Market Overview:

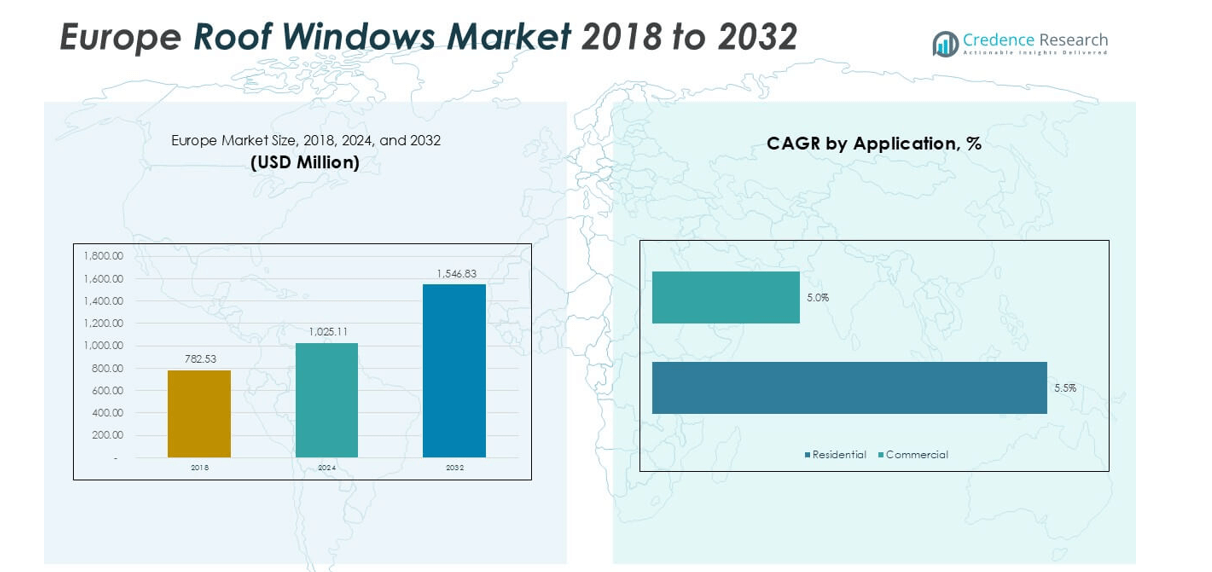

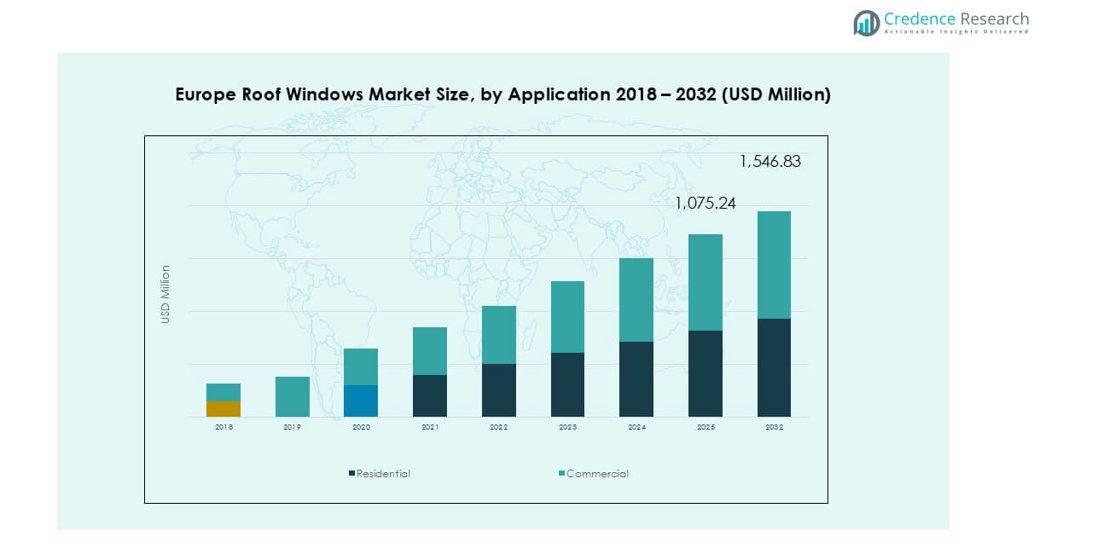

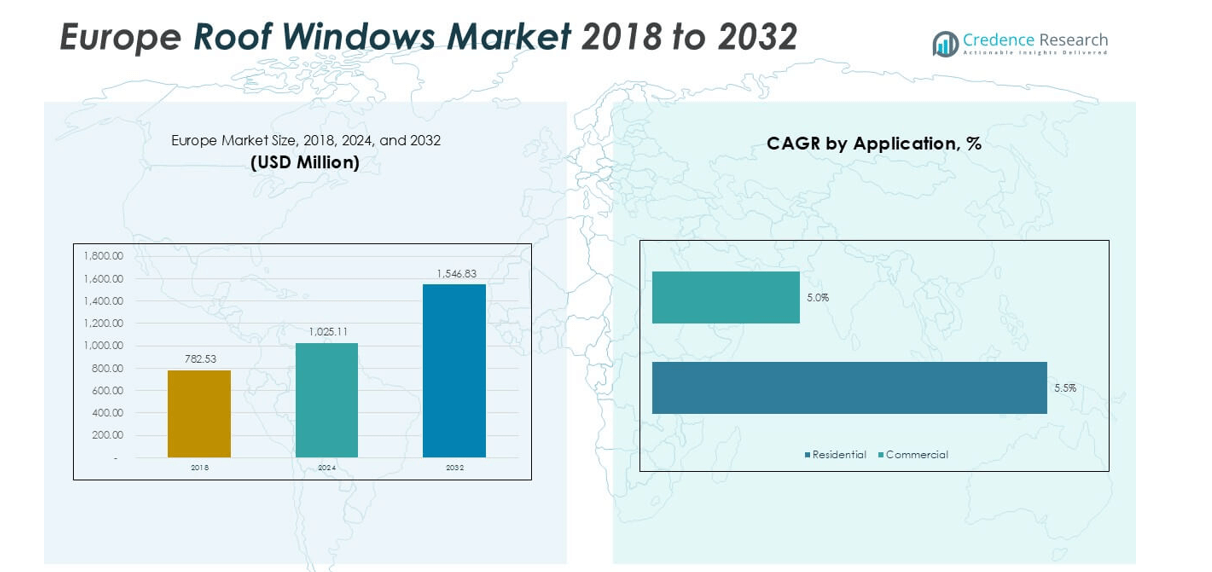

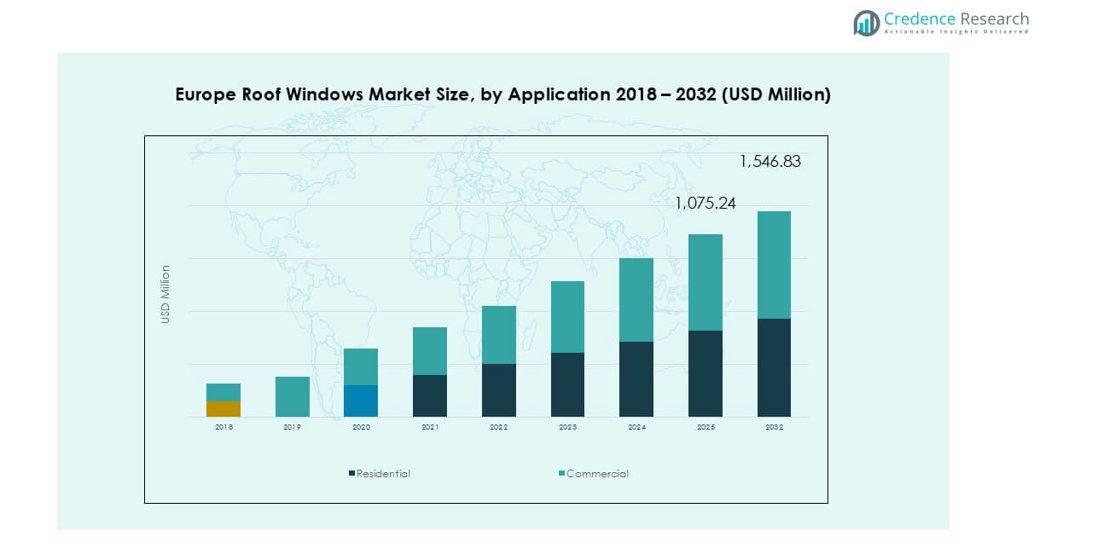

Europe Roof Windows market size was valued at USD 782.53 million in 2018, reached USD 1,025.11 million in 2024, and is anticipated to reach USD 1,546.83 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Roof Windows Market Size 2024 |

USD 1,025.11 million |

| Europe Roof Windows Market, CAGR |

5.3% |

| Europe Roof Windows Market Size 2032 |

USD 1,546.83 million |

The Europe roof windows market is led by major players such as Velux Group, Roto Frank AG, Lamilux, Karl Lingel Fensterbau GmbH & Co. KG, Skyfens, and Brett Martin. Velux Group holds a dominant position with a wide product range and strong presence across Western and Northern Europe. Roto Frank AG and Lamilux focus on premium and customized daylight solutions, strengthening their market reach through innovation and partnerships. Western Europe accounts for over 45% of the total market share in 2024, driven by renovation activities and strict energy-efficiency regulations. Northern Europe follows with around 25% share, supported by adoption of triple-glazed, energy-efficient solutions.

Market Insights

- The Europe roof windows market was valued at USD 1,025.11 million in 2024 and is projected to reach USD 1,546.83 million by 2032, growing at a CAGR of 5.3% during the forecast period.

- Rising demand for energy-efficient and sustainable construction solutions drives adoption of double- and triple-glazed roof windows, supported by EU building performance regulations and renovation incentives.

- Market trends include growing preference for smart, automated roof windows, eco-certified wood, and recyclable PVC frames, catering to premium and environmentally conscious buyers.

- The market is moderately consolidated, with Velux Group, Roto Frank AG, and Lamilux leading, while smaller players compete through cost-effective solutions and regional distribution expansion.

- Western Europe leads with over 45% market share, followed by Northern Europe with 25%, while residential applications dominate with more than 65% share, driven by home renovation projects and rising demand for natural lighting solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

