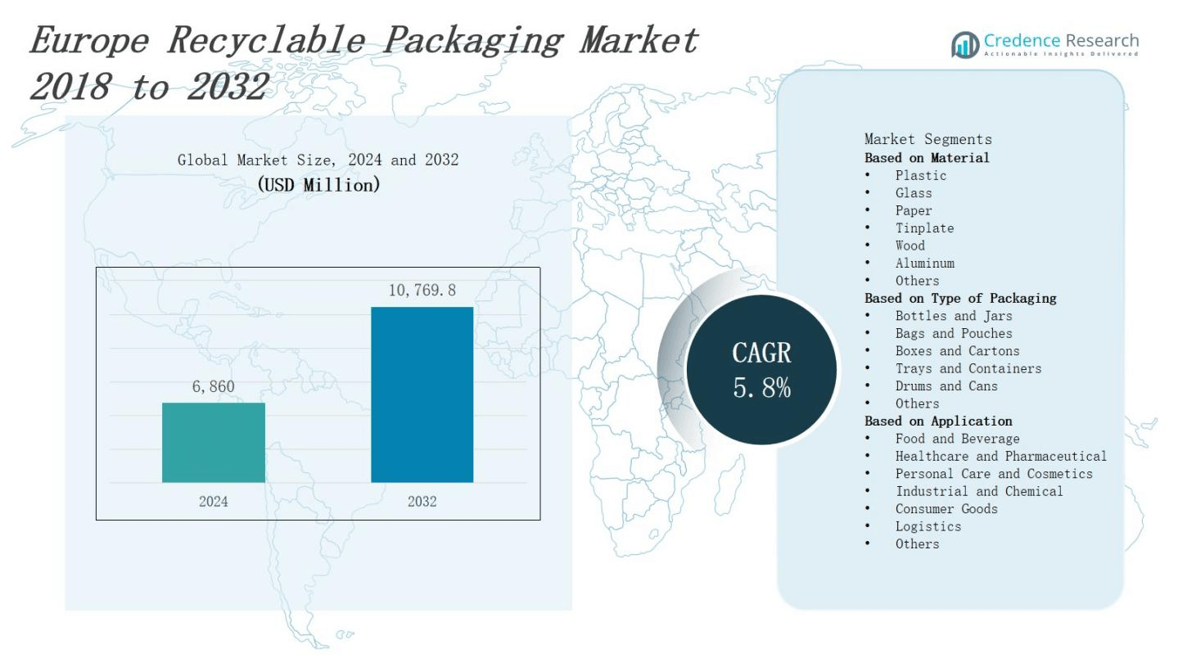

The Europe recyclable packaging market is projected to grow from USD 6,860 million in 2024 to USD 10,769.8 million by 2032, reflecting a compound annual growth rate of 5.8%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Recyclable Packaging Market Size 2024 |

USD 6,860 million |

| Europe Recyclable Packaging Market, CAGR |

5.8% |

| Europe Recyclable Packaging Market Size 2032 |

USD 10,769.8 million |

Stricter EU regulations on single-use plastics and growing consumer demand for sustainable solutions drive the Europe recyclable packaging market. Manufacturers increase investments in advanced recycling technologies, such as chemical recycling and closed‑loop systems, to meet circular economy goals. Brands adopt bio‑based polymers and pursue lightweight designs to reduce material consumption. Digital printing and smart labeling trends enhance traceability and customization. Collaborations across the value chain accelerate innovations in depolymerization and mechanical recycling efficiency. Rising e‑commerce volumes prompt development of recyclable mailer solutions. Producers integrate life cycle assessments into product design to demonstrate environmental credentials and support regulatory compliance.

