Market Overview

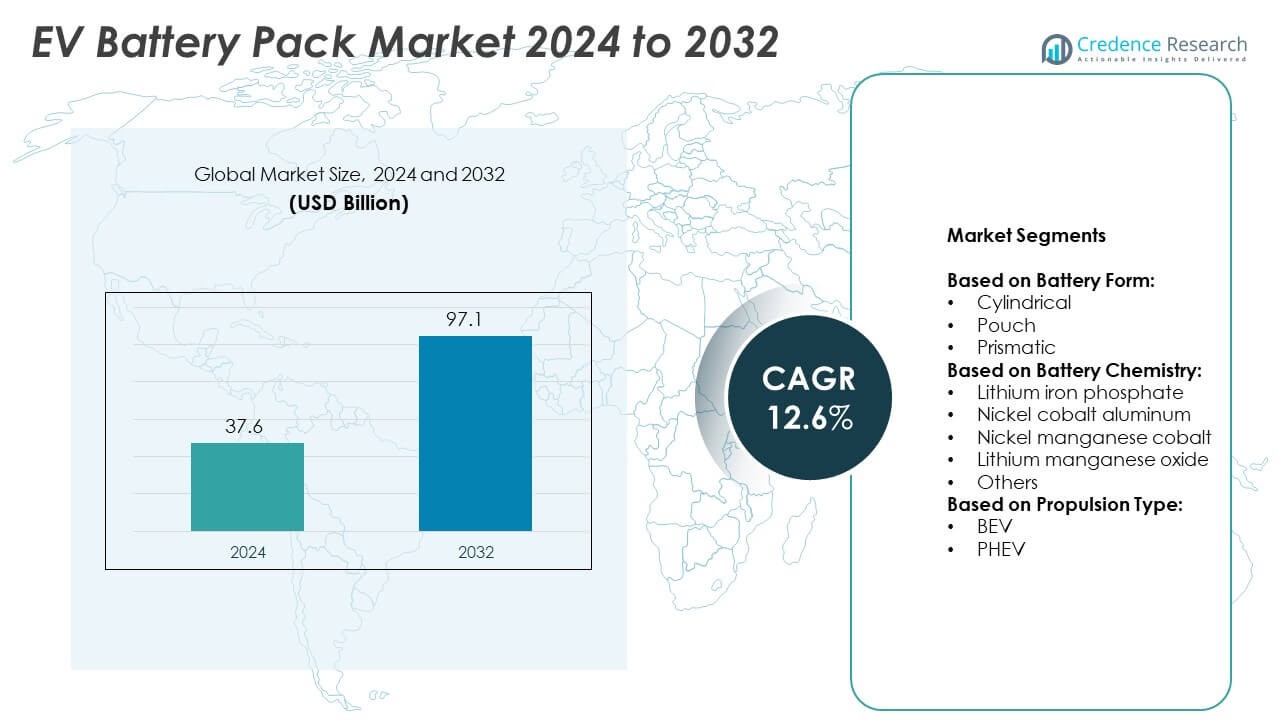

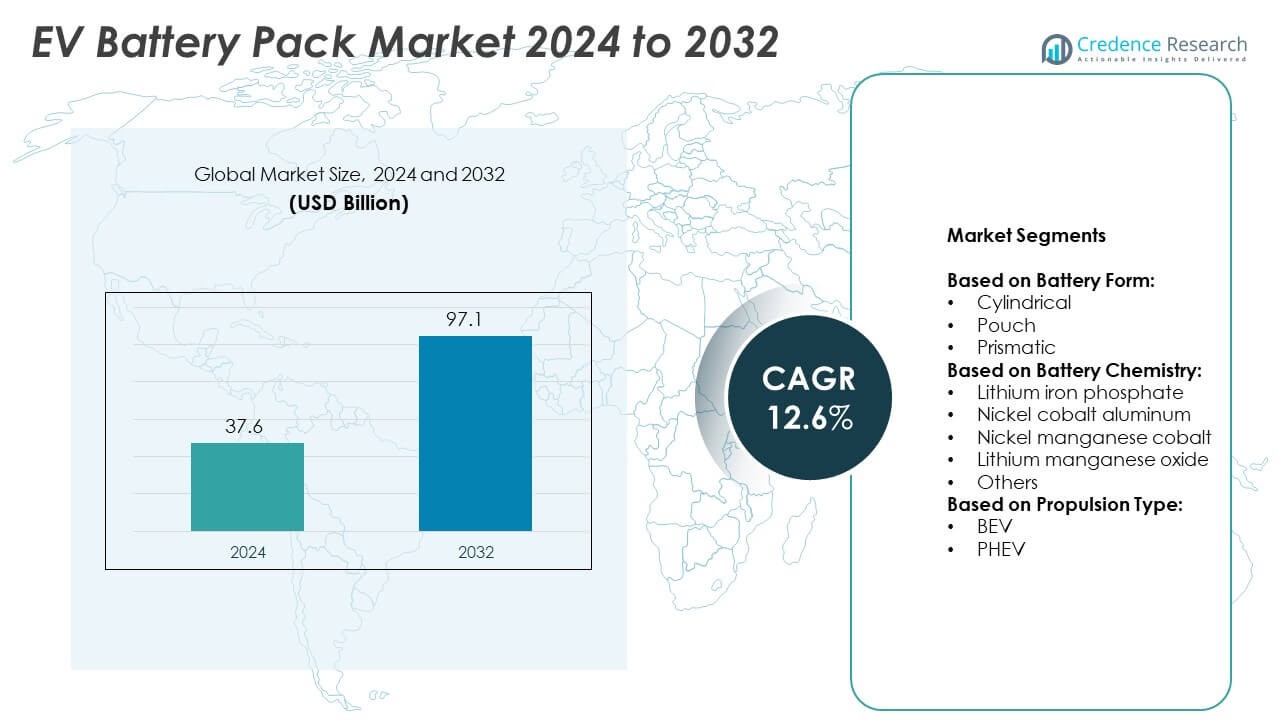

EV Battery Pack Market size was valued at USD 37.6 billion in 2024 and is anticipated to reach USD 97.1 billion by 2032, at a CAGR of 12.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EV Battery Pack Market Size 2024 |

USD 37.6 Billion |

| EV Battery Pack Market, CAGR |

12.6% |

| EV Battery Pack Market Size 2032 |

USD 97.1 Billion |

The EV Battery Pack market grows with rising electric vehicle adoption, stricter emission norms, and strong government incentives. Manufacturers focus on developing higher energy density, faster charging, and safer chemistries to improve performance. It benefits from expanding charging infrastructure and integration into renewable energy storage systems. Recycling initiatives and second-life applications reduce material dependency and enhance sustainability. Digital battery management systems with predictive analytics further strengthen reliability. These drivers and trends position the market for steady growth across multiple sectors.

North America leads with strong EV adoption supported by government incentives and large-scale manufacturing projects, while Europe advances through strict emission regulations and growing battery production hubs. Asia Pacific dominates in production and innovation, driven by China, Japan, and South Korea. Latin America and Middle East & Africa show gradual progress with renewable integration and pilot EV projects. Key players shaping the EV Battery Pack market include Panasonic, LG Energy Solution, Samsung, and TOSHIBA, each focusing on innovation and capacity expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- EV Battery Pack market was valued at USD 37.6 billion in 2024 and is projected to reach USD 97.1 billion by 2032, growing at a CAGR of 12.6%.

- Demand for electric vehicles and government incentives drive large-scale adoption of advanced battery packs.

- Solid-state and high-density chemistries, along with recycling and second-life use, define major trends.

- Leading players focus on innovation, gigafactory expansion, and partnerships with automakers to secure supply chains.