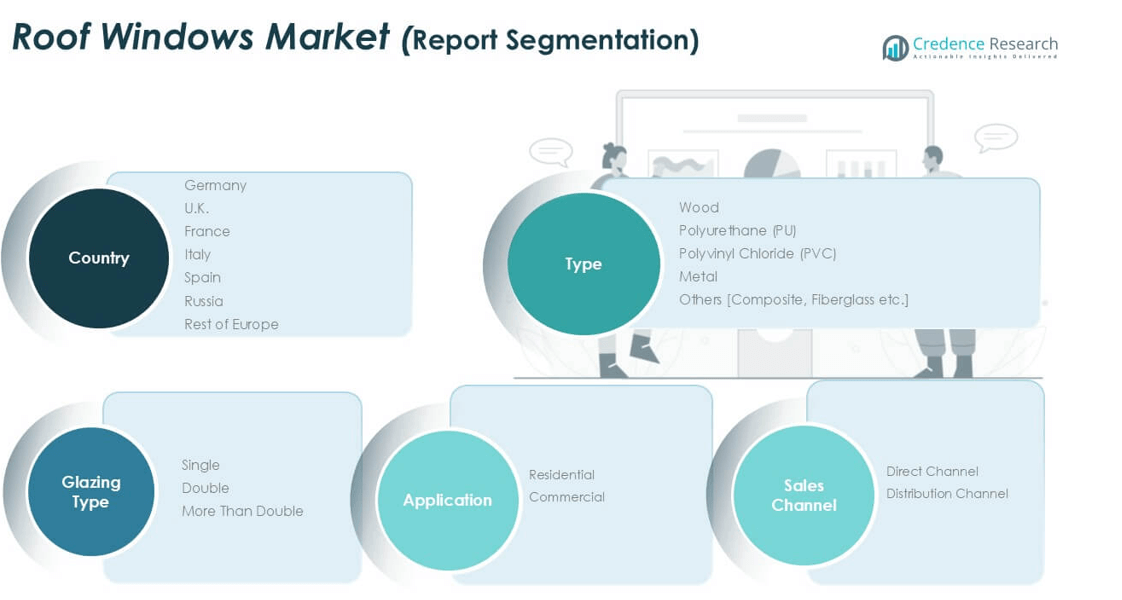

By Type

Wood roof windows dominate the Europe market, holding over 40% share in 2024 due to their aesthetic appeal and natural insulation properties. Consumers prefer wood for premium residential projects as it offers durability, energy efficiency, and compatibility with traditional architecture. Polyurethane (PU) follows, favored for its moisture resistance and suitability in kitchens and bathrooms. PVC windows grow steadily due to low maintenance needs and cost-effectiveness, while metal windows cater to industrial applications. Demand for sustainable wood products and eco-certified timber drives continued growth in this segment across Europe’s renovation and new construction markets.

- For instance, FAKRO’s PTP-V PU-coated roof window line performed well across Europe in 2023, contributing to the company’s strong overall position in the market.

By Application

The residential segment accounts for more than 65% of the market share in 2024, driven by rising demand for energy-efficient homes and daylight solutions. Homeowners increasingly adopt roof windows to improve indoor air quality, reduce energy costs, and enhance living spaces. Renovation projects and government incentives for green buildings also boost adoption. The commercial segment sees growth in offices, schools, and healthcare facilities seeking improved ventilation and natural lighting. Rising focus on workplace wellness and sustainability standards in Europe supports demand from commercial buildings, though residential remains the leading application.

- For instance, in 2023, Germany’s KfW bank and the Federal Office for Economic Affairs and Export Control (BAFA) collaborated to offer financial incentives for energy-efficiency measures under the Federal Subsidy for Efficient Buildings (BEG). Under this program, direct grants were provided by BAFA, while low-interest loans, often paired with repayment grants, were issued through KfW.

By Glazing Type

\Double glazing leads the Europe roof windows market with over 50% market share in 2024, supported by superior thermal insulation and energy savings. It strikes a balance between performance and cost, making it a preferred choice in residential and light commercial installations. Triple glazing gains momentum in Northern and Central Europe due to stricter energy-efficiency regulations and demand for enhanced noise reduction. Single glazing is declining as consumers shift toward higher-performance solutions. Energy regulations such as EU directives on building efficiency further drive adoption of double and triple-glazed roof windows across the region.

Market Overview

Rising Demand for Energy Efficiency

Europe roof windows market grows strongly as homeowners prioritize energy-efficient building solutions. Stringent EU energy performance regulations encourage installation of insulated roof windows to lower heating and cooling costs. Double and triple-glazed units reduce thermal losses, helping meet nearly zero-energy building (nZEB) standards. Renovation incentives and green building certifications like BREEAM and LEED drive higher adoption. Consumers prefer windows that combine daylighting, ventilation, and energy savings, making energy efficiency a leading factor influencing purchasing decisions across residential and commercial construction segments in Europe.

- For instance, over 95% of VELUX’s European 2023 product range met EN 14351 energy performance standards. The company’s high-performance products, such as specific triple-glazed roof windows, featured Uw-values as low as 1.0 W/m²K or better.

