Market Overview:

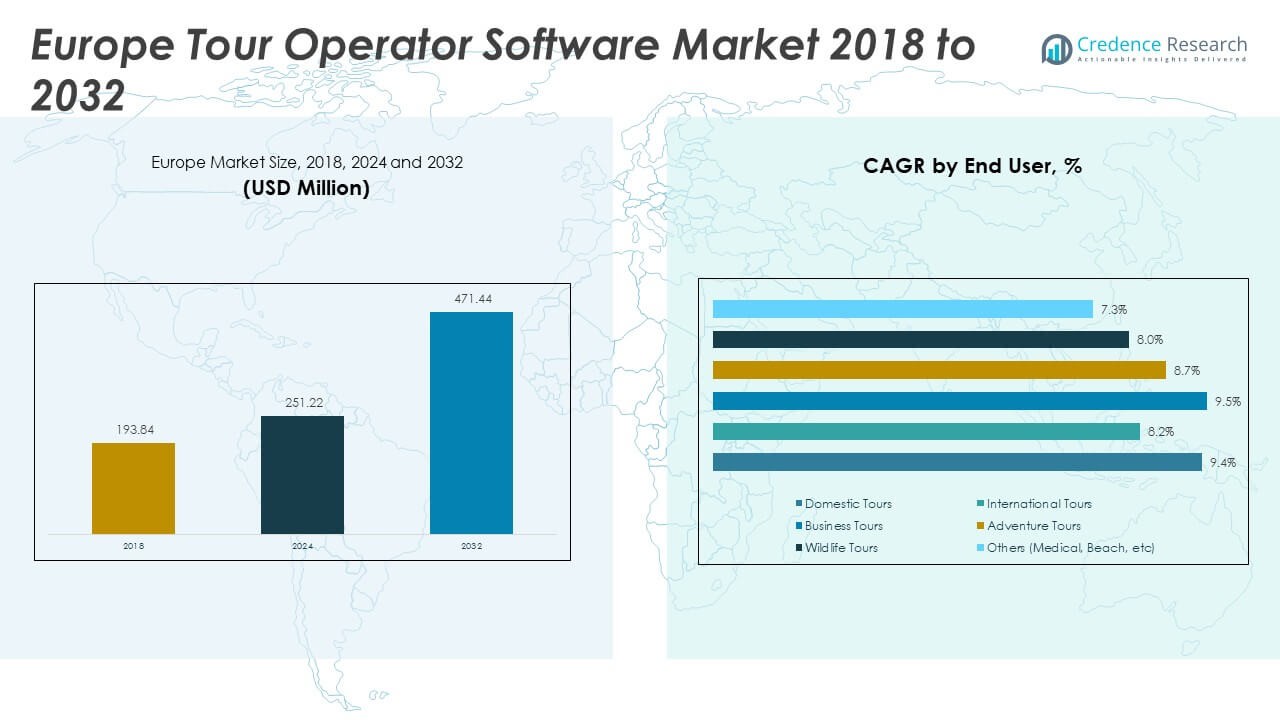

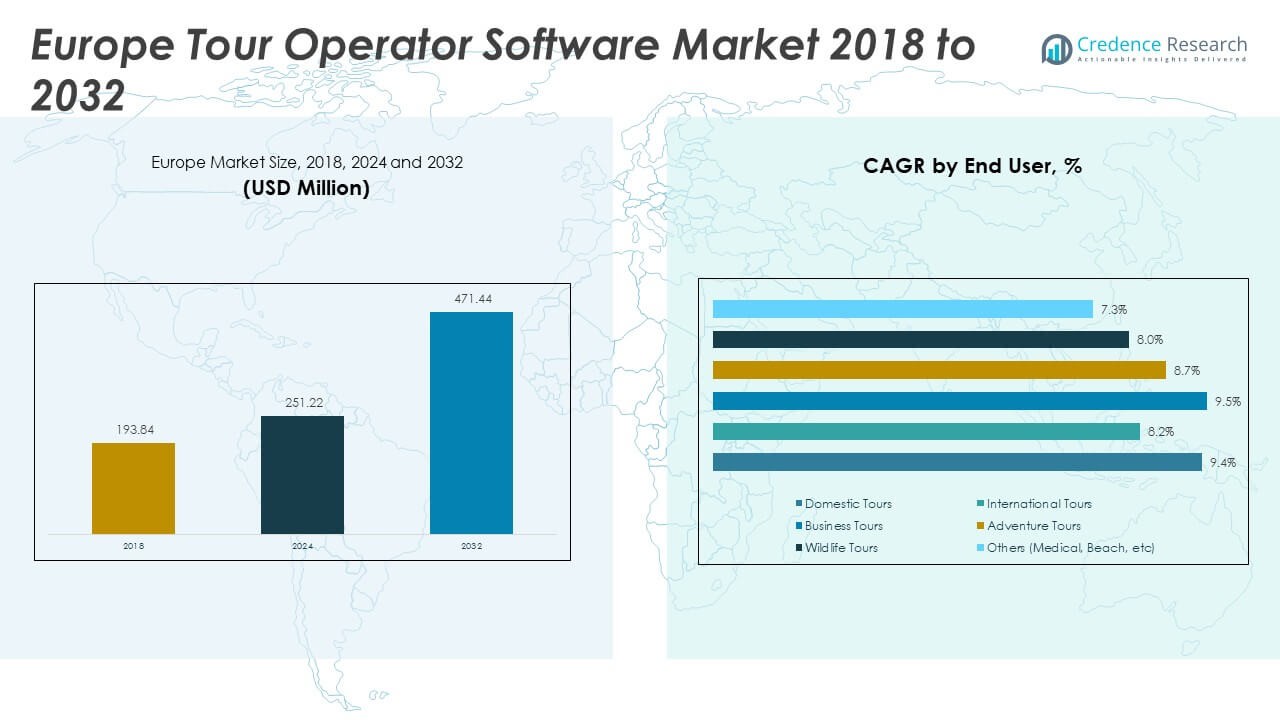

The Europe Tour Operator Software Market size was valued at USD 193.84 million in 2018 to USD 251.22 million in 2024 and is anticipated to reach USD 471.44 million by 2032, at a CAGR of 8.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Tour Operator Software Market Size 2024 |

USD 251.22 Million |

| Europe Tour Operator Software Market, CAGR |

8.20% |

| Europe Tour Operator Software Market Size 2032 |

USD 471.44 Million |

Growing digital adoption across the tourism sector is driving the demand for advanced tour operator software in Europe. Operators are using these platforms to streamline booking systems, manage customer relationships, automate payments, and improve overall efficiency. The rising preference for personalized travel experiences, along with the expansion of online booking channels, is pushing travel agencies and operators to invest in modern software. Cloud-based solutions and integration with mobile apps are further supporting market growth, making travel services more accessible and efficient.

Geographically, Western Europe holds a strong position due to its advanced tourism infrastructure, high technology adoption, and large base of established operators. Countries such as Germany, the UK, France, and Spain lead the market, benefiting from their strong inbound and outbound travel volumes. Meanwhile, Eastern and Southern Europe are emerging as growth markets, driven by rising tourism activities, increasing investments in digitalization, and growing adoption of software among mid-sized and regional operators. These regions are expected to contribute significantly to future expansion as operators modernize their processes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Tour Operator Software Market was valued at USD 193.84 million in 2018, reached USD 251.22 million in 2024, and is projected to hit USD 471.44 million by 2032, at a CAGR of 8.20%.

- Germany (24%), United Kingdom (21%), and France (18%) dominate the market, supported by advanced tourism infrastructure, digital adoption, and strong inbound and outbound travel activity.

- Eastern Europe (12%) is the fastest-growing region, fueled by rising tourism activity, digital adoption among mid-sized operators, and growing investments in travel technology.

- By component, software accounts for 58% of the market in 2024, driven by strong demand for automation, personalization, and integrated booking solutions.

