Market Overview

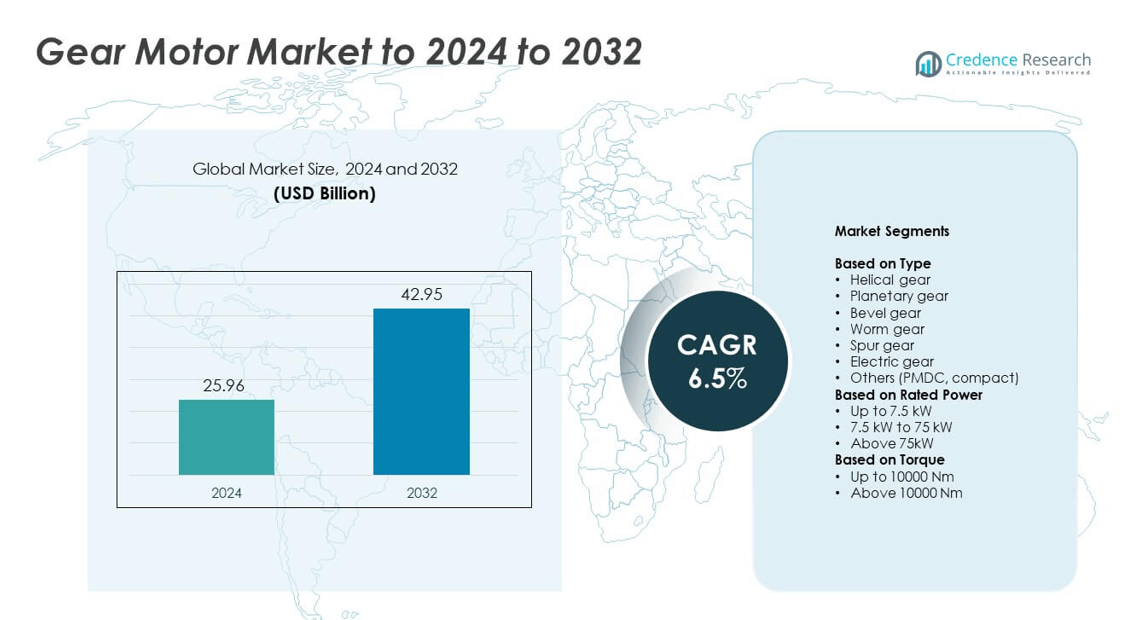

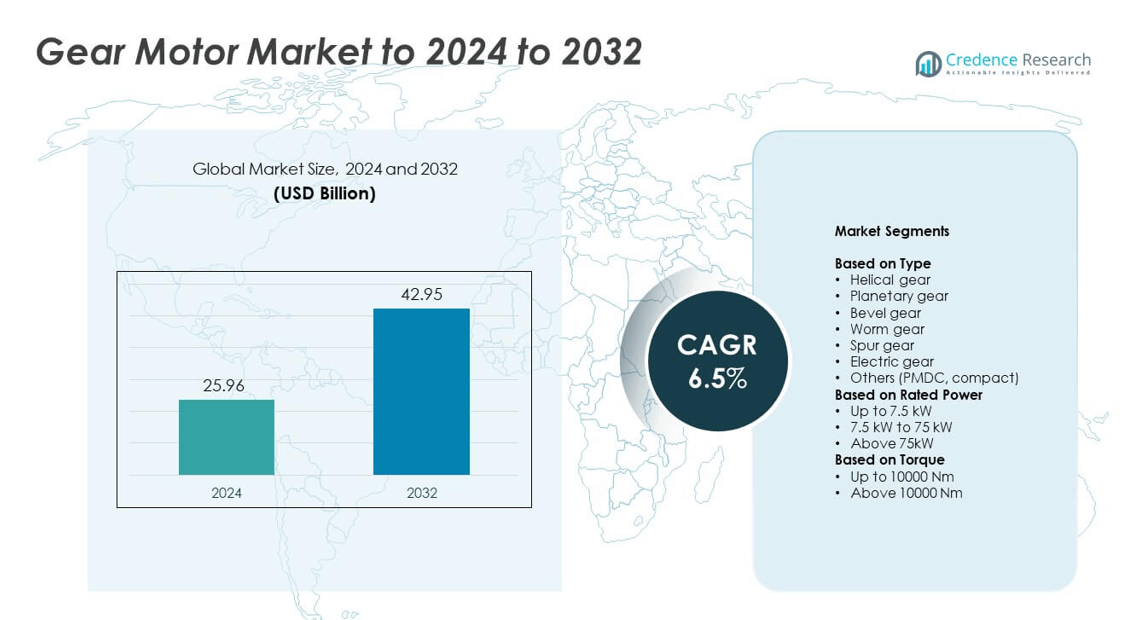

The Gear Motor Market size was valued at USD 25.96 billion in 2024 and is anticipated to reach USD 42.95 billion by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gear Motor Market Size 2024 |

