Market Overview

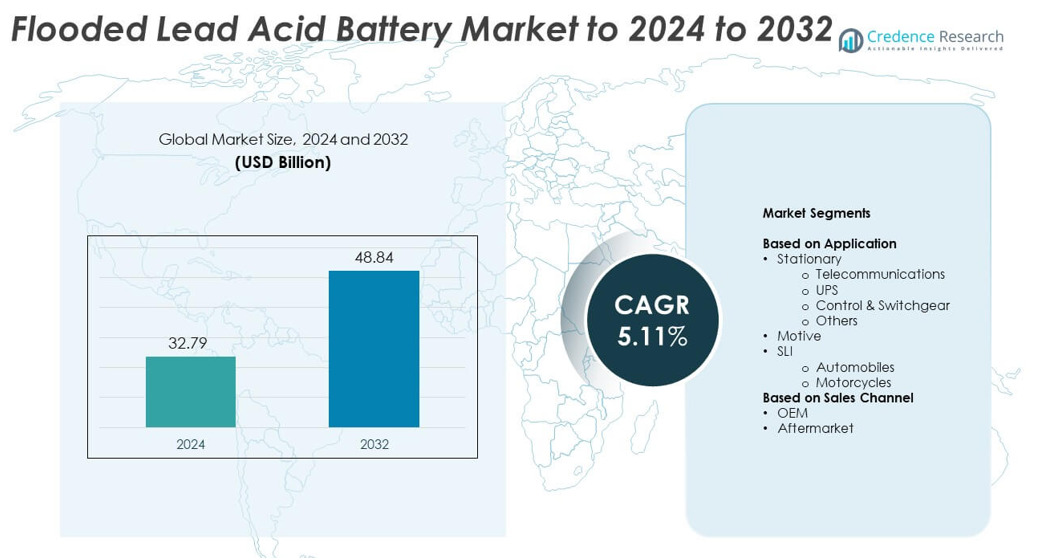

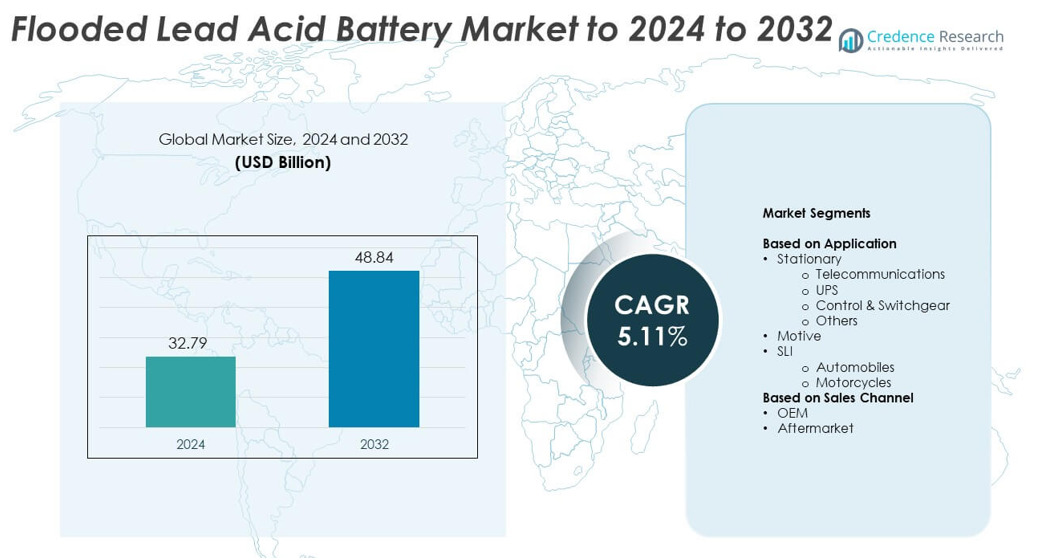

Flooded Lead Acid Battery Market size was valued at USD 32.79 Billion in 2024 and is anticipated to reach USD 48.84 Billion by 2032, at a CAGR of 5.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flooded Lead Acid Battery Market Size 2024 |