- High production costs and raw material volatility act as restraints for wider adoption.

- North America grows with investments from Tesla and GM, Europe advances with strict emission policies, and Asia Pacific dominates with China, Japan, and South Korea leading production and technology innovation.

- Latin America and Middle East & Africa show steady but smaller growth, supported by pilot EV projects, renewable integration, and early-stage charging infrastructure development.

Market Drivers

Rising Adoption of Electric Vehicles Driving Demand

The global shift toward electric mobility creates strong demand for energy storage solutions. Consumers prefer electric cars due to lower emissions, government incentives, and fuel cost savings. Automakers expand production capacity to meet growing requirements for passenger and commercial electric vehicles. EV Battery Pack market benefits from this acceleration, supported by large-scale vehicle electrification projects. Charging infrastructure development further strengthens consumer confidence in battery-powered transport. It ensures consistent growth by addressing both private and public transportation needs.

- For instance, Tesla’s battery production at its various Gigafactories, including the one in Nevada, supported the global production of 1,773,443 vehicles, of which 1,679,338 were Model 3 and Model Y by the year 2024.

Technological Advancements Enhancing Energy Density and Efficiency

Manufacturers invest in research to develop batteries with higher energy density and faster charging rates. These improvements extend driving range and reduce charging time, making electric vehicles more practical. The EV Battery Pack market integrates solid-state and advanced lithium chemistries for improved performance. It supports lightweight designs, which improve overall vehicle efficiency. Companies also focus on reducing cobalt use, lowering supply risk and production cost. Enhanced battery management systems ensure safety, reliability, and longer operational life.

- For instance, BYD concluded the year with a record-breaking sales volume of over 3.02 million new energy vehicles (NEVs), the vast majority of which were delivered in China, by the year 2023.

Government Policies and Environmental Regulations Supporting Growth

National and regional authorities introduce policies to reduce carbon emissions and air pollution. Subsidies, tax benefits, and zero-emission mandates encourage faster adoption of electric vehicles. The EV Battery Pack market benefits from strict emission standards applied to automakers. It aligns with international climate targets by promoting sustainable mobility solutions. Regulatory frameworks accelerate the transition toward green technologies across transportation sectors. Incentives for renewable-powered charging stations reinforce the market’s environmental value chain.

Expanding Energy Storage Needs Across Multiple Sectors

Beyond transportation, demand rises in renewable energy storage, industrial operations, and grid applications. EV Battery Pack market adapts to diverse use cases, supporting residential and commercial energy backup systems. It enables integration of solar and wind energy by stabilizing intermittent power supply. Businesses adopt battery solutions for uninterrupted power, reducing reliance on traditional grids. Increased deployment in developing economies highlights potential for broader energy access. Rapid urbanization and electrification efforts amplify demand for scalable and reliable battery systems.

Market Trends

Shift Toward Solid-State and Advanced Chemistries

The EV Battery Pack market is experiencing a clear move toward solid-state technology. Solid-state batteries promise higher energy density, improved safety, and longer life cycles. Automakers and suppliers invest in pilot production to accelerate commercialization. It creates opportunities to reduce reliance on scarce materials and improve cost efficiency. Lithium iron phosphate chemistry also gains ground due to stability and affordability. This trend reflects a strong industry effort to balance innovation and supply security.

- For instance, LGES confirmed in February 2024 that it was preparing for the mass production of its 46-Series cylindrical batteries and expanded its portfolio with new offerings for electric vehicles (EVs) and energy storage systems (ESS).

Rapid Expansion of Recycling and Second-Life Applications

Rising concerns over raw material shortages push focus toward recycling and reuse. Companies invest in closed-loop systems to recover lithium, nickel, and cobalt from used batteries. It extends value creation while reducing dependence on mining activities. The EV Battery Pack market also explores second-life applications in stationary storage. Repurposed batteries support grid balancing, renewable integration, and residential backup systems. This trend ensures sustainability across the full battery lifecycle.