- Services hold 42% share, reflecting operator demand for customization, integration support, and ongoing technical assistance.

Market Drivers:

Rising Demand for Digital Transformation in Travel Operations:

The Europe Tour Operator Software Market is expanding due to the rapid digitalization of the travel industry. Operators are shifting from manual processes to automated platforms to streamline bookings and operations. Cloud-based tools allow companies to manage reservations, itineraries, and payments more efficiently. The growing demand for seamless customer experiences is pushing travel agencies to adopt integrated platforms. Personalization through customer data analytics strengthens client engagement and loyalty. Mobile-friendly solutions are further improving accessibility and convenience for both operators and customers. It is becoming essential for operators to leverage software to stay competitive.

- For instance, Intuitive Systems’ iVector platform offers comprehensive omni-channel reservation capabilities with connectivity to suppliers worldwide, enabling real-time itinerary building and dynamic packaging that boosts conversion rates and customer choice.

Increasing Adoption of Cloud-Based Platforms Across Operators:

Cloud solutions are driving significant adoption in the Europe Tour Operator Software Market. Operators are drawn to flexible subscription models that lower upfront costs. Cloud integration enables scalability, security, and accessibility across multiple locations. Agencies use these platforms to collaborate in real time, enhancing coordination across offices. Software vendors are introducing AI-driven tools that optimize schedules, pricing, and resource allocation. Travel agencies prefer cloud platforms for their ability to update in line with regulatory requirements. Strong vendor support and regular upgrades improve operational efficiency. It is now common for even smaller operators to migrate to cloud systems.

- For example, iVectorOne by Intuitive Systems is a single API platform integrating bedbanks, DMCs, and hotel suppliers, reducing supplier connection maintenance and enabling rapid addition or replacement of services. Its AI-driven tools optimize scheduling and pricing dynamically, while strong vendor support ensures continuous upgrades aligned with regulations.

Growing Demand for Personalized Travel Experiences:

Customers are seeking tailored travel packages, driving innovation in the Europe Tour Operator Software Market. Operators use advanced analytics to design personalized tours based on preferences. Platforms integrate CRM tools that track customer behavior and past purchases. Personalization strengthens retention and builds stronger relationships with clients. Operators use AI-driven recommendations to provide unique travel experiences. This approach allows companies to differentiate from generic offerings. Increasing demand for curated luxury tours and niche travel packages accelerates adoption. It is clear that personalization has become a central growth driver for operators.

Regulatory Push and Rising Need for Transparency:

Regulations in Europe are influencing adoption of advanced operator software. The Europe Tour Operator Software Market benefits from strict data protection frameworks such as GDPR. Operators need platforms that ensure compliance and secure customer information. Automated software helps companies meet reporting requirements and reduce errors. Transparency in pricing and service delivery has become critical for customer trust. Platforms enable agencies to generate accurate invoices and comply with tax rules. Vendors are embedding compliance modules into their solutions to meet legal standards. It is now necessary for operators to modernize to remain compliant and competitive.

Market Trends:

Integration of Artificial Intelligence and Automation:

Artificial intelligence is reshaping the Europe Tour Operator Software Market by streamlining decision-making. Operators are deploying AI-driven tools for demand forecasting, itinerary planning, and chatbots. Automation reduces the workload on staff and improves response times for customers. AI enhances customer service by offering instant recommendations and dynamic package adjustments. Travel companies are experimenting with predictive analytics to anticipate seasonal travel trends. Intelligent systems also support upselling and cross-selling strategies. It is enabling operators to move towards more efficient and customer-focused business models.

- For instance, Expedia’s virtual agent, built with AI powered by ChatGPT, assists customers by compiling personalized itineraries from natural language conversations, which helps streamline the planning and booking process. Other AI-driven travel platforms, like Hopper, utilize predictive analytics to forecast flight and hotel prices, allowing customers to book at the most optimal time and potentially increasing conversion rates.