Urbanization and Renovation Activities

Rapid urbanization and a strong focus on housing renovations boost demand for roof windows in Europe. Older buildings are increasingly upgraded to improve natural lighting and comply with modern building codes. Renovation projects in countries like Germany, France, and the UK contribute significantly to market expansion. Roof windows offer an effective solution for adding light and ventilation without major structural changes. Government subsidies and energy renovation programs further accelerate installation, making retrofitting a critical driver supporting steady growth throughout the forecast period.

- For instance, VELUX initiated and supported the “Living Places” concept, a project in partnership with EFFEKT architects and Artelia engineers, with a prototype unveiled in Copenhagen in April 2023. The project demonstrated that it is possible to build homes with an ultra-low carbon footprint and a high-quality indoor climate using existing materials and technology.

Preference for Aesthetic and Premium Designs

Consumers in Europe increasingly favor roof windows that enhance home aesthetics and comfort. Demand rises for wood-framed and custom-designed windows that match interior styles and improve property value. Manufacturers respond with sleek frames, larger glazing areas, and motorized opening systems for convenience. Integration with smart home systems is becoming common, offering remote operation and climate control features. This trend toward premiumization not only supports higher sales volumes but also boosts average selling prices, driving revenue growth for suppliers in the regional market.

Key Trend & Opportunity

Smart and Automated Roof Windows

The adoption of IoT-enabled and solar-powered roof windows is rising across Europe. These systems feature rain sensors, automatic ventilation, and integration with smart home ecosystems, appealing to tech-savvy homeowners. Growing interest in home automation and energy management solutions drives this segment. Companies launch app-controlled and voice-assisted roof windows to enhance user convenience. This trend creates opportunities for manufacturers to differentiate offerings and capture premium market segments, particularly in Northern and Western Europe where smart home adoption is advancing rapidly.

- For instance, VELUX ACTIVE with NETATMO is a smart window system that automatically controls electric VELUX products to maintain a healthy indoor climate, with app-based control and integration with Apple HomeKit and Google Home. A related, simpler system, VELUX App Control, also offers smartphone control and voice command integration.

Sustainable and Eco-Friendly Materials

Sustainability plays a critical role in shaping product innovation in the roof windows market. Manufacturers focus on FSC-certified wood, recycled PVC, and low-carbon production processes. Eco-labeling and compliance with circular economy regulations attract environmentally conscious buyers. Demand grows for products with lower embodied carbon and improved recyclability. This creates opportunities for suppliers offering eco-certified, energy-efficient solutions that support climate goals. Such initiatives also help companies gain a competitive edge and meet stricter European Union sustainability requirements for construction materials.

- For instance, the VELUX Group sources 100% certified wood for its products, which includes wood certified by either the Forest Stewardship Council (FSC) or the Programme for the Endorsement of Forest Certification (PEFC). This certification applies to the timber used in its products, not just for European factories.

Key Challenge

High Installation and Maintenance Costs

Roof windows involve complex installation compared to standard windows, driving up labor costs. Skilled professionals are required to ensure watertight fitting and compliance with insulation standards, which can deter cost-sensitive customers. Maintenance, particularly for wood-framed windows, adds to long-term expenses. In price-sensitive markets, high upfront and ongoing costs can limit adoption, especially in large-scale retrofit projects. Manufacturers face the challenge of offering affordable solutions without compromising quality, making cost optimization a crucial factor for wider market penetration.

Fluctuating Raw Material Prices

Volatility in prices of key materials such as wood, glass, and PVC impacts production costs. Supply chain disruptions, energy price spikes, and inflation in Europe create cost pressures for manufacturers. Rising raw material prices may lead to higher product prices, reducing demand in cost-sensitive markets. Companies must adopt strategies like long-term supplier contracts and local sourcing to mitigate risk. Managing cost fluctuations while maintaining margins is a persistent challenge, particularly for smaller players competing against large international brands.

