Market overview

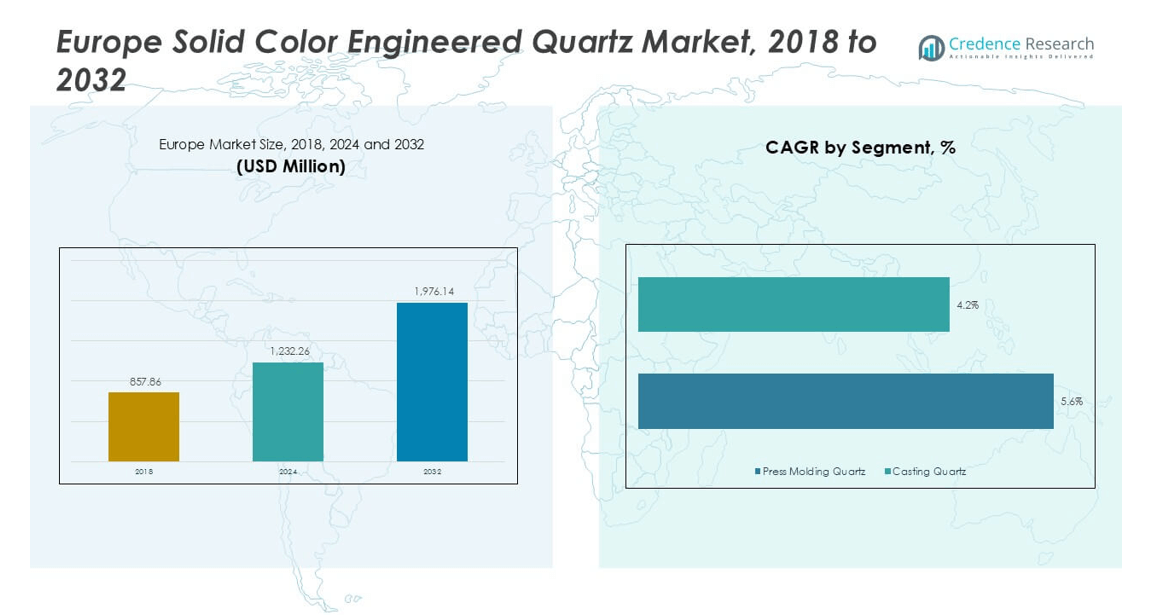

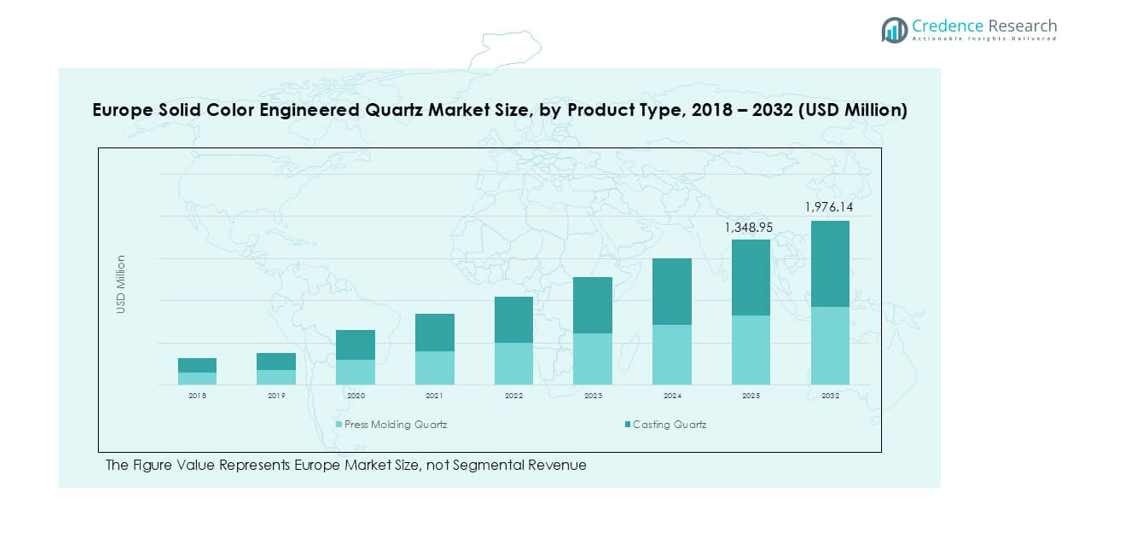

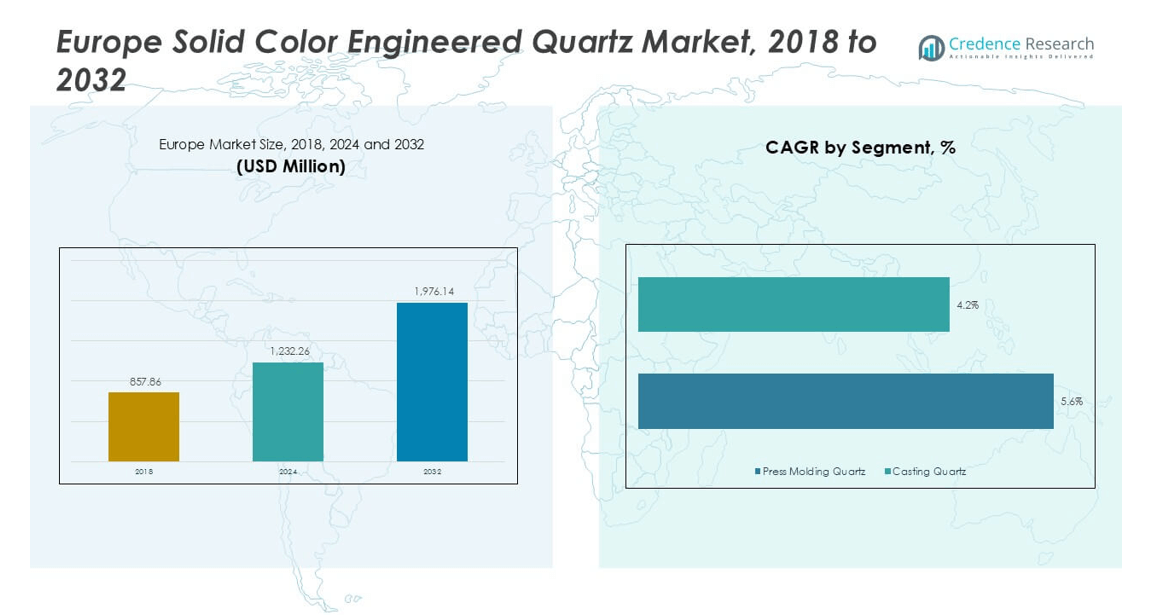

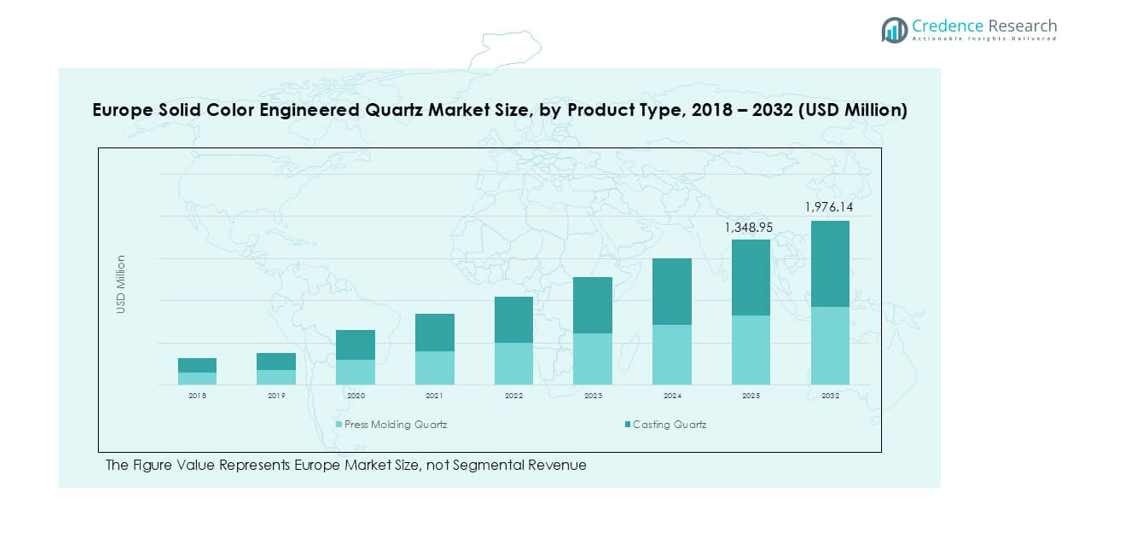

The Europe Solid Color Engineered Quartz market size was valued at USD 857.86 million in 2018, reaching USD 1,232.26 million in 2024, and is anticipated to reach USD 1,976.14 million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Solid Color Engineered Quartz Market Size 2025 |

USD 1,232.26 million |

| Europe Solid Color Engineered Quartz Market, CAGR |

5.6% |

| Europe Solid Color Engineered Quartz Market Size 2032 |

USD 1,976.14 million |

The Europe solid color engineered quartz market is shaped by leading players such as Cosentino S.A., Caesarstone, Compac The Surfaces Company, Technistone, Breton S.p.A., Santa Margherita, Quarella, Lapitec, Quartzforms, and Stone Italiana. These companies dominate through advanced production technologies, wide product portfolios, and strong brand positioning in both residential and commercial segments. Regionally, Germany leads with around 20% share in 2024, supported by robust construction activity and strict sustainability standards. The United Kingdom follows with 18%, driven by home renovation projects, while France holds about 14%, supported by demand for luxury interiors. Together, these regions anchor Europe’s growth.