USD 25.96 billion |

| Gear Motor Market, CAGR |

6.5% |

| Gear Motor Market Size 2032 |

USD 42.95 billion |

The Gear Motor Market is dominated by major players such as Siemens, SEW Eurodrive, Bonfiglioli, Bauer Gear, and Sumitomo Heavy Industries. These companies focus on innovation, energy efficiency, and smart automation to strengthen their market presence. Advanced product development, digital integration, and regional expansion strategies have enhanced their competitiveness in industrial and renewable applications. Asia Pacific led the market with a 34% share in 2024, driven by rapid industrialization, infrastructure growth, and increasing automation across China, Japan, and India. North America and Europe followed, supported by strong adoption in manufacturing and energy sectors.

Market Insights

- The Gear Motor Market was valued at USD 25.96 billion in 2024 and is projected to reach USD 42.95 billion by 2032, growing at a CAGR of 6.5%.

- Increasing industrial automation, renewable energy projects, and logistics expansion are key drivers boosting global demand for efficient gear systems.

- Trends such as integration of IoT-enabled motors, energy-efficient designs, and compact modular solutions are reshaping product innovation.

- The market is moderately consolidated, with major players focusing on advanced drive systems, product customization, and smart manufacturing technologies to maintain competitiveness.

- Asia Pacific led the market with 34% share in 2024, followed by North America with 32% and Europe with 28%, while the helical gear segment dominated by type with a 34% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The helical gear segment dominated the gear motor market in 2024 with a 34% share. Its leadership is driven by smooth torque transmission, high load capacity, and quiet operation. Helical gears are widely used in automotive manufacturing, conveyor systems, and industrial machinery due to their efficiency and precision. Continuous advancements in gear grinding and lubrication systems have improved performance and durability. Demand from sectors such as material handling and robotics further supports helical gear adoption as industries pursue higher mechanical efficiency and reduced noise levels.

- For instance, SEW-Eurodrive K-series gearmotors reach up to 50,000 Nm torque.

By Rated Power

Gear motors rated up to 7.5 kW accounted for 41% of the market share in 2024. This segment benefits from rising demand in automation equipment, packaging systems, and light-duty conveyors. Compact design, energy efficiency, and low maintenance make small-rated motors ideal for industrial and commercial applications. Expanding deployment in food processing, textile, and logistics facilities also fuels growth. Manufacturers continue innovating in compact gear assemblies and integrated drive technologies, meeting the demand for reliable low-power systems in continuous-duty operations.

- For instance, KEB helical-worm gearmotors span 0.12–7.5 kW power ratings.

By Torque

The up to 10000 Nm segment led the market with a 58% share in 2024. Its dominance stems from extensive use in material handling, elevators, and automation systems. These gear motors offer high torque density, precision control, and extended service life under moderate loads. Industrial modernization and the integration of automated production lines are further driving adoption. Increasing use in wind turbine yaw drives and small construction machinery highlights the segment’s efficiency advantages and adaptability across a wide range of industrial applications.

Key Growth Drivers

Rising Industrial Automation and Smart Manufacturing

Growing automation across industries is boosting demand for gear motors. These systems support precise motion control in robotic arms, conveyors, and packaging machines. Manufacturers are increasingly integrating smart motor technologies with sensors and IoT connectivity for predictive maintenance and efficiency optimization. Expansion of automated production lines in automotive and electronics sectors continues to accelerate gear motor adoption, enabling higher output consistency and energy savings across industrial operations.

- For instance, ABB’s Smart Sensor cuts downtime by up to 70% and energy by ~10%.