Regional Analysis

Western Europe

Western Europe dominates the Europe roof windows market with over 45% market share in 2024, driven by strong construction activity in Germany, France, and the UK. High renovation rates and strict energy-efficiency regulations, including EU directives on building performance, boost adoption. Consumers prefer double- and triple-glazed windows for insulation and noise reduction. Premium housing and heritage building restorations also support demand for wood-framed windows. Well-established players such as VELUX and Roto Frank maintain a robust distribution network in the region, ensuring wide availability and innovative solutions that cater to both residential and commercial projects.

Northern Europe

Northern Europe holds around 25% market share in 2024, benefiting from colder climates and strict energy-efficiency standards. Countries like Sweden, Norway, and Denmark prioritize triple-glazed windows to reduce heat loss and meet nZEB requirements. High disposable income and advanced construction practices support adoption of smart, automated roof windows. Homeowners value natural light and ventilation, making roof windows popular in new builds and renovations. Strong focus on sustainability drives demand for FSC-certified wood and eco-friendly materials. Local manufacturers and distributors play a significant role in offering customized solutions suitable for Nordic weather conditions.

Southern Europe

Southern Europe accounts for approximately 15% of the market share in 2024, with demand concentrated in Italy, Spain, and Portugal. Warmer climates favor roof windows for enhanced ventilation and daylight, reducing reliance on artificial cooling. Single and double-glazed windows dominate, offering a cost-effective solution for residential projects. Growth is supported by urban housing developments and refurbishment programs in historic city centers. Adoption of energy-efficient designs is rising due to EU funding and regulations. Manufacturers focus on lightweight, UV-resistant materials to withstand higher sun exposure, driving innovation tailored to Mediterranean construction needs.

Eastern Europe

Eastern Europe represents about 10% of the market share in 2024, but shows the fastest growth rate due to rising construction activities in Poland, Czech Republic, and Hungary. Increasing disposable incomes and government support for housing renovation drive adoption of energy-efficient roof windows. Double-glazed products gain popularity as homeowners seek improved insulation and reduced heating costs. The market benefits from competitive pricing and expansion of international players entering the region. Infrastructure modernization and urbanization trends create opportunities for suppliers targeting residential and small commercial projects. Rising awareness of EU energy standards supports further market penetration.