Western Europe leads the europe recyclable packaging market with 50% share, propelled by robust recycling infrastructure and major players such as Mondi Group and Stora Enso. It drives demand for high‑purity recycled polymers and closed‑loop solutions. Northern Europe commands 15% share through stringent regulations and innovation, with DS Smith and Smurfit Kappa developing smart packaging. Eastern Europe holds 20% share, where ALPLA Group and Costantia Flexibles expand collection networks. Southern Europe covers 15% share with growing e‑commerce demand, and Amcor Plc and Mayr‑Melnhof tailor lightweight mailers and refillable containers. Brand Company, S.L. and PERA LABEL and PACKAGING address niche demands.

Market Insights

- The europe recyclable packaging market will expand from USD 6,860 million in 2024 to USD 10,769.8 million by 2032 at a 5.8% CAGR.

- The EU enforces strict recycling targets and EPR schemes that compel producers to adopt recycled polymers.

- Consumer demand for sustainable solutions drives brands to source bio‑based materials and pursue lightweight designs.

- Companies deploy chemical recycling and AI‑driven sorting systems to boost material recovery and feedstock purity.

- Industry consortiums standardize packaging formats and digital labels guide consumers on correct recycling steps.

- Inconsistent collection infrastructure and volatile resin prices create feedstock reliability and cost pressures.

- Western Europe leads with 50% share; Eastern Europe holds 20%; Northern and Southern Europe each account for 15%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Strict Regulatory Framework

The European Union enforces rigorous recycling targets and landfill reduction quotas under its Circular Economy Action Plan. It compels producers and converters to adopt materials that comply with recyclability criteria. The europe recyclable packaging market benefits from mandated content requirements that boost demand for recycled polymers. Stakeholders must align with Extended Producer Responsibility schemes to manage end‑of‑life waste. It spurs investments in collection infrastructure and sorting facilities to achieve compliance.

Rising Consumer Preference

Eco‑conscious attitudes influence purchasing patterns across Europe. The europe recyclable packaging market gains momentum as brands highlight sustainability credentials on labels. Shoppers favor products that minimize environmental impact and reduce plastic pollution. It drives brand owners to source recycled content and showcase recyclability claims. Retailers collaborate with suppliers to introduce recyclable mailers and refillable containers. Movement strengthens transparency and fosters trust between companies and end users. It catalyzes packaging redesign.

- For instance, Tetra Pak developed tethered caps that reduce plastic usage by up to 15%, complying with upcoming EU single-use plastic bans, and introduced over 17 million paper straws in 2020 as plastic alternatives.

Technological Innovation

Advanced sorting systems and chemical recycling methods enhance material recovery rates. It reduces contamination and ensures high‑quality feedstock for new packaging. The europe recyclable packaging market attracts research in depolymerization processes that break plastics into monomers. Manufacturers deploy AI‑driven quality control and automated optical sorting to streamline operations. Collaboration between technology providers and converters yields plants that prove circular solutions. It accelerates scale‑up of closed‑loop manufacturing. It promotes cost‑effective processes.

- For instance, TOMRA’s advanced object recognition sorting technology enhances plastic packaging recycling circularity in Europe by optimizing the classification of complex post-consumer plastics, enabling better feedstock for mechanical recycling.

Supply Chain Collaboration

Industry players align to optimize collection and sorting networks across Europe. It strengthens linkages between brand owners, recyclers and logistics providers. The europe recyclable packaging market embraces consortiums that standardize packaging formats and labeling guidelines. Joint ventures drive infrastructure upgrades and investments in sorting centers. Policy makers engage stakeholders to refine EPR frameworks and grant funding for circular projects. It fosters data sharing initiatives that improve traceability and operational efficiency.

Market Trends

Shift Toward Bio‑based and Compostable Materials

Manufacturers introduce bio‑based polymers to replace conventional plastics. It reduces dependence on fossil feedstocks and aligns with carbon neutrality. The europe recyclable packaging market gains traction from compostable film adoption in food and beverage segments. Brands market materials that degrade under industrial composting conditions. Research focuses on optimizing mechanical properties and barrier performance. Partnerships emerge to certify compostable packaging under EU norms. Consumers welcome materials that complete lifecycle in closed loops.