Expansion of Renewable Energy and Infrastructure Projects

Rapid development in wind energy, solar tracking systems, and infrastructure projects is driving gear motor demand. Gear motors play a critical role in torque transmission and load control in wind turbines and construction machinery. Governments worldwide are investing in renewable capacity and infrastructure modernization, creating consistent opportunities. Increased use of electromechanical drive systems for cranes, hoists, and transport systems further strengthens this growth driver within heavy engineering and energy applications.

- For instance, Bonfiglioli 700TW yaw drives cover 16,000–260,000 Nm torque.

Growing Demand in Material Handling and Logistics

The rise of e-commerce and automated warehouses is fueling demand for efficient material handling systems powered by gear motors. They provide smooth motion and precise control for conveyors, lifts, and automated storage systems. Growing warehouse automation in developed and emerging markets supports consistent demand. Continuous investment in electric drive technologies by logistics and warehouse equipment manufacturers ensures better load management, reduced downtime, and improved throughput efficiency.

Key Trends and Opportunities

Shift Toward Energy-Efficient and Compact Gear Motors

Manufacturers are developing compact, high-efficiency gear motors to reduce energy losses and improve system reliability. Lightweight housings and advanced lubrication systems enhance performance under continuous operations. The demand for eco-efficient machinery across sectors such as packaging, textiles, and food processing creates opportunities for innovation. These designs align with sustainability goals and help users reduce operational costs while meeting international energy efficiency standards.

- For instance, NORD IE5+ motors show up to ~95% efficiency, 0.35–3.70 kW range.

Integration of Smart and IoT-Enabled Gear Systems

The market is witnessing a surge in smart gear motors with embedded sensors for performance monitoring and diagnostics. IoT-enabled systems provide real-time data on torque, vibration, and temperature, reducing maintenance costs. Industries are adopting predictive maintenance programs using cloud-connected gear drives to minimize unplanned downtime. This integration offers significant opportunities for manufacturers to deliver value-added solutions across manufacturing, logistics, and energy applications.

- For instance, WEG’s MFM platform reported 33% loss reduction at deployments.

Rising Customization for Industry-Specific Solutions

Demand for customized gear motor solutions is increasing across sectors such as marine, healthcare, and robotics. Manufacturers are focusing on modular designs that enable easy configuration for specific torque and speed requirements. This flexibility supports innovation and performance optimization for specialized machinery. Industry-focused R&D investments and advanced design software tools allow producers to develop gear solutions tailored to operational challenges and space constraints.

Key Challenges

High Initial Cost and Complex Maintenance Requirements

Despite their efficiency, gear motors involve high installation and maintenance costs, limiting adoption in cost-sensitive industries. Complex designs require skilled technicians for assembly and servicing, increasing operational expenses. Unplanned maintenance can disrupt industrial workflows, affecting productivity. The need for regular inspection and component replacement also impacts lifecycle costs. This challenge remains significant for small and medium enterprises seeking affordable automation solutions.

Rising Competition from Alternative Drive Technologies

The growing adoption of direct drive and magnetic gear systems poses a challenge to traditional gear motors. These alternatives offer reduced mechanical losses, lower noise, and longer service life. Advancements in variable frequency drives and brushless motors are shifting preference toward systems requiring less mechanical transmission. Manufacturers must innovate through lightweight designs, improved lubrication, and digital monitoring features to stay competitive in the evolving industrial drive landscape.

Regional Analysis

North America

North America held a 32% share of the gear motor market in 2024, driven by advanced automation adoption in manufacturing and logistics sectors. Strong investments in robotics, packaging, and industrial automation are fueling steady demand across the United States and Canada. The growing emphasis on energy-efficient machinery and industrial modernization supports long-term growth. Key manufacturers focus on integrating digital control and smart monitoring technologies. Expanding wind energy projects and electric vehicle production also contribute to regional growth, reinforcing North America’s position as a major consumer of high-performance gear motors.

Europe

Europe accounted for 28% of the market share in 2024, supported by a well-established industrial base and strong focus on energy efficiency. Germany, Italy, and the UK lead regional production, driven by automation in automotive, food processing, and renewable energy sectors. EU directives promoting energy-efficient equipment and sustainable manufacturing enhance gear motor demand. The region also benefits from advanced research in mechatronic systems and compact drive solutions. Increasing replacement of conventional drives with efficient gear units further supports Europe’s steady market expansion across both industrial and renewable energy applications.