- For instance, Samsung SDI reported a record-breaking annual revenue of KRW 22.7 trillion (approximately $17 billion), driven by strong sales in its electric vehicle (EV) and energy storage system (ESS) battery businesses, by the year 2023.

Integration of Digital Monitoring and Predictive Analytics

Battery management systems evolve with advanced sensors and predictive analytics. These solutions provide real-time performance data, enabling precise optimization and safety. It strengthens reliability in both passenger and commercial electric vehicles. The EV Battery Pack market benefits from predictive maintenance features that extend service life. Cloud platforms and AI-based models improve energy forecasting and fleet management. Digitalization emerges as a trend redefining efficiency and user experience in energy storage.

Growing Localized Manufacturing and Supply Chain Diversification

Automakers and governments emphasize regional production to reduce supply chain risks. Localized plants ensure quicker response to demand and lower logistics costs. It addresses geopolitical uncertainties surrounding raw material sourcing. The EV Battery Pack market witnesses investments in North America, Europe, and Asia-Pacific for capacity expansion. Partnerships between cell manufacturers and vehicle producers accelerate scaling efforts. This trend secures stable supply while supporting regional energy independence goals.

Market Challenges Analysis

High Production Costs and Raw Material Constraints

The EV Battery Pack market faces persistent challenges linked to raw material availability and pricing volatility. Lithium, cobalt, and nickel remain critical components, yet supply shortages increase procurement risks. Mining restrictions and geopolitical issues intensify cost pressures on manufacturers. It forces companies to explore alternatives such as reducing cobalt content or shifting to lithium iron phosphate chemistry. Production expenses also rise due to complex manufacturing processes and quality control needs. High costs directly influence vehicle affordability and delay broader adoption of electric mobility.

Safety Concerns and Infrastructure Limitations

Thermal runaway risks and fire hazards present ongoing safety challenges for battery developers. Strict testing requirements and safety certifications increase design and production complexity. It demands continuous investment in battery management systems and advanced cooling technologies. The EV Battery Pack market also struggles with limited charging infrastructure in many regions. Slow charging networks restrict consumer confidence and reduce adoption rates, especially in emerging economies. Without large-scale charging expansion and consistent safety improvements, long-term growth potential remains restrained.

Market Opportunities

Expansion into Energy Storage and Grid Integration

The EV Battery Pack market holds strong opportunities in renewable energy integration and grid stability. Batteries support storage of excess solar and wind energy, enabling consistent supply during peak demand. It provides solutions for frequency regulation, backup power, and off-grid applications. Utilities and industrial facilities increasingly adopt large-scale storage systems powered by repurposed EV batteries. This trend creates dual benefits of sustainability and cost reduction. Rising demand for decentralized power further expands the scope of battery pack deployment.

Innovation in Fast-Charging and Next-Generation Technologies

Growing investments in ultra-fast charging and advanced chemistries create new opportunities for adoption. It enables shorter charging times, improving convenience for both individual users and commercial fleets. The EV Battery Pack market benefits from ongoing breakthroughs in solid-state and high-density designs. Strategic collaborations between automakers and technology firms accelerate product development cycles. Emerging applications in aviation, marine, and heavy equipment sectors expand potential demand. Continued innovation ensures market participants can address evolving energy and mobility needs.

Market Segmentation Analysis:

By Battery Form:

The EV Battery Pack market segments by battery form into cylindrical, pouch, and prismatic types. Cylindrical cells remain widely adopted due to proven durability, strong energy density, and efficient thermal management. It dominates early designs and continues to be used in mass-market models. Pouch cells gain popularity because of their flexibility, lightweight structure, and ability to fit compact spaces, making them suitable for high-performance electric vehicles. Prismatic cells attract attention with their larger capacity, stability, and simplified assembly process, appealing to both commercial and passenger vehicle producers. Each form addresses specific design and performance needs, driving adoption across diverse vehicle platforms.