Market Insights

- The Europe solid color engineered quartz market was valued at USD 857.86 million in 2018, reached USD 1,232.26 million in 2024, and is projected to hit USD 1,976.14 million by 2032, at a CAGR of 5.6%.

- Market growth is driven by rising residential renovations, premium kitchen installations, and demand for durable, low-maintenance surfaces in both homes and commercial spaces.

- Trends highlight sustainability, with manufacturers adopting eco-friendly production processes and offering customized designs to meet Europe’s growing demand for modern, minimalist interiors.

- The competitive landscape features major players including Cosentino S.A., Caesarstone, Compac, Technistone, and Breton S.p.A., focusing on innovation, distribution expansion, and design versatility.

- Regionally, Germany leads with 20% share, followed by the UK at 18% and France at 14%, while countertops dominate applications with over 45% share in 2024.

Market Segmentation Analysis:

By Product Type

In 2024, press molding quartz dominated the Europe solid color engineered quartz market, holding over 60% share. Its dominance stems from high durability, consistent texture, and cost-effectiveness compared to casting quartz. Press molding quartz is widely adopted in mass production due to lower processing complexity and faster turnaround. The rising demand for standardized and uniform slabs in residential and commercial projects further supports growth. Casting quartz, while gaining traction for premium finishes and design flexibility, remains a smaller segment due to higher production costs.

- For instance, Caesarstone, a leading manufacturer of engineered quartz surfaces, operates a state-of-the-art production facility in Bar-Lev, Israel, utilizing advanced Breton technology to produce high-quality press-molded quartz slabs.

By Application

The countertops segment led the market in 2024, accounting for more than 45% share. Countertops are favored for kitchens and bathrooms, where resistance to stains, scratches, and moisture is critical. Growing residential remodeling activities, alongside a surge in luxury home construction across Europe, fuels demand. Countertops made from solid color engineered quartz also offer wide color availability and seamless finishing, driving popularity. Flooring and wall applications are expanding steadily, supported by modern interior design trends, but they remain secondary to countertops in terms of overall adoption.

