| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Thermoplastic Polyurethane Adhesive Market Size 2023 |

USD 277.89 Million |

| Europe Thermoplastic Polyurethane Adhesive Market, CAGR |

7.4% |

| Europe Thermoplastic Polyurethane Adhesive Market Size 2032 |

USD 529.43 Million |

Market Overview

Europe Thermoplastic Polyurethane Adhesive Market size was valued at USD 277.89 million in 2023 and is anticipated to reach USD 529.43 million by 2032, at a CAGR of 7.4% during the forecast period (2023-2032).

The Europe Thermoplastic Polyurethane (TPU) Adhesive market is witnessing steady growth due to rising demand from key end-use sectors such as automotive, construction, footwear, and electronics. Increasing emphasis on lightweight and durable bonding solutions in automotive manufacturing, along with the growing popularity of flexible and transparent adhesives in consumer electronics, is fueling market expansion. The construction industry’s shift toward high-performance adhesives for flooring, insulation, and panel bonding further supports market demand. Additionally, the footwear sector increasingly adopts TPU adhesives for enhanced durability and flexibility. The market also benefits from the rising adoption of eco-friendly and solvent-free adhesives, aligning with stringent EU environmental regulations. Technological advancements in adhesive formulations and growing investment in sustainable materials continue to shape market trends. As industries prioritize performance and sustainability, TPU adhesives are gaining preference over conventional bonding agents, positioning the market for continued growth throughout the forecast period.

The geographical analysis of the Europe Thermoplastic Polyurethane (TPU) Adhesive market reveals significant growth across key countries such as Germany, the UK, France, Italy, and Spain, driven by robust industrialization, expanding automotive production, and increasing demand for sustainable adhesive solutions. Germany leads in technological advancements and adoption across automotive and electronics sectors, while the UK and France benefit from rising investments in infrastructure and packaging industries. Italy and Spain show strong uptake in textiles and construction, supporting TPU adhesive penetration. Additionally, Northern and Eastern European countries are witnessing increased demand due to rapid industrial development and supportive environmental regulations. Prominent players shaping the competitive landscape include BASF, Covestro AG, Henkel AG & Co. KGaA, Arkema, The Lubrizol Corporation, Huntsman International LLC, and Wanhua. These companies are actively engaged in research and development, strategic partnerships, and product innovations to cater to evolving market needs and strengthen their regional presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Thermoplastic Polyurethane (TPU) Adhesive market was valued at USD 277.89 million in 2023 and is expected to reach USD 529.43 million by 2032, growing at a CAGR of 7.4% during the forecast period.

- The global thermoplastic polyurethane adhesive market was valued at USD 945.51 million in 2023 and is projected to reach USD 1,624.75 million by 2032, growing at a CAGR of 6.2% during the forecast period.

- The market is driven by rising demand for lightweight, flexible, and high-performance bonding solutions in the automotive, electronics, and footwear industries.

- Increasing focus on sustainable and solvent-free adhesives is encouraging manufacturers to innovate with eco-friendly TPU adhesive formulations.

- Advancements in liquid TPU adhesives are enabling their widespread use in precision applications such as medical devices and consumer electronics.

- Intense competition exists among key players such as BASF, Covestro AG, Henkel AG & Co. KGaA, and Arkema, who are focusing on R&D and strategic expansions.

- Market growth is restrained by the high production cost and limited heat resistance of TPU adhesives compared to traditional adhesives.

- Germany, the UK, France, and Italy are leading regions due to strong industrial and manufacturing bases.