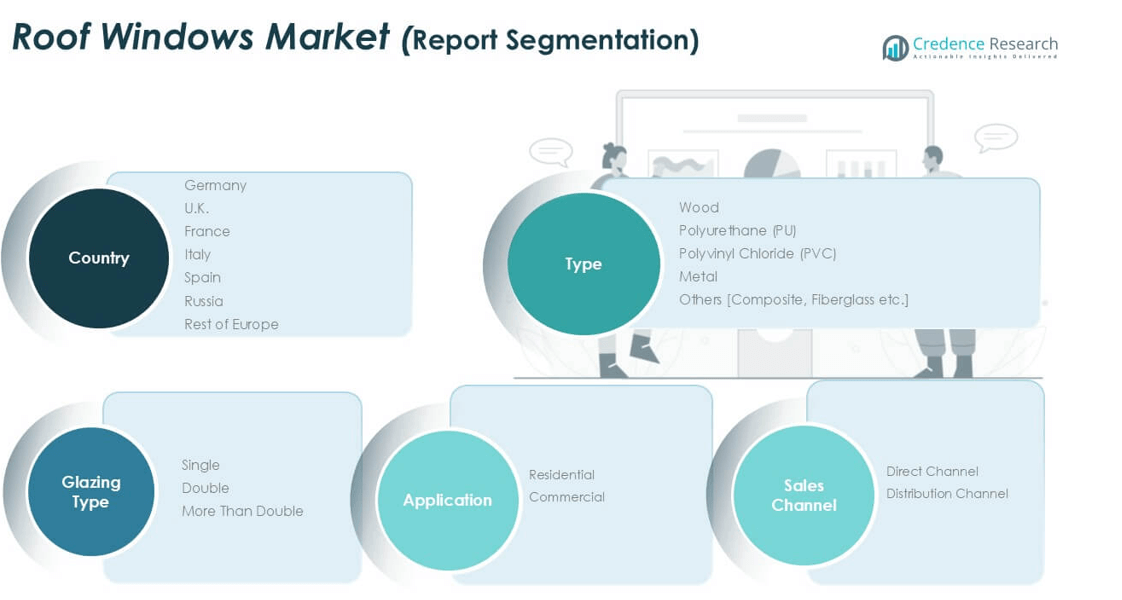

Market Segmentations:

By Type

- Wood

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Metal

- Others

By Application

By Glazing Type

- Single

- Double

- Triple and More

By Sales Channel

- Direct Channel

- Distribution Channel

By Geography

- Western Europe

- Northern Europe

- Southern Europe

- Eastern Europe

Competitive Landscape

The Europe roof windows market is moderately consolidated, with leading players such as Velux Group, Roto Frank AG, and Lamilux holding significant market share. Velux Group dominates with an extensive distribution network, innovative double- and triple-glazed solutions, and focus on energy efficiency. Roto Frank AG emphasizes precision engineering and premium hardware systems, catering to residential and commercial segments. Lamilux strengthens its position with customized daylight systems and automated solutions for industrial applications. Emerging players like RoofLITE and Skyfens compete by offering cost-effective, easy-to-install products targeting price-sensitive customers. Companies invest in sustainable materials, smart window technologies, and expansion into Eastern European markets to capture growing demand. Strategic partnerships with builders, architects, and distributors enhance market penetration. Competitive intensity is increasing as manufacturers focus on digital marketing, product differentiation, and compliance with EU energy regulations to maintain leadership and expand their presence across diverse European sub-regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Roto Frank Dachsystem-Technologie GmbH

- Velux Group

- Roto Frank AG

- Karl Lingel Fensterbau GmbH & Co. KG

- Lamilux

- Skyfens

- Skylights Plus

- Brett Martin

- RoofLITE

- AHRD

- Dakota Group

- The Metal Window Company Limited

Recent Developments

- In 2023, LAMILUX launched the Modular Glass Skylight MS78 (also referred to as a Modular Glass Roof), a customizable daylight system for buildings that combines flexibility, rapid installation, and a focus on aesthetics and sustainability.

- In April 2025, Velux launched the VELUX Skylight System, with a solar-powered, pre-installed room-darkening shade as a standard feature on all glass skylights from April 7, 2025. The new shade design lets in more daylight and provides improved thermal performance (45% U-value improvement, 19% better solar heat gain coefficient). The Skylight System supports smart home integration and features built-in rain sensors.

- In March 2025, Velux and Guardian Glass announced a joint development agreement for tempered vacuum insulated glass (VIG). This collaboration aims to advance VIG technology, focusing on developing manufacturing processes and capabilities to meet the growing demand for high-performance, energy-efficient windows.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Glazing Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe roof windows market is expected to grow steadily through 2032 with strong renovation demand.

- Energy-efficiency regulations will continue to drive adoption of double- and triple-glazed roof windows.

- Smart and automated roof window solutions will gain higher penetration in residential and commercial projects.

- Rising preference for sustainable and eco-certified materials will shape future product development.

- Manufacturers will expand offerings with customizable and larger daylight solutions to enhance aesthetics.

- Eastern Europe will show the fastest growth rate, supported by urbanization and housing upgrades.

- Integration with smart home systems will become a standard feature in premium product lines.

- Cost optimization and improved installation solutions will help attract price-sensitive customers.

- Partnerships with architects and builders will strengthen distribution networks across Europe.

- Innovation in noise reduction and thermal insulation will remain a key competitive differentiator.