- For instance, Cosentino, a global leader in the production of innovative surfaces, manufactures its Silestone quartz countertops at a facility in Cantoria, Spain, producing over 1 million square meters of slabs annually.

By End User

The residential sector captured the largest market share of over 55% in 2024. Rising urbanization, increasing disposable income, and consumer preference for durable and low-maintenance surfaces drive residential uptake. Kitchen renovations and bathroom upgrades are key contributors, particularly in Western Europe where home improvement spending is strong. The commercial sector, including hotels, offices, and retail spaces, is showing steady growth as quartz becomes a preferred alternative to natural stone due to better cost efficiency and uniform quality. However, residential demand continues to anchor the market’s expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Growth Drivers

Rising Demand for Premium Surfaces in Residential Renovation

Europe’s solid color engineered quartz market is strongly driven by home renovation and remodeling activities, particularly in Western Europe. Homeowners increasingly prefer quartz for kitchens and bathrooms due to its durability, resistance to scratches, and low maintenance compared to natural stone. Rising disposable income and urban housing upgrades also fuel adoption. With the European housing stock aging, demand for quartz surfaces in renovation projects remains strong. Consumers prioritize materials that combine aesthetic appeal with functional performance, positioning quartz as a premium alternative to granite and marble in household applications.

- For instance, Cosentino’s solar-powered Cantoria plant in Spain generates about 34,000 MWh annually, supplying ~27% of its factory’s electricity, reinforcing sustainability credentials tied with premium branding.

Expanding Commercial Infrastructure Development

The growth of commercial spaces such as hotels, offices, retail centers, and healthcare facilities significantly boosts demand for engineered quartz. Developers favor quartz for its uniform finish, cost-effectiveness, and easy installation, which suits high-traffic environments. In the hospitality sector, quartz countertops and flooring solutions are increasingly used to deliver both durability and luxury appeal. Ongoing investments in modernizing Europe’s commercial real estate, supported by EU-backed infrastructure projects, further strengthen demand. Commercial end-users value engineered quartz for its ability to meet safety, hygiene, and aesthetic requirements while lowering long-term maintenance costs.

- For instance, Caesarstone’s Bar Lev facility processed ~185,943 tons of product in 2022, showcasing scale suited for large commercial contracts.

Technological Advancements in Manufacturing

Advancements in quartz surface production technologies are a critical growth driver. European manufacturers are adopting automation, advanced pressing systems, and eco-friendly binders to improve product quality and sustainability. Innovations in digital printing allow manufacturers to create varied textures and finishes, enhancing design versatility. These advancements enable quartz to better compete with natural stone and ceramic alternatives. With sustainability becoming a regulatory priority, companies are focusing on low-emission production and recycled content. This technological progress not only reduces costs but also aligns with Europe’s environmental goals, expanding the adoption of engineered quartz across industries.

Key Trends & Opportunities

Shift Toward Sustainable and Eco-Friendly Surfaces

Sustainability has emerged as a defining trend in the European market. Engineered quartz manufacturers are investing in greener production processes, including recycling quartz waste, reducing water usage, and switching to renewable energy sources. Consumers also increasingly seek surfaces with reduced environmental impact, pushing suppliers to highlight eco-certifications and compliance with EU environmental regulations. This trend offers opportunities for companies that position their quartz products as environmentally responsible, thereby appealing to both residential and commercial buyers focused on green building certifications such as BREEAM and LEED.

- For instance, Cosentino’s HybriQ+ technology ensures that its Silestone® slabs contain at least 20 % recycled materials and are produced using 100 % renewable electricity, with 99 % water reuse in processing.