- For instance, As the world’s leading EV battery supplier, with a 37.9% global market share in 2024.

By Battery Chemistry:

Chemistry segmentation highlights lithium iron phosphate, nickel cobalt aluminum, nickel manganese cobalt, lithium manganese oxide, and others. Lithium iron phosphate achieves strong growth due to long cycle life, cost efficiency, and safety benefits, especially in mass-market electric cars. Nickel cobalt aluminum offers higher energy density, making it suitable for premium models requiring extended range. Nickel manganese cobalt remains a balanced choice, delivering a mix of performance, stability, and cost control. Lithium manganese oxide supports fast charging and moderate performance, often deployed in smaller vehicles. It reflects a diverse mix of chemistries aligned to vehicle price points and regional strategies.

- For instance, Panasonic Energy Co., Ltd. made significant advancements in its battery technology and production, focusing on expanding its capacity for 2170 and 4680 cylindrical automotive lithium-ion batteries, by the year 2024.

By Propulsion Type:

The EV Battery Pack market segments by propulsion type into battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). BEVs lead adoption with strong demand for zero-emission mobility and growing infrastructure support. Automakers prioritize BEV production to meet emission targets and long-term sustainability goals. PHEVs retain importance in regions with limited charging networks, offering both electric driving and internal combustion backup. It bridges the transition toward full electrification by balancing consumer convenience and environmental compliance. The segment highlights varying adoption paths but ensures steady expansion of overall battery demand.

Segments:

Based on Battery Form:

- Cylindrical

- Pouch

- Prismatic

Based on Battery Chemistry:

- Lithium iron phosphate

- Nickel cobalt aluminum

- Nickel manganese cobalt

- Lithium manganese oxide

- Others

Based on Propulsion Type:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 28.5% share of the EV Battery Pack market in 2024, driven by strong demand for electric vehicles across the United States and Canada. Government incentives, tax rebates, and stricter emission norms accelerate adoption of battery electric vehicles in the region. Automakers expand local production of battery packs to reduce reliance on imports and secure supply stability. It benefits from strong investments by companies such as Tesla, General Motors, and Ford in building gigafactories. Collaboration with technology firms strengthens research into high-density and cost-effective chemistries suitable for long-range vehicles. The region also emphasizes recycling initiatives to ensure sustainability and reduce dependence on global supply chains. Continuous advancements in charging infrastructure further enhance consumer confidence and broaden market penetration.

Europe

Europe held 25.2% share of the EV Battery Pack market in 2024, supported by robust policy frameworks and strong consumer adoption of electric mobility. The European Union enforces strict CO₂ emission limits and promotes subsidies for electric vehicle purchases, boosting battery demand. Automakers such as Volkswagen, BMW, and Stellantis actively invest in regional battery cell production to secure supply. It benefits from strong government support for research into solid-state and next-generation technologies. Leading countries like Germany, France, and the UK expand charging networks and establish strategic partnerships for battery recycling. The region focuses on circular economy principles, ensuring efficient reuse and second-life applications of battery packs. Strategic alignment between governments and manufacturers helps accelerate innovation while meeting climate neutrality targets by 2050.

Asia Pacific

Asia Pacific dominated the EV Battery Pack market with 37.6% share in 2024, fueled by massive adoption in China, Japan, and South Korea. China remains the world’s largest market for electric vehicles, supported by subsidies, infrastructure, and domestic production scale. Leading battery manufacturers such as CATL, BYD, and Panasonic drive capacity expansion across the region. It benefits from strong supply chain integration, access to critical raw materials, and continuous innovation in battery chemistry. Japan and South Korea invest heavily in solid-state and advanced lithium technologies, aiming to strengthen global competitiveness. Expansion of electric buses, two-wheelers, and commercial fleets further contributes to demand. Growing industrialization and urbanization in developing economies also create opportunities for broader electrification and storage adoption.

