Market Overview

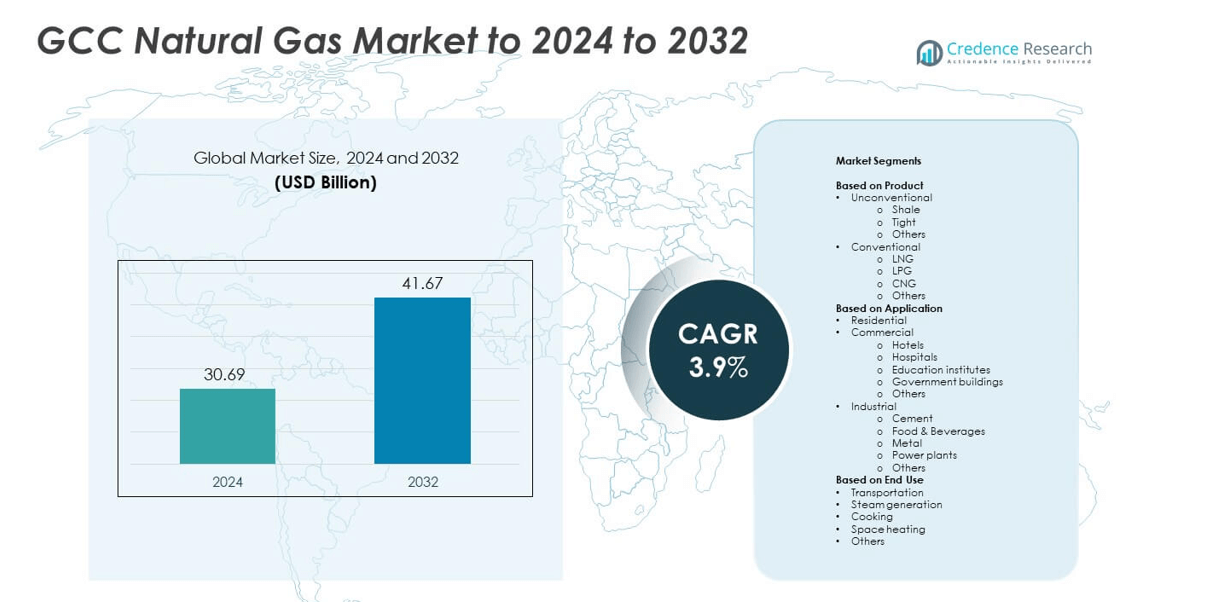

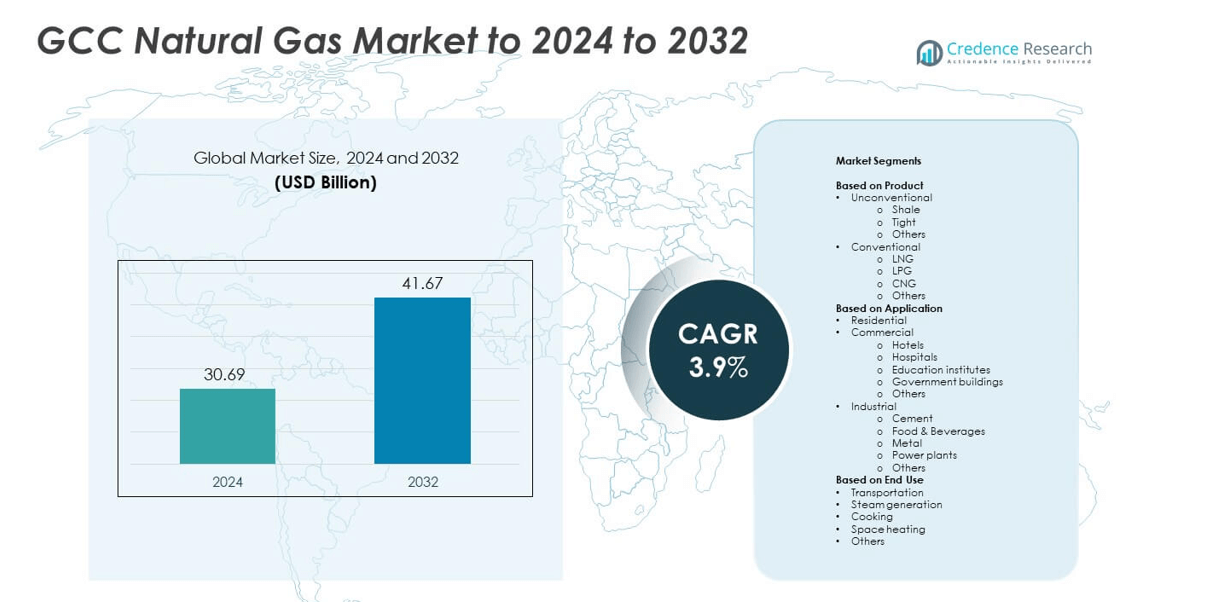

GCC Natural Gas Market size was valued at USD 30.69 Billion in 2024 and is anticipated to reach USD 41.67 Billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| GCC Natural Gas Market Size 2024 |