Growing Adoption in Luxury and Customized Applications

The rising preference for customized interiors is creating new opportunities. Consumers demand personalized quartz surfaces with varied colors, finishes, and textures that suit modern architectural designs. Luxury homes, high-end hotels, and designer offices increasingly adopt solid color quartz for its seamless appearance and premium appeal. The trend toward minimalist, monochrome, and modern interior designs in Europe is also boosting demand for solid color surfaces. Manufacturers offering tailored solutions, including custom slabs and unique textures, are well-positioned to capture this niche but high-value opportunity.

Key Challenges

Competition from Alternative Surface Materials

Engineered quartz faces strong competition from alternatives such as natural stone, ceramics, laminates, and even newer composite materials. While quartz offers durability and design consistency, natural marble and granite still hold significant appeal in luxury segments. Ceramic slabs, with improved design technologies, are gaining ground in flooring and wall applications. Price-sensitive consumers may opt for laminates or other lower-cost substitutes. This competitive pressure forces quartz producers to focus on innovation, branding, and cost efficiency to maintain market share.

Regulatory and Environmental Compliance Costs

Strict environmental regulations in Europe present another challenge. Compliance with emissions standards, recycling mandates, and restrictions on harmful chemicals in resins increases production costs. Manufacturers also face rising energy costs, particularly with the EU’s focus on carbon reduction. Companies unable to adopt eco-friendly practices risk reputational damage and regulatory penalties. Smaller manufacturers may struggle with the financial burden of adapting facilities, creating consolidation opportunities for larger players but challenges for smaller firms. These regulatory demands, though necessary, place significant strain on profitability and operational flexibility.

Regional Analysis

United Kingdom

The United Kingdom held a market share of around 18% in 2024, driven by strong demand from residential remodeling and premium kitchen installations. High consumer spending on home upgrades, coupled with a preference for durable and low-maintenance materials, supports adoption. The UK’s commercial sector, especially hospitality and office renovations, further fuels growth. Increasing popularity of minimalist interior designs also favors solid color quartz over patterned alternatives. With urban housing stock requiring modernization, the UK market continues to present opportunities for both domestic manufacturers and importers targeting high-value residential and commercial applications.

France

France accounted for nearly 14% of the market in 2024, supported by growing demand in luxury residential projects and design-focused commercial spaces. French consumers prioritize aesthetic appeal and sustainability, making solid color quartz a preferred choice over natural stone. The country’s thriving hospitality sector, especially boutique hotels and restaurants, contributes to adoption. Government initiatives encouraging sustainable construction materials also align with quartz’s eco-friendly production advancements. Rising urban redevelopment projects, particularly in Paris and Lyon, create further opportunities. The French market emphasizes design innovation and environmental compliance, shaping manufacturer strategies.

Germany

Germany captured approximately 20% of the market in 2024, making it the leading regional market in Europe. Strong construction activity, particularly in high-end residential and commercial projects, drives demand. German consumers favor engineered quartz for its durability, hygiene properties, and modern aesthetics. The country’s strict environmental regulations encourage manufacturers to adopt eco-friendly production methods, supporting the shift toward sustainable quartz solutions. Germany’s strong retail sector also supports quartz adoption in kitchen and bath upgrades. With a robust industrial base and focus on premium materials, Germany remains a central hub for quartz adoption and innovation.

Italy

Italy represented nearly 12% of the market share in 2024, supported by its long-standing tradition in design and architecture. Italian consumers and designers emphasize aesthetics, which positions solid color quartz as a suitable alternative to natural marble. Demand is strong in both residential and high-end commercial applications, including luxury hotels and office spaces. Italy’s exports of quartz slabs also contribute to regional growth, with domestic manufacturers innovating in design and finishes. Rising adoption in urban housing projects and continued investment in premium interiors strengthen Italy’s role as both a producer and consumer of quartz surfaces.