Expansion of Mobile-First Travel Management Solutions:

The shift toward mobile platforms is a key trend in the Europe Tour Operator Software Market. Customers prefer booking and managing trips via mobile applications. Operators are investing in apps that provide instant booking confirmations, itineraries, and payment gateways. Mobile platforms enhance user convenience and accessibility, strengthening client loyalty. Travel companies design apps with offline features for use in remote areas. Push notifications are widely used to engage travellers with updates and offers. It is positioning mobile-first solutions as a dominant channel for customer engagement.

Growing Popularity of Virtual Tours and Digital Engagement:

Virtual tour technology is gaining traction in the Europe Tour Operator Software Market. Agencies use virtual reality and immersive content to showcase destinations. These solutions allow customers to preview experiences before committing to bookings. Digital engagement tools such as interactive itineraries increase customer confidence. Operators use online content marketing and social platforms to reach broader audiences. Younger travellers are particularly responsive to immersive and interactive promotions. It is driving software vendors to integrate multimedia capabilities into their platforms.

Emphasis on Sustainable and Eco-Friendly Travel Management:

Sustainability is influencing travel software development in the Europe Tour Operator Software Market. Operators highlight eco-friendly travel packages through integrated platforms. Customers prefer agencies that showcase responsible travel choices. Software solutions help operators measure carbon footprints and display sustainable options. Platforms include tools for tracking eco-friendly accommodations and transport. Operators promote sustainable practices as part of their branding strategy. It is encouraging travel companies to integrate sustainability into core digital offerings.

Market Challenges Analysis:

High Implementation Costs and Technology Barriers:

The Europe Tour Operator Software Market faces challenges due to high upfront costs for advanced platforms. Small and medium operators often hesitate to invest heavily in new systems. Training employees to adapt to digital tools creates additional expenses. Resistance to change among traditional operators slows adoption. Integration with legacy systems remains complex and time-consuming. Software upgrades and licensing fees also place financial pressure on companies. It is often difficult for smaller players to compete with larger operators that have stronger digital capabilities.

Cybersecurity Risks and Data Management Concerns:

Data protection remains a pressing challenge for the Europe Tour Operator Software Market. Travel companies handle sensitive customer data, making them targets for cyberattacks. Regulatory compliance with GDPR adds complexity to operations. Operators face reputational damage if breaches occur. Data storage across multiple platforms increases risks of unauthorized access. Vendors must strengthen encryption and authentication protocols. Customers demand higher transparency in data usage policies. It is vital for operators to prioritize cybersecurity to maintain trust and operational reliability.

Market Opportunities:

Rising Demand for Niche and Experiential Travel:

The Europe Tour Operator Software Market presents opportunities through niche travel experiences. Customers seek adventure tourism, wellness retreats, and cultural immersion. Operators can leverage software to design tailored packages for these segments. Platforms provide tools to integrate local partnerships and manage customized itineraries. Growing interest in unique travel styles creates space for innovation. Operators offering specialized tours gain competitive differentiation. It is becoming increasingly profitable for agencies to invest in niche offerings.

Expanding Use of Data Analytics for Competitive Advantage:

Analytics adoption creates new opportunities for the Europe Tour Operator Software Market. Operators use data-driven insights to optimize pricing, improve demand forecasting, and track customer behavior. Predictive analytics helps companies anticipate emerging travel trends. Platforms with analytics features support better decision-making across business functions. Agencies that embrace analytics can improve margins and customer satisfaction. Software vendors are enhancing platforms with integrated reporting dashboards. It is enabling operators to maintain a stronger market position through informed strategies.