Report Scope

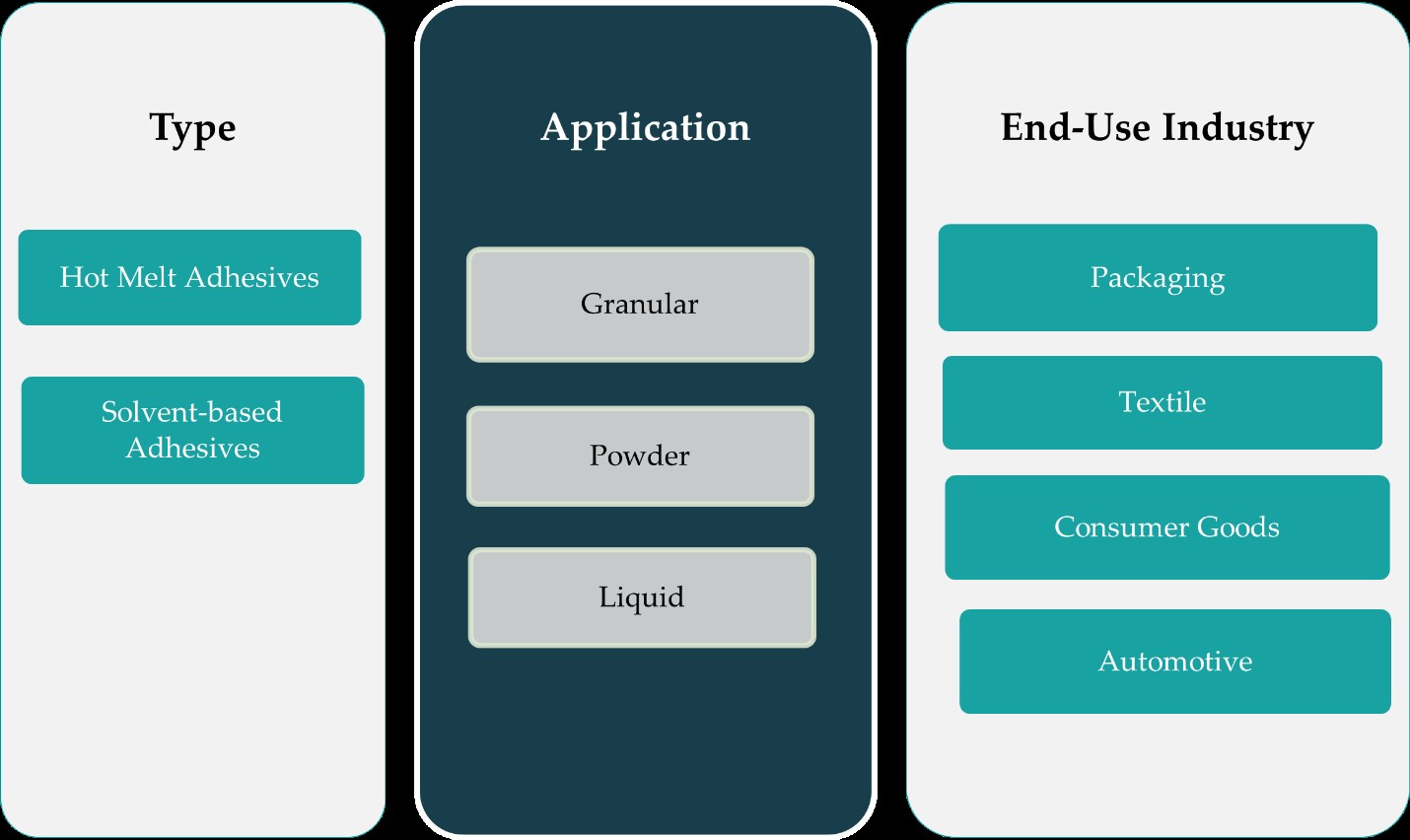

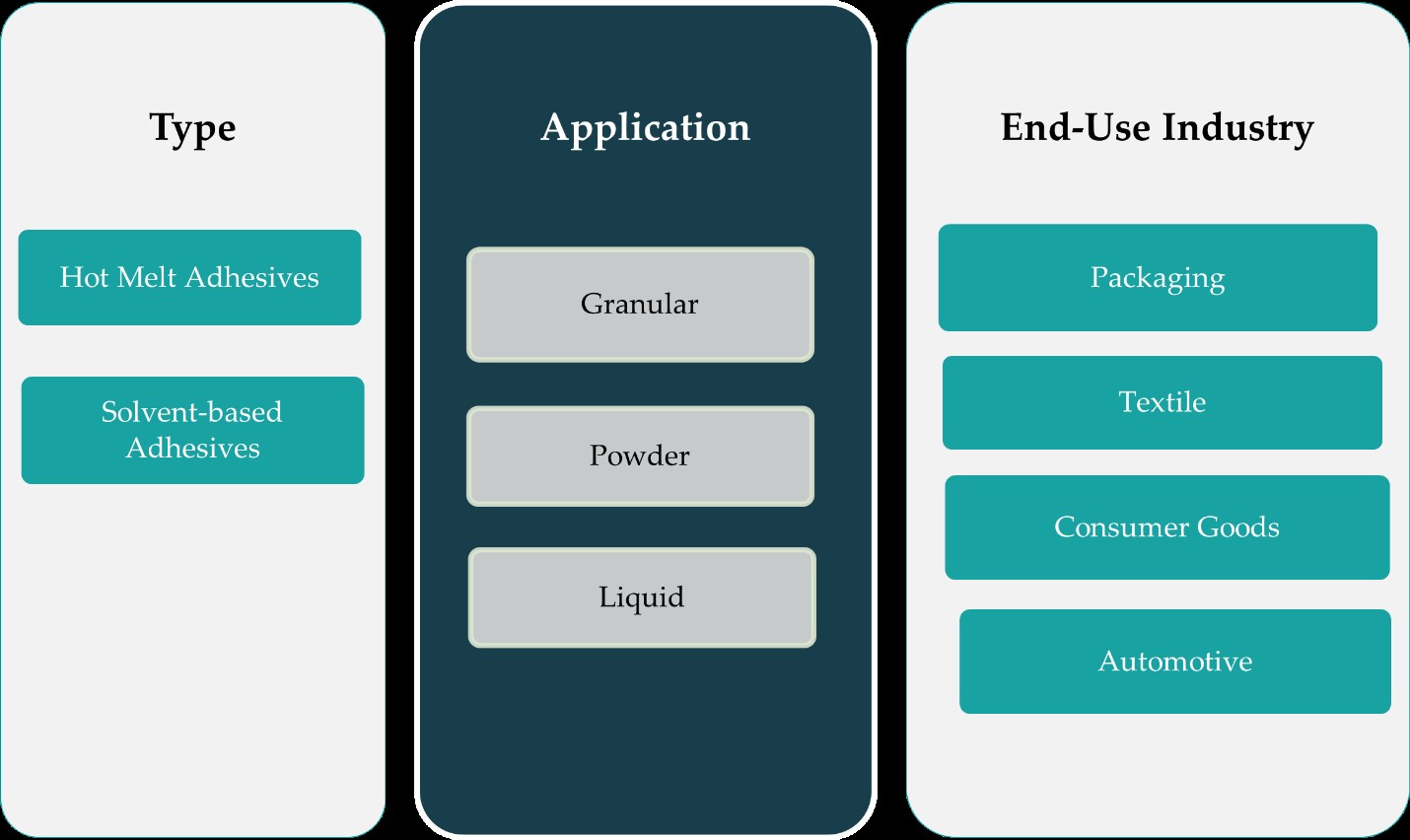

This report segments the Europe Thermoplastic Polyurethane Adhesive Market as follows:

Market Drivers

Rising Demand from Automotive and Transportation Industry

The growing automotive and transportation sector in Europe significantly drives the demand for thermoplastic polyurethane (TPU) adhesives. Automakers are increasingly adopting lightweight materials and innovative bonding solutions to enhance fuel efficiency and meet stringent emission standards. For instance, the European Commission has emphasized the role of TPU adhesives in supporting lightweight vehicle designs to comply with CO2 emission reduction targets. Additionally, Germany’s Federal Ministry for Economic Affairs and Climate Action has highlighted the use of TPU adhesives in electric vehicle (EV) battery assembly, addressing the need for high-performance bonding solutions in green mobility initiatives.

Expansion in the Construction and Building Sector

The construction industry across Europe plays a crucial role in propelling the TPU adhesive market. Increasing infrastructure development and renovation activities have led to a surge in demand for high-performance adhesives used in flooring, insulation panels, wall coverings, and window installations. For instance, the European Union’s Horizon Europe program has supported research into low-VOC TPU adhesives for energy-efficient building projects. Similarly, the UK’s Department for Levelling Up, Housing and Communities has promoted the use of environmentally friendly adhesives in residential and commercial construction to meet sustainability standards.