USD 32.79 Billion |

| Flooded Lead Acid Battery Market, CAGR |

5.11% |

| Flooded Lead Acid Battery Market Size 2032 |

USD 48.84 Billion |

The flooded lead acid battery market is highly competitive, with leading players such as EnerSys, Clarios, East Penn Manufacturing Company, Exide Industries Limited, and Amara Raja Batteries Ltd. dominating global production and supply. These companies focus on expanding manufacturing capacities, improving recycling processes, and integrating automation to enhance product quality and efficiency. Strategic collaborations with automotive OEMs and renewable energy developers are strengthening their market presence. Asia Pacific leads the global market with a 34% share, driven by large-scale vehicle production, telecom network expansion, and growing adoption of energy storage systems across China, India, and Japan.

Market Insights

- The flooded lead acid battery market was valued at USD 32.79 Billion in 2024 and is projected to reach USD 48.84 Billion by 2032, growing at a CAGR of 5.11%.

- Rising demand from automotive, telecom, and industrial sectors drives market growth, supported by reliable performance and cost efficiency.

- Technological advancements such as improved plate design, automation, and recycling initiatives are shaping market trends.

- The market is moderately competitive, with key players focusing on R&D, sustainability, and partnerships with OEMs and renewable energy providers.

- Asia Pacific leads with a 34% share, followed by North America at 32% and Europe at 28%; the stationary segment dominates with a 48% share, driven by telecom and UPS applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The stationary segment dominated the flooded lead acid battery market in 2024 with a 48% share. This dominance is driven by extensive use in telecommunications, UPS systems, and control and switchgear applications that require reliable backup power. Telecommunications accounted for the largest share within stationary systems due to rising demand for uninterrupted connectivity and network stability. Flooded lead acid batteries remain preferred in this category for their cost efficiency, easy maintenance, and long service life, particularly in off-grid installations and base transceiver stations across emerging economies.

- For instance, EnerSys PowerSafe OPzS cells list 216–3360 Ah and 20-year design life.

By Sales Channel

The aftermarket segment held the largest market share of 56% in 2024. This dominance is fueled by frequent battery replacements in automobiles, motorcycles, and industrial equipment, where flooded lead acid batteries serve as dependable and affordable power sources. The growing number of vehicles in use globally, combined with replacement demand in telecommunication and energy storage systems, supports aftermarket growth. OEM sales continue to expand steadily, backed by rising vehicle production and industrial electrification trends, but aftermarket remains the primary revenue contributor due to large-scale replacement cycles.

- For instance, Clarios converts nearly 200,000 used car batteries into new ones daily.

Key Growth Drivers

Rising Demand from Automotive and Transportation Sector

The automotive sector remains the primary growth driver for the flooded lead acid battery market. Increasing vehicle production, particularly in Asia-Pacific, continues to boost demand for SLI batteries. Their low cost, reliability, and ability to deliver high surge currents make them ideal for starting and lighting functions. Growing motorcycle ownership and commercial vehicle expansion further strengthen market adoption. Additionally, the rise in electric rickshaws and hybrid vehicles in developing nations continues to support large-scale deployment of flooded lead acid batteries.

- For instance, Exide Industries reported an annual combined installed capacity of 66 million automotive and motorcycle batteries in February 2024.

Growing Adoption in Telecom and Data Center Infrastructure

The rapid expansion of telecom networks and data centers is fueling the use of flooded lead acid batteries in stationary backup systems. These batteries provide stable power and long operational life in applications where consistent energy supply is vital. The rising number of cell towers, along with growing internet connectivity in rural regions, drives continuous investment in backup power solutions. The need for cost-effective and robust energy storage in large-scale IT facilities also strengthens market demand.

- For instance, Indus Towers operates about 219,736 towers across India, requiring robust backup power.

Industrial Growth and Expansion of Renewable Energy Installations

Rising industrialization and deployment of renewable energy systems are major contributors to market growth. Flooded lead acid batteries serve as reliable energy storage solutions for grid support, off-grid systems, and industrial backup. Manufacturing, chemical, and energy sectors increasingly use these batteries to ensure operational reliability. The global push for renewable energy integration, combined with government support for decentralized power systems, enhances their adoption. Their recyclability and long cycle life further support sustained use in large industrial setups.