- For another example, BASF SE offers Ecoflex, a bio-based and compostable polymer used in agricultural films and compostable coffee capsules, promoting sustainability with over 30 years of development in biodegradable polymers.

Rise of Smart Packaging Technologies

Sensors integrate into packaging to monitor freshness and temperature. It enhances transparency and reduces waste in cold chain operations. The europe recyclable packaging market benefits from NFC tags and QR codes that guide consumers on proper recycling. Technology firms partner with recyclers to collect data on material recovery. Brands deploy sensors to optimize logistic flows and prove environmental claims. Regulators encourage digital labeling to standardize recycling instructions across member states.

- For instance, Toxin Guard® by Toxin Alert Inc. detects bacterial growth in meat products, providing early spoilage warnings through smart packaging indicators.

Expansion of Regional Recycling Hubs

Governments fund sorting centers and recycling parks to streamline material flow. It shortens transport cycles and cuts carbon emissions. The europe recyclable packaging market experiences growth near industrial clusters in Germany, the Netherlands and Scandinavia. Private and public entities share infrastructure costs. Industry federations promote cross-border waste shipments under harmonized standards. New EU grants accelerate facility upgrades across Eastern Europe. Investment schemes support advanced processing units for multi‑layer packaging.

Design for Recycling Strategies

Producers reformulate packaging to simplify material blends and facilitate separation. It requires standardization of polymer types and reduction of labels that prevent recycling. The europe recyclable packaging market adapts mono‑material structures that improve recyclability. Design teams evaluate end‑of‑life scenarios during product development. Industry guidelines set thresholds for adhesive and ink content. Design‑for‑recycling tools assist engineers in meeting recyclability scores. Brands test packaging for recyclability compliance. It drives continuous design improvements.

Market Challenges Analysis

Fragmented Collection and Sorting Infrastructure

National systems vary widely and hinder efficient material recovery. The europe recyclable packaging market suffers from inconsistent collection rates and complex sorting requirements. Stakeholders face high costs to upgrade outdated equipment. It requires coordination among municipalities and private operators. Contamination rates remain high due to unclear labeling. Seasonal shifts in waste generation hinder collection efficiency, and public awareness campaigns aggravate contamination issues. Regulators impose fines for non‑compliance with waste directives. Industry players struggle to secure reliable feedstock.

Economic Pressures and Fluctuating Recycled Material Prices

Volatile oil prices influence recycled resin competitiveness. The europe recyclable packaging market confronts periods when virgin polymers cost less than recycled content. Producers hesitate to invest in circular processes without price stability. It forces companies to absorb higher costs or pass them to consumers. Rapid regulatory amendments create uncertainty, and frequent global supply chain disruptions exacerbate raw material shortages. Investors demand clear return estimates before funding new plants. Manufacturers face tight margins during low demand. Policymakers revisit incentives to balance market dynamics.

Market Opportunities

Integration of Advanced Recycling Technologies

Companies deploy chemical recycling to convert mixed plastics into high-purity monomers. It reduces reliance on virgin feedstocks and cuts carbon emissions. The europe recyclable packaging market stands to benefit when companies scale depolymerization units. Stakeholders gain opportunity to retrofit existing plants with advanced sorting systems. Collaborations with technology providers unlock access to patented catalysts and processes. Regulatory incentives support pilot projects and facilitate investment decisions. Market entrants can secure long-term contracts with brand owners seeking circular materials.

Expansion into Emerging Consumer Segments and Digital Commerce

Brands target subscription services and direct-to-consumer channels with recyclable formats. It creates demand for lightweight mailers and refillable containers. Small and medium enterprises have opportunity to differentiate through eco labels. E‑commerce platforms integrate QR codes to educate consumers on recycling steps. The europe recyclable packaging market can capture value by partnering with start‑ups. Joint ventures offer access to new geographic regions and distribution networks. Investors show interest in sustainable packaging ventures with strong ESG credentials.