Spain

Spain accounted for close to 11% of the European market in 2024, driven by strong residential adoption and rising exports of engineered quartz. The country’s manufacturers are recognized globally for quartz production, contributing significantly to both domestic supply and international demand. Solid color quartz is widely used in Spanish kitchens and bathrooms, aligning with modern interior trends. The growing tourism sector, particularly hotels and restaurants, adds commercial demand. Spain’s focus on design flexibility and competitive pricing helps it expand market presence, while domestic innovation continues to support its leadership in quartz exports.

Russia

Russia held about 9% of the Europe market in 2024, driven mainly by commercial construction projects and an expanding middle class. Rising consumer awareness of premium materials supports adoption in urban centers such as Moscow and St. Petersburg. However, market growth faces challenges from economic volatility and import dependence. Solid color engineered quartz is increasingly favored in residential renovations due to its durability and modern design appeal. The commercial sector, particularly retail and office spaces, adds to demand. Despite geopolitical and regulatory constraints, Russia remains a growth pocket in Eastern Europe.

Rest of Europe

The rest of Europe collectively accounted for nearly 16% of the market in 2024, with strong contributions from Nordic countries, Eastern European nations, and smaller Western European economies. Residential demand is expanding due to urban housing upgrades and rising disposable incomes. Commercial projects, including hotels, offices, and retail outlets, also support market penetration. Countries such as Poland and the Netherlands are witnessing increased adoption of quartz surfaces due to affordability and durability. Sustainability-driven construction regulations across the EU encourage quartz use, creating opportunities for manufacturers targeting eco-certified, design-oriented, and competitively priced solutions.

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Quartz

By Application

- Flooring

- Walls

- Countertops

- Door Jambs

- Others

By End User

By Geography

- United Kingdom

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe solid color engineered quartz market is moderately consolidated, with a mix of multinational leaders and regional specialists driving competition. Companies such as Cosentino S.A., Caesarstone, Compac the Surfaces Company, Technistone, and Breton S.p.A. hold strong positions due to their broad product portfolios, advanced manufacturing technologies, and extensive distribution networks. Italian and Spanish manufacturers play a key role, leveraging their expertise in design and production to capture both domestic and export demand. Innovation in finishes, textures, and sustainable manufacturing practices has become a critical differentiator, as European buyers increasingly value eco-certified and customizable quartz solutions. Strategic partnerships with architects, designers, and distributors further strengthen market penetration, particularly in high-growth residential and commercial projects. Smaller players focus on niche applications and competitive pricing to maintain relevance. With growing emphasis on sustainability, design flexibility, and premium quality, competition is expected to intensify as companies expand product lines and invest in advanced technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cosentino S.A.

- Caesarstone

- Compac The Surfaces Company

- Technistone

- Breton S.p.A.

- Santa Margherita

- Quarella

- Lapitec

- Quartzforms

- Stone Italiana

Recent Developments

- In July 2025, Caesarstone launched ICON™, a revolutionary crystalline silica-free solid surface (less than 1% silica) with approximately 80% recycled content, prioritizing both safety for fabricators and sustainability for consumers.

- In July 2025, Vicostone launched 10 new quartz colors for the fall season, focusing on inspirations from natural elements and aesthetics.

- In May 2025, RAK Ceramics commissioned its new next-generation slab production facility using Continua+ PCR 2180 technology, marking a significant technological leap in large-format engineered quartz and ceramic surfaces.

- In May 2024, WK Stone partnered with Eight Homes to offer Quantum Zero, a recycled surface as a safe alternative to high-silica engineered stone

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong demand from residential renovations.

- Countertops will remain the leading application due to durability and design appeal.

- Commercial projects will increasingly adopt quartz for hotels, offices, and retail spaces.

- Germany will continue to lead the market, supported by strict sustainability standards.

- The UK and France will show strong growth with high remodeling activity.

- Manufacturers will invest more in eco-friendly and low-emission production processes.

- Customized designs and color options will attract premium buyers across Europe.

- Competition will intensify as regional players expand their product portfolios.

- Technological innovations will enhance efficiency and broaden design flexibility.

- Sustainability certifications will become a key factor in purchasing decisions.