Key Trends and Opportunities

Shift Toward Advanced Manufacturing and Automation

Manufacturers are investing in advanced production technologies to enhance performance and efficiency. Automation and precision filling systems improve battery consistency and reduce production defects. Enhanced plate designs and separators extend battery life and improve energy density. These technological upgrades allow manufacturers to offer cost-effective products with higher reliability. The adoption of automated quality control and testing also strengthens supply chain efficiency, enabling faster delivery to automotive and industrial customers.

- For instance, Rolls S6 L16-HC flooded battery is rated 445 Ah at the 20-hour rate.

Growing Preference for Energy Storage Applications

Flooded lead acid batteries are gaining traction in renewable and grid energy storage projects. Utilities and microgrid operators are adopting these batteries for peak load management and backup support. Their high charge acceptance rate and low operational cost make them suitable for hybrid renewable systems. Expanding rural electrification initiatives and increasing solar installations in emerging economies create strong growth prospects. Government incentives promoting energy storage adoption further enhance market potential across regions.

- For instance, HOPPECKE processes about 36,000 tonnes of used lead-acid batteries each year.

Rising Focus on Sustainable Battery Recycling

The global push for environmental sustainability is creating opportunities in battery recycling and material recovery. Recycling initiatives are being expanded to reduce lead contamination and recover reusable materials from spent batteries. Industry players are investing in advanced recycling facilities to meet environmental regulations and enhance resource efficiency. Growing consumer and corporate awareness of circular economy practices strengthens this trend. The integration of recycling processes within manufacturing operations improves cost efficiency and environmental performance.

Key Challenges

Environmental and Safety Concerns Associated with Lead

Lead contamination and hazardous waste management remain major challenges for the flooded lead acid battery industry. Improper recycling and disposal practices can result in environmental damage and health risks. Strict regulations on lead emissions and waste handling increase compliance costs for manufacturers. The need for safer recycling technologies and closed-loop production systems adds pressure on companies. Addressing these issues while maintaining competitive pricing continues to be a significant market challenge.

Competition from Advanced Battery Technologies

The growing adoption of lithium-ion and other advanced battery chemistries is restraining flooded lead acid battery demand. These newer technologies offer higher energy density, faster charging, and lower maintenance requirements. The shift toward electric vehicles and renewable energy systems that prefer lightweight, long-lasting solutions intensifies competition. Manufacturers are compelled to innovate and improve performance to remain competitive. The slower energy efficiency and maintenance needs of lead acid systems limit their appeal in evolving power storage markets.

Regional Analysis

North America

North America held a 32% share of the flooded lead acid battery market in 2024. The region benefits from strong demand across automotive, telecommunications, and industrial backup applications. The U.S. leads the market due to extensive vehicle fleets and robust data center expansion. Replacement demand from the aftermarket segment also drives steady growth. Environmental regulations encouraging recycling programs enhance sustainability and cost efficiency. Canada’s growing renewable energy storage applications further contribute to market development, supported by reliable supply chains and established manufacturing infrastructure across the region.

Europe

Europe accounted for 28% of the global flooded lead acid battery market in 2024. The region’s growth is driven by high vehicle ownership, industrial electrification, and renewable integration. Germany, France, and the U.K. lead in adoption, supported by established automotive and telecom sectors. Strong recycling frameworks and environmental standards promote sustainable production and reuse. Rising demand for standby power in commercial facilities and transportation applications supports market stability. Ongoing R&D efforts focused on improving efficiency and lead recovery processes also strengthen Europe’s position in the global battery supply chain.

Asia Pacific

Asia Pacific dominated the global flooded lead acid battery market with a 34% share in 2024. The region’s growth is led by China, India, Japan, and South Korea, driven by large-scale automotive production and infrastructure development. Rapid urbanization and expanding telecom networks create strong demand for stationary power systems. Industrial applications and renewable energy projects in China and India further support volume growth. The region benefits from low manufacturing costs, favorable government policies, and expanding distribution networks, making it the key production hub for global battery manufacturers.