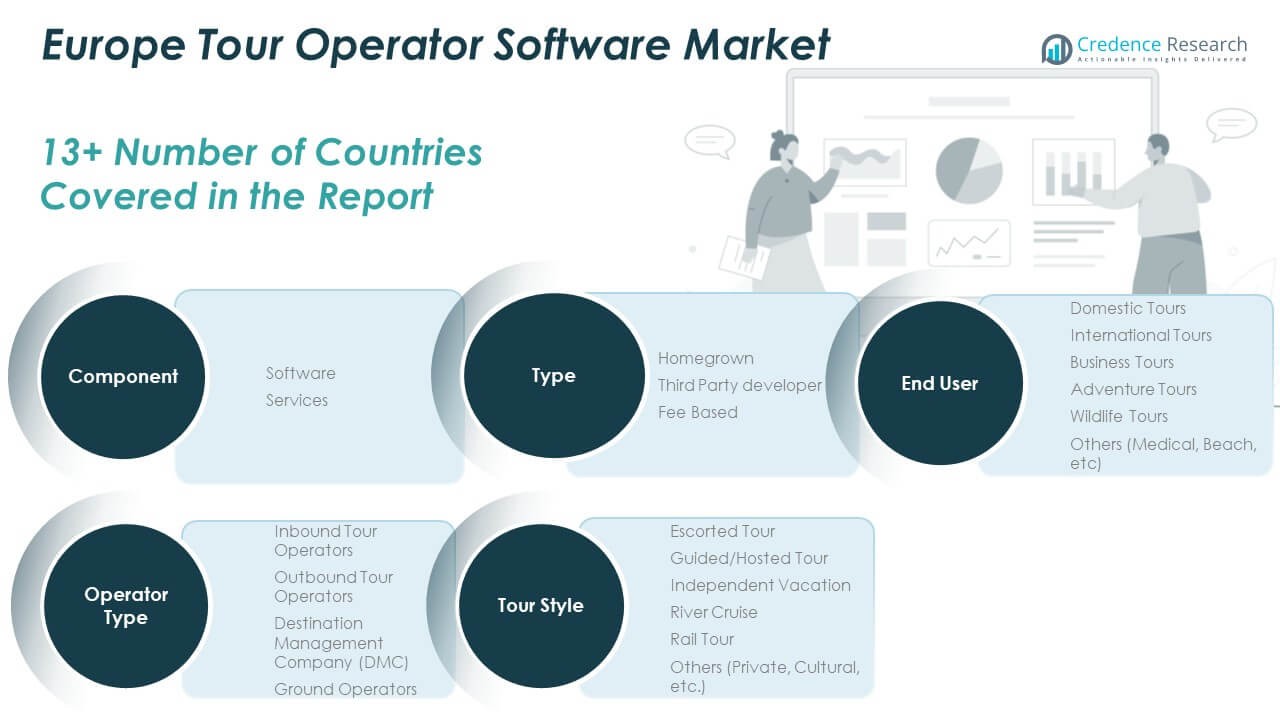

Market Segmentation Analysis:

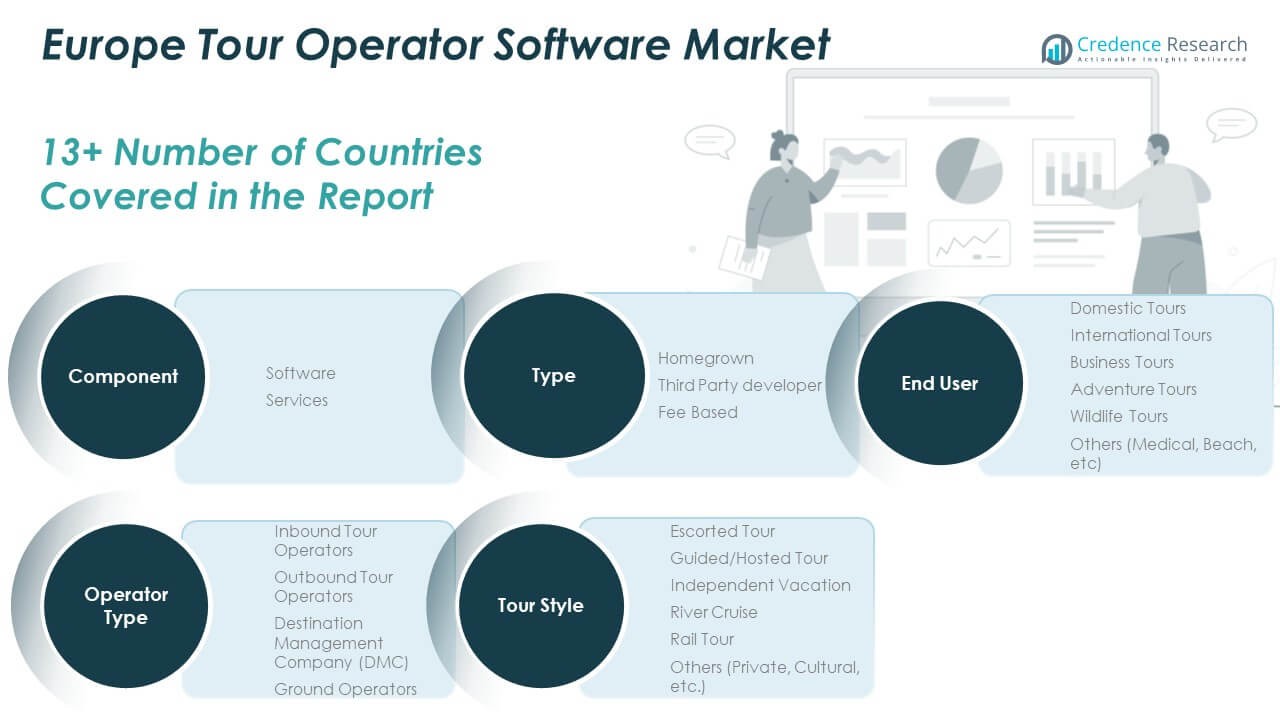

By Type

In the Europe Tour Operator Software Market, homegrown solutions remain important for smaller operators seeking high customization. Third-party developers dominate the segment, offering scalability, innovation, and integration with advanced tools. Fee-based models are steadily expanding, supported by subscription flexibility and reduced upfront investment requirements.

- For instance, third-party platforms like Intuitive Systems’ iVector offer unmatched scalability and integration with advanced technologies. Their fee-based models provide flexible subscription pricing, minimizing upfront investment and enabling rapid adoption of innovative features like AI-driven dynamic packaging and single API connectivity to multiple suppliers.

By Component

Software holds the largest share, driven by demand for automation, booking management, and personalization features. Services are also growing as operators prioritize implementation support, integration expertise, and continuous technical assistance. Both components complement each other, ensuring streamlined operations and enhanced customer experiences.

- For instance, service components such as implementation support and continuous technical assistance are growing as operators prioritize seamless integration and uptime, enhancing overall customer experience and operational smoothness.

By Operator Type

Inbound tour operators represent a major share due to Europe’s strong tourism inflows and need for efficient customer handling. Outbound operators also hold significant ground, using advanced platforms for seamless cross-border bookings. Destination Management Companies (DMCs) and ground operators increasingly rely on software to improve operational coordination and real-time service delivery.

By Tour Style

Escorted and guided tours dominate due to consistent demand from group travellers and premium customers. Independent vacations are expanding quickly as younger travellers prioritize flexibility and personalization. River cruises and rail tours remain niche but show growth potential, while private and cultural tours align with rising interest in unique and tailored travel experiences.

By End User

Domestic tours continue to serve a steady customer base, while international tours lead adoption due to Europe’s interconnected travel ecosystem. Business tours gain traction with corporate travel expansion. Adventure and wildlife tours are witnessing growth from travellers seeking experiential and eco-friendly options, while other niche categories also contribute to market diversity.

Segmentation:

By Type

- Homegrown

- Third Party Developer

- Fee Based

By Component

By Operator Type

- Inbound Tour Operators

- Outbound Tour Operators

- Destination Management Company (DMC)

- Ground Operators

By Tour Style

- Escorted Tour

- Guided/Hosted Tour

- Independent Vacation

- River Cruise

- Rail Tour

- Others (Private, Cultural, etc.)