Growing Adoption in Footwear and Textile Manufacturing

The footwear and textile sectors represent another strong driver for TPU adhesive consumption in Europe. Footwear manufacturers are continuously innovating to create durable, flexible, and lightweight products that meet both performance and aesthetic demands. TPU adhesives are favored for bonding synthetic fabrics, leathers, soles, and linings due to their excellent elasticity, abrasion resistance, and eco-compatibility. Furthermore, the fashion and sportswear industries are integrating TPU adhesives into their production processes to achieve seamless bonding without compromising on design or comfort. The rise of athleisure and performance-based apparel, coupled with consumer preference for sustainable products, is pushing manufacturers to opt for solvent-free and recyclable adhesive solutions. This shift toward sustainable fashion and responsible sourcing practices amplifies the use of TPU adhesives in the regional footwear and textile ecosystem.

Focus on Eco-Friendly and Regulatory-Compliant Adhesive Solutions

Stringent environmental regulations and increasing consumer awareness regarding sustainability are driving the demand for eco-friendly TPU adhesives in Europe. The EU’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework and other regulatory bodies encourage the use of non-toxic, low-VOC, and recyclable materials. TPU adhesives, which are often solvent-free and recyclable, align well with these regulatory standards. Manufacturers are investing in research and development to introduce bio-based and waterborne TPU adhesive variants that offer comparable or superior performance to conventional products. The growing pressure on industrial sectors to reduce their environmental footprint has led to wider adoption of TPU adhesives in packaging, electronics, and general manufacturing. As companies strive for greener operations and improved compliance, the demand for sustainable adhesive technologies continues to gain momentum across Europe.

Market Trends

Rising Preference for Sustainable and Bio-Based Adhesives

One of the most notable trends in the Europe TPU adhesive market is the growing shift toward sustainable and bio-based adhesive formulations. Driven by increasing environmental concerns and stringent EU regulations on VOC emissions, manufacturers are developing eco-friendly TPU adhesives that align with green building standards and circular economy principles. For instance, the European Chemicals Agency (ECHA) has supported initiatives to replace solvent-based adhesives with bio-based TPU formulations derived from renewable resources. Similarly, the EU’s Horizon Europe program has funded research into water-based TPU adhesives to reduce carbon footprints and comply with green manufacturing standards.

Technological Advancements in Adhesive Performance

Continuous innovation in adhesive technologies is transforming the TPU adhesive landscape in Europe. Manufacturers are focusing on enhancing the mechanical and thermal properties of TPU adhesives to cater to more demanding industrial applications. For instance, Germany’s Federal Ministry for Economic Affairs and Climate Action has supported projects to develop advanced TPU adhesives with improved resistance to abrasion, heat, and chemicals for automotive and industrial machinery applications. Additionally, collaborations between research institutions and adhesive manufacturers have led to the development of smart adhesive systems with self-healing properties, enabling next-generation applications in consumer electronics and medical devices.

Increased Application in High-Growth End-Use Sectors

The widening application scope of TPU adhesives across emerging end-use sectors is a key trend propelling market growth. Beyond traditional industries like footwear and construction, TPU adhesives are now gaining traction in fast-growing sectors such as wearable electronics, healthcare, and renewable energy. Their biocompatibility and flexibility make them suitable for medical device assembly and wearable sensors. In the renewable energy sector, TPU adhesives are increasingly used in bonding solar panels and insulation systems. This broadening application range reflects a shift toward high-value, niche markets where performance, reliability, and compliance are paramount, creating new growth avenues for European manufacturers.