Market Segmentation Analysis:

By Material

Plastic holds dominant share due to lightweight properties and cost efficiency. It drives innovation in recycling processes to recover PET and HDPE. Glass maintains value in beverage and pharmaceutical sectors through infinite recyclability. Paper gains traction in e‑commerce and food service because it meets sustainability goals. Aluminum attracts demand for beverage cans thanks to high recovery rates and energy savings. Tinplate supports food packaging with strong barrier properties. Wood and other biopolymers occupy niche segments.

- For instance, WestRock’s CanCollar® Eco replaces plastic rings in beer packaging, eliminating millions of plastic rings annually.

By Type of Packaging

Bottles and jars account for the largest volume thanks to their reuse potential and structural integrity. It supports beverage and cosmetics brands that demand premium presentation. Bags and pouches rise in direct‑to‑consumer channels where lightweight shipment lowers costs. Boxes and cartons secure food items and retail products with printable surfaces. Trays and containers serve fresh‑food applications by providing protection and visibility. Drums and cans suit industrial chemicals and bulk materials. Other formats address specialized needs.

- For instance, ALPLA’s rePETec thin-wall containers (developed with ENGEL and Brink) incorporate up to 100% recycled PET (rPET). These transparent, compliant containers set new sustainability standards in food packaging.

By Application

Food and beverage leads demand by requiring safe, recyclable containers for liquids and solids. It encourages investment in material recovery systems. Healthcare and pharmaceutical sectors prioritize sterile, recyclable formats to ensure patient safety and regulatory compliance. Personal care and cosmetics leverage recyclable packaging for brand positioning and waste reduction. Industrial and chemical users select robust containers to minimize contamination. Consumer goods utilize varied formats that meet design and recycling criteria. Logistics segments require protective, returnable solutions for supply chains.

Segments:

Based on Material

- Plastic

- Glass

- Paper

- Tinplate

- Wood

- Aluminum

- Others

Based on Type of Packaging

- Bottles and Jars

- Bags and Pouches

- Boxes and Cartons

- Trays and Containers

- Drums and Cans

- Others

Based on Application

- Food and Beverage

- Healthcare and Pharmaceutical

- Personal Care and Cosmetics

- Industrial and Chemical

- Consumer Goods

- Logistics

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

Western Europe

Western Europe commands the largest portion of the europe recyclable packaging market, holding 50% share thanks to advanced recycling infrastructure and stringent waste directives. It drives demand for high‑purity recycled polymers and closed‑loop solutions. Germany and France lead investments in sorting centers and depolymerization units. Brands leverage robust collection networks to secure feedstock. Northern Europe holds 15%, Eastern Europe accounts for 20%, and Southern Europe contributes 15%. It benefits from integrated logistics and proximity to major converters. Stakeholders in this region optimize partnerships to maintain market dominance.

Northern Europe

Northern Europe secures 15% share in the europe recyclable packaging market by focusing on innovation and sustainable design. It incorporates smart labeling and QR codes to improve recycling rates. Sweden and Denmark support circularity through public–private initiatives and stringent waste targets. Brands introduce recyclable mailers for direct‑to‑consumer channels. Western Europe maintains 50%, Eastern Europe records 20%, and Southern Europe registers 15%. It uses digital platforms to educate consumers on proper disposal. Industry alliances foster cross‑border material exchange.

Southern Europe

Southern Europe captures 15% of the europe recyclable packaging market driven by growing e‑commerce and tourism sectors. It upgrades seaside resort collection points to manage seasonal waste spikes. Italy and Spain fund sorting facilities and incentives for recycled‑content packaging. Eastern Europe holds 20%, Northern Europe retains 15%, and Western Europe dominates with 50%. It harnesses regional EPR schemes to secure investments in recycling parks. Stakeholders develop lightweight trays and pouches tailored to Mediterranean preferences. Market players in this region strengthen networks to boost material recovery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ALPLA Group

- Smurfit Kappa

- Costantia Flexibles

- Mayr‑Melnhof

- PERA LABEL and PACKAGING

- Klockner Pentaplast

- The Brand Company, S.L.