USD 30.69 Billion |

| GCC Natural Gas Market, CAGR |

3.9% |

| GCC Natural Gas Market Size 2032 |

USD 41.67 Billion |

The GCC natural gas market is led by major players such as Saudi Aramco, Qatar Energy, ADNOC, Shell, BP, and TotalEnergies, which drive growth through upstream expansion, LNG infrastructure development, and technology integration. These companies focus on enhancing production efficiency, carbon management, and energy diversification to meet regional and global demand. Saudi Arabia remains the leading region, commanding a 38% market share in 2024, supported by large-scale projects like the Jafurah gas field and extensive processing infrastructure. Qatar follows with a strong position driven by its North Field expansion and global LNG export dominance.

Market Insights

- The GCC Natural Gas Market was valued at USD 30.69 billion in 2024 and is expected to reach USD 41.67 billion by 2032, growing at a CAGR of 3.9%.

- Rising industrialization, clean energy demand, and expansion of LNG and power generation facilities are key drivers fueling market growth across the region.

- Ongoing investment in digital gas monitoring, hydrogen projects, and carbon capture technologies is shaping future market trends and sustainability goals.

- The market is moderately consolidated, with leading companies such as Saudi Aramco, Qatar Energy, ADNOC, and Shell expanding LNG and unconventional gas portfolios to strengthen competitiveness.

- Saudi Arabia leads the market with a 38% share, followed by Qatar at 31% and the UAE at 17%, while the conventional segment dominates overall with a 78% share driven by LNG production and regional infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The conventional segment dominated the GCC natural gas market with a 78% share in 2024. Conventional sources such as LNG, LPG, and CNG remain the backbone of regional energy supply due to established infrastructure and lower extraction costs. LNG leads within this segment, supported by strong export capacities in Qatar and Saudi Arabia. Rising investments in liquefaction plants and cross-border pipelines further strengthen supply reliability. Meanwhile, unconventional gas, including shale and tight gas, is gaining attention as governments explore diversification and self-sufficiency in energy production.

- For instance, QatarEnergy LNG operates 14 LNG trains with total capacity of 77 million tonnes per year.

By Application

The industrial segment held the largest 52% share of the GCC natural gas market in 2024. Power plants dominate industrial consumption, driven by expanding electricity demand and transition toward cleaner fuels. Large-scale industrial facilities in Saudi Arabia and the UAE are increasingly using gas for process heating and power generation. Cement and metal industries are also key contributors, adopting natural gas to lower emissions and reduce dependence on oil-based fuels. Rising investment in energy-intensive manufacturing continues to reinforce industrial dominance across the GCC.

- For instance, the Saudi Electricity Company (SEC) had an installed capacity of 53.53 GW in 2019, according to the World Benchmarking Alliance.

By End Use

The power generation and steam generation category led the market with a 46% share in 2024. Power utilities across Qatar, Oman, and the UAE rely heavily on natural gas for electricity and thermal energy production. The shift toward gas-fired plants supports regional emission targets and ensures stable grid operations. Transportation and cooking applications are growing as CNG vehicles and domestic gas networks expand. Rising urbanization and infrastructure investments continue to drive end-use diversification, aligning with national sustainability and energy-efficiency goals across the GCC.

Key Growth Drivers

Rising Demand for Clean Energy Transition

The GCC is increasingly shifting toward natural gas to replace oil in power generation and industrial applications. Governments are investing in gas infrastructure to meet growing electricity needs while lowering carbon emissions. This transition aligns with national energy diversification goals such as Saudi Vision 2030 and UAE Energy Strategy 2050. Expanding residential and commercial gas distribution networks further supports demand growth, strengthening natural gas as the primary bridge fuel in the region’s clean energy transition.

- For instance, Aramco’s Fadhili Gas Plant processes 2.5 bscf/d, with an approved expansion toward 4 bscf/d by 2027.