Customization and Product Differentiation Strategies

As market competition intensifies, manufacturers are increasingly focusing on product customization and differentiation to meet diverse application requirements. End-users across industries demand TPU adhesives with specific characteristics such as faster curing times, higher elasticity, or better substrate compatibility. This has led to a surge in customized adhesive solutions tailored for distinct use cases. Companies are also offering value-added services like technical support, on-site testing, and supply chain collaboration to enhance customer experience and strengthen brand loyalty. By prioritizing customer-specific formulations and strategic partnerships, manufacturers are positioning themselves competitively in a dynamic and evolving market.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Disruptions

One of the primary challenges facing the Europe TPU adhesive market is the volatility in raw material prices, particularly those derived from petrochemical sources such as polyols and diisocyanates. These materials form the backbone of TPU adhesive production, and their cost fluctuations directly impact manufacturing expenses and profit margins. Global supply chain disruptions, geopolitical tensions, and trade restrictions have further intensified procurement challenges across Europe. Unpredictable transportation costs and extended lead times have also hindered timely product delivery, affecting manufacturers’ ability to meet demand. Small and medium-sized enterprises (SMEs), in particular, face difficulties in absorbing these cost pressures, leading to pricing inconsistencies and reduced competitiveness. As the market grows more dynamic, supply chain resilience and raw material sustainability remain critical concerns for industry players operating in the region.

Stringent Regulatory Compliance and Environmental Constraints

The increasingly strict environmental regulations in Europe, while promoting sustainability, also pose compliance challenges for TPU adhesive manufacturers. Regulatory bodies such as the European Chemicals Agency (ECHA) and frameworks like REACH enforce rigorous standards on chemical composition, emissions, and safety. For instance, the EU’s REACH framework mandates costly reformulations and additional testing for solvent-based TPU adhesives to reduce volatile organic compound (VOC) emissions. Additionally, the European Commission has supported initiatives to develop bio-based alternatives, emphasizing the need for significant R&D investment to align with evolving regulatory standards while maintaining cost-efficiency.

Market Opportunities

The Europe Thermoplastic Polyurethane (TPU) Adhesive market presents significant growth opportunities driven by increasing demand for high-performance, sustainable bonding solutions across various industries. As the region moves toward stringent environmental regulations and circular economy goals, there is a rising preference for eco-friendly and solvent-free adhesive formulations. This shift creates opportunities for manufacturers to invest in bio-based TPU adhesives derived from renewable resources, aligning with both regulatory compliance and end-user sustainability goals. Furthermore, the push for lightweight, durable materials in automotive, aerospace, and electronics sectors is accelerating the need for advanced adhesives that offer superior flexibility, thermal stability, and chemical resistance. Companies that can deliver innovative, low-VOC, and recyclable adhesives stand to gain a competitive edge in the European market.

Additionally, the growing demand for smart and multifunctional adhesives in emerging applications such as wearable devices, medical electronics, and renewable energy systems opens new avenues for product diversification. The healthcare sector, in particular, offers promising potential due to the biocompatibility and skin-friendly properties of TPU adhesives, which are ideal for assembling medical sensors, patches, and devices. Similarly, the renewable energy sector’s focus on efficient solar module assembly and insulation solutions supports the adoption of TPU adhesives that meet performance and sustainability standards. Moreover, advancements in automation and adhesive application technologies create further opportunities for growth, especially as industries prioritize operational efficiency and precision. As customization and product specialization gain momentum, European manufacturers have the opportunity to expand their portfolios and strengthen their presence in both domestic and international markets.

Market Segmentation Analysis:

By Type:

The Europe TPU adhesive market is segmented by type into hot melt adhesives and solvent-based adhesives, with hot melt adhesives emerging as the dominant category. Hot melt TPU adhesives are increasingly favored for their rapid curing times, ease of application, and environmental benefits, particularly in automotive, packaging, and textile industries. These adhesives do not require solvents or drying time, making them ideal for high-speed assembly lines and sustainable production processes. Additionally, growing regulatory pressure to limit VOC emissions is accelerating the shift toward hot melt solutions across the region. While solvent-based adhesives still hold a notable share due to their strong bonding capabilities and compatibility with complex substrates, their usage is gradually declining due to environmental concerns and compliance challenges. As manufacturers continue to invest in R&D for solvent-free and low-VOC alternatives, hot melt adhesives are expected to lead the market’s growth trajectory, supported by technological advancements and expanding industrial applications.