Latin America

Latin America represented 4.8% share of the EV Battery Pack market in 2024, with Brazil and Mexico leading adoption. The region benefits from rising interest in electric mobility for urban fleets and government-led initiatives to reduce carbon emissions. Local production remains limited, but partnerships with international automakers support gradual growth. It gains momentum through pilot projects in public transport and expansion of hybrid vehicle options. Economic constraints and infrastructure gaps limit large-scale adoption, yet incentives and renewable integration projects drive future opportunities. Countries invest in early-stage battery recycling and second-life applications to build sustainable ecosystems. Gradual development of charging infrastructure across major cities will support steady growth of market share in coming years.

Middle East & Africa

Middle East & Africa held 3.9% share of the EV Battery Pack market in 2024, with growth driven by government-led electrification programs. The United Arab Emirates and Saudi Arabia spearhead investments in electric mobility and renewable integration. It benefits from pilot projects focused on electric buses, taxis, and luxury vehicles in urban centers. Limited infrastructure and affordability barriers restrict adoption in several African economies, but renewable projects create opportunities for distributed storage solutions. Partnerships with global automakers support knowledge transfer and capacity building. The region emphasizes sustainable energy transition by integrating solar-powered charging solutions with battery packs. Future growth will depend on supportive policy frameworks, large-scale investment, and development of regional supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rapport

- Rivian

- PMBL Limited

- Panasonic

- LG Energy Solution

- Samsung

- TOSHIBA

- Octillion Power Systems

- VARTA

- FRIWO

Competitive Analysis

The leading players in the EV Battery Pack market include Panasonic, LG Energy Solution, Samsung, TOSHIBA, VARTA, Rivian, Octillion Power Systems, PMBL Limited, Rapport, and FRIWO. These companies compete by focusing on innovation, large-scale production, and strategic partnerships with automakers. They expand research into high-density chemistries and solid-state designs to enhance efficiency and extend driving range. Manufacturing capacity is being scaled through gigafactories and regional facilities to ensure secure supply chains and reduce costs. Strong emphasis on sustainability is evident through investments in recycling and second-life applications, which address raw material constraints and environmental impact. Competition also intensifies through alliances with vehicle producers to secure long-term contracts and achieve faster integration of advanced battery systems. Firms invest in digital monitoring technologies and advanced battery management systems to improve safety and reliability. Product differentiation is driven by performance metrics such as charging speed, durability, and cycle life, aligning with diverse consumer and fleet requirements. Emerging players focus on niche applications and flexible pack designs, while established leaders strengthen market presence with global distribution networks. The competitive landscape highlights continuous innovation, supply chain expansion, and sustainability as critical elements defining industry leadership.

Recent Developments

- In 2024, LG Energy Solution launched the “Battery Challenge 2024” global startup competition to foster next‑generation battery technologies

- In August 2024, Tata Motors partnered with Octillion Power Systems to acquire battery packs for EVs, indicating a strategic collaboration on battery supply.

- In September 2023, Rivian’s CFO noted they would benefit in late 2023 and 2024 from easing battery raw material prices, improving margins.

Report Coverage

The research report offers an in-depth analysis based on Battery Form, Battery Chemistry, Propulsion Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric vehicles will keep driving large-scale adoption of battery packs.

- Companies will invest in solid-state batteries to improve energy density and safety.

- Recycling and second-life use of batteries will become a mainstream practice.

- Regional manufacturing will expand to reduce supply chain risks and import reliance.

- Governments will strengthen policies to encourage zero-emission vehicle adoption.

- Charging infrastructure will scale rapidly to support long-distance electric travel.

- Digital battery management systems will enhance efficiency, safety, and performance.

- Commercial fleets and public transport will increase dependence on advanced battery packs.

- Partnerships between automakers and technology firms will speed product development.

- Emerging markets will open new growth opportunities with urban electrification projects.