By End User

- Domestic Tours

- International Tours

- Business Tours

- Adventure Tours

- Wildlife Tours

- Others

By Country

- Europe (regional overview)

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe

Western Europe dominates the Europe Tour Operator Software Market with a 63% share, supported by advanced tourism infrastructure, established travel agencies, and high levels of digital adoption. Germany, the United Kingdom, and France lead the region due to their significant inbound and outbound travel volumes. Operators are early adopters of automation, personalization, and compliance-focused solutions, strengthening market leadership. Cloud-based platforms and mobile integration are widely deployed, enabling scalability and efficiency across operations. Strong vendor presence and continuous innovation further drive adoption. Western Europe remains the central hub of growth, setting benchmarks for technology usage and customer service delivery.

Southern Europe

Southern Europe holds a 17% share, driven by its strong position as a leisure and cultural tourism hotspot. Spain and Italy generate major demand, supported by high international arrivals and diverse tourism offerings. Operators in this region rely on software to manage seasonal peaks, large group tours, and personalized itineraries. Guided and cultural travel experiences strengthen the need for advanced booking and management platforms. Regional operators are investing in partnerships to expand service capabilities. Adoption continues to grow as digital transformation becomes a priority. Southern Europe is solidifying its contribution by leveraging unique tourism appeal and increasing operator efficiency.

Eastern Europe

Eastern Europe accounts for a 12% share and represents the fastest-growing region in the market. Rising middle-class spending, expanding tourism infrastructure, and digital transformation initiatives accelerate adoption in countries such as Poland, Hungary, and the Czech Republic. Operators focus on cost-efficient, cloud-based platforms that support modern booking and customer management. Domestic and adventure tours fuel growth, attracting both local and international travellers. Governments encourage tourism expansion through investments and supportive programs. The region is emerging as a strong growth hub with untapped opportunities. It is expected to reshape the regional balance with consistent technology adoption and modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Europe Tour Operator Software Market features a competitive landscape shaped by global vendors and regional specialists. Companies compete on innovation, pricing models, and integration capabilities, with strong focus on automation and cloud-based deployment. Larger players leverage established portfolios and partnerships, while mid-sized firms differentiate with customized solutions for niche operators. It is characterized by consolidation trends, where mergers and partnerships enhance market reach. Vendors emphasize compliance with European regulations and data security standards, ensuring trust and adoption. Continuous product upgrades and focus on mobile-first platforms strengthen competitive positioning across the region.

Recent Developments:

- In September 2025, TUI Group’s experiences division, TUI Musement, integrated 750 multi-day tours across 30 countries into the TravelExchange platform. This strategic partnership enhances the distribution of diverse tours, such as privately guided tours, self-drive itineraries, and mini cruises, across European source markets including Germany, Spain, France, and Italy.

- In 2025, Banyan Software acquired Intuitive Systems, a UK-based leader in leisure travel booking software. Intuitive Systems, known for its flagship iVector platform launched in 2005, supports dynamic packaging and pricing and serves tour operators, hotel wholesalers, and online travel agencies. This acquisition aims to support Intuitive’s growth and international expansion under Banyan Software’s portfolio (April 2025).

- DER Touristik reported strong growth in 2024 with an optimistic outlook for 2025, reflecting continuing high travel demand in Europe, which supports the ongoing expansion of digital tools and services in the tour operator market.

Report Coverage:

The research report offers an in-depth analysis based on type, component, operator type, tour style, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Cloud-based solutions will dominate adoption as operators seek scalability and flexibility.

- Mobile-first platforms will become essential for customer engagement and real-time booking.

- AI-driven personalization will enhance travel planning and strengthen loyalty.

- Partnerships between software providers and large operators will intensify.

- Data security and compliance with GDPR will remain central to vendor strategies.

- Growth in niche and experiential travel will fuel tailored software demand.

- Mid-sized operators will adopt cost-effective platforms to remain competitive.

- Integration of VR and AR for virtual tours will gain traction.

- Eastern Europe will emerge as a dynamic growth hub in the region.

- Vendors will expand service offerings to include analytics and customization support.