Asia Pacific

Asia Pacific dominated the gear motor market with a 34% share in 2024, led by China, Japan, and India. Expanding manufacturing activities, industrial automation, and infrastructure projects are the key drivers. Rapid growth in the automotive, construction, and electronics sectors fuels continuous adoption. Government initiatives promoting smart factories and renewable energy are accelerating demand for efficient drive systems. Local manufacturers are increasing production capacity and investing in precision engineering to meet domestic and export requirements. Rising demand from logistics and renewable industries positions Asia Pacific as the fastest-growing regional market.

Latin America

Latin America captured a 4% share of the gear motor market in 2024, primarily driven by industrial growth in Brazil and Mexico. Expansion in mining, food processing, and energy sectors supports gear motor adoption. Regional industries are upgrading legacy systems with efficient and durable drive technologies to improve productivity. Increased focus on renewable energy and infrastructure modernization is creating new opportunities. However, high equipment costs and limited local manufacturing capacity slightly constrain market expansion. Ongoing industrial automation efforts are expected to enhance regional demand in the coming years.

Middle East & Africa

The Middle East & Africa region held a 2% share of the market in 2024, supported by ongoing developments in construction, oil and gas, and utilities. Countries such as Saudi Arabia, the UAE, and South Africa are investing in industrial automation and renewable energy projects, creating a gradual demand rise. Gear motors are increasingly used in water treatment plants, material handling, and power generation. While infrastructure expansion drives growth, limited industrial diversification and dependence on imports pose challenges. Continued investment in industrial modernization is likely to support future demand in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Helical gear

- Planetary gear

- Bevel gear

- Worm gear

- Spur gear

- Electric gear

- Others (PMDC, compact)

By Rated Power

- Up to 7.5 kW

- 7.5 kW to 75 kW

- Above 75kW

By Torque

- Up to 10000 Nm

- Above 10000 Nm

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Major players such as Siemens, SEW Eurodrive, Bonfiglioli, Bauer Gear, Sumitomo Heavy Industries, Nidec, Regal Rexnord, Flender, Nabtesco, Harmonic Drive, Power Build, Shanthi Gears, Jiangsu Guomao Reducer, Emerson Electric, Portescap, and ORIENTAL MOTOR USA CORP collectively shape the competitive landscape of the gear motor market. The market remains moderately consolidated, with companies emphasizing advanced manufacturing, efficiency optimization, and digital integration. Leading manufacturers are expanding production capacity, investing in smart motor technologies, and adopting Industry 4.0-driven processes to enhance reliability and precision. Strategic partnerships, product innovation, and acquisitions are common strategies to strengthen global presence. Increasing demand for energy-efficient and compact gear drives is pushing firms to develop lightweight, high-torque solutions. Regional expansion, automation support services, and after-sales networks are also key competitive differentiators, enabling market players to maintain strong positions amid growing industrial and renewable energy applications.

Key Player Analysis

- Siemens

- SEW Eurodrive

- Bonfiglioli

- Bauer Gear

- Sumitomo Heavy Industries

- Nidec

- Regal Rexnord

- Flender

- Nabtesco

- Harmonic Drive

- Power Build

- Shanthi Gears

- Jiangsu Guomao Reducer

- Emerson Electric

- Portescap

- ORIENTAL MOTOR USA CORP

Recent Developments

- In 2025, SEW-EURODRIVE Introduced the WES Series stainless steel drives, a hygienic and compact drive solution that uses SPIROPLAN® right-angle gearing.

- In 2024, ORIENTAL MOTOR USA CORP announced the launch of its new AZX Series 600W servo motor.

- In 2024, Sumitomo Drive Technologies Introduced the new DA10, a compact single-stage gearbox for precision applications, at SPS.

Report Coverage

The research report offers an in-depth analysis based on Type, Rated Power, Torque and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising automation across industries will continue to boost gear motor demand globally.

- Integration of IoT and smart monitoring features will enhance operational efficiency.

- Energy-efficient and compact gear motor designs will gain wider adoption.

- Growth in electric vehicles and renewable energy projects will drive new applications.

- Manufacturers will focus on modular and customizable gear solutions for diverse sectors.

- Increased use of robotics and precision machinery will strengthen market penetration.

- Expanding industrial infrastructure in Asia Pacific will create major growth opportunities.

- Advancements in materials and lubrication technologies will improve gear durability.

- Strategic partnerships and acquisitions will accelerate technological innovation.

- The shift toward sustainable and low-noise drive systems will define future market trends.