By Application:

Based on application, the Europe TPU adhesive market is categorized into granular, powder, and liquid forms, with liquid adhesives gaining significant traction due to their versatility and ease of processing. Liquid TPU adhesives are widely used in applications that require high precision, smooth finishes, and flexible bonding, particularly in footwear, electronics, automotive interiors, and medical devices. Their ability to penetrate substrates deeply and form uniform coatings makes them ideal for complex assemblies and fine-detail work. On the other hand, granular and powder forms are primarily utilized in specific industrial processes such as extrusion and compounding, where controlled melting behavior is essential. While these forms offer benefits like extended shelf life and easier handling, they are generally limited to specialized uses. The liquid segment is poised for faster growth, driven by rising demand for adaptable, high-performance adhesives that can meet diverse functional and regulatory requirements across multiple industries in the European market.

Segments:

Based on Type:

- Hot Melt Adhesives

- Solvent-based Adhesives

Based on Application:

Based on End- User:

- Packaging

- Textile

- Consumer Goods

- Automotive

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Regional Analysis

Germany

Germany holds the largest share of the Europe TPU adhesive market, accounting for approximately 22% of the regional revenue in 2023. As Europe’s manufacturing hub, Germany’s strong presence in the automotive, electronics, and machinery sectors drives the demand for high-performance TPU adhesives. The country’s robust automotive industry, including OEMs and component manufacturers, heavily relies on TPU adhesives for lightweight assemblies and interior applications. Additionally, Germany’s growing focus on green technologies and sustainable manufacturing supports the adoption of solvent-free, recyclable adhesive solutions. The presence of major chemical and adhesive producers further strengthens the domestic supply chain, fostering innovation and advanced product development. Government incentives promoting energy efficiency and emissions reduction also encourage industries to adopt TPU adhesives in construction and electronics sectors. Germany’s mature industrial base and leadership in engineering excellence continue to position it as a key growth engine in the regional TPU adhesive landscape.

United Kingdom and France

The United Kingdom and France together represent a combined market share of approximately 25%, with the UK contributing around 13% and France holding about 12% in 2023. The UK market is primarily driven by advancements in automotive manufacturing, aerospace, and packaging, where TPU adhesives offer durability, flexibility, and chemical resistance. Additionally, growing investments in smart infrastructure and consumer electronics promote the use of high-performance bonding agents. In France, the construction and footwear industries are major contributors to TPU adhesive consumption. With a rising trend toward sustainable building practices and eco-conscious fashion, both countries are witnessing increased demand for low-VOC adhesive formulations. Government policies supporting green manufacturing and regional innovation programs further enhance market potential across these economies. Both countries also emphasize research partnerships and collaboration among adhesive manufacturers, enabling new product introductions and technology upgrades.

Italy and Spain

Italy and Spain collectively account for 17% of the European TPU adhesive market, with Italy contributing 9% and Spain 8%. In Italy, the growing demand from luxury automotive, furniture, and textile sectors supports the adoption of TPU adhesives, particularly in high-end applications where aesthetics and performance are crucial. Spain, on the other hand, is seeing increased consumption of TPU adhesives in the construction and renewable energy sectors. Ongoing residential and commercial infrastructure projects and solar installations are creating strong demand for weather-resistant adhesive solutions. Both countries benefit from government-backed sustainability initiatives and energy-efficient construction mandates, prompting industries to shift toward advanced, eco-friendly adhesive technologies. Additionally, regional SMEs and exporters are increasingly adopting automation, which further drives the use of adaptable TPU adhesive products.

Rest of Europe

The Rest of Europe, including countries such as Poland, Sweden, Russia, Denmark, Belgium, Austria, Switzerland, and the Netherlands, collectively contributes around 36% of the market share in 2023. Among these, Poland and Sweden are emerging as key markets due to industrial growth, foreign direct investment, and expanding automotive and electronics sectors. Russia continues to see steady demand, particularly in industrial and construction applications, though geopolitical factors and import dependencies pose challenges. The Netherlands and Belgium benefit from strong logistics and chemical production infrastructure, promoting steady adhesive consumption across packaging and manufacturing sectors. Meanwhile, Switzerland and Austria focus on premium and niche applications in medical devices and precision electronics, driving innovation in TPU adhesive formulations. Collectively, these countries offer significant opportunities for market expansion through localized production, cross-border collaboration, and adoption of sustainable adhesive technologies in line with EU climate goals.