- Mondi Group

- Amcor Plc

- DS Smith

- Stora Enso

Competitive Analysis

Leading players deploy varied strategies to capture value in the europe recyclable packaging market. Stora Enso focuses on paper‑based materials and forges partnerships for closed‑loop systems. Mondi Group invests in chemical recycling and expands recovery capacity. DS Smith drives lightweight carton designs that simplify sorting. Smurfit Kappa rolls out smart labels and refillable models. Amcor Plc secures long‑term supply of post‑consumer resin. ALPLA Group upgrades sorting lines to boost feedstock purity. Costantia Flexibles adapts film formats with eco additives. Klockner Pentaplast pursues barrier recycling breakthroughs. The Brand Company, S.L. targets niche segments with glass and tinplate. PERA LABEL and PACKAGING integrates traceability features into product lines. It forces firms to balance capital outlays with market pricing. Firms differentiate through certifications, digital tools and robust service networks to earn contracts across food, healthcare and cosmetics sectors.

Recent Developments

- In February 2025, Huhtamaki launched an innovation called ProDairy, which is a recyclable single-coated paper cup specifically designed for yogurt and dairy products.

- In June 2025, Mondi, a global packaging leader based in the UK, entered into a partnership with Saga Nutrition, a French pet food manufacturer, to develop recyclable packaging for Saga’s dry pet food products.

- In April 1, 2025, Mondi Group completed the acquisition of Schumacher Packaging’s Western Europe operations, adding over 1 billion m² of sustainable packaging capacity.

- On June 11, 2025, INEOS Olefins & Polymers Europe launched advanced recycled plastic production at its Lavera site in Southern France .

Market Concentration & Characteristics

The Europe recyclable packaging market exhibits moderate concentration, with a handful of large firms commanding the lion’s share and numerous specialized players serving niche segments. It features Stora Enso, Mondi Group, DS Smith, Smurfit Kappa and Amcor Plc as dominant suppliers of paper‑based and polymer solutions, while ALPLA Group and Klockner Pentaplast lead in plastic formats. The europe recyclable packaging market demands substantial capital investment in sorting and recycling infrastructure, which raises entry barriers and fosters partnerships among converters, technology providers and waste managers. Regulatory compliance drives standardization of packaging designs, and Extended Producer Responsibility schemes ensure accountability throughout the value chain. It rewards companies that secure reliable feedstock through long‑term contracts and demonstrate performance via life‑cycle assessments. Market dynamics hinge on raw‑material price volatility and evolving consumer preferences, which compel continuous innovation in material science and process efficiency.

Report Coverage

The research report offers an in-depth analysis based on Material, Type of Packaging, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Regulators enforce extended producer responsibility frameworks across member states to boost packaging recyclability and accountability.

- Companies adopt advanced chemical recycling processes at scale to convert mixed plastics into high-purity monomers.

- Brands integrate smart labels and QR codes on packaging to guide consumers through recycling steps.

- Manufacturers increase use of mono-material packaging designs to simplify sorting and improve recyclability across products.

- Investors fund expansion of regional sorting centers, recycling parks to strengthen feedstock supply and processing.

- Stakeholders harmonize cross-border recycling standards to ensure consistent material quality and regulatory compliance throughout Europe.

- Technology providers deploy AI-driven quality control, automated optical sorting systems to boost material recovery rates.

- Organizations integrate life-cycle assessments into product development processes to demonstrate environmental credentials and optimize design.

- Start-ups innovate bio-based polymer alternatives to cater niche segments, meet brand demand for sustainable solutions.

- Supply chains ensure transparency by tracking recycled material provenance, performance metrics to guarantee responsible sourcing.