Latin America

Latin America held a 4% share of the flooded lead acid battery market in 2024. The market is primarily driven by increasing demand for automotive batteries, power backup systems, and off-grid renewable energy storage. Brazil and Mexico dominate regional sales due to strong vehicle assembly operations and telecom expansion. Growth in industrial applications and the replacement of aging power systems also support market performance. Government initiatives promoting localized battery recycling and renewable energy adoption are helping create sustainable growth opportunities across the Latin American region.

Middle East and Africa

The Middle East and Africa captured a 2% share of the flooded lead acid battery market in 2024. Growth is fueled by rising investments in telecom infrastructure, off-grid energy projects, and automotive maintenance demand. Countries such as the UAE, Saudi Arabia, and South Africa are leading markets, supported by rapid urban development and growing industrialization. Expansion of solar-based energy systems in rural and remote areas drives further battery deployment. Increasing focus on cost-effective backup power solutions continues to strengthen the market outlook in this emerging region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Application

- Stationary

- Telecommunications

- UPS

- Control & Switchgear

- Others

- Motive

- SLI

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The flooded lead acid battery market features key players such as EnerSys, Clarios, East Penn Manufacturing Company, Inc., Exide Industries Limited, Amara Raja Batteries Ltd., Johnson Controls International, Varta AG, Contemporary Amperex Technology Co., Limited, Crown Battery, GS Yuasa Corporation, Trojan Battery Company, C&D Technologies Inc., Leoch International Technology Limited Inc., HOPPECKE Battery GmbH & Co. KG., Robert Bosch GmbH, NorthStar Battery Company, Furukawa Battery Co., Ltd., and B.B. Battery. Market competition is defined by product innovation, cost efficiency, and global distribution networks. Leading manufacturers focus on enhancing energy density, reliability, and recycling efficiency to strengthen their market position. Strategic partnerships with OEMs and renewable energy developers are expanding application reach across automotive, industrial, and telecom sectors. Continuous investment in R&D supports improvements in battery performance and sustainability. Companies also emphasize aftersales services, digital monitoring solutions, and regional expansion to maintain long-term competitiveness in a growing global energy storage market.

Key Player Analysis

- EnerSys

- Clarios

- East Penn Manufacturing Company, Inc.

- Exide Industries Limited

- Amara Raja Batteries Ltd.

- Johnson Controls International

- Varta AG

- Contemporary Amperex Technology Co., Limited

- Crown Battery

- GS Yuasa Corporation

- Trojan Battery Company

- C&D Technologies Inc.

- Leoch International Technology Limited Inc.

- HOPPECKE Battery GmbH & Co. KG.

- Robert Bosch GmbH

- NorthStar Battery Company

- Furukawa Battery Co., Ltd.

- B. Battery

Recent Developments

- In 2024, CATL launched the TENER energy storage system, a 6.25-megawatt-hour (MWh) unit designed with a focus on zero capacity degradation for the first five years of use

- In 2024, Amara Raja Batteries (India) established a battery pack assembly plant within its Giga Corridor in Divitipalli, India.

- In 2023, C&D Technologies launched its Pure Lead Max (PLM) Valve-Regulated Lead-Acid (VRLA) battery, which offers a longer service life and reduced cost of ownership for data centers.

Report Coverage

The research report offers an in-depth analysis based on Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness growing demand from the automotive and telecom sectors due to expanding infrastructure.

- Increasing renewable energy integration will boost applications in off-grid and hybrid power systems.

- Technological improvements will enhance battery efficiency, durability, and maintenance performance.

- Expansion of recycling programs will strengthen sustainable production and raw material recovery.

- Developing economies in Asia-Pacific will drive large-scale manufacturing and export growth.

- Rising aftermarket demand from vehicle replacement cycles will sustain steady revenue streams.

- Industrialization across emerging nations will increase installations for backup and stationary uses.

- Automation in production lines will reduce costs and improve output consistency.

- Regulatory support for energy storage and recycling will enhance market competitiveness.

- Competition from lithium-ion and solid-state batteries will push innovation in flooded lead acid technology.