Key Player Analysis

- BASF

- Covestro AG

- Henkel AG & Co. KGaA

- Arkema

- Abifor

- The Lubrizol Corporation

- Wanhua

- Huntsman International LLC

- Kolon Industries

- Avery Dennison Corporation

- American Polyfilm Inc.

- COIM Group

- Others

Competitive Analysis

The competitive landscape of the Europe Thermoplastic Polyurethane (TPU) Adhesive market is marked by the presence of several well-established global and regional players who are continuously investing in innovation, product development, and strategic collaborations to strengthen their market position. Leading companies such as BASF, Covestro AG, Henkel AG & Co. KGaA, Arkema, Abifor, The Lubrizol Corporation, Wanhua, Huntsman International LLC, Kolon Industries, Avery Dennison Corporation, American Polyfilm Inc., and COIM Group are actively involved in expanding their adhesive portfolios to meet the evolving requirements of industries such as automotive, construction, electronics, and packaging. These players focus on developing sustainable, solvent-free, and high-performance TPU adhesives to align with stringent environmental regulations and increasing consumer demand for eco-friendly products. Many companies are also enhancing their regional footprint through mergers, acquisitions, and the establishment of new manufacturing units. Additionally, R&D initiatives targeting bio-based TPU formulations, enhanced adhesion properties, and ease of application are helping these firms stay ahead of the competition.

Recent Developments

- In March 2025, Huntsman secured ISCC+ certification for its TPU production sites in Jinshan, China, and Osnabrück, Germany, enabling the production of mass balance-certified products to support sustainability goals.

- In February 2025, Covestro showcased its stretchable TPU films for medical wearables at MD&M West 2025, emphasizing applications in healthcare and electronics.

- In February 2025, Henkel inaugurated a new Application Engineering Center in Chennai, India, to accelerate adhesive product development for electronics.

- In January 2025, H.B. Fuller launched Advantra 9217 adhesive for mono cartons at PrintPack India 2025, designed for high-speed operations with enhanced weather resistance.

- In August 2024, Huntsman launched the AVALON® GECKO TPU range, offering slip resistance for footwear applications while incorporating circularity principles.

Market Concentration & Characteristics

The Europe Thermoplastic Polyurethane (TPU) Adhesive market exhibits a moderately concentrated structure, characterized by the presence of a mix of global leaders and regional manufacturers competing on technology, product quality, and innovation. A few major players hold a significant share of the market due to their extensive product portfolios, strong distribution networks, and continuous investments in research and development. These firms are actively introducing advanced, sustainable adhesive solutions to meet evolving environmental regulations and consumer expectations. The market also demonstrates high entry barriers, primarily due to the capital-intensive nature of production, strict compliance standards, and the need for technical expertise. Furthermore, the industry is characterized by rapid innovation cycles, with growing demand for eco-friendly, low-VOC, and high-performance adhesives across end-use sectors such as automotive, electronics, construction, and textiles. As sustainability becomes a core focus, the market is witnessing increased competition around green chemistry and bio-based TPU adhesive formulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to grow steadily, driven by increasing demand across automotive, electronics, and construction sectors.

- Sustainability initiatives are prompting manufacturers to develop bio-based and recyclable TPU adhesives to meet environmental regulations.

- Advancements in hot melt adhesive technology are enhancing performance, leading to broader adoption in various industries.

- The medical sector is increasingly utilizing TPU adhesives for applications requiring flexibility and biocompatibility.

- Automotive manufacturers are adopting TPU adhesives to reduce vehicle weight and improve fuel efficiency.

- Integration of TPU adhesives in consumer electronics is rising due to their durability and adaptability to various materials.

- Research and development efforts are focused on improving adhesive properties to cater to specialized industrial needs.

- The packaging industry is shifting towards solvent-free TPU adhesives to align with eco-friendly practices.

- Emerging economies in Eastern Europe are expected to contribute significantly to market growth due to industrial expansion.

- Strategic collaborations and mergers among key players are anticipated to enhance product offerings and market reach.