Expanding Industrial and Power Generation Applications

Rapid industrialization and infrastructure development across the GCC are driving higher natural gas consumption. Power generation remains the largest consumer segment, supported by rising population and urbanization. Industries such as cement, steel, and petrochemicals are adopting gas-based systems for cost-efficient and reliable operations. Regional governments are prioritizing gas supply security through pipeline projects and LNG terminals, ensuring consistent access for industrial and utility users.

- For instance, Emirates Global Aluminium’s Jebel Ali site runs captive gas power of 2,974 MW to support smelting.

Growing Investment in LNG Infrastructure

Large-scale LNG export and import terminals are boosting natural gas capacity across the GCC. Qatar’s North Field expansion and UAE’s floating LNG facilities are key projects enhancing regional supply flexibility. These investments improve cross-border trade and enable participation in global gas markets. The development of LNG bunkering hubs and storage capacities further positions the GCC as a central node in international gas logistics.

Key Trends and Opportunities

Adoption of Digital and Smart Gas Management Systems

Digital technologies are transforming the GCC gas industry through automation, IoT-based monitoring, and predictive analytics. Utilities are implementing smart metering and data-driven systems to optimize supply and detect leakages. Real-time analytics improve safety and operational efficiency, reducing system losses. This digital shift creates new opportunities for technology providers and supports sustainability through enhanced resource management.

- For instance, the Dubai Electricity and Water Authority (DEWA) installed over 2.1 million smart electricity and water meters across Dubai by 2021.

Exploration of Unconventional Gas Reserves

GCC nations are investing in the development of shale and tight gas to diversify domestic supply. Saudi Aramco’s unconventional gas exploration in the Jafurah basin and Oman’s tight gas projects highlight the growing emphasis on self-reliance. These initiatives aim to reduce dependence on imports and strengthen long-term energy security. Technological advancements in drilling and reservoir management are accelerating the economic viability of these resources.

- For instance, BP’s Block 61 (Khazzan + Ghazeer) in Oman produces about 1.5 bscf/d, with recoverable resources around 10.5 tcf.

Expansion of Regional Gas Interconnection Projects

Cross-border gas pipelines are expanding energy integration across the GCC. The Dolphin Gas Project connecting Qatar, UAE, and Oman exemplifies successful regional collaboration. Future projects aim to enhance supply stability and balance seasonal demand variations. This interconnectivity also supports industrial diversification and strengthens the GCC’s position as an integrated gas network hub.

Key Challenges

Price Volatility and Export Dependence

Natural gas prices remain sensitive to global demand fluctuations and geopolitical events. The GCC’s heavy reliance on LNG exports exposes economies to market instability and reduced revenue predictability. Balancing export commitments with domestic supply needs is a persistent challenge. Policymakers are focusing on long-term contracts and diversification strategies to mitigate volatility risks.

Infrastructure and Environmental Constraints

Expanding gas infrastructure across vast and arid regions poses logistical and environmental challenges. Pipeline construction and storage facilities require substantial investment and environmental assessments. Managing emissions from gas production and processing remains critical for meeting climate commitments. Sustainable infrastructure planning and adoption of low-emission technologies are essential to ensure future growth without compromising ecological standards.

Regional Analysis

Saudi Arabia

Saudi Arabia held a 38% share of the GCC natural gas market in 2024. The country’s dominance stems from large-scale production and distribution infrastructure, supported by projects such as the Jafurah unconventional gas field. The government’s strategy to expand gas-based power generation and industrial feedstock has boosted domestic demand. Investments in pipelines and processing facilities further strengthen supply reliability. Rising adoption in petrochemical and manufacturing sectors continues to drive steady market expansion, aligning with Saudi Vision 2030’s target of reducing oil dependency and promoting cleaner energy alternatives.

Qatar

Qatar accounted for 31% of the GCC natural gas market in 2024. The country remains a global leader in LNG exports, driven by the expansion of the North Field project. Qatar’s advanced liquefaction infrastructure and strong international trade network sustain its competitive edge. Domestic gas consumption is also increasing due to the growing power generation and industrial sectors. The country’s strategic investments in carbon capture and energy efficiency reinforce its position as a sustainable gas producer and exporter in the region.

United Arab Emirates

The United Arab Emirates captured a 17% share of the GCC natural gas market in 2024. Abu Dhabi’s significant gas reserves and Dubai’s focus on LNG imports have supported energy diversification. Major projects like the Ghasha gas field and ADNOC’s hydrogen initiatives are expanding production capacity. The UAE’s integrated pipeline network and LNG terminals enhance regional supply stability. Increasing demand from the power and manufacturing sectors, combined with renewable integration goals, is driving the country’s balanced approach toward energy security and decarbonization.

Oman

Oman represented a 9% share of the GCC natural gas market in 2024. The country’s production growth is driven by developments in tight and sour gas fields such as Khazzan and Mabrouk. Oman’s strategy focuses on boosting LNG exports while maintaining domestic supply for industrial use. OQ and BP continue to expand upstream investments to improve extraction efficiency. Rising industrial activity, particularly in chemicals and energy-intensive manufacturing, supports natural gas demand. Ongoing infrastructure modernization ensures the country’s position as a stable regional gas supplier.

Kuwait and Bahrain

Kuwait and Bahrain collectively accounted for a 5% share of the GCC natural gas market in 2024. Kuwait’s demand is primarily led by electricity generation, supported by LNG imports through the Al-Zour terminal. Bahrain focuses on optimizing its limited reserves through efficient extraction and import strategies. Both countries are investing in cleaner energy infrastructure to reduce reliance on oil-fired systems. Increasing population, urbanization, and industrialization continue to push natural gas consumption, while long-term diversification initiatives aim to enhance energy sustainability.

Market Segmentations:

By Product

- Unconventional

- Conventional

By Application

- Residential

- Commercial

- Hotels

- Hospitals

- Education institutes

- Government buildings

- Others

- Industrial

- Cement

- Food & Beverages

- Metal

- Power plants

- Others

By End Use

- Transportation

- Steam generation

- Cooking

- Space heating

- Others

By Geography

- Saudi Arabia

- Qatar

- United Arab Emirates

- Oman

- Kuwait and Bahrain

Competitive Landscape

The GCC natural gas market is highly competitive, with key players such as Saudi Aramco, Qatar Energy, ADNOC, BP, Shell, TotalEnergies, Chevron, ExxonMobil, ENI, Equinor, Occidental, Lukoil, Rosneft, Petrobras, PDO, Bahrain Gas, Dubai Petroleum, and Aramco actively shaping the regional landscape. The competition is driven by expanding LNG infrastructure, upstream exploration, and downstream diversification projects. Companies are focusing on optimizing production efficiency, adopting advanced drilling technologies, and investing in low-carbon operations. Strategic collaborations with international energy firms are enhancing knowledge transfer and boosting capacity expansion. Government-backed initiatives promoting gas-based industrialization are strengthening regional competitiveness. Firms are also prioritizing decarbonization, digital transformation, and integrated energy management to meet sustainability targets. Increasing partnerships in hydrogen, carbon capture, and renewable integration reflect the industry’s transition toward cleaner and more resilient energy systems, positioning the GCC as a global hub for natural gas innovation and sustainable production.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Saudi Aramco

- Qatar Energy

- ADNOC

- BP

- Shell

- TotalEnergies

- Chevron

- ExxonMobil

- ENI

- Equinor

- Occidental

- Lukoil

- Rosneft

- Petrobras

- PDO

- Bahrain Gas

- Dubai Petroleum

- Aramco

Recent Developments

- In 2024, Abu Dhabi National Oil Company has moved forward with its plans to build a liquefied natural gas facility in Ruwais, UAE.

- In 2023, Saudi Aramco agreed to acquire a strategic minority stake in the liquefied natural gas (LNG) company MidOcean Energy, marking its official entry into the global LNG market

- In 2023, QatarEnergy Signed a series of long-term supply agreements for its LNG, with major Asian buyers such as Sinopec

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing demand for cleaner fuels will continue to drive natural gas adoption across the GCC.

- LNG infrastructure expansion will strengthen regional export capacity and trade flexibility.

- Rising investments in unconventional gas fields will enhance domestic production stability.

- Industrial and power generation sectors will remain the largest consumers of natural gas.

- Digitalization and IoT-based monitoring will improve operational efficiency and safety in gas networks.

- Regional pipeline integration will enhance cross-border energy cooperation and supply reliability.

- Carbon capture and storage initiatives will support emission reduction and sustainability goals.

- Increasing urbanization will boost residential and commercial gas consumption.

- Hydrogen and blue ammonia projects will diversify gas-based energy applications.

- Policy support and regulatory reforms will continue to attract private investments in